Market Overview:

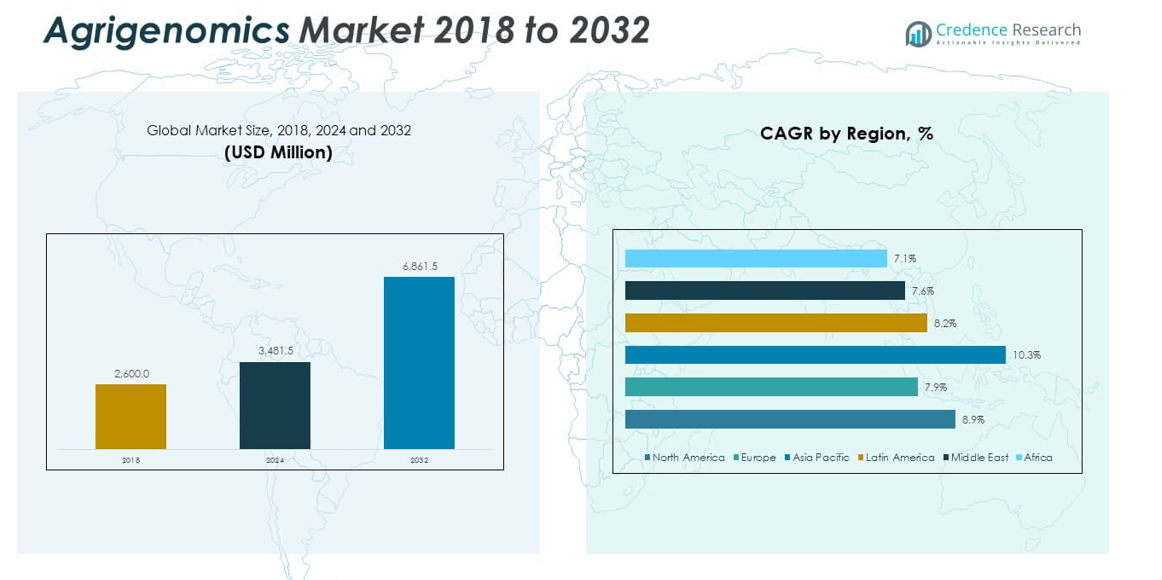

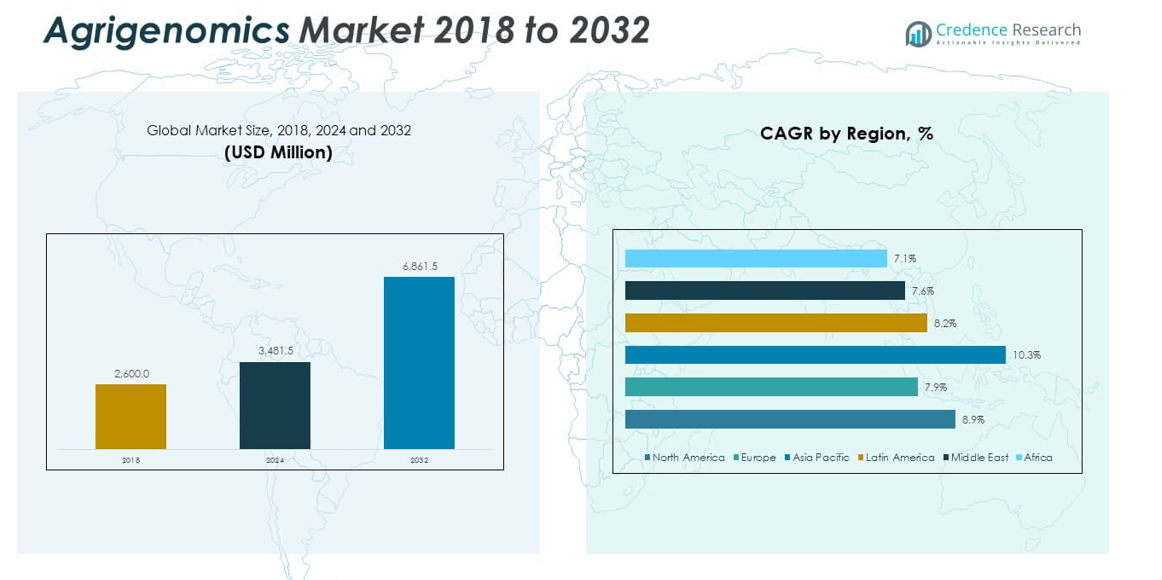

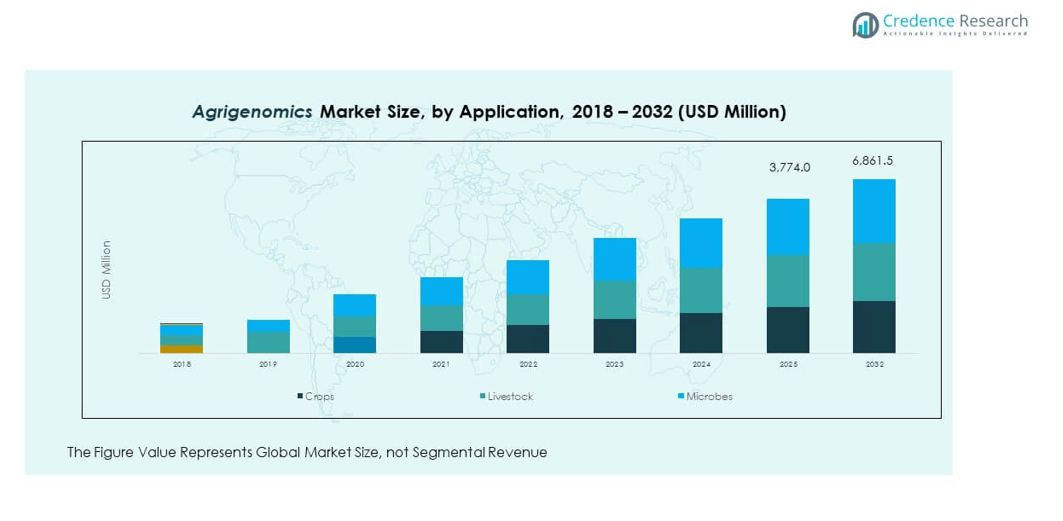

The Global Agrigenomics Market size was valued at USD 2,600.0 million in 2018 to USD 3,481.5 million in 2024 and is anticipated to reach USD 6,861.5 million by 2032, at a CAGR of 8.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agrigenomics Market Size 2024 |

USD 3,481.5 million |

| Agrigenomics Market , CAGR |

8.90% |

| Agrigenomics Market Size 2032 |

USD 6,861.5 million |

The market grows with the rising demand for advanced agricultural productivity solutions and sustainable farming practices. Agrigenomics supports crop improvement, livestock health, and disease resistance, enabling higher yields and reduced input costs. The adoption of next-generation sequencing, gene editing, and bioinformatics tools drives innovation, while government funding for agricultural research and private-sector investments accelerates deployment across developing and developed economies. Strong applications in seed development, trait selection, and livestock genomics further strengthen its market potential.

The market shows significant regional variations. North America and Europe dominate due to established agricultural research infrastructure, high adoption of genomic technologies, and strong government policies favoring precision agriculture. Asia Pacific emerges as the fastest-growing region, led by China and India, where food security concerns and large-scale farming modernization programs fuel adoption. Latin America shows increasing potential through soybean and corn genomic applications, while the Middle East and Africa explore agrigenomics for water-efficient crops and sustainable food production.

Market Insights:

- The Global Agrigenomics Market size was valued at USD 2,600.0 million in 2018 to USD 3,481.5 million in 2024 and is anticipated to reach USD 6,861.5 million by 2032, at a CAGR of 8.90%.

- Market drivers include demand for high-yield crops, livestock improvement, and sustainability in agriculture.

- High costs and strict regulations remain key restraints.

- North America leads with strong research infrastructure and adoption, while Asia Pacific shows fastest growth.

- Europe emphasizes sustainable agriculture and advanced R&D collaborations.

- Latin America strengthens applications in soybeans and corn genomics.

- Middle East and Africa explore water-efficient crops and sustainable food production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for High-Yield Crops and Livestock Improvement:

The Global Agrigenomics Market expands with the rising focus on crop productivity and livestock health. Farmers and agribusinesses adopt genomic tools to enhance yield, disease resistance, and nutritional value. It supports hybrid seed development and improves genetic selection for livestock breeding programs. Adoption strengthens as global food demand increases and climate change pressures force farmers to seek resilient genetic solutions. This trend creates a long-term need for sequencing and genotyping technologies, making agrigenomics critical for agricultural sustainability.

- For example, Illumina collaborated with the USDA to sequence 97 wheat lines, enabling identification of yield-associated markers that delivered up to 15% yield improvement in select drought-prone test sites. Illumina used its NovaSeq 6000 System, achieving an average sequencing depth of 30× per sample, which provided high-resolution marker data for US wheat breeders.

Integration of Advanced Genomic Technologies:

It benefits from the growing availability of next-generation sequencing, CRISPR-based gene editing, and bioinformatics solutions. These tools enable faster, more accurate, and cost-effective analysis of plant and animal genomes. Technology integration allows for precision trait mapping, molecular breeding, and genetic disease detection, which are widely adopted by seed companies, biotechnology firms, and agricultural research institutes. The increasing accessibility of genomic data drives better decision-making in farming and strengthens the market’s position.

- For instance, Corteva Agriscience used CRISPR-Cas9 in 2022 to develop a waxy corn line with zero transgene integration, improving starch quality for industrial processing by 20%.

Rising Investment in Agricultural Research and Development:

Government funding and private-sector initiatives accelerate adoption across the Global Agrigenomics Market. Public research organizations invest in crop diversity studies, genetic resource management, and disease control programs. Private companies leverage agrigenomics for product differentiation, focusing on proprietary seed varieties and livestock genetics. Strategic collaborations between universities, biotech firms, and governments foster innovation pipelines. Strong R&D initiatives ensure continuous advancements in genetic technologies, making them more affordable and scalable for commercial agriculture.

Food Security and Sustainability Concerns:

It expands as food demand grows due to rising global population and shifting consumption patterns. Agrigenomics plays a critical role in addressing hunger, improving nutrition, and enabling climate-resilient crops. Sustainability initiatives encourage genetic solutions that reduce pesticide and fertilizer use while improving productivity. The growing emphasis on sustainable agriculture aligns with consumer preferences for safe and nutritious food, creating long-term opportunities. Genomic innovation becomes essential in balancing environmental sustainability with global food supply needs.

Market Trends:

Expansion of Precision Agriculture Through Genomics:

The Global Agrigenomics Market sees a strong trend toward precision agriculture. Genomic tools integrate with precision farming technologies such as sensors, drones, and AI-based analytics to optimize planting, irrigation, and nutrient use. This fusion of digital agriculture with genomic data creates data-driven farming ecosystems. It ensures higher crop efficiency, resource optimization, and improved profitability for farmers. Adoption strengthens as agribusinesses seek sustainability and efficiency under rising global food pressures.

- For example, Bayer Crop Science integrated its digital platform Climate FieldView with genomic trait data across 500+ US production sites in 2023. Company results showed that nitrogen application rates could be reduced by 12% while maintaining or increasing yield in 70% of the trial locations, with real-time in-field sensor data linked to genomic profiles.

Growing Role of Bioinformatics in Agrigenomics:

Bioinformatics emerges as a key trend, supporting large-scale genomic data analysis in crops and livestock. It enables researchers to decode genetic sequences quickly, identify markers, and apply predictive models. The demand for bioinformatics software and cloud-based genomic platforms increases across agricultural research institutions. It strengthens the capacity to handle large genomic datasets, creating a strong push toward digital agriculture. This trend ensures better integration of big data into farming decision-making systems.

- For instance, Thermo Fisher Scientific’s Axiom Analysis Suite, documented in 2024 product application notes, processed over 50,000 maize and rice samples per year with automated marker analysis and variant calling workflows, reducing turnaround time for breeding decisions to under 48hours per sample set.

Increasing Collaborations and Partnerships:

Collaborative research initiatives among governments, universities, and private companies are reshaping the Global Agrigenomics Market. Joint ventures aim to accelerate technology adoption, share genomic data, and foster innovation pipelines. It drives advancements in trait-specific crops, drought-resistant varieties, and genetically improved livestock. These partnerships help address regional agricultural challenges, reduce technology costs, and enhance accessibility in emerging economies. The trend also accelerates regulatory approvals and improves commercialization speed.

Adoption of Genomic Solutions in Emerging Markets:

Developing economies increasingly adopt agrigenomics to modernize farming systems. Countries in Asia Pacific, Latin America, and Africa invest in genomic programs to enhance crop resilience and livestock health. Governments prioritize genomic solutions for food security and export competitiveness. It enables smallholder farmers to access improved seeds and livestock breeds, bridging productivity gaps. Expanding adoption in these regions presents a key growth avenue, reinforcing the market’s global reach.

Market Challenges Analysis:

High Costs and Limited Accessibility:

The Global Agrigenomics Market faces challenges due to high costs of sequencing, genotyping, and advanced bioinformatics tools. Many small and medium-scale farmers lack access to genomic technologies, creating adoption gaps. It limits penetration in low-income regions where agriculture is the main livelihood. High infrastructure costs in laboratories, specialized skills requirements, and lack of standardized platforms add to challenges. These cost barriers restrict scalability in developing markets, slowing widespread adoption.

Regulatory and Ethical Concerns in Genetic Modification:

The market also experiences headwinds due to regulatory hurdles and ethical debates around genetically modified organisms (GMOs). Strict compliance requirements delay commercialization and increase approval costs. It faces resistance from consumer groups wary of genetically engineered foods. Different regulatory frameworks across countries create complexity for companies expanding globally. Ethical concerns related to biodiversity, genetic ownership, and ecosystem impact add further challenges. Balancing innovation with regulation remains a critical challenge for market growth.

Market Opportunities:

Expansion in Emerging Agricultural Economies:

The Global Agrigenomics Market presents growth opportunities in developing regions with large agricultural bases. Countries in Asia Pacific, Africa, and Latin America focus on modernizing farming practices to ensure food security. Governments and international organizations invest in genomic research centers, boosting accessibility for local farmers. It creates opportunities for technology providers to establish partnerships, transfer knowledge, and strengthen their presence. The growing demand for resilient crops and livestock ensures continuous opportunities.

Increasing Adoption of Marker-Assisted Selection and Gene Editing:

The rising use of marker-assisted selection (MAS) and CRISPR gene-editing technologies offers significant opportunities. It enables faster and more precise crop and livestock improvement, reducing dependency on traditional breeding. Seed companies and biotechnology firms adopt these tools for competitive advantage. Expanding applications in disease resistance, yield enhancement, and nutritional improvement create commercial opportunities. The growing regulatory support for non-GMO genome editing in some regions further enhances adoption potential.

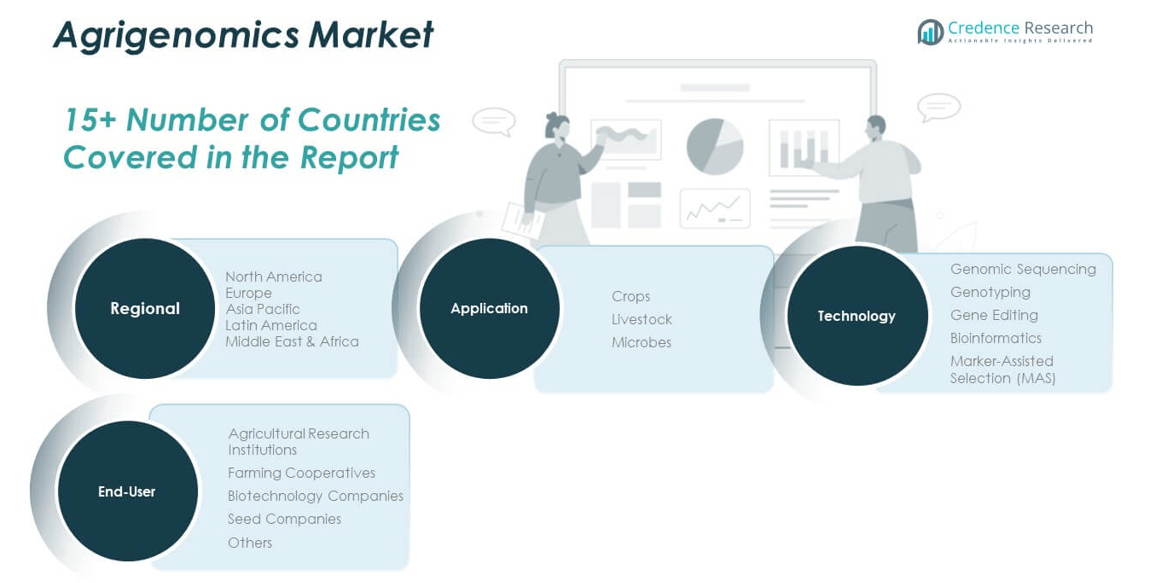

Market Segmentation Analysis:

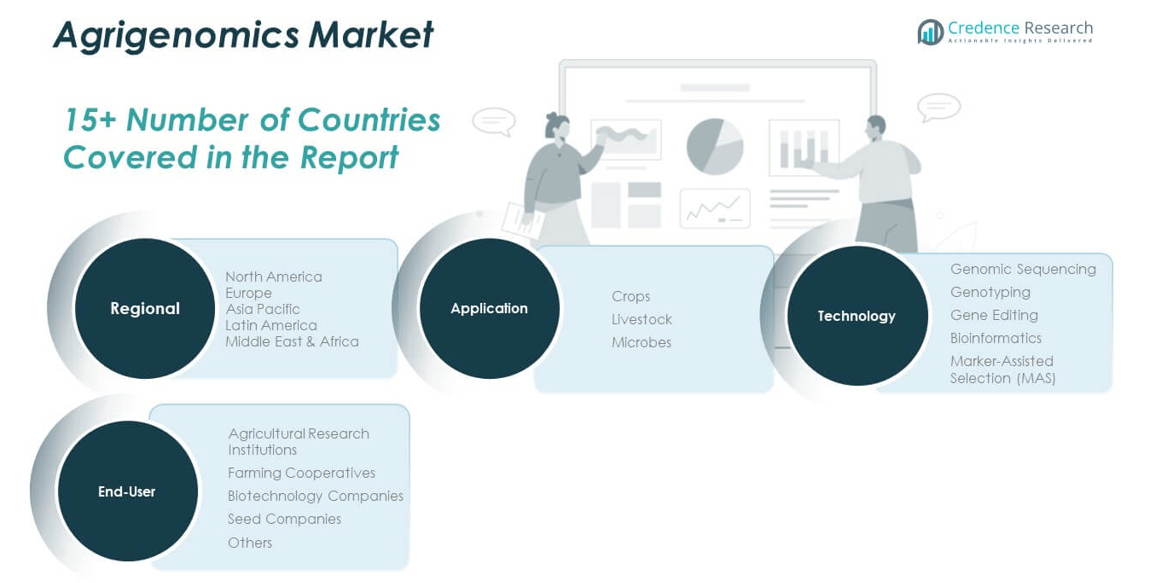

By Technology

The Global Agrigenomics Market shows strong adoption of genomic sequencing, driven by its role in decoding complex plant and animal genomes. Genotyping supports large-scale trait mapping, while gene editing enables precision improvements in crops and livestock. Bioinformatics grows rapidly as it manages vast genetic datasets, supporting predictive breeding and decision-making. Marker-Assisted Selection (MAS) is widely used in seed development for faster trait identification. Together, these technologies form the foundation of agrigenomics, driving efficiency and innovation across agricultural research and commercialization.

- For instance, Genus plc applied genomic sequencing and MAS across its dairy cattle programs, reducing the incidence of bovine respiratory disease by 30% in 2022 herds

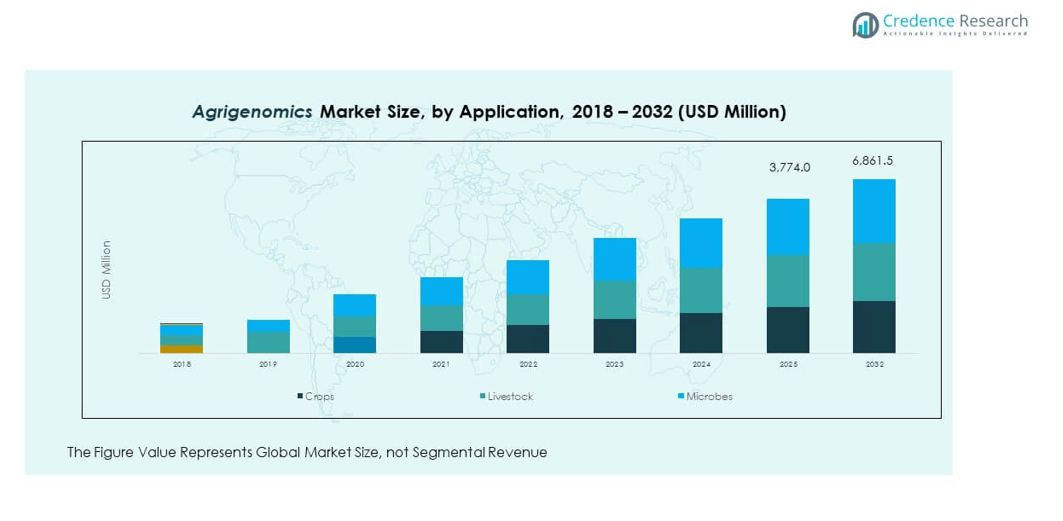

By Application

Crops dominate the Global Agrigenomics Market as farmers and companies seek higher yields, pest resistance, and climate-resilient traits. Livestock applications follow closely, focusing on disease resistance, productivity, and genetic improvement in dairy and meat sectors. Microbes, though a smaller segment, gain importance in soil health, biopesticides, and microbial interactions that enhance crop growth. Each application strengthens agricultural sustainability while addressing global food demand.

- For instance, Syngenta’s 2024 research bulletin reported sequencing of 250 rice accessions, revealing key Saltol gene variants. Commercial release of Saltol-containing hybrids resulted in a documented 10% yield increase over previous varieties in large-scale saline field trials in India and Southeast Asia

By End-User

Agricultural research institutions lead adoption, supported by government and academic funding for genomic studies. Biotechnology companies and seed firms invest heavily in proprietary crop varieties and livestock genetics to gain market advantage. Farming cooperatives integrate agrigenomic solutions to support collective productivity gains. Other end-users, including private farms and start-ups, expand their role by adopting genomics-based precision agriculture.

Segmentation:

By Technology

- Genomic Sequencing

- Genotyping

- Gene Editing

- Bioinformatics

- Marker-Assisted Selection (MAS)

By Application

By End-User

- Agricultural Research Institutions

- Farming Cooperatives

- Biotechnology Companies

- Seed Companies

- Others

Regional Analysis:

North America

The North America Global Agrigenomics Market size was valued at USD 1,105.0 million in 2018, reached USD 1,464.3 million in 2024, and is anticipated to reach USD 2,882.0 million by 2032, at a CAGR of 8.9%. The region accounts for 42% of the 2024 market share, making it the leading hub for agrigenomics adoption. North America benefits from advanced research infrastructure, high agricultural R&D spending, and the presence of key market players such as Illumina and Thermo Fisher. The United States leads with large-scale implementation of crop and livestock genomics, supported by strong government funding and private investment. Canada and Mexico are expanding through sustainable farming practices and modernized agricultural biotechnology programs. The region’s dominance is further reinforced by strong integration of genomics with precision agriculture technologies.

Europe

The Europe Global Agrigenomics Market size was valued at USD 530.4 million in 2018, reached USD 674.6 million in 2024, and is anticipated to reach USD 1,233.4 million by 2032, at a CAGR of 7.9%. Europe holds 19% of the 2024 market share, supported by strong regulatory frameworks and sustainability-driven policies. Germany, France, and the United Kingdom lead genomic adoption in agriculture, focusing on biodiversity preservation, eco-friendly crop improvements, and livestock health. Public-private collaborations and EU-backed research programs accelerate innovation and commercialization. The region places strong emphasis on ethical practices in genetic modification, ensuring consumer acceptance and regulatory compliance. This makes Europe an influential market in shaping sustainable and technologically advanced agricultural practices.

Asia Pacific

The Asia Pacific Global Agrigenomics Market size was valued at USD 588.9 million in 2018, reached USD 826.3 million in 2024, and is anticipated to reach USD 1,804.1 million by 2032, at a CAGR of 10.3%. With 24% of the 2024 market share, it stands as the fastest-growing region in agrigenomics. China and India are the key drivers, with large-scale programs focusing on food security and agricultural modernization. Japan and South Korea contribute through high-tech genomic research, while Australia focuses on drought-resistant crop development. Growing population, rising protein demand, and government support for sustainable farming practices strengthen the adoption of genomic tools in the region. Asia Pacific’s rapid growth highlights its central role in addressing global food supply challenges.

Latin America

The Latin America Global Agrigenomics Market size was valued at USD 216.3 million in 2018, reached USD 287.5 million in 2024, and is anticipated to reach USD 535.7 million by 2032, at a CAGR of 8.2%. With an 8% market share in 2024, Latin America is becoming a key player in crop genomics, particularly in soybeans, corn, and sugarcane. Brazil and Argentina dominate the regional market due to their large-scale agribusiness operations and export competitiveness. Genomic technologies are applied to enhance seed quality, crop resilience, and livestock traits. Government programs and private-sector initiatives focus on integrating genomics into agricultural practices to improve productivity and sustainability. The region’s growing role in global agricultural trade further strengthens its adoption of agrigenomics.

Middle East

The Middle East Global Agrigenomics Market size was valued at USD 101.1 million in 2018, reached USD 127.1 million in 2024, and is anticipated to reach USD 226.5 million by 2032, at a CAGR of 7.6%. Holding 4% of the 2024 market share, the region emphasizes food security and water-efficient agriculture. Israel leads with advanced biotechnology capabilities, while GCC countries such as Saudi Arabia and the UAE invest heavily in drought-resistant crops and livestock genomics to reduce dependency on imports. Government-led initiatives and collaborations with international research institutions strengthen the role of genomics in ensuring sustainable food production. The region’s focus remains on addressing harsh climatic conditions through genetic innovation.

Africa

The Africa Global Agrigenomics Market size was valued at USD 58.2 million in 2018, reached USD 101.7 million in 2024, and is anticipated to reach USD 179.8 million by 2032, at a CAGR of 7.1%. Africa accounts for 3% of the 2024 market share, with South Africa leading in genomic adoption due to its advanced agricultural research capacity. Egypt is also expanding investments in crop improvement programs. The continent faces challenges related to infrastructure, costs, and accessibility, which slow widespread adoption. However, international collaborations, funding programs, and knowledge transfer initiatives are bridging these gaps. With a large agricultural workforce and rising food demand, Africa is expected to emerge as a significant future market for agrigenomics solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Illumina, Inc.

- Eurofins Scientific SE

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Benson Hill

- Inari

- Neogen Corporation

- LGC Limited

- KeyGene

- Pacific Biosciences of California, Inc.

- Oxford Nanopore Technologies plc

- Corteva Agriscience

Competitive Analysis:

The Global Agrigenomics Market is characterized by the presence of both established biotechnology leaders and specialized genomic solution providers. Companies such as Illumina, Thermo Fisher Scientific, and Eurofins Scientific dominate with advanced sequencing platforms, comprehensive testing services, and strong R&D capabilities. It remains highly competitive as firms invest in expanding genomic databases, bioinformatics tools, and precision agriculture applications. Mid-sized companies like Benson Hill, Inari, and KeyGene focus on innovation in seed traits and gene editing technologies, while Corteva Agriscience and Neogen strengthen their positions through integrated agricultural solutions. Competition intensifies as partnerships between research institutions and companies drive rapid innovation, and regional players expand offerings to address local agricultural needs. The market shows a balanced mix of global giants and emerging players striving for technological leadership and market penetration.

Recent Developments:

- In June 2025, Illumina, Inc. announced it will acquire SomaLogic, a leader in proteomics technology, for $350million in cash, with the total transaction valued up to $425million including performance-based milestones. This deal, combining SomaLogic’s proteomics expertise with Illumina’s next-generation sequencing (NGS) platform innovation, is set to advance Illumina’s multiomics strategy in the agrigenomics and healthcare markets.

- In April 2025, Eurofins Scientific SE completed the acquisition of SYNLAB’s clinical diagnostics operations in Spain. This move expands Eurofins’ presence in the clinical diagnostics sector, allowing the company to serve more than 10million patients annually and process over 100million laboratory tests through a workforce exceeding 2,000 staff. The deal consolidates Eurofins’ leadership in clinical and molecular diagnostics, enabling broader genomics and analytical service capabilities throughout Spain.

- In July 2024, Thermo Fisher Scientific Inc. finalized its acquisition of Olink Holding for approximately $3.1billion. Olink, a Sweden-based provider of next-generation proteomics solutions, brings its proprietary Proximity Extension Assay (PEA) platform to Thermo Fisher’s Life Sciences Solutions business. The PEA technology supports high-throughput protein analysis integrated with PCR and NGS systems and includes a library of over 5,300 validated protein biomarker targets, enhancing Thermo Fisher’s offering in genomics and protein biomarker discovery.

Market Concentration & Characteristics:

The Global Agrigenomics Market demonstrates a moderately concentrated structure, with a few dominant players controlling significant market share through advanced sequencing platforms, comprehensive service portfolios, and strong R&D networks. Illumina, Thermo Fisher Scientific, and Eurofins Scientific lead, while regional and niche players compete by offering cost-effective and application-specific solutions. It maintains a balance between innovation-driven giants and emerging biotech firms that specialize in gene editing, marker-assisted selection, and bioinformatics. Market characteristics include rapid technological evolution, high R&D intensity, and strategic partnerships that expand application areas. Growing regulatory frameworks, combined with increasing government support for sustainable agriculture, further shape the industry’s competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on technology, application, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of gene editing and marker-assisted selection will accelerate crop and livestock improvements.

- Integration of bioinformatics and AI will enhance genomic data analysis for precision agriculture.

- Expansion in Asia Pacific will outpace other regions due to large-scale modernization programs.

- Collaborations between biotech firms and research institutes will drive innovation pipelines.

- Portable and field-based sequencing technologies will improve accessibility for farmers.

- Sustainable agriculture policies will encourage broader adoption of genomic solutions.

- Livestock genomics will gain importance in meeting rising protein demand.

- Regulatory clarity on gene editing will support commercialization across markets.

- Private and public funding in agricultural R&D will strengthen market expansion.

- Emerging economies will witness faster adoption through international knowledge transfer.