Market Overview:

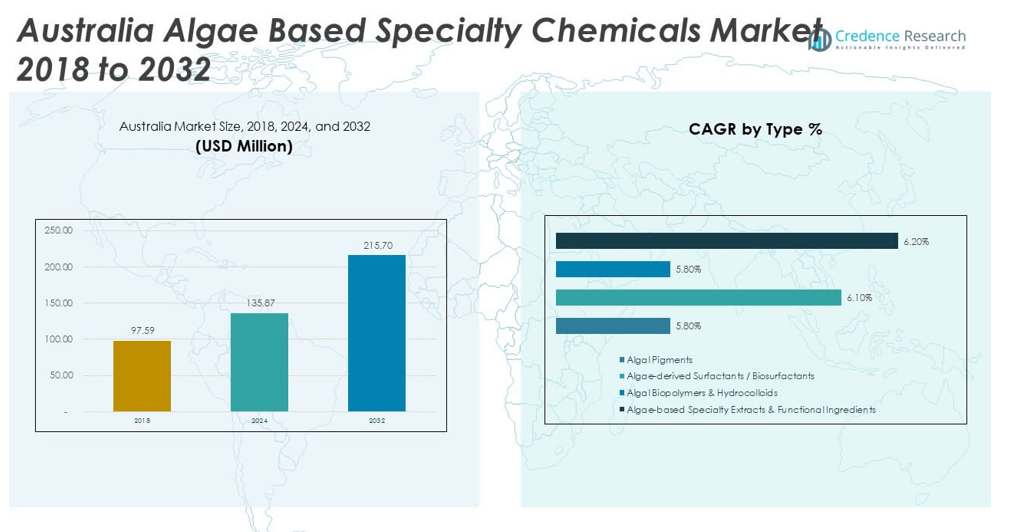

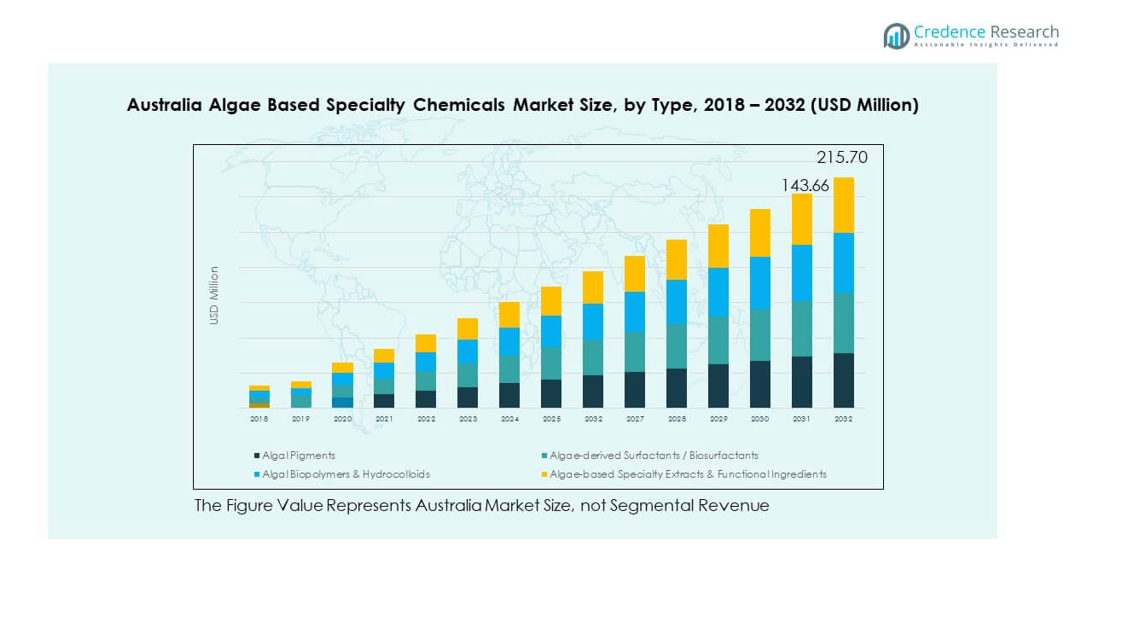

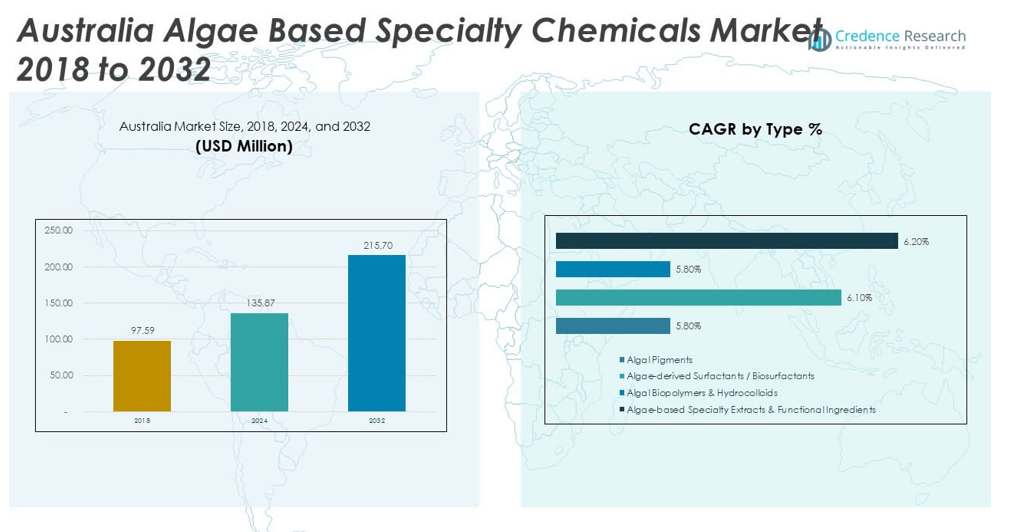

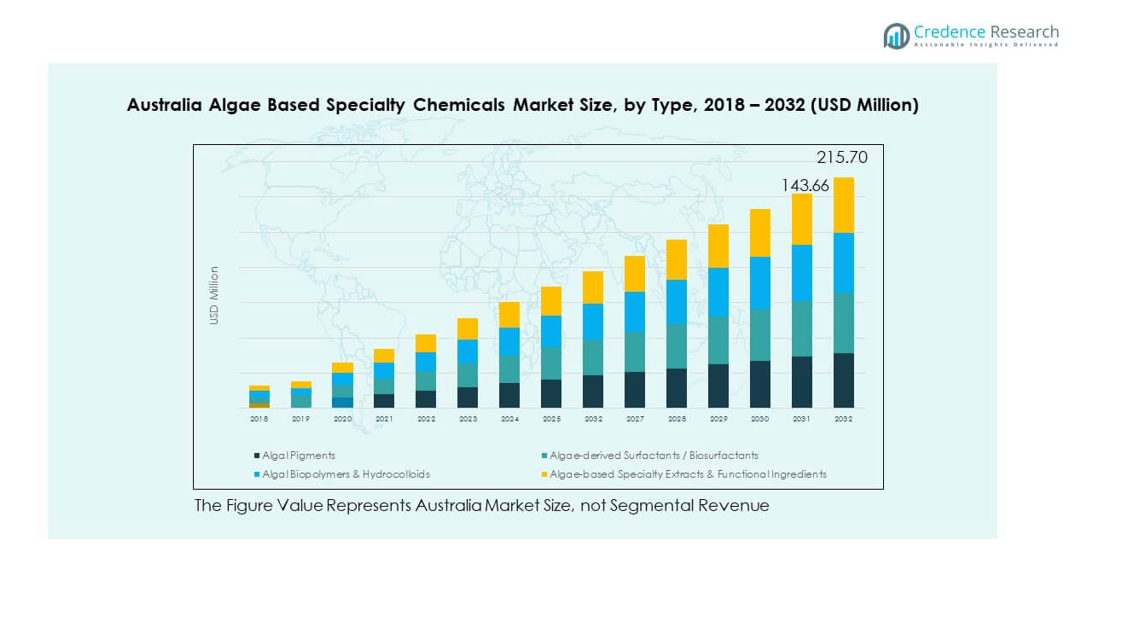

The Australia Algae Based Specialty Chemicals Market size was valued at USD 97.59 million in 2018 to USD 135.87 million in 2024 and is anticipated to reach USD 215.7 million by 2032, at a CAGR of 6.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Algae Based Specialty Chemicals Market Size 2024 |

USD 135.87 million |

| Australia Algae Based Specialty Chemicals Market, CAGR |

6.14% |

| Australia Algae Based Specialty Chemicals Market Size 2032 |

USD 215.7 million |

Growth in the market is driven by rising demand for sustainable and renewable raw materials across multiple industries. Algae-based specialty chemicals offer applications in pharmaceuticals, food and beverages, cosmetics, and agriculture. Companies are investing in advanced cultivation and extraction technologies to improve scalability and efficiency. Government policies promoting eco-friendly products further support adoption. Increasing consumer awareness of clean-label ingredients and bio-based solutions strengthens industry growth. Manufacturers leverage algae’s versatility to produce pigments, biopolymers, and functional ingredients. This trend positions algae as a reliable alternative to petroleum-based chemicals.

Regionally, Eastern Australia leads due to strong industrial clusters, advanced biotechnology research, and access to coastal resources that support algae cultivation. Southern Australia shows significant growth potential with applications in agriculture, aquaculture, and bioplastics. Western and Northern regions are emerging markets, benefiting from aquaculture development and government-backed diversification projects. Neighboring countries like China, India, and Japan strengthen regional collaboration through trade and research partnerships. It benefits from proximity to these markets, enhancing its export potential. This geographic spread highlights a balanced market structure with established hubs and emerging growth zones.

Market Insights

- The Australia Algae Based Specialty Chemicals Market was valued at USD 97.59 million in 2018, grew to USD 135.87 million in 2024, and is projected to reach USD 215.7 million by 2032, at a CAGR of 6.14%.

- Eastern Australia accounted for 42% of the market in 2024, supported by industrial clusters, coastal resources, and biotechnology research, while Southern Australia followed with 33% driven by agriculture and aquaculture.

- Western and Northern Australia jointly represented 25% share, benefiting from aquaculture development and government-backed initiatives, though still limited in large-scale infrastructure.

- Algal pigments held the largest share at 38% of the total market in 2024, driven by strong use in pharmaceuticals, nutraceuticals, and cosmetics.

- Algal biopolymers and hydrocolloids accounted for 27% share, supported by their rising role in packaging, food processing, and bio-based material applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Preference for Sustainable Alternatives Across Industrial Applications

The Australia Algae Based Specialty Chemicals Market benefits from industries replacing petroleum-based products with eco-friendly alternatives. Algae-derived compounds reduce dependency on finite fossil resources and lower carbon footprints. Demand from pharmaceuticals, agriculture, and cosmetics encourages research in product diversification. Manufacturers view algae as a sustainable raw material that can support long-term supply security. Policy initiatives favor renewable feedstocks and create stable demand. Industrial end-users prioritize materials that meet environmental compliance standards. The increasing focus on sustainability strengthens investment in scalable algae processing technologies. This transformation positions algae-based products as viable industrial inputs.

- For example, Aurora Algae operated a demonstration facility in Karratha, Western Australia, featuring six open ponds that produced up to 15 tonnes of dried algal biomass per month, supplying industries such as nutraceuticals, aquaculture, and pharmaceuticals.

Government Policies Encouraging Bio-Based Chemical Development

Supportive regulations and national strategies push investments in renewable chemical development. Subsidies for clean technology adoption encourage production expansion. It supports companies aiming to achieve environmental targets. Government partnerships promote large-scale algae cultivation in coastal zones. National agencies emphasize reducing industrial emissions by replacing traditional chemicals with bio-based options. The Australia Algae Based Specialty Chemicals Market aligns with these long-term policies. Incentives for renewable feedstock development encourage innovation and infrastructure growth. Policy stability ensures investor confidence in this emerging chemical domain.

- For example, MBD Energy, with support from the Australian government’s CRC Mining initiative, developed a proof-of-concept algae biosequestration facility at Tarong Power Station in Queensland that used coal-fired flue gas to cultivate microalgae for biomass and by-product research.

Advancements in Algae Cultivation and Extraction Technologies

Breakthroughs in photobioreactor designs and harvesting methods improve production efficiency. Modern extraction techniques ensure higher purity levels and consistent output. Enhanced cultivation technologies reduce operational costs and expand industrial scalability. These advances make algae-based chemicals more competitive with synthetic substitutes. Integration of automation improves yield monitoring and reduces waste levels. Pilot projects highlight promising commercial applications across varied sectors. The Australia Algae Based Specialty Chemicals Market leverages these innovations to attract industry partnerships. Continuous R&D ensures greater adaptability in production systems.

Consumer Awareness Driving Demand for Green and Natural Products

Shifting consumer preferences influence the chemical industry to adopt bio-based formulations. Natural and safe product attributes drive demand in personal care and nutraceuticals. Food producers integrate algae-based additives for health-conscious buyers. Retailers highlight eco-friendly products to match consumer expectations. Public awareness campaigns about sustainable sourcing add credibility to algae-based solutions. This growing preference accelerates industry interest in reliable supply chains. The Australia Algae Based Specialty Chemicals Market gains momentum from customer-driven sustainability trends. It motivates companies to strengthen transparency and traceability in production.

Market Trends

Expanding Role of Algae-Based Ingredients in High-Value Personal Care Segments

Cosmetics and skincare industries integrate algae-derived compounds for moisturizing and antioxidant properties. These bioactive materials enhance product safety while supporting premium positioning. Personal care companies market algae-based solutions to attract eco-conscious consumers. New formulations in sunscreens and anti-aging creams increase visibility of algae-based innovation. Demand for marine-sourced active ingredients boosts R&D partnerships. The Australia Algae Based Specialty Chemicals Market benefits from such consumer-focused innovation. It creates opportunities for localized suppliers to scale and export. The trend ensures algae-based chemicals penetrate long-lasting consumer goods segments.

Integration of Algae-Derived Compounds in Functional Foods and Beverages

Nutraceutical and health beverage producers use algae-derived omega-3s and proteins. These functional compounds strengthen claims of improved nutrition and wellness. The rising interest in plant-based diets supports algae-based food additives. Companies explore fortified beverages and supplements enriched with algae. It enables producers to differentiate products in competitive retail markets. The Australia Algae Based Specialty Chemicals Market finds opportunities in expanding health-focused industries. Supply chain partnerships with food processors enhance commercial success. Functional nutrition remains a long-term trend shaping algae utilization.

- For example, Marinova, an Australian biotechnology company, specializes in extracting fucoidan from brown seaweed and supplies it to global nutrition, functional food, and supplement markets, with active research collaborations evaluating its bioactive efficacy in areas such as immunity, gut health, and healthy aging.

Commercial Adoption of Algae-Based Bioplastics and Packaging Solutions

Bioplastics made from algae provide biodegradable alternatives to conventional plastics. Packaging companies integrate these materials to meet circular economy targets. Governments and brands aim to reduce plastic waste through innovation. Algae-derived polymers offer strength and flexibility for packaging applications. Companies demonstrate algae-based bottles and films at commercial scale. It positions algae chemicals as a vital solution in sustainable packaging markets. The Australia Algae Based Specialty Chemicals Market tracks this demand shift toward eco-friendly materials. The trend accelerates with rising consumer support for biodegradable solutions.

Collaborations Between Research Institutions and Industry Players

Academic institutions partner with companies to accelerate algae-based chemical innovation. Research centers support pilot-scale algae farms with commercial viability studies. Industry groups fund projects to identify high-value compounds. Collaborations improve technology adoption and knowledge transfer. It ensures efficient scaling of algae-based specialty chemicals. The Australia Algae Based Specialty Chemicals Market leverages public-private partnerships for rapid growth. R&D alliances encourage patent development and new intellectual property. Joint ventures promote investment confidence and market entry.

- For example, Algenie, spun out from University of Technology Sydney and its C3 climate cluster, deployed a patented helix-shaped photobioreactor capable of producing 100 tonnes of algae annually in a shipping container-sized unit. It leverages automation and AI for strain optimisation and aims to supply feedstocks for fuels, plastics, and sustainable materials.

Market Challenges Analysis

High Production Costs and Technological Limitations in Large-Scale Manufacturing

Production of algae-based chemicals requires advanced cultivation and extraction infrastructure. High operational costs reduce competitiveness against conventional chemicals. Limited commercial-scale photobioreactors restrict output efficiency. Capital-intensive technology investment creates barriers for small producers. It affects scalability and impacts profitability across the supply chain. The Australia Algae Based Specialty Chemicals Market must overcome these cost and technology gaps. Limited access to advanced processing facilities slows industry expansion. Balancing affordability with innovation remains a critical challenge.

Supply Chain Constraints and Limited Consumer Awareness in Niche Markets

Supply chains for algae-based inputs face logistical and quality control issues. Climatic conditions impact algae yield reliability. Limited domestic suppliers restrict continuous production volumes. Consumer awareness of algae-based chemicals outside food and cosmetics remains low. It prevents wide-scale adoption in industrial and construction applications. The Australia Algae Based Specialty Chemicals Market requires strong marketing and outreach strategies. Distribution networks need reinforcement to ensure consistent market presence. Overcoming awareness gaps is essential for expanding commercial acceptance.

Market Opportunities

Expanding Industrial Applications Across Pharmaceuticals, Agriculture, and Nutraceuticals

Pharmaceutical companies integrate algae-based compounds into drug formulations for therapeutic benefits. Agricultural inputs such as biofertilizers and biostimulants adopt algae-derived nutrients. It opens opportunities for sustainable farming solutions aligned with eco-standards. Nutraceuticals explore algae proteins and omega-3 fatty acids for dietary supplements. The Australia Algae Based Specialty Chemicals Market expands into high-growth industries with proven demand. End-user diversification ensures long-term business security. Industrial applications strengthen resilience against single-sector dependency.

Growing Export Potential Through Innovation and Regional Collaborations

Australian producers can supply algae-based specialty chemicals to Asia-Pacific and global markets. Regional trade partnerships increase export competitiveness. It creates avenues for wider market penetration. Innovation in high-value compounds positions domestic producers as global suppliers. The Australia Algae Based Specialty Chemicals Market gains advantage from regional collaborations. Export-driven strategies support revenue expansion and global recognition. Collaboration with nearby economies encourages cost-effective logistics. Market opportunities grow with innovation-driven partnerships.

Market Segmentation Analysis

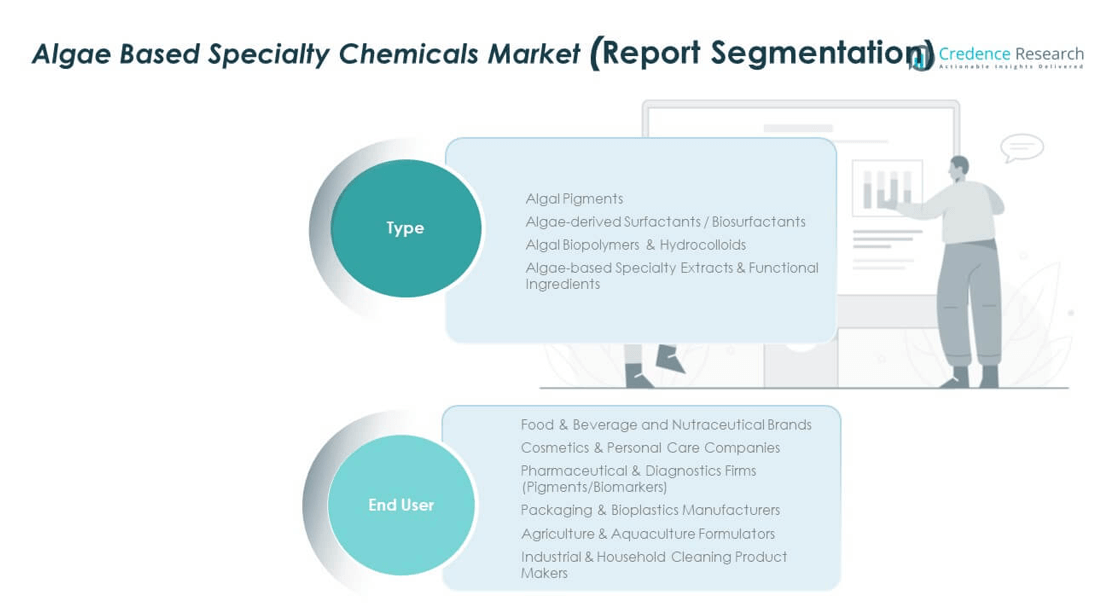

By type, algal pigments hold a dominant position in the Australia Algae Based Specialty Chemicals Market due to their extensive use in pharmaceuticals, nutraceuticals, and cosmetics for natural coloring and antioxidant properties. Algae-derived surfactants and biosurfactants gain traction in eco-friendly cleaning and personal care products, supported by rising consumer demand for biodegradable alternatives. Algal biopolymers and hydrocolloids see expanding adoption in packaging and food processing due to their stabilizing and thickening abilities. Algae-based specialty extracts and functional ingredients strengthen their presence in nutraceuticals, driven by the increasing preference for plant-based health solutions.

- For example, Evonik’s Rheance® D50 is a glycolipid biosurfactant produced from renewable raw materials in Europe, marketed for use in sustainable personal care formulations and suitable for certified natural cosmetics.

By end user, food and beverage and nutraceutical brands represent the leading segment with widespread use of algae-derived proteins, pigments, and omega-3s. Cosmetics and personal care companies integrate algae-based compounds for natural formulations that appeal to eco-conscious consumers. Pharmaceutical and diagnostics firms explore algae for pigments, biomarkers, and therapeutic compounds, driving niche demand. Packaging and bioplastics manufacturers embrace algae biopolymers to replace petroleum-based plastics and align with sustainability standards. Agriculture and aquaculture formulators use algae-based fertilizers and stimulants to improve crop yields and animal nutrition. Industrial and household cleaning product makers adopt algae biosurfactants to create safe, biodegradable cleaning solutions, ensuring broad market penetration.

- For example, E.I.D. Parry’s Parry Nutraceuticals produces organic Spirulina recognized for its exceptionally high protein content, typically reported in the 60–70% range of dry weight, and supplies it globally for use in nutritional supplements.

Segmentation

By Type

- Algal Pigments

- Algae-derived Surfactants / Biosurfactants

- Algal Biopolymers & Hydrocolloids

- Algae-based Specialty Extracts & Functional Ingredients

By End User

- Food & Beverage and Nutraceutical Brands

- Cosmetics & Personal Care Companies

- Pharmaceutical & Diagnostics Firms (Pigments/Biomarkers)

- Packaging & Bioplastics Manufacturers

- Agriculture & Aquaculture Formulators

- Industrial & Household Cleaning Product Makers

Regional Analysis

Eastern Australia

Eastern Australia holds the largest share of the Australia Algae Based Specialty Chemicals Market, accounting for 42% of the total market. This dominance stems from strong industrial clusters, advanced biotechnology hubs, and proximity to coastal resources. Universities and research centers in Sydney and Brisbane drive innovations in algae cultivation and processing. Food and pharmaceutical companies in the region integrate algae-derived compounds into their production pipelines. It benefits from established supply chain infrastructure and government-backed sustainability programs. The region remains the core base for large-scale commercial deployment.

Southern Australia

Southern Australia represents 33% of the market, driven by agriculture, aquaculture, and industrial applications. Adelaide acts as a center for R&D collaborations and pilot projects that promote bioplastics and specialty ingredients. It demonstrates strong adoption of algae-based fertilizers and bio-stimulants in sustainable farming practices. The cosmetics and nutraceutical sectors in this region increase demand for algae-derived extracts. It benefits from supportive regional programs that encourage clean technology investments. Southern Australia emerges as a balanced hub combining agriculture with industrial innovation.

Western and Northern Australia

Western and Northern Australia together contribute 25% of the market, with rising interest in algae-based products. Western Australia benefits from mining-linked environmental initiatives and coastal conditions favorable for algae farms. Northern Australia shows gradual adoption in aquaculture, supported by government-funded programs to diversify regional industries. It demonstrates potential in sustainable packaging through algae-based biopolymers. Infrastructure limitations reduce large-scale production, yet investment opportunities continue to expand. The combined subregions provide growth prospects for future expansion and export capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CABB Chemicals

- BASF SE

- Accepta

- Cyanotech Corporation

- Earthrise Nutritionals

- Omega Chemicals Pty Ltd

- CP Kelco

- Cargill

- DSM

- Other Key Players

Competitive Analysis

The Australia Algae Based Specialty Chemicals Market features a competitive landscape shaped by global leaders and domestic innovators. Companies such as BASF SE, DSM, and Cargill leverage global expertise and advanced R&D to introduce high-value algae-based products. Local firms like Omega Chemicals Pty Ltd strengthen regional supply through tailored formulations and close partnerships with end users. It creates an environment where international companies focus on scale while domestic players emphasize customization and niche applications. Strategic collaborations, acquisitions, and new product launches remain central to building market positions. The competitive environment is marked by continuous innovation, with companies prioritizing sustainable solutions and expanding algae-based product portfolios to meet rising demand across diverse industries.

Recent Developments

- In February 2025, GC Rieber VivoMega launched “Algae 1060 TG Premium,” an algae-based EPA and DHA product designed for dietary supplements and functional foods. This new product expands the range of algae-derived specialty chemistry in the Australian market and is intended to support the growing demand for plant-based omega-3 ingredients in nutrition and food applications.

- In April 2023, Green Water Labs introduced an innovative algae control product specifically formulated to eliminate and prevent algae growth in various applications. While Green Water Labs is a global player, their bio-based solution is designed for safe use around people, pets, and within environmentally sensitive markets, potentially including the expanding Australian algae-based chemicals sector.

Report Coverage

The research report offers an in-depth analysis based on Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Algae Based Specialty Chemicals Market will expand with increasing adoption across pharmaceuticals, nutraceuticals, and cosmetics.

- Demand for bio-based raw materials will strengthen due to policy support and sustainability commitments.

- Research advancements in photobioreactors and extraction methods will improve production efficiency and scalability.

- Algae-derived bioplastics will gain traction in packaging industries seeking biodegradable solutions.

- Nutritional applications will grow with higher demand for omega-3s, proteins, and functional extracts.

- Strategic collaborations between universities, research centers, and private firms will accelerate innovation pipelines.

- Regional players will scale operations to capture domestic demand and strengthen export competitiveness.

- Industrial applications in agriculture and aquaculture will expand through biofertilizers and stimulants.

- Consumer-driven demand for clean-label and eco-friendly products will elevate market visibility.

- Investments in large-scale algae cultivation farms will create a resilient foundation for long-term growth.