Market Overview:

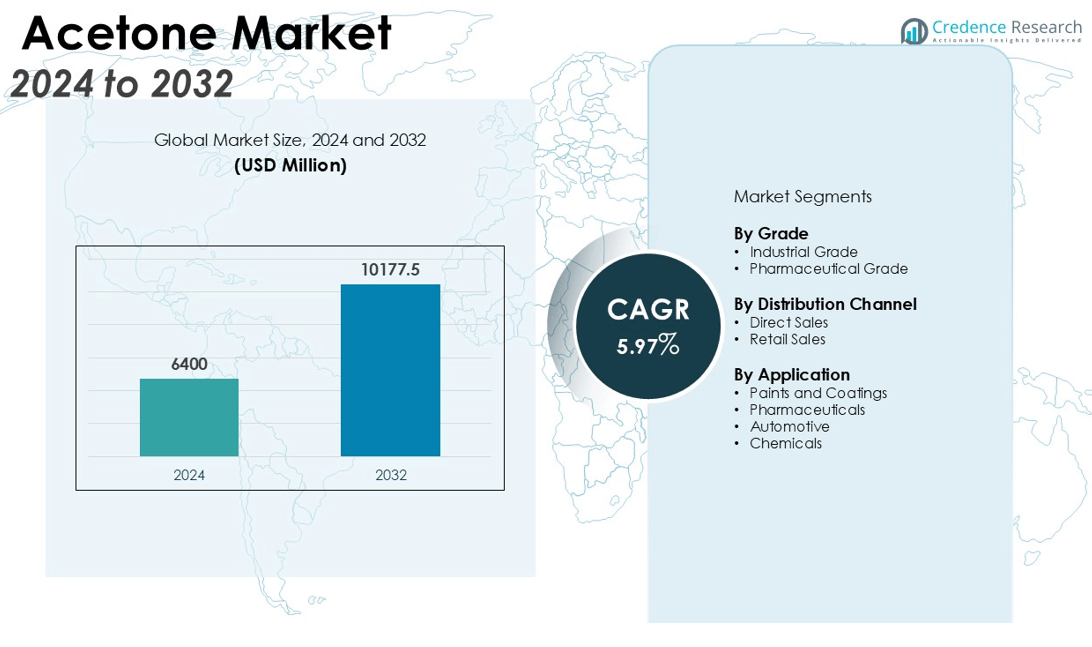

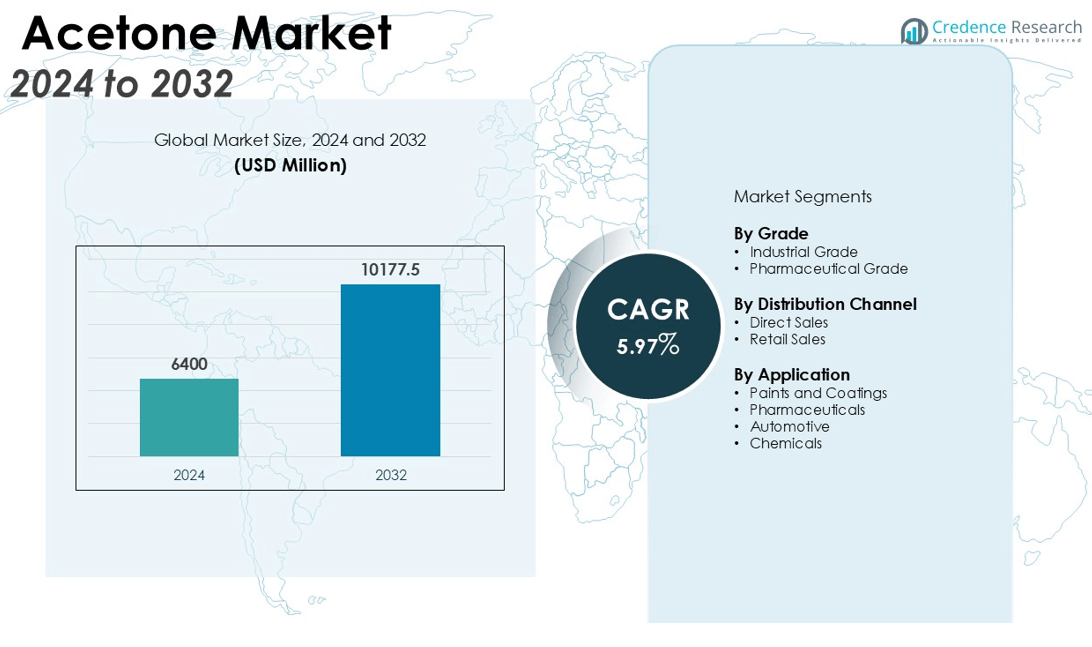

The Acetone Market size was valued at USD 6400 million in 2024 and is anticipated to reach USD 10177.5 million by 2032, at a CAGR of 5.97% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acetone Market Size 2024 |

USD 6400 million |

| Acetone Market, CAGR |

5.97% |

| Acetone Market Size 2032 |

USD 10177.5 million |

Key drivers of the acetone market include its widespread use as a solvent in paints and coatings, adhesives, and cleaning products. Additionally, acetone serves as a crucial feedstock in the production of methyl methacrylate (MMA) and bisphenol A (BPA), which are essential for manufacturing plastics and resins. The pharmaceutical sector also contributes significantly to market growth, utilizing acetone in drug formulation and synthesis. Furthermore, the increasing demand for acetone in the production of consumer goods and personal care products is further boosting market growth.

Regionally, the Asia Pacific region leads the global acetone market, accounting for a significant share of the demand. This dominance is attributed to rapid industrialization, urbanization, and the presence of key manufacturing hubs in countries like China and India. The region’s robust chemical and pharmaceutical industries further bolster acetone consumption. North America and Europe also represent substantial markets, driven by advancements in chemical manufacturing and stringent environmental regulations that promote the use of acetone as a low-VOC solvent. The rising focus on sustainable and eco-friendly production processes is expected to fuel further demand for acetone in these regions.

Market Insights:

- The acetone market was valued at USD 6,400 million in 2024 and is projected to reach USD 10,177.5 million by 2032, growing at a CAGR of 5.97% during the forecast period.

- Acetone is widely used in paints, coatings, and adhesives due to its excellent solvent properties, supporting the demand for high-performance, eco-friendly coatings.

- Acetone is a key feedstock in producing methyl methacrylate (MMA) and bisphenol A (BPA), crucial for manufacturing plastics and resins.

- Acetone plays a vital role in pharmaceutical drug formulation, particularly for dissolving active ingredients in oral and injectable medications.

- Acetone is increasingly used in consumer goods such as cosmetics and cleaning products, valued for its low toxicity and high evaporation rate.

- Volatility in raw material prices, especially for petrochemical by-products like cumene, poses challenges to acetone production costs and market stability.

- Stricter environmental regulations and the push for sustainable alternatives are driving the need for cleaner technologies in acetone production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Widespread Use in Paints, Coatings, and Adhesives

The acetone market benefits significantly from its extensive use in paints, coatings, and adhesives. Its excellent solvent properties make it an ideal choice for thinning paints and coatings, providing enhanced application characteristics. Acetone is crucial in industrial and automotive coatings, where durability and finish are critical. The increasing demand for high-quality, efficient, and environmentally friendly coatings further supports acetone consumption in this segment.

- For instance, Sunnyside Corporation’s acetone is compliant with stringent air quality regulations and is classified as a VOC-exempt solvent, possessing a VOC value of 0 grams per liter.

Demand for Acetone in Chemical Manufacturing

Acetone serves as a vital feedstock in the production of key chemicals, including methyl methacrylate (MMA) and bisphenol A (BPA). MMA, essential for the production of acrylic resins and plastics, drives significant demand for acetone in the manufacturing process. Similarly, BPA is a fundamental compound used in the production of polycarbonate plastics and epoxy resins. The growing application of these chemicals in the automotive, electronics, and construction industries directly contributes to the steady rise in acetone consumption.

- For instance, Mitsubishi Chemical produces high-purity Bisphenol A utilizing an advanced process, resulting in a product with a precise melting point of 153°C.

Growth in Pharmaceutical and Healthcare Sectors

The pharmaceutical industry is another major driver of acetone market growth. It is widely used in drug formulation and synthesis, particularly for extracting compounds and preparing certain formulations. Acetone’s ability to dissolve a wide range of active ingredients makes it indispensable for the production of oral and injectable medications. Increased research and development activities in the pharmaceutical sector, combined with rising healthcare demand globally, are expected to further elevate acetone consumption in this field.

Industrial Applications and Emerging Uses in Consumer Goods

Acetone’s role in manufacturing various consumer goods, including cosmetics, personal care items, and cleaning products, continues to expand. It serves as a solvent and cleaning agent in these applications, offering a versatile solution across multiple product categories. The growing trend toward cleaner, safer formulations in personal care and cleaning products will increase acetone usage, as it remains a preferred solvent due to its low toxicity and high evaporation rate.

Market Trends:

Growing Demand in End-Use Industries

The acetone market is experiencing significant demand across various end-use industries, including automotive, pharmaceuticals, and consumer goods. In the automotive industry, acetone is used in manufacturing products such as paints, coatings, and adhesives, which has expanded its market presence. The pharmaceutical sector relies on acetone for its solvent properties in drug formulation processes, further driving market growth. It is also used extensively in cosmetics and personal care products, particularly in nail polish removers and other beauty products, supporting its position in the consumer goods segment. These growing applications across multiple industries are expected to sustain the market’s positive trajectory.

- For instance, Sunoco’s Philadelphia facility has the capacity to produce 700 million pounds of acetone annually, a crucial component for manufacturing high-performance paints and coatings used in the automotive industry.

Technological Advancements and Sustainability Trends

The acetone market is witnessing innovations aimed at enhancing its production process and environmental footprint. Producers are focusing on adopting more sustainable production methods to meet the increasing demand for eco-friendly solutions. Advances in catalytic processes have led to higher efficiency and lower energy consumption, contributing to market growth. The shift towards bio-based acetone production is gaining momentum, driven by the rising preference for renewable raw materials over petroleum-based feedstocks. These technological improvements not only support cost reduction but also align with global sustainability goals, positioning the market for future success.

- For instance, LanzaTech has progressed its sustainable acetone production by proving stable output in an 80-L pilot reactor, a crucial stage in advancing its gas fermentation technology toward commercial scale.

Market Challenges Analysis:

Fluctuating Raw Material Prices

One of the key challenges facing the acetone market is the volatility of raw material prices. The market is heavily dependent on petrochemical by-products such as cumene, which are subject to fluctuations due to changing crude oil prices. These price fluctuations create uncertainties for manufacturers, affecting the cost structure and profitability of acetone production. Such instability in raw material pricing forces companies to adapt quickly, impacting overall market dynamics.

Environmental and Regulatory Constraints

Increasing environmental regulations present another challenge for the acetone market. As governments worldwide implement stricter policies to reduce industrial emissions and environmental pollution, acetone producers must invest in cleaner technologies and compliance measures. These regulations, while promoting sustainability, increase production costs and can limit the pace of market expansion. Additionally, the growing push for greener alternatives to conventional solvents may lead to competition from bio-based or eco-friendly solvents, further intensifying pressure on the acetone market.

Market Opportunities:

Expansion in Emerging Markets

The acetone market holds significant opportunities in emerging economies, where industrialization and urbanization are rapidly advancing. Countries in Asia-Pacific, particularly China and India, are experiencing growth in automotive, pharmaceutical, and consumer goods industries, all of which require acetone for various applications. As these markets continue to expand, the demand for acetone-based products is expected to rise. It is anticipated that the growing industrial base in these regions will offer considerable opportunities for market players to establish a strong presence and enhance production capabilities.

Shift Toward Bio-Based Acetone

here is a growing opportunity in the acetone market with the shift towards bio-based production methods. As sustainability concerns rise globally, bio-based acetone, produced from renewable raw materials, is gaining traction as a greener alternative to conventional acetone derived from petrochemicals. Companies are increasingly investing in research and development to improve the efficiency of bio-based acetone production processes. This trend presents an opportunity for producers to tap into the rising consumer preference for eco-friendly products and to meet evolving regulatory demands for sustainable solutions.

Market Segmentation Analysis:

By Grade

The acetone market is primarily segmented by grade into industrial and pharmaceutical grades. Industrial-grade acetone is widely used in manufacturing processes, especially in paints, coatings, and adhesives, due to its strong solvent properties. Pharmaceutical-grade acetone is used in drug formulation and synthesis, where higher purity is required to meet stringent industry standards.

- For instance, Solvay launched a project on April 1, 2025, to reduce its transportation carbon footprint in Brazil, starting with an initial fleet of 20 vehicles for its chemical deliveries.

By Distribution Channel

The market is divided into direct sales and retail distribution channels. Direct sales dominate, particularly in the industrial sector, where acetone is purchased in bulk by manufacturers for large-scale production. Retail sales serve consumer goods industries, such as cosmetics and cleaning products, where acetone is sold in smaller quantities through supermarkets, online platforms, and specialty stores.

- For instance, a major producer like BASF has a manufacturing facility with an annual production capacity of 150 thousand tons of acetone, which is sold directly to industrial clients.

By Application

Acetone has diverse applications across several industries, including paints and coatings, pharmaceuticals, automotive, and chemicals. It serves as a key solvent in the production of paints and coatings, providing enhanced durability and finish. In pharmaceuticals, it is used for drug synthesis and formulation. The automotive industry utilizes acetone in coatings and adhesives, while the chemical industry relies on acetone as a feedstock for producing essential chemicals like methyl methacrylate (MMA) and bisphenol A (BPA), which are critical in plastics and resins manufacturing.

Segmentations:

By Grade

- Industrial Grade

- Pharmaceutical Grade

By Distribution Channel

- Direct Sales

- Retail Sales

By Application

- Paints and Coatings

- Pharmaceuticals

- Automotive

- Chemicals

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Strong Industrial Demand

North America holds a dominant market share of 35% in the acetone market, driven by its diverse industrial landscape. The demand for acetone is primarily fueled by its applications in automotive, pharmaceuticals, and consumer goods. The United States, in particular, is a major consumer, with industries such as paints, coatings, and adhesives driving consumption. It is also a leading market for acetone-based solvents used in personal care products. The region’s focus on advanced manufacturing technologies and sustainability practices further strengthens its position.

Asia-Pacific: Rapid Growth and Expanding Applications

Asia-Pacific accounts for 30% of the global acetone market, experiencing the highest growth rate. Countries like China, India, and Japan are witnessing increased industrialization, boosting the demand for acetone in automotive production, pharmaceuticals, and consumer goods. The region’s expanding manufacturing sector and rising urbanization are key factors contributing to this growth. The shift toward sustainable and advanced production methods also presents additional opportunities for market players. With a large population and growing industrial base, the region is expected to continue driving significant demand for acetone-based products.

Europe: Innovation and Sustainability Focus

Europe holds a market share of 25% in the acetone market, supported by its well-established industrial and automotive sectors. The region’s emphasis on sustainability and regulatory compliance has fueled the demand for bio-based acetone alternatives. Germany, France, and the United Kingdom are key contributors, particularly in automotive and pharmaceutical applications. The market’s growth is also influenced by technological innovations in acetone production processes. Europe continues to lead in the adoption of eco-friendly solutions, enhancing its position in the global acetone market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DOMO Chemicals

- Kumho P&B Chemicals

- Arkema

- Solvay

- INEOS

- Shell plc

- CEPSA Quimica, S.A.

- SABIC

- Honeywell International Inc

- Mitsui Chemicals, Inc.

Competitive Analysis:

The acetone market is highly competitive, with several key players dominating the landscape. Major manufacturers such as BASF, Dow Chemical Company, and LG Chem lead the market, leveraging advanced production technologies and a strong distribution network. These companies focus on maintaining a diverse product portfolio and strategic partnerships to expand their market presence. The market also includes regional players like Reliance Industries and Mitsubishi Chemical, which have established strong footholds in specific geographic regions, particularly Asia-Pacific. These companies differentiate themselves through cost-effective production methods, innovation in sustainable solutions, and adherence to environmental regulations. With growing demand from industries like pharmaceuticals, paints, and coatings, companies are also investing in bio-based acetone production to meet the rising demand for eco-friendly products. The increasing focus on sustainability and technological advancements in acetone production will intensify competition in the coming years. The AcetoneMarket will likely see further consolidation and innovation as companies aim to capture a larger market share.

Recent Developments:

- In July 2025, Honeywell International Inc. announced its second-quarter results, which exceeded financial guidance, and subsequently raised its full-year outlook for organic growth and earnings per share.

- In March 2023, Mitsui Chemicals planned to optimize production by reducing its toluene diisocyanate (TDI) output capacity at its Omuta facility to 50,000 tons per year.

Market Concentration & Characteristics:

The acetone market exhibits moderate concentration, with a few major players dominating the industry. Large multinational companies such as BASF, Dow Chemical Company, and LG Chem lead the market, benefiting from strong financial capabilities, extensive production networks, and established brand recognition. However, regional players also play a significant role, especially in emerging markets, where they capitalize on local demand and cost advantages. The market is characterized by steady demand from diverse applications, including paints, coatings, pharmaceuticals, and chemicals. As demand for sustainable and eco-friendly products grows, key players are focusing on innovations such as bio-based acetone production. Competitive strategies include cost leadership, technological advancements, and expanding production capacities. The AcetoneMarket remains dynamic, driven by both global players and regional manufacturers striving to capture a larger market share.

Report Coverage:

The research report offers an in-depth analysis based on Grade, Distribution Channel, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The acetone market is projected to reach approximately USD 10.1 billion by 2030, reflecting a steady upward trajectory.

- Asia-Pacific is expected to maintain its dominance, driven by rapid industrialization and increased demand from emerging economies.

- The adoption of bio-based acetone production methods is anticipated to rise, aligning with global sustainability initiatives.

- Technological advancements in catalytic processes are likely to enhance production efficiency and reduce environmental impact.

- The pharmaceutical sector’s growth is expected to bolster acetone demand, particularly for high-purity applications.

- The automotive industry’s shift towards lightweight materials may increase the need for acetone in manufacturing processes.

- Regulatory pressures are anticipated to encourage the development and adoption of greener acetone production technologies.

- The paints and coatings industry is expected to continue as a significant consumer of acetone, driven by demand for high-quality finishes.

- Fluctuations in raw material prices may impact acetone production costs, influencing market dynamics.

- Strategic partnerships and collaborations among key players are likely to intensify, aiming to expand market reach and technological capabilities.