Market Overview

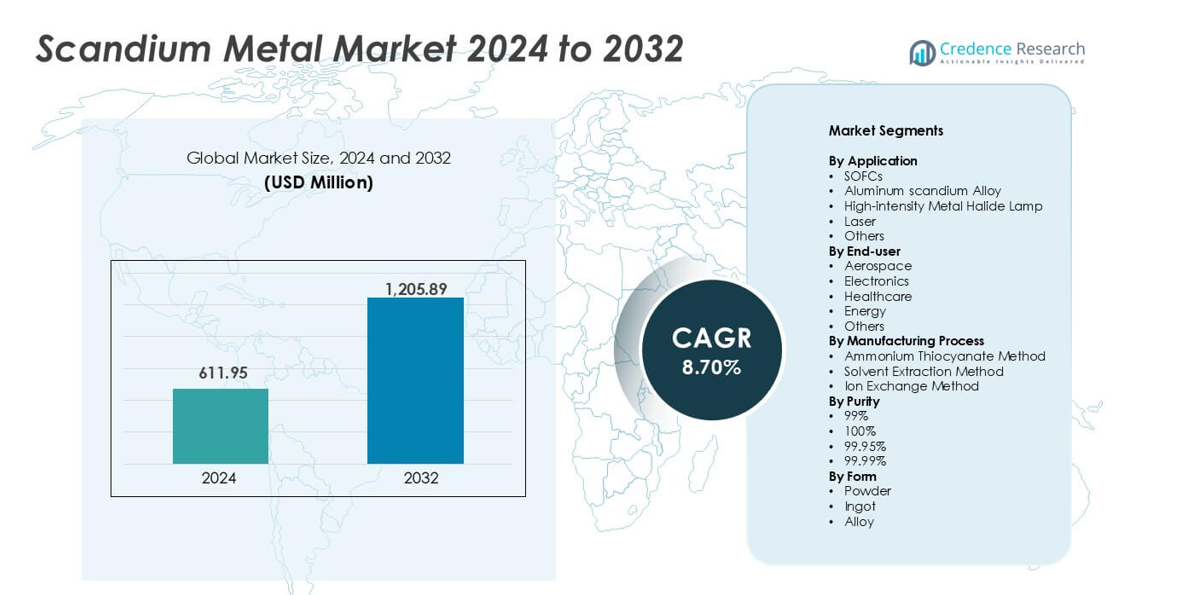

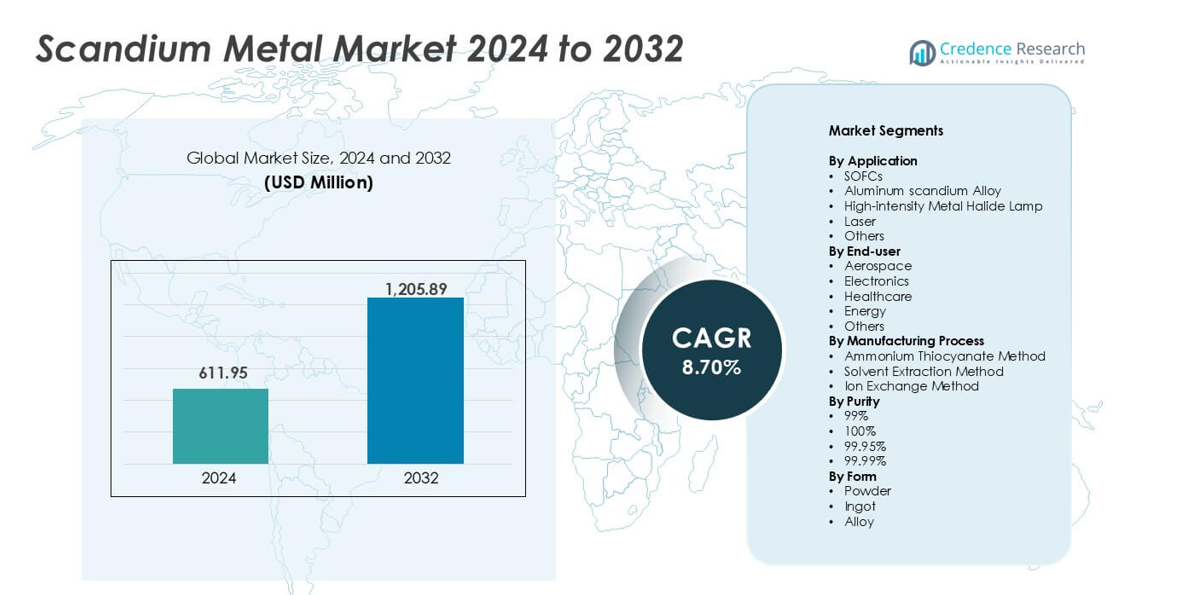

The global demand for the Scandium Metal Market was valued at USD 611.95 Million in 2024 is expected to reach USD 1,205.89 Million in 2032 growing at a CAGR of 8.70% between 2025 and 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Scandium Metal Market Size 2024 |

USD 611.95 Million |

| Scandium Metal Market, CAGR |

8.70% |

| Scandium Metal Market Size 2032 |

USD 1,205.89 Million |

The scandium metal market is shaped by major players such as Thermo Fisher Scientific (Alfa Aesar), Hunan Oriental Scandium, Rare Element Resources, Xi’an Zhiyue Material Tech, China Minmetals, Scandium International Mining, NioCorp Development, Stanford Advanced Materials, Rio Tinto, Sumitomo Metal Mining, and RusAL. These companies focus on high-purity production, advanced extraction processes, and long-term supply partnerships with aerospace and energy manufacturers. North America leads the market with 35% share due to strong aerospace demand, followed by Asia Pacific at 30% driven by alloy and electronics growth, while Europe holds 28% supported by advanced manufacturing and clean-energy programs.

Market Insights

- The scandium metal market reached USD 611.95 million in 2024 and is expected to hit USD 1,205.89 million by 2032, registering a CAGR of 8.70%.

- Rising demand for lightweight and high-strength alloys in aerospace and SOFC applications drives strong adoption, with SOFCs leading applications at about 42% share.

- Key trends include wider use of aluminum-scandium alloys in next-generation aircraft and expanding investment in advanced extraction technologies that improve purity and recovery rates.

- Competition intensifies as major players expand mining projects and refine processing methods, while high production costs and limited global supply remain major restraints.

- North America leads with 35% share, followed by Asia Pacific at 30% and Europe at 28%, while aerospace dominates end-user demand with nearly 48% share due to its focus on durable and lightweight materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

SOFCs hold the largest share in the scandium metal market, accounting for about 42% due to rising demand for high-efficiency power systems. This dominance grows as fuel-cell manufacturers use scandium to improve ionic conductivity and boost long-term stability. Aluminum-scandium alloys follow with strong uptake in lightweight components for transport projects. High-intensity metal halide lamps, lasers, and other uses add steady demand from niche industries. Growth across these applications stems from expanding clean-energy adoption and clearer performance gains when scandium enhances strength and heat resistance.

- For instance, Bloom Energy’s SOFC units operate at operating temperatures above 800°C and deliver modular outputs of up to 200 kW, supported by scandium-stabilized electrolytes that raise durability.

By End-user

Aerospace leads the market with nearly 48% share because aircraft builders use scandium-based alloys to reduce weight and improve fatigue resistance. Major jet programs increase consumption as lighter structures help cut fuel use. Electronics follows as manufacturers adopt scandium for advanced lighting, high-performance sensors, and solid-oxide fuel-cell systems. Healthcare and energy add emerging demand from imaging tools and next-generation clean-power devices. Other end users use scandium for specialty components where durability and heat stability remain essential.

- For instance, Airbus’ APWorks Scalmalloy shows a measured tensile strength of 520 MPa and a yield strength of 480 MPa, enabling lighter airframe and component designs.

By Manufacturing Process

The solvent extraction method dominates with around 55% share due to its higher recovery rate and suitability for large-scale production. Producers favor this technique because it delivers consistent purity and supports stable output for alloy and SOFC applications. The ion-exchange method captures rising interest for precision extraction from complex ores. The ammonium thiocyanate method holds a smaller share as its use fits-controlled lab-scale or specialty output. Growing demand for purer scandium supplies encourages process upgrades and investment in more efficient extraction routes.

Key Growth Drivers

Growing Demand for Lightweight and High-Strength Materials

Aircraft and automotive programs drive strong demand for scandium metal because producers need lighter and stronger alloys to meet efficiency standards. Aerospace manufacturers use aluminum-scandium alloys to improve fatigue resistance, reduce structural weight, and support next-generation aircraft designs. Automotive companies explore these alloys for battery enclosures, body structures, and performance components that improve range in electric vehicles. This shift accelerates as producers seek materials that enhance durability without adding mass. Rising investments in sustainable mobility, fuel-efficient fleets, and composite-metal hybrid structures continue to support wider scandium adoption across major transportation platforms.

- For instance, APWorks’ Scalmalloy delivers a tensile strength of 520 MPa and supports 3D-printed aircraft brackets that weigh up to 30% less than conventional aluminum parts.

Expansion of Solid Oxide Fuel Cell (SOFC) Deployment

SOFC manufacturers rely on scandium to improve ionic conductivity and long-term stability in electrolytes, which helps fuel cells run more efficiently at lower temperatures. Industrial users expand SOFC installations to support decentralized power, data-center backup systems, and clean hydrogen programs. Growth in off-grid energy solutions also increases scandium consumption because operators seek reliable and compact power units. Government incentives for clean-energy projects and rising corporate interest in low-carbon operations strengthen this trend. These factors position scandium as a critical material for advanced fuel-cell platforms that require stronger thermal performance and longer operational lifespans.

- For instance, Bloom Energy’s SOFC modules operate at temperatures near 800°C and deliver continuous outputs of up to 100 kW, supported by scandium-stabilized electrolytes that maintain long-term performance.

Rising Investment in High-Performance Electronic and Optical Devices

Electronics and lighting manufacturers adopt scandium for high-intensity metal halide lamps, advanced lasers, and high-resolution sensors. These applications benefit from scandium’s ability to deliver better light quality, improved beam uniformity, and enhanced thermal durability. Semiconductor developers study scandium alloys for potential use in next-generation chips and specialized power devices. Demand increases as industrial automation, medical imaging, and precision manufacturing expand across global markets. Continuous R&D spending in photonics and optical engineering also drives new uses for scandium compounds, encouraging suppliers to improve purity levels and secure more stable production pipelines for these fast-growing sectors.

Key Trends & Opportunities

Advances in Scandium-Aluminum Alloy Commercialization

Manufacturers expand production of aluminum-scandium alloys for aerospace, mobility, and defense programs as research validates their superior strength-to-weight performance. More foundries and metal producers experiment with scalable alloying techniques that reduce production costs and improve weldability. As fabrication methods advance, these alloys move from niche applications to broader structural use in aircraft frames, EV components, and marine vessels. This shift creates strong opportunities for material suppliers who can deliver consistent, high-purity scandium output. The trend supports a wider push toward lightweight engineering across global transport systems seeking improved energy efficiency.

- For instance, Rusal’s scandium-aluminum alloy “RS400” shows a measured yield strength of 390 MPa with weld-integrity retention verified in large-panel aerospace

Emergence of New Extraction and Processing Technologies

Producers invest in more efficient extraction routes, including ion-exchange systems, advanced solvent-extraction stages, and modular refining units built near resource sites. These upgrades create opportunities for lower-cost production and improved metal purity, which benefits SOFC makers and alloy manufacturers. Mining companies test scandium recovery from red-mud waste, nickel laterites, and titanium production streams, which could expand global supply without opening new mines. These efforts attract strategic partnerships between miners, technology developers, and aerospace material suppliers. The trend reduces supply risk and supports long-term market growth.

- For instance, Rio Tinto’s plant in Quebec recovers scandium from titanium-dioxide waste and delivers annual output of up to 3 tonnes of high-purity scandium oxide using proprietary extraction stages.

Key Challenges

Limited Availability and Supply Concentration

Scandium production remains constrained because only a few countries operate consistent extraction or refining facilities. Many deposits remain underdeveloped, and producers rely on by-product recovery from nickel or titanium operations, which limits the reliability of output. Supply concentration increases price volatility and disrupts contract planning for alloy manufacturers and SOFC developers. New projects face lengthy permitting timelines and high capital needs, creating a barrier for market expansion. This challenge limits large-scale adoption, especially in sectors that require stable long-term supply for commercial manufacturing.

High Production Costs and Technical Barriers

Extraction and purification processes remain expensive because scandium occurs in low concentrations and requires complex processing steps to achieve required purity levels. These costs affect downstream prices for alloys, fuel-cell components, and optical materials, slowing broader industrial uptake. Many potential users hesitate to shift to scandium-enhanced products due to the high cost of qualification and testing. Technical challenges in scaling new extraction technologies also restrict commercial supply. Until producers reduce operational costs through process innovation or resource diversification, affordability will remain a major restraint on global market growth.

Regional Analysis

North America

North America holds about 35% share of the scandium metal market, driven by advanced aerospace programs and strong SOFC development activity in the U.S. Aircraft manufacturers use aluminum-scandium alloys to meet lightweight design needs, while energy companies adopt scandium-supported fuel-cell systems for clean power projects. The region benefits from ongoing research partnerships that support improved extraction technologies and higher-purity output. Canada contributes steady demand through mining initiatives that explore scandium recovery from critical mineral deposits. Growing investment in next-generation mobility and defense platforms continues to support North America’s leadership position.

Europe

Europe accounts for nearly 28% share due to strong adoption across aerospace, defense, and high-performance electronics. Leading aircraft manufacturers increase scandium use in lightweight alloys to reduce emissions and strengthen structural durability. The region invests in innovation for fuel-cell systems, advanced optical devices, and alloy development. Rising sustainability targets and the shift toward low-carbon manufacturing support wider uptake. Countries such as Germany and France lead consumption due to strong industrial bases and ongoing R&D programs. Scandium recovery from industrial waste streams also enhances long-term supply potential.

Asia Pacific

Asia Pacific holds about 30% share and represents the fastest-growing regional market. China drives demand through expanding electronics, lighting, and alloy production, supported by large-scale industrial capacity. Japan and South Korea invest in SOFC technologies and precision equipment that rely on scandium for better performance and stability. Australia strengthens supply prospects through emerging scandium mining projects designed to support global production. Growth rises as regional manufacturers increase adoption in transportation, industrial automation, and clean-energy systems. Rising investment in advanced materials and expanding industrial activity reinforce Asia Pacific’s rapid growth.

Latin America

Latin America holds roughly 4% share, supported by emerging demand in aerospace maintenance, specialty alloys, and industrial lighting applications. Brazil leads the region due to its growing aerospace manufacturing base and interest in lightweight metal development. Mining activities across selected countries present long-term opportunities for scandium recovery from nickel and titanium operations. Adoption rises as manufacturers explore high-strength alloys for industrial equipment and energy systems. While still developing, the region shows steady progress due to rising material innovation and improving technical collaboration with global suppliers.

Market Segmentations:

By Application

- SOFCs

- Aluminum scandium Alloy

- High-intensity Metal Halide Lamp

- Laser

- Others

By End-user

- Aerospace

- Electronics

- Healthcare

- Energy

- Others

By Manufacturing Process

- Ammonium Thiocyanate Method

- Solvent Extraction Method

- Ion Exchange Method

By Purity

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the scandium metal market features a mix of mining companies, specialty material producers, and technology developers that focus on scalable extraction and high-purity output. Leading players expand supply through new mining projects, advanced recovery methods, and partnerships with aerospace and fuel-cell manufacturers. Companies strengthen their position by improving alloy quality, lowering production costs, and securing long-term offtake agreements with major industrial users. Producers also invest in R&D to enhance solvent-extraction and ion-exchange technologies, which helps improve efficiency and purity levels. Global suppliers target key sectors such as aerospace, electronics, and energy, where demand for scandium-supported materials continues to rise. Strategic mergers, exploration programs, and pilot-scale production sites support market expansion and reduce supply constraints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific Inc. (Alfa Aesar)

- Hunan Oriental Scandium Co., Ltd.

- Rare Element Resources Ltd.

- Xi’an Zhiyue Material Tech. Co., Ltd.

- China Minmetals Corporation

- Scandium International Mining Corporation

- NioCorp Development Ltd.

- Stanford Advanced Materials

- Rio Tinto

- Sumitomo Metal Mining Co., Ltd.

- RusAL

Recent Developments

- In October 2025, Scandium International Mining Corp. was granted a new 21-year mining lease for its Nyngan Scandium Project in New South Wales, Australia, moving the project toward construction and future production.

- In 2025, Rio Tinto announced a major capacity expansion at its Sorel-Tracy, Quebec facility with support from the Canada Growth Fund, increasing nameplate scandium oxide capacity to 9 tonnes/year. The U.S. Department of Defense is seeking to purchase up to $40 million of scandium oxide from Rio Tinto over the next five years, highlighting strategic supply alignment for North America.

- In December 2023, Hunan Oriental Scandium has an annual production capacity of 4 tons of metallic scandium and 300 tons each for aluminum-scandium alloy and scandium-containing alloy wire for 3D printing.

Report Coverage

The research report offers an in-depth analysis based on Application, End-user, Manufacturing Process, Purity, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as aerospace programs increase adoption of lightweight scandium-aluminum alloys.

- SOFC deployment will expand usage because manufacturers need higher efficiency and longer operating life.

- New extraction technologies will boost supply stability and support wider commercial adoption.

- Mining of scandium from waste streams and by-product sources will gain stronger investment.

- Electronics and optical device makers will increase demand for high-purity scandium compounds.

- Partnerships between miners and alloy producers will strengthen long-term supply chains.

- More countries will classify scandium as a strategic material, driving policy support.

- Declining processing costs will encourage broader use in transportation and energy sectors.

- Asia Pacific will gain stronger market presence through rapid industrial growth and new projects.

- Continuous R&D will create new applications in advanced manufacturing and clean-energy systems.