Market Overview:

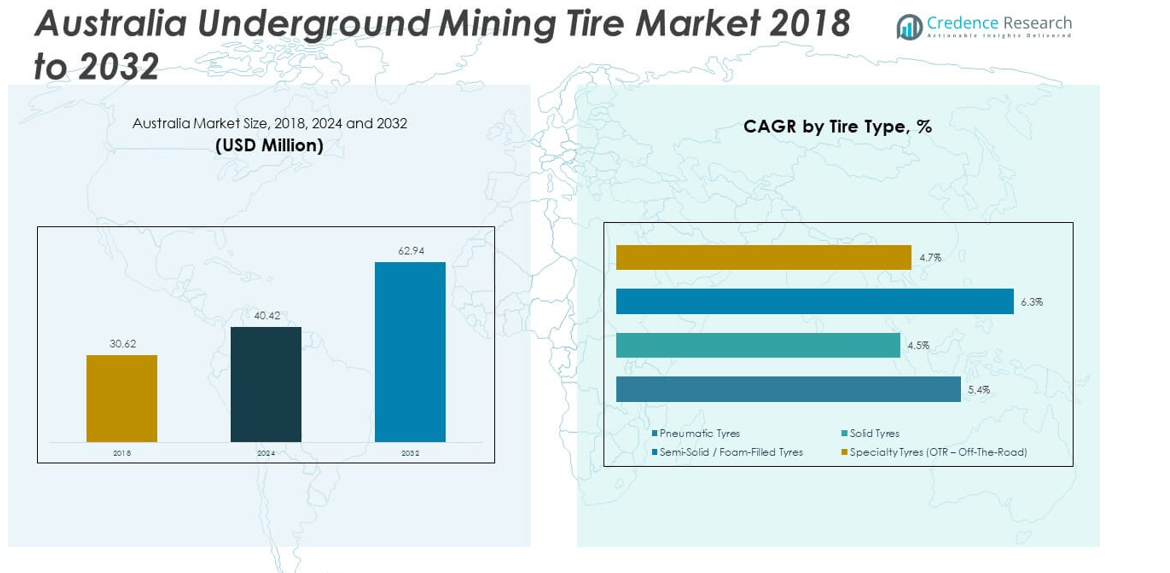

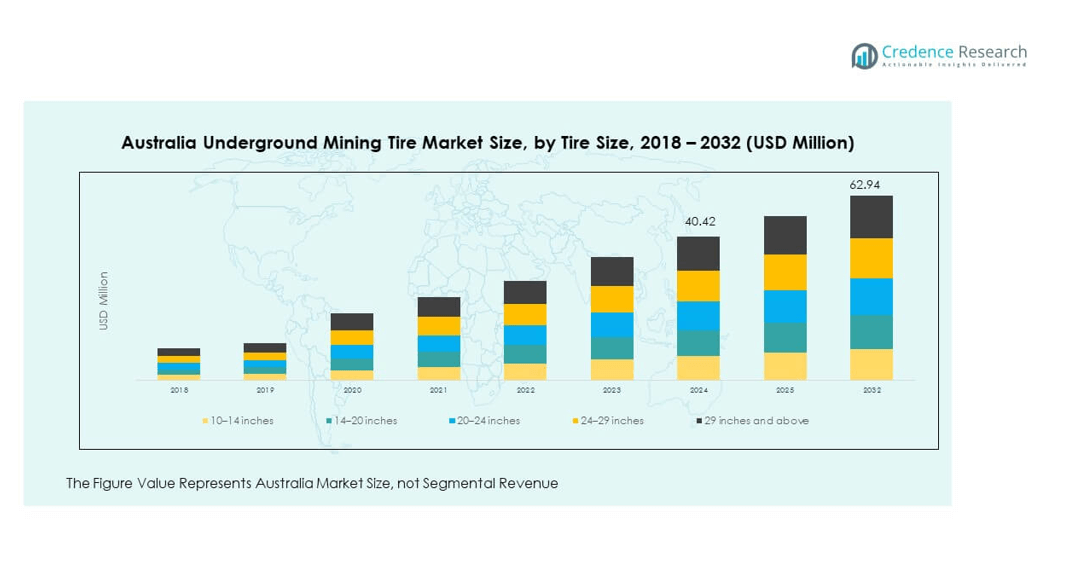

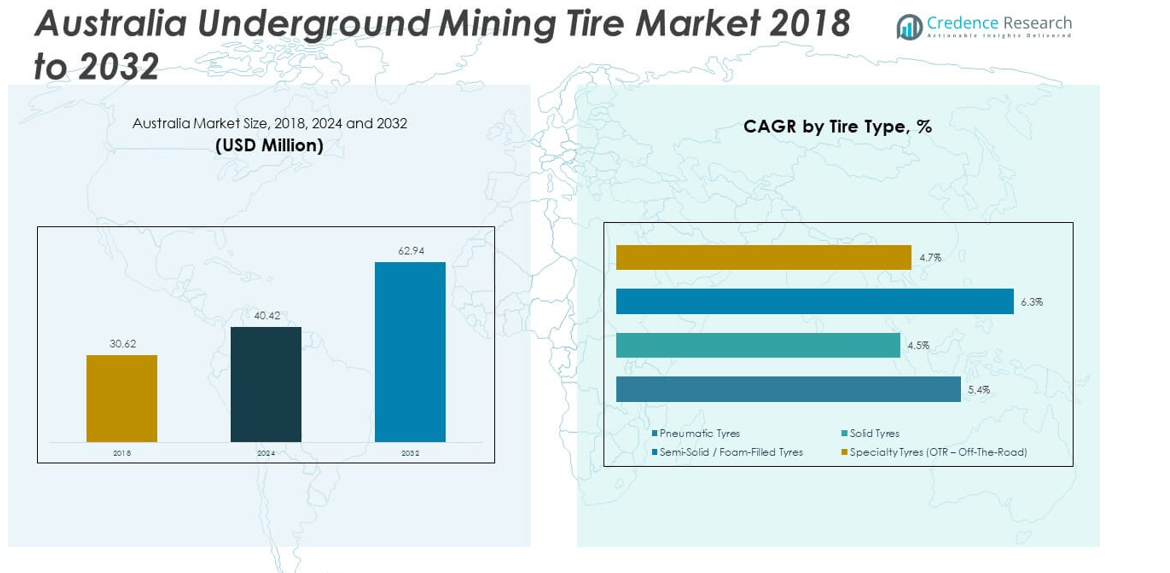

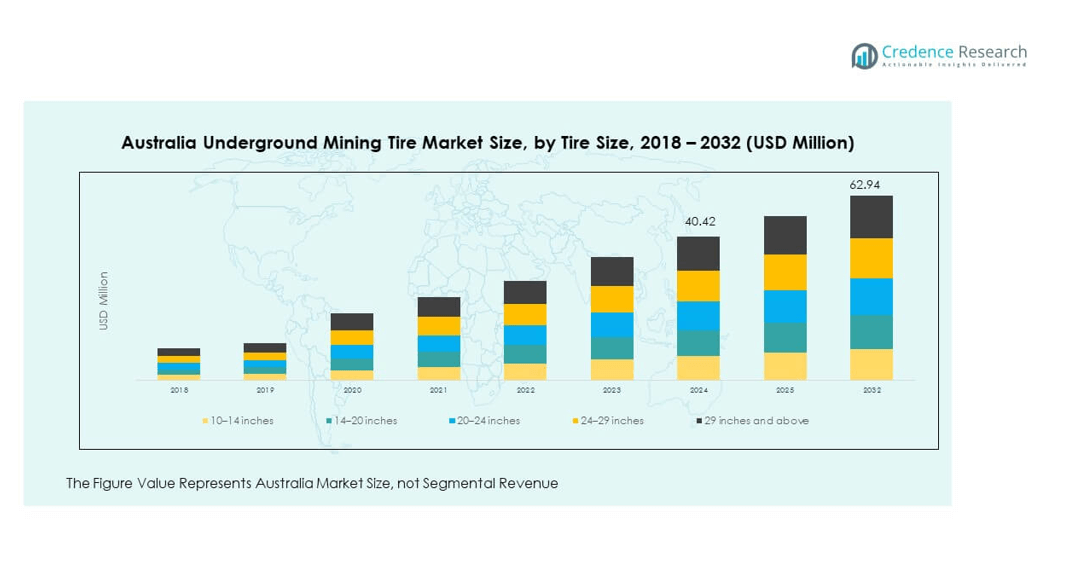

The Australia Underground Mining Tire Market size was valued at USD 30.62 million in 2018 to USD 40.42 million in 2024 and is anticipated to reach USD 62.94 million by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Underground Mining Tire Market Size 2024 |

USD 40.42 million |

| Australia Underground Mining Tire Market, CAGR |

5.69% |

| Australia Underground Mining Tire Market Size 2032 |

USD 62.94 million |

Growing mining activities in Australia, particularly in iron ore, coal, and gold extraction, drive demand for specialized underground mining tires. Increasing investment in advanced machinery, along with stricter safety regulations, compels mining companies to adopt durable, puncture-resistant, and heat-tolerant tires designed for deep mining operations. Rising demand for productivity enhancement and reduction of downtime further supports tire adoption. Moreover, the shift toward automation and the use of heavy-duty underground vehicles amplify the requirement for high-performance tires across mines in the country.

From a regional perspective, Western Australia remains the hub for underground mining tire demand, supported by large-scale iron ore and gold projects. Queensland contributes significantly due to its strong coal mining sector, while New South Wales continues to expand underground coal operations. Emerging growth is observed in Northern Territory and South Australia, where exploration activities are increasing. These regional dynamics make Australia a strategic market with both established demand centers and upcoming opportunities for underground mining tire manufacturers.

Market Insights:

- The Australia Underground Mining Tire Market was valued at USD 30.62 million in 2018, reached USD 40.42 million in 2024, and is projected to attain USD 62.94 million by 2032, registering a CAGR of 5.69% during the forecast period.

- Strong demand arises from expanding underground mining operations in iron ore, coal, and gold, which require durable, puncture-resistant, and heat-tolerant tires.

- Rising investment in advanced mining equipment drives the adoption of high-performance tires designed to handle heavier loads and improve efficiency.

- Market restraints include high procurement costs of premium tires and intense price competition between suppliers and mining companies.

- Supply chain challenges, heavy reliance on imports, and limited local production capacity create risks of delays and higher operating costs for operators.

- Western Australia leads the market due to large-scale gold and iron ore projects, while Queensland and New South Wales generate significant demand from coal mining.

- Emerging opportunities are visible in South Australia and Northern Territory, where new exploration and underground projects are increasing tire adoption potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Advanced Tires Due to Growing Underground Mining Activities:

The Australia Underground Mining Tire Market experiences strong demand due to expansion of underground mining operations for iron ore, gold, and coal. Large mining projects require reliable, heat-tolerant, and puncture-resistant tires that support productivity under harsh conditions. The demand for tires that can handle deeper shafts and longer haul cycles continues to grow across multiple states. It has encouraged suppliers to introduce more durable compounds and reinforced designs that extend tire life. Mining companies seek efficiency, which boosts adoption of specialized tires that minimize downtime. Stricter safety standards across mining sites also push operators to choose quality tires that lower operational risks. Increasing mechanization of underground mines raises the dependence on equipment fitted with high-performance tires. This shift positions the sector for consistent demand during the forecast period.

- For instance, Michelin launched the X Mine D2 tire designed for underground mining, which delivers up to 20,000 operational hours under extreme conditions, supporting longer haul cycles in deep shaft mines.

Investments in Heavy Equipment That Require High-Performance Tires:

Mining operators invest in heavy-duty vehicles such as load-haul-dump machines, shuttle cars, and drilling trucks that require strong tire performance. The Australia Underground Mining Tire Market benefits from this shift toward fleet modernization, as old equipment is being replaced with more powerful machines. Tires must handle heavier loads, higher torque, and longer operating cycles without failure. It creates pressure on manufacturers to innovate tread designs, compounds, and casing strength. Mining companies in regions such as Western Australia and Queensland seek to reduce maintenance frequency by using reliable tire solutions. It allows operators to extend equipment usage without costly replacements. Strong equipment investment pipelines in gold and coal mines secure long-term tire demand. Expansion of contract mining services further supports consistent fleet upgrades that favor new tire purchases.

- For instance, Michelin Mine X Tweel technology is being piloted in shuttle cars that demand tires able to withstand continuous use under heavy loads with zero puncture risks, demonstrating over 5,000 hours of use without replacement in trials conducted at BHP’s underground coal operations in Queensland.

Shift Toward Productivity Enhancement Through Tire Technology Innovation:

Mining firms emphasize productivity improvement, and tire technology plays a vital role in achieving this goal. The Australia Underground Mining Tire Market experiences demand for radial tires that improve traction, stability, and fuel efficiency. It also benefits from demand for tire monitoring systems that provide real-time insights on performance, pressure, and wear levels. Improved tire designs with better cut resistance and reduced heat build-up directly support productivity goals. Operators gain cost advantages by reducing downtime associated with tire failure in challenging environments. Digital integration into tire management provides visibility that supports decision-making on maintenance scheduling. Companies increasingly focus on total cost of ownership, making premium tires an attractive investment. Enhanced performance characteristics strengthen the case for adoption across multiple underground projects. Growing demand for reliability ensures sustained growth for the sector.

Government Regulations and Sustainability Goals Driving Safer Operations:

Stricter government regulations regarding safety, emissions, and mine operations contribute to growing adoption of reliable tires. The Australia Underground Mining Tire Market responds to compliance needs by offering products that reduce environmental impact and ensure operator safety. It benefits from greater focus on tire recyclability and reduced waste management issues. Mining operators comply with standards by sourcing premium tires that meet durability and safety benchmarks. Regulators encourage mines to adopt modern tires with improved safety margins, reducing accident risk. It has led to increased partnerships between mining companies and tire suppliers focused on compliance-driven solutions. Rising awareness of sustainability across Australia compels operators to adopt greener technologies in tire manufacturing. This trend highlights regulatory influence in shaping tire adoption and market growth.

Market Trends:

Increasing Adoption of Automation and Tire Monitoring in Underground Mines:

Automation has transformed underground mining, with vehicles and equipment operating in hazardous zones with limited human intervention. The Australia Underground Mining Tire Market aligns with this shift through integration of digital tire monitoring systems. It enables operators to track performance and make data-driven maintenance decisions. Tires embedded with sensors provide information on temperature, pressure, and tread wear. It helps reduce sudden failures that disrupt automated fleet operations. Companies view monitoring as essential for extending tire life and improving safety. Automation growth encourages demand for specialized tires designed to handle consistent stress under remote control. Tire manufacturers increasingly integrate digital features to align with automation-focused mining strategies.

- For instance, Camso Sensor Ready tire system integrates pressure and temperature sensors capable of transmitting real-time data every 15 minutes to mine control centers. This technology is deployed in automated fleet in Australia’s underground coal mines, leading to a reported reduction in sudden tire failures by 30% within the first year of deployment.

Growth of Radial Tire Adoption Over Bias Tire Usage:

Mining operators show a clear shift from traditional bias tires toward radial tires with improved durability and performance. The Australia Underground Mining Tire Market sees strong interest in radial designs due to better traction, heat resistance, and stability. It supports fuel efficiency and reduces overall operating costs for mines with heavy-duty fleets. Operators adopt radial tires for long-life cycles, especially in deep underground sites where replacement logistics are complex. It encourages manufacturers to increase availability of radial options across different load categories. The market benefits from improved awareness among operators about life cycle savings with radial adoption. Tire producers continue to phase out older bias designs while focusing on premium radial products. This transition marks a major trend driving growth momentum.

Increasing Customization in Tire Design for Specialized Mining Needs:

Mining companies demand customized tire designs tailored to specific underground conditions. The Australia Underground Mining Tire Market responds with tailored solutions such as cut-resistant compounds and reinforced sidewalls. It addresses unique challenges of coal seams, gold mines, and hard rock operations. Tire manufacturers focus on providing site-specific solutions that reduce replacement frequency. It has created a trend where product differentiation drives competitive advantage. Mining operators seek tires designed for their fleet type, environment, and usage intensity. Customization increases reliance on partnerships between suppliers and mining firms. This focus on tailored tire solutions drives sustained innovation in the industry.

Rising Demand for Sustainable Tire Solutions Across Mining Operations:

Sustainability remains a growing concern, and mining companies seek tires with reduced environmental impact. The Australia Underground Mining Tire Market shifts toward products that feature recyclable materials and lower emissions during production. It benefits from corporate responsibility commitments by large mining firms that prioritize green sourcing. Demand for eco-friendly tire disposal methods and retreading solutions is gaining traction. It allows operators to cut waste while managing operational costs effectively. Tire manufacturers invest in sustainable materials without compromising durability. The market trends toward balancing high performance with environmental responsibility. This direction strengthens the long-term positioning of eco-conscious suppliers.

Market Challenges Analysis:

High Operating Costs and Price Pressure Affecting Tire Procurement:

The Australia Underground Mining Tire Market faces significant challenges due to high operating costs across mining operations. It becomes difficult for operators to manage rising costs of premium tires while balancing fleet productivity. Intense price pressure exists between tire manufacturers and mining companies negotiating supply contracts. Mining firms often push for lower pricing, which limits profitability for suppliers. Long replacement cycles reduce repeat sales opportunities and impact revenue stability. Procurement departments in mines focus on cost-cutting measures that restrict adoption of advanced but expensive tires. It forces tire manufacturers to compete aggressively on pricing strategies. The cost barrier continues to challenge expansion in value-driven segments of the industry.

Supply Chain Disruptions and Limited Local Manufacturing Capacity:

The Australia Underground Mining Tire Market also struggles with supply chain disruptions and limited local production facilities. It relies heavily on imported tires, making it vulnerable to shipping delays, tariffs, and currency fluctuations. Disruptions in raw material availability increase uncertainty for tire manufacturers. Limited domestic manufacturing capacity restricts flexibility in meeting sudden spikes in demand. Mines located in remote areas face logistical hurdles in receiving timely tire replacements. Long lead times create risk of downtime when supply is delayed. It pressures mining operators to stockpile tires, increasing their operational costs. Supply chain vulnerabilities pose one of the biggest obstacles to consistent market growth.

Market Opportunities:

Expansion of Mining Projects Across Emerging Australian Regions:

The Australia Underground Mining Tire Market holds significant opportunities due to expanding mining activities across emerging regions such as Northern Territory and South Australia. It benefits from increased exploration in gold, copper, and rare earth deposits. Tire suppliers can secure long-term contracts with operators planning large-scale underground projects. Mining firms in emerging regions demand modern tires to support new fleet investments. It creates opportunities for manufacturers to introduce specialized products designed for regional geology. Tire companies that establish strong distribution networks in these zones gain competitive advantage. Growth in exploration licenses indicates long-term demand potential.

Rising Interest in Advanced Retreading and Recycling Solutions:

The Australia Underground Mining Tire Market also sees opportunity in retreading and recycling solutions that extend tire life. It allows operators to manage costs while meeting sustainability goals. Tire suppliers investing in retreading facilities can offer value-added services alongside new product sales. Recycling initiatives reduce environmental impact, aligning with corporate responsibility mandates in mining companies. It helps build supplier reputation in a highly competitive market. The sector favors companies that combine innovation with sustainable tire lifecycle management. This opportunity highlights the growing need for greener, cost-effective solutions in the mining ecosystem.

Market Segmentation Analysis:

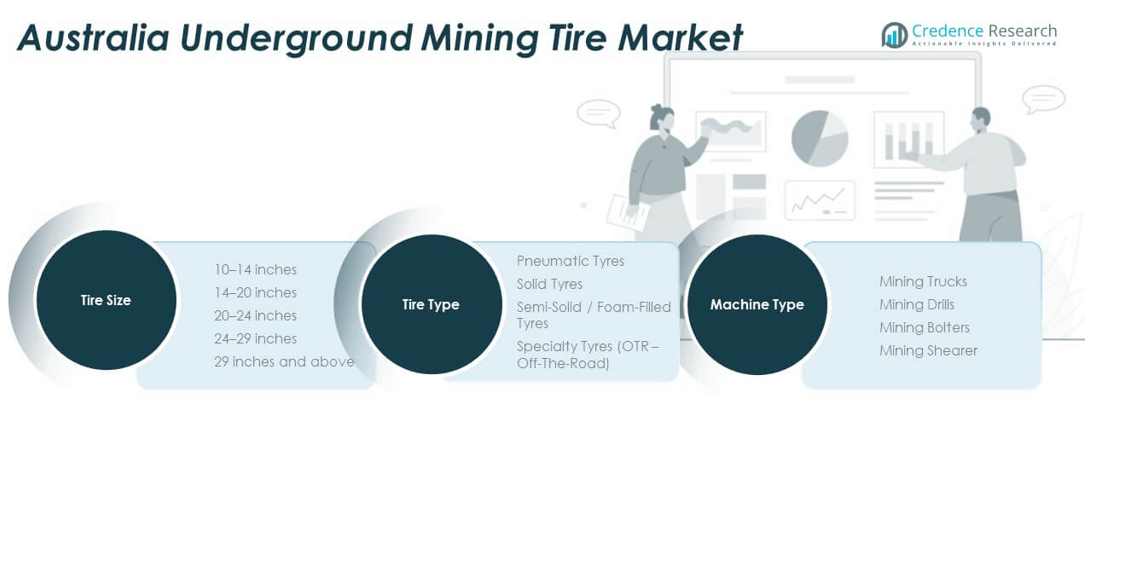

By Tire Size

The Australia Underground Mining Tire Market shows varying demand across tire sizes. The 10–14 inches and 14–20 inches segments cater to light-duty underground vehicles, while 20–24 inches and 24–29 inches dominate medium- to heavy-duty fleets. The 29 inches and above segment supports large mining trucks and loaders, offering durability in deeper and harsher mines. Growing preference for larger sizes reflects rising mechanization and high-capacity fleet upgrades.

- For instance, Titan Tire supplies 29-inch and above radial tires to Australian mining fleets, with operational data from underground coal mines showing average service life operational hours under rigorous mining cycles.

By Machine Type

Mining trucks account for the largest share, driven by their critical role in ore and waste transport. Mining drills and bolters follow, requiring resilient tires that can withstand heavy torque and frequent operations. Mining shearers hold a smaller share but demand specialized tire performance to support continuous underground cutting. It highlights how different machine categories shape tire consumption patterns in the industry.

- For instance, Mining trucks equipped with Michelin X Mine D2 tires cover over 200,000 kilometers annually in underground settings, emphasizing their critical contribution to ore and waste haulage under challenging environmental conditions.

By Tire Type

Pneumatic tyres dominate with strong adoption due to traction efficiency and cost effectiveness across underground fleets. Solid tyres gain appeal where puncture resistance and low maintenance are priorities in challenging environments. Semi-solid or foam-filled tyres strike a balance between flexibility and strength, making them suitable for mixed-use mines. Specialty OTR tires serve niche demands where conditions require highly customized solutions. This segmentation reflects the adaptability and performance-focused evolution of tire demand.

Segmentation:

By Tire Size

- 10–14 inches

- 14–20 inches

- 20–24 inches

- 24–29 inches

- 29 inches and above

By Machine Type

- Mining Trucks

- Mining Drills

- Mining Bolters

- Mining Shearer

By Tire Type

- Pneumatic Tyres

- Solid Tyres

- Semi-Solid / Foam-Filled Tyres

- Specialty Tyres (OTR – Off-The-Road)

Regional Analysis:

Western Australia – Dominant Regional Hub

Western Australia leads the Australia Underground Mining Tire Market, holding around 45% share. The dominance comes from large-scale iron ore and gold mining operations that require heavy-duty underground vehicles and premium tire solutions. It benefits from high fleet modernization and consistent investment in expanding underground projects. Strong global demand for iron ore strengthens long-term mining activities in this region, directly supporting tire sales. Mining companies in Western Australia also adopt advanced tire monitoring technologies to reduce downtime. The region continues to serve as the largest and most stable contributor to market revenues.

Queensland and New South Wales – Coal Mining Powerhouses

Queensland secures the second position with 25% share, driven by its extensive coal mining industry and ongoing underground expansion projects. The state relies heavily on durable tires for mining trucks and drilling equipment used in high-production mines. New South Wales follows with 15% share, supported by coal-dominant underground operations. It benefits from rising safety regulations and equipment upgrades across key mining zones. Both states remain critical demand centers for medium-to-large tire segments, making them important secondary markets.

South Australia and Northern Territory – Emerging Growth Regions

South Australia accounts for 10% share, supported by copper and gold exploration projects that increasingly require underground fleet expansion. It benefits from new investments in rare earth mining that stimulate demand for specialized tire solutions. Northern Territory holds 5% share, reflecting its smaller but growing role in underground gold and base metal mining. It is gradually attracting investment, creating opportunities for tire suppliers seeking new markets. Together, these emerging regions provide untapped potential and are expected to grow faster than the national average.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Underground Mining Tire Market is moderately consolidated, with global giants such as Bridgestone, Goodyear, and Continental competing alongside regional specialists like Kal Tire, Bearcat, and Big Tyre. It relies on a balance of multinational expertise and local distribution networks to serve remote mines effectively. Large players leverage technology in radial tire design, retreading, and digital monitoring solutions to secure contracts with major mining firms. Regional companies focus on customized offerings, quick service, and cost-efficient solutions to build competitive advantage. The market demonstrates strong rivalry as suppliers compete on durability, performance, and after-sales service. Innovation in sustainable materials and recycling programs is becoming a differentiator for established brands. Competitive positioning depends not only on product quality but also on the ability to deliver consistent supply in remote mining zones across Australia.

Recent Developments:

- In 2025, Bridgestone Australia Limited announced the introduction of new Enliten technology tires featuring over 65% recycled and renewable materials. These tires are being supplied for the 2025 Bridgestone World Solar Challenge, supporting 33 teams across Australia in a sustainability-focused initiative. This marks a significant step in Bridgestone’s commitment to innovation and sustainable tire technology within Australia.

- In early 2025, Goodyear Australia completed the sale of its Off-the-Road (OTR) tire business, including its Australian operations, to Yokohama Rubber. This acquisition enhances Yokohama’s product lineup in mining and construction machinery tires while allowing Goodyear to focus its portfolio on core industry-leading products and services.

- Bearcat Australia introduced a new model, the BearCat ETS, in 2025 featuring Australia’s first extendable tactical ramp. This advancement enhances operational capabilities for tactical teams by enabling safe access to elevated structures. The deployment includes five new BearCats across New South Wales, supporting critical responses in high-risk situations.

Market Concentration & Characteristics:

The Australia Underground Mining Tire Market shows a medium-to-high concentration, with a few multinational brands controlling significant market share. It is characterized by steady demand from large mining operators that favor established suppliers for reliability and service coverage. High entry barriers exist due to the capital-intensive nature of tire production and stringent quality requirements for underground applications. Local players capture niche opportunities through service-based models and customized solutions. It reflects a market where brand reputation, innovation, and distribution reach strongly influence competitive advantage.

Report Coverage:

The research report offers an in-depth analysis based on tire size, machine type, and tire type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing underground mining projects will drive steady demand for premium tires.

- Adoption of radial tires will accelerate due to their superior performance.

- Tire monitoring systems will gain wider use to improve fleet safety and efficiency.

- Demand for sustainable and recyclable tire solutions will expand.

- Local retreading and recycling facilities will attract more investment.

- Western Australia will retain dominance, while South Australia and Northern Territory will emerge faster.

- Global manufacturers will intensify partnerships with regional distributors.

- Customization of tire compounds for site-specific conditions will become a norm.

- Rising automation in mining will push demand for digitally integrated tires.

- Competitive differentiation will shift toward lifecycle management and service excellence.