Market Overview

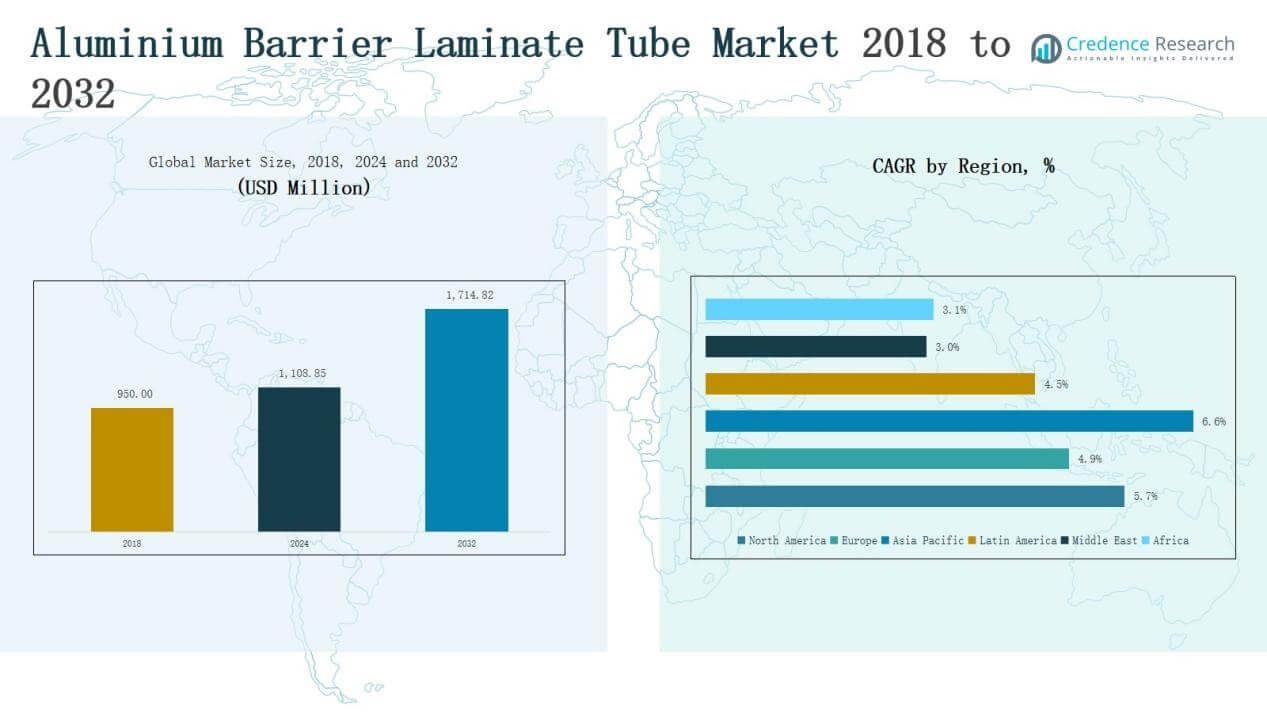

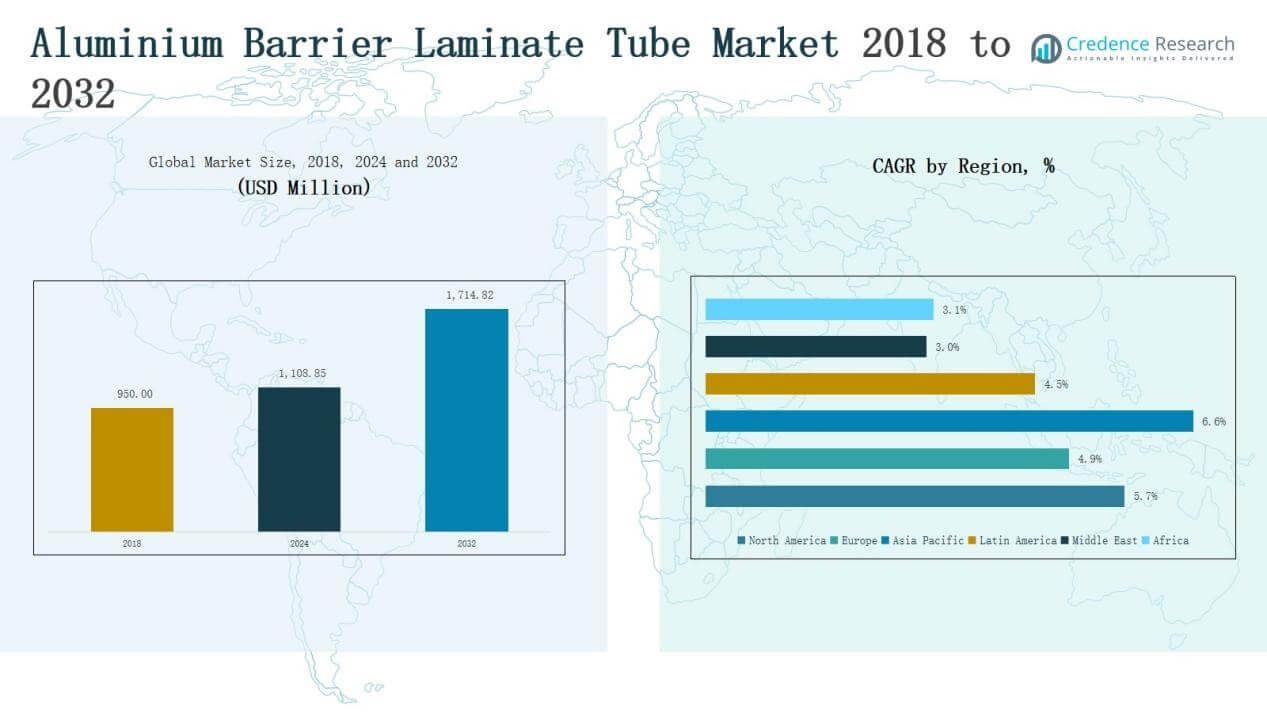

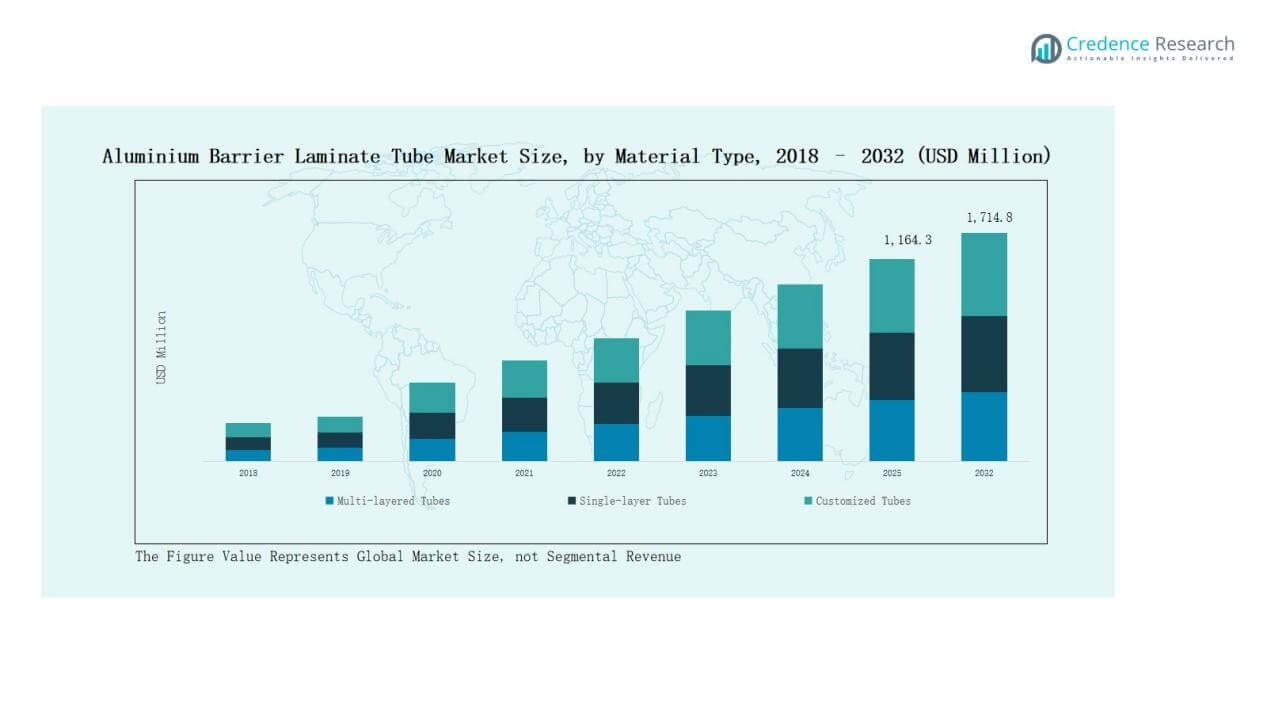

Aluminium Barrier Laminate Tube Market size was valued at USD 950.00 million in 2018, reaching USD 1,108.85 million in 2024, and is anticipated to reach USD 1,714.82 million by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Barrier Laminate Tube Market Size 2024 |

USD 1,108.85 Million |

| Aluminium Barrier Laminate Tube Market, CAGR |

5.69% |

| Aluminium Barrier Laminate Tube Market Size 2032 |

USD 1,714.82 Million |

The Aluminium Barrier Laminate Tube Market is shaped by key players such as Essel Propack Ltd., Huhtamaki Oyj, Montebello Packaging Inc., Hoffmann Neopac AG, Linhardt GmbH & Co. KG, Pirlo GmbH & Co. KG, Impact International Pty. Ltd., Tubapack S.A., Intrapac International Corp., and Ambertube International. These companies compete on innovation, product customization, and sustainable laminate solutions, with strong portfolios serving pharmaceuticals, cosmetics, and food industries. Among regions, Asia Pacific led the market in 2024 with a 35.8% share, driven by expanding pharmaceutical manufacturing, rising cosmetics consumption, and rapid urbanization, reinforcing its position as the global growth hub.

Market Insights

Market Insights

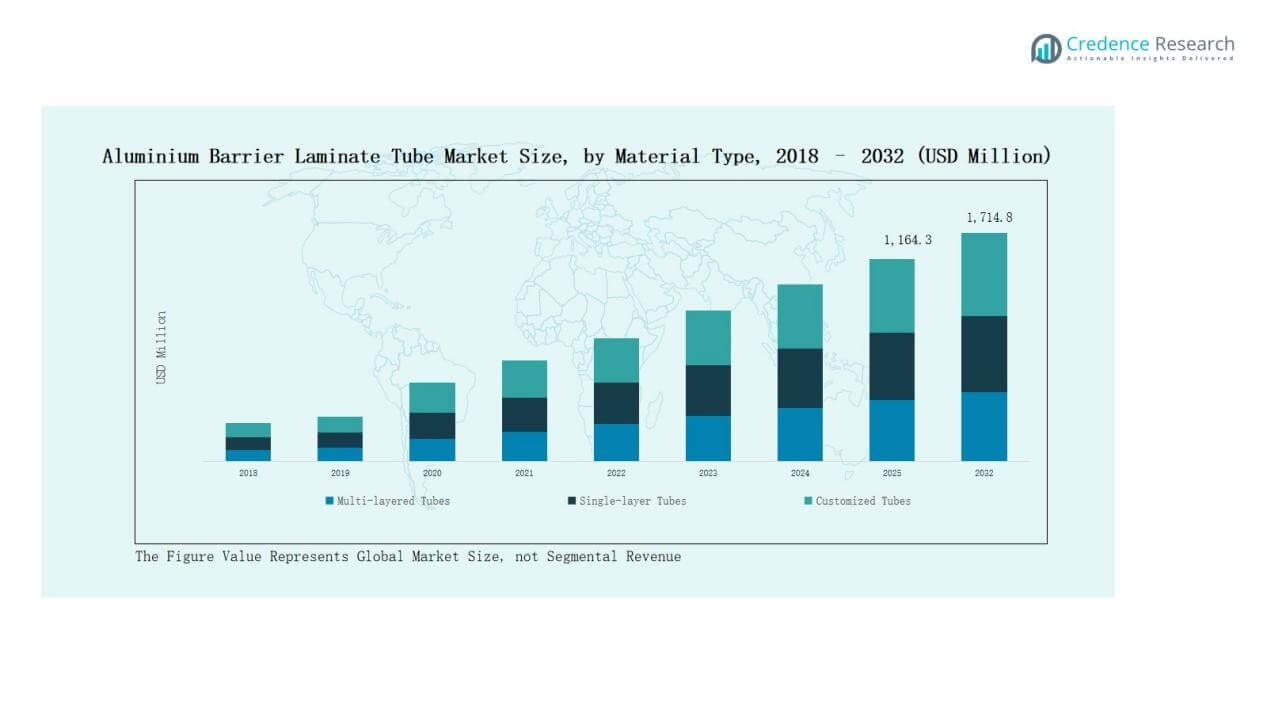

- The Aluminium Barrier Laminate Tube Market grew from USD 950.00 million in 2018 to USD 1,108.85 million in 2024, projected to reach USD 1,714.82 million by 2032.

- Multi-layered tubes led with 58% share in 2024, supported by strong adoption in pharmaceuticals and premium cosmetics for superior protection and extended shelf life.

- Pharmaceuticals dominated applications with 41% share in 2024, while cosmetics & personal care followed at 36%, reflecting rising demand for safe and aesthetic packaging solutions.

- Screw caps accounted for 46% share in 2024, driven by secure sealing and versatility, while flip-top caps held 32% share in personal care and cosmetics.

- Asia Pacific led with 35.8% share in 2024, followed by North America at 29.8% and Europe at 24.8%, with Asia Pacific maintaining the fastest growth trajectory.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Material Type

Multi-layered tubes held a 58% share in 2024, making them the leading material type in the Aluminium Barrier Laminate Tube Market. Their dominance comes from superior barrier protection against oxygen, moisture, and light, which extends product shelf life. Pharmaceuticals and premium cosmetics increasingly rely on multi-layered formats to maintain product integrity. Single-layered tubes, with a 28% share, remain cost-effective solutions for mass-market applications. Customized tubes, holding a 14% share, gain traction with rising demand for branding and differentiation, particularly in cosmetics packaging.

For instance, Dolypackage developed customized cosmetic tubes with recyclable multilayer structures and limited-edition print options to support brand differentiation in cosmetic launches.

By Application

Pharmaceuticals dominated the market with a 41% share in 2024, reflecting the sector’s strict need for barrier properties to protect sensitive formulations. Increasing demand for topical creams, ointments, and gels reinforces tube usage. Cosmetics & personal care followed with a 36% share, supported by growth in premium skincare and haircare packaging. Food & beverage captured a 12% share, driven by sauces and condiments. Household products and industrial applications jointly accounted for the remaining 11%, mainly in adhesives, sealants, and cleaning products.

For instance, SGD Pharma launched innovative type I tubular vials featuring an external low coefficient of friction coating, aimed at enhancing the packaging and protection of injectable drugs for pharmaceutical customers.

By Closure Type

Screw caps accounted for the largest share at 46% in 2024, owing to their ease of use, secure sealing, and compatibility across diverse applications. Flip-top caps followed with a 32% share, favored in cosmetics and personal care for consumer convenience. Standard caps represented 14%, primarily used in cost-sensitive markets. Specialized dispensing systems held an 8% share, gaining steady growth from premium pharmaceutical and cosmetic brands that emphasize precision and controlled application.

Key Growth Drivers

Key Growth Drivers

Rising Demand in Pharmaceuticals

The pharmaceutical sector is the largest user of aluminium barrier laminate tubes, driven by the growing need for safe and hygienic packaging of ointments, creams, and gels. These tubes provide superior protection against contamination, extend product shelf life, and ensure patient safety. With rising healthcare expenditure and increased production of topical drugs, manufacturers prefer multi-layered tubes for their barrier strength. This demand positions pharmaceuticals as a consistent growth driver, accounting for a major share of global consumption.

For instance, Perfektüp announced its pharmaceutical aluminium tubes comply with FDA, EMA, and USP requirements, ensuring hygienic and high-barrier packaging for dermatological ointments and ophthalmic gels used by international pharma clients.

Expansion of Cosmetics and Personal Care Products

The cosmetics and personal care industry strongly supports market growth, with increasing demand for premium packaging solutions. Consumers seek durable, lightweight, and aesthetically appealing packaging for skincare, haircare, and oral care products. Aluminium barrier laminate tubes meet these requirements while offering customization and branding opportunities. Growth in e-commerce beauty sales and rising disposable incomes further expand this segment. Companies are investing in design-focused tubes, reinforcing cosmetics as a powerful driver of long-term demand.

For instance, In March 2023, Benefit launched its POREfessional pore care line in recyclable aluminium packaging to enhance sustainability in skincare products.

Shift Toward Sustainable Packaging

Sustainability is a key growth catalyst as consumers and regulators push for eco-friendly packaging solutions. Aluminium barrier laminate tubes are recyclable, lightweight, and resource-efficient, making them favorable compared to plastic-based alternatives. The market benefits from the increasing adoption of green materials and advancements in recyclable laminate structures. Brands actively promote sustainable packaging as part of their corporate responsibility strategies. This shift ensures steady adoption across industries, positioning eco-friendly tubes as a driver of future growth.

Key Trends & Opportunities

Adoption of Smart and Customized Tubes

The trend toward personalization and differentiation is driving demand for customized and smart tubes. Brands increasingly use tubes with advanced printing, QR codes, and digital labeling for better consumer engagement and product authentication. Customized solutions with unique colors, textures, and finishes allow companies to stand out in competitive markets. This opportunity is particularly strong in cosmetics and premium pharmaceuticals, where branding and user interaction are vital to customer loyalty.

For instance, Hoffmann Neopac expanded its TubePlus customization service, offering metallic finishes and tactile varnishes aimed at premium beauty products to help brand differentiation.

Growth in Emerging Markets

Rapid industrialization and rising consumer awareness in Asia-Pacific, Latin America, and Africa offer significant growth opportunities. Expanding pharmaceutical manufacturing in India and China, coupled with increasing cosmetics consumption in Southeast Asia, boosts tube demand. Similarly, Latin America and Africa witness higher adoption due to improving retail infrastructure and urbanization. Manufacturers expanding production capacity and distribution networks in these markets are well-positioned to capture future growth, making emerging economies critical to overall market expansion.

For instance, Essel Propack (part of EPL Limited) announced the expansion of its tubes manufacturing plant in Assam, India, to cater to growing demand from pharmaceutical and personal care companies in the region.

Key Challenges

High Production Costs

The production of aluminium barrier laminate tubes involves advanced technology and multilayer manufacturing processes, which increase costs compared to conventional plastic tubes. Fluctuations in raw material prices, especially aluminium, further add to production expenses. Smaller manufacturers often struggle to compete with global players due to these cost pressures. This challenge may limit adoption in price-sensitive markets, slowing overall growth despite rising demand in premium segments.

Recycling and Waste Management Issues

While aluminium tubes are recyclable, the multilayer laminate structure combining aluminium and polymers complicates recycling. Many regions lack specialized facilities to handle these products effectively. Improper disposal can lead to higher environmental concerns, creating a challenge for sustainable growth. Companies must invest in advanced recycling technologies and collaborate with waste management systems to overcome this limitation, which otherwise poses regulatory and reputational risks.

Competition from Alternative Packaging

Aluminium barrier laminate tubes face growing competition from plastic and biodegradable packaging alternatives. Innovations in bio-based plastics and flexible packaging solutions attract industries seeking cost efficiency and sustainability. These substitutes often provide lower costs and easier recycling, creating pressure on aluminium tube adoption. To maintain competitiveness, manufacturers must highlight barrier advantages and invest in recyclable laminate technologies. Without such measures, alternative packaging could hinder the market’s growth trajectory.

Regional Analysis

North America

The North America Aluminium Barrier Laminate Tube Market was valued at USD 287.38 million in 2018, reaching USD 330.54 million in 2024, and is anticipated to hit USD 510.33 million by 2032, registering a CAGR of 5.7%. The region accounted for 29.8% share in 2024, supported by strong pharmaceutical and personal care industries in the U.S. and Canada. Growing demand for premium packaging solutions and sustainability-driven innovation continues to drive adoption. The market benefits from advanced manufacturing technologies and a mature healthcare infrastructure that strengthens long-term growth potential.

Europe

The Europe Aluminium Barrier Laminate Tube Market stood at USD 245.67 million in 2018, expanding to USD 275.41 million in 2024, and is projected to reach USD 401.87 million by 2032, with a CAGR of 4.9%. Europe represented a 24.8% market share in 2024, largely driven by Germany, France, and the UK. Rising demand for eco-friendly and recyclable packaging aligns with stringent EU sustainability regulations. Growth in cosmetics and personal care, coupled with advancements in pharmaceutical packaging standards, reinforces Europe’s position as a key contributor to global revenue.

Asia Pacific

The Asia Pacific Aluminium Barrier Laminate Tube Market was valued at USD 330.13 million in 2018, rising to USD 397.35 million in 2024, and is forecast to achieve USD 659.87 million by 2032, recording the highest CAGR of 6.6%. The region captured a 35.8% share in 2024, making it the largest market globally. China, India, and Southeast Asia drive demand due to expanding pharmaceutical manufacturing, rising cosmetic consumption, and rapid urbanization. Growing middle-class income and e-commerce penetration further boost sales. Asia Pacific remains the fastest-growing region, offering significant opportunities for manufacturers.

Latin America

The Latin America Aluminium Barrier Laminate Tube Market was valued at USD 48.45 million in 2018, reaching USD 55.87 million in 2024, and is expected to touch USD 78.66 million by 2032, at a CAGR of 4.5%. Latin America held a 5.0% market share in 2024, led by Brazil and Mexico. The market is shaped by increasing use of laminate tubes in cosmetics, food products, and pharmaceuticals. Expanding retail networks and growing investments in local packaging industries enhance growth prospects, although economic volatility in the region may pose moderate challenges.

Middle East

The Middle East Aluminium Barrier Laminate Tube Market was valued at USD 19.95 million in 2018, increasing slightly to USD 20.62 million in 2024, and projected to reach USD 25.90 million by 2032, with a CAGR of 3.0%. The region accounted for a 1.9% market share in 2024, reflecting relatively modest adoption compared to larger regions. Demand is concentrated in GCC countries, where pharmaceutical imports and rising consumer spending on cosmetics support growth. However, limited local manufacturing and reliance on imports restrict rapid expansion in this region.

Africa

The Africa Aluminium Barrier Laminate Tube Market was valued at USD 18.43 million in 2018, expanding to USD 29.06 million in 2024, and projected to reach USD 38.19 million by 2032, at a CAGR of 3.1%. Africa represented a 2.7% market share in 2024, with South Africa and Egypt leading demand. Growth is driven by increasing healthcare awareness, pharmaceutical packaging demand, and expanding food and beverage industries. Limited infrastructure and lower adoption of advanced packaging technologies remain barriers, yet the region holds untapped opportunities for long-term market penetration.

Market Segmentations

Market Segmentations

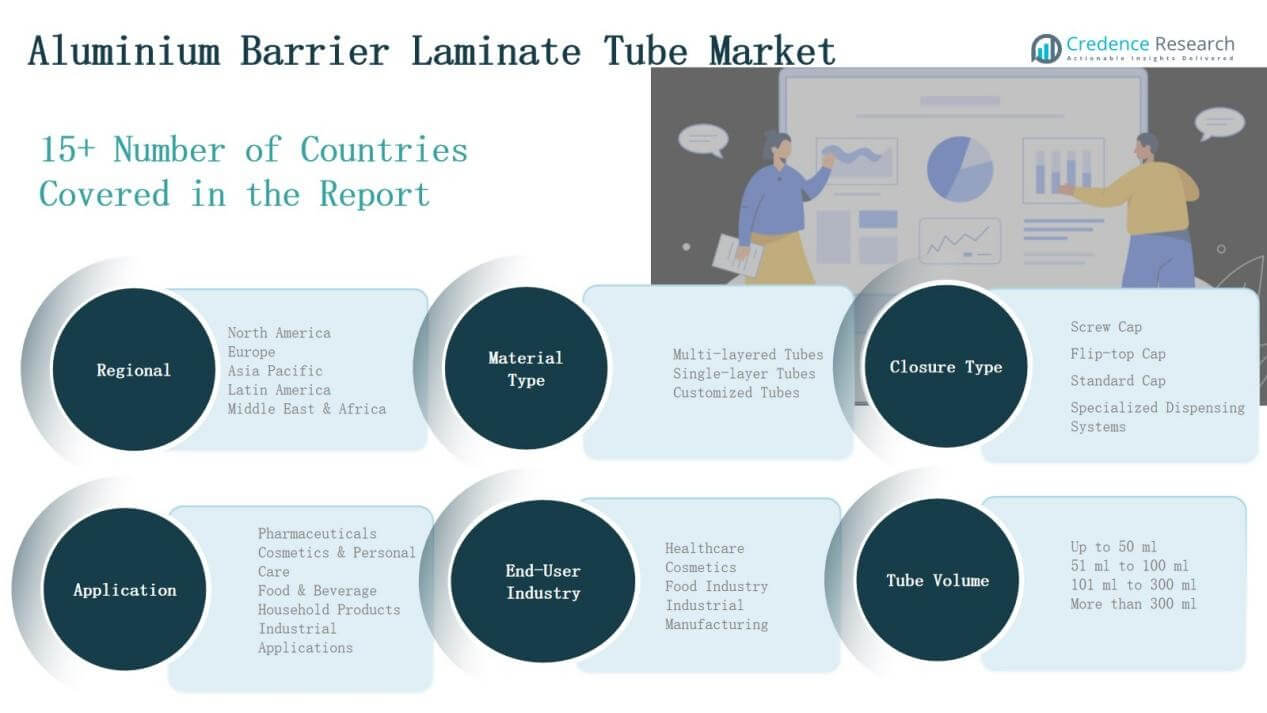

By Material Type

- Multi-layered Tubes

- Single-layer Tubes

- Customized Tubes

By Application

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverage

- Household Products

- Industrial Applications

By Closure Type

- Screw Cap

- Flip-top Cap

- Standard Cap

- Specialized Dispensing Systems

By End-User Industry

- Healthcare

- Cosmetics

- Food Industry

- Industrial Manufacturing

By Tube Volume

- Up to 50 ml

- 51 ml to 100 ml

- 101 ml to 300 ml

- More than 300 ml

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Aluminium Barrier Laminate Tube Market is moderately consolidated, with a mix of global leaders and regional players competing on innovation, product quality, and customization. Key companies such as Essel Propack Ltd., Huhtamaki Oyj, Montebello Packaging Inc., Hoffmann Neopac AG, Linhardt GmbH & Co. KG, Pirlo GmbH & Co. KG, and Impact International Pty. Ltd. hold significant market presence through extensive product portfolios and strong regional distribution networks. These players focus on advancing multi-layered tube technologies, recyclable laminates, and eco-friendly packaging solutions to address growing sustainability concerns. Strategic partnerships with pharmaceutical and cosmetics manufacturers enhance their competitive edge. Meanwhile, regional players like Tubapack S.A. and Intrapac International Corp. strengthen competition by offering cost-effective, customized solutions in niche markets. Continuous investments in advanced printing technologies, lightweight designs, and high-barrier laminates are shaping competition, while rising demand in Asia-Pacific presents opportunities for market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ambertube International

- Essel Propack Ltd.

- Pirlo GmbH & Co. KG

- Montebello Packaging Inc.

- Hoffmann Neopac AG

- Linhardt GmbH & Co. KG

- Impact International Pty. Ltd.

- Huhtamaki Oyj

- Tubapack S.A.

- Intrapac International Corp.

Recent Developments

- In 2024, Huhtamaki introduced a fully recyclable mono-material PP tube that maintains strong barrier properties while eliminating the aluminium layer.

- In June 2025, ALPLA Group acquired KM Packaging, strengthening its closures portfolio with caps and dispensing components for laminated and ABL tubes.

- In May 2025, Indorama Ventures acquired a 24.9% stake in EPL Limited, boosting its presence in the Indian laminated and ABL packaging sector.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Closure Type, End User Industry, Tube Volume and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for multi-layered tubes will continue to rise due to superior barrier properties.

- Pharmaceutical packaging will remain the dominant application segment in global adoption.

- Cosmetics and personal care tubes will see higher demand through premium and customized designs.

- Sustainable and recyclable laminate tubes will gain wider acceptance across industries.

- Digital printing and smart labeling will enhance product differentiation and consumer engagement.

- Asia Pacific will remain the fastest-growing region, supported by strong manufacturing and consumption.

- Europe will maintain leadership in sustainable packaging innovations and eco-friendly materials.

- Strategic partnerships between tube makers and brand owners will drive product innovation.

- Expansion in e-commerce will fuel demand for durable and safe tube packaging solutions.

- Competition from alternative packaging materials will push manufacturers toward continuous R&D investment.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations

Market Segmentations