Market Overview:

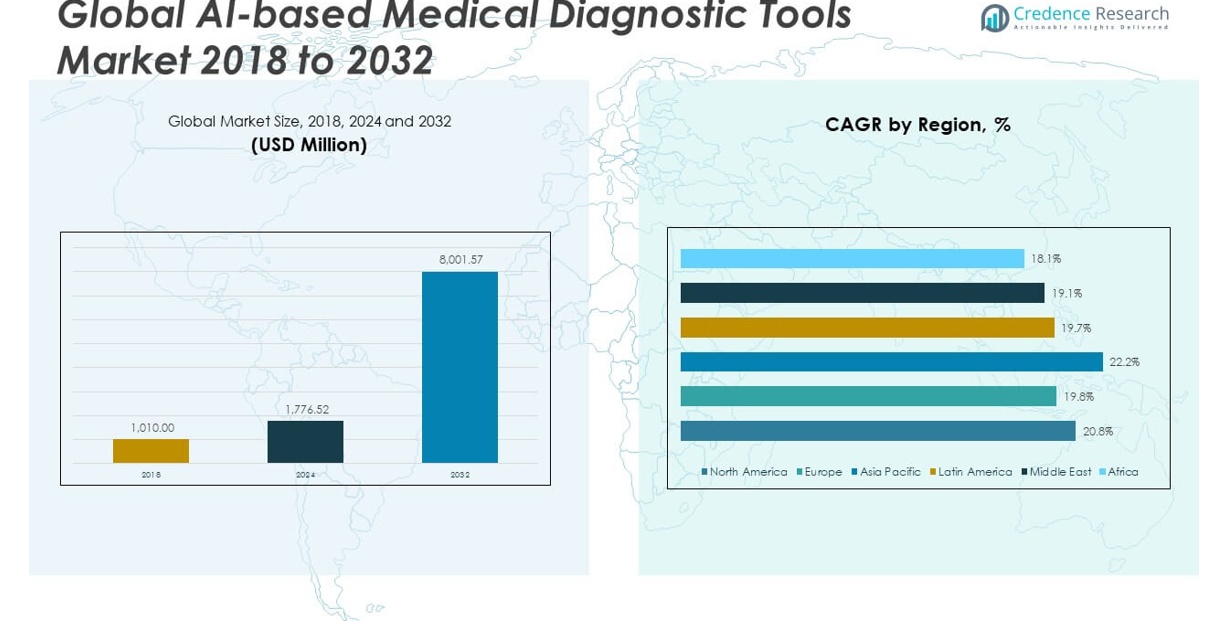

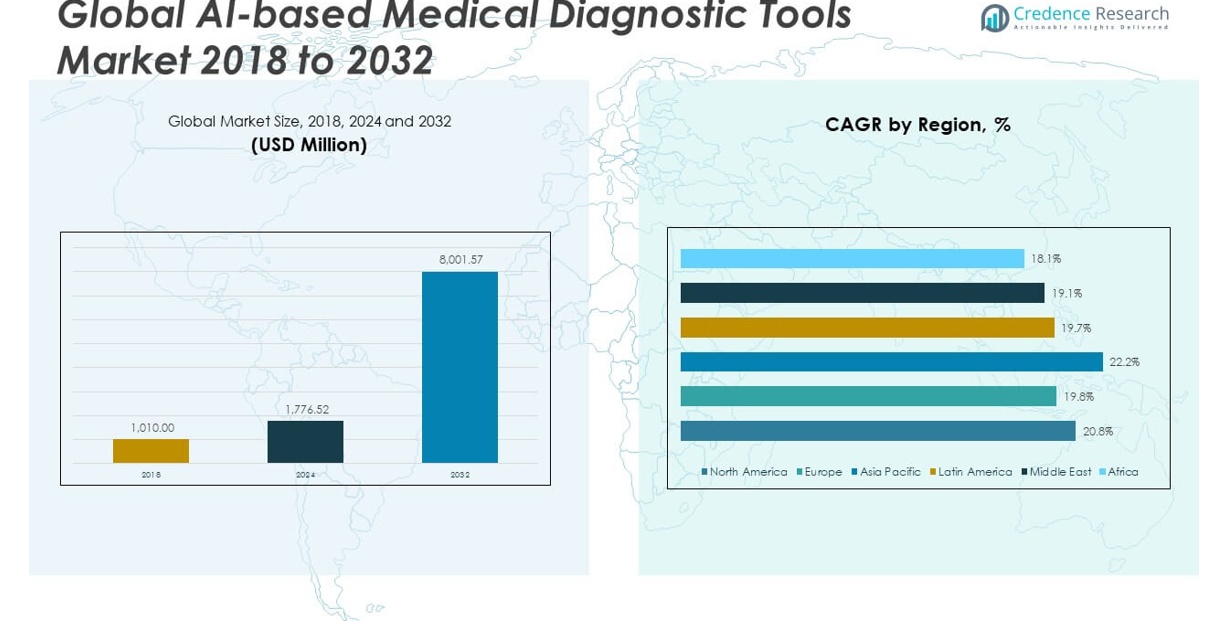

The Global AI-based Medical Diagnostic Tools Market size was valued at USD 1,010.00 million in 2018 to USD 1,776.52 million in 2024 and is anticipated to reach USD 8,001.57 million by 2032, at a CAGR of 20.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI-based Medical Diagnostic Tools Market Size 2024 |

USD 1,776.52 million |

| AI-based Medical Diagnostic Tools Market, CAGR |

20.77% |

| AI-based Medical Diagnostic Tools Market Size 2032 |

USD 8,001.57 million |

The market is being fueled by several key drivers. The global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is rising, leading to an increased need for early and accurate diagnosis. AI-based diagnostic tools offer scalable solutions that can analyze large volumes of data quickly and effectively, facilitating timely intervention and treatment. In addition, the shortage of skilled medical professionals in many parts of the world is encouraging healthcare systems to rely more heavily on AI technologies to supplement clinical expertise. Regulatory support and favorable reimbursement policies in regions such as North America and Europe are encouraging innovation and accelerating product approvals. Moreover, advancements in wearable devices, cloud computing, and mobile health applications are expanding the reach of AI diagnostics beyond hospitals to home and remote care environments. Strategic partnerships between technology firms and healthcare institutions, as well as rising investment in health tech startups, are further intensifying the development and deployment of advanced diagnostic solutions powered by artificial intelligence.

Regionally, North America dominates the global AI-based medical diagnostic tools market. This leadership is attributed to the presence of a highly developed healthcare infrastructure, early adoption of advanced technologies, supportive regulatory frameworks, and significant investments by both government and private sectors. The United States, in particular, is at the forefront of clinical trials, AI software development, and implementation of AI-based diagnostic platforms in hospitals and diagnostic centers. Europe follows closely, with increasing integration of AI diagnostics across public health systems in countries like Germany, the UK, and France, driven by strong governmental initiatives and research funding. The Asia-Pacific region is expected to exhibit the fastest growth over the forecast period, propelled by the rising incidence of chronic diseases, improving healthcare access, and government-backed digital health programs in countries such as China, India, Japan, and South Korea. Innovative AI health startups in Asia are also playing a pivotal role in scaling diagnostics to underserved populations. Meanwhile, Latin America, the Middle East, and Africa are gradually adopting AI tools in diagnostic applications, particularly in urban centers and private healthcare facilities, though infrastructure and funding constraints continue to pose challenges. Overall, the regional dynamics reflect a clear global momentum toward embracing AI for enhancing medical diagnostics, reducing costs, and improving health outcomes.

Market Insigts:

- The Global AI-based Medical Diagnostic Tools Market was valued at USD 1,010.00 million in 2018, reached USD 1,776.52 million in 2024, and is projected to reach USD 8,001.57 million by 2032, growing at a CAGR of 20.77% during the forecast period.

- Rising burden of chronic diseases such as cancer, cardiovascular disorders, diabetes, and neurological conditions is intensifying demand for early and accurate diagnosis, which AI tools enable through rapid data analysis and reduced diagnostic errors.

- Ongoing shortage of diagnostic professionals, including radiologists and pathologists, is driving adoption of AI-based tools that reduce workload pressure and improve turnaround time in both developed and emerging healthcare systems.

- Advancements in cloud computing, wearable devices, mobile health apps, and Internet of Medical Things (IoMT) are boosting AI integration into real-time, remote diagnostic environments across hospitals and homecare.

- Regulatory bodies in North America, Europe, and Asia are facilitating faster product approvals through sandbox testing, fast-track pathways, and pilot programs, while venture capital and private equity investment are increasing in health tech startups.

- Regulatory fragmentation, data privacy laws (e.g., GDPR, HIPAA), lack of standardized datasets, and poor interoperability between AI tools and legacy systems are key challenges restricting global scalability.

- Regionally, North America leads the market with advanced infrastructure and government support, Europe follows with public health AI initiatives, and Asia-Pacific is expected to grow fastest due to rising disease incidence, digital health investments, and startup expansion in China, India, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Early and Accurate Diagnosis Across Chronic and Complex Diseases:

The growing global burden of chronic and life-threatening diseases such as cancer, cardiovascular disorders, diabetes, and neurological conditions is intensifying the need for early and accurate diagnosis. Traditional diagnostic methods often lack the precision and speed needed to detect such conditions at an early stage. AI-based diagnostic tools offer the ability to analyze massive volumes of medical data, enabling faster identification of abnormalities and facilitating earlier intervention. These tools reduce human error and improve consistency in diagnosis, especially in complex or rare cases. The Global AI-based Medical Diagnostic Tools Market is benefiting significantly from this trend, with healthcare providers increasingly incorporating AI to enhance decision-making and clinical outcomes. It is becoming a vital solution to improve diagnostic efficiency in high-volume hospital settings and underserved areas alike.

- For instance, Google Health’s AI model for breast cancer screening demonstrated a significant improvement in detection rates. In a large-scale prospective study involving over 463,000 women, AI-supported screening increased the breast cancer detection rate by 17.6% compared to standard screening, without increasing the recall rate.

Shortage of Skilled Medical Professionals and Increasing Workload Pressure:

The global shortage of skilled radiologists, pathologists, and other diagnostic professionals is placing immense pressure on healthcare systems. Medical professionals face high caseloads, limited time per patient, and growing demand for diagnostic accuracy. AI-based diagnostic tools help bridge this gap by offering decision support, pre-screening capabilities, and automated image analysis, thereby reducing workload and improving productivity. These tools allow clinicians to focus more on complex decision-making and patient care while AI handles routine diagnostic tasks. It supports overburdened systems by improving turnaround time and reducing diagnostic fatigue. This structural need is creating strong momentum in the Global AI-based Medical Diagnostic Tools Market.

- For instance, Aidoc’s AI-powered radiology platform has been shown in clinical studies to substantially reduce report turnaround time and increase radiologist confidence. Its brain solution, FDA-cleared for detecting acute intracranial hemorrhage, demonstrated a significant reduction in report turnaround time in real-world hospital settings.

Integration of AI with Digital Health Infrastructure and Emerging Technologies:

Widespread digitization of healthcare infrastructure is accelerating AI integration into diagnostics. Cloud-based platforms, wearable health devices, and Internet of Medical Things (IoMT) ecosystems generate real-time patient data, which AI systems can process for actionable insights. Hospitals and diagnostic labs are adopting AI solutions that integrate seamlessly with electronic health records (EHRs) and radiology information systems (RIS), allowing for streamlined workflows and real-time diagnostics. It enables remote diagnostics and telemedicine services, supporting expanded access to care, especially in rural or low-resource settings. The synergy between AI and emerging technologies is enhancing data accuracy and system interoperability. This convergence continues to drive innovation and adoption in the diagnostic landscape.

Growing Regulatory Support and Commercial Investments Fueling Market Expansion:

Supportive regulatory policies and growing financial investment are encouraging the adoption of AI diagnostics across markets. Government agencies in North America, Europe, and parts of Asia are accelerating AI approvals through clear guidelines, sandbox testing, and fast-track review processes. Commercial investment from venture capitalists, healthcare giants, and technology firms is funding startups and scaling validated diagnostic platforms. Strategic collaborations between healthcare institutions and AI developers are fostering innovation, pilot programs, and large-scale deployments. It is helping to build trust in AI tools through clinical validation and improved transparency. These regulatory and financial enablers are vital in advancing the maturity of the Global AI-based Medical Diagnostic Tools Market.

Market Trends:

Integration of Multi-Modal Data Enhances Diagnostic Precision:

The Global AI-based Medical Diagnostic Tools Market is witnessing a growing trend toward integrating multi-modal data sources to improve diagnostic accuracy. Tools now analyze a combination of electronic health records (EHR), radiological images, pathology slides, and genomic data to generate comprehensive insights. This convergence enhances the capability to detect complex diseases and improves the reliability of differential diagnoses. Companies are prioritizing solutions that unify structured and unstructured data using deep learning and natural language processing (NLP) techniques. Interoperability standards are becoming more critical, pushing vendors to align their platforms with evolving data exchange protocols. The market reflects a shift from isolated diagnostic models to interconnected ecosystems of clinical intelligence.

- For instance, Arterys’ cloud-based AI platform integrates radiology images, pathology data, and EHRs, enabling clinicians to access a unified patient view. In clinical deployments, Arterys’ platform has demonstrated a 25% reduction in diagnostic turnaround time for complex oncology cases by leveraging multi-modal data fusion and deep learning algorithms.

Personalized Diagnostics Drive Patient-Centric Innovation:

AI-based diagnostics are moving toward more personalized and predictive models, transforming clinical workflows. Tools now consider patient-specific variables such as lifestyle, genetic risk, comorbidities, and treatment history to tailor diagnostic outcomes. This trend enables earlier disease detection and individualized care planning, especially for chronic conditions like cancer, diabetes, and cardiovascular disorders. The Global AI-based Medical Diagnostic Tools Market benefits from this shift by fostering partnerships between AI developers and personalized medicine initiatives. Stakeholders are focusing on algorithm transparency and explainability to ensure clinicians trust and adopt these tailored recommendations. It also aligns with payer demands for outcome-based reimbursements and clinical effectiveness.

- For instance, Qure.ai’s qXR-LN AI tool for lung cancer screening incorporates patient history and risk factors to personalize diagnostic recommendations. In a prospective randomized control trial at University Hospitals Cleveland Medical Center, the tool improved early lung cancer detection rates by 19% compared to standard protocols, supporting more individualized care pathways.

Decentralization and Point-of-Care Diagnostics Expand Reach:

AI-based diagnostic tools are increasingly being deployed outside of traditional hospital settings. Point-of-care devices equipped with embedded AI enable real-time testing and diagnosis in remote clinics, ambulatory centers, and even patients’ homes. This decentralization supports broader access to healthcare, especially in low-resource regions where specialist availability is limited. The market is responding with compact, cloud-connected diagnostic platforms that leverage edge computing for local inference while syncing with central databases. It is also creating new opportunities in mobile health (mHealth) applications and wearable diagnostics that complement telehealth services. This shift is reshaping care delivery models and broadening the scope of AI utility in early intervention and monitoring.

Regulatory and Ethical Frameworks Shape Market Innovation:

Regulatory evolution is influencing how developers design, validate, and deploy AI diagnostic tools. Agencies like the FDA and EMA are refining approval pathways to accommodate adaptive algorithms and continuous learning systems. The Global AI-based Medical Diagnostic Tools Market is aligning its innovation pipeline with these emerging compliance standards. Ethical considerations, such as bias mitigation, data privacy, and accountability, are becoming central to product design and deployment strategies. Startups and established players alike are investing in transparent AI development frameworks and engaging with third-party audits. This regulatory maturation is guiding responsible innovation and improving stakeholder confidence across clinical and commercial channels.

Market Challenges Analysis:

Regulatory Ambiguities and Compliance Complexity Hinder Market Expansion:

The Global AI-based Medical Diagnostic Tools Market faces significant barriers due to fragmented and evolving regulatory frameworks. Many jurisdictions lack clear guidelines for approving adaptive AI algorithms that learn from new data over time. Developers must navigate lengthy approval cycles, extensive validation protocols, and jurisdiction-specific compliance demands. It limits the speed at which innovations can move from prototype to clinical deployment. The uncertainty surrounding liability and accountability for AI-generated diagnoses further complicates adoption. Healthcare providers remain cautious, delaying procurement and integration until they gain regulatory clarity. It creates operational bottlenecks that slow the pace of commercialization.

Data Quality, Bias, and Interoperability Remain Persistent Challenges:

Effective AI-driven diagnostics rely on high-quality, diverse, and well-labeled datasets, which are often fragmented or biased. The Global AI-based Medical Diagnostic Tools Market grapples with challenges in accessing standardized data across institutions and populations. Tools trained on homogenous datasets may underperform in diverse clinical settings, raising concerns about diagnostic accuracy and health equity. Data privacy laws such as GDPR and HIPAA also restrict the free flow of medical information, making cross-border AI training more complex. Interoperability gaps between AI platforms and legacy healthcare IT systems further limit integration. It slows real-time decision support at the point of care and increases implementation costs for providers.

Market Opportunities:

Growing Demand for Early Disease Detection and Preventive Care:

The Global AI-based Medical Diagnostic Tools Market has strong growth potential driven by rising demand for early diagnosis and preventive healthcare. Governments and health systems are shifting focus from treatment to early intervention, opening opportunities for AI tools that detect diseases in pre-symptomatic stages. These solutions offer value in oncology, neurology, and cardiology where early action significantly improves outcomes. It positions AI as a critical enabler of predictive and proactive healthcare. Startups and research institutes are partnering with diagnostic labs to integrate machine learning into screening workflows. The trend supports long-term cost savings and better patient outcomes.

Emerging Markets Offer Untapped Adoption Potential:

Rapid healthcare digitization in emerging economies presents a scalable opportunity for AI diagnostics. Countries in Asia, Latin America, and Africa are investing in telemedicine infrastructure and mobile health solutions to improve access. The Global AI-based Medical Diagnostic Tools Market can grow by delivering portable, cloud-connected diagnostic platforms suited for decentralized care. It helps address physician shortages and diagnostic delays in underserved regions. Local partnerships with public health agencies and NGOs can accelerate pilot deployments and market entry. Demand for low-cost, AI-enhanced diagnostic tools is rising, creating space for region-specific innovation.

Market Segmentation Analysis:

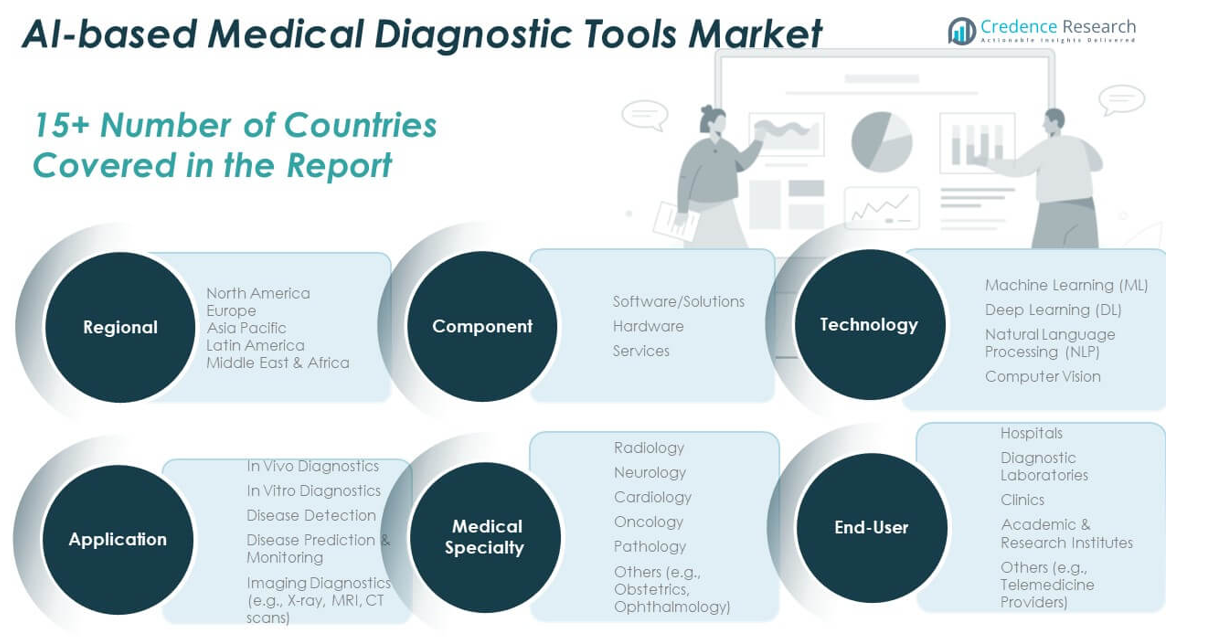

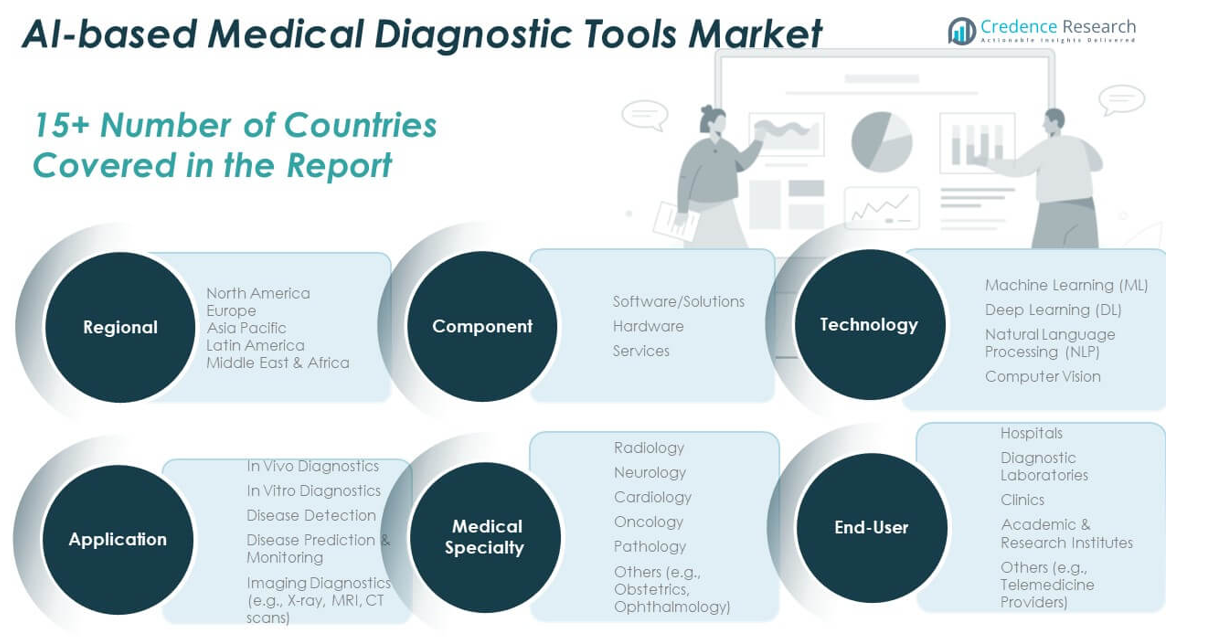

By Component

The market is segmented into Software/Solutions, Hardware, and Services. Software/solutions dominate the segment due to their central role in automating image analysis, processing clinical data, and supporting decision-making. Hardware components, including AI-integrated imaging devices and processors, provide the required computational power. Services such as system integration, training, and support ensure proper implementation and usability, supporting long-term adoption.

- For instance, Siemens Healthineers’ AI-Rad Companion software suite, integrated into their imaging hardware, has been adopted healthcare institutions worldwide, automating organ segmentation and quantification in CT and MRI scans, and reducing manual processing time.

By Application

Key applications include In Vivo Diagnostics, In Vitro Diagnostics, Disease Detection, Disease Prediction & Monitoring, and Imaging Diagnostics. Disease detection leads the segment due to high demand for early diagnosis in oncology, cardiology, and neurology. Imaging diagnostics, involving X-ray, MRI, and CT scans, is growing steadily with AI enhancing image accuracy. Predictive and monitoring tools are gaining interest with the rise of remote health monitoring.

- For instance, Zebra Medical Vision’s AI algorithms for chest X-ray analysis have been deployed in over 50 hospitals, automatically detecting more than 40 clinical findings and achieving an area under the curve (AUC) of 0.92 for lung nodule detection in real-world clinical validation studies.

By End-User

The end-user segment includes Passenger Systems and Non-passenger Systems. Passenger systems represent the larger share, driven by clinical diagnostics and patient-facing applications. Non-passenger systems, though smaller, support administrative and operational processes like data management and workflow optimization.

By Medical Specialty

The Global AI-based Medical Diagnostic Tools Market shows strong specialization trends across key clinical domains. Radiology holds the largest share, driven by widespread use of AI in automating image interpretation in X-rays, CT scans, and MRIs. It improves diagnostic speed and accuracy, making it essential in high-volume hospital settings. Neurology is expanding with AI tools aiding in early detection of neurodegenerative disorders like Alzheimer’s and Parkinson’s through brain imaging and cognitive assessments. Cardiology leverages AI for ECG analysis, echocardiography, and risk prediction models, especially in acute care environments. Oncology benefits from AI-assisted tumor detection, biopsy analysis, and personalized treatment planning, supporting precision medicine initiatives. Pathology is witnessing increasing AI integration in digital slide analysis, histopathology, and biomarker detection, helping to overcome pathologist shortages.

By Technology

Machine Learning and Deep Learning hold the highest share due to their effectiveness in pattern recognition and predictive analytics. Natural Language Processing is widely used for analyzing clinical notes, while Computer Vision plays a key role in medical imaging analysis. The Global AI-based Medical Diagnostic Tools Market leverages all these technologies to enhance clinical accuracy and efficiency.

Segmentation:

By Component:

- Software/Solutions

- Hardware

- Services

By Application:

- In Vivo Diagnostics

- In Vitro Diagnostics

- Disease Detection

- Disease Prediction & Monitoring

- Imaging Diagnostics (e.g., X-ray, MRI, CT scans)

By End-User:

- Passenger Systems

- Non-passenger Systems

by Medical Specialty

- Radiology

- Neurology

- Cardiology

- Oncology

- Pathology

- Others (e.g., Obstetrics, Ophthalmology)

By Technology:

- Machine Learning (ML)

- Deep Learning (DL)

- Natural Language Processing (NLP)

- Computer Vision

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America AI-based Medical Diagnostic Tools Market size was valued at USD 407.23 million in 2018, reached USD 708.47 million in 2024, and is anticipated to reach USD 3,187.04 million by 2032, growing at a CAGR of 20.8%. North America leads the Global AI-based Medical Diagnostic Tools Market due to its advanced healthcare infrastructure and strong technological ecosystem. The United States dominates the region, driven by early adoption of AI tools, substantial investment in health tech, and high levels of AI integration in hospital settings. Regulatory agencies like the FDA are creating fast-track pathways for AI diagnostics. Hospitals, diagnostic centers, and research institutions are active in clinical validation and large-scale deployment. Collaborations between healthcare providers and AI developers continue to drive operational adoption and real-world use cases.

Europe

The Europe AI-based Medical Diagnostic Tools Market size was valued at USD 225.23 million in 2018, reached USD 378.00 million in 2024, and is projected to reach USD 1,590.33 million by 2032, at a CAGR of 19.8%. Europe maintains a strong position with public healthcare systems investing in AI to improve diagnostic efficiency. Countries such as Germany, the UK, and France are leading with national strategies, research grants, and ethical AI frameworks. Integration into electronic health systems and growing demand for accurate disease detection are fueling market expansion. Regional institutions are focused on data privacy and interoperability, influencing AI tool development. Increasing collaboration across EU member states is supporting standardized, cross-border adoption.

Asia Pacific

The Asia Pacific AI-based Medical Diagnostic Tools Market was valued at USD 256.84 million in 2018, reached USD 471.04 million in 2024, and is estimated to hit USD 2,333.26 million by 2032, registering the highest CAGR of 22.2%. Asia Pacific is the fastest-growing region in the market, propelled by rising chronic disease prevalence and expanding digital health initiatives. China, India, Japan, and South Korea are leading AI integration into diagnostics through government programs, start-up ecosystems, and infrastructure development. Telemedicine and mobile diagnostics are scaling rapidly across rural and semi-urban areas. Cloud computing and localized AI solutions are addressing population-specific health needs. Regional innovation is accelerating market penetration, especially in resource-limited environments.

Latin America

The Latin America AI-based Medical Diagnostic Tools Market size was USD 62.92 million in 2018, rose to USD 109.59 million in 2024, and is expected to reach USD 457.45 million by 2032, at a CAGR of 19.7%. Latin America is gradually adopting AI diagnostics, led by Brazil and Mexico, where healthcare reforms and public-private initiatives are shaping digital transformation. Urban hospitals and private healthcare groups are early adopters of AI tools for disease detection and imaging diagnostics. Limited access to specialists is creating a need for AI-supported diagnosis in underserved regions. Language customization and interoperability remain hurdles, but local integration is improving through collaboration with North American technology firms.

Middle East

The Middle East AI-based Medical Diagnostic Tools Market was valued at USD 35.96 million in 2018, grew to USD 58.97 million in 2024, and is forecast to reach USD 237.69 million by 2032, at a CAGR of 19.1%. Middle Eastern nations like the UAE and Saudi Arabia are investing heavily in AI-driven healthcare as part of their national digital visions. Hospitals and medical research centers are exploring AI in radiology, oncology, and pathology to improve clinical workflows. Partnerships with global AI providers are increasing to build capacity and expertise. Though the market is concentrated in high-income areas, investment in smart medical cities and digital health infrastructure continues to expand regional uptake.

Africa

The Africa AI-based Medical Diagnostic Tools Market stood at USD 21.82 million in 2018, reached USD 50.46 million in 2024, and is projected to reach USD 195.79 million by 2032, at a CAGR of 18.1%. Africa holds the smallest share but presents long-term potential due to unmet healthcare needs. Mobile health and AI-powered diagnostics are being piloted in rural and remote regions to overcome physician shortages. Countries like South Africa, Kenya, and Nigeria are beginning to adopt AI tools through donor-funded programs and public health initiatives. Infrastructure challenges and limited AI training data remain barriers. The region is focusing on low-cost, scalable AI solutions tailored for primary care environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens Healthineers

- IBM Watson Health (Merative)

- GE HealthCare

- Aidoc

- Zebra Medical Vision

- Arterys

- ai

- PathAI

- AliveCor

- Riverain Technologies

- ai

- Quibim

- Caption Health (formerly Bay Labs)

- ai

- Enlitic

- Tempus

Competitive Analysis:

The Global AI-based Medical Diagnostic Tools Market features a competitive landscape characterized by the presence of both established healthcare technology firms and emerging AI startups. Leading players include IBM Watson Health, Aidoc, Zebra Medical Vision, Siemens Healthineers, GE Healthcare, and PathAI. These companies focus on product innovation, clinical validation, and regulatory compliance to strengthen their market positions. Strategic partnerships with hospitals, academic institutions, and cloud service providers are common approaches to accelerate adoption. Startups are introducing niche solutions targeting specific conditions or imaging modalities, creating competitive pressure for larger firms to diversify portfolios. The market also reflects growing interest from tech giants such as Google Health and Amazon Web Services entering the diagnostic space. It is evolving rapidly through investments in deep learning, natural language processing, and computer vision. Intellectual property, real-world evidence, and global scalability remain critical success factors shaping competition in the Global AI-based Medical Diagnostic Tools Market.

Recent Developments:

- In May 2025, Qure.ai launched AIRA, an AI-powered co-pilot designed to support health workers in low- and middle-income countries, enhancing efficiency and protocol adherence in patient care.In April 2025, Qure.ai entered a collaboration with University Hospitals Cleveland Medical Center to deploy its FDA-cleared qXR-LN AI tool for early lung cancer detection via chest X-rays, with a prospective randomized control trial underway to validate its effectiveness.ai also partnered with Strategic Radiology in June 2024 to enhance radiology efficiency for over 1,700 U.S. radiologists using AI-powered imaging solutions. The company now has 18 FDA clearances, the highest number for lung cancer AI tools globally, and its solutions are deployed in more than 100 countries.

- In April 2025, Siemens Healthineers unveiled several new diagnostic imaging solutions at the Asian Oceanian Congress of Radiology (AOCR) 2025, including the virtually helium-free 1.5T MAGNETOM Flow MRI, the Dual Source CT scanner SOMATOM Pro.Pulse, and AI-powered ultrasound systems ACUSON Maple and ACUSON Sequoia. These innovations are designed to enhance precision medicine and support informed clinical decision-making across the healthcare continuum.Additionally, in May 2025, Siemens Healthineers presented the Magnetom Flow RT Pro Edition MRI system, which features AI-powered image reconstruction and energy-saving capabilities, reducing energy consumption by up to 45% compared to previous models.

- In March 2025, GE HealthCare launched the AI-driven Invenia ABUS Premium, a patient-friendly ultrasound system designed to accelerate scanning and improve early cancer detection in dense breasts. The system features integrated Verisound AI and AI Assistant for faster, reproducible scanning and reading, enhancing image quality and workflow efficiency.At RSNA 2024, GE HealthCare also introduced Sonic DL for 3D, a deep-learning innovation that reduces scan times by up to 86% and extends high-speed imaging to brain, spine, and body applications. In November 2024, GE HealthCare announced a collaboration with RadNet’s DeepHealth to distribute SmartMammo and other AI-powered breast imaging solutions in the U.S., aiming to elevate personalized breast care.

Market Concentration & Characteristics:

The Global AI-based Medical Diagnostic Tools Market exhibits moderate market concentration, with a mix of large multinational companies and a growing number of specialized startups. It is characterized by rapid technological advancement, high R&D intensity, and strong regulatory oversight. The market favors companies with capabilities in machine learning, cloud integration, and medical imaging. Competitive dynamics are driven by clinical validation, scalability, and interoperability with existing healthcare systems. Strategic alliances and acquisitions are common as firms seek to expand their product portfolios and global reach. The market continues to evolve through innovation in deep learning and real-time diagnostics, supported by rising healthcare digitization and demand for precision medicine.

Report Coverage:

The research report offers an in-depth analysis based on components, applications, systems, end-users, and technologies. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will continue to grow rapidly, driven by increasing demand for faster, more accurate diagnostic solutions across clinical environments.

- AI tools will become more integrated into standard diagnostic workflows, supported by improvements in data interoperability and system compatibility.

- Advances in edge computing and embedded AI will enhance the capabilities of point-of-care and portable diagnostic devices.

- Regulatory frameworks will evolve to support adaptive algorithms and real-time learning systems, encouraging broader adoption.

- Cloud-based diagnostic platforms will gain prominence, enabling remote diagnostics and telehealth expansion in underserved areas.

- Startups focusing on niche diagnostics and rare disease detection will attract significant investment and collaboration opportunities.

- AI-enabled tools will increasingly support multi-modal diagnostics by combining imaging, pathology, genomic, and clinical data.

- Healthcare systems will prioritize explainable AI to ensure clinician trust and meet compliance and ethical standards.

- Public-private partnerships will drive large-scale deployment in emerging markets and rural healthcare settings.

- Continuous innovation in deep learning and computer vision will push the boundaries of automated image interpretation.