Market Overview

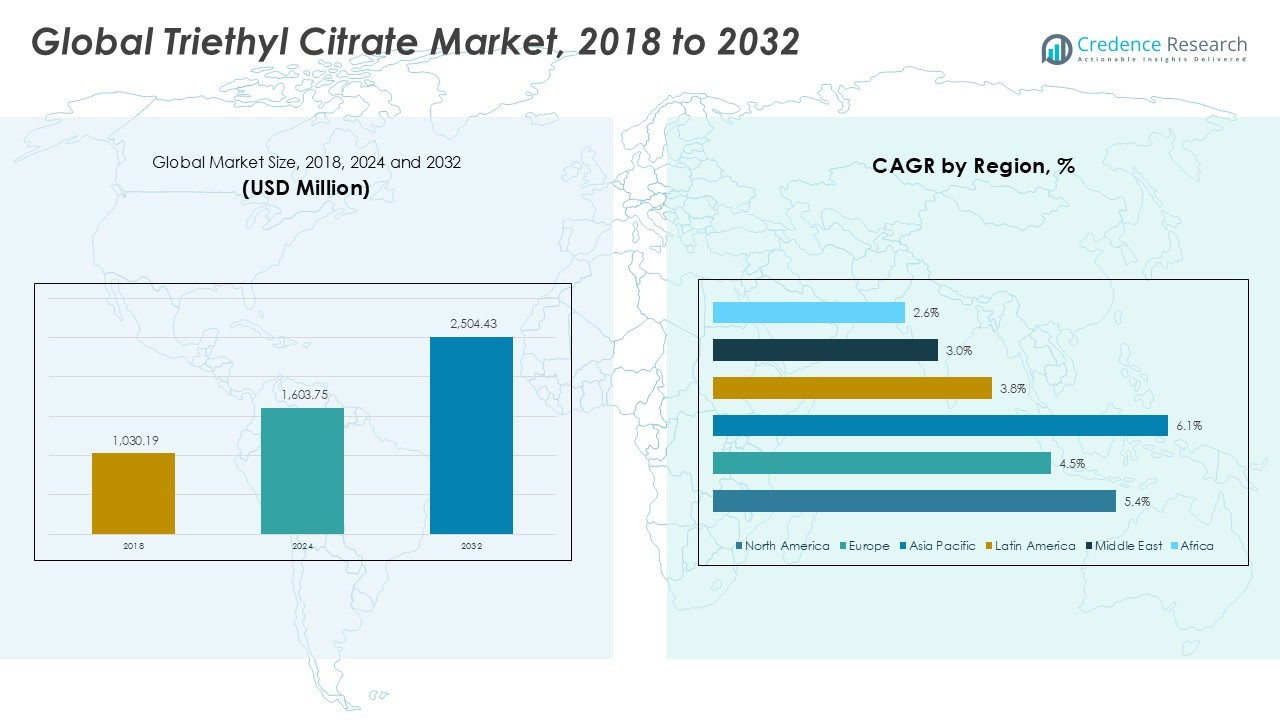

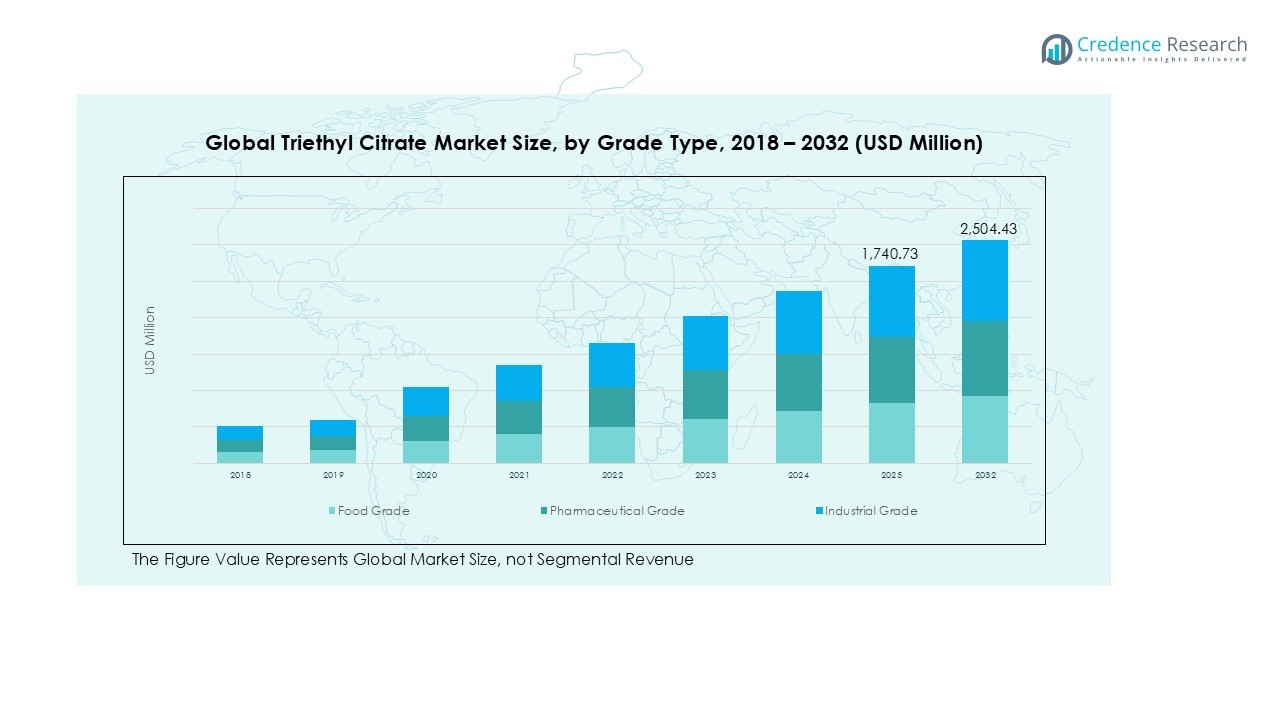

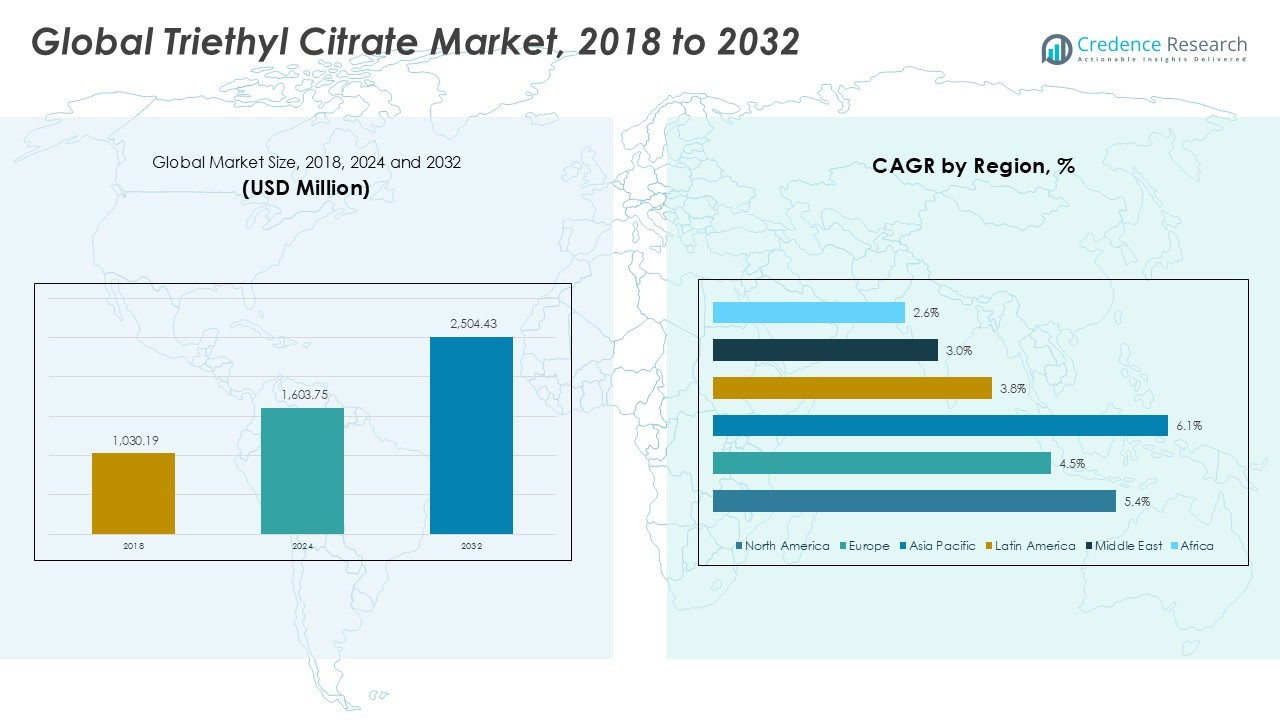

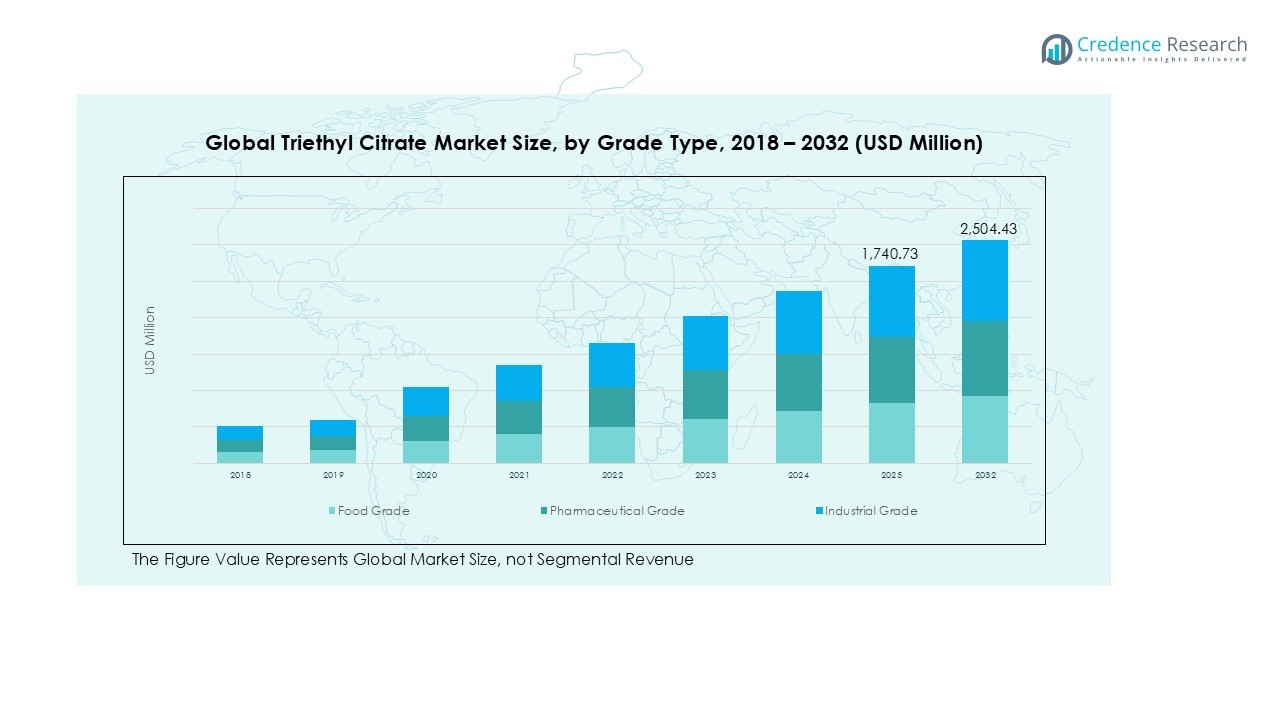

The Triethyl Citrate market size was valued at USD 1,030.19 million in 2018 and grew to USD 1,603.75 million in 2024. It is anticipated to reach USD 2,504.43 million by 2032, growing at a CAGR of 5.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Triethyl Citrate Market Size 2024 |

USD 1,603.75 Million |

| Triethyl Citrate Market, CAGR |

5.33% |

| Triethyl Citrate Market Size 2032 |

USD 2,504.43 Million |

The Triethyl Citrate market is led by key players including Jungbunzlauer Suisse AG, Merck KGaA, Vertellus LLC, Shandong Kunda Biotechnology, Zhengzhou Meiya Chemical, Fuso Chemical Industrial Co., Ltd., and Anhui Leafchem Co., Ltd. These companies drive growth through product innovation, strategic partnerships, and expansion into high-demand regions. Asia Pacific emerges as the leading region, accounting for approximately 45% of the global market share in 2024, driven by rising pharmaceutical production, expanding food and beverage consumption, and growing personal care demand. Europe follows with a 27% share, supported by strict regulatory standards and sustainability initiatives, while North America holds 18%, fueled by pharmaceutical and industrial applications. The strategic focus of top players on eco-friendly solutions and regulatory compliance across these regions reinforces their market leadership and positions them for continued growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Triethyl Citrate market was valued at USD 1,603.75 million in 2024 and is projected to reach USD 2,504.43 million by 2032, growing at a CAGR of 5.33%. Food grade holds the largest share by grade type, while plasticizers lead the application segment.

- Growth is driven by rising demand in the food and beverage sector, expanding pharmaceutical applications, and the shift toward eco-friendly plasticizers in industrial and personal care products.

- Key trends include increasing adoption in personal care and cosmetics, growth in pharmaceutical tablet coatings, and innovation in solvent and industrial applications to meet sustainability and regulatory standards.

- The market is moderately competitive, dominated by players like Jungbunzlauer Suisse AG, Merck KGaA, and Vertellus LLC, focusing on product innovation, strategic partnerships, and regional expansion.

- Restraints include high production costs and complex regulatory compliance. Regionally, Asia Pacific leads with 45% share, followed by Europe at 27% and North America at 18%, with other regions collectively contributing the remainder.

Market Segmentation Analysis:

By Grade Type:

The Triethyl Citrate market is primarily segmented into Food Grade, Pharmaceutical Grade, and Industrial Grade. Food Grade dominates the segment, capturing approximately 45% of the market share, driven by its extensive use as a safe additive and preservative in processed foods and beverages. Pharmaceutical Grade follows closely, supported by rising demand for safe excipients in tablet coatings and oral formulations. Industrial Grade, while smaller in share, sees steady growth due to applications in plasticizers and solvents for specialized industrial processes. Overall, the grade segmentation is shaped by stringent safety regulations and expanding application areas.

- For instance, Jungbunzlauer supplies Food Grade Triethyl Citrate for use in bakery glazes and chewing gum, emphasizing its safety profile.

By Application:

Application-wise, Plasticizers lead the Triethyl Citrate market with a 40% share, fueled by increasing demand for phthalate-free and eco-friendly plasticizers in packaging and consumer products. Solvent applications follow, particularly in coatings, inks, and cleaning agents, supported by its non-toxic and biodegradable properties. Pharmaceutical Tablet Coating has witnessed rapid adoption, reflecting the growth in the pharmaceutical industry. Cosmetics also contribute meaningfully, as Triethyl Citrate enhances stability and skin safety in personal care formulations. Other niche applications collectively form a smaller yet growing portion of the market.

- For instance, MilliporeSigma uses Triethyl Citrate (TEC) as a plasticizer in pharmaceutical film coatings to enhance flexibility and durability while complying with FDA safety standards to prevent cracking and control drug release.

By End User Industry:

The Food & Beverages segment dominates the end-user industry category, holding around 42% of the market share, driven by rising demand for food safety and clean-label ingredients. Pharmaceuticals represent a significant sub-segment due to the increasing production of tablets and capsules requiring safe excipients. Beauty Care benefits from expanding personal care markets, using Triethyl Citrate in deodorants and cosmetics. Construction and Automotive sectors utilize it in coatings and plasticizers, though their share is comparatively modest. The market is propelled by regulatory compliance, sustainability trends, and rising consumer awareness across industries.

Key Growth Drivers

Rising Demand in Food & Beverage Industry

Triethyl Citrate’s extensive use as a safe additive and preservative in processed foods and beverages is driving market growth. The increasing focus on clean-label products and food safety standards has accelerated adoption of food-grade Triethyl Citrate. Manufacturers are integrating it to enhance shelf life, maintain product quality, and comply with regulatory norms. The growing global population and rising per capita consumption of packaged foods further amplify demand, positioning the food and beverage sector as a major driver of Triethyl Citrate market expansion.

- For instance, Citrofol® AI by Jungbunzlauer serves as a flavor carrier and processing aid, especially for dried egg white products, enhancing foam stability.

Expanding Pharmaceutical Applications

Pharmaceutical tablet coatings and excipients are increasingly leveraging Triethyl Citrate due to its non-toxic, biodegradable, and stable properties. Rising production of oral solid dosage forms and the need for patient-friendly, safe excipients have bolstered its adoption. Pharmaceutical companies prefer Triethyl Citrate for improving tablet release profiles and stability without compromising efficacy. This expanding pharmaceutical use, particularly in emerging markets with growing healthcare access, significantly contributes to market growth and solidifies the compound’s role in modern drug formulation.

- For instance, Ningbo Inno Pharmchem supplies high-quality Triethyl Citrate to enhance tablet flexibility and controlled drug release, ensuring coating integrity throughout manufacturing and transit.

Shift Towards Eco-friendly Plasticizers

Environmental regulations and consumer preference for sustainable products are driving the shift from phthalate-based plasticizers to safer alternatives such as Triethyl Citrate. Its biodegradability and low toxicity make it ideal for use in packaging, coatings, and industrial applications. Manufacturers increasingly adopt Triethyl Citrate to meet green chemistry standards, enhance product safety, and reduce environmental impact. This trend is reinforced by government regulations promoting eco-friendly materials, creating a strong growth trajectory for Triethyl Citrate in the industrial and consumer product segments.

Key Trends & Opportunities

Growth in Personal Care and Cosmetics Applications

The personal care industry is presenting a lucrative opportunity for Triethyl Citrate, particularly in deodorants, creams, and skin-care formulations. Its ability to improve stability and reduce skin irritation aligns with the demand for safe and natural ingredients. Rising consumer awareness about product safety and regulatory compliance in cosmetics is creating new avenues for market penetration. The trend of premium, health-conscious beauty products offers manufacturers an opportunity to expand the application of Triethyl Citrate in high-margin segments.

- For instance, Acme-Hardesty’s EnSense Silk TEC formulation enhances moisturization, improves product lubricity, and stabilizes perfumes in personal care formulations, benefiting both product performance and skin feel.

Increasing Pharmaceutical Tablet Production

The global rise in oral dosage formulations, particularly tablets and capsules, provides a strong growth opportunity for Triethyl Citrate as a coating agent. Its effectiveness in controlling drug release and maintaining tablet integrity positions it as a preferred choice for pharmaceutical manufacturers. This trend is driven by the expanding healthcare sector, higher disease prevalence, and growth in emerging markets. Companies investing in innovative excipient solutions can capitalize on this trend to strengthen their market presence and meet regulatory safety standards efficiently.

- For instance, Jungbunzlauer’s CITROFOL® AI grade Triethyl Citrate is used as a plasticizer in controlled-release pharmaceutical coatings, optimizing drug delivery performance.FF

Innovation in Industrial and Solvent Applications

Triethyl Citrate’s versatility as a solvent and plasticizer opens opportunities in industrial and specialty chemical applications. Its compatibility with coatings, inks, and adhesives, combined with regulatory favorability due to non-toxicity, encourages new product innovations. Emerging industries seeking sustainable and safe chemical alternatives can adopt Triethyl Citrate, enhancing its industrial footprint. Continuous innovation in formulation and process optimization provides manufacturers opportunities to differentiate products and penetrate new markets effectively.

Key Challenges

High Production Costs

Triethyl Citrate production involves complex chemical synthesis processes and strict quality controls, leading to higher manufacturing costs compared to conventional alternatives. This can limit its adoption, especially in cost-sensitive markets or industries relying on bulk materials. Companies may face challenges balancing affordability with regulatory compliance and quality standards. High raw material prices and energy-intensive processes further compound the cost issue, potentially slowing growth unless manufacturers optimize production efficiency or scale economies.

Regulatory Compliance and Safety Standards

Although Triethyl Citrate is considered safe, stringent regulatory frameworks across regions can pose challenges for market expansion. Compliance with food, pharmaceutical, and cosmetic regulations requires continuous monitoring and adaptation, which can be resource-intensive. Delays in approvals or differences in regional regulations may impact supply chain efficiency and market penetration. Manufacturers must invest in quality assurance, testing, and documentation to ensure compliance, which can increase operational complexity and affect the speed of market adoption.

Regional Analysis

North America:

North America holds a significant share of the Triethyl Citrate market, accounting for approximately 18% in 2024. The region’s market was valued at USD 191.86 million in 2018 and grew to USD 291.40 million in 2024, with projections reaching USD 458.06 million by 2032, reflecting a CAGR of 5.4%. Growth is driven by rising demand in the food, pharmaceutical, and personal care sectors, alongside stringent regulatory compliance ensuring high-quality additive use. The U.S. dominates regional consumption, supported by expanding pharmaceutical production and eco-friendly industrial applications, positioning North America as a stable and mature market.

Europe:

Europe represents a major Triethyl Citrate market, contributing roughly 27% of the global share in 2024. The market expanded from USD 293.85 million in 2018 to USD 441.04 million in 2024 and is anticipated to reach USD 648.67 million by 2032 at a CAGR of 4.5%. Strong adoption in food-grade applications, pharmaceutical tablet coatings, and cosmetics drives demand, particularly in Germany, France, and the UK. Environmental regulations and the push for phthalate-free plasticizers reinforce growth, while industrial applications maintain steady expansion. Europe continues to offer opportunities through innovation and sustainability-focused initiatives.

Asia Pacific:

Asia Pacific dominates the global Triethyl Citrate market with an estimated 45% share in 2024, reflecting robust growth across the region. Valued at USD 449.52 million in 2018, the market reached USD 725.66 million in 2024 and is projected to hit USD 1,202.43 million by 2032, growing at a CAGR of 6.1%. Expanding pharmaceutical production, rising packaged food consumption, and increasing personal care product demand drive growth. China, India, and Japan are key contributors, fueled by industrialization, regulatory compliance, and rising consumer awareness of safe and sustainable ingredients, positioning Asia Pacific as the fastest-growing regional market.

Latin America:

Latin America accounts for an estimated 5% share of the global Triethyl Citrate market in 2024. The region’s market grew from USD 49.58 million in 2018 to USD 76.24 million in 2024, with projections reaching USD 105.63 million by 2032 at a CAGR of 3.8%. Growth is primarily supported by the food and beverage sector, along with emerging pharmaceutical applications in Brazil and Argentina. Increasing urbanization, rising disposable income, and demand for safe additives in processed foods provide new opportunities. Regulatory support for sustainable and non-toxic additives further reinforces the market’s gradual expansion.

Middle East:

The Middle East holds approximately 3% of the global Triethyl Citrate market in 2024. Market valuation increased from USD 28.06 million in 2018 to USD 39.82 million in 2024, with forecasts reaching USD 52.16 million by 2032 at a CAGR of 3.0%. Growth is driven by adoption in the food, pharmaceutical, and cosmetic sectors, particularly in GCC countries and Israel. Investments in healthcare infrastructure, coupled with rising consumer demand for safe and compliant additives, support market expansion. Although smaller in size, the region offers strategic opportunities for niche and high-value applications.

Africa:

Africa contributes roughly 2% to the global Triethyl Citrate market in 2024. The market grew from USD 17.34 million in 2018 to USD 29.59 million in 2024 and is expected to reach USD 37.49 million by 2032, at a CAGR of 2.6%. Demand is primarily driven by the food and beverage and pharmaceutical sectors, with South Africa and Egypt leading regional consumption. Increasing awareness of food safety, urbanization, and gradual adoption of industrial applications support market growth. Despite slower expansion compared to other regions, Africa offers potential for niche applications and gradual penetration of eco-friendly additives.

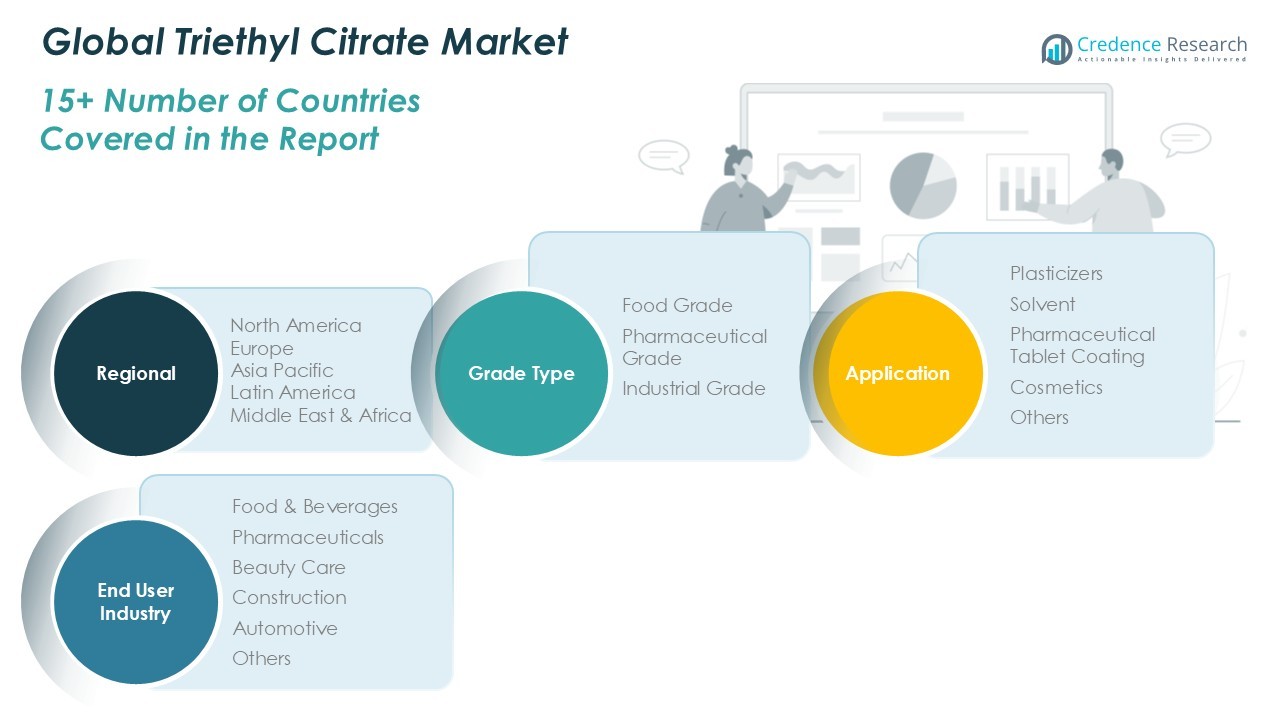

Market Segmentations:

By Grade Type:

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

By Application:

- Plasticizers

- Solvent

- Pharmaceutical Tablet Coating

- Cosmetics

- Others

By End User Industry:

- Food & Beverages

- Pharmaceuticals

- Beauty Care

- Construction

- Automotive

- Others

By Region

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Competitive Landscape

The competitive landscape of the Triethyl Citrate market includes major players such as Jungbunzlauer Suisse AG, Merck KGaA, Vertellus LLC, Shandong Kunda Biotechnology, Zhengzhou Meiya Chemical, Fuso Chemical Industrial Co., Ltd., and Anhui Leafchem Co., Ltd. These companies actively focus on product innovation, strategic partnerships, and expansion into high-growth regions to strengthen their market presence. Leading players are investing in research and development to improve product quality, diversify grade types, and enhance applications across food, pharmaceutical, and personal care industries. The market is characterized by moderate consolidation, with both global and regional players leveraging cost optimization, regulatory compliance, and sustainable production processes as key differentiators. Competitive strategies also include mergers, acquisitions, and distribution network expansion to capture emerging opportunities in Asia Pacific, North America, and Europe, ensuring steady revenue growth and long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Jungbunzlauer Suisse AG invested significantly in its production facilities for CITROFOL® AI Triethyl Citrate, focusing on ensuring supply reliability and advancing sustainable manufacturing practices.

- In January 2025, Eastman Chemical Company announced a price increase for Triacetin, a related plasticizer, reflecting ongoing adjustments in their specialty chemicals pricing strategy.

- In 2025, Jungbunzlauer Suisse AG further promoted sustainability initiatives by expanding its range of eco-friendly and biodegradable Triethyl Citrate products, meeting growing regulatory requirements and consumer demand for safe additives in food, pharmaceuticals, and personal care applications.

- In early 2025, Japanese and South Korean manufacturers introduced Triethyl Citrate-based deodorants and lotions with advanced skin-friendly profiles, incorporating up to 5% Triethyl Citrate per formulation to enhance absorption and shelf-life.

Report Coverage

The research report offers an in-depth analysis based on Grade Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for food-grade Triethyl Citrate will continue to rise due to increasing focus on clean-label and safe food products.

- Pharmaceutical applications will expand, driven by growth in tablet coatings and oral dosage formulations.

- Eco-friendly plasticizers will gain traction as industries shift away from phthalate-based alternatives.

- Personal care and cosmetic industries will increasingly adopt Triethyl Citrate for safe and stable formulations.

- Innovation in solvent and industrial applications will create new market opportunities.

- Asia Pacific will remain the fastest-growing region due to rising pharmaceutical and packaged food demand.

- Europe will focus on sustainability and regulatory compliance, strengthening market adoption.

- North America will maintain steady growth driven by industrial and pharmaceutical sectors.

- Companies will prioritize strategic partnerships, mergers, and acquisitions to enhance global presence.

- Regulatory compliance and quality standards will continue to shape market strategies and product development.