| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Packaging Market Size 2024 |

USD 78.17 million |

| Aseptic Packaging Market, CAGR |

10.78% |

| Aseptic Packaging Market Size 2032 |

USD 176.89 million |

Market Overview:

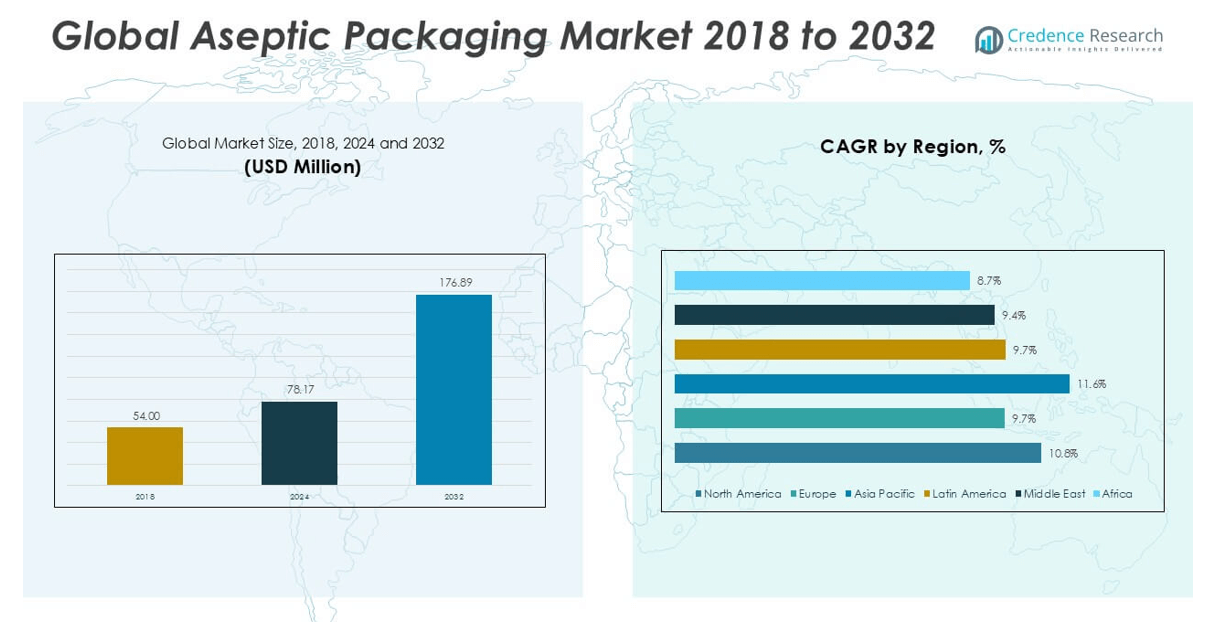

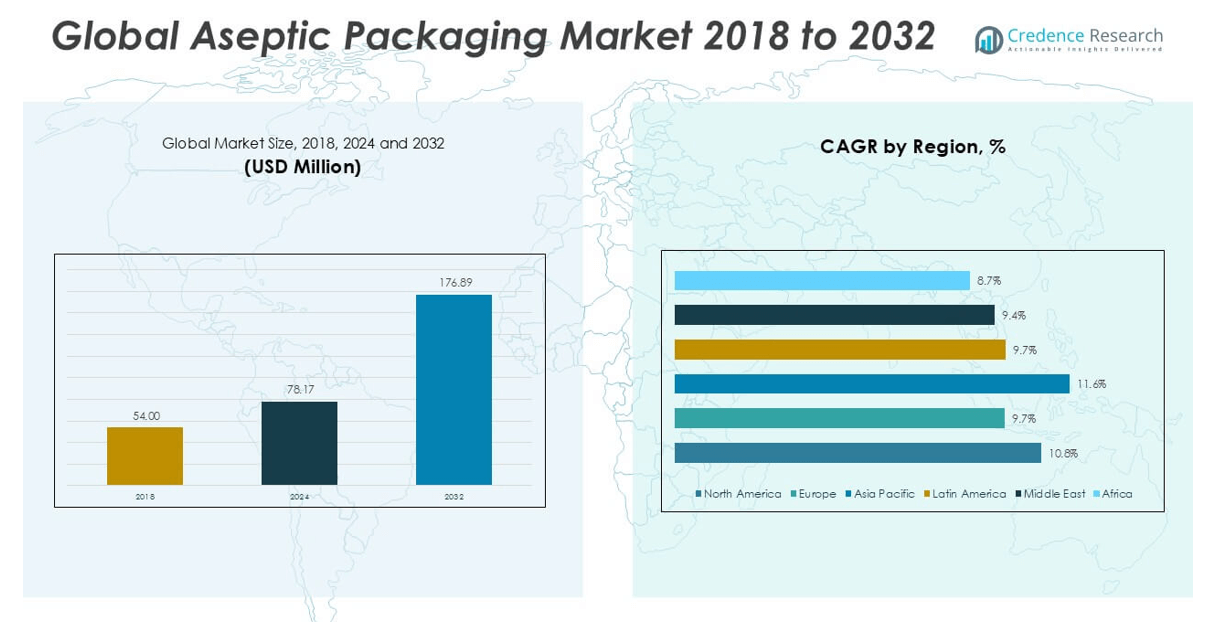

The Aseptic Packaging market size was valued at USD 54.00 million in 2018, increased to USD 78.17 million in 2024, and is anticipated to reach USD 176.89 million by 2032, at a CAGR of 10.78% during the forecast period.

The aseptic packaging market is led by prominent players such as Tetra Pak International SA, SIG Combibloc Group, Amcor, Robert Bosch GmbH, and Schott AG, known for their advanced technologies, broad product offerings, and global footprint. These companies focus on sustainability, innovation, and strategic partnerships to maintain market leadership. Tetra Pak and SIG dominate the beverage and dairy segments, while Schott AG and Becton, Dickinson and Company play a crucial role in pharmaceutical packaging. Regionally, Asia Pacific emerged as the leading market in 2024, holding 42.2% of the global market share, driven by rapid industrialization, increasing consumption of packaged foods, and expanding pharmaceutical sectors in countries like China and India. North America and Europe follow, supported by strong regulatory frameworks and technological adoption. Competitive intensity continues to grow, with regional players like Greatview Aseptic Packaging and Uflex Limited gaining market share through cost-efficient and flexible packaging solutions.

Market Insights

- The global aseptic packaging market was valued at USD 78.17 million in 2024 and is projected to reach USD 176.89 million by 2032, growing at a CAGR of 10.78% during the forecast period.

- Rising demand for shelf-stable and preservative-free food and beverages, along with increasing pharmaceutical applications, is driving the market growth.

- Key trends include growing preference for sustainable and recyclable materials, technological advancements in aseptic filling equipment, and increasing use of prefilled syringes and pouches.

- The market is highly competitive with major players like Tetra Pak, SIG Combibloc, Amcor, and Robert Bosch GmbH focusing on innovation, expansion, and sustainability strategies, while new regional players offer cost-effective alternatives.

- Asia Pacific dominated the market with a 42.2% share in 2024, followed by North America at 26.3% and Europe at 18.4%; among segments, cartons held the highest product share, and beverages led the application segment due to high consumption of dairy and ready-to-drink products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

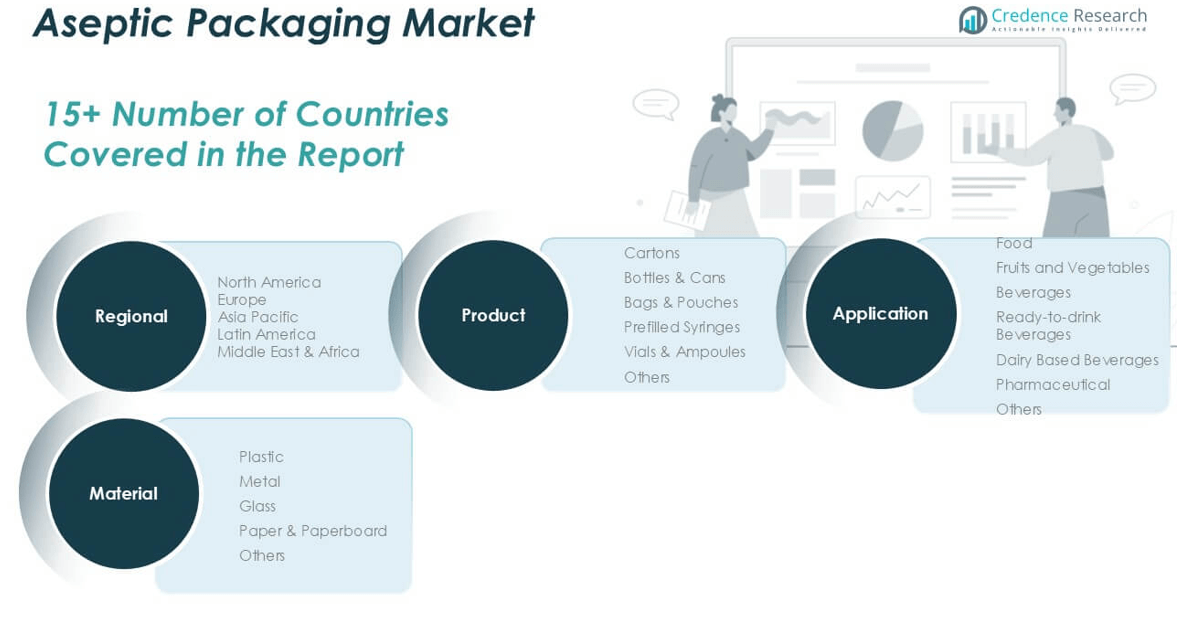

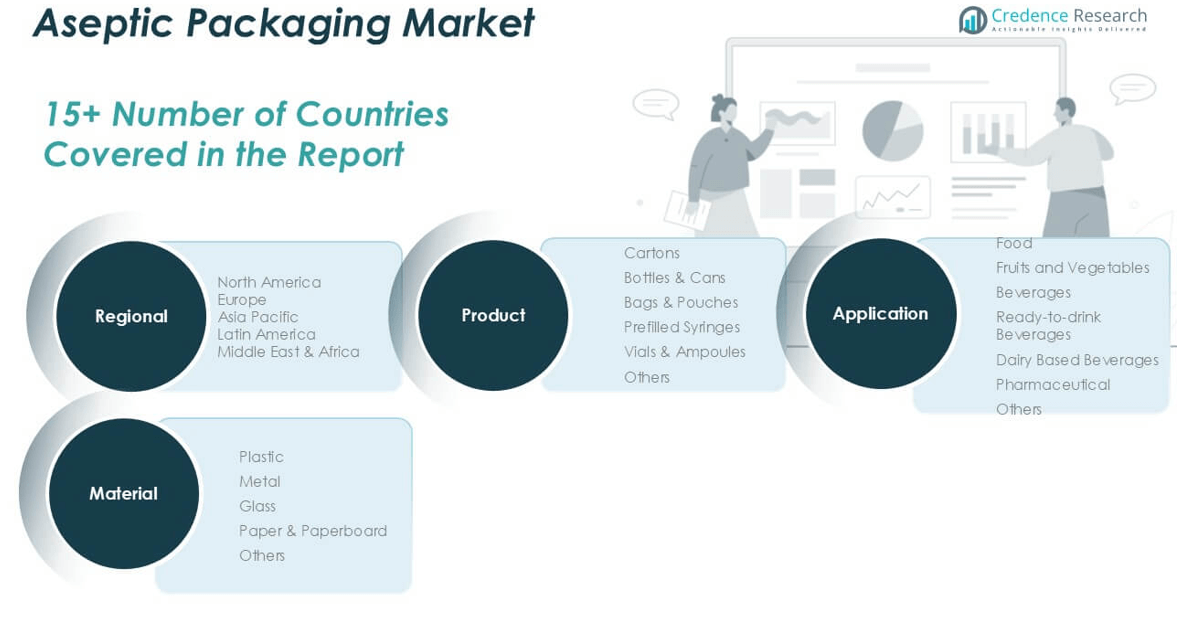

By Product

Cartons emerged as the dominant product segment in the aseptic packaging market, accounting for the largest market share in 2024. Their widespread use in packaging dairy and beverage products, particularly milk and juice, is driven by their excellent barrier properties, lightweight nature, and recyclability. Bottles & cans also held a significant share due to their durability and suitability for carbonated beverages. Bags & pouches are gaining traction for their convenience and cost-effectiveness, especially in single-serve applications. Meanwhile, prefilled syringes and vials & ampoules are increasingly used in the pharmaceutical industry, supported by rising demand for injectable drugs.

- For instance, Tetra Pak reported that over 81 billion of its aseptic cartons were sold globally in 2023, with more than 5,000 filling machines installed across 160 countries, highlighting its global dominance in carton-based packaging.

By Application

The beverages segment held the largest market share in 2024 within the aseptic packaging market, driven by the rising demand for ready-to-drink and dairy-based beverages. Aseptic packaging ensures extended shelf life without the need for refrigeration, making it ideal for the beverage industry. The pharmaceutical segment is rapidly growing due to the need for sterile and contamination-free packaging solutions. Food, along with fruits and vegetables, also represents a notable share, as manufacturers aim to reduce preservatives while maintaining product freshness. The “others” category includes nutraceuticals and liquid food supplements, which are also benefitting from aseptic technologies.

- For instance, SIG Combibloc disclosed that it delivered over 48 billion beverage cartons in 2023, and its aseptic filling systems achieved an output rate of up to 24,000 packs per hour, significantly enhancing productivity for beverage manufacturers.

By Material

Plastic dominated the material segment of the aseptic packaging market, holding the highest market share in 2024, owing to its flexibility, durability, and cost-efficiency. Plastic materials are widely used for bottles, caps, and pouches, particularly in food and beverage applications. Paper & paperboard follow closely, especially in carton packaging, due to their sustainability and ease of printing. Glass remains critical for pharmaceutical products requiring high chemical resistance. Metal, although less dominant, finds applications in cans and medical-grade containers. The “others” category includes composite materials that offer innovative, multi-layered barrier solutions for extended product shelf life.

Market Overview

Rising Demand for Shelf-Stable Food and Beverages

A significant driver for the aseptic packaging market is the growing consumer demand for shelf-stable food and beverage products. Aseptic packaging extends product shelf life without refrigeration or preservatives, making it ideal for dairy-based drinks, juices, and liquid foods. As urbanization increases and consumers seek convenient, ready-to-consume products, manufacturers are turning to aseptic technologies to maintain product quality and safety. Additionally, the rising popularity of on-the-go consumption is further fueling the adoption of aseptic packaging across various regions.

- For instance, Amcor launched its AmLite Ultra Recyclable aseptic pouch in 2023, which provides a shelf life of up to 12 months for dairy and juice products and has already been adopted by more than 12 major global food and beverage brands.

Growth in the Pharmaceutical and Healthcare Sector

The expansion of the pharmaceutical and healthcare industries is accelerating the demand for aseptic packaging solutions. With increasing global emphasis on sterile and contamination-free drug delivery, aseptic packaging has become essential for injectable drugs, vaccines, and biologics. Prefilled syringes, vials, and ampoules are experiencing heightened usage, driven by rising chronic diseases and the aging population. Additionally, regulatory requirements for drug safety and packaging integrity are compelling pharmaceutical companies to invest in high-quality aseptic systems, thereby boosting market growth.

- For instance, SCHOTT AG produced over 12 billion pharmaceutical containers in 2023, including vials, prefilled syringes, and ampoules, with its FIOLAX® borosilicate glass vials used by more than 90% of the top 50 injectable drug manufacturers.

Increased Focus on Reducing Food Waste

A growing global emphasis on minimizing food waste has positioned aseptic packaging as a sustainable solution. By enabling long shelf life and maintaining the nutritional integrity of products, aseptic packaging reduces spoilage and waste across the supply chain. Governments and organizations are promoting efficient food preservation techniques, especially in developing regions with limited cold chain infrastructure. This trend supports wider adoption of aseptic technology in food distribution and storage, offering economic and environmental benefits, and driving demand across food and beverage sectors.

Key Trends & Opportunities

Sustainability and Eco-friendly Packaging Innovations

Sustainability remains a key trend, pushing companies to develop recyclable and bio-based aseptic packaging materials. Consumer awareness regarding environmental impact and regulatory pressures are driving innovations in eco-friendly packaging solutions. Manufacturers are increasingly focusing on reducing plastic usage, improving paper-based barrier properties, and enhancing recycling processes. This shift creates opportunities for developing green alternatives and establishing partnerships focused on circular economy models, ultimately boosting brand value and market differentiation.

- For instance, Tetra Pak reported that in 2023, 82% of all their beverage cartons were made using responsibly sourced paperboard certified by the Forest Stewardship Council (FSC), and the company processed over 50 billion plant-based packages using bio-based polymers derived from sugarcane.

Technological Advancements in Packaging Equipment

Ongoing advancements in aseptic processing and filling technologies are creating growth opportunities in the market. Modern equipment enhances precision, reduces contamination risks, and increases operational efficiency. Automation, robotics, and smart sensors are being integrated into aseptic packaging lines to ensure consistency and meet stringent hygiene standards. These innovations help manufacturers reduce downtime, increase throughput, and adapt to changing packaging formats, making it easier to meet evolving consumer and regulatory demands across different sectors.

- For instance, IMA S.p.A. introduced its IMA Life aseptic processing platform capable of filling 600 vials per minute in isolator mode, with an integrated visual inspection system that reduces defect rate to under 0.1% per batch.

Key Challenges

High Initial Capital Investment

One of the primary challenges in adopting aseptic packaging is the high initial investment required for equipment, materials, and processing infrastructure. Setting up aseptic lines demands advanced machinery, cleanroom facilities, and skilled labor, which can be cost-prohibitive for small and mid-sized enterprises. This financial barrier slows down adoption in price-sensitive markets, particularly in emerging economies where budget constraints and limited technological access restrict market penetration.

Complex Regulatory and Validation Requirements

Aseptic packaging, especially for pharmaceutical and medical products, is subject to rigorous regulatory compliance and validation protocols. Meeting these standards involves detailed documentation, periodic audits, and stringent testing procedures. Companies must align with regional and international guidelines such as FDA, EMA, or ISO standards. These complex and time-consuming requirements can delay product launches and increase operational costs, posing a challenge for market players striving to maintain both quality and speed-to-market.

Limited Consumer Awareness in Emerging Markets

In several developing regions, consumer awareness about the benefits of aseptic packaging remains limited. Many consumers still associate product safety and freshness with refrigeration, hindering the acceptance of ambient-stored aseptic products. Furthermore, low literacy levels and lack of trust in new packaging technologies may slow adoption rates. Addressing this challenge requires investment in consumer education campaigns and effective marketing strategies to highlight the safety, convenience, and sustainability of aseptic solutions.

Regional Analysis

North America

North America held a significant position in the global aseptic packaging market, with a market size of USD 20.59 million in 2024, up from USD 14.46 million in 2018, and is projected to reach USD 46.50 million by 2032, growing at a CAGR of 10.8%. The region accounted for approximately 26.3% of the global market in 2024. Growth is primarily driven by the high demand for ready-to-drink beverages, dairy alternatives, and pharmaceutical packaging innovations. Strong regulatory frameworks, widespread consumer awareness, and investments in sustainable packaging solutions further contribute to the region’s dominance in the aseptic packaging industry.

Europe

Europe represented around 18.4% of the global aseptic packaging market in 2024, with a market size of USD 14.36 million, rising from USD 10.48 million in 2018, and is expected to reach USD 30.03 million by 2032 at a CAGR of 9.7%. The market is driven by stringent food safety regulations, increasing consumption of organic and preservative-free products, and strong environmental policies supporting recyclable materials. The dairy and beverage sectors dominate the demand for aseptic packaging in Europe, supported by a well-established manufacturing base and consumer preference for sustainable and convenient packaging formats across key economies like Germany, France, and the U.K.

Asia Pacific

Asia Pacific led the global aseptic packaging market in 2024 with the largest market share of approximately 42.2%, valued at USD 32.99 million, up from USD 22.20 million in 2018. The market is forecast to grow to USD 79.33 million by 2032, driven by the highest regional CAGR of 11.6%. Rapid urbanization, growing middle-class population, and the rising demand for shelf-stable food and beverages contribute to the market’s growth. Countries like China, India, and Japan are witnessing a surge in aseptic technology adoption, supported by expanding pharmaceutical industries and investments in advanced packaging infrastructure and sustainable solutions.

Latin America

In 2024, Latin America accounted for around 6.0% of the global aseptic packaging market, with a value of USD 4.74 million, increasing from USD 3.30 million in 2018. It is projected to reach USD 9.92 million by 2032, growing at a CAGR of 9.7%. The region’s growth is supported by rising consumption of packaged dairy and beverage products, particularly in Brazil, Mexico, and Argentina. Increasing food exports and the expansion of pharmaceutical packaging facilities also drive market expansion. Despite infrastructure challenges, Latin America is gradually embracing aseptic technologies due to growing awareness of food safety and packaging efficiency.

Middle East

The Middle East aseptic packaging market reached USD 2.88 million in 2024, rising from USD 2.12 million in 2018, and is expected to grow to USD 5.89 million by 2032, at a CAGR of 9.4%. The region held a market share of approximately 3.7% in 2024. Growth is primarily fueled by increased demand for long-shelf-life beverages and pharmaceuticals in countries such as Saudi Arabia and the UAE. Limited cold chain infrastructure and climatic conditions further encourage aseptic packaging adoption. Investments in food processing and healthcare industries continue to bolster market growth, despite regulatory and logistical challenges in the region.

Africa

Africa held a market share of approximately 3.3% in the global aseptic packaging market in 2024, with a market size of USD 2.61 million, up from USD 1.44 million in 2018. The market is expected to reach USD 5.21 million by 2032, registering a CAGR of 8.7%. Growth in Africa is largely driven by increasing urbanization, rising demand for packaged food and beverages, and the need for extended shelf-life products in remote regions. Although infrastructure and regulatory support are limited, growing investments in local food and pharmaceutical production are likely to spur aseptic packaging adoption across the continent.

Market Segmentations:

By Product

- Cartons

- Bottles & Cans

- Bags & Pouches

- Prefilled Syringes

- Vials & Ampoules

- Others

By Application

- Food

- Fruits and Vegetables

- Beverages

- Ready-to-drink Beverages

- Dairy Based Beverages

- Pharmaceutical

- Others

By Material

- Plastic

- Metal

- Glass

- Paper & Paperboard

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The aseptic packaging market features a competitive landscape marked by the presence of established global players and a growing number of regional entrants. Key companies such as Tetra Pak, SIG Combibloc, Amcor, and Robert Bosch GmbH dominate due to their strong technological expertise, extensive product portfolios, and global distribution networks. These players focus on innovation, sustainability, and automation to maintain a competitive edge, with continuous investments in recyclable materials and energy-efficient packaging lines. Companies like Schott AG and Becton, Dickinson and Company are influential in the pharmaceutical aseptic segment, offering sterile and contamination-free solutions. Meanwhile, emerging players such as Greatview Aseptic Packaging and Uflex Limited are gaining traction in price-sensitive regions by offering cost-effective alternatives and customizable solutions. Strategic collaborations, mergers, and acquisitions remain key tactics for market expansion and technology integration. As consumer demand for safe, sustainable, and convenient packaging grows, competition in the aseptic packaging sector is expected to intensify globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch GmbH

- Reynolds Group Holdings Limited

- Becton, Dickinson and Company

- IMA S.P.A

- Schott AG

- Amcor

- Greatview Aseptic Packaging Co. Ltd

- IPI SRL (Coesia Group)

- Tetra Pak International SA

- SIG Combibloc Group

- DS Smith PLC

- Uflex Limited

- Elopak AS

- CDF Corporation

- Smurfit Kappa

- Mondi PLC

- Printpack

- Sealed Air Corporation

Recent Developments

- In July 2025, Robert Bosch GmbH continues its dominance in aseptic processing by focusing on technological advancements and increased production capacity. The company is heavily invested in automation, sustainability, and the integration of IoT solutions for real-time monitoring within its aseptic packaging lines. These investments aim to enhance process reliability, boost production speed, and ensure adherence to stringent quality standards.

- In July 2025, BD celebrated 25 years of its ChloraPrep™ skin antiseptic, highlighting the use of advanced assembly and packaging technology, including robotics, to improve efficiency and sterility in production.

- In June 2025, SCHOTT Pharma began construction of a new production facility for ready-to-use (RTU) sterile cartridges in Lukácsháza, Hungary, with a EUR 100+ million investment. This expansion will feature advanced technology, including state-of-the-art machinery, automated washing lines, and steam sterilization, ensuring high-quality sterile products. The facility will support SCHOTT Pharma’s global growth strategy and focus on sustainable, high-value aseptic packaging. It will be the company’s second site for sterile cartridge production, following St. Gallen, Switzerland.

- In February 2025, BD announced a voluntary recall of one lot of ChloraPrep™ Clear 1 mL applicators due to fungal contamination, underscoring the importance of rigorous aseptic packaging standards.

- In October 2024, BD partnered with ten23 health® to advance RFID-enabled prefillable syringes, enhancing efficiency and traceability in aseptic manufacturing for injectable drugs.

Market Concentration & Characteristics

The Aseptic Packaging Market exhibits a moderately concentrated structure, with a mix of global industry leaders and strong regional players competing across diverse applications. It is characterized by high capital investment requirements, advanced technological capabilities, and strict regulatory compliance, particularly in pharmaceutical and food sectors. The market favors companies with integrated manufacturing and supply chain capabilities, allowing them to deliver cost-effective, scalable, and safe packaging solutions. Leading firms such as Tetra Pak, SIG Combibloc, Amcor, and Robert Bosch GmbH maintain a competitive edge through product innovation, automation, and sustainable packaging initiatives. Barriers to entry remain relatively high due to the need for sterile processing environments and adherence to food safety and medical packaging standards. It also reflects a shift toward lightweight, recyclable materials and smart packaging technologies, driven by evolving consumer preferences and environmental mandates. Demand concentration is highest in Asia Pacific, supported by population growth, urbanization, and rising packaged food and pharmaceutical consumption.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The aseptic packaging market will continue to grow steadily due to increasing demand for shelf-stable food and beverage products.

- Pharmaceutical applications will expand further as the need for sterile, contamination-free packaging rises globally.

- Sustainability will drive innovation, with companies investing in recyclable and bio-based packaging materials.

- Asia Pacific will remain the fastest-growing region, supported by rising consumption and expanding manufacturing infrastructure.

- Technological advancements in aseptic filling equipment will improve operational efficiency and reduce contamination risks.

- Ready-to-drink beverages and dairy-based products will dominate consumption trends in key global markets.

- Demand for prefilled syringes, vials, and ampoules will increase with growing healthcare needs and injectable drug use.

- Automation and smart packaging integration will enhance traceability and product safety across supply chains.

- Food safety regulations and quality standards will continue to shape packaging innovations and compliance requirements.

- Strategic partnerships, acquisitions, and capacity expansions will remain critical for companies to strengthen market position.