Market Overview:

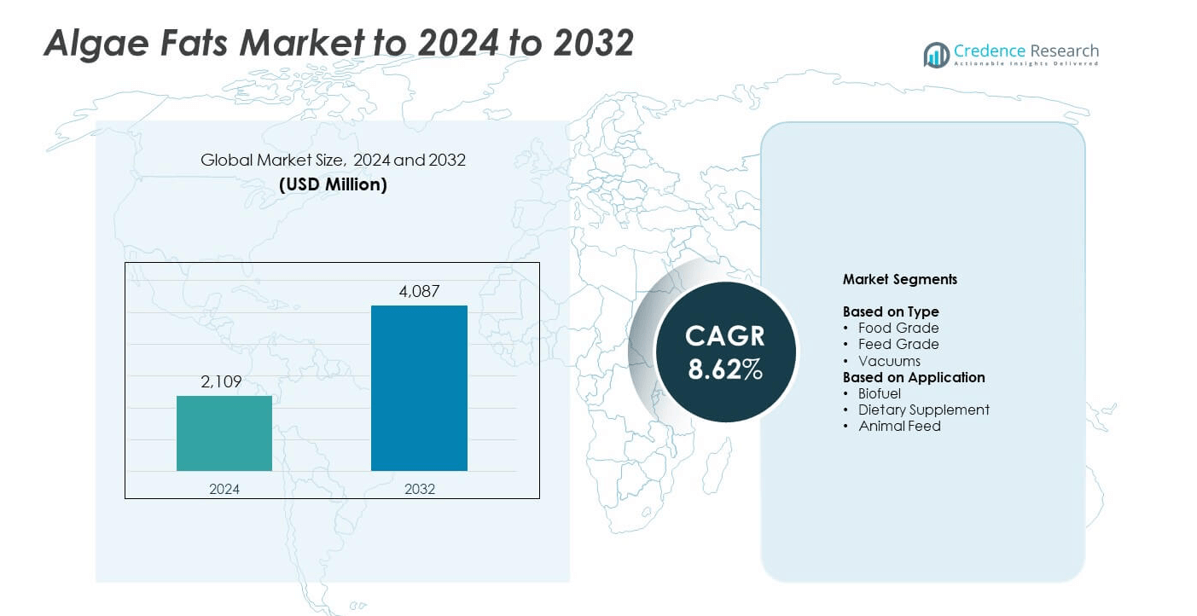

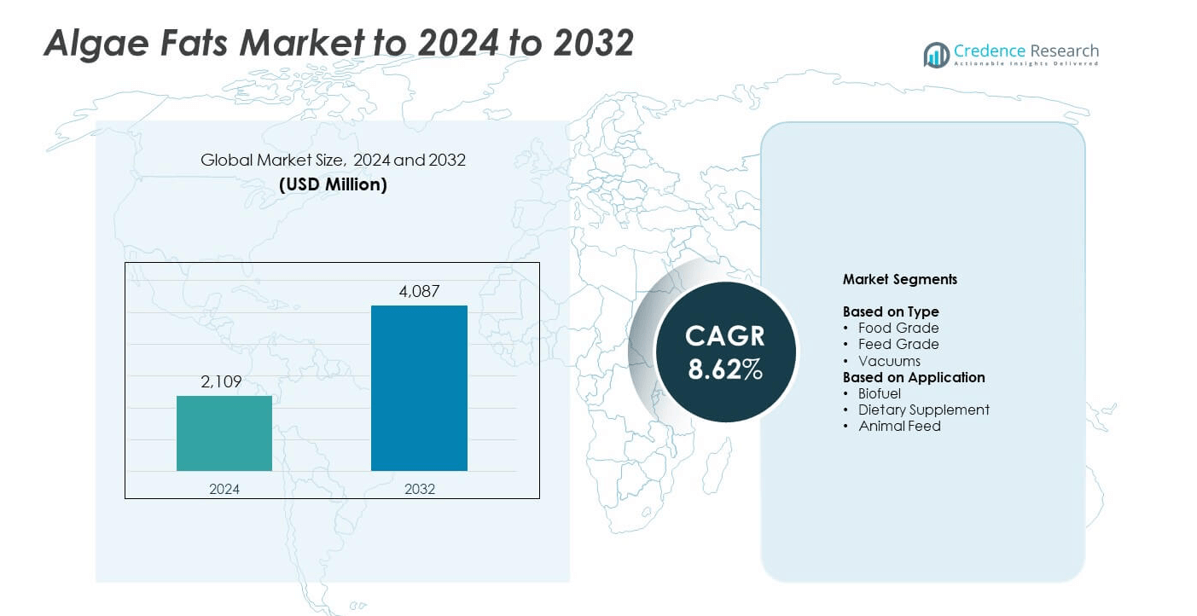

The Algae Fats Market size was valued at USD 2,109 million in 2024 and is anticipated to reach USD 4,087 million by 2032, at a CAGR of 8.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algae Fats Market Size 2024 |

USD 2,109 million |

| Algae Fats Market, CAGR |

8.62% |

| Algae Fats Market Size 2032 |

USD 4,087 million |

The algae fats market is led by key players including BASF, Corbion, Evonik, Solazyme, DSM, Lonza, Cargill, and Neste, along with emerging participants such as TerraVia, DuPont, and Aker BioMarine. These companies focus on sustainable lipid extraction, microalgae cultivation, and omega-3 production to meet the growing demand for plant-based nutrition. North America dominated the market with a 34.2% share in 2024, driven by strong adoption in dietary supplements and functional foods. Europe followed with a 29.5% share, supported by stringent environmental regulations and clean-label preferences, while Asia Pacific accounted for 25.7%, reflecting rapid growth in health and aquaculture applications

.Market Insights

- The algae fats market was valued at USD 2,109 million in 2024 and is projected to reach USD 4,087 million by 2032, growing at a CAGR of 8.62%.

- Rising demand for plant-based omega-3 sources and sustainable nutrition products is driving market growth, with strong uptake in functional foods and dietary supplements.

- Advancements in microalgae cultivation and lipid extraction technologies are improving efficiency, enabling wider applications in biofuels, nutraceuticals, and animal feed.

- The market is moderately competitive, with leading companies investing in large-scale production, R&D, and strategic collaborations to expand product portfolios and lower production costs.

- North America held a 34.2% market share in 2024, followed by Europe at 29.5% and Asia Pacific at 25.7%, while the food-grade segment led by type with a 53.8% share, and dietary supplements dominated by application with 48.5%, reflecting strong global demand for sustainable, high-quality lipid ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The food grade segment dominated the algae fats market with a 53.8% share in 2024. This dominance stems from its extensive use in functional foods, beverages, and nutraceutical formulations due to high omega-3 and DHA content. Food grade algae fats are preferred for their plant-based origin and sustainability, aligning with the global shift toward vegan and eco-conscious diets. Increasing awareness about cardiovascular and cognitive health further boosts their inclusion in dietary products. The feed grade segment is also expanding, driven by livestock nutrition enhancement and aquaculture feed formulations.

- For instance, Fermentalg’s DHA ORIGINS oil delivers a minimum 550 mg/g DHA (as fatty acids), among the highest natural concentrations available.

By Application

The dietary supplement segment led the market with a 48.5% share in 2024. Demand is primarily driven by the rising need for plant-based omega-3 alternatives to fish oil, especially among vegan consumers. Algae-derived DHA and EPA supplements support brain, heart, and eye health, making them popular in preventive healthcare. Growing consumer preference for clean-label and allergen-free ingredients strengthens this segment’s position. The biofuel application segment is also gaining traction due to algae’s high lipid yield, offering a renewable source for sustainable energy production.

- For instance, KD Nutra’s Alga3 vegan concentrates reach up to 95% total omega-3 content from algal oils for supplement use.

Key rowth Drivers

Rising Demand for Plant-Based Omega-3 Sources

The growing shift toward vegan and vegetarian diets is boosting demand for plant-based omega-3 fatty acids. Algae fats provide sustainable DHA and EPA sources, reducing reliance on fish oil. Their eco-friendly production and absence of marine contaminants make them ideal for health supplements and fortified foods. Expanding awareness of cardiovascular and cognitive health benefits supports higher consumption, particularly in developed regions. Food manufacturers are incorporating algae fats into beverages, nutrition bars, and dairy alternatives to meet clean-label and ethical consumer preferences.

- For instance, Polaris’ Omegavie Algae 100/400 provides at least 400 mg/g DHA (as TG) and 100 mg/g EPA (as TG) for plant-based formulations.

Expanding Use in Functional Foods and Nutraceuticals

The use of algae-derived fats in functional foods and nutraceuticals continues to rise due to their superior bioavailability and stability. Consumers increasingly prefer foods enriched with omega-3 for preventive health management. Algae-based DHA and EPA ingredients are gaining traction in infant formula, bakery, and fortified snacks. The trend is further supported by growing investments in microalgae cultivation and extraction technologies. This expansion enhances product diversity and supports global initiatives promoting healthy and sustainable nutrition sources.

- For instance, Algarithm’s betamega³ micro-encapsulated powder supplies 120 mg/g DHA, designed for easy inclusion in foods and drinks.

Supportive Government Regulations and Sustainability Goals

Government incentives for bio-based products and sustainable resource utilization are driving market growth. Algae fats are recognized as low-impact alternatives with minimal environmental footprint. Regulatory support for renewable ingredients in food, feed, and biofuel sectors is increasing adoption. Many countries promote algae cultivation for carbon sequestration and resource-efficient production. These policies, combined with rising corporate commitments to sustainability, encourage large-scale investment and innovation in algae-based lipid processing, reinforcing long-term market expansion across multiple industries.

Key Trends and Opportunities

Advancements in Algae Cultivation Technologies

Emerging photobioreactor systems and closed-loop cultivation methods are improving algae lipid yields. These technologies enhance scalability, reduce contamination risks, and enable consistent quality. Automated systems with AI-based monitoring optimize nutrient supply and light exposure, boosting productivity. The adoption of precision cultivation allows year-round production independent of climate conditions. Companies are exploring hybrid models integrating wastewater recycling, further cutting production costs and enhancing environmental performance, creating strong opportunities for large-scale industrial adoption.

- For instance, Algalif’s Iceland site expansion increased output to 100 tons biomass and 5,000 kg natural astaxanthin annually across 12,500 m² facilities.

Growing Focus on Algae-Based Biofuels

The transition toward renewable energy is creating new opportunities for algae fats in biofuel production. Algae’s high lipid content and rapid growth rate make it a promising alternative to petroleum-based sources. Governments and energy firms are investing in pilot-scale bio-refineries to commercialize algae-derived biodiesel and jet fuels. Rising fossil fuel costs and emission reduction mandates accelerate development in this space. Collaborative efforts between biotech and energy firms continue to advance extraction efficiency and overall process economics.

- For instance, Sapphire Energy’s Green Crude Farm targeted 100 barrels of algae-derived crude per day at full operation during its commercial demo phase.

Key Challenges

High Production and Processing Costs

Despite technological progress, algae fat production remains capital-intensive due to costly cultivation and extraction processes. Maintaining optimal conditions for algal growth requires advanced photobioreactors and nutrient inputs, increasing operational expenses. The downstream processing of lipids also involves energy-intensive methods. These factors limit scalability and commercial adoption, particularly for smaller manufacturers. Reducing production costs through process optimization and renewable feedstock integration remains essential for improving global competitiveness.

Limited Market Awareness and Supply Chain Constraints

Consumer awareness about algae-derived fats is still limited compared to conventional omega-3 sources. Inconsistent raw material supply and lack of standardized production infrastructure create market inefficiencies. Transporting and storing wet biomass adds logistical challenges, especially in regions without local cultivation facilities. These barriers slow mass adoption across food and biofuel industries. Expanding industry collaborations and awareness campaigns will be critical to strengthening supply networks and improving market visibility.

Regional Analysis

North America

North America held a 34.2% share of the algae fats market in 2024, driven by strong demand for plant-based omega-3 supplements and functional foods. The United States leads regional growth due to high adoption of vegan dietary products and supportive regulatory frameworks promoting sustainable ingredients. Expanding nutraceutical manufacturing and growing consumer awareness of DHA and EPA health benefits further boost demand. Key players are investing in large-scale algae cultivation and refining facilities to enhance domestic production capacity and reduce dependence on imported marine oils.

Europe

Europe accounted for a 29.5% share of the global algae fats market in 2024, supported by stringent environmental regulations and sustainability goals under the EU Green Deal. The region’s preference for natural and renewable lipid sources drives product innovation in dietary supplements and infant nutrition. Countries such as Germany, France, and the Netherlands are advancing algae biotechnology research for clean omega-3 production. Growing consumer inclination toward ethical and plant-based products continues to strengthen market presence across the continent.

Asia Pacific

Asia Pacific captured a 25.7% share of the algae fats market in 2024, emerging as one of the fastest-growing regions. Rapid population growth, increasing health awareness, and expansion of aquaculture and food processing industries drive consumption. China, Japan, and South Korea lead regional adoption, supported by advancements in photobioreactor systems and algae cultivation technologies. Rising demand for sustainable feed ingredients and dietary supplements enhances growth prospects. Government support for renewable bio-resources further accelerates algae-based lipid production.

Latin America

Latin America represented a 6.3% share of the algae fats market in 2024, driven by expanding applications in animal feed and biodiesel sectors. Brazil and Chile are key contributors, leveraging favorable climatic conditions and growing investments in algal biofuel research. Rising awareness about sustainable nutrition and eco-friendly production supports regional market penetration. However, limited infrastructure and higher production costs restrain large-scale commercialization. Collaborative efforts among regional research institutes and global biotechnology firms are gradually improving competitiveness.

Middle East and Africa

The Middle East and Africa accounted for a 4.3% share of the algae fats market in 2024, primarily fueled by increasing investments in sustainable food technologies. The United Arab Emirates and South Africa are emerging hubs for algae cultivation under controlled environments. The market benefits from rising consumer interest in health supplements and the region’s strategic push toward renewable energy resources. Although early in development, growing collaborations with global firms and supportive sustainability initiatives are expected to enhance regional capacity.

Market Segmentations:

By Type

- Food Grade

- Feed Grade

- Vacuums

By Application

- Biofuel

- Dietary Supplement

- Animal Feed

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The algae fats market features several leading players such as BASF, Corbion, Evonik, Solazyme, DSM, Lonza, Cargill, Nature’s Way, TerraVia, Archer Daniels Midland, Ocean Spray, DuPont, NOW Foods, Aker BioMarine, and Neste. These companies focus on developing high-quality, sustainable omega-3 and lipid ingredients through advanced microalgae cultivation and bioprocessing technologies. The competitive environment is shaped by innovation in strain optimization, extraction efficiency, and large-scale production methods to reduce costs and improve yield. Strategic collaborations with food, nutraceutical, and biofuel firms enable technology sharing and accelerate market reach. Manufacturers emphasize eco-friendly sourcing and adherence to global sustainability standards to attract environmentally conscious consumers. Continuous research into DHA- and EPA-rich formulations supports new product launches across supplements, functional foods, and animal nutrition segments. The market competition remains intense, with firms investing in vertical integration and capacity expansion to secure reliable algae biomass supply and strengthen their global distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF

- Corbion

- Evonik

- Solazyme

- DSM

- Lonza

- Cargill

- Nature’s Way

- TerraVia

- Archer Daniels Midland

- Ocean Spray

- DuPont

- NOW Foods

- Aker BioMarine

- Neste

Recent Developments

- In 2025, Aker BioMarine Launched Revervia, a high-potency, algae-based DHA oil for the dietary supplement market, marketed as having one of the highest natural concentrations of DHA available.

- In Oct 2024, dsm-firmenich Expanded its life’s® portfolio with the worldwide launch of life’sDHA B54-0100, the company’s most potent algal oil to date, delivering high concentrations of both DHA and EPA.

- In 2023, Corbion N.V. Launched AlgaPrime DHA P3, a higher-concentration algae-based omega-3 ingredient specifically designed for use in animal food applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to rising demand for sustainable omega-3 sources.

- Technological advances in algae cultivation will enhance lipid yield and production efficiency.

- Increasing consumer preference for plant-based nutrition will strengthen market penetration.

- Governments will promote algae-based biofuels as part of renewable energy programs.

- Strategic partnerships between biotech and food companies will drive product innovation.

- Expansion in nutraceutical and functional food applications will boost long-term adoption.

- Scaling up commercial algae farms will reduce production costs and improve supply stability.

- Growing awareness of environmental impact will accelerate algae-based ingredient use.

- Emerging economies in Asia and Latin America will offer strong growth opportunities.

- Continuous research in strain development will improve fatty acid content and quality.