Market Overview:

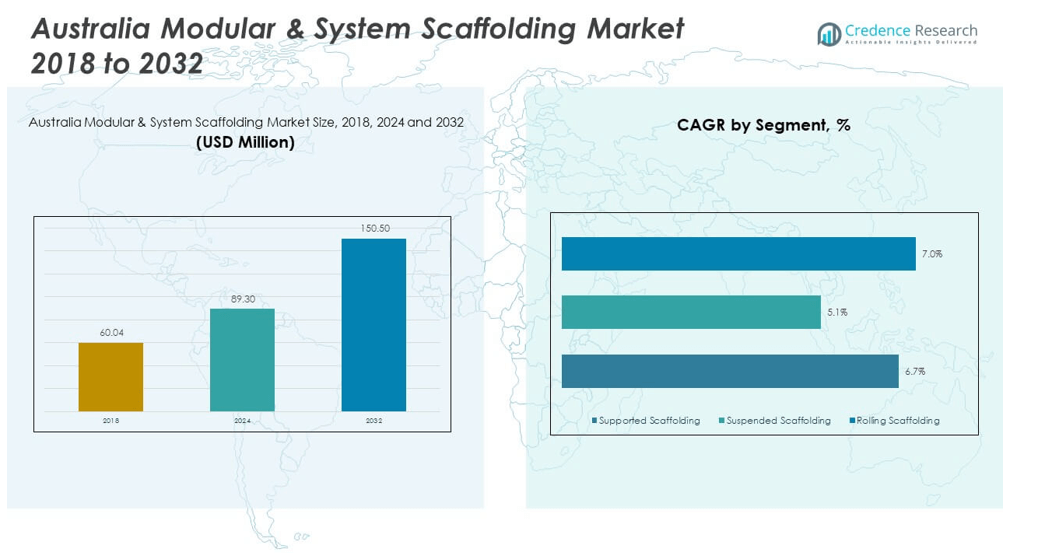

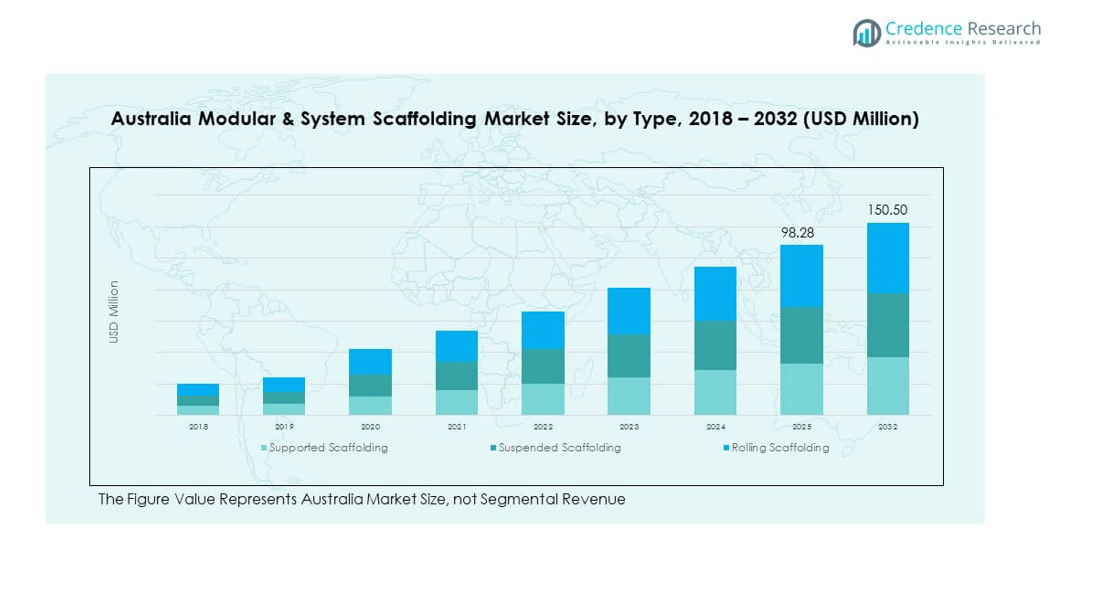

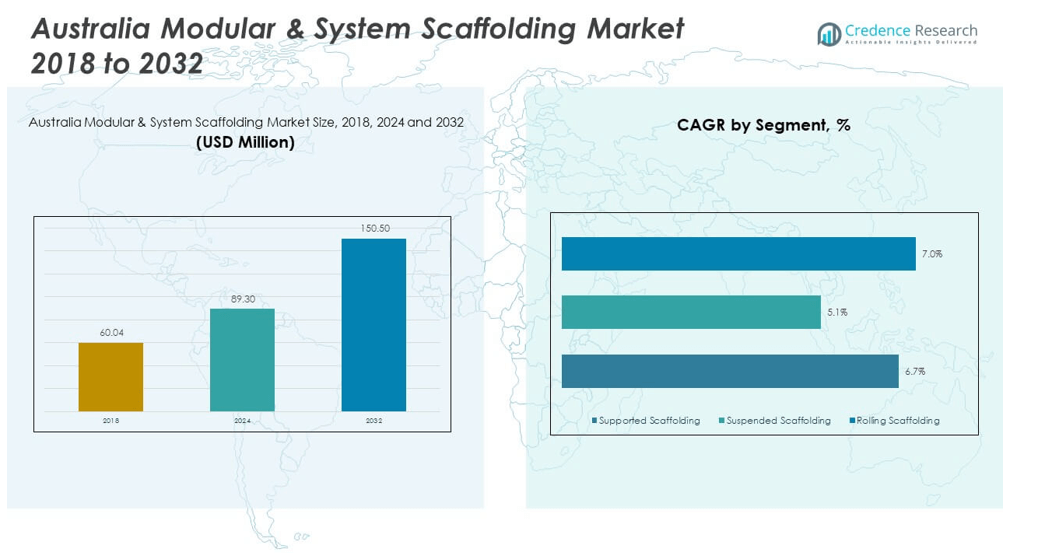

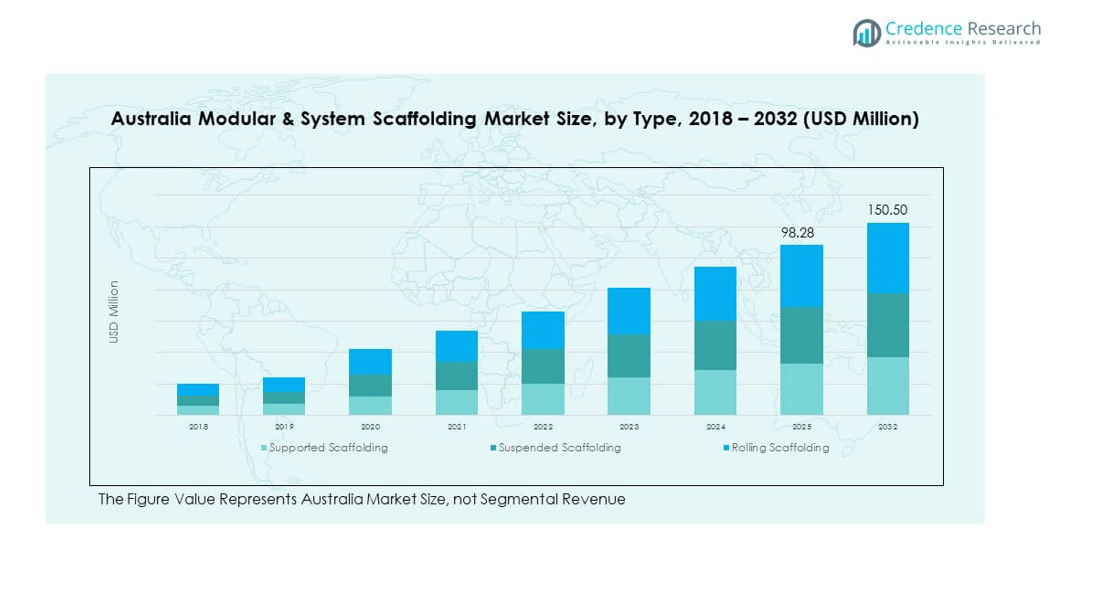

The Australia Modular & System Scaffolding Market size was valued at USD 60.04 million in 2018 to USD 89.30 million in 2024 and is anticipated to reach USD 150.50 million by 2032, at a CAGR of 6.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Modular & System Scaffolding Market Size 2024 |

USD 89.30 million |

| Australia Modular & System Scaffolding Market, CAGR |

6.67% |

| Australia Modular & System Scaffolding Market Size 2032 |

USD 150.50 million |

The market growth is primarily driven by rising infrastructure development and urban expansion across major Australian cities. Increasing investments in residential, commercial, and industrial construction projects have amplified the demand for modular and system scaffolding due to their flexibility, safety, and ease of assembly. Additionally, the shift toward prefabricated construction methods and the enforcement of stringent occupational safety standards are encouraging contractors to adopt advanced scaffolding systems. The growing focus on productivity and cost-efficiency in building activities further supports the adoption of modular scaffolding solutions across sectors.

Regionally, New South Wales and Victoria dominate the market due to ongoing mega infrastructure projects, rapid urbanization, and government-backed development initiatives. Queensland is emerging as a promising region, fueled by rising construction in mining and energy-related infrastructure. Western Australia, while traditionally reliant on resource-based sectors, is also seeing a gradual uptick in scaffolding demand due to diversification in industrial activities. These regional dynamics highlight a robust growth trajectory across Australia, with demand driven by both public and private sector investments in construction and maintenance projects.

Market Insights:

- The Australia Modular & System Scaffolding Market was valued at USD 89.30 million in 2024 and is expected to reach USD 150.50 million by 2032, growing at a CAGR of 6.67%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Rising infrastructure development and housing initiatives are driving demand for modular scaffolding across urban and regional projects.

- Regulatory compliance and stringent workplace safety standards are pushing contractors to adopt certified and engineered scaffolding systems.

- The shift toward prefabricated construction methods increases reliance on modular scaffolding for faster and safer assembly.

- High labor costs and skilled workforce shortages continue to challenge efficient scaffolding deployment and project timelines.

- New South Wales and Victoria dominate market share due to high-density developments, while Queensland and Western Australia show emerging potential.

- Diverse applications across construction, industrial maintenance, and event management widen the market’s user base and support future growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Robust Growth in Urban Infrastructure and Residential Projects Across Major Cities

The Australia Modular & System Scaffolding Market is gaining momentum due to the continued expansion of residential and urban infrastructure projects in cities such as Sydney, Melbourne, and Brisbane. Government-led housing initiatives and private investments in high-rise buildings are creating demand for safer, more efficient scaffolding systems. Urban densification has accelerated the need for modular scaffolding in space-constrained construction sites. Builders prefer system scaffolding due to its flexibility, reduced setup time, and compliance with modern safety standards. Projects targeting mixed-use developments and green buildings also rely on innovative scaffold designs. Regulatory mandates for fall protection and worker safety influence adoption decisions. These infrastructure-driven dynamics strengthen the market’s role in Australia’s construction sector.

Increased Adoption Due to Stringent Workplace Health and Safety Compliance Standards

Australia enforces rigorous workplace safety laws, driving contractors and project managers to adopt reliable scaffolding systems. The need to minimize worksite accidents and meet occupational health requirements has increased the demand for engineered modular scaffolding. Unlike traditional systems, modular scaffolding offers enhanced stability and adaptability to complex structures. Companies invest in certified products to avoid legal liabilities and insurance penalties. Regular audits and enforcement by Safe Work Australia further pressure construction firms to upgrade scaffolding equipment. This focus on workplace safety supports consistent demand. The Australia Modular & System Scaffolding Market benefits directly from the country’s regulatory framework and safety culture.

- For instance, PERI’s UP Flex modular scaffolding system is officially certified to EN 12810/12811 standards and is structurally qualified to meet AS/NZS 1576 load criteria, as per scaffold inspections in Australia. The system’s design incorporates advanced safety features such as gravity-lock ledgers, toeboards, and anti‑uplift decking that support faster assembly and safer working conditions.

Growing Construction Activity in Industrial and Infrastructure Sectors

Large-scale infrastructure programs like road upgrades, airport expansions, and rail network developments stimulate demand for modular scaffolding. The need for scalable and load-bearing platforms during industrial construction phases makes system scaffolding indispensable. Engineering and resource-related projects in Western Australia and Queensland also rely on scaffolding for maintenance and assembly operations. The growing size and complexity of these projects require modular systems to ensure structural integrity and workforce safety. Project timelines and cost optimization goals push stakeholders toward prefabricated solutions. Industrial sites prioritize scaffolding that allows uninterrupted workflows and quicker dismantling. This drives sustained engagement with modular scaffold manufacturers across sectors.

- For example, Uni‑span Group supplies ringlock-based scaffolding and formwork systems widely used in African civil and industrial infrastructure, and through Uni‑span Australia (now Acrow), these systems support construction and industrial contracts in Queensland. These solutions are engineered for high adaptability and efficiency,

Accelerated Shift Toward Pre-engineered and Prefabricated Construction Technologies

Developers and contractors are increasingly adopting pre-engineered buildings and prefabricated units to save time and labor costs. Modular scaffolding aligns perfectly with this shift, offering easy transport, rapid installation, and repeat usability. It enables synchronized workflows on fast-paced construction sites without compromising safety. With the rise of modular buildings in education, health, and commercial sectors, scaffolding systems must support off-site assembly and modular integration. Scaffolding suppliers collaborate with modular contractors to provide custom-fit systems. The Australia Modular & System Scaffolding Market grows in tandem with the modernization of construction processes. This shift creates a sustained pipeline for advanced scaffolding components and system innovation.

Market Trends

Integration of Digital Technologies for Scaffolding Planning and Project Optimization

Construction firms are integrating software-based planning tools to design and manage scaffolding systems with precision. BIM and 3D modeling allow contractors to simulate scaffold layouts and load performance before installation. It enhances safety, reduces human error, and improves resource utilization. Companies can digitally track scaffold components across sites to streamline logistics. Real-time inspection data helps project managers ensure compliance and structural stability. This digital trend is fostering partnerships between scaffolding providers and tech firms. The Australia Modular & System Scaffolding Market embraces digitalization to improve operational control. Tech-driven scaffolding solutions offer long-term advantages for large-scale builders.

- For example, ScaffPlan is an all-in-one scaffold design platform, founded in Brisbane, Australia, built for intelligent 3D and BIM-integrated modeling with millimeter-level accuracy, automated gear list generation, and live collaboration tools connecting office and field teams. The software supports clash detection, safety rules, inbuilt engineering reports, and multi-format import/export workflows trusted by scaffolders and contractors globally.

Sustainable Construction Practices Driving Use of Reusable and Eco-friendly Scaffold Materials

Builders and developers are placing greater emphasis on sustainability, prompting interest in reusable and recyclable scaffolding systems. Modular scaffolding made from high-grade aluminum or galvanized steel aligns with green building codes. These materials reduce waste generation and carbon footprint during the construction cycle. Companies choose eco-certified scaffolding to qualify for environmental ratings and government incentives. Long-term cost savings from reusability also attract firms with frequent project turnover. Manufacturers promote products with minimal maintenance needs and high corrosion resistance. The Australia Modular & System Scaffolding Market adapts to this sustainability shift with innovation in material engineering and lifecycle management.

Rise of Rental-Based Scaffold Business Models Among Mid-sized Contractors

The scaffolding rental model is gaining traction as contractors seek cost-effective alternatives to ownership. It allows access to high-quality systems without upfront capital investment. Mid-sized and emerging firms leverage rental services to scale scaffolding use based on project timelines. Rental providers offer technical support, installation, and dismantling services, reducing the burden on builders. Demand for flexible, short-term access to modular scaffolds is increasing in urban and regional markets. This trend is reshaping market dynamics, favoring service-based revenue models. The Australia Modular & System Scaffolding Market sees new opportunities for growth through scaffold-as-a-service platforms and leasing partnerships.

Growing Demand for Customizable Scaffold Systems in Niche Construction Segments

Niche construction sectors such as heritage restoration, event staging, and film production increasingly require tailored scaffolding configurations. These applications demand lightweight, adaptive, and non-intrusive scaffolding. Custom scaffold systems must accommodate architectural constraints and deliver precise height or access control. Companies in these segments seek modular scaffolding for efficient deployment without damaging structures or surroundings. This trend expands the market beyond conventional construction. Scaffold manufacturers respond by offering specialized kits and adjustable modules. The Australia Modular & System Scaffolding Market is diversifying to meet evolving client demands in specialized sectors beyond infrastructure and commercial projects.

- For instance, event staging companies like AT‑PAC have engineered custom scaffold structures tailored for unique venues, outdoor landscapes, and temporary installations in the events industry. Their systems feature quick deployment and modularity to accommodate architectural constraints and rapidly changing requirements.

Market Challenges Analysis

High Labor Costs and Skilled Workforce Shortage Affect Scaffold Deployment Efficiency

Australia faces a persistent shortage of skilled labor in the construction industry, including scaffold assemblers and inspectors. The modular and system scaffolding setup requires trained professionals who understand load dynamics, assembly instructions, and site safety protocols. Labor shortages lead to delays in scaffold deployment, driving up project costs. Rising wages further strain the profitability of scaffold service providers. Training programs and certifications exist but fail to meet real-time demand. Some contractors resort to outsourcing or international labor, complicating compliance with local safety standards. The Australia Modular & System Scaffolding Market faces operational inefficiencies due to workforce constraints.

Complex Regulatory Environment and Costly Compliance Burdens for Small Contractors

Scaffolding businesses must comply with a range of federal and state-level safety, insurance, and environmental regulations. Frequent inspections, safety audits, and documentation requirements add administrative burdens to small and mid-sized scaffold providers. Any deviation or oversight can result in penalties or worksite bans. Compliance-related costs such as certification, worker training, and product testing affect the pricing structure of scaffolding services. This regulatory complexity discourages new entrants and limits regional expansion of small firms. The Australia Modular & System Scaffolding Market experiences competitive friction between large, compliant players and smaller, resource-constrained providers.

Market Opportunities

Rising Demand from Government-Funded Infrastructure Upgrades and Housing Programs

Australia’s government continues to fund major transportation, utilities, and public housing programs under long-term infrastructure plans. These projects require scalable and compliant scaffolding solutions across phases. Opportunities emerge for suppliers offering standardized, safe, and reusable modular systems. Public-private partnerships also create recurring demand for scaffold maintenance contracts. The Australia Modular & System Scaffolding Market aligns with this trajectory by offering value-based solutions that comply with procurement policies and safety mandates.

Expansion into Remote and Industrial Construction Zones Drives Regional Growth Potential

Emerging construction zones in Northern Territory, Western Australia, and rural Queensland demand modular scaffolding for energy, defense, and logistics infrastructure. These regions need lightweight, mobile scaffolding systems that support remote deployment. Suppliers offering reliable logistics, rental support, and rapid servicing can expand their footprint. This opens untapped market potential for scaffold firms targeting regional diversification beyond urban centers.

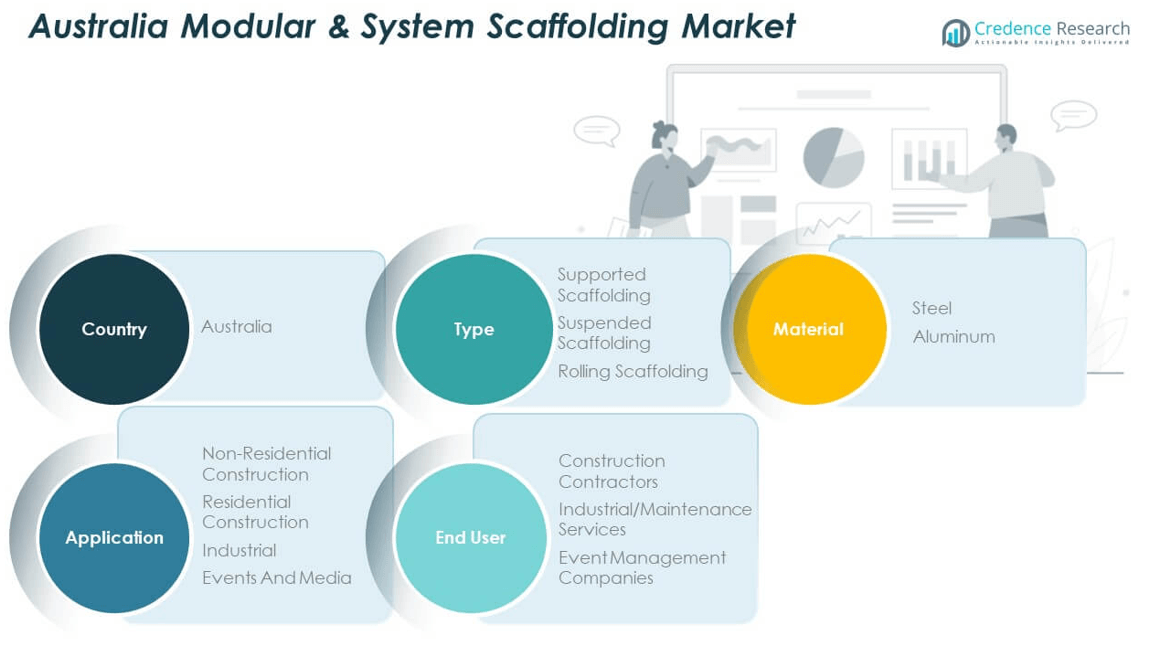

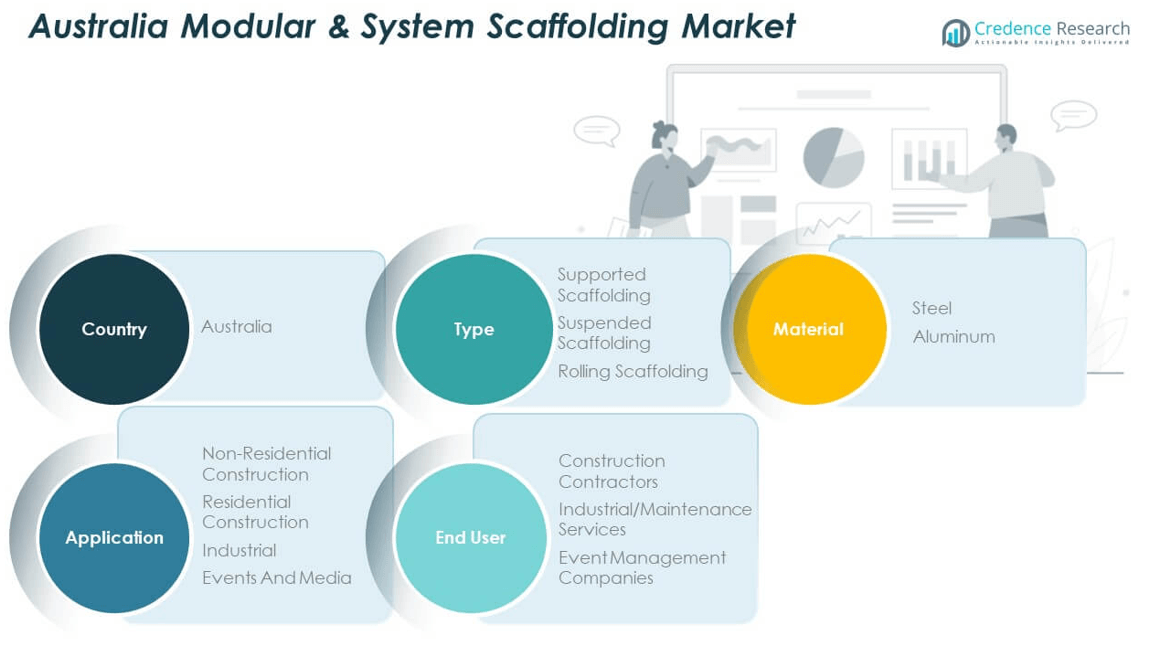

Market Segmentation Analysis:

The Australia Modular & System Scaffolding Market comprises diverse segments that reflect its widespread adoption across construction and industrial domains.

By type, supported scaffolding dominates due to its broad utility in high-rise and infrastructure projects. Suspended scaffolding finds use in maintenance and facade work where ground access is restricted, while rolling scaffolding caters to mobile and indoor applications. Each type addresses specific operational needs in height access and flexibility.

By material, steel holds the largest share owing to its high strength, durability, and load-bearing capacity, making it suitable for heavy-duty applications. Aluminum is gaining traction due to its lightweight properties and ease of transport, favored in projects requiring frequent setup and relocation.

- For example, Kwikstage steel scaffolding is a modular, heavy‑load capable system well-suited to extended-duration civil and tunneling environments.

By application, non-residential construction leads due to large-scale developments across commercial and public infrastructure. Residential construction follows, supported by housing programs. Industrial applications drive steady demand in resource-based sectors. Events and media, though smaller, represent a growing niche requiring customized and aesthetic scaffolding solutions.

- For example, BrandSafway through its Brand Industrial Services (Australia) division—provides comprehensive access system services, including engineered scaffolding and shoring solutions for major industrial and infrastructure clients.

By end user, construction contractors form the core demand base, driven by active site requirements and safety compliance. Industrial and maintenance service providers rely on modular scaffolds for plant operations, shutdowns, and inspections. Event management companies increasingly adopt system scaffolding for temporary structures and stage setups, reinforcing the market’s versatility across sectors. The Australia Modular & System Scaffolding Market reflects strong alignment between product features and user-specific needs across these segments.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

Regional Analysis:

New South Wales leads the Australia Modular & System Scaffolding Market with a market share of 32.5%, driven by dense urban development and ongoing infrastructure upgrades. Major public works, such as Sydney Metro and WestConnex, create steady demand for modular scaffolding systems. High-rise residential and commercial projects across the Greater Sydney region fuel continuous scaffolding deployment. Contractors prioritize system scaffolding to meet strict safety standards and project deadlines in metropolitan zones. Government-backed affordable housing schemes further contribute to volume demand. The state’s commitment to smart infrastructure supports future market stability.

Victoria holds the second-largest share of 27.1%, supported by Melbourne’s extensive construction pipeline and rapid suburban expansion. Ongoing developments in transport, healthcare, and education infrastructure stimulate consistent scaffolding needs. The state’s push for sustainable and prefabricated construction aligns with modular scaffolding adoption. Builders leverage scaffold rental services to manage project costs and increase operational flexibility. Victoria’s urban policies and population growth strategies sustain long-term infrastructure demand. The Australia Modular & System Scaffolding Market sees Victoria as a core region for both innovation and deployment.

Queensland accounts for 18.6% of the market, with growth driven by industrial activity and regional development in mining and energy sectors. Brisbane and surrounding urban centers experience rising residential construction, adding to scaffold utilization. Resource-based projects in Central and Northern Queensland require durable, modular solutions that support remote work conditions. Companies focus on mobile scaffolding systems suitable for site access and fast assembly. Western Australia contributes 13.4%, fueled by diversified construction activities beyond mining. South Australia, Tasmania, and other territories collectively represent 8.4%, showing emerging opportunities through small-scale infrastructure upgrades and community developments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Australian Scaffold

- Cogent Scaffolding

- Caledonia Group

- East Coast Scaffolding

- Benchmark Scaffolding

- Industroquip

- Kennards Hire

- Coates

Competitive Analysis:

Major multinational firms dominate the Australia Modular & System Scaffolding Market, offering extensive safety‑certified systems and full-service support. PERI GmbH, Layher Holding GmbH, Waco Kwikform and ULMA Group hold strong market positions, leveraging innovation and scale to deliver premium scaffold solutions. It firms its regional presence through local offices and logistic facilities, ensuring rapid supply and technical support across Australia. Smaller domestic players focus on customised service, competitive price and regional networks to win local projects. Market rivalry pushes providers to differentiate via product innovation, rental‑as‑a‑service models, and sustainable material offerings. Price pressure from emerging regional suppliers forces established firms to justify premium pricing with advanced features, compliance credentials and bundling services. It benefits clients seeking reliability and economies of scale, while newcomers gain traction through agility and localized focus.

Recent Developments:

- In May 2025, Cogent Scaffolding secured a significant partnership by providing all scaffolding services for the West Village – Callista project in collaboration with Hutchinson Builders, one of their longstanding construction partners. This project underscores Cogent’s ongoing role in major construction developments, offering extensive scaffolding access and solutions.

- In February 2025, Australian Scaffold introduced its new Edge Protection Bracket Design, designed for superior safety and compliance with the latest Australian Edge Protection Standard 2023. This innovation allows for mounting directly onto the first screw line of corrugated roofs, reduces installation time, and minimizes damage, setting a new benchmark for roof edge safety in both sale and hire markets nationwide.

Market Concentration & Characteristics:

The Australia Modular & System Scaffolding Market reflects a moderately concentrated structure with several global leaders and many regional specialists active in the sector. Top players such as PERI GmbH, Layher, ULMA and Waco Kwikform maintain consistent visibility through certified systems, large inventories and technical support networks. It retains resilience due to recurring demand from infrastructure and industrial projects. Smaller firms maintain agility by offering cost‑effective, tailored solutions for local and mid‑sized construction sites. Competition takes form via innovation, compliance certifications and service packages. The mix of large branded firms and nimble regional providers ensures clients access both advanced systems and competitive pricing. Market features include moderate entry barriers, emphasis on safety certification, regional logistics capabilities and differentiated service models.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased infrastructure investment across urban and regional Australia will sustain long-term demand for modular scaffolding solutions.

- Adoption of digital tools for scaffold planning and compliance tracking will enhance operational efficiency and reduce safety risks.

- The rental-based scaffolding model is expected to gain wider acceptance among mid-sized and small contractors.

- Demand for lightweight and corrosion-resistant materials will drive innovation in scaffolding component manufacturing.

- Green building initiatives and sustainability mandates will boost interest in reusable and recyclable scaffold systems.

- Growth in industrial maintenance and shutdown services will create recurring opportunities for modular scaffolding deployment.

- Expansion into remote and resource-intensive regions will encourage scalable and mobile scaffolding solutions.

- Technological integration, such as IoT-enabled safety monitoring, will enhance scaffolding safety and performance.

- Regulatory developments and safety audits will continue to influence procurement preferences toward certified systems.

- Strategic partnerships between scaffold suppliers and construction firms will shape market consolidation and service bundling.