| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AC-DC Power Conversion Market Size 2024 |

USD 23,602.59 million |

| AC-DC Power Conversion Market, CAGR |

5.79% |

| AC-DC Power Conversion Market Size 2032 |

USD 38,251.69 million |

Market Overview:

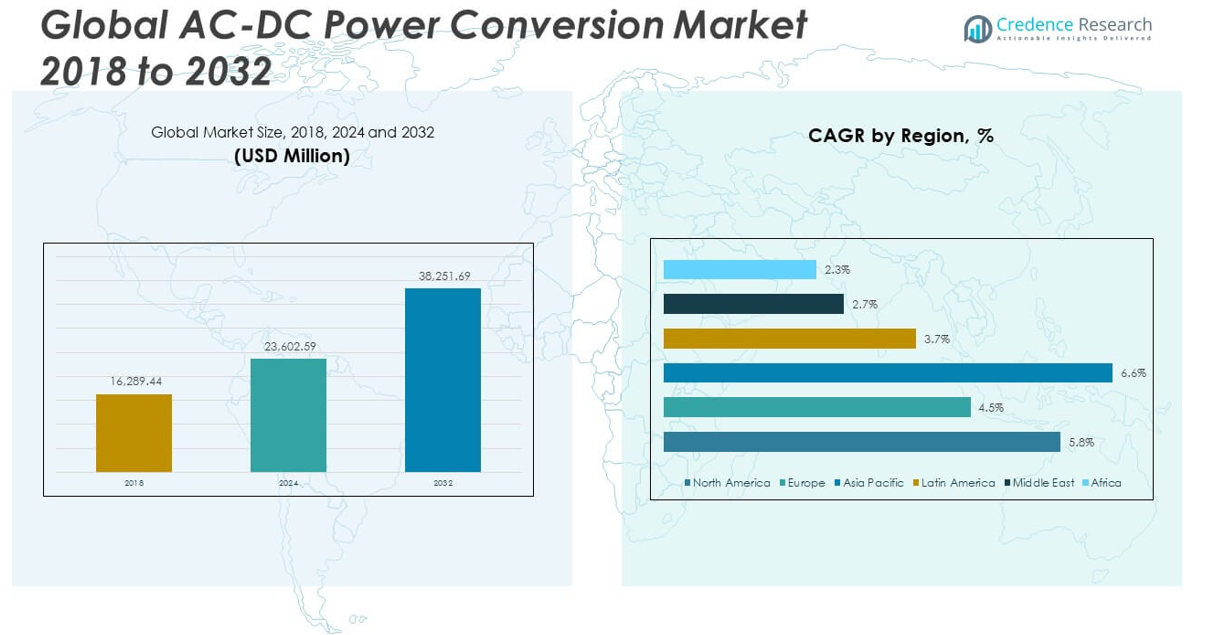

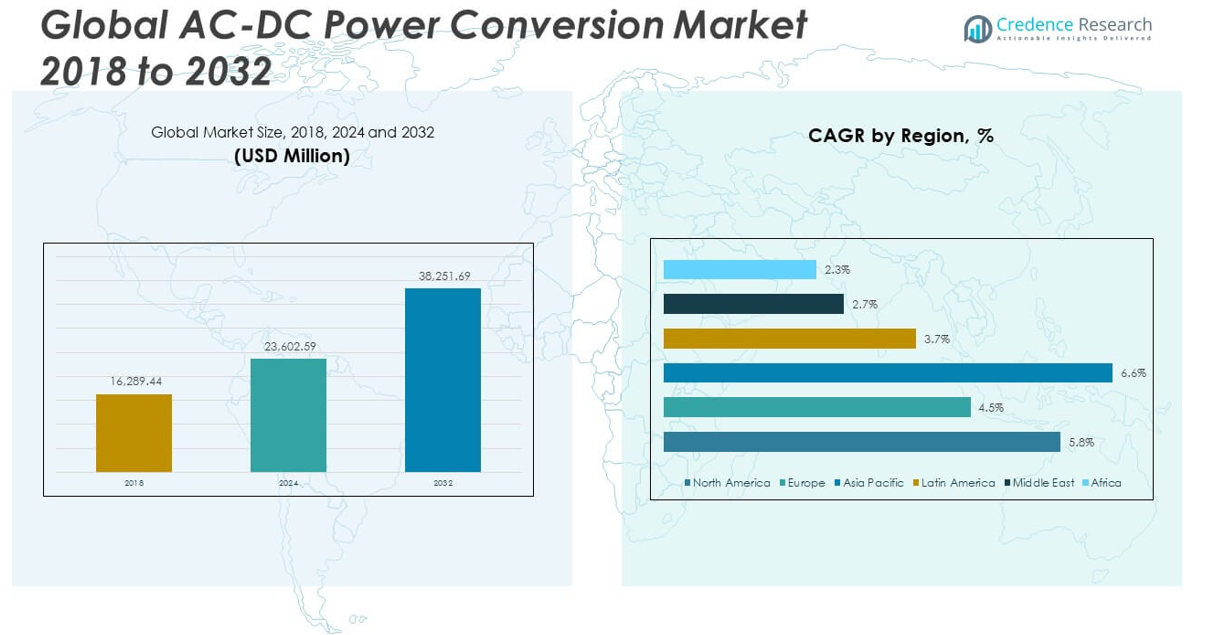

The Global AC-DC Power Conversion Market size was valued at USD 16,289.44 million in 2018 to USD 23,602.59 million in 2024 and is anticipated to reach USD 38,251.69 million by 2032, at a CAGR of 5.79% during the forecast period.

Several factors are propelling the expansion of the AC-DC power conversion market. The proliferation of consumer electronics, such as smartphones, laptops, and wearable devices, necessitates efficient power conversion to ensure optimal performance and energy efficiency. Additionally, the surge in electric vehicle (EV) adoption is significantly contributing to market growth, as EVs rely on AC-DC converters for battery charging and power management. The renewable energy sector, particularly solar and wind power, also drives demand for AC-DC converters, as these systems generate DC power that must be converted for grid integration or storage. Moreover, advancements in power electronics, including the development of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), are enhancing the efficiency and performance of AC-DC converters, further stimulating market growth.

Regionally, the Asia-Pacific (APAC) region dominates the AC-DC power conversion market. This dominance is attributed to the rapid industrialization, large-scale manufacturing capabilities, and significant investments in renewable energy infrastructure in countries like China, India, and Japan. North America and Europe also represent substantial markets, driven by technological advancements, stringent energy efficiency regulations, and the presence of key industry players. The European market is characterized by a strong emphasis on sustainability and renewable energy adoption, further propelling the demand for efficient power conversion solutions. Collectively, these regions are fostering a competitive landscape that encourages innovation and the development of advanced AC-DC power conversion technologies.

Market Insights:

- The global AC-DC power conversion market is expected to grow from USD 16,289.44 million in 2018 to USD 38,251.69 million by 2032, at a CAGR of 5.79% during the forecast period.

- Rising demand for consumer electronics, such as smartphones, laptops, and wearables, is a major driver, requiring efficient AC-DC power conversion for optimal device performance.

- The expansion of electric vehicles (EVs) significantly contributes to market growth, as these vehicles rely on AC-DC converters for battery charging and energy management.

- The growth of the renewable energy sector, particularly solar and wind power, drives demand for AC-DC converters that are essential for grid integration and energy storage.

- Technological advancements, such as the development of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), are enhancing the efficiency and performance of AC-DC converters.

- The Asia-Pacific region leads the global market due to rapid industrialization, large-scale manufacturing, and investments in renewable energy infrastructure.

- The high initial investment required for advanced power conversion systems and the complexity of meeting diverse industry standards remain significant challenges for the market’s expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Consumer Electronics

The growth of the global AC-DC power conversion market is largely driven by the rising demand for consumer electronics. Devices such as smartphones, laptops, tablets, and wearables require efficient AC-DC power conversion to operate effectively. The proliferation of these electronic devices worldwide fuels the need for robust power conversion systems. Consumer electronics are becoming an integral part of daily life, and with their increasing functionality, they require more reliable and energy-efficient power supplies. The global AC-DC power conversion market directly benefits from this trend as the need for more advanced, compact, and efficient power converters grows to meet consumer expectations.

Expansion of Electric Vehicle Adoption

The rapid adoption of electric vehicles (EVs) is another critical factor propelling the global AC-DC power conversion market. EVs rely heavily on AC-DC converters to manage battery charging systems and ensure efficient energy transfer. With growing environmental concerns and the shift towards renewable energy sources, electric vehicles are becoming more prevalent across the globe. As automakers continue to develop and improve EVs, the need for high-performance AC-DC converters that can manage high-power demands in a compact form will continue to rise. This trend is contributing significantly to the overall growth of the market, as more consumers and industries invest in electric mobility.

- For example, Tesla’s adoption of silicon carbide (SiC) power modules, supplied by STMicroelectronics, in the Model 3’s main inverter resulted in a verified 5–8% increase in inverter efficiency compared to t

- he IGBT modules used in the Model S. This improvement raised inverter efficiency from 82% to 90%, enabling a significantly longer vehicle range.

Growth in Renewable Energy Integration

The increasing global focus on renewable energy sources, such as solar and wind power, is a major driver of the AC-DC power conversion market. These renewable energy systems primarily generate DC power, which must be converted to AC for grid integration or storage. As more countries invest in renewable energy infrastructure to meet sustainability goals, the demand for efficient power conversion solutions will grow. AC-DC converters are crucial for optimizing the energy produced by solar panels, wind turbines, and other renewable sources, enabling better integration with the grid and storage systems. This trend contributes to a surge in demand for advanced, high-efficiency AC-DC power converters, ensuring the seamless integration of renewable energy into national and regional grids.

- For example, ABB supplied 95 PCS6000 medium-voltage converters to GE Renewable Energy for the Dogger Bank wind farm the world’s largest offshore wind project. Each converter is installed in a 13 MW GE Haliade-X wind turbine, with the first phase expected to generate 1.2 GW of power.

Technological Advancements in Power Electronics

Technological advancements in power electronics, such as the development of wide-bandgap semiconductors, are significantly enhancing the performance of AC-DC converters. Materials like silicon carbide (SiC) and gallium nitride (GaN) are improving the efficiency, thermal performance, and switching speeds of power conversion devices. These innovations enable AC-DC converters to operate at higher power densities and greater efficiencies, supporting the evolving requirements of industries and applications. The global AC-DC power conversion market is benefitting from these advancements, as they lead to more reliable and cost-effective power conversion solutions. Industries like telecommunications, automotive, and industrial manufacturing are increasingly adopting these advanced technologies, further driving market growth.

Market Trends:

Shift Toward Higher Efficiency and Compact Designs

The global AC-DC power conversion market is witnessing a strong trend toward higher efficiency and more compact designs in power conversion systems. As industries strive to meet stricter energy efficiency regulations and reduce operational costs, there is a growing demand for AC-DC converters that can operate with minimal energy loss. This trend is driven by the need for equipment that not only consumes less power but also takes up less space. To meet these requirements, manufacturers are focusing on improving the design of power conversion devices by integrating advanced components and using cutting-edge materials. These compact, high-efficiency power converters are being widely adopted across industries such as telecommunications, automotive, and consumer electronics, where space and energy savings are of paramount importance.

Integration of Smart Power Conversion Systems

Another key trend in the AC-DC power conversion market is the integration of smart power conversion systems. These systems leverage advanced communication protocols, sensors, and monitoring capabilities to optimize power conversion and improve system reliability. Smart AC-DC converters are capable of detecting changes in load and adjusting their output to ensure consistent and efficient power delivery. They also allow for real-time monitoring and diagnostics, enabling predictive maintenance and minimizing downtime. This integration of smart technologies is transforming the way power conversion systems are used in critical applications, such as data centers, industrial machinery, and renewable energy installations, by providing better control, enhanced efficiency, and reduced maintenance costs.

Adoption of Wide-Bandgap Semiconductors in Power Conversion Systems

Wide-bandgap semiconductors, such as silicon carbide (SiC) and gallium nitride (GaN), are gaining traction in the AC-DC power conversion market due to their superior performance characteristics compared to traditional silicon-based semiconductors. These materials enable higher switching frequencies, improved thermal management, and greater power density, which translates into more efficient and compact power converters. The adoption of wide-bandgap semiconductors is particularly evident in applications that require high-power conversion, such as electric vehicles, renewable energy systems, and industrial equipment. This trend is driving the development of next-generation AC-DC converters that can operate at higher voltages and frequencies without sacrificing efficiency or reliability.

- Infineon’s CoolSiC™ (silicon carbide) and CoolGaN™ (gallium nitride) product lines are leading examples of wide-bandgap semiconductor adoption. CoolSiC™ MOSFETs, with a 3 eV bandgap, support high-voltage (650V+) and high-frequency operations, while CoolGaN™ devices, with a 3.4 eV bandgap and superior electron mobility, enable switching frequencies and power densities unattainable with silicon. Infineon documentation details that CoolGaN at 100 V enables 40% higher power in a given form factor compared to the latest silicon technology.

Growing Demand for Energy Storage Solutions in Power Conversion

Energy storage systems are becoming an integral part of AC-DC power conversion solutions, particularly in the context of renewable energy and electric vehicles. As renewable energy generation relies on variable sources such as wind and solar, the need for efficient energy storage solutions has grown. AC-DC power converters play a crucial role in integrating these energy storage systems with the grid or vehicle power systems by ensuring seamless power flow between the storage units and the primary energy source. The increasing adoption of energy storage solutions, such as lithium-ion batteries, is driving the demand for advanced AC-DC converters capable of handling high-efficiency charging and discharging processes. This trend reflects the broader shift toward more sustainable and reliable energy solutions across various sectors.

- For example, Sunshine Power’s PowerTitan2.0 is the world’s first 10 MWh fully liquid-cooled energy storage system, featuring an “AC/DC integrated” structure that combines battery units and PCS in a single cabinet. This design reduces land use by 29% and increases full-life cycle discharged energy by over 7% compared to traditional two-stage systems. The system achieves a round-trip efficiency of 89.5% and is engineered for rapid grid integration and high safety, as confirmed by company and industry sources.

Market Challenges Analysis:

High Initial Investment and Development Costs

One of the primary challenges faced by the global AC-DC power conversion market is the high initial investment and development costs associated with advanced power conversion systems. The integration of new materials, such as wide-bandgap semiconductors, and the incorporation of smart technologies significantly increase the upfront cost of manufacturing these systems. Many businesses, especially small to medium-sized enterprises, find it difficult to justify these costs, particularly in industries where budgets are constrained. Although the long-term benefits, such as improved efficiency and reduced operational costs, are evident, the initial financial burden can be a major hurdle. This challenge can slow the adoption of cutting-edge AC-DC conversion technologies in certain sectors and regions, impacting overall market growth.

Complexity in Meeting Diverse Industry Standards and Regulations

The global AC-DC power conversion market also faces the challenge of adhering to diverse industry standards and regulatory requirements. Power conversion systems are used across a wide range of applications, including consumer electronics, automotive, industrial equipment, and renewable energy. Each of these sectors has its own set of stringent regulations and performance criteria that power conversion devices must meet. Ensuring compliance with these varying standards can complicate the design, testing, and certification processes, leading to longer development timelines and increased costs. Companies must invest significant resources to stay updated on regulatory changes and ensure that their products meet global and regional standards, which can create challenges in maintaining competitiveness in the market.

Market Opportunities:

Rising Demand for Renewable Energy Integration

The increasing global emphasis on renewable energy presents significant opportunities for the global AC-DC power conversion market. As countries focus on transitioning to cleaner energy sources, the need for efficient power conversion systems that integrate renewable energy sources such as solar and wind with the grid is growing. AC-DC converters are essential for converting the DC power generated by these sources into usable AC power. With governments and organizations heavily investing in renewable infrastructure, the demand for advanced AC-DC converters capable of handling renewable energy integration is expected to rise. This trend offers significant growth potential for companies providing innovative power conversion solutions in the renewable energy sector.

Expansion of Electric Vehicle Infrastructure

The rapid adoption of electric vehicles (EVs) is another promising opportunity for the AC-DC power conversion market. As the automotive industry shifts toward electrification, EVs require efficient charging infrastructure, where AC-DC converters play a crucial role in battery charging and power management. The expansion of EV charging stations globally is expected to create high demand for reliable and fast-charging power conversion systems. As the adoption of electric vehicles continues to rise, the market for AC-DC converters in automotive applications will expand, presenting growth opportunities for manufacturers in the EV sector.

Market Segmentation Analysis:

The global AC-DC power conversion market is segmented by component and application, each contributing to its overall growth.

By component AC-DC converters dominate the component segment, as they are widely used in various industries for converting alternating current (AC) to direct current (DC). DC-DC converters are also growing in demand, particularly in electric vehicles (EVs) and renewable energy systems, for converting DC power between different voltage levels. Power modules are gaining traction due to their ability to handle high power levels efficiently, making them ideal for industrial automation and telecommunications applications. The others segment includes specialized power conversion solutions tailored for niche applications.

- For example, TDK-Lambda’s HWS series of AC-DC power supplies are widely used across industrial, medical, and test equipment sectors. The HWS300-24/A model, for example, provides 300 W output at 24 VDC, with a typical efficiency of 87% and a universal input range of 85–265 VAC.

By application front, consumer electronics lead the market, driven by the proliferation of smartphones, laptops, and other portable devices that rely on efficient power conversion. Industrial automation is another key segment, as industries continue to adopt advanced power systems to improve operational efficiency. Telecommunications companies require reliable power conversion systems to support their infrastructure. The renewable energy sector, particularly solar and wind power, is expanding rapidly and driving demand for AC-DC converters that facilitate grid integration and energy storage. The electric vehicle (EV) segment is growing steadily with the rise of electric mobility, fueling the demand for efficient charging solutions. The others segment includes applications in areas such as medical devices and defense systems, contributing to the market’s diversification.

- For example, Siemens’ SITOP PSU8600 is a modular, networked power supply system for industrial automation. It features integrated communication (PROFINET/OPC UA), output currents up to 40 A, and efficiency up to 94%.

Segmentation:

By Component:

- AC-DC Converters

- DC-DC Converters

- Power Modules

- Others

By Application:

- Consumer Electronics

- Industrial Automation

- Telecommunications

- Renewable Energy

- Electric Vehicles (EVs)

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America AC-DC Power Conversion Market

The North America AC-DC Power Conversion Market size was valued at USD 5,333.98 million in 2018, and is anticipated to reach USD 12,397.95 million by 2032, at a CAGR of 5.8% during the forecast period. The market is primarily driven by the demand for advanced power conversion technologies in industries such as automotive, consumer electronics, and renewable energy. North America holds a significant market share, thanks to the United States, where there is a growing adoption of electric vehicles (EVs) and renewable energy solutions. The increasing number of EV charging stations and the expansion of green energy infrastructure have further boosted market growth. The region’s established manufacturing base and focus on technological advancements in power electronics support continued market expansion. Key players in the region continue to invest heavily in R&D to drive innovation in power conversion solutions, ensuring North America remains a dominant force in the global AC-DC power conversion market.

Europe AC-DC Power Conversion Market

The Europe AC-DC Power Conversion Market size was valued at USD 3,001.07 million in 2018, and is anticipated to reach USD 6,044.02 million by 2032, at a CAGR of 4.5% during the forecast period. Europe has a strong foothold in the global market, driven by stringent energy efficiency regulations and the ongoing adoption of renewable energy solutions. The market is fueled by the region’s shift towards clean energy, with countries like Germany, France, and the United Kingdom focusing on reducing carbon footprints. The growth of electric vehicles and the demand for efficient power conversion in industrial applications contribute to the market’s expansion. Europe’s commitment to sustainability and green technologies is expected to drive the adoption of AC-DC converters, further boosting the region’s market share.

Asia Pacific AC-DC Power Conversion Market

The Asia Pacific AC-DC Power Conversion Market size was valued at USD 6,781.95 million in 2018, and is anticipated to reach USD 17,600.18 million by 2032, at a CAGR of 6.6% during the forecast period. The region is the largest market for AC-DC power conversion, accounting for a significant portion of global market share. Rapid industrialization, increasing demand for consumer electronics, and the proliferation of electric vehicles in countries like China, India, and Japan are driving the growth of the market. The Asia Pacific region is also a global leader in manufacturing and exports of renewable energy solutions, including solar power, which requires efficient power conversion systems. As the region continues to invest heavily in infrastructure development and smart technologies, the demand for advanced AC-DC power conversion systems will increase, further solidifying its market dominance.

Latin America AC-DC Power Conversion Market

The Latin America AC-DC Power Conversion Market size was valued at USD 610.04 million in 2018, and is anticipated to reach USD 1,205.03 million by 2032, at a CAGR of 3.7% during the forecast period. The market in this region is growing steadily, driven by the increasing adoption of renewable energy systems, particularly solar power. Latin America’s efforts to reduce dependence on traditional energy sources have led to greater investment in clean energy, which in turn drives the demand for efficient AC-DC power conversion solutions. The automotive industry, especially in countries like Brazil and Mexico, is also contributing to the growth of the market, as electric vehicle adoption increases. While the region faces challenges such as limited infrastructure, ongoing economic development and energy diversification efforts offer a promising outlook for the AC-DC power conversion market.

Middle East AC-DC Power Conversion Market

The Middle East AC-DC Power Conversion Market size was valued at USD 347.62 million in 2018, and is anticipated to reach USD 571.23 million by 2032, at a CAGR of 2.7% during the forecast period. The region is witnessing slow but steady growth, driven by increasing demand for power conversion systems in the industrial and energy sectors. The Middle East’s focus on renewable energy development, particularly solar power, is a significant factor contributing to the market’s expansion. Countries like Saudi Arabia and the UAE are making substantial investments in sustainable energy projects, which require efficient AC-DC power conversion systems. The growth of the region’s manufacturing and construction sectors is also driving demand for these systems, making the Middle East an emerging market for AC-DC power conversion solutions.

Africa AC-DC Power Conversion Market

The Africa AC-DC Power Conversion Market size was valued at USD 214.79 million in 2018, and is anticipated to reach USD 433.28 million by 2032, at a CAGR of 2.3% during the forecast period. The market in Africa is relatively small but shows promise due to the increasing adoption of renewable energy systems and the development of electrification projects in rural areas. The growing need for efficient power conversion in off-grid applications, particularly in sub-Saharan Africa, is spurring the demand for AC-DC converters. Furthermore, the expansion of telecommunications and industrial sectors in major African economies, such as South Africa and Nigeria, is contributing to market growth. Although challenges such as infrastructure and economic stability remain, ongoing investments in power infrastructure and energy access are expected to drive the AC-DC power conversion market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AMP Consortium

- Altair

- Analog Devices

- Artesyn Embedded Power

- Astec Power

- Bell Labs

- Broadcom

- CUI Inc.

- Cisco

- Dell

- Infineon Technologies AG

- Delta

Competitive Analysis:

The global AC-DC power conversion market is highly competitive, with numerous players offering innovative solutions to meet the increasing demand for efficient power conversion technologies. Key market players include established companies such as Texas Instruments, Infineon Technologies, ABB, and Schneider Electric, which dominate the industry through their advanced product offerings and strong R&D capabilities. These companies focus on delivering high-performance, energy-efficient converters for diverse applications, ranging from consumer electronics to industrial automation and electric vehicles. New entrants and startups are increasingly leveraging technological advancements, such as wide-bandgap semiconductors and smart power conversion systems, to differentiate themselves in the market. Market competition is further intensified by the rising demand for sustainable and renewable energy solutions, compelling companies to innovate and develop products that cater to both industrial and consumer needs. Collaboration, strategic partnerships, and mergers and acquisitions are common strategies employed to expand market share and drive growth in the global AC-DC power conversion market.

Recent Developments:

- In March 2025, Amber Semiconductor (AmberSemi) announced at APEC 2025 the public demonstration of its first commercial semiconductor line for AC to DC power conversion. This new offline AC-DC conversion product is designed for major size reduction and simplified integration, with production samples available to Alpha customers in Q2 2025 and broader availability in Q3 2025.

- In March 2025, Siemens announced the completion of its acquisition of Altair Engineering Inc., a leading provider of industrial simulation and analysis software, for approximately USD 10 billion. This strategic move is designed to expand Siemens’ industrial software portfolio, integrating Altair’s advanced simulation, high-performance computing, and AI capabilities into the Siemens Xcelerator digital business platform.

- In April 2025, Efficient Power Conversion (EPC) showcased a compact 5 kW AC-DC power supply at APEC 2025, surpassing 100 W/in³ in power density. This product leverages gallium nitride (GaN) technology to dramatically improve server power architectures. EPC also demonstrated a 48 V to 12 V LLC reference design with over 95.5% efficiency and more than 5 kW/in³ power density, underlining GaN’s transformative impact on high-performance computing and robotics.

- In March 2024, Advanced Energy Industries launched the Evergreen™ platform, a next-generation high-power modular AC-DC conversion system designed for rapid system configuration and power scaling. The new platform includes the 10 kW FCM10K air-cooled, hot-swappable module and the 30 kW FCM30K shelf, both of which can be combined on a standard 19” rack to scale output for demanding industrial and precision power applications.

Market Concentration & Characteristics:

The global AC-DC power conversion market is moderately concentrated, with a few dominant players holding significant market share. Large companies like Texas Instruments, ABB, and Infineon Technologies lead the market due to their strong brand presence, extensive product portfolios, and advanced technological innovations. The market is characterized by high competition, driven by continuous advancements in power conversion technology, such as wide-bandgap semiconductors and smart systems. Smaller players and startups focus on niche segments, often developing specialized products for applications in renewable energy, electric vehicles, and industrial automation. The increasing demand for energy-efficient and sustainable solutions is shaping the market, encouraging both established and new companies to invest in research and development. Partnerships, collaborations, and mergers are common strategies to increase market reach and expand product offerings, ensuring competitiveness in a rapidly evolving landscape.

Report Coverage:

The research report offers an in-depth analysis based on component and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global AC-DC power conversion market will continue to grow as demand for energy-efficient solutions increases across industries.

- Advancements in wide-bandgap semiconductor technology will improve converter efficiency and reduce power loss.

- The adoption of electric vehicles will drive significant growth in the demand for high-performance AC-DC converters for charging infrastructure.

- Increased investments in renewable energy projects will expand the market for AC-DC converters in solar and wind energy systems.

- Integration of smart power conversion systems will enhance operational efficiency and enable predictive maintenance.

- Expansion in emerging markets, particularly in Asia-Pacific, will fuel further growth due to increasing industrialization and energy demand.

- The shift toward electric mobility and decentralized power systems will increase the need for reliable and fast-charging AC-DC power converters.

- Strict energy efficiency regulations will push industries to adopt more advanced power conversion technologies.

- Industry consolidation will likely occur as companies seek strategic mergers and acquisitions to strengthen their market position.

- Increased focus on sustainability and eco-friendly solutions will encourage the development of low-carbon and energy-efficient AC-DC converters.