Market Overview:

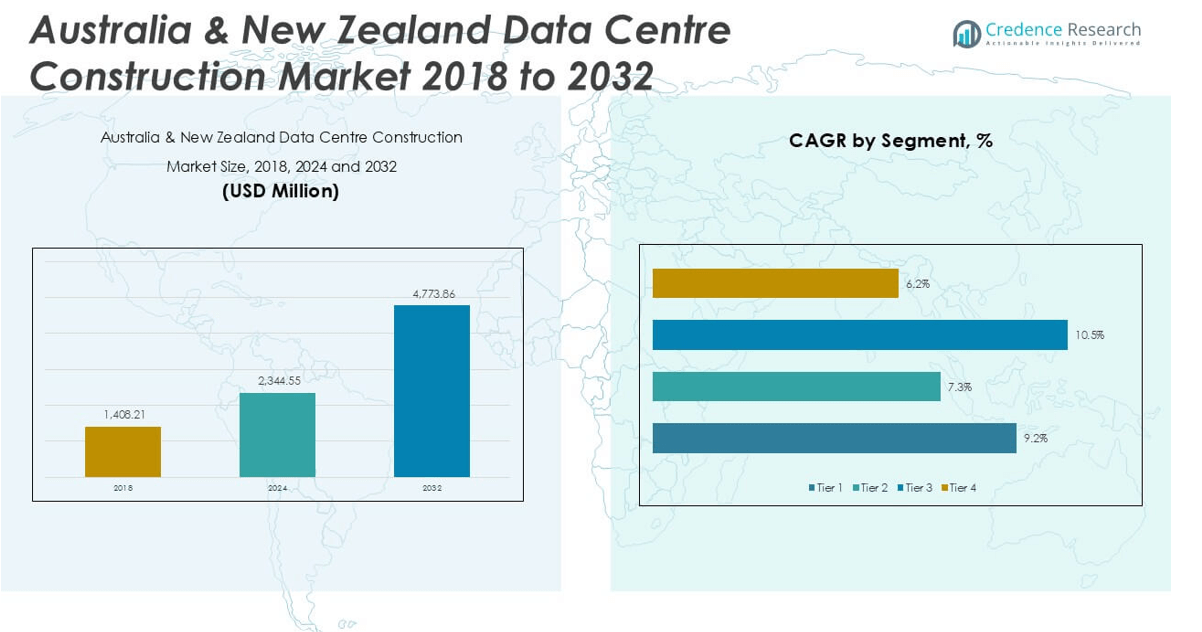

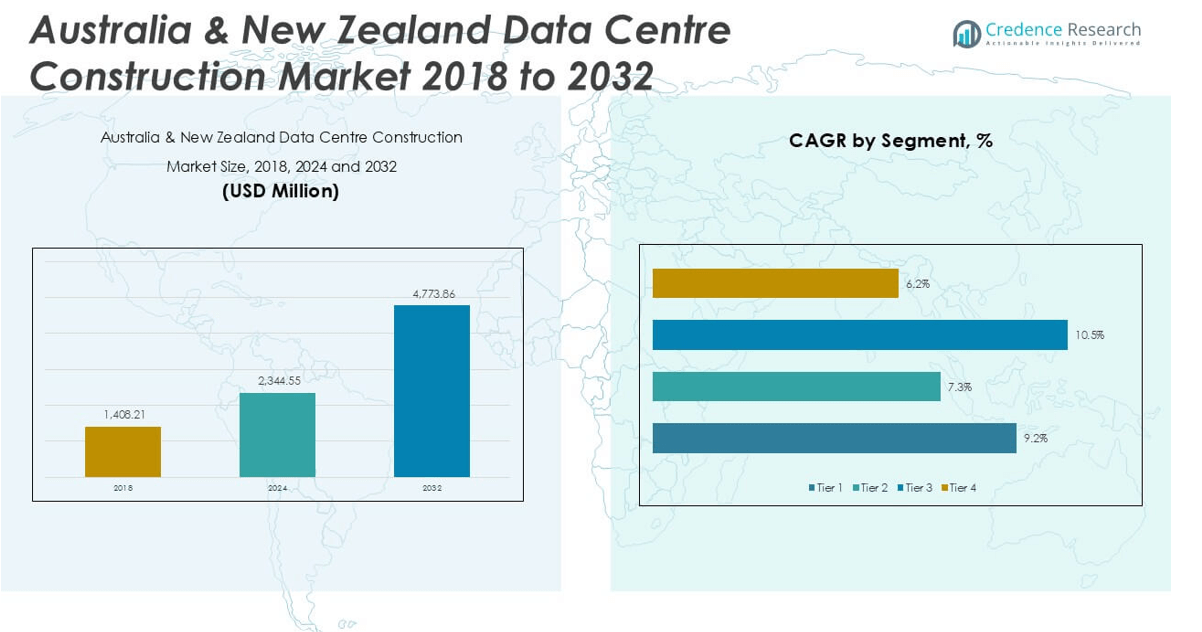

The Australia & New Zealand Data Centre Construction market size was valued at USD 1,408.21 million in 2018, increased to USD 2,344.55 million in 2024, and is anticipated to reach USD 4,773.86 million by 2032, at a CAGR of 8.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia & New Zealand Data Centre Construction Market Size 2024 |

USD 2,344.55 million |

| Australia & New Zealand Data Centre Construction Market, CAGR |

8.66% |

| Australia & New Zealand Data Centre Construction Market Size 2032 |

USD 4,773.86 million |

The Australia & New Zealand Data Centre Construction market is led by prominent players such as Stowe Australia, Kapitol Group, FDC Construction & Fitout, AECOM, Aurecon, Turner & Townsend, and Rider Levett Bucknall. These companies play a key role in delivering advanced, sustainable, and large-scale data centre facilities across the region. They offer integrated solutions spanning design, engineering, project management, and construction. Australia dominates the regional landscape, accounting for 78% of the total market share in 2024, driven by strong demand in cities like Sydney and Melbourne. New Zealand follows with a 22% share, supported by renewable energy initiatives and growing enterprise digitalization.

Market Insights

- The Australia & New Zealand Data Centre Construction market was valued at USD 2,344.55 million in 2024 and is projected to reach USD 4,773.86 million by 2032, growing at a CAGR of 8.66% during the forecast period.

- Market growth is driven by increasing demand for cloud services, digital transformation across industries, and rising investments in hyperscale and edge data centres.

- A key trend includes the shift towards modular and energy-efficient infrastructure, with Tier 3 facilities holding the largest segment share at over 45% due to their operational efficiency and cost-effectiveness.

- Leading players such as Stowe Australia, AECOM, and Turner & Townsend dominate the competitive landscape, while smaller firms face challenges related to high capital requirements and limited skilled labor.

- Australia accounted for 78% of the regional market share in 2024, supported by major projects in Sydney and Melbourne, while New Zealand contributed 22%, driven by sustainability and stable infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

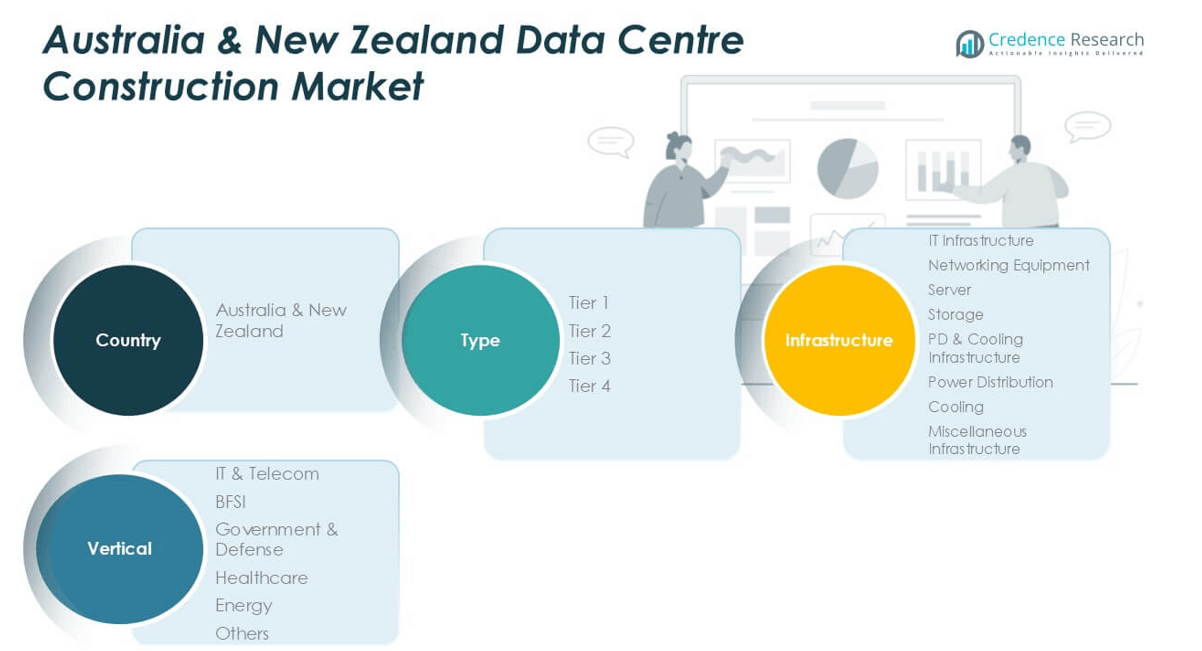

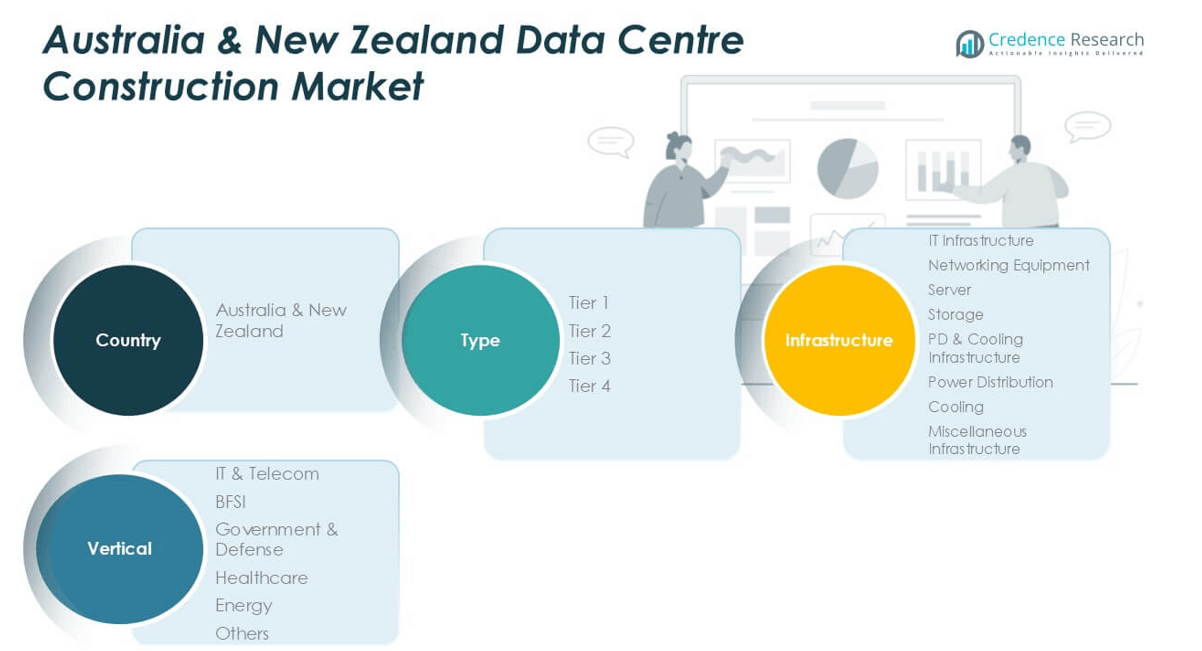

By Type

In the Australia & New Zealand Data Centre Construction market, Tier 3 data centres held the dominant share in 2024, accounting for over 45% of the market. Their high popularity stems from the balance they offer between performance, redundancy, and cost-efficiency, making them suitable for large enterprises and hyperscale cloud providers. Increasing demand for uninterrupted services, especially from sectors such as banking and telecommunications, has driven this growth. Tier 3 facilities ensure high availability and maintainability, which is crucial for organizations aiming to minimize downtime without incurring the extensive costs of Tier 4 infrastructures.

- For instance, Stowe Australia delivered the Sydney Processing Centre to Tier 3 standards, specifying infrastructure that ensures approximately 99.982% availability, equating to under 1.6 hours of downtime annually through redundant systems and multiple power and cooling paths.

By Infrastructure

Among infrastructure segments, IT Infrastructure emerged as the leading contributor, holding nearly 35% of the market share in 2024. This dominance is fueled by the rising deployment of advanced computing systems and cloud platforms that require robust server, networking, and storage capabilities. The growing need for high-performance computing and scalable storage solutions, especially by data-intensive industries, supports the expansion of this segment. Within IT Infrastructure, Server components led the sub-category due to increasing virtual workloads and demand for edge computing capabilities in urban and regional hubs.

- For instance, FDC Construction & Fitout’s remediation of an 11,000 m² facility in Sydney doubled critical power and cooling capacity to support 3,000 kW of IT load while upgrading to Tier 3 resilience and adding four new high‑density computer rooms.

By Vertical

Within verticals, the IT and Telecom segment held the largest market share of over 40% in 2024. The increasing adoption of 5G technology, IoT, and AI applications has created a surge in data consumption and processing needs, leading to rapid investments in regional data centre infrastructure. Telecom providers are expanding their network capabilities and edge facilities, while tech companies are deploying hyperscale and colocation centres to support digital service delivery. This vertical continues to lead due to its foundational role in supporting digital transformation across other sectors such as BFSI, healthcare, and retail.

Market Overview

Rising Cloud Adoption and Digital Transformation

The rapid acceleration of cloud computing and digital transformation initiatives across enterprises is a major growth driver in the Australia & New Zealand data centre construction market. Businesses across sectors such as finance, retail, and healthcare are migrating to cloud platforms to improve scalability and operational efficiency. This shift necessitates robust, secure, and high-capacity data centre infrastructure. In addition, government-backed digital transformation strategies and investments in smart city initiatives are further boosting demand for new data centre facilities across both countries.

- For instance, by 2024 Australian organisations are projected to spend nearly AUD 26.6 billion on public cloud services, with enterprise cloud adoption estimated at 94% among organisations with more than 1,000 employees.

Surge in Data Consumption and IoT Integration

Growing data consumption driven by streaming services, smart devices, and the proliferation of IoT has significantly increased the need for advanced data centres. Enterprises are integrating IoT and AI technologies into their operations, which demand low-latency, high-speed processing, and secure storage. As real-time data processing becomes critical, the demand for edge and hyperscale data centres in Australia and New Zealand continues to rise, propelling construction projects and upgrades to meet performance and storage requirements.

- For instance, NextDC now operates 13 data centres across Australia and New Zealand including Edge facility SC1 in Maroochydore—supporting thousands of smart-device endpoints and enabling sub‑millisecond latency for latency‑sensitive applications such as AI inferencing and virtual desktop infrastructure. In Australia, M2M/IoT connections are projected to reach 11.1 million by end‑2024, underscoring a swelling need for robust data infrastructure

Government Policies and Green Infrastructure Incentives

Favorable government regulations, combined with sustainability targets, are fueling investments in energy-efficient and green-certified data centres. Both Australia and New Zealand are promoting renewable energy use and carbon neutrality, encouraging operators to construct environmentally sustainable facilities. Incentives and regulatory frameworks supporting green construction, such as tax benefits and fast-tracked approvals, are motivating data centre developers to invest in innovative infrastructure aligned with environmental standards, creating long-term growth opportunities in the market.

Key Trends & Opportunities

Growth of Edge Data Centres in Regional Areas

A key trend shaping the market is the expansion of edge data centres beyond major metropolitan zones. As latency-sensitive applications such as autonomous vehicles, telemedicine, and real-time analytics gain traction, service providers are investing in regional edge facilities to ensure fast data access. This trend presents significant opportunities for localized data centre construction, allowing operators to cater to underserved regions while enhancing connectivity and reducing data transmission delays.

- For instance, Kapitol Group completed NextDC’s D1 Darwin facility, capable of hosting roughly 1,000 racks and supporting up to 7 MW of IT load in Australia’s Northern Territory.

Increased Demand for Modular and Scalable Designs

The industry is witnessing a shift towards modular, prefabricated, and scalable data centre designs to meet growing and dynamic workload requirements. These designs enable faster deployment, reduced construction time, and cost efficiency while allowing future capacity expansion. As businesses prioritize agility, flexibility, and reduced downtime, demand for modular infrastructure is expected to create new avenues for contractors and equipment providers focused on data centre projects across Australia and New Zealand.

- For instance, Reset Data, backed by Centuria, deploys liquid immersion cooling pods at about 2.4 m² footprint capable of delivering 140 kW, enabling up to 1.5 MW in just 100 m² of white space drastically boosting density and reducing energy waste.

Key Challenges

High Capital Investment and Long ROI Cycles

Constructing modern data centres requires significant capital investment, which often acts as a barrier, especially for new entrants and smaller players. The return on investment (ROI) timeline can be long due to high construction costs, operational expenses, and the need for advanced technology integration. This financial burden makes the market more favorable to established players and limits the entry of new operators, slowing the pace of infrastructure expansion in certain regions.

Power Supply Constraints and Energy Efficiency Issues

Ensuring a stable, cost-effective, and sustainable power supply remains a major challenge in data centre construction. As energy demands increase, especially for hyperscale centres, accessing reliable grid capacity while maintaining efficiency becomes complex. Additionally, data centres face increasing pressure to align with energy-efficiency standards and reduce carbon footprints, which adds to design and operational costs. Balancing performance with sustainability remains a persistent obstacle for developers in both countries.

Skilled Workforce Shortage in Construction and IT Integration

The market is experiencing a shortage of skilled professionals across both construction and IT infrastructure integration. The growing complexity of data centre projects, including advanced cooling systems, high-density server deployment, and green technologies, requires specialized expertise. The talent gap delays project timelines and increases dependency on international contractors or outsourced labor, adding cost and complexity. Addressing this skills deficit is essential for sustaining future market growth.

Regional Analysis

Australia

Australia dominated the Australia & New Zealand Data Centre Construction market in 2024, accounting for approximately 78% of the total market share. This leadership is driven by strong investments in hyperscale facilities, rising cloud adoption, and a surge in demand from the IT and telecom sector. Major cities such as Sydney and Melbourne continue to act as data centre hubs due to favorable infrastructure, reliable energy supply, and proximity to enterprise clients. Additionally, government-led digital initiatives and commitments to renewable energy integration have further encouraged the construction of sustainable and efficient data centres across the region.

New Zealand

New Zealand accounted for around 22% of the market share in 2024, with steady growth supported by increasing demand for cloud services, digital transformation in government and banking sectors, and rising enterprise data needs. The country is witnessing growing interest from global data centre operators, particularly in cities like Auckland and Wellington, due to stable political conditions, a cool climate ideal for energy-efficient operations, and a renewable energy-driven power grid. Despite its smaller size compared to Australia, New Zealand is emerging as a strategic destination for regional data centre expansion and resilient infrastructure development.

Market Segmentations:

By Type:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Infrastructure:

- IT Infrastructure

- Networking Equipment

- Server

- Storage

- PD & Cooling Infrastructure

- Power Distribution

- Cooling

- Miscellaneous Infrastructure

By Vertical:

- IT and Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- Healthcare

- Energy

- Others

By Geography:

Competitive Landscape

The competitive landscape of the Australia & New Zealand Data Centre Construction market is characterized by the presence of both regional construction specialists and global engineering consultancies. Leading players such as Stowe Australia, Kapitol Group, FDC Construction & Fitout, AECOM, Aurecon, Turner & Townsend, and Rider Levett Bucknall are actively involved in delivering large-scale, energy-efficient, and technologically advanced data centre projects. These firms compete on factors such as design innovation, cost efficiency, sustainability credentials, and project delivery timelines. Strategic partnerships with cloud providers, utility companies, and real estate developers are also shaping competitive dynamics. Companies are investing in modular construction capabilities, integrated service offerings, and green building certifications to meet rising client expectations and regulatory requirements. Additionally, the entry of global hyperscale operators has raised the bar for quality and operational standards, compelling domestic players to enhance technical capabilities and scale. The market is expected to see increased consolidation and specialization as demand intensifies across key metros and regional locations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stowe Australia

- Kapitol Group

- FDC Construction & Fitout

- AECOM

- Aurecon

- Turner & Townsend

- Rider Levett Bucknall

Recent Developments

- In June 2024, DPR Construction sees data center and manufacturing markets on the rise, while owners in healthcare, life sciences, commercial, and higher education are adapting to tighter economic conditions.

- In June 2024, Cisco revealed the Nexus HyperFabric AI clusters, a new simplified data centre infrastructure solution with NVIDIA for generative AI. This solution aims to simplify the deployment of AI applications.

- In September 2023, Schneider Electric partnered with GreenSquareDC to build a green data centre in Western Australia, with construction set to commence in early 2024.

- In August 2022, DCI Data Centers, a fully-owned portfolio company of Brookfield, commenced construction on Auckland’s largest data centre, AKL02. This project is set to inject another $400 million into the local economy.

Market Concentration & Characteristics

The Australia & New Zealand Data Centre Construction Market exhibits a moderately concentrated structure, with a mix of large multinational engineering firms and regional construction specialists leading the competitive space. It features a blend of high capital intensity, advanced technological integration, and strong regulatory compliance. Major players such as Stowe Australia, AECOM, Aurecon, and Turner & Townsend dominate large-scale and hyperscale projects due to their technical expertise and proven delivery capabilities. The market favors firms with a strong focus on sustainability, modular design, and energy-efficient solutions. It is characterized by long project cycles, significant upfront investment, and a growing preference for prefabricated data centre components. Clients in IT, telecom, and BFSI sectors demand high availability and low-latency infrastructure, pushing construction providers to adopt precision-driven design and execution. Demand is concentrated in urban hubs like Sydney, Melbourne, and Auckland, while regional expansion is gaining traction through edge data centre developments. Strategic partnerships and vertical integration remain critical competitive advantages.

Report Coverage

The research report offers an in-depth analysis based on Type, Infrastructure, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising cloud computing and digital transformation initiatives.

- Increased adoption of AI, IoT, and big data analytics will boost demand for high-capacity data centres.

- Energy-efficient and green-certified data centre construction will become a major industry focus.

- Modular and prefabricated construction methods will gain popularity for faster deployment.

- Tier 3 data centres will continue to dominate due to their balance of performance and cost.

- Investments in edge data centres will rise to support low-latency applications across regional areas.

- The IT and telecom sector will remain the leading vertical, followed by BFSI and government.

- Australia will maintain its market leadership with ongoing expansion in key cities like Sydney and Melbourne.

- New Zealand will attract new players seeking renewable energy integration and stable infrastructure.

- Competition will intensify as global and local players invest in scalable and sustainable infrastructure.