| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Medical Device Contract Manufacturing Market Size 2024 |

USD 1,287.68 Million |

| Australia Medical Device Contract Manufacturing Market, CAGR |

12.04% |

| Australia Medical Device Contract Manufacturing Market Size 2032 |

USD 3,197.31 Million |

Market Overview

Australia Medical Device Contract Manufacturing Market size was valued at USD 1,287.68 million in 2024 and is anticipated to reach USD 3,197.31 million by 2032, at a CAGR of 12.04% during the forecast period (2024-2032).

The Australia Medical Device Contract Manufacturing market is driven by several key factors, including the increasing demand for advanced medical technologies, a growing aging population, and a rising prevalence of chronic diseases. These trends are pushing healthcare providers to adopt innovative devices, creating significant opportunities for contract manufacturers. Additionally, the market benefits from technological advancements such as 3D printing, automation, and enhanced materials, which streamline production processes and improve product quality. The rising focus on cost-effective healthcare solutions has led to greater outsourcing of manufacturing services, further fueling market growth. Additionally, the supportive regulatory environment and ongoing investments in healthcare infrastructure contribute to the industry’s expansion. As healthcare systems continue to modernize, there is a marked trend toward partnerships between device developers and contract manufacturers, ensuring faster time-to-market and optimized production capabilities for complex medical devices. These factors together create a robust foundation for sustained growth in the sector.

The geographical landscape of the Australia Medical Device Contract Manufacturing market is shaped by key regions such as New South Wales, Victoria, Queensland, Western Australia, and South Australia, each contributing uniquely to the industry through established healthcare infrastructure, innovation hubs, and skilled labor forces. New South Wales and Victoria, in particular, serve as major centers for research, development, and manufacturing activities due to their robust medical technology ecosystems. The market features a mix of leading domestic and global players that drive competition and innovation. Key players in the space include ResMed, Cochlear Limited, Freudenberg Medical, Osmosis Medical, and CSL Limited. These companies are known for their strong product portfolios, advanced manufacturing capabilities, and strategic partnerships across the healthcare value chain. Their presence not only strengthens the industry but also supports the broader goal of delivering high-quality, compliant, and technologically advanced medical devices to meet growing domestic and international demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Medical Device Contract Manufacturing market was valued at USD 1,287.68 million in 2024 and is projected to reach USD 3,197.31 million by 2032, growing at a CAGR of 12.04%.

- The global medical device contract manufacturing market was valued at USD 79,181.52 million in 2024 and is expected to reach USD 1,90,413.88 million by 2032, growing at a CAGR of 11.59% during the forecast period (2024-2032).

- Increasing demand for cost-efficient, high-quality medical devices is a primary driver of market growth.

- The adoption of advanced technologies like AI, IoT, and 3D printing is reshaping the contract manufacturing landscape.

- The market is highly competitive, with major players such as ResMed, Cochlear Limited, and CSL Limited leading through innovation and strategic partnerships.

- Regulatory complexities and stringent compliance requirements pose challenges to new entrants and small-scale manufacturers.

- Geographically, New South Wales and Victoria are the leading hubs for medical device manufacturing due to strong infrastructure and R&D facilities.

- A growing emphasis on sustainability and expansion into emerging global markets offer new growth opportunities for Australian contract manufacturers.

Report Scope

This report segments the Australia Medical Device Contract Manufacturing Market as follows:

Market Drivers

Growing Demand for Advanced Medical Devices

The demand for advanced medical devices is one of the primary drivers of the Australian Medical Device Contract Manufacturing market. For instance, Australia’s medical equipment industry has seen a surge in demand for innovative devices, particularly in response to public health needs. Technological advancements in healthcare, such as minimally invasive surgeries, wearable health monitors, and robotic-assisted procedures, have revolutionized the way medical treatments are administered. These manufacturers provide expertise in producing high-quality, precision medical devices at scale, meeting the growing demand for sophisticated products across various therapeutic areas, including cardiology, orthopedics, and diagnostics. This trend is expected to continue, as the push for more advanced medical technology accelerates globally.

Rising Prevalence of Chronic Diseases and Aging Population

Australia’s aging population is a critical factor driving the growth of the medical device sector. As the number of elderly individuals increases, there is a corresponding rise in age-related diseases such as diabetes, cardiovascular conditions, and arthritis, which require specialized medical devices. Additionally, chronic disease management, such as diabetes monitoring and cardiovascular care, is increasingly dependent on technological solutions like home diagnostic devices and implantable devices. The growing prevalence of these conditions necessitates the rapid development and manufacturing of medical devices that can address these healthcare challenges. Medical device contract manufacturers in Australia are well-positioned to meet this demand by providing scalable and cost-effective production solutions that can adapt to the dynamic healthcare needs of an aging population.

Advancements in Manufacturing Technology

The Australian medical device contract manufacturing market is also fueled by continuous advancements in manufacturing technologies, which enhance the efficiency, precision, and cost-effectiveness of medical device production. For instance, the Australian government has recognized the importance of advanced manufacturing technologies, investing in initiatives that promote automation, 3D printing, and smart manufacturing. These technologies enable the creation of complex, custom-built devices at a fraction of the time and cost compared to traditional manufacturing methods. Contract manufacturers equipped with cutting-edge capabilities can provide high-quality, precision devices with faster time-to-market, meeting the increasingly tight timelines set by medical device developers. Furthermore, advancements in material science, including the use of biocompatible materials and more durable components, allow for the development of more effective, long-lasting devices, contributing to the overall growth of the sector.

Outsourcing and Cost-Effective Solutions

Outsourcing has become a strategic approach for medical device companies looking to optimize production processes while maintaining a focus on core competencies such as product development and marketing. By partnering with contract manufacturers, companies can reduce their overhead costs, avoid large capital investments in manufacturing infrastructure, and leverage the expertise of specialized partners. This trend is particularly strong in the Australian market, where medical device companies seek cost-effective solutions while ensuring compliance with stringent regulatory standards. Contract manufacturers in Australia are well-equipped to navigate the regulatory landscape, offering services such as testing, validation, and certification to meet the strict requirements of local and international markets. As the pressure to reduce healthcare costs intensifies, outsourcing manufacturing to experienced contract partners becomes an increasingly attractive option for medical device companies.

Market Trends

Integration of IoT and AI Technologies

One of the most prominent trends in the Australian medical device contract manufacturing market is the integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies into medical devices. The increasing demand for digital health solutions has led to the development of smart medical devices that can connect to the internet and transmit real-time data, allowing healthcare providers to remotely monitor patients and make timely medical decisions. For instance, the Australian government has recognized the importance of digital health solutions, investing in initiatives that promote IoT-enabled medical devices and AI-driven healthcare analytics. This shift towards more intelligent, connected devices enables more personalized and efficient patient care, offering significant advantages in managing chronic conditions and post-operative recovery. As healthcare becomes increasingly data-driven, manufacturers are compelled to adapt and innovate to stay competitive in this rapidly evolving landscape.

Adoption of Advanced Manufacturing Techniques

Another significant trend in the Australian medical device contract manufacturing market is the adoption of advanced manufacturing techniques, including 3D printing, robotic automation, and precision machining. These technologies allow for the production of complex medical devices with high accuracy and efficiency, which is particularly crucial for items requiring detailed customization or intricate designs, such as implants and prosthetics. 3D printing, in particular, enables the creation of custom-made devices tailored to individual patients, which is becoming increasingly important as demand for personalized medicine grows. Robotic automation streamlines production processes, reduces human error, and enhances scalability, enabling manufacturers to meet rising demand without compromising quality. These advancements not only lower production costs but also shorten time-to-market, giving manufacturers a competitive edge in an increasingly fast-paced industry. Additionally, these techniques allow for the efficient production of smaller batches of devices, catering to niche markets or specialized products.

Emphasis on Sustainability and Eco-Friendly Practices

Sustainability has become a key focus within the Australian medical device contract manufacturing sector. For instance, Australian medical device manufacturers are actively exploring opportunities in emerging markets, leveraging government trade agreements and incentives to expand their global footprint. With the increasing global emphasis on reducing carbon footprints and managing waste, manufacturers are adopting eco-friendly practices to align with both regulatory requirements and consumer demand for sustainable products. This trend includes using recyclable and biodegradable materials, reducing energy consumption during manufacturing processes, and minimizing waste through more efficient production techniques. Manufacturers are also seeking to implement circular economy principles, such as product take-back programs or reprocessing and repurposing medical devices. These practices not only help manufacturers comply with environmental regulations but also enhance their corporate social responsibility profiles, attracting both environmentally conscious consumers and healthcare organizations. As sustainability becomes a more significant part of the business model, medical device manufacturers are positioning themselves as responsible players in the industry, meeting the rising expectations of both regulatory bodies and end-users.

Expansion into Emerging Markets

As the demand for medical devices continues to rise globally, Australian medical device contract manufacturers are increasingly looking to expand into emerging markets in Asia, Latin America, and Africa. These regions are experiencing rapid urbanization and industrialization, which is contributing to an increase in healthcare infrastructure investments and the demand for medical devices. Additionally, many emerging markets are seeing a rise in chronic diseases, aging populations, and a growing middle class, all of which require advanced medical solutions. By targeting these high-growth regions, Australian manufacturers can diversify their customer base and capitalize on new revenue streams. Furthermore, expanding into emerging markets allows manufacturers to leverage cost advantages, take advantage of local government incentives, and overcome potential supply chain challenges. The global push for accessible and affordable healthcare is opening new avenues for growth, and Australian medical device contract manufacturers are well-positioned to capture these opportunities through strategic partnerships and market entry initiatives.

Market Challenges Analysis

Stringent Regulatory Compliance and Standards

One of the significant challenges facing the Australian medical device contract manufacturing sector is navigating stringent regulatory requirements. These regulations cover various stages of the product lifecycle, including design, development, testing, and post-market surveillance. For instance, the Australian Therapeutic Goods Administration (TGA) enforces strict regulations on medical device manufacturing, requiring adherence to ISO certifications and CE marking standards. For contract manufacturers, staying up-to-date with evolving regulatory frameworks can be resource-intensive and may delay time-to-market for new products. Furthermore, non-compliance can result in significant financial penalties and damage to brand reputation, making regulatory adherence a critical challenge for manufacturers seeking to expand their global reach.

Supply Chain Disruptions and Raw Material Shortages

Another challenge faced by the Australian medical device contract manufacturing industry is supply chain disruptions and raw material shortages. The global medical device sector relies on a variety of specialized materials, such as biocompatible polymers and metals, which can be subject to price volatility and supply chain bottlenecks. Disruptions, whether due to geopolitical issues, natural disasters, or the impact of global pandemics like COVID-19, can result in delayed shipments, increased costs, and difficulties in meeting production timelines. For contract manufacturers, managing these risks while maintaining high standards of quality and on-time delivery is an ongoing challenge. Furthermore, fluctuations in raw material prices can erode profit margins, particularly for manufacturers working with fixed-cost contracts. Ensuring a stable and resilient supply chain requires diversification of suppliers, investment in strategic partnerships, and enhanced forecasting capabilities to minimize the impact of these disruptions on production schedules.

Market Opportunities

The Australian medical device contract manufacturing market presents significant opportunities driven by the increasing demand for advanced healthcare solutions and a growing focus on cost-effective production. As healthcare providers seek more sophisticated medical devices to address an aging population and rising chronic disease rates, the need for specialized contract manufacturers becomes more pronounced. These manufacturers can leverage their expertise in high-quality, precision manufacturing to meet the growing demand for both high-volume and customized medical devices, ranging from diagnostics equipment to surgical instruments. Moreover, the shift toward personalized medicine, which requires patient-specific devices, further fuels demand for contract manufacturers capable of producing bespoke solutions. The expanding use of technologies such as 3D printing, automation, and AI-driven production systems creates additional opportunities to enhance manufacturing efficiency and speed up time-to-market, allowing Australian manufacturers to capture a larger share of the global market.

Another significant opportunity lies in the growing trend of outsourcing manufacturing by medical device companies, particularly as firms aim to reduce costs and focus on core competencies such as research and development. Australian contract manufacturers are well-positioned to cater to this demand, offering cost-effective and flexible production solutions while adhering to strict regulatory standards. Additionally, the global expansion of healthcare markets, particularly in emerging regions such as Asia and Africa, presents new avenues for Australian manufacturers to explore. By capitalizing on these international opportunities, local contract manufacturers can tap into fast-growing markets, leveraging Australia’s strong reputation for high-quality medical devices. As global healthcare infrastructure continues to improve and the demand for medical technology rises, Australian medical device contract manufacturers have a unique opportunity to expand their global footprint while contributing to advancements in healthcare.

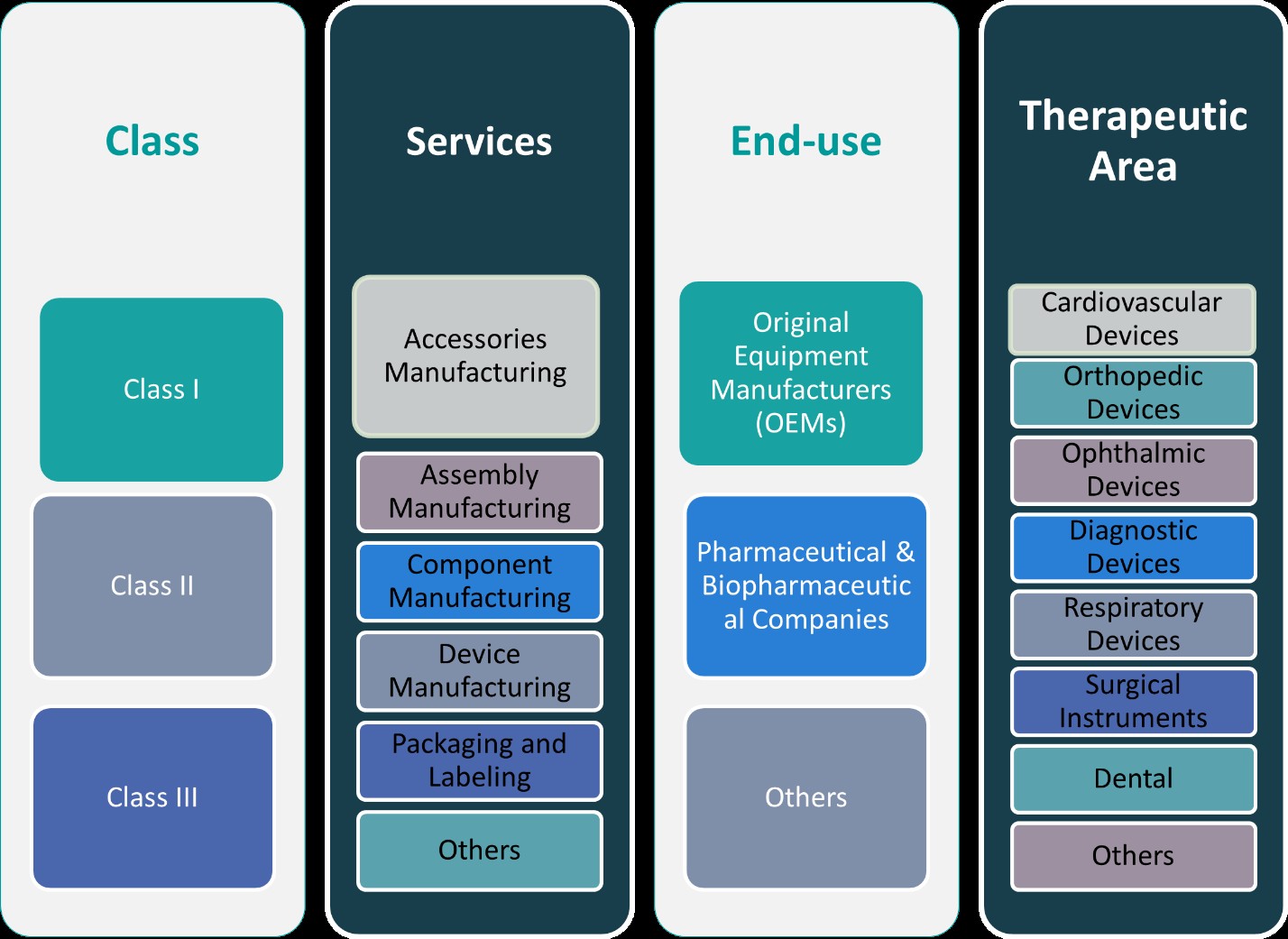

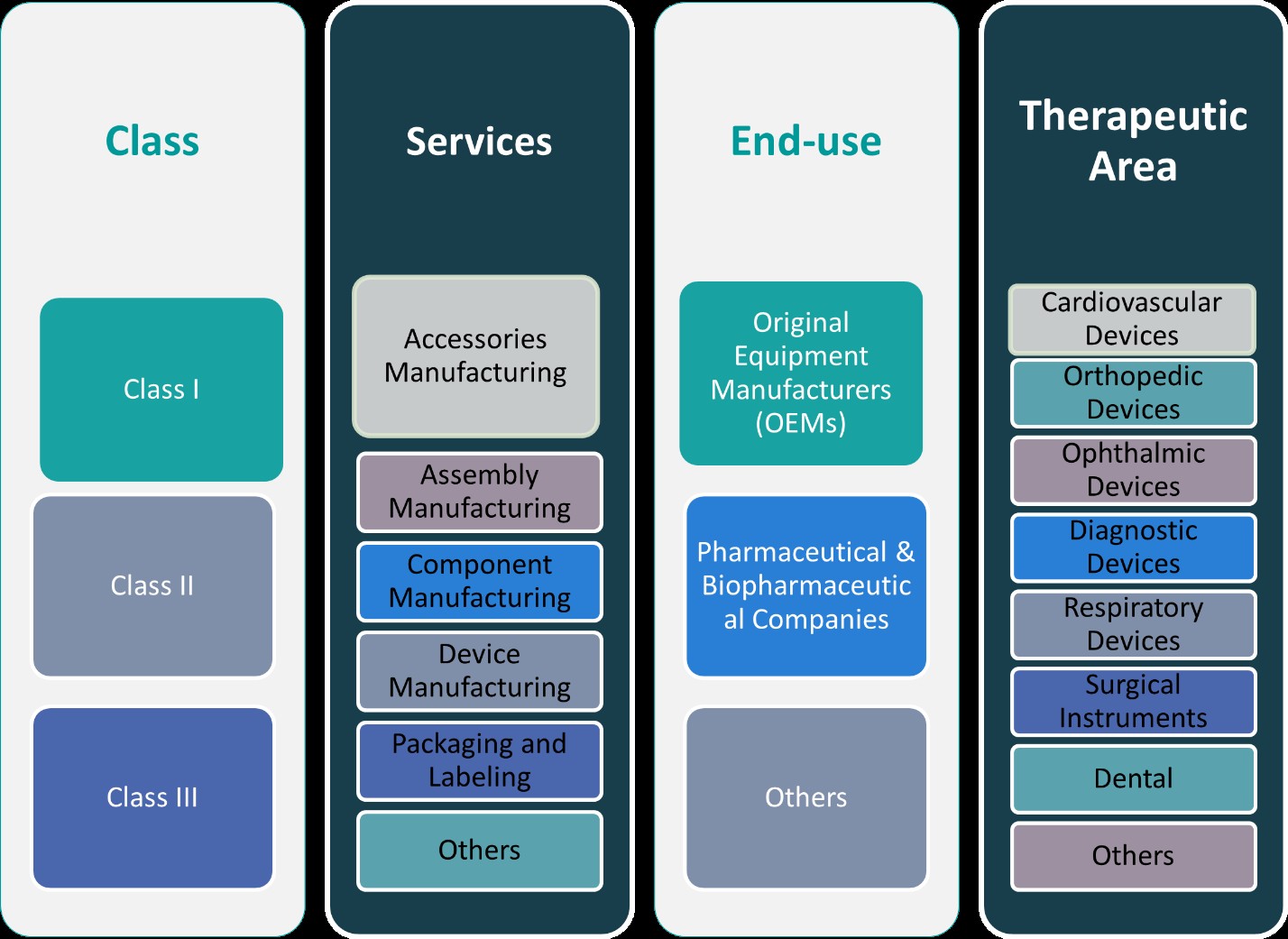

Market Segmentation Analysis:

By Class:

The Australian medical device contract manufacturing market can be segmented by device classification into Class I, Class II, and Class III devices. Class I devices are low-risk products such as bandages, thermometers, and surgical instruments that generally require minimal regulatory control. These products are simpler to manufacture and involve fewer regulatory hurdles, offering opportunities for cost-efficient production. Class II devices, which include more complex devices like infusion pumps and diagnostic equipment, pose moderate risk and require more stringent regulatory oversight. Manufacturers involved in Class II device production must adhere to specific standards and certification processes, ensuring higher complexity in manufacturing and quality control. Class III devices, such as pacemakers and heart valves, represent high-risk products requiring the highest level of regulatory scrutiny and advanced manufacturing capabilities. Manufacturers of Class III devices face more stringent compliance and validation processes, which, while challenging, provide opportunities for contract manufacturers to leverage specialized expertise and deliver high-quality, life-critical products.

By Services:

The market for medical device contract manufacturing in Australia is also segmented by services, each catering to distinct manufacturing needs. Accessories manufacturing includes the production of supplementary components for medical devices, such as power adapters or connectors, which are crucial for the proper functioning of devices. Assembly manufacturing involves the integration of individual components into final, functioning devices, a critical service for manufacturers who need high levels of precision and efficiency. Component manufacturing focuses on producing individual parts, such as sensors or actuators, that form the building blocks of medical devices. Device manufacturing refers to the complete production of finished medical devices, ranging from diagnostics equipment to surgical tools, requiring advanced engineering and compliance with international standards. Packaging and labeling services are essential for ensuring medical devices are safely packaged and comply with regulatory requirements for distribution. Lastly, other services like testing, validation, and sterilization provide additional value to manufacturers seeking comprehensive solutions, further expanding the opportunities for contract manufacturers in the Australian medical device sector.

Segments:

Based on Class:

- Class I

- Class II

- Class III

Based on Services:

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Based on End- Use:

- Original Equipment Manufacturers (OEMs)

- Pharmaceutical & Biopharmaceutical Companies

- Others

Based on Therapeutic Area:

- Cardiovascular Devices

- Orthopedic Devices

- Ophthalmic Devices

- Diagnostic Devices

- Respiratory Devices

- Surgical Instruments

- Dental

- Others

Based on the Geography:

- New South Wales

- Victoria

- Queensland

- Western Australia (WA)

- South Australia

Regional Analysis

New South Wales (NSW)

New South Wales (NSW) holds the largest market share, accounting for approximately 35% of the market. The state’s dominance can be attributed to its strong healthcare infrastructure, advanced research and development capabilities, and proximity to major medical device manufacturers and suppliers. Sydney, as a hub for innovation and technology, plays a key role in driving demand for contract manufacturing services. Additionally, NSW’s highly skilled workforce and favorable regulatory environment further position it as the leading region in the market.

Victoria

Victoria follows closely with a market share of around 30%. Known for its thriving medical technology and biotechnology industries, Victoria is home to a significant number of medical device companies and contract manufacturers. The state’s strong emphasis on healthcare innovation, coupled with institutions such as the University of Melbourne and Monash University, fosters a collaborative environment for the development of new medical technologies. Melbourne, in particular, serves as a central point for medical device research, attracting both domestic and international companies to the region. As a result, Victoria continues to experience robust demand for contract manufacturing services across various device categories.

Queensland

Queensland represents approximately 20% of the market share and is known for its growing presence in the medical device sector. The region benefits from a combination of government incentives and a focus on healthcare innovation, particularly in the fields of diagnostics and wearables. Brisbane, as the state’s capital, has seen increasing investment in medical device development, attracting new manufacturers and expanding the need for contract manufacturing services. Queensland’s strong healthcare ecosystem and increasing demand for more affordable medical technologies provide opportunities for manufacturers to scale and diversify their offerings.

Western Australia (WA) and South Australia

Western Australia (WA) and South Australia contribute to the remaining 15% of the market share, with WA accounting for 10% and South Australia around 5%. WA’s medical device manufacturing is centered around Perth, with a focus on specialized equipment for mining and healthcare sectors. South Australia, on the other hand, is home to Adelaide, a city with a growing presence in medical technology, particularly in areas like medical imaging and prosthetics. While these regions have smaller market shares compared to NSW, Victoria, and Queensland, their contributions are increasing as demand for medical device outsourcing services continues to grow, and as these regions invest more in healthcare technology development.

Key Player Analysis

- ResMed

- Cochlear Limited

- Freudenberg Medical

- Osmosis Medical

- CSL Limited

Competitive Analysis

The competitive landscape of the Australia Medical Device Contract Manufacturing market is shaped by the presence of several established players who bring strong expertise, innovation, and global reach to the industry. Key players include ResMed, Cochlear Limited, Freudenberg Medical, Osmosis Medical, and CSL Limited. These companies maintain a competitive edge through extensive product portfolios, advanced manufacturing capabilities, and strategic collaborations within the healthcare ecosystem. These firms differentiate themselves through innovation, offering a wide range of manufacturing services such as device assembly, component production, and packaging tailored to the evolving needs of medical device companies. Many are increasingly adopting advanced technologies like automation, 3D printing, and smart manufacturing systems to enhance precision, scalability, and efficiency in production processes. To maintain a competitive edge, manufacturers are also investing heavily in research and development, building strategic partnerships with medical technology firms, and expanding their global reach. Their competitive strategies focus on ensuring timely delivery, high product quality, and compliance with international standards such as ISO 13485. As demand rises for complex and personalized medical devices, competition is expected to further intensify, with manufacturers striving to offer more integrated and value-added services across the device lifecycle.

Recent Developments

- In February 2025, Jabil completed the acquisition of Pii, a contract development and manufacturing organization (CDMO) specializing in aseptic filling, lyophilization, and oral solid dose manufacturing.

- In November 2024, Integer completed the sale of its non-medical Electrochem business for $50 million, making it a pure-play medical technology company and allowing it to redeploy capital into high-growth medtech markets.

- In October 2024, At CPHI Milan 2024, Thermo Fisher launched its Accelerator Drug Development platform, a 360° CDMO and CRO offering. This service provides customizable manufacturing, clinical research, and supply chain solutions for small molecules, biologics, and cell and gene therapies, covering the full drug development lifecycle.

Market Concentration & Characteristics

The Australia Medical Device Contract Manufacturing market exhibits a moderate to high level of market concentration, with a mix of well-established manufacturers and a growing number of specialized firms. The market is characterized by a strong focus on precision, quality, and regulatory compliance, which are essential in meeting the stringent requirements of medical device production. Larger contract manufacturers typically dominate due to their ability to provide end-to-end solutions, advanced technological infrastructure, and long-standing relationships with global medtech companies. However, niche players are gaining traction by offering specialized services and greater flexibility. The industry operates in a highly regulated environment, fostering a culture of quality assurance and innovation. Market characteristics include a shift towards integrated manufacturing solutions, growing adoption of automation, and rising demand for customized, low-to-medium volume production. The market also benefits from Australia’s strong research ecosystem and skilled workforce, making it an attractive destination for medical device outsourcing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Class, Services, End-Use, Therapeutic Area and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for contract manufacturing in Australia’s medical device sector will continue to grow due to increased outsourcing by OEMs.

- Technological advancements will drive innovation and efficiency in manufacturing processes.

- Regulatory support and streamlined approvals will encourage domestic production partnerships.

- Rising healthcare needs and aging population will boost the requirement for complex medical devices.

- Local manufacturers will expand capabilities to offer end-to-end solutions for global clients.

- Investment in automation and digital health technologies will enhance production capacity and quality.

- International collaborations will increase as Australian firms seek global market integration.

- Sustainability and eco-friendly practices will become a priority across production processes.

- Skilled workforce development will remain essential to support advanced manufacturing needs.

- Government incentives and R&D funding will strengthen the sector’s global competitiveness.