Market Overview

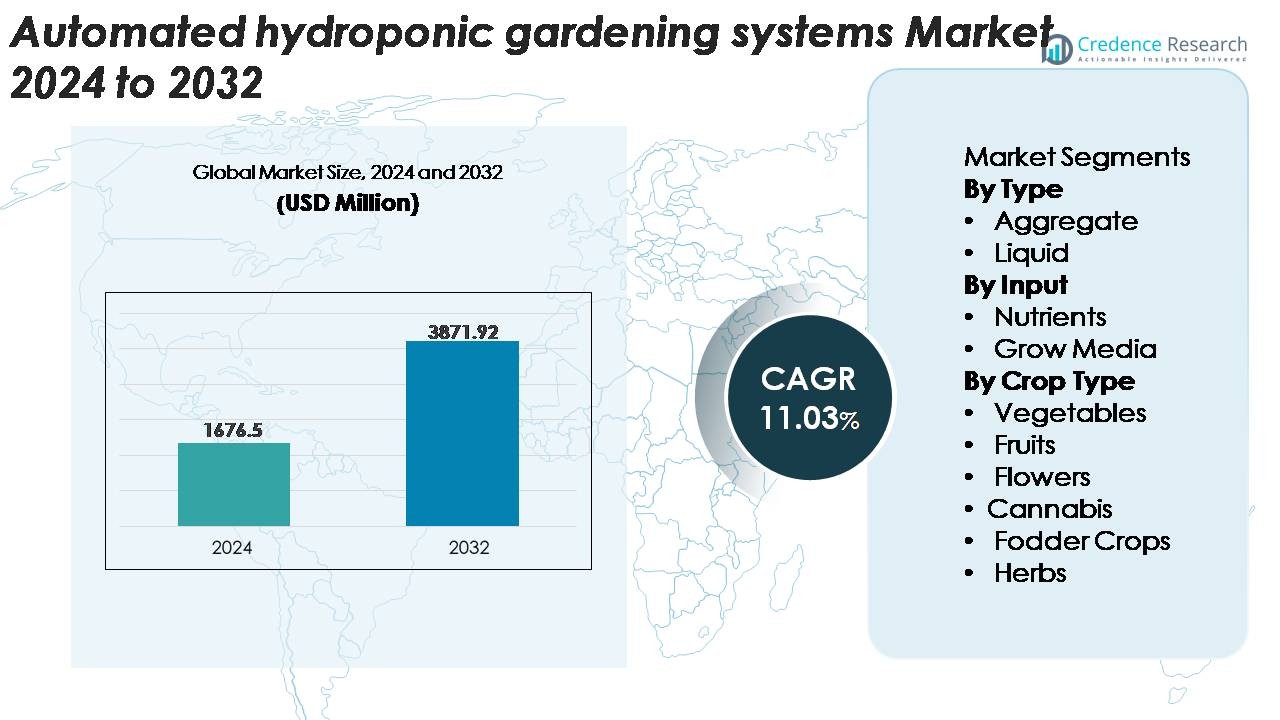

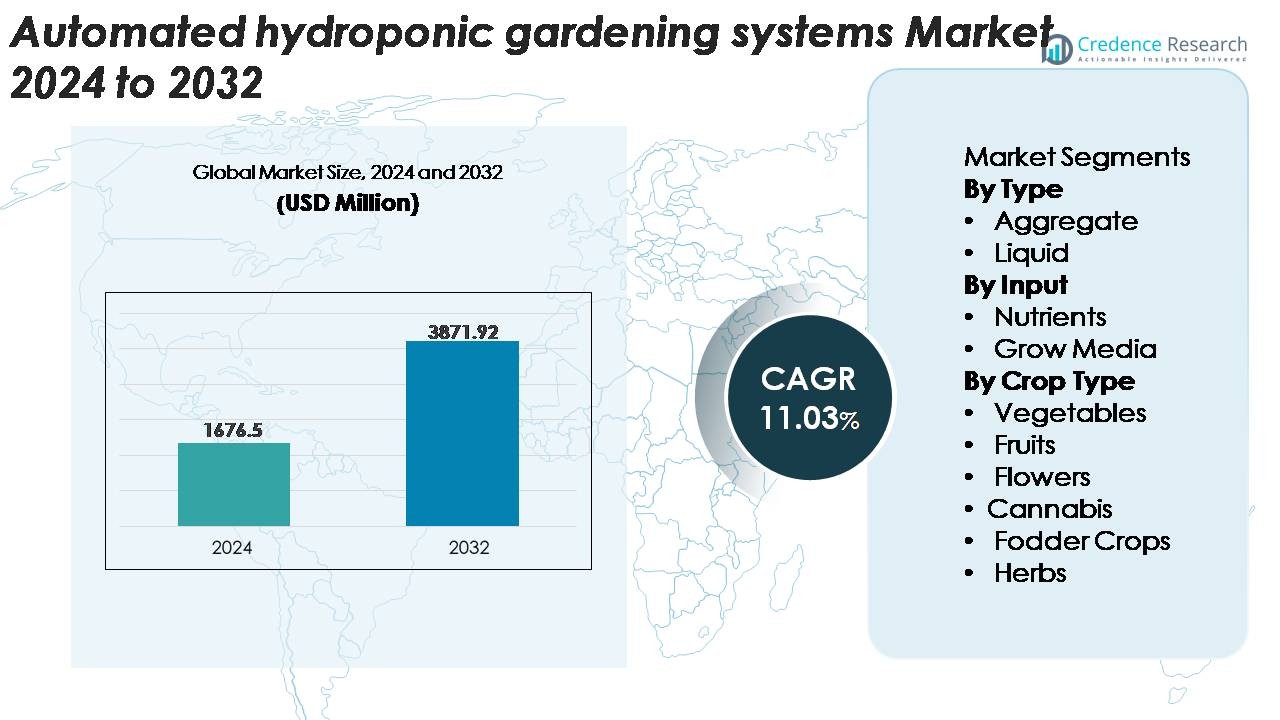

The global Automated Hydroponic Gardening Systems Market was valued at USD 1,676.5 million in 2024 and is projected to reach USD 3,871.92 million by 2032, expanding at a CAGR of 11.03% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automated Hydroponic Gardening Systems Market Size 2024 |

USD 1,676.5 Million |

| Automated Hydroponic Gardening Systems Market, CAGR |

11.03% |

| Automated Hydroponic Gardening Systems Market Size 2032 |

USD 3,871.92 Million |

The automated hydroponic gardening systems market is shaped by a diverse group of global players, including Hydroponic Systems International, General Hydroponics, Pegasus Agritech, Heliospectra AB, Logiqs B.V., Village Farms International, Rockwool A/S, Thanet Earth Limited, The Scotts Company LLC, and Koninklijke Philips N.V. These companies compete through advancements in automation, LED horticultural lighting, precision nutrient delivery, and scalable controlled-environment farming infrastructure. North America leads the global market with a 37–39% share, supported by robust adoption of indoor farming technologies and strong participation from agritech innovators. Europe follows with a 28–30% share, driven by advanced greenhouse networks and sustainability-focused food production initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The automated hydroponic gardening systems market was valued at USD 1,676.5 million in 2024 and is projected to reach USD 3,871.92 million by 2032, growing at a CAGR of 11.03%, driven by expanding adoption across residential and commercial environments.

- Strong market drivers include rising demand for pesticide-free, home-grown produce and the widespread integration of IoT sensors, automated dosing units, and intelligent climate control that enables precise, low-maintenance cultivation.

- Key trends feature the rapid expansion of smart indoor gardens, LED-optimized growth systems, modular vertical racks, and subscription-based nutrient solutions, supported by innovations from leading players such as Heliospectra AB, Logiqs B.V., and General Hydroponics.

- Market restraints include high initial setup costs, technical learning curves for first-time users, and reliance on uninterrupted power and system stability, which can affect adoption in cost-sensitive regions.

- Regionally, North America leads with 37–39%, followed by Europe at 28–30% and Asia-Pacific at 22–24%; segment-wise, aggregate-type systems hold the largest share, while vegetables dominate the crop category.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Aggregate systems represent the dominant sub-segment, holding the largest market share due to their strong compatibility with scalable hobbyist and commercial installations. Their stable root-support structure, lower risk of system clogging, and suitability for drip and ebb-and-flow configurations drive continued adoption. These systems also support a wider variety of crops and allow growers to fine-tune moisture and aeration levels with minimal operational complexity. Liquid-based hydroponics continues to expand, particularly in fully automated nutrient film and deep-water culture setups, but its uptake remains secondary due to higher monitoring needs and pump dependence.

- For instance, commercial basil production in multi-tier systems, nutrient film technique (NFT) platforms typically operate with channel flow velocities of approximately 1.5 to 2.0 L/min per channel, a widely recommended range to ensure consistent nutrient delivery without over-saturating the roots.

By Input

Nutrients form the leading sub-segment, capturing the largest share as precise nutrient dosing directly influences plant growth rates, crop uniformity, and yield optimization in automated hydroponic environments. Advanced multi-part nutrient formulations designed for automatic dosing systems support consistent pH stability and rapid nutrient uptake, making them integral to both commercial and high-end residential installations. Grow media continues to gain traction, particularly inert substrates such as coco coir and perlite, but its overall share remains smaller because nutrient inputs require repeated replenishment and represent a recurring cost component in system operation.

- For instance, CANNA’s buffered coco coir substrates feature an air-filled porosity of approximately 28% and water-holding capacity exceeding 60%, enabling stable root-zone moisture levels in commercial tomato systems spanning more than 1,000 m², while also supporting uniform EC distribution during 24-hour fertigation cycles.

By Crop Type

Vegetables remain the dominant crop sub-segment, accounting for the largest share due to strong household and commercial demand for leafy greens, tomatoes, cucumbers, and peppers cultivated under predictable, pesticide-free conditions. Automated hydroponic systems ensure consistent nutrient delivery, climate control, and rapid harvest cycles, making them ideal for high-turnover vegetable production. Fruits, flowers, herbs, fodder, and cannabis continue to grow as specialty segments, with cannabis showing accelerated adoption in regions with regulated cultivation frameworks. However, vegetable production maintains leadership because of higher global consumption volumes and shorter crop durations that support year-round automated harvesting.

Key Growth Drivers

Rising Urbanization and Demand for Space-Efficient Food Production

Accelerating urbanization and shrinking arable land continue to fuel demand for space-efficient, high-yield food production systems, positioning automated hydroponic gardening as a practical solution for modern cities. Consumers and commercial growers increasingly turn to vertical farming modules, balcony units, and indoor racks that optimize limited square footage while delivering reliable output. Automation technologies including programmable dosing, intelligent irrigation, and integrated sensor arrays further reduce human intervention and allow even novice users to maintain consistent plant health. Urban households favor these systems for their ability to produce fresh vegetables, herbs, and fruits year-round without soil, pests, or weather-related disruptions. Additionally, government-led smart city initiatives and urban farming incentives support adoption among residential users, schools, and community programs. As densely populated regions seek self-sufficiency and localized food supply chains, automated hydroponic gardening systems become instrumental in addressing sustainability goals, food accessibility, and consumer interest in clean, pesticide-free produce.

· For example, Heliospectra’s ELIXIA LED horticulture platform integrates with the company’s helioCORE™ software to provide automated light scheduling, intensity management, and multi-channel spectral control. The system is widely used in vertical farming racks with multiple tiers, allowing growers to fine-tune lighting conditions for consistent crop performance.

Advancements in Sensor-Based Automation and Smart Farming Technologies

Technological innovation strongly accelerates the adoption of automated hydroponic systems, especially as IoT sensors, AI-driven controllers, and cloud-connected monitoring platforms become more affordable and accessible. Systems equipped with automated nutrient dosing, pH regulation, climate control, and real-time anomaly detection significantly reduce the risk of human error and ensure consistent crop performance. Growers benefit from data-rich dashboards that provide insights on root-zone conditions, water usage, crop growth cycles, and system efficiency, enabling precise decision-making and predictive adjustments. Integration of machine learning allows advanced systems to optimize lighting schedules, aeration patterns, and nutrient calibration based on crop type, environmental readings, and previous yield outcomes. These innovations support commercial farms, research facilities, and smart home users seeking reliable, high-output cultivation with minimal labor. As automation continues scaling across residential and industrial agriculture, sensor-enhanced hydroponics will remain at the center of modern controlled-environment farming.

- For instance, Autogrow’s IntelliDose system regulates pH and EC with dosing accuracy within ±0.1 pH and ±0.1 mS/cm, while its multi-sensor modules track temperature, humidity, and nutrient levels across zones in real time.

Increasing Consumer Preference for Pesticide-Free and Sustainable Produce

Growing awareness of food safety, chemical-free farming, and sustainability has become a major catalyst for automated hydroponic gardening adoption. Consumers increasingly demand fresh vegetables, herbs, and fruits grown without pesticides, synthetic fertilizers, or soil contaminants preferences that automated hydroponic systems naturally support. These systems use significantly less water than traditional agriculture, often reducing consumption by up to 90% through recirculating designs that minimize waste. Additionally, the ability to cultivate year-round in controlled indoor environments ensures consistent supply regardless of external climate variability, droughts, or soil degradation. For households, hydroponic units offer the appeal of hyper-local food production, reducing dependency on long-distance supply chains and lowering greenhouse gas emissions associated with transportation. Meanwhile, businesses and institutions adopt hydroponics to meet ESG priorities and sustainable sourcing commitments. As environmental stewardship and health-conscious purchasing gain momentum globally, demand for automated, eco-friendly food production technologies continues to strengthen.

Key Trends & Opportunities

Expansion of Home-Based Smart Gardening Ecosystems

The surge in smart home adoption creates new opportunities for manufacturers to integrate automated hydroponic gardening systems with broader connected ecosystems. Users increasingly expect seamless control through mobile apps, voice assistants, and cloud-linked platforms that allow monitoring of pH levels, lighting schedules, nutrient dosing, and growth progress from anywhere. Compact countertop hydroponic kits, modular vertical racks, and plug-and-play indoor gardens appeal to tech-forward consumers seeking convenience, sustainability, and freshness at home. Manufacturers are responding with integrated LED grow lights, automated nutrient cartridges, predictive alerts, and subscription-based consumable refills. The trend is further reinforced by rising interest in wellness, organic food production, and hobby gardening among younger demographics. As consumer expectations shift toward app-driven, low-maintenance indoor farming, companies offering intuitive, aesthetically designed, and fully automated systems stand to capture significant growth within the residential segment.

- For instance, AeroGarden’s Wi-Fi–enabled Bounty Elite system connects to the AeroGarden app and supports automated control of pump cycles, with its 50 W full-spectrum LED array delivering light intensities up to 2,500 lumens to sustain herb and leafy-green growth in compact indoor settings.

Growing Commercial Adoption Across Restaurants, Retailers, and Institutions

Commercial establishments including restaurants, supermarkets, hotels, universities, and corporate campuses are increasingly adopting automated hydroponic systems to produce fresh, on-site ingredients and enhance sustainability branding. Farm-to-fork operations benefit from reduced spoilage, improved flavor quality, and real-time harvest control, making hydroponics an appealing option for culinary and retail environments. Automated systems simplify labor requirements while ensuring consistent production through integrated climate management, nutrient dosing, and automated irrigation. Retailers leverage in-store hydroponic displays to promote freshness and transparency, allowing customers to witness real-time crop growth. Institutions adopt the systems for research, educational purposes, and self-sustaining food programs. The commercial opportunity continues to expand as businesses seek cost-efficient methods to grow specialty herbs, microgreens, and premium produce with predictable output, minimal footprint, and improved inventory control.

· For example, Urban Cultivator’s Commercial model is widely used in restaurants and culinary schools and features fully automated irrigation and climate-managed growth chambers. The unit supports multiple trays simultaneously and uses controlled full-spectrum LED lighting around 4,000 K to maintain consistent microgreen development across varieties.

Opportunity for Sustainable, Water-Efficient Agriculture in Arid Regions

Hydroponics presents a transformative opportunity for regions facing water scarcity, degraded soil conditions, and extreme climates. Automated hydroponic systems offer significant water savings through recirculation and controlled nutrient delivery, making them highly suitable for arid and semi-arid regions across the Middle East, Africa, and parts of Asia. Governments and private developers increasingly invest in controlled-environment agriculture (CEA) to reduce dependency on food imports and strengthen domestic supply resilience. Automation further enhances feasibility by reducing operational skill requirements and enabling remote monitoring in large-scale desert greenhouses. As climate change intensifies challenges related to soil fertility and freshwater availability, hydroponics becomes a strategic solution for sustainable food production. This creates new investment opportunities for technology providers, agritech developers, and integrators focusing on resilient agriculture.

Key Challenges

High Initial Capital Costs and Technical Complexity

Despite strong market potential, high upfront investment remains a major barrier to widespread adoption of automated hydroponic systems. Commercial-grade installations require substantial expenditure on LED grow lighting, climate control, pumps, dosing units, sensors, and automated control software. Even residential units with advanced features can be cost-prohibitive for first-time users. Technical complexity further compounds the challenge, as growers must understand nutrient chemistry, water management, and system maintenance to achieve optimal results. Although automation reduces human oversight, troubleshooting issues such as pump failures, nutrient imbalances, or pH fluctuations still demands specialized knowledge. These factors slow adoption among entry-level consumers and small enterprises, particularly in price-sensitive markets. Manufacturers must address cost barriers through modular designs, scalable configurations, and user-friendly automation to unlock broader market penetration.

Vulnerability to System Failures and Operational Risks

Automated hydroponic gardening systems depend heavily on continuous power supply, sensor accuracy, and stable mechanical operations. A single pump malfunction, dosing error, or electrical interruption can rapidly disrupt nutrient flow and oxygenation, putting entire crop cycles at risk. System failures are particularly consequential in large-scale installations where high-density plant clusters depend uniformly on automated processes. Additionally, software glitches, sensor drift, and calibration inaccuracies can compromise environmental stability and require immediate intervention to avoid crop loss. While automation enhances efficiency, it also concentrates risk by increasing reliance on interconnected subsystems. Growers must invest in backup power, redundant components, and routine system audits to mitigate operational vulnerabilities. These risks pose ongoing challenges to reliability, especially for new users and cost-constrained operators.

Regional Analysis

North America

North America holds the largest market share of approximately 37–39%, driven by early adoption of controlled-environment agriculture technologies, strong consumer demand for pesticide-free produce, and widespread integration of sensor-based automation in residential and commercial farming. The U.S. leads the region with high uptake among urban households, restaurants, and research institutions investing in precision agriculture. Favorable funding for agri-tech startups and expansion of vertical farming initiatives further accelerates system deployment. Canada’s growth is fueled by climate-controlled greenhouse operations that rely on automated hydroponics to maintain year-round crop production despite harsh seasonal variations.

Europe

Europe accounts for around 28–30% of global market share, supported by strong sustainability policies, rising consumer interest in organic foods, and extensive indoor farming networks across Western Europe. Countries such as the Netherlands, Germany, and France champion hydroponic innovation through highly automated greenhouse clusters and growing investments in urban farming infrastructure. Stringent environmental regulations and energy-efficiency targets encourage adoption of LED grow lights, nutrient-optimization platforms, and automated pH and CO₂ management systems. Increasing retail partnerships, farm-to-store concepts, and integration of hydroponics into educational and community programs further reinforce regional expansion.

Asia-Pacific

Asia-Pacific represents 22–24% of the market and is the fastest-expanding region due to rapidly growing urban populations, limited arable land, and rising demand for reliable food production systems. Japan and South Korea lead in adopting fully automated indoor farms, while China accelerates hydroponic integration within large-scale smart agriculture projects. Southeast Asian nations increasingly adopt compact automated systems to support urban households and small commercial growers. Government-backed agri-modernization programs, rising middle-class consumption, and investments in water-efficient farming technologies are key drivers. The region’s growth trajectory is further strengthened by expanding greenhouse infrastructure in India and Australia.

Latin America

Latin America captures 6–8% of the global market, influenced by growing interest in resource-efficient agriculture and increasing penetration of hydroponic greenhouses in countries such as Brazil, Mexico, and Chile. Climate volatility and soil degradation challenges make automated hydroponics particularly attractive for stable, year-round vegetable and herb production. Commercial adoption is gradually rising among premium food producers, hospitality chains, and research institutions. However, higher initial system costs and limited technical expertise slow adoption in smaller markets. Ongoing government support for sustainable farming and the region’s expanding agri-tech ecosystem help strengthen medium-term growth prospects.

Middle East & Africa (MEA)

The Middle East & Africa region holds 5–6% market share but demonstrates strong long-term potential due to acute water scarcity, harsh climatic conditions, and heavy dependence on food imports. Countries such as the UAE, Saudi Arabia, and Israel invest significantly in automated hydroponic and vertical farming projects to enhance domestic food security. Automation helps optimize water usage, reduce operational labor, and maintain consistent yields in desert environments. In Africa, adoption remains emerging, driven by pilot projects, agri-innovation hubs, and NGO-supported programs promoting resource-efficient urban farming. Gradual infrastructure development will support steady regional expansion.

Market Segmentations:

By Type

By Input

By Crop Type

- Vegetables

- Fruits

- Flowers

- Cannabis

- Fodder Crops

- Herbs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automated hydroponic gardening systems market is characterized by a mix of established agritech manufacturers, smart-home solution providers, greenhouse technology companies, and emerging IoT-driven startups. Players compete on automation capabilities, nutrient-management precision, system scalability, and ease of consumer adoption. Leading companies focus on integrating advanced sensors, adaptive lighting algorithms, and cloud-based monitoring to differentiate product performance and reliability. Partnerships with smart-home ecosystems, retail gardening brands, and commercial farming operators further strengthen market presence. Many vendors pursue subscription-based models for nutrient cartridges, software updates, and maintenance services to enhance recurring revenue. Innovation pipelines increasingly emphasize modular vertical farming racks, compact countertop systems, and AI-powered controllers tailored for diverse user groups. As consumer interest in pesticide-free, home-grown produce rises, and commercial growers seek stable year-round cultivation, competition intensifies around cost efficiency, energy optimization, system durability, and aesthetic design driving continuous technological advancement across the market.

Key Player Analysis

- Hydroponic Systems International (Spain)

- General Hydroponics (U.S.)

- Pegasus Agritech (India)

- Heliospectra AB (Sweden)

- Logiqs B.V. (Netherlands)

- The Scotts Company LLC (U.S.)

- Koninklijke Philips N.V. (Netherlands)

Recent Developments

- In October 2025, Hydroponic Systems International published new technical guidance on integrating sticky traps with biological control in modern IPM programs for hydroponic greenhouses, reinforcing its focus on advanced pest-management solutions that support high-yield automated cultivation.

- In December 2024, Heliospectra AB introduced its Dynamic MITRA X C3 and C4 multi-channel LED solutions, offering precision spectrum control, dynamic zoning, and advanced design tools to optimize crop performance in automated greenhouses and indoor farms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Input, Crop type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automated hydroponic gardening systems will increasingly integrate AI-driven controls for nutrient dosing, lighting optimization, and predictive crop management.

- Adoption of compact, plug-and-play indoor gardening units will grow as households prioritize fresh, pesticide-free produce with minimal maintenance.

- Commercial farms, restaurants, and retailers will expand onsite hydroponic installations to enhance supply-chain resilience and improve product freshness.

- Advancements in energy-efficient LED grow lights will reduce operating costs and support wider system deployment in residential and industrial settings.

- Sensor accuracy and real-time analytics will strengthen system reliability, enabling precise monitoring of pH, EC, CO₂, and environmental conditions.

- Vertical farming models will expand, driven by demand for high-density production in space-constrained urban regions.

- Hydroponics adoption in arid and water-scarce regions will accelerate due to strong water-efficiency advantages.

- Manufacturers will introduce modular, scalable systems to accommodate users ranging from beginners to commercial growers.

- Subscription-based nutrient and consumable delivery models will become more common, increasing recurring revenue streams.

- Collaboration among agritech companies, smart-home platforms, and greenhouse technology providers will drive continuous innovation and market expansion.

Market Segmentation Analysis:

Market Segmentation Analysis: