| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Market Size 2024 |

USD 5,925.56 million |

| Algae Market, CAGR |

6.60% |

| Algae Market Size 2032 |

USD 10,248.84 million |

Market Overview

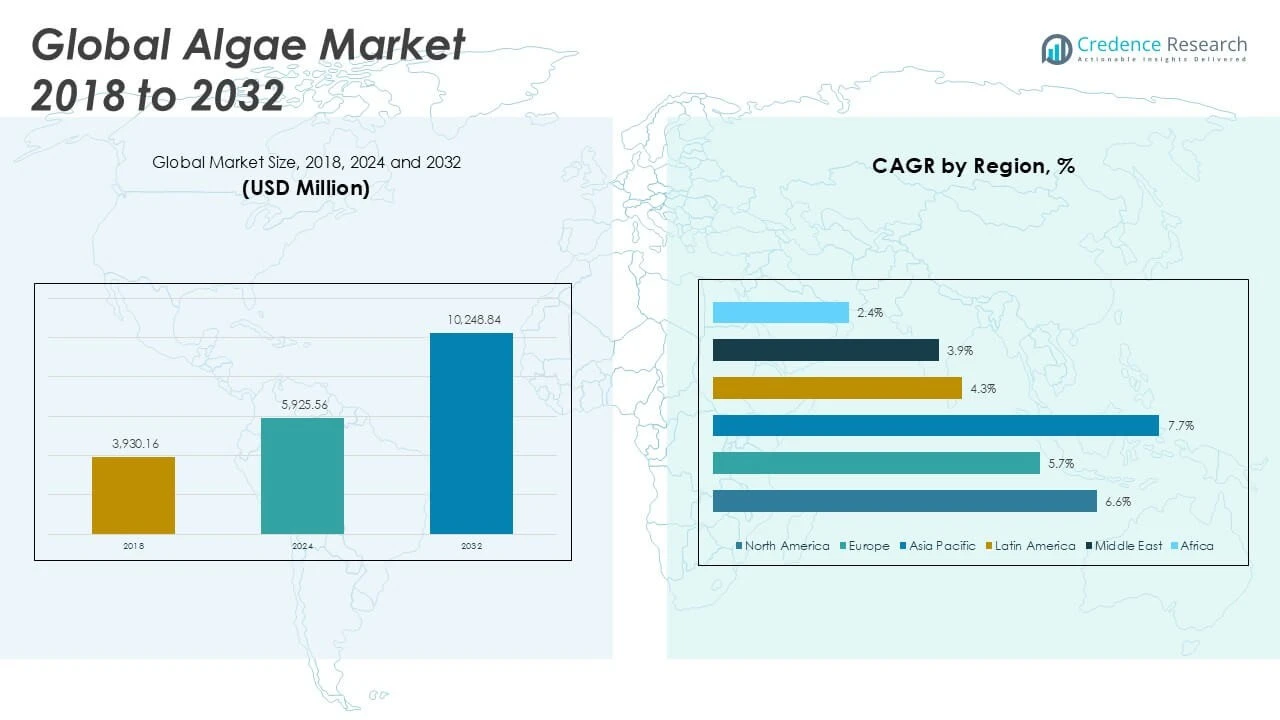

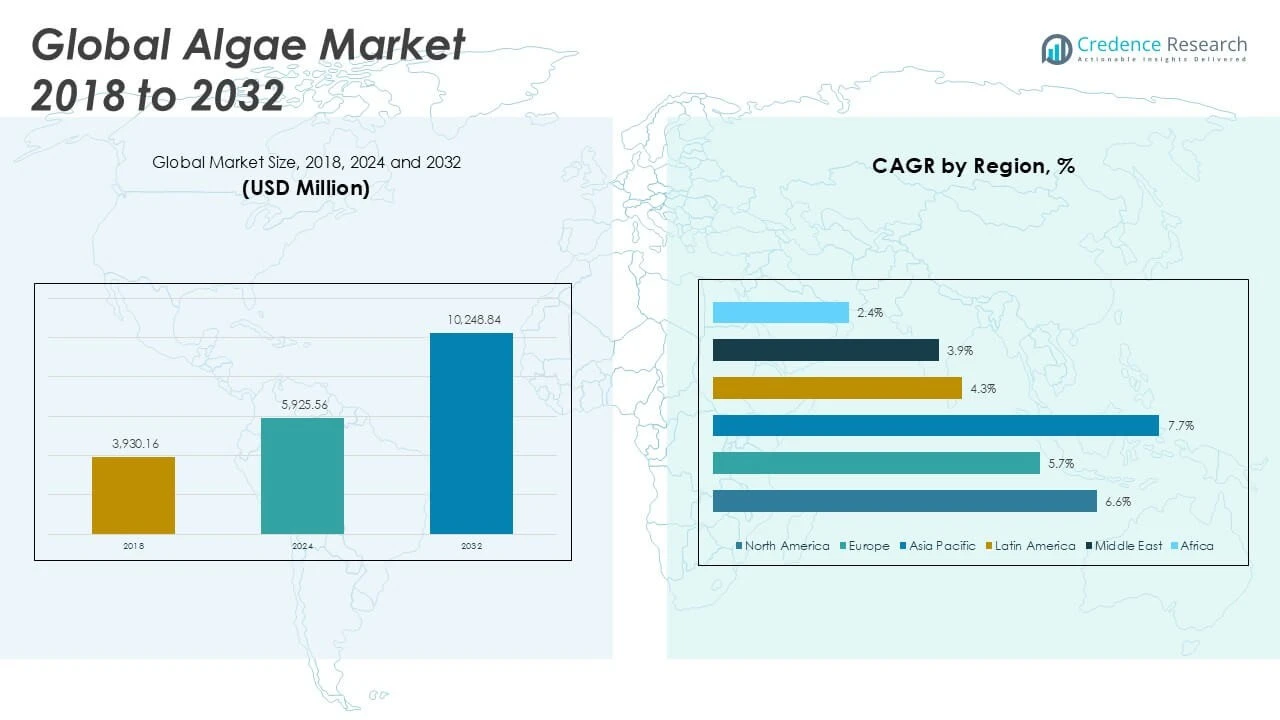

The Algae Market size was valued at USD 3,930.16 million in 2018 to USD 5,925.56 million in 2024 and is anticipated to reach USD 10,248.84 million by 2032, at a CAGR of 6.60% during the forecast period.

The Algae Market experiences robust growth driven by rising demand for sustainable food, feed, and biofuel alternatives, as well as increasing consumer awareness regarding the nutritional benefits of algae-based products. Food and beverage manufacturers incorporate algae into functional foods and supplements, leveraging its rich protein, omega-3, and antioxidant content. The market also benefits from the expansion of the cosmetics and personal care sector, where algae extracts enhance product formulations for skin hydration and anti-aging. Growth in the animal feed industry supports higher algae adoption due to its role in improving livestock health and productivity. Advances in cultivation technology, along with investments in large-scale algae production, improve cost-efficiency and product quality. Regulatory support for renewable energy and circular economy initiatives further propels the use of algae in bioplastics and biofuels. Collectively, these trends position the Algae Market as a dynamic segment within the broader sustainable products industry.

The Algae Market demonstrates robust growth across key global regions, with North America, Europe, and Asia Pacific leading the expansion. North America benefits from advanced biotechnology and strong demand for algae-based ingredients in food, nutraceutical, and biofuel sectors, with the United States and Canada serving as primary markets. Europe’s growth is fueled by strict sustainability regulations and high consumer acceptance of natural products, particularly in countries such as Germany, France, and the Netherlands. Asia Pacific stands out for its rapid market expansion, driven by large-scale production in China, Japan, and South Korea, and increasing use of algae in functional foods and aquaculture. Among the leading players in the Algae Market are DSM, BASF SE, and Corbion, all of which focus on innovative product development and strategic partnerships. Cargill, Incorporated also plays a significant role, leveraging its global network and expertise in food and feed solutions.

Market Insights

- The Algae Market was valued at USD 5,925.56 million in 2024 and is projected to reach USD 10,248.84 million by 2032, reflecting a CAGR of 6.60% during the forecast period.

- Rising demand for sustainable food, functional ingredients, and biofuels drives market growth, with manufacturers leveraging algae’s nutritional benefits in food, feed, and supplement applications.

- Key trends include the launch of protein-rich algae products, algae-infused beverages, and increased adoption in personal care, animal feed, and renewable energy sectors.

- Leading players such as DSM, BASF SE, Corbion, and Cargill, Incorporated invest in research, expand product portfolios, and form strategic partnerships to maintain competitive advantage.

- High production costs, scalability challenges, and regulatory complexities restrain market growth, limiting broad adoption for smaller producers and new market entrants.

- North America and Asia Pacific dominate the market due to advanced R&D, strong consumer demand, and robust production capabilities, while Europe follows with significant contributions from France and Germany.

- Market expansion is further supported by favorable government policies, investment in large-scale algae cultivation, and a growing focus on sustainable and plant-based solutions worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Nutritional and Functional Ingredients

Consumers seek healthier and more sustainable dietary options, driving interest in algae-based ingredients for food and beverage applications. The Algae Market benefits from the rich nutritional profile of algae, including essential proteins, omega-3 fatty acids, vitamins, and antioxidants. Manufacturers incorporate algae into functional foods, dietary supplements, and beverages to meet growing consumer preferences for natural and plant-based products. The rising incidence of lifestyle-related diseases also contributes to the adoption of algae as a preventive and health-supportive ingredient. Food processors and health brands highlight algae’s ability to enhance nutritional content while supporting clean label initiatives. As a result, the sector’s expansion is supported by continuous product launches and increased research into algae’s health benefits.

- For instance, the International Diabetes Federation estimates that 20–25% of adults globally suffer from metabolic syndrome, increasing demand for preventive healthcare solutions like algae-based ingredients.

Innovation in Cosmetics and Personal Care Formulations

Personal care and cosmetic brands leverage algae extracts for their bioactive properties, enhancing product performance and consumer appeal. The Algae Market finds new opportunities as formulators recognize the moisturizing, anti-aging, and antioxidant benefits of various algae species. Algae-derived compounds improve skin hydration, protect against environmental stressors, and support skin barrier function. Research and development activities focus on sustainable sourcing and the creation of unique cosmetic ingredients with proven efficacy. Global trends toward natural and eco-friendly products encourage wider adoption of algae-based actives. It strengthens the market position by catering to evolving consumer expectations for both performance and sustainability.

- For instance, algae-derived compounds such as polysaccharides, vitamins, and antioxidants are widely used in skincare products for their moisturizing and anti-aging benefits.

Expansion of Biofuel and Renewable Energy Applications

Governments and industries focus on renewable energy solutions, leading to significant investments in algae-based biofuels. The Algae Market receives strong support from regulatory frameworks that promote low-carbon alternatives and energy independence. Algae can serve as a high-yield feedstock for biodiesel and bioethanol, reducing reliance on fossil fuels and lowering greenhouse gas emissions. Energy producers value algae’s rapid growth rates and minimal land requirements compared to traditional crops. Large-scale cultivation facilities, advanced harvesting technologies, and government grants support the scale-up of algae biofuel production. It continues to attract investment from both public and private sectors seeking to meet climate and energy targets.

Growth of Algae in Animal Feed and Agriculture

The animal feed industry increasingly turns to algae as a functional feed additive, seeking solutions that enhance livestock health, productivity, and product quality. The Algae Market gains momentum from its ability to supply essential nutrients, improve immune response, and reduce the need for synthetic additives in animal diets. Algae-based feeds contribute to sustainable agriculture by lowering environmental impacts and offering alternatives to traditional protein sources. Feed producers and agribusinesses adopt algae to differentiate their offerings and comply with evolving feed regulations. Ongoing research confirms the positive effects of algae inclusion on growth rates and product quality in livestock and aquaculture. The sector’s growth aligns with broader trends in sustainable food systems and animal nutrition.

Market Trends

Expansion of Algae-Based Functional Foods and Nutraceuticals

Manufacturers embrace algae’s nutritional profile by developing a wide range of functional foods and nutraceuticals. The Algae Market trends toward innovative product launches, including protein-rich powders, plant-based omega-3 supplements, and algae-infused beverages. Brands market these offerings for their health benefits, emphasizing clean-label attributes and natural ingredients. It aligns with consumer demand for sustainable and plant-derived nutrition while supporting dietary trends such as veganism and flexitarianism. Companies highlight the superior digestibility and bioavailability of algae nutrients to differentiate their products. Partnerships between food producers and biotechnology firms accelerate research and commercialization of new algae-based ingredients.

- For instance, algae-infused components are among the few plant-based sources of omega-3 fatty acids, potent antioxidants, and proteins, making them valuable for addressing various health concerns.

Integration of Algae in Sustainable Biofuel Production

Biofuel producers prioritize algae due to its high lipid content and ability to grow in diverse environments. The Algae Market trends toward large-scale investment in algae-derived biodiesel and bioethanol as governments enforce stricter emission standards. Industry leaders develop advanced cultivation and extraction techniques to maximize yield and reduce production costs. It supports the transition to cleaner energy sources and attracts attention from both investors and policymakers. Researchers explore novel strains and cultivation systems that further enhance energy output. The shift toward renewable energy strengthens the market’s long-term outlook and fosters ongoing technological innovation.

- For instance, the European Union has mandated that 20% of all used resources be renewable, encouraging the adoption of algae biofuels.

Growth of Algae Use in Cosmetics and Personal Care Products

Cosmetics companies incorporate algae extracts into formulations targeting hydration, anti-aging, and antioxidant benefits. The Algae Market sees rising demand for skin care, hair care, and sun protection products enriched with algae-derived compounds. Brands highlight the efficacy of marine and freshwater algae species for improving skin texture and resilience. It aligns with global preferences for natural and sustainable personal care solutions. Research collaborations focus on isolating unique bioactives that deliver specific cosmetic outcomes. Eco-conscious packaging and sourcing practices further boost algae’s appeal in the beauty sector.

Advancements in Algae-Based Animal Feed and Agriculture

Agriculture and aquaculture sectors integrate algae as a premium feed ingredient, supporting animal health and growth. The Algae Market trends toward expanded use of algae in livestock and fish feed to improve nutritional value and immune function. Companies develop specialized algae blends tailored to different animal species, responding to growing demand for antibiotic-free and sustainable feed options. It enhances feed efficiency and product quality while reducing environmental impacts. Research efforts validate the benefits of algae supplementation in animal diets, driving greater adoption across the industry. The market’s focus on sustainability and innovation positions algae as a key solution in future agricultural practices.

Market Challenges Analysis

High Production Costs and Scalability Barriers

The Algae Market faces persistent challenges related to high production costs and limited scalability of cultivation technologies. It contends with significant expenses for infrastructure, energy, and specialized inputs required for controlled growth environments. Small- and medium-scale producers struggle to compete with established agricultural commodities, hindering broad market penetration. The absence of standardized cultivation protocols often leads to inconsistent yield and quality. Investment in large-scale production facilities remains capital intensive, deterring new market entrants. Industry stakeholders focus on optimizing processes and developing cost-effective solutions to address these barriers.

Regulatory Complexity and Market Acceptance Issues

Complex regulatory landscapes and limited consumer awareness present obstacles for the Algae Market. It must comply with diverse food safety, labeling, and environmental standards across global markets, which can slow product approval and commercialization. Limited public understanding of algae’s benefits leads to cautious adoption among consumers and industries. Companies face difficulties in educating end users and differentiating algae-derived products in competitive segments. The lack of harmonized global regulations complicates export and import processes for algae products. Sustained efforts are required to build trust, streamline compliance, and foster wider market acceptance.

- For instance, the European Commission has proposed 23 targeted actions to unlock the potential of algae for the EU’s Blue Bioeconomy, addressing key challenges such as food security and climate change mitigation.

Market Opportunities

Emerging Applications in Food, Health, and Nutrition

The Algae Market presents significant opportunities in the development of innovative food, health, and nutrition products. It enables manufacturers to deliver plant-based proteins, omega-3 fatty acids, and functional ingredients that align with global wellness and dietary trends. Companies leverage algae’s versatility to create high-value supplements, snacks, and beverages targeting health-conscious consumers. The growing demand for sustainable and allergen-free ingredients opens new markets for algae-derived alternatives. Research and product development focus on enhancing taste, texture, and nutrient profiles to increase consumer appeal. Expansion into fortified foods and medical nutrition solutions offers further growth potential for industry participants.

Sustainable Solutions for Energy and Environmental Management

Algae Market participants can capitalize on the rising focus on renewable energy and environmental sustainability. It provides a scalable solution for biofuel production, carbon capture, and wastewater treatment, supporting climate and resource management goals. Governments and industries pursue algae-based initiatives to reduce carbon footprints and promote circular economy practices. Strategic investments in large-scale cultivation and bioprocessing technologies accelerate the transition to greener alternatives. The ability to integrate algae into existing agricultural and industrial systems enhances its commercial attractiveness. These opportunities position algae as a cornerstone of future sustainable development strategies across multiple sectors.

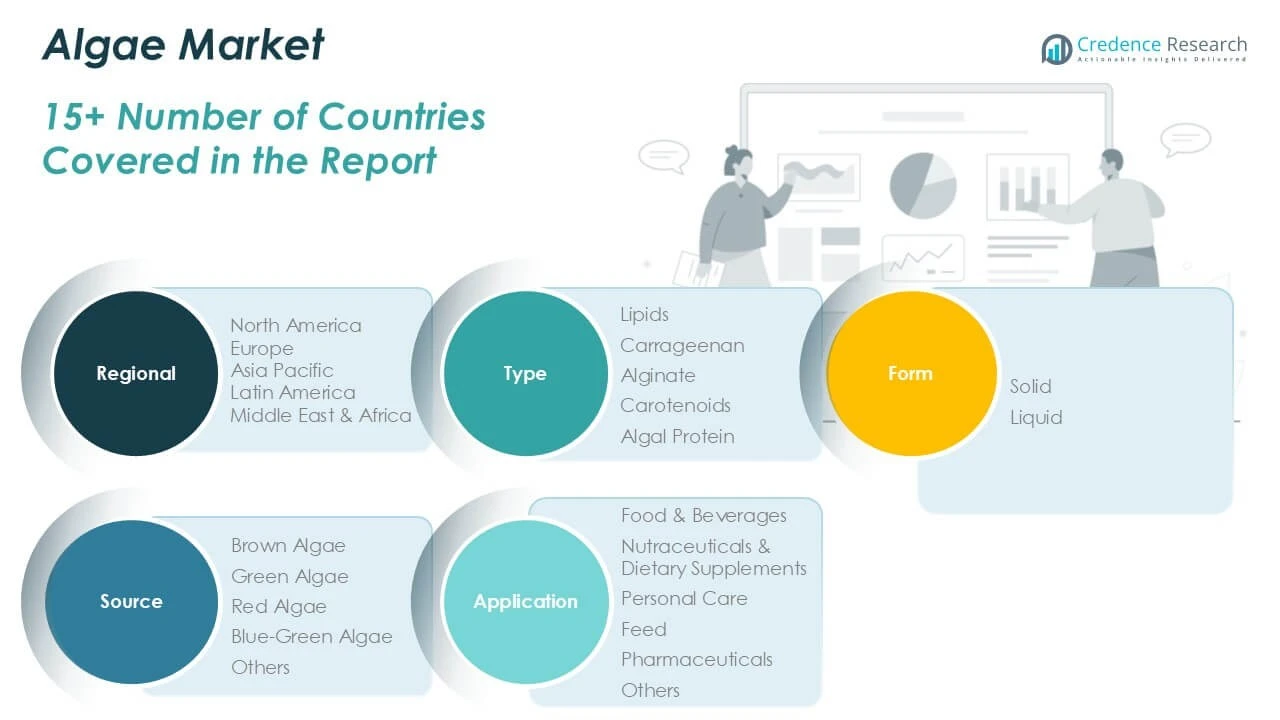

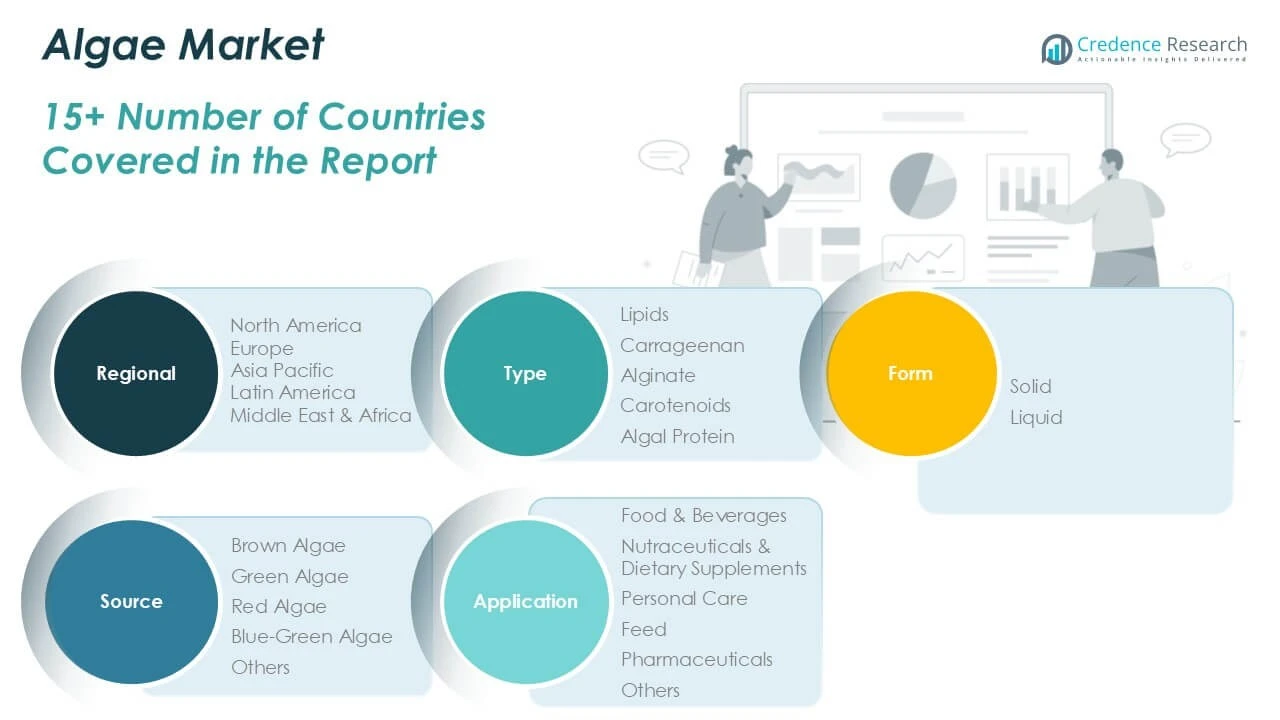

Market Segmentation Analysis:

By Type:

It features lipids, carrageenan, alginate, carotenoids, and algal protein. Lipids and carotenoids attract strong demand from dietary supplement and pharmaceutical manufacturers, who value their omega-3 content and antioxidant properties. Carrageenan and alginate, derived primarily from brown and red algae, serve as essential thickeners, stabilizers, and gelling agents in food, beverage, and personal care formulations. Algal protein appeals to plant-based nutrition markets, addressing the rising demand for clean-label and allergen-free protein alternatives.

By Form:

The Algae Market divides into solid and liquid categories. Solid algae products, such as powders, flakes, and tablets, enable easy integration into food, feed, and nutraceutical formulations. Liquid forms allow use in beverages, cosmetic serums, and liquid feed applications, supporting broader consumer reach and functional versatility. Each form aligns with specific production and end-user requirements, enabling market participants to diversify their offerings.

By Source:

The Algae Market includes brown, green, red, and blue-green algae, as well as other varieties. Brown algae excel in producing alginate and hydrocolloids for industrial and food applications. Green algae, rich in chlorophyll and nutrients, find uses in dietary supplements and animal feed. Red algae dominate the carrageenan market, serving as natural texturizers and emulsifiers. Blue-green algae, including spirulina and chlorella, supply high-value proteins and micronutrients to the wellness, food, and aquaculture industries. This detailed segmentation enables targeted innovation and enhances the market’s adaptability to evolving consumer and industrial trends.

Segments:

Based on Type:

- Lipids

- Carrageenan

- Alginate

- Carotenoids

- Algal Protein

Based on Form:

Based on Source:

- Brown Algae

- Green Algae

- Red Algae

- Blue-Green Algae

- Others

Based on Application:

- Food & Beverages

- Nutraceuticals & Dietary Supplements

- Personal Care

- Feed

- Pharmaceuticals

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Algae Market

North America Algae Market grew from USD 1,515.49 million in 2018 to USD 2,258.05 million in 2024 and is projected to reach USD 3,917.83 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.6%. North America holds a 38% market share in 2024, driven by high adoption in the United States and Canada. It benefits from established nutraceutical, food, and biofuel sectors that integrate algae-based ingredients. Leading companies invest in research to advance algae cultivation and expand into high-value product segments. The U.S. leads regional demand, supported by favorable regulatory frameworks and rising interest in sustainable protein sources. Canada contributes with innovative algae production for both human and animal nutrition, reinforcing North America’s leadership in the global market.

Europe Algae Market

Europe Algae Market expanded from USD 967.11 million in 2018 to USD 1,397.53 million in 2024 and is anticipated to reach USD 2,253.18 million by 2032, growing at a CAGR of 5.7%. Europe commands a 24% market share in 2024, with strong contributions from France, Germany, and the Netherlands. The region benefits from strict sustainability regulations and high consumer preference for natural and plant-based products. Key players leverage advanced processing technologies to offer algae in food, pharmaceuticals, and cosmetics. The market receives support from EU initiatives promoting the circular economy and sustainable aquaculture. France and Germany serve as primary hubs for algae research and commercial scale-up.

Asia Pacific Algae Market

Asia Pacific Algae Market rose from USD 1,172.47 million in 2018 to USD 1,863.36 million in 2024 and is forecast to reach USD 3,506.15 million by 2032, with the highest CAGR of 7.7%. Asia Pacific holds a 31% market share in 2024, anchored by rapid growth in China, Japan, South Korea, and India. The region capitalizes on a strong aquaculture sector and growing demand for functional foods and dietary supplements. China drives production scale and exports, while Japan and South Korea lead in high-value algae product innovation. India’s expanding nutraceuticals market presents further opportunities for algae suppliers. Regulatory reforms and government funding support industry expansion across the region.

Latin America Algae Market

Latin America Algae Market increased from USD 135.83 million in 2018 to USD 201.31 million in 2024 and is projected to reach USD 293.25 million by 2032, demonstrating a CAGR of 4.3%. Latin America accounts for a 3% market share in 2024, with Brazil and Mexico emerging as primary contributors. It benefits from rising awareness of algae’s benefits for food, feed, and aquaculture applications. Brazil invests in research and sustainable cultivation, while Mexico expands its algae production for use in dietary supplements and cosmetics. Export opportunities strengthen the region’s market position.

Middle East Algae Market

Middle East Algae Market advanced from USD 95.56 million in 2018 to USD 129.82 million in 2024 and is expected to reach USD 183.54 million by 2032, with a CAGR of 3.9%. The Middle East holds a 2% market share in 2024, led by the United Arab Emirates, Saudi Arabia, and Israel. It focuses on large-scale production for biofuel and sustainable agriculture. Water scarcity and the need for innovative agricultural inputs encourage adoption of algae-based solutions. The UAE invests in research collaborations and pilot projects to diversify its energy and food sectors. Regional governments seek to enhance food security through new algae initiatives.

Africa Algae Market

Africa Algae Market grew from USD 43.70 million in 2018 to USD 75.50 million in 2024 and is forecasted to reach USD 94.91 million by 2032, registering the lowest CAGR of 2.4%. Africa represents a 1% market share in 2024, with South Africa, Egypt, and Kenya as key countries. The market is in the early stages of development, with limited production scale but rising interest in algae as a sustainable resource. South Africa leads regional efforts with pilot projects focused on food and feed applications. Egypt explores algae for water treatment and nutritional supplements. Africa’s future growth depends on investments in infrastructure and technology transfer.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DSM

- BASF SE

- Corbion

- Cargill, Incorporated

- Cynotech Corporation

- E.I.D Parry

- International Flavors & Fragrances Inc

- Earthrise Nutritionals LLC

- CP Kelco U.S., Inc

- Algea

- ACCEL Carrageenan Corporation

- Algatechnologies Ltd

- Algenol

- Archer-Daniels-Midland Company

Competitive Analysis

The Algae Market features a competitive landscape shaped by innovation, technological advancements, and strategic collaborations among industry leaders. Key players such as DSM, BASF SE, Corbion, Cargill, Incorporated, Cynotech Corporation, E.I.D Parry, International Flavors & Fragrances Inc, Earthrise Nutritionals LLC, CP Kelco U.S., Inc, Algea, ACCEL Carrageenan Corporation, Algatechnologies Ltd, Algenol, and Archer-Daniels-Midland Company drive market momentum through their diversified product portfolios and global reach. These companies focus on developing high-value algae-based ingredients for food, nutraceutical, personal care, and biofuel applications. They invest heavily in research and development to create sustainable, efficient cultivation and processing techniques. Strategic acquisitions, joint ventures, and partnerships with biotechnology firms enable them to access new markets and expand their technological capabilities. Leading players also strengthen their supply chains and scale up production to meet rising global demand. They emphasize product quality, safety, and regulatory compliance to enhance brand reputation and customer trust. This competitive environment encourages ongoing innovation and positions these companies to capitalize on emerging opportunities in health, nutrition, and sustainability.

Recent Developments

- In October 2024, Dsm-firmenich unveiled its latest omega-3 ingredient, life’s DHA B54-0100. Each gram of life’s DHA B54-0100 delivers 545mg of DHA and 80mg of EPA, amounting to a total of 620mg of omega-3s in every serving.

- In May 2024, French startup Edonia, specializing in plant-based meat alternatives derived from microalgae, successfully raised EUR 2 million in funding from Asterion Ventures. Edonia’s offerings are designed to produce significantly lower CO2 emissions than both traditional meat and soy-based alternatives. By utilizing EU-approved microalgae such as spirulina and chlorella, the company aims to accelerate commercialization and deliver a flavorful, sustainable protein option.

- In June 2024, Brevel, Ltd., a company specializing in microalgae protein, inaugurated its first commercial facility. Spanning 27,000 square feet (approximately 2,500 square meters), this new plant is equipped to produce substantial quantities of microalgae protein powder, catering to the rapidly growing global alternative protein market. The protein produced is clean, non-GMO, and environmentally friendly, representing a significant advancement in providing a commercially viable solution for alternative protein sources.

- in June 4, 2024, Brevel announced the opening of its commercial facility in southern Israel, designed to produce hundreds of tons of neutral-tasting, highly functional algae protein. The company asserts that this product has the potential to rival pea and soy protein. This facility will produce a consistent supply of a white powdered microalgae protein concentrate containing 60-70% protein, along with various high-value co-products. Brevel’s protein offers advantages over soy and pea protein in terms of flavor and color, while also being non-allergenic and significantly more sustainable regarding water and land use, as well as carbon dioxide emissions.

- In February 2024, Cargill launched a new DHA algal oil, emphasizing its health benefits throughout all life stages, from supporting brain development in infants to aiding cognitive function in adults. Cargill highlighted that its DHA is derived from microalgae through a controlled fermentation process, positioning it as a more sustainable alternative to traditional fish oil sourcing.

Market Concentration & Characteristics

The Algae Market features a moderately concentrated landscape, with a select group of multinational corporations and specialized producers dominating global supply. It is characterized by strong research orientation, significant capital investment, and a high degree of technological innovation, especially in large-scale cultivation, extraction, and processing methods. Leading companies focus on developing differentiated products that address nutritional, pharmaceutical, and biofuel applications, while smaller players concentrate on niche segments or regional markets. The market shows a preference for sustainable production practices and clean-label ingredients, aligning with evolving consumer expectations for health and environmental responsibility. It relies on strategic partnerships, robust supply chains, and regulatory compliance to maintain quality and support market expansion. Rapid advancements in biotechnology and ongoing investment in R&D shape its competitive dynamics, fostering continual product development and enabling industry players to capture emerging growth opportunities.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Algae Market is projected to experience steady growth, driven by increasing demand for sustainable and plant-based products across various industries.

- Advancements in algae cultivation and processing technologies are expected to enhance production efficiency and product quality.

- Growing awareness of the health benefits associated with algae-based products will likely boost their adoption in the food and nutraceutical sectors.

- The biofuel industry is anticipated to increasingly incorporate algae as a renewable energy source, contributing to energy diversification efforts.

- Algae’s application in wastewater treatment and carbon capture solutions is expected to gain traction, aligning with environmental sustainability goals.

- The cosmetics and personal care industry is projected to expand its use of algae-derived ingredients, catering to consumer preferences for natural products.

- Collaborations between research institutions and industry players are likely to accelerate innovation and commercialization of algae-based solutions.

- Regulatory support and government initiatives promoting sustainable practices are expected to favor the growth of the algae sector.

- Emerging markets in Asia-Pacific and Latin America are anticipated to offer significant growth opportunities due to favorable climatic conditions and increasing industrial applications.

- Continued investment in research and development is essential to overcome existing challenges and unlock the full potential of algae across diverse applications.