Market Overview

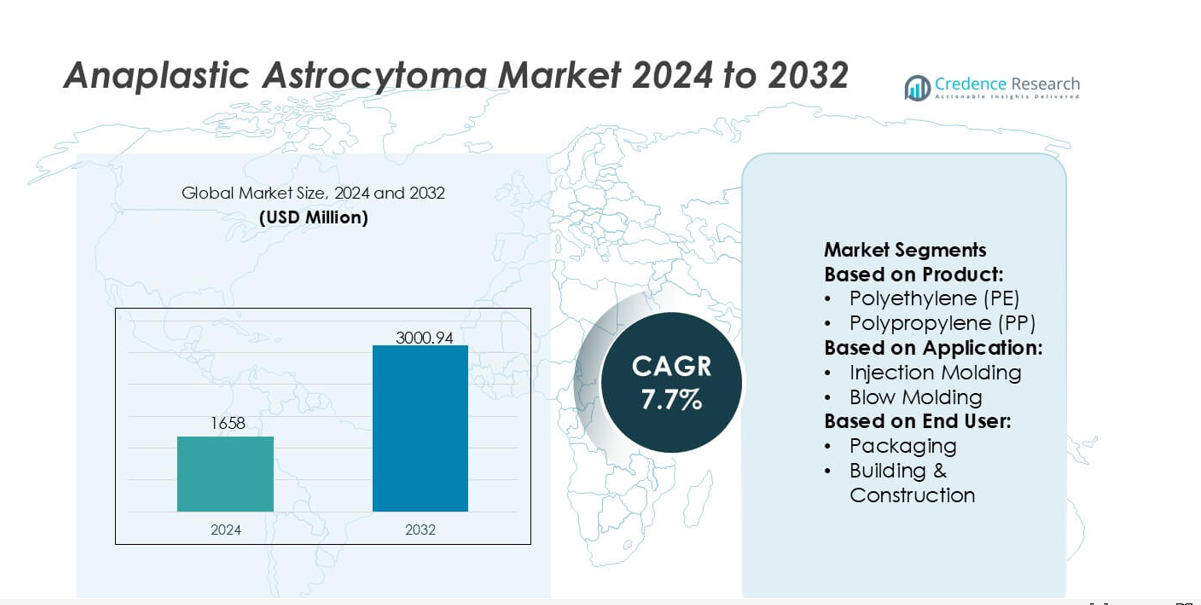

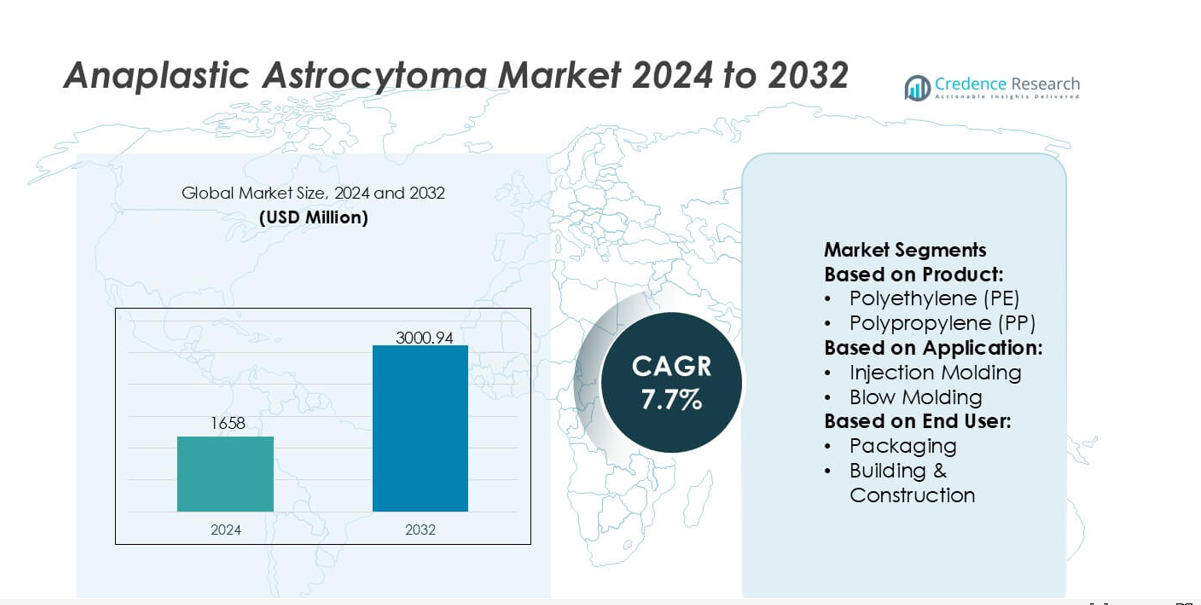

Anaplastic Astrocytoma Market size was valued USD 1658 million in 2024 and is anticipated to reach USD 3000.94 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anaplastic Astrocytoma Market Size 2024 |

USD 1658 million |

| Anaplastic Astrocytoma Market, CAGR |

7.7% |

| Anaplastic Astrocytoma Market Size 2032 |

USD 3000.94 million |

The Anaplastic Astrocytoma Market is influenced by a diverse group of technology, diagnostics, and therapy developers that expand capabilities in molecular testing, advanced imaging, and targeted treatment platforms. These companies strengthen competitiveness through investments in precision diagnostics, AI-enabled clinical tools, and innovative neuro-oncology research pipelines that address tumor complexity and improve care outcomes. North America remains the leading region, holding an exact 41% market share, supported by strong clinical infrastructure, high adoption of genomic profiling, and extensive participation in clinical trials for next-generation therapies. The region’s advanced healthcare ecosystem continues to reinforce its leadership in innovation and treatment access.

Market Insights

- The market was valued at USD 1658 million in 2024 and is projected to reach USD 3000.94 million by 2032 at a 7.7% CAGR.

- Demand grows as molecular diagnostics, AI-enabled imaging, and targeted therapies strengthen treatment precision, supporting broader adoption across high-grade glioma care.

- Trends show rising investment in immunotherapy research and biomarker-driven personalization, while competition intensifies as innovators enhance neuro-oncology pipelines.

- Restraints emerge from high treatment costs, limited access to advanced imaging in emerging economies, and persistent therapeutic resistance that affects long-term outcomes.

- Regional analysis indicates North America leads with a 41% share, while Europe and Asia-Pacific expand through stronger clinical infrastructure and increasing uptake of genomic profiling, supporting improved segment penetration across diagnostics and treatment technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Polyethylene (PE) holds the dominant share in the Anaplastic Astrocytoma Market’s polymer-related value chain, supported by its broad processing flexibility, chemical stability, and cost-efficient scalability that enhances adoption across specialized medical and laboratory equipment. Its strong demand reflects wide compatibility with sterilization processes and integration into diagnostic consumables used in oncology settings. Product categories such as PP, PC, PA, and PEEK expand relevance due to superior mechanical performance, while advanced polymers including LCPs and PPSU gain traction for high-precision components. Growing requirements for durable, biocompatible materials continue to strengthen PE-led product utilization.

- For instance, Eastman Chemical Company’s medical-grade copolyester (such as Eastar 6763 or Tritan) exhibits a melt flow rate of approximately 8 to 9 g/10 min (at relevant test conditions) and a tensile strength around 24 MPa at break (or higher at yield), enabling reliable formation of precision-molded oncologic assay cartridges and sterile transfer components used in advanced neuro-diagnostic workflows.

By Application

Injection molding emerges as the leading application segment with the highest market share, driven by its precision, repeatability, and suitability for producing complex oncology-related device housings, diagnostic cartridges, and research equipment components. Its dominance is supported by high throughput and compatibility with engineered polymers such as PEEK, ABS, and PC that meet stringent clinical performance standards. Blow molding, extrusion, and thermoforming follow due to their roles in packaging, tubing, and protective casings used in therapy and diagnostic workflows. Increasing emphasis on reliability, dimensional accuracy, and contamination-free fabrication sustains injection molding’s leadership.

- For instance, Chevron Phillips Chemical Co., LLC’s Marlex® polyethylene grades used in medical molding applications deliver a tensile yield strength of 26.2 MPa and an elongation at break of 650 mm/mm, while maintaining a melt index of 0.9 g/10 min, enabling precise formation of diagnostic device housings and maintaining high structural integrity under repeated sterilization cycles.

By End-user

Medical Devices represents the dominant end-user segment with a substantial share as demand accelerates for precision-engineered components used in neuro-oncology diagnostics, surgical tools, and advanced monitoring systems supporting Anaplastic Astrocytoma management. The segment benefits from stringent regulatory expectations for safety, biocompatibility, and durability, driving adoption of high-performance polymers like PC, PEEK, PA, and PPSU. Packaging, automotive, electrical & electronics, and consumer goods maintain secondary roles, leveraging polymer versatility for auxiliary equipment, transport containers, and handling systems. Expanding neurosurgical innovation continues to reinforce the medical device sector’s leading position.

Key Growth Drivers

Advancement in Molecular Diagnostics and Personalized Medicine

The Anaplastic Astrocytoma Market grows as oncology centers adopt genomic profiling, MGMT methylation analysis, and IDH1/IDH2 mutation testing to tailor therapeutic strategies. These precision diagnostics enable clinicians to improve treatment selection, predict tumor behavior, and monitor therapeutic response more accurately. Expanded integration of next-generation sequencing and liquid biopsy platforms strengthens early detection capabilities and supports personalized therapy planning. As molecular subtype classification becomes central to clinical management, demand rises for advanced diagnostic tools and companion tests that refine decision-making and increase overall treatment effectiveness.

- For instance, Celanese Corporation’s Fortron® PPS and Celanex® PBT materials used in molecular diagnostic cartridges deliver a tensile modulus of 11,000 MPa and heat deflection temperatures exceeding 205°C, while its DURACON® POM grades exhibit dimensional tolerance stability within ±0.02 mm during high-precision microfluidic molding, enabling reliable formation of NGS assay chambers and mutation-detection components under repeated thermal cycling.

Increasing Adoption of Targeted Therapies and Combination Regimens

Market expansion is driven by the rising use of targeted agents, including kinase inhibitors and epigenetic modulators, that complement radiation and chemotherapy protocols. Combination regimens enhance survival outcomes by addressing tumor heterogeneity and overcoming resistance mechanisms. Clinical trials exploring synergistic effects of immunotherapies, anti-angiogenic treatments, and molecularly guided agents continue to accelerate therapeutic innovation. As evidence for improved progression control strengthens, healthcare providers increasingly integrate multimodal approaches, driving sustained demand for advanced therapeutics and precision-based treatment frameworks across neuro-oncology centers.

- For instance, SABIC’s LEXAN™ HPX polycarbonate portfolio used in oncology drug-delivery and diagnostic systems provides a notched Izod impact strength of approximately 65 J/m to 85 J/m (or around 850 J/m in certain highly specialized, unnotched test methods) and supports gamma sterilization without a measurable reduction in optical clarity.

Growth of Advanced Neuro-Imaging and AI-Enabled Treatment Planning

The adoption of high-resolution MRI, functional imaging, and AI-driven predictive models supports more accurate tumor mapping and progression monitoring in anaplastic astrocytoma care. These technologies allow clinicians to delineate margins, optimize surgical planning, and assess treatment response with greater precision. AI-powered segmentation tools and automated diagnostic systems reduce variability in interpretation while enabling faster clinical decisions. As hospitals integrate digital workflows and enhanced imaging analytics, efficiency and accuracy in patient management improve, fueling broader adoption of advanced imaging technologies and expanding market penetration.

Key Trends & Opportunities

Expansion of Immunotherapy Research and Novel Biomarker Development

Ongoing research into immune checkpoint inhibitors, neoantigen-based vaccines, and T-cell modulating therapies presents significant opportunities for therapeutic advancement. Biomarker discovery efforts including PD-L1 expression, IDH mutation signatures, and microenvironmental indicators enhance patient stratification and enable more targeted immunotherapy applications. Academic institutions and biotech companies increasingly collaborate to accelerate translational research and expand clinical pipelines. As immunotherapies gain traction for aggressive gliomas, the market benefits from expanding trial activity, differentiated treatment modalities, and greater precision in therapy response prediction.

- For instance, Sumitomo Chemical Co., Ltd has advanced specialized high-purity polymer materials such as SUMILITE® PPS, which provides a tensile strength of 135 MPa and maintains dimensional change below 0.03 mm during high-temperature bioprocessing steps used in immunotherapy reagent handling.

Shift Toward Minimally Invasive and Image-Guided Surgical Interventions

Growing adoption of neuronavigation, intraoperative MRI, and laser ablation systems supports demand for minimally invasive procedures in anaplastic astrocytoma management. These techniques reduce surgical trauma, enhance precision in tumor resection, and support faster recovery while maintaining neurological function. Advancements in robotics-assisted surgery further strengthen procedural accuracy and consistency. This shift promotes innovation in neurosurgical equipment and increases the market potential for integrated imaging surgery platforms. Healthcare facilities prioritize advanced intraoperative technologies, creating new opportunities for vendors specializing in high-precision surgical solutions.

- For instance, BASF’s Ultrason® E (PESU) used in MRI-compatible surgical instruments exhibits a tensile modulus of 2,400 MPa and maintains dimensional stability during continuous exposure to 134°C steam sterilization.

Rising Investment in Clinical Trials and Accelerated Regulatory Pathways

Global funding for glioma-related clinical trials continues to increase, enabling exploration of next-generation therapies and adaptive treatment models. Expedited regulatory frameworks, orphan drug incentives, and fast-track designations encourage manufacturers to advance novel therapeutics for rare central nervous system tumors. This environment supports rapid innovation, shortens development timelines, and increases the number of available treatment options. As trial enrollment expands across emerging markets, pharmaceutical and biotechnology companies gain stronger commercial potential and broader patient access opportunities.

Key Challenges

High Treatment Costs and Limited Accessibility in Emerging Regions

The complex and resource-intensive nature of anaplastic astrocytoma treatment—spanning imaging, molecular diagnostics, surgery, radiation, and targeted therapies—creates significant cost burdens. Many emerging markets face limited access to advanced neuro-oncology centers, specialized equipment, and clinical expertise, constraining patient outcomes. High out-of-pocket expenditure and insufficient reimbursement policies further restrict treatment uptake. These financial and infrastructural gaps hinder equitable access, slow technology adoption, and create disparities in care quality across different geographic regions.

Therapeutic Resistance and Limited Long-Term Survival Outcomes

Anaplastic astrocytoma presents substantial clinical challenges due to its heterogeneous biology, invasive growth patterns, and resistance to standard treatments such as temozolomide and radiotherapy. Rapid tumor progression and recurrence remain persistent obstacles despite advances in targeted and combination therapies. Limited availability of predictive biomarkers complicates therapy customization and reduces the reliability of outcome forecasting. These scientific and clinical constraints continue to hamper long-term survival improvements, underscoring the need for more effective mechanisms to overcome resistance and improve disease management.

Regional Analysis

North America

North America holds a dominant 41% share of the Anaplastic Astrocytoma Market, supported by strong clinical infrastructure, extensive adoption of precision diagnostics, and widespread access to advanced neuro-oncology therapies. The region benefits from high research funding, rapid integration of AI-enabled imaging, and strong participation in immunotherapy and targeted therapy trials. Pharmaceutical companies maintain a steady pipeline of next-generation treatments, reinforcing competitive momentum. Favorable reimbursement structures and early adoption of molecular testing further strengthen market leadership, ensuring continued growth as health systems expand personalized medicine and improve treatment pathways for high-grade gliomas.

Europe

Europe captures an estimated 28% share, driven by well-established oncology networks, strong academic collaborations, and increasing uptake of genomic profiling for treatment planning. Countries such as Germany, the U.K., and France lead in implementing advanced neuro-imaging and integrating minimally invasive surgical technologies across specialty centers. Regulatory incentives for orphan drugs support innovation in glioma therapy development, while regional investment in clinical trials enhances access to emerging modalities. Growing adoption of biomarker-guided therapy and harmonized cancer care frameworks continues to strengthen Europe’s position as a key contributor to treatment advancement and evidence-based neuro-oncology practice.

Asia-Pacific

Asia-Pacific accounts for nearly 23% of the market and demonstrates rapid expansion due to rising cancer incidence, improving diagnostic capabilities, and growing investment in neurosurgical infrastructure. China, Japan, and South Korea lead innovation through strong adoption of MRI advancements, precision radiotherapy systems, and hybrid surgical–imaging platforms. Increasing access to genomic testing and broader medical insurance coverage support higher treatment uptake. The region experiences intensified clinical research activity, particularly in targeted therapy and immuno-oncology trials. As specialized oncology centers expand, Asia-Pacific emerges as a high-growth region with improving care quality and better integration of advanced therapies.

Latin America

Latin America represents approximately 5% of the global market, shaped by uneven access to advanced neuro-oncology services and varied adoption of precision diagnostics. Countries like Brazil, Mexico, and Argentina invest in expanding tertiary care hospitals and upgrading imaging systems to strengthen cancer management capabilities. Limited reimbursement for targeted therapies and high treatment costs continue to constrain market penetration. However, regional improvements in clinical education, growing participation in international trials, and investments in digital pathology create opportunities for future growth. Ongoing health system modernization gradually enhances access to higher-quality diagnostics and treatment modalities.

Middle East & Africa

The Middle East & Africa region holds nearly 3% of the market, influenced by constrained access to specialized neuro-oncology centers and limited availability of advanced imaging and molecular testing. Gulf nations, particularly the UAE and Saudi Arabia, drive regional growth through investments in oncology centers, robotic surgery systems, and high-precision radiotherapy platforms. Broader regions, however, face challenges related to affordability and workforce availability. Initiatives to expand cancer registries, improve diagnostic capacity, and establish referral networks gradually support better treatment pathways. Strengthening infrastructure and strategic partnerships create long-term opportunities for improved market participation.

Market Segmentations:

By Product:

- Polyethylene (PE)

- Polypropylene (PP)

By Application:

- Injection Molding

- Blow Molding

By End User:

- Packaging

- Building & Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Anaplastic Astrocytoma Market players such as Eastman Chemical Company, Chevron Phillips Chemical Co., LLC, Celanese Corporation, SABIC, Sumitomo Chemical Co., Ltd., BASF, Arkema, Evonik Industries AG, Dow Inc., and DuPont de Nemours, Inc. the Anaplastic Astrocytoma Market is shaped by continuous innovation in diagnostic technologies, advanced imaging solutions, and precision-driven therapeutic platforms. Companies strengthen their position by expanding molecular testing capabilities, improving biomarker discovery pipelines, and integrating AI-driven analytics into clinical decision workflows. Strong investment in R&D accelerates development of targeted therapies, immuno-oncology candidates, and minimally invasive surgical technologies tailored for aggressive gliomas. Market participants also prioritize regulatory compliance, strategic partnerships with research institutions, and advancements in device materials that enhance durability and biocompatibility. Collectively, these efforts create a dynamic environment centered on improved clinical outcomes and technological leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Mitsui Chemicals, Idemitsu Kosan, and Sumitomo Chemical entered into a Memorandum of Understanding to integrate Sumitomo Chemical’s polypropylene (PP) and linear low-density polyethylene (LLDPE) businesses in Japan into Prime Polymer, a joint venture owned by Mitsui and Idemitsu.

- In April 2025, UBE Corporation announced the completion of its acquisition of Lanxess’s polyurethane systems business. The purchase included production facilities in the US, Europe, and Asia, expanding Ube’s global footprint in PU materials.

- In April 2025, India launches plastic parks to boost industry. Under the Scheme for Setting up Plastic Parks, the Department of Chemicals and Petrochemicals aims to create a state-of-the-art infrastructure that supports the domestic downstream plastic processing sector.

- In December 2024, Symphony Environmental Ltd., a United Kingdom-based packaging technology company launched biodegradable resin for plastics industry. The new product, branded NbR, is made with natural minerals to reduce the amount of fossil-derived polyethylene (PE) or polypropylene (PP) used, and it has been formulated to biodegrade safely in nature

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance through broader adoption of molecular profiling and precision-based treatment planning.

- Immunotherapy and combination regimens will gain traction as clinical evidence strengthens.

- AI-enabled imaging and decision-support tools will increasingly guide diagnosis and treatment pathways.

- Minimally invasive neurosurgical technologies will expand adoption across specialized centers.

- Growth in biomarker discovery will support better patient stratification and therapy response prediction.

- Clinical trial activity will accelerate development of next-generation targeted therapies.

- Digital pathology and remote diagnostics will enhance care accessibility in underserved regions.

- Regulatory incentives for rare CNS tumors will encourage faster therapeutic innovation.

- Investment in neuro-oncology infrastructure will strengthen multidisciplinary treatment capabilities.

- Rising global awareness and improved diagnostic availability will support earlier detection and better outcomes.