| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Fat-Free Yogurt Market Size 2024 |

USD 3488.64 Million |

| Asia Pacific Fat-Free Yogurt Market, CAGR |

11.26% |

| Asia Pacific Fat-Free Yogurt Market Size 2032 |

USD 8193.62 Million |

Market Overview

Asia Pacific Fat-Free Yogurt Market size was valued at USD 3488.64 million in 2024 and is anticipated to reach USD 8193.62 million by 2032, at a CAGR of 11.26% during the forecast period (2024-2032).

The Asia Pacific fat-free yogurt market is driven by rising health consciousness and a growing preference for low-fat dairy products. Increasing awareness of obesity, diabetes, and cardiovascular diseases has led consumers to seek healthier alternatives, fueling demand for fat-free yogurt. The expansion of organized retail, e-commerce penetration, and growing disposable incomes further support market growth. Additionally, the increasing prevalence of lactose intolerance has driven demand for dairy-free and plant-based fat-free yogurts. Market players are innovating with probiotic-enriched formulations, diverse flavors, and convenient packaging to attract health-conscious consumers. The trend of clean-label and organic ingredients is gaining traction, with consumers preferring natural, additive-free products. Furthermore, aggressive marketing strategies and endorsements by fitness influencers and celebrities are expanding product reach. Countries like China, India, and Japan are witnessing strong demand due to urbanization and evolving dietary habits, positioning the region as a key growth hub for fat-free yogurt consumption.

The Asia Pacific fat-free yogurt market is expanding rapidly, driven by increasing health consciousness and changing dietary preferences across key regions such as China, Japan, India, Australia, and Southeast Asia. Urbanization and rising disposable incomes are fueling demand, with consumers seeking high-protein, probiotic-rich, and low-calorie dairy alternatives. Countries like South Korea and Thailand are witnessing a surge in functional yogurt consumption, while India and Indonesia present growth opportunities due to increasing lactose intolerance awareness. Key players dominating the market include Nestlé, Danone S.A., Yakult Honsha, Chobani, and FAGE International S.A., alongside regional brands like Almarai and Yeo Valley. These companies focus on product innovation, organic offerings, and plant-based alternatives to cater to evolving consumer demands. Expanding distribution channels, including e-commerce and modern retail stores, further support market penetration, allowing brands to reach a broader consumer base while leveraging digital marketing to enhance brand visibility and engagement.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific fat-free yogurt market was valued at USD 3,488.64 million in 2024 and is projected to reach USD 8,193.62 million by 2032, growing at a CAGR of 11.26% during the forecast period.

- Rising health consciousness and demand for low-fat, high-protein, and probiotic-rich dairy products are driving market growth.

- Increasing consumer preference for organic, clean-label, and plant-based fat-free yogurts is shaping market trends.

- Key players such as Nestlé, Danone S.A., Yakult Honsha, and Chobani focus on product innovation and expanding distribution networks.

- High production costs of organic yogurt and price sensitivity in emerging economies pose challenges to market expansion.

- China, Japan, and Australia lead the market, while India and Southeast Asia offer significant growth opportunities due to increasing urbanization.

- E-commerce platforms and modern retail stores are enhancing product accessibility, boosting sales across diverse consumer segments.

Report Scope

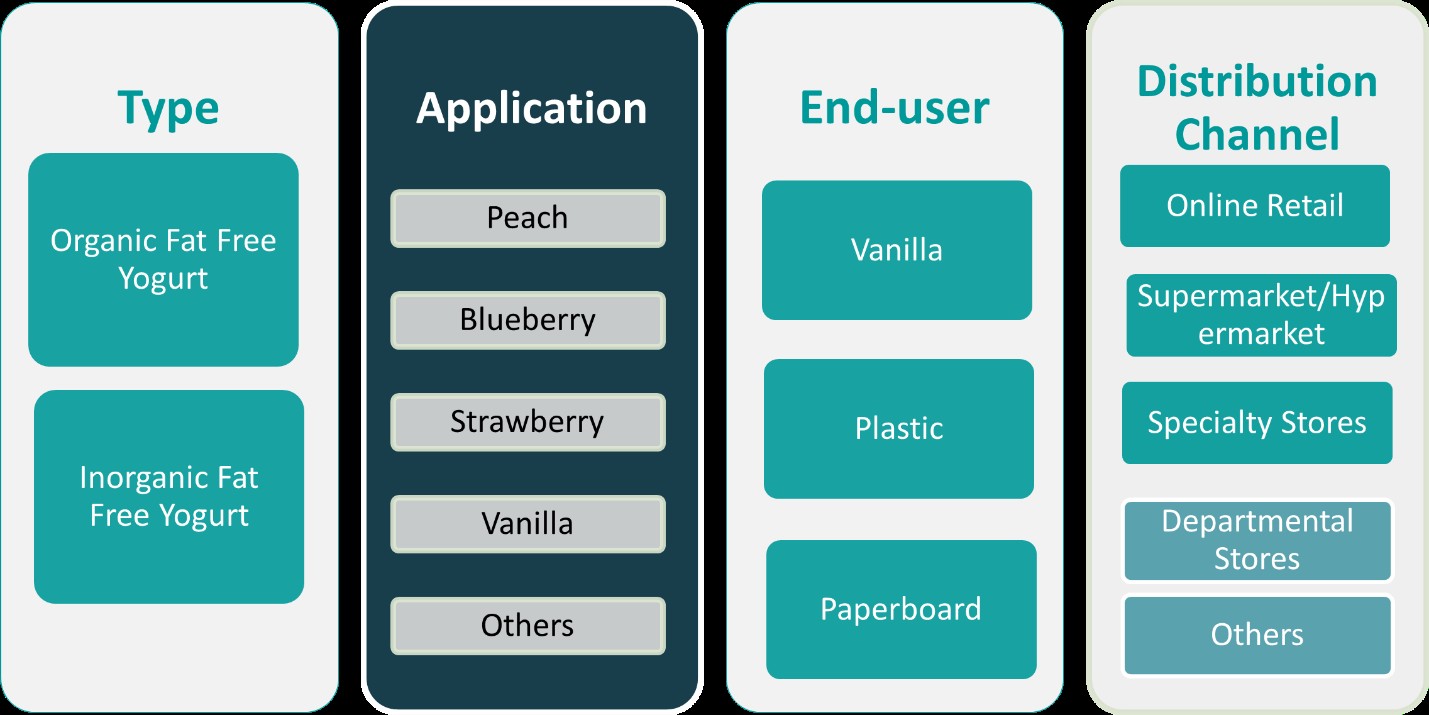

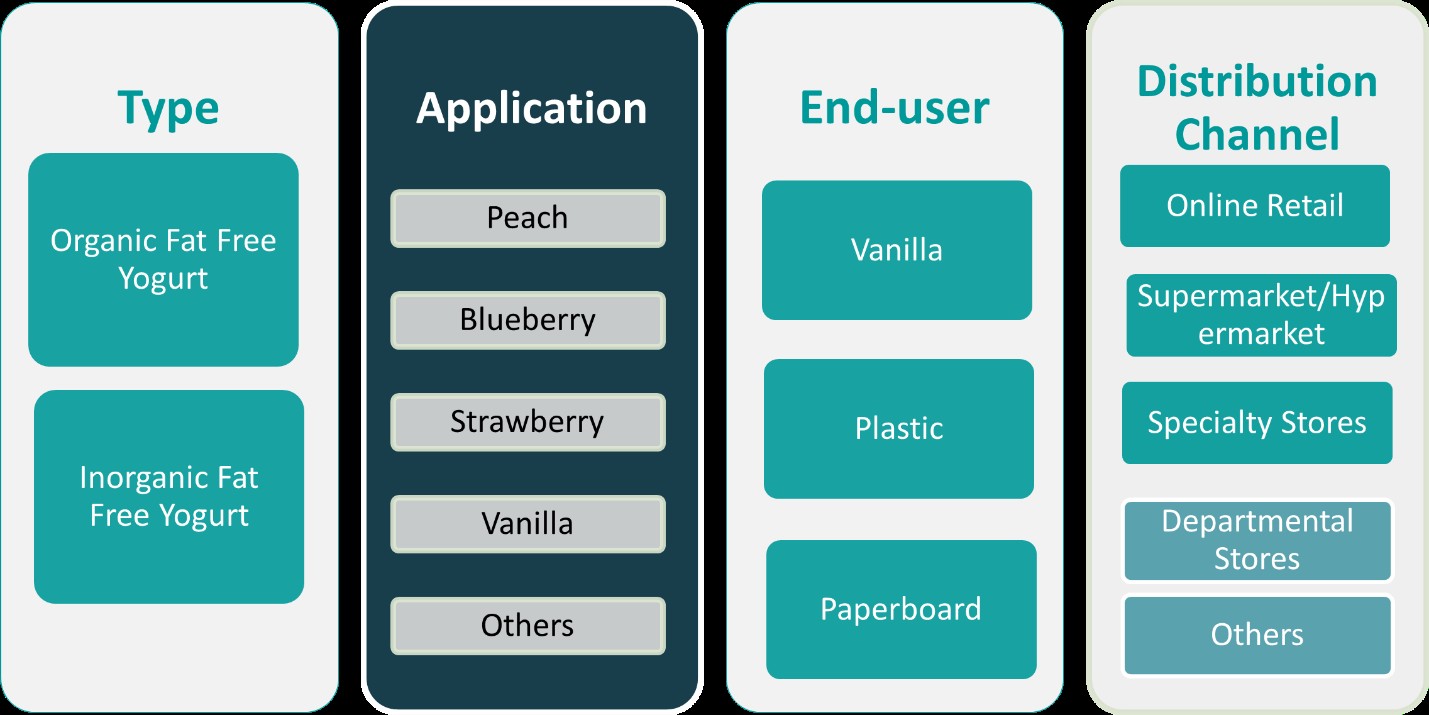

This report segments the Asia Pacific Fat Free Yogurt Market as follows:

Market Drivers

Innovation in Product Offerings and Packaging

Continuous product innovation is a crucial driver in the Asia Pacific fat-free yogurt market. Manufacturers are introducing diverse flavors, fortified formulations, and enhanced textures to appeal to a broader consumer base. For instance, companies are incorporating probiotics, vitamins, and high-protein content into their products, making fat-free yogurt a functional food that attracts fitness enthusiasts and individuals seeking digestive health benefits. Additionally, innovative packaging solutions such as single-serve packs, resealable containers, and sustainable packaging materials are enhancing product convenience and shelf appeal. The growing influence of Western dietary habits, particularly among urban populations, has further fueled demand for premium and flavored fat-free yogurt variants.

Expanding Retail and E-Commerce Channels

The rapid expansion of organized retail and e-commerce platforms is significantly contributing to the growth of the fat-free yogurt market in Asia Pacific. Supermarkets, hypermarkets, and specialty stores offer a diverse range of fat-free yogurt brands, making them more accessible to consumers. For example, online grocery platforms and food delivery services are driving convenience-driven purchases, especially among young, urban consumers. Subscription-based models and digital promotions have further accelerated online sales, making fat-free yogurt a staple in health-conscious diets. With rising disposable incomes and evolving shopping behaviors, the retail landscape is expected to play a pivotal role in the market’s long-term growth.

Growing Health Consciousness and Demand for Low-Fat Dairy Products

The rising awareness of health and wellness is a major driver of the Asia Pacific fat-free yogurt market. Consumers are increasingly adopting healthier dietary habits to combat obesity, diabetes, and cardiovascular diseases, fueling the demand for fat-free dairy alternatives. Yogurt, known for its probiotic benefits, is widely perceived as a healthy food choice, and the availability of fat-free options aligns with consumers’ preference for lower-calorie and nutrient-dense foods. Additionally, government initiatives promoting healthy eating and awareness campaigns about the risks of high-fat diets further contribute to the market’s expansion. The shift toward preventive healthcare and fitness trends encourages the consumption of functional foods, positioning fat-free yogurt as a preferred option among health-conscious individuals.

Rising Lactose Intolerance and Demand for Dairy Alternatives

The increasing prevalence of lactose intolerance across the Asia Pacific region is another key factor driving market growth. A significant portion of the population in countries such as China, Japan, and South Korea experiences lactose intolerance, leading to a surge in demand for dairy-free and easily digestible yogurt alternatives. This has encouraged manufacturers to develop fat-free yogurt made from plant-based sources such as soy, almond, and coconut milk, catering to consumers with dietary restrictions. Furthermore, the growing popularity of vegan and flexitarian diets has strengthened the market for dairy-free fat-free yogurt. With advancements in food technology, companies are formulating plant-based yogurts that closely mimic the taste and texture of traditional dairy yogurt, further driving consumer acceptance and market expansion.

Market Trends

Increasing Popularity of Probiotic-Enriched Yogurt

Consumers in the Asia Pacific region are increasingly prioritizing gut health, driving demand for probiotic-enriched fat-free yogurt. The awareness of digestive health benefits associated with probiotics has surged, with many consumers actively seeking products that promote a balanced gut microbiome. For instance, traditional dietary practices in APAC nations feature fermented foods rich in probiotics, such as kimchi in South Korea and miso in Japan, laying a strong foundation for the acceptance of modern probiotic products. Fat-free yogurts infused with probiotics such as Lactobacillus and Bifidobacterium are gaining traction due to their role in enhancing digestion, immunity, and overall well-being. Market players are leveraging this trend by introducing fortified yogurt variants that cater to health-conscious individuals. Additionally, the growing influence of functional foods and nutraceuticals in daily diets has positioned probiotic-infused fat-free yogurt as a preferred choice among consumers looking for convenient, health-boosting options.

Premiumization and Diverse Flavor Innovations

The Asia Pacific fat-free yogurt market is witnessing a trend toward premium and exotic flavors, driven by evolving consumer preferences and willingness to experiment with new taste profiles. While classic flavors like vanilla, strawberry, and blueberry remain popular, companies are introducing unique options such as matcha, mango-passionfruit, black sesame, and lychee to appeal to diverse palates. For instance, brands like Brownes Dairy have innovated by introducing exciting flavors like tutti fruity and bubble gum, as well as kombucha yoghurt with flavors like ginger and lemon, to keep the product offerings fresh and appealing. The rise of gourmet and artisanal yogurt offerings, featuring organic ingredients and natural sweeteners, is further fueling market growth. Additionally, limited-edition seasonal flavors and regional-inspired varieties cater to local tastes, enhancing consumer engagement. The premiumization trend also extends to packaging, with brands adopting eco-friendly, resealable, and aesthetically appealing designs to attract modern consumers.

Rising Demand for Plant-Based and Dairy-Free Alternatives

The demand for plant-based fat-free yogurt is rising as consumers embrace vegan, lactose-free, and flexitarian diets. Countries such as China, Japan, and Australia have witnessed a surge in consumers shifting away from traditional dairy products due to lactose intolerance, ethical concerns, and environmental sustainability. This trend has led to the development of plant-based fat-free yogurts derived from soy, almond, oat, and coconut milk. Manufacturers are investing in advanced food processing technologies to enhance the taste and texture of dairy-free yogurt, making it comparable to traditional options. The increasing availability of plant-based yogurt in supermarkets, health food stores, and online platforms further supports market expansion, catering to the evolving dietary preferences of health-conscious and environmentally aware consumers.

Expansion of Online Retail and Subscription-Based Models

The rapid growth of e-commerce platforms and direct-to-consumer sales is transforming the distribution landscape of fat-free yogurt in Asia Pacific. Online grocery services, food delivery apps, and subscription-based models provide consumers with convenient access to a variety of yogurt options. Companies are leveraging digital marketing, social media influencers, and personalized promotions to drive online sales and customer retention. Subscription services, offering regular doorstep deliveries of customized yogurt assortments, are gaining popularity, particularly among health-conscious urban consumers. This shift toward digital retail channels is expected to continue, further enhancing product accessibility and market penetration across the region.

Market Challenges Analysis

High Production Costs and Pricing Challenges

The Asia Pacific fat-free yogurt market faces significant challenges due to high production costs associated with sourcing quality raw materials and advanced processing techniques. Producing fat-free yogurt requires specialized equipment to maintain texture, consistency, and nutritional value while eliminating fat content. Additionally, incorporating probiotics, plant-based alternatives, and organic ingredients further raises production expenses. These costs are often passed on to consumers, making fat-free yogurt more expensive than regular yogurt. In price-sensitive markets such as India and Southeast Asia, this poses a barrier to widespread adoption. Furthermore, fluctuations in dairy prices, supply chain disruptions, and inflationary pressures can impact production costs, making it difficult for manufacturers to maintain competitive pricing. Companies must balance affordability with premium product offerings to sustain demand and expand market penetration.

Limited Consumer Awareness and Market Penetration

Despite growing health consciousness, fat-free yogurt remains a niche product in many parts of Asia Pacific due to limited consumer awareness and accessibility. While urban populations in countries like China, Japan, and Australia are embracing healthier dairy alternatives, rural areas and developing markets still lack adequate exposure to such products. For example, in China, where over 92% of the population experiences lactose intolerance, there is a strong demand for lactose-free yogurt products, yet awareness and availability remain limited in rural areas. Many consumers perceive fat-free yogurt as less flavorful or less satisfying than full-fat alternatives, leading to slower adoption rates. Additionally, distribution challenges in emerging markets hinder product availability in smaller retail stores and traditional grocery outlets. To overcome these barriers, companies must invest in consumer education initiatives, aggressive marketing strategies, and localized product offerings that cater to regional taste preferences. Expanding retail presence through supermarkets, convenience stores, and e-commerce platforms will be crucial in driving market penetration and long-term growth.

Market Opportunities

The Asia Pacific fat-free yogurt market presents significant growth opportunities driven by shifting consumer preferences and expanding health-conscious demographics. The increasing demand for functional foods, particularly those enriched with probiotics, vitamins, and high-protein content, offers manufacturers a chance to introduce innovative product variants. Consumers are actively seeking gut-friendly and immunity-boosting foods, positioning fat-free yogurt as a preferred dietary choice. Additionally, the growing popularity of plant-based and dairy-free alternatives presents an untapped market segment. Companies that invest in research and development to enhance the taste, texture, and nutritional value of plant-based fat-free yogurts can attract lactose-intolerant consumers and those following vegan or flexitarian diets. Collaborations with health professionals and fitness influencers can further strengthen brand positioning, fostering greater consumer trust and awareness.

Expanding retail and e-commerce channels also provide lucrative opportunities for market players. The rapid adoption of online grocery shopping, coupled with increasing smartphone penetration, enables brands to reach a wider consumer base. Direct-to-consumer sales through digital platforms, subscription-based yogurt delivery models, and targeted online marketing campaigns can drive brand loyalty and product accessibility. Additionally, premiumization trends, such as organic, clean-label, and exotic flavor offerings, cater to the evolving preferences of affluent and urban consumers. Companies that focus on sustainable packaging solutions and environmentally friendly production practices can enhance their market appeal, aligning with the region’s growing emphasis on sustainability. With increasing disposable incomes and urbanization across emerging economies, the demand for fat-free yogurt is expected to rise, providing manufacturers with a substantial opportunity to expand their market footprint and drive long-term growth.

Market Segmentation Analysis:

By Type:

The Asia Pacific fat-free yogurt market is segmented into organic and inorganic variants, each catering to distinct consumer preferences. Organic fat-free yogurt is gaining traction due to the rising demand for clean-label, chemical-free, and naturally sourced products. Health-conscious consumers increasingly prefer organic options as they are free from synthetic additives, preservatives, and pesticides, aligning with the growing trend of sustainable and ethical consumption. Regulatory support for organic dairy farming in countries like Australia, Japan, and India further boosts market adoption. However, the higher production costs and premium pricing of organic fat-free yogurt limit its accessibility in price-sensitive markets. On the other hand, inorganic fat-free yogurt remains dominant due to its affordability and widespread availability. Large-scale dairy manufacturers produce inorganic variants using conventional farming methods and fortified ingredients, making them more cost-effective for the average consumer. The presence of diverse flavors and fortified formulations in this segment ensures steady demand across supermarkets, convenience stores, and online retail platforms, contributing to market growth.

By Application:

Flavor innovations play a crucial role in driving consumer preferences within the Asia Pacific fat-free yogurt market. Among the key flavor segments, strawberry and vanilla remain the most popular choices due to their universal appeal and versatility in both standalone consumption and culinary applications. Blueberry and peach flavors are gaining prominence, particularly among consumers seeking antioxidant-rich and refreshing yogurt options. These fruit-based variants are often marketed as premium or probiotic-enriched products, attracting health-conscious buyers. The “others” category includes exotic and regionally inspired flavors such as matcha, mango, lychee, and black sesame, which appeal to local tastes and experimental consumers. The increasing influence of Western dietary habits, coupled with the growing preference for natural fruit-based sweeteners over artificial additives, is shaping flavor trends in the market. Companies investing in seasonal and limited-edition flavors, as well as personalized yogurt assortments, are likely to gain a competitive edge, catering to evolving consumer preferences and expanding their market presence across Asia Pacific.

Segments:

Based on Type:

- Organic Fat-Free Yogurt

- Inorganic Fat-Free Yogurt

Based on Application:

- Peach

- Blueberry

- Strawberry

- Vanilla

- Others

Based on End- User:

Based on Distribution Channel:

- Online Retail

- Supermarket/Hypermarket

- Specialty Stores

- Departmental Stores

- Others

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China and Japan

China and Japan collectively account for the largest share of the Asia Pacific fat-free yogurt market, with China holding approximately 28% and Japan around 20% of the regional revenue. The growing consumer preference for healthier dairy alternatives, coupled with the influence of Western dietary habits, has fueled demand in these countries. In China, the increasing urban population and rising disposable incomes drive the adoption of fat-free yogurt, particularly among young professionals and fitness-conscious individuals. Japanese consumers, known for their preference for functional and probiotic-rich foods, favor fat-free yogurt due to its digestive health benefits. The presence of well-established dairy companies, such as Yakult and Meiji in Japan, further supports market growth by offering a diverse range of fortified and flavored fat-free yogurt products. Additionally, e-commerce and convenience stores play a crucial role in enhancing accessibility, with online grocery platforms driving significant sales in urban areas.

India and Australia

India and Australia together contribute to approximately 18% of the Asia Pacific fat-free yogurt market, with India holding 10% and Australia 8%. In India, the demand for fat-free yogurt is rising due to increasing health awareness, lactose intolerance concerns, and a growing preference for protein-rich diets. However, price sensitivity remains a key challenge, limiting market penetration in rural areas. The expansion of modern retail chains and online grocery platforms is improving accessibility, while local dairy brands are introducing affordable fat-free yogurt options to cater to middle-income consumers. Meanwhile, in Australia, strong demand for organic and clean-label yogurt products is driving market expansion. Australian consumers prioritize sustainability, leading to increased investments in eco-friendly packaging and ethically sourced ingredients. The presence of premium dairy brands offering probiotic-infused fat-free yogurt has further accelerated market growth, positioning Australia as a lucrative market for innovation-driven companies.

South Korea and Southeast Asia

South Korea, along with Southeast Asian nations such as Thailand, Indonesia, and Vietnam, collectively holds approximately 15% of the Asia Pacific fat-free yogurt market. South Korea accounts for 7%, driven by a high demand for probiotic-enriched dairy products and functional beverages. The country’s well-developed convenience store network and strong presence of local dairy brands facilitate widespread product availability. Meanwhile, Thailand, Indonesia, and Vietnam together represent 8%, with rapid urbanization and rising health consciousness fueling market growth. The younger population in these nations is increasingly adopting fat-free yogurt as a breakfast staple or a healthy snack option. The expansion of multinational brands, coupled with aggressive marketing campaigns emphasizing gut health benefits, is further boosting consumer adoption in this region.

Malaysia, the Philippines, Taiwan, and Rest of Asia Pacific

Malaysia, the Philippines, Taiwan, and the rest of the Asia Pacific region together contribute to approximately 19% of the market share. Taiwan leads this segment with 6%, owing to its strong dairy industry and consumer preference for high-quality yogurt products. Malaysia and the Philippines account for 5% and 4%, respectively, benefiting from the growing influence of Western dietary habits and increasing disposable incomes. The rest of the Asia Pacific region holds 4%, where market growth is driven by increasing urbanization and the expansion of international dairy brands. The improving cold chain logistics and retail infrastructure in these countries are enhancing product availability, while government initiatives promoting dairy consumption further support market expansion.

Key Player Analysis

- Nestlé

- Almarai

- Arla Foods amba

- ASDA

- Brummel & Brown

- Chobani, LLC

- Danone S.A.

- FAGE International S.A.

- Graham’s Dairies Limited

- Nature’s Fynd

- Nestlé, S.A.

- Riverford Organic Farmers Ltd

- Sainsbury’s

- Stonyfield

- Target Corporation

- The Hain Celestial Group

- Wm Morrison Supermarkets Limited

- Yakult Honsha

- Yeo Valley

- Yoplait by General Mills Inc.

Competitive Analysis

The Asia Pacific fat-free yogurt market is highly competitive, with leading players focusing on product innovation, strategic partnerships, and expanding distribution networks. Companies such as Nestlé, Danone S.A., Yakult Honsha, Chobani, FAGE International S.A., Almarai, and Yeo Valley dominate the market, leveraging strong brand presence and extensive product portfolios. These players continuously introduce new flavors, probiotic-infused variants, and plant-based alternatives to cater to evolving consumer preferences. Multinational brands invest heavily in marketing campaigns and health-focused branding to gain a competitive edge. E-commerce and modern retail expansion further enhance accessibility, enabling brands to penetrate both urban and rural markets. Additionally, premiumization strategies, such as organic and functional yogurt offerings, help companies differentiate themselves. However, competition from regional dairy brands and private-label products remains strong, especially in price-sensitive markets. As demand for healthier dairy alternatives rises, companies are expected to intensify R&D efforts, ensuring sustained growth and innovation in the market.

Recent Developments

- In October 2024, Nestlé Lindahls expanded its high-protein range with new flavors, including fat-free protein yogurt pouches. However, these are not specifically labeled as fat-free yogurt but are part of a broader health-focused product line.

- In July 2024, Nestlé developed a technology to reduce fat in dairy ingredients by up to 60% without compromising taste or texture, though this is not specifically for fat-free yogurt.

Market Concentration & Characteristics

The Asia Pacific fat-free yogurt market exhibits a moderate to high market concentration, with a mix of global dairy giants and regional players competing for market share. Leading companies such as Nestlé, Danone S.A., Yakult Honsha, and Chobani dominate the industry, leveraging strong brand recognition, extensive distribution networks, and product innovation. The market is characterized by intense competition, where companies differentiate through organic, probiotic-rich, and plant-based yogurt offerings. Premiumization trends are shaping consumer preferences, driving demand for clean-label, functional, and fortified fat-free yogurts. Additionally, the market benefits from expanding retail and e-commerce channels, enabling greater accessibility across urban and rural regions. While established brands maintain dominance, emerging local dairy firms and private-label products create price competition. Sustainability and eco-friendly packaging are becoming key differentiators, as environmentally conscious consumers seek brands that align with their values. Continuous R&D efforts and evolving dietary trends further influence market dynamics and competitive strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific fat-free yogurt market is expected to witness sustained growth due to rising health awareness and increasing demand for low-fat dairy alternatives.

- Expanding urbanization and higher disposable incomes will drive market penetration across emerging economies.

- Product innovation, including organic, plant-based, and probiotic-infused variants, will remain a key focus for manufacturers.

- E-commerce and modern retail expansion will enhance product accessibility, boosting consumer adoption.

- Companies will increasingly invest in sustainable packaging and eco-friendly production methods to meet growing environmental concerns.

- Rising lactose intolerance awareness will fuel demand for dairy-free and lactose-free fat-free yogurt alternatives.

- Competitive pricing and private-label products will intensify market competition, particularly in price-sensitive regions.

- Government initiatives promoting health and wellness will support market expansion through favorable regulations and dietary guidelines.

- Advanced marketing strategies, including digital campaigns and influencer collaborations, will strengthen brand positioning.

- Research and development efforts will continue to drive innovation, ensuring sustained consumer interest and market growth.