| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roof Bolters Market Size 2024 |

USD 3,092.53 million |

| Roof Bolters Market, CAGR |

4.78% |

| Roof Bolters Market Size 2032 |

USD 4,481.95 million |

Market Overview:

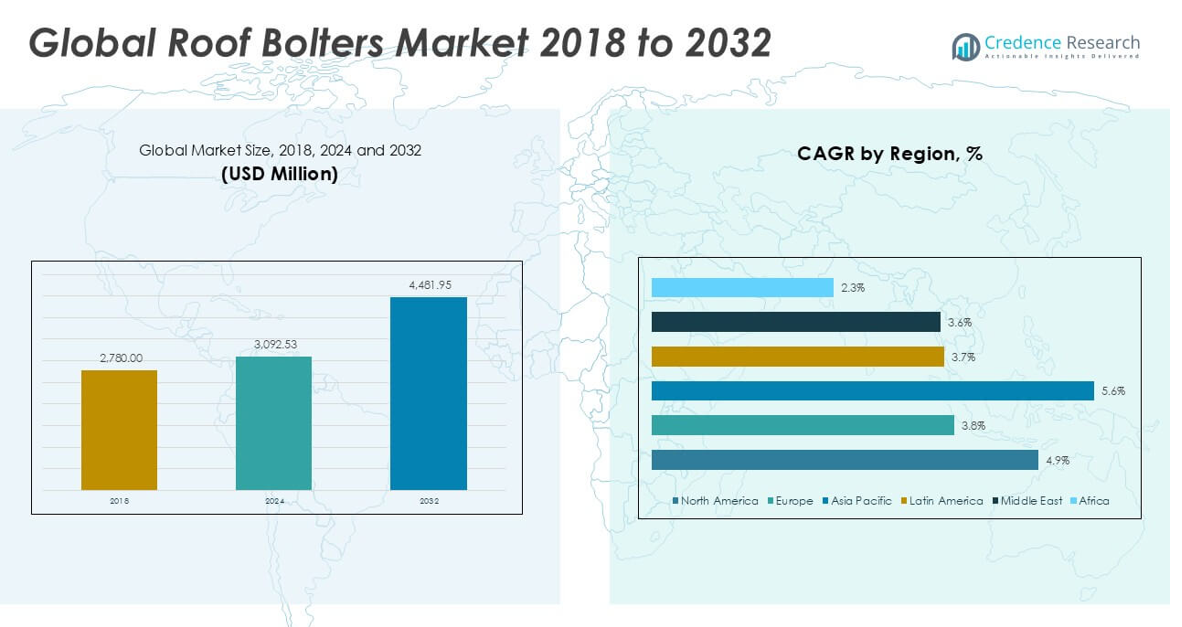

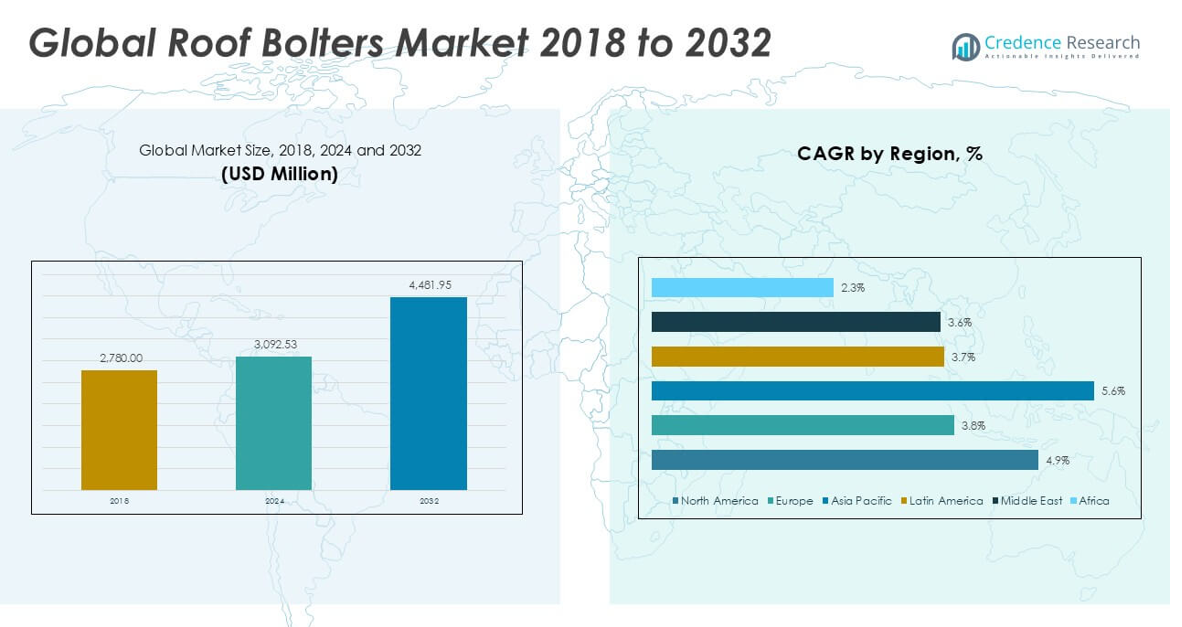

The Roof Bolters market size was valued at USD 2,780.00 million in 2018, reached USD 3,092.53 million in 2024, and is anticipated to reach USD 4,481.95 million by 2032, at a CAGR of 4.78% during the forecast period.

The Roof Bolters market is driven by key players such as Caterpillar, J.H. Fletcher, Eaton, MacLean Engineering, Quarry Mining, Atlas Copco (Epiroc), Shaanxi Zhongtuo Mine Equipment, Komatsu Mining, Sandvik, and Rambor. These companies focus on product innovation, automation, and global expansion to strengthen their market positions. Asia Pacific leads the global Roof Bolters market, accounting for approximately 37.7% of the total market share in 2024, fueled by rising underground mining activities and rapid infrastructure development in countries like China, India, and Australia. North America and Europe follow, driven by stringent safety regulations and established mining operations. Continuous technological advancements and increasing emphasis on worker safety remain the key strategies adopted by market leaders to maintain their competitive advantage.

Market Insights

- The Roof Bolters market was valued at USD 2,780.00 million in 2018, reached USD 3,092.53 million in 2024, and is projected to reach USD 4,481.95 million by 2032, growing at a CAGR of 4.78% during the forecast period.

- Growing underground mining activities and strict worker safety regulations are major drivers boosting the demand for roof bolting equipment across global markets.

- The market is witnessing trends such as increasing adoption of automated and remote-controlled roof bolters, along with expanding applications in tunnels, underground power plants, and storage facilities.

- Key players like Caterpillar, J.H. Fletcher, and Atlas Copco (Epiroc) dominate the competitive landscape by focusing on technological advancements, while small regional players contribute to price competition.

- Asia Pacific holds the largest regional share at 37.7%, followed by North America at 29.7%, with the Track Carried Roof Bolters segment leading in type due to higher efficiency and demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Roof Bolters market, when segmented by type, is primarily divided into Hand Held Roof Bolters and Track Carried Roof Bolters. Among these, Track Carried Roof Bolters dominate the market, accounting for the largest revenue share in 2024. This dominance is driven by their superior operational efficiency, higher drilling capacity, and enhanced safety features, which make them the preferred choice for large-scale underground operations. The increasing demand for mechanized mining equipment and the growing focus on worker safety further support the growth of this sub-segment.

- For instance, Sandvik’s DS411 track-mounted roof bolter is equipped with a 4.5-meter feed length and can install 1.8-meter bolts with a bolting speed of 12 bolts per hour, significantly improving cycle times in large underground mining sites.

By End-User:

Based on end-user segmentation, the Roof Bolters market is categorized into Mines, Tunnels, Underground Power Plants, Storage Facilities, and Others. Mines and Tunnels hold the largest market share within this segment due to the extensive use of roof bolters for ground support in mining operations. The growing demand for minerals and the rising number of underground mining projects are key drivers propelling this segment. Additionally, the emphasis on improving underground safety standards and reducing manual interventions further accelerates the adoption of roof bolters in mining and tunneling applications.

- For instance, MacLean Engineering’s RB3 Scissor Bolter is widely used in tunnel applications and can install 1.8 to 2.4-meter resin bolts with an onboard capacity of up to 600 kilograms of consumables, significantly reducing operator downtime and manual handling.

Market Overview

Increasing Demand for Underground Mining Operations

The global expansion of underground mining activities, particularly for coal, metals, and minerals, is a significant driver for the Roof Bolters market. As surface deposits deplete, mining companies are increasingly moving towards deeper underground sites, requiring robust and efficient roof bolting solutions to ensure worker safety and structural stability. This surge in underground mining projects directly boosts the demand for advanced and high-capacity roof bolters that can operate in challenging and confined environments.

- For instance, Caterpillar’s RB1200 Roof Bolter is designed for confined spaces and supports drilling at depths of up to 3.6 meters, meeting the high-capacity needs of deep underground mining operations worldwide.

Rising Emphasis on Worker Safety Regulations

Strict regulatory frameworks focusing on the safety of mine workers are propelling the adoption of roof bolters globally. Governments and safety authorities are enforcing stringent guidelines that mandate the installation of effective ground support systems in underground facilities. Roof bolters play a critical role in preventing rock falls and structural collapses, making them indispensable in meeting safety compliance. This regulatory pressure significantly accelerates the market growth as mining operators prioritize equipment that enhances workplace safety.

- For instance, Epiroc’s Boltec EC Roof Bolter integrates the Rig Control System (RCS) with operator protection cabins tested to withstand 35 joules of impact, directly addressing strict safety standards for underground equipment in compliance with ISO 3449 regulations.

Technological Advancements in Roof Bolting Equipment

Continuous advancements in roof bolting technology, such as automation, remote operation, and enhanced drilling capabilities, are key growth drivers for the market. Modern roof bolters offer improved precision, higher productivity, and reduced manual labor, addressing both safety and operational efficiency requirements. Manufacturers are focusing on developing lightweight, versatile, and easy-to-operate equipment that can function effectively in harsh underground conditions, further increasing their adoption across mining and infrastructure projects.

Key Trends & Opportunities

Integration of Automation and Remote-Controlled Systems

A major trend shaping the Roof Bolters market is the growing integration of automation and remote-controlled systems in bolting equipment. Automated roof bolters significantly minimize human exposure to hazardous underground environments, enhancing safety and operational efficiency. This shift towards automation presents a valuable opportunity for equipment manufacturers to innovate and deliver advanced, user-friendly machines that align with the evolving digital transformation of mining operations.

- For instance, J.H. Fletcher & Co. introduced the N3016-AD/E roof bolter with a fully automated drilling cycle and remote tramming capabilities, enabling operators to control the bolter from distances exceeding 15 meters, significantly reducing human exposure to high-risk zones.

Expansion into Non-Mining Underground Applications

While mining remains the primary market, there is a rising opportunity for roof bolters in other underground construction sectors, such as tunnels, power plants, and storage facilities. The growing need for infrastructure development, particularly in urban areas requiring underground solutions, expands the application scope of roof bolting equipment. This diversification provides new revenue streams for manufacturers aiming to tap into infrastructure and civil engineering projects beyond traditional mining.

- For instance, Quarry Mining’s QRS Roof Bolter is extensively used in tunnel construction projects, with a modular design supporting bolt lengths up to 3.6 meters and dual-bolt installation heads that improve efficiency in large-scale infrastructure applications like metro systems and underground storage development.

Key Challenges

High Initial Investment and Maintenance Costs

One of the key challenges limiting the widespread adoption of roof bolters is their high initial purchase and maintenance costs. Small and medium-sized mining operations often face budget constraints that prevent them from investing in technologically advanced equipment. Additionally, ongoing maintenance requirements and the need for skilled operators further escalate the total cost of ownership, posing a financial burden for cost-sensitive end-users.

Operational Challenges in Harsh Underground Conditions

Roof bolters must perform reliably in harsh and unpredictable underground conditions, which presents considerable operational challenges. Factors such as limited space, difficult geological formations, and equipment wear can affect machine performance and increase downtime. These operational hurdles require manufacturers to design more durable and adaptable equipment, but achieving this balance between resilience and cost remains a persistent challenge for the industry.

Skilled Labor Shortage

The effective operation and maintenance of roof bolting equipment require highly trained personnel. However, the mining and underground construction industries are facing a global shortage of skilled labor. The lack of qualified operators and maintenance technicians can hinder equipment efficiency, increase safety risks, and slow the adoption of advanced roof bolters. Addressing this skills gap remains a crucial barrier to maximizing the potential of modern bolting technologies.

Regional Analysis

North America

In 2024, North America held a significant position in the Roof Bolters market, accounting for approximately 29.7% of the global market share, with a market size of USD 919.80 million, up from USD 837.34 million in 2018. The region is anticipated to reach USD 1,342.14 million by 2032, growing at a CAGR of 4.9% during the forecast period. Growth is primarily driven by the presence of well-established mining industries in the United States and Canada, along with stringent safety regulations that encourage the adoption of advanced roof bolting equipment.

Europe

Europe represented around 22.5% of the global market share in 2024, with a market size of USD 695.12 million, increasing from USD 653.30 million in 2018. The market is projected to reach USD 935.71 million by 2032, growing at a CAGR of 3.8%. The steady growth in the region is supported by underground mining operations in countries like Russia, Poland, and Germany, along with rising investments in tunnel construction and other infrastructure projects requiring roof bolting systems for ground support and safety assurance.

Asia Pacific

Asia Pacific dominates the Roof Bolters market with the largest share, capturing approximately 37.7% of the global market in 2024, growing from USD 1,023.04 million in 2018 to USD 1,164.61 million in 2024. The market is expected to reach USD 1,796.27 million by 2032, expanding at the fastest CAGR of 5.6%. Rapid industrialization, increasing underground mining activities, and significant infrastructure development in countries like China, India, and Australia are the primary growth drivers. The region’s focus on modernizing mining equipment and enhancing worker safety further supports market expansion.

Latin America

In 2024, Latin America accounted for approximately 4.8% of the global Roof Bolters market share, with a market size of USD 149.34 million, up from USD 135.94 million in 2018. The market is projected to reach USD 198.42 million by 2032, growing at a CAGR of 3.7%. The growth in this region is mainly fueled by the expansion of mining activities in countries such as Chile, Peru, and Brazil, where the demand for reliable ground support systems is rising alongside investments in mineral exploration and underground construction projects.

Middle East

The Middle East held a modest 3.4% share of the global Roof Bolters market in 2024, with a market size of USD 106.98 million, growing from USD 102.86 million in 2018. The market is expected to reach USD 141.60 million by 2032, at a CAGR of 3.6%. Growth in the region is driven by infrastructure projects such as tunnels and underground storage facilities, particularly in countries like Saudi Arabia and the UAE. Although mining activities are limited compared to other regions, the ongoing development of underground facilities sustains market demand.

Africa

Africa represented the smallest share of the Roof Bolters market, capturing approximately 1.8% of the global market in 2024, with a market size of USD 56.69 million, up from USD 27.52 million in 2018. The market is projected to reach USD 67.81 million by 2032, registering a CAGR of 2.3%. Growth remains slow due to limited adoption of advanced mining equipment and infrastructural challenges. However, increasing investments in the mining sector, especially in South Africa and surrounding regions, present potential opportunities for gradual market expansion over the forecast period.

Market Segmentations:

By Type

- Hand Held Roof Bolters

- Track Carried Roof Bolters

By End-User

- Mines, Tunnels

- Underground Power Plants

- Storage Facilities

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Roof Bolters market is characterized by the presence of several well-established players and a moderate level of market consolidation. Key companies such as Caterpillar, J.H. Fletcher, Eaton, MacLean Engineering, Quarry Mining, and Atlas Copco (Epiroc) lead the market with strong global distribution networks, advanced product portfolios, and continuous technological innovations. These players focus on enhancing equipment safety, automation, and operational efficiency to maintain their competitive edge. Companies are increasingly investing in research and development to introduce lightweight, energy-efficient, and remotely operated roof bolters that align with evolving industry standards and safety regulations. Strategic collaborations, mergers, and acquisitions are common as manufacturers aim to expand their geographic presence and strengthen their service capabilities. Additionally, regional players, particularly in Asia Pacific and Latin America, offer cost-competitive solutions, intensifying price competition. The competitive landscape is also shaped by the growing demand for customized equipment that can address specific underground mining and construction needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- H. Fletcher

- Eaton

- MacLean Engineering

- Quarry Mining

- Atlas Copco (Epiroc)

- Shaanxi Zhongtuo Mine Equipment

- Komatsu Mining

- Sandvik

- Rambor

Recent Developments

- In June 2024, Komatsu introduced the second generation of its Z2 product line for drill and bolting equipment, marking a significant step in underground mining technology.

- In May 2025, Caterpillar’s 2024 Annual and Sustainability Reports, released in May 2025, highlight ongoing investments in innovation, sustainability, and safety across all business segments, including underground mining equipment such as roof bolters.

Market Concentration & Characteristics

The Roof Bolters Market shows moderate concentration with several key global players holding significant shares, while regional manufacturers continue to provide competitive pressure. It features a balance between established brands and smaller companies offering cost-effective solutions, particularly in price-sensitive regions. The market demonstrates steady demand driven by safety regulations, the growth of underground mining, and infrastructure development. Product differentiation relies on technological advancements, including automation, remote-control capabilities, and improved safety features. Companies actively pursue innovation to strengthen their positions and meet evolving operational requirements in confined underground spaces. Competitive pricing, customization options, and after-sales services are essential factors influencing buyer decisions. The market remains highly responsive to regulatory changes and shifts in mining practices. It benefits from the increasing need for equipment that enhances worker safety and operational efficiency. Regional demand varies, with Asia Pacific holding the largest share due to rapid industrial growth and expansion of mining activities in countries like China and India.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Roof Bolters market is expected to witness steady growth driven by the increasing demand for underground mining operations worldwide.

- Advancements in automation and remote-controlled equipment will play a key role in shaping future product development.

- Companies will focus on enhancing safety features to meet strict regulatory standards and improve worker protection.

- The demand for track carried roof bolters will continue to rise due to their higher efficiency and suitability for large-scale operations.

- Asia Pacific will remain the leading regional market, supported by rapid industrialization and expanding mining projects.

- North America and Europe will sustain stable growth, driven by technological upgrades and replacement of outdated equipment.

- Emerging markets in Latin America and Africa will offer growth opportunities as mining investments increase in these regions.

- Competitive pricing and the availability of cost-effective regional alternatives will intensify price-based competition.

- Manufacturers will prioritize energy-efficient and low-maintenance equipment to address rising operational cost concerns.

- Customization and equipment versatility will gain importance to meet diverse underground application requirements.