Market Overview:

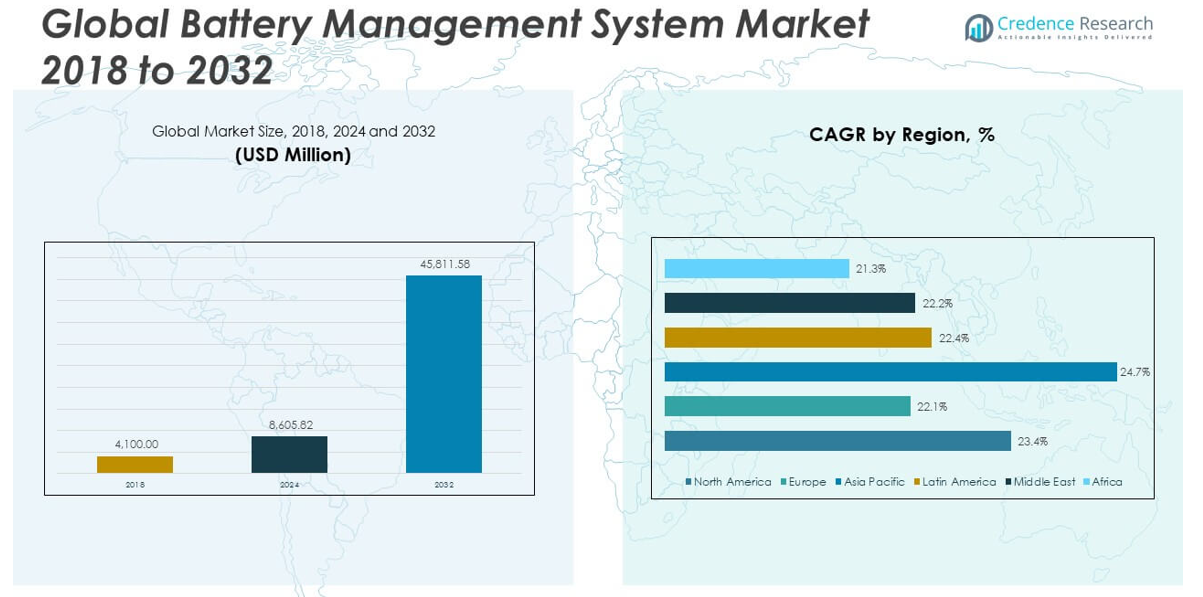

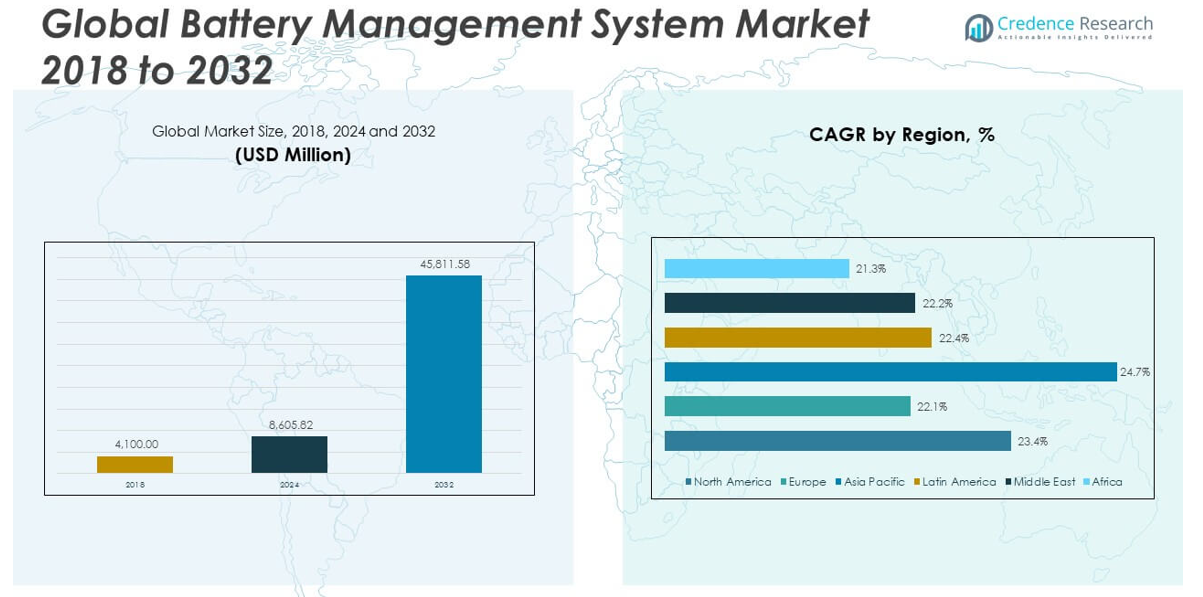

The Battery Management System Market size was valued at USD 4,100.00 million in 2018 to USD 8,605.82 million in 2024 and is anticipated to reach USD 45,811.58 million by 2032, at a CAGR of 23.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Battery Management System Market Size 2024 |

USD 8,605.82 million |

| Battery Management System Market, CAGR |

23.37% |

| Battery Management System Market Size 2032 |

USD 45,811.58 million |

The Battery Management System (BMS) market is primarily driven by the accelerating adoption of electric vehicles (EVs) across the globe. As governments enforce stricter emission regulations and incentivize EV production, automotive manufacturers are integrating advanced BMS to enhance battery safety, efficiency, and lifecycle. In addition, the growing deployment of renewable energy sources such as solar and wind is fueling the demand for energy storage systems, where BMS plays a critical role in ensuring optimal battery performance and grid reliability. Technological advancements in smart battery systems, including real-time monitoring, artificial intelligence integration, and wireless BMS architecture, further contribute to market growth by enabling predictive maintenance and improved energy efficiency. The increasing usage of lithium-ion batteries in consumer electronics, medical devices, and industrial applications also reinforces the demand for sophisticated BMS solutions that can monitor and balance complex battery operations.

Asia Pacific dominates the global Battery Management System market, accounting for the largest revenue share due to the region’s strong presence in electric vehicle manufacturing and battery production. China leads with expansive EV adoption, government subsidies, and investments in battery technologies, making it a central hub for BMS demand. India, South Korea, and Japan are also contributing significantly through their growing automotive industries and renewable energy initiatives. North America holds a substantial market position, supported by favorable regulatory frameworks, increasing electric mobility, and large-scale energy storage projects in the United States and Canada. Europe is witnessing robust growth as well, driven by stringent emission norms, the rise of EV sales, and strategic initiatives like the European Battery Alliance. Countries such as Germany, France, and the Netherlands are investing in domestic battery supply chains, which in turn boosts the regional demand for BMS solutions. Together, these regions are shaping the global BMS landscape through innovation, policy support, and rising consumer demand.

Market Insights:

- The Battery Management System Market was valued at USD 8,605.82 million in 2024 and is projected to reach USD 45,811.58 million by 2032, expanding at a strong CAGR of 23.37%.

- The accelerating global shift toward electric vehicles is a primary growth driver, with automakers integrating BMS to enhance battery safety, efficiency, and lifespan.

- Rising deployment of renewable energy sources like solar and wind is fueling demand for reliable battery storage systems, where BMS ensures performance and grid stability.

- Technological advancements such as AI integration, real-time monitoring, and wireless architecture are enabling smarter and safer battery systems across applications.

- BMS demand is expanding in consumer electronics, industrial automation, and IoT devices, where compact and efficient battery management is essential.

- High customization requirements due to diverse battery chemistries and rising compliance costs present integration and scalability challenges for manufacturers.

- Asia Pacific leads the market with the largest revenue share, followed by North America and Europe, supported by EV manufacturing, energy policies, and battery supply chain investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Electrification of the Automotive Industry is Fueling BMS Demand

The growing shift toward electric vehicles (EVs) is a key driver for the Battery Management System Market. Governments worldwide are enforcing stricter emission regulations, prompting automakers to accelerate EV production. These vehicles require advanced BMS to monitor battery temperature, voltage, current, and state of charge. It ensures safety, enhances battery life, and supports real-time diagnostics for performance optimization. The rise in EV adoption, particularly in China, Europe, and the United States, has significantly boosted the demand for efficient battery management solutions. Manufacturers are also integrating wireless BMS technologies to reduce wiring complexity and improve vehicle efficiency. The transportation sector continues to embrace BMS innovations to meet consumer expectations for safety and extended driving range.

- For example, Texas Instrumentsrecently introduced a wireless BMS for EVs that can collect data from nearly 100 individual battery cells within milliseconds. The system achieves 2-millivolt (mV) accuracy in voltage measurement and boasts an error rate of only 1 packet in 10 million, a performance validated by the independent safety authority TUV SUD for compliance with ISO 26262 ASIL D, the highest automotive safety integrity level.

Growth in Renewable Energy Storage Systems Requires Advanced Battery Oversight

The rapid expansion of renewable energy systems such as solar and wind is increasing reliance on energy storage solutions. These systems depend on battery storage to maintain a stable power supply, and the role of BMS in managing these batteries is becoming increasingly critical. It balances energy input and output, prevents overcharging, and safeguards battery longevity. The rising number of microgrid installations and grid-connected storage systems has created a steady demand for reliable BMS platforms. Battery Management System Market participants are developing scalable, modular BMS designs for large-scale energy storage deployments. Countries with strong renewable energy agendas, including Germany, China, and India, are driving investments in smart battery control technologies. The need to support grid flexibility and ensure uninterrupted power delivery reinforces the importance of BMS integration.

Technological Advancements Are Enabling Smarter and Safer Battery Systems

Ongoing technological innovation is transforming battery management capabilities across industries. Integration of artificial intelligence, real-time analytics, and cloud connectivity has allowed BMS to perform predictive maintenance and dynamic energy optimization. It enables precise monitoring of individual battery cells, reduces downtime, and improves operational efficiency. Leading companies are also adopting digital twin technology to simulate battery behavior under various conditions, helping to prevent faults before they occur. Wireless BMS is gaining traction for its ability to reduce weight and improve signal communication, particularly in automotive and aerospace sectors. The Battery Management System Market is responding to these trends by prioritizing software-defined solutions and advanced data processing tools. Increasing demand for intelligent battery infrastructure across industrial and commercial sectors continues to shape BMS innovation.

- For example, Ayaa Technologyfeatures triple-layer temperature monitoring and argon-based suppression in its BMS for large-format batteries, providing thermal event remediation that extinguishes potential fires in under 60 seconds. Lifecycle tracking mechanisms are embedded to facilitate cell and material recycling at end of life, supporting a circular economy approach.

Rising Consumer Electronics and Industrial Applications Expand BMS Scope

The growing use of rechargeable batteries in smartphones, laptops, power tools, and medical devices has amplified the need for compact and efficient BMS units. These devices require accurate battery monitoring to prevent overheating, maximize charge cycles, and ensure user safety. It plays a vital role in protecting high-density batteries from degradation and thermal runaway. In industrial settings, BMS supports operations in robotics, automated machinery, and warehouse mobility systems. Battery Management System Market vendors are developing customized BMS solutions for these diverse use cases. The continuous growth of the Internet of Things (IoT) ecosystem and portable power technologies adds further momentum to BMS deployment. Consumer demand for reliability, portability, and fast charging reinforces the need for high-performance battery management systems.

Market Trends:

Emergence of Cloud-Connected Battery Management Platforms

Battery management systems are increasingly leveraging cloud computing to enable remote access, data logging, and performance analytics. Cloud-connected BMS allows users to track battery health, usage patterns, and maintenance needs in real time. It improves decision-making for fleet managers, energy operators, and industrial users by centralizing diagnostics across distributed battery networks. This capability also supports firmware updates, software patches, and predictive alerts without physical access. The Battery Management System Market is witnessing increased adoption of cloud-based platforms in commercial fleets, grid storage, and logistics operations. Cloud integration reduces downtime and enhances lifecycle planning by offering intelligent insights from aggregated battery data. Leading vendors are investing in secure and scalable cloud ecosystems tailored to different battery applications.

- For example, NXP Semiconductors has commercialized an AI-powered, cloud-connected High-Voltage Battery Management System (HVBMS) using the S32G GoldBox vehicle networking platform. This system integrates with Electra Vehicles, Inc.’s EVE-Ai™ 360 Adaptive Controls to create a real-time digital twin of a battery in the cloud; this approach delivers a documented improvement of battery state-of-health (SOH) accuracy by up to 12%compared to traditional methods.

Standardization and Regulatory Harmonization Are Influencing Product Development

Growing international emphasis on safety and interoperability is pushing BMS manufacturers to comply with global standards. Regulatory agencies across regions are introducing stricter norms for battery certification, thermal management, and fail-safe operations. It influences design frameworks, safety features, and testing protocols in both automotive and stationary energy sectors. The Battery Management System Market is aligning product development with standards such as ISO 26262 for functional safety and IEC 62660 for performance. Standardization fosters consistency, simplifies integration into OEM systems, and supports cross-border deployment of battery-powered solutions. Industry collaboration with regulatory bodies is becoming more frequent to ensure compliance while maintaining innovation. This trend is reshaping how vendors approach R&D, system validation, and product launches.

Growing Focus on Second-Life Battery Applications

Manufacturers and energy providers are exploring the reuse of retired EV batteries in less demanding applications such as stationary storage. This shift toward circular economy practices is creating a secondary demand for BMS tailored to second-life battery packs. It requires systems that can assess residual capacity, monitor inconsistent cell behavior, and adapt to variable performance thresholds. The Battery Management System Market is evolving to offer adaptive BMS solutions capable of managing heterogeneous battery conditions in repurposed deployments. These BMS solutions support safe usage while extending the value of battery assets beyond their original lifecycle. Interest in second-life batteries is increasing among utilities, commercial buildings, and rural electrification projects. This trend presents new revenue opportunities for BMS providers addressing sustainability goals.

- For example, companies such as B2U Storage Solutions have operationalized commercial-scale second-life BMS platforms. Their EV Pack Storage (EPS) technology is deployed in facilities like the SEPV Cuyama site, using hundreds of retired Honda vehicle battery packs that are continuously monitored and automatically disconnected when any parameter exceeds safe operating thresholds.

Miniaturization and Integration into Custom Battery Packs

Demand for compact and embedded BMS units is rising in industries where space, weight, and customization are critical. Portable medical devices, drones, wearable electronics, and micro-mobility solutions require miniature battery packs with built-in management features. It is pushing BMS manufacturers to develop high-density, low-power systems with multilayer protection in small footprints. The Battery Management System Market is expanding its focus beyond large-scale automotive and grid batteries to support these niche and emerging applications. Engineers are embedding BMS functionality directly into battery enclosures to save space and streamline assembly. This trend promotes flexibility and design freedom across consumer electronics, aerospace, and industrial automation markets. Miniaturized BMS solutions are becoming a strategic differentiator in competitive product design.

Market Challenges Analysis:

Complexity in Integration with Diverse Battery Chemistries and Architectures

Battery management systems must operate across a wide range of battery chemistries, including lithium-ion, lead-acid, nickel-metal hydride, and emerging solid-state types. Each chemistry demands unique voltage thresholds, thermal profiles, and safety protocols. This diversity creates challenges in standardizing BMS designs and algorithms across industries. It often requires customized solutions that increase development time, engineering costs, and product complexity. The Battery Management System Market faces mounting pressure to deliver flexible yet precise control mechanisms compatible with both legacy and next-generation battery technologies. Inconsistent battery behavior, especially in large-format or second-life packs, further complicates integration. Managing performance, safety, and compliance across such a fragmented ecosystem limits scalability and slows adoption in cost-sensitive sectors.

High Costs of Advanced BMS Solutions and Regulatory Compliance

The growing need for sophisticated BMS features—such as wireless communication, predictive analytics, and cloud connectivity adds to the total system cost. For price-sensitive markets like entry-level electric vehicles, small-scale energy storage, or consumer electronics, these costs can pose significant barriers. It becomes difficult for manufacturers to balance advanced functionality with affordability, especially in emerging economies. The Battery Management System Market must also navigate evolving safety and environmental regulations, which require rigorous testing, documentation, and certification. These compliance demands increase time-to-market and necessitate investments in specialized resources and testing infrastructure. Smaller vendors often struggle to meet these requirements, limiting their ability to compete globally and slowing innovation cycles.

Market Opportunities:

Expansion of Electric Aviation and Maritime Sectors Unlocks New Demand

Emerging segments such as electric aviation and marine transport are creating promising growth avenues for battery management technologies. Electric aircraft, drones, and electric boats require highly reliable and lightweight BMS to manage battery performance under dynamic operating conditions. These sectors demand real-time diagnostics, thermal regulation, and fault detection for enhanced safety and efficiency. The Battery Management System Market stands to benefit from tailored solutions that meet aviation and maritime regulatory standards. It offers suppliers a chance to diversify their portfolios and tap into high-value, early-stage markets. As electrification spreads across all modes of transport, specialized BMS applications will see growing investment.

Rural Electrification and Microgrid Initiatives Support Market Penetration

Governments and energy developers are investing in off-grid solutions to improve energy access in rural and remote areas. Microgrids and distributed storage systems require dependable battery management to optimize performance and extend battery life in resource-constrained settings. The Battery Management System Market can support these initiatives through low-cost, durable BMS platforms suited for harsh environments. It enables stable electricity supply and supports critical services such as healthcare, communication, and education. Public-private partnerships in regions like Sub-Saharan Africa, South Asia, and Latin America present a significant opportunity for market expansion. These projects increase BMS visibility and adoption beyond industrialized regions.

Market Segmentation Analysis:

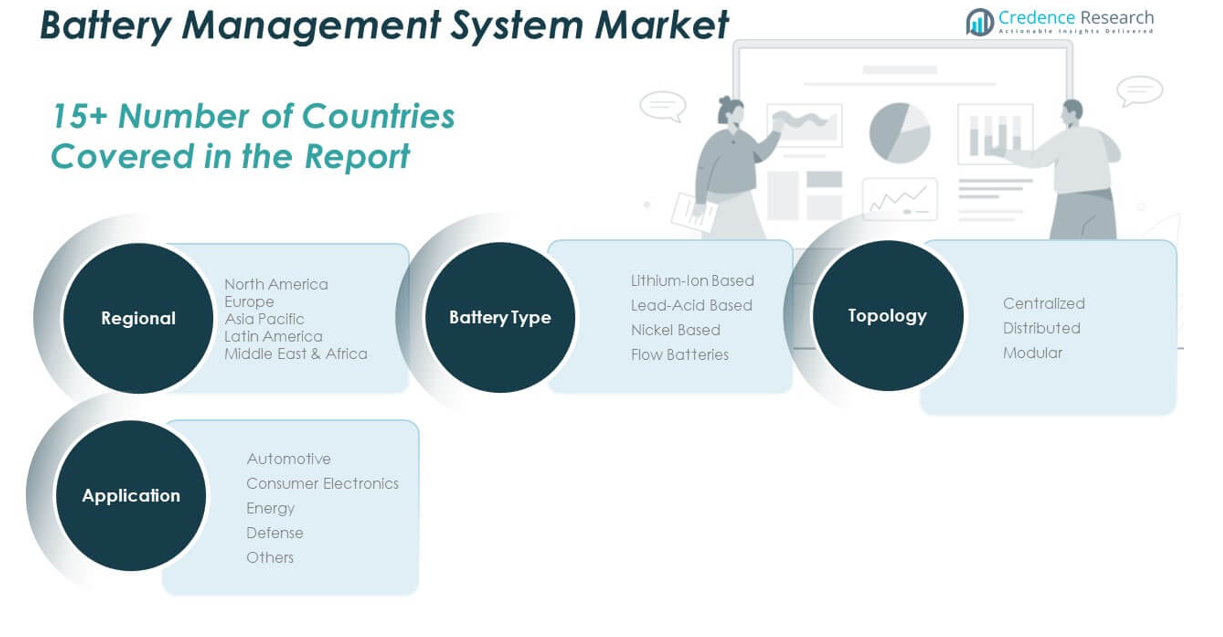

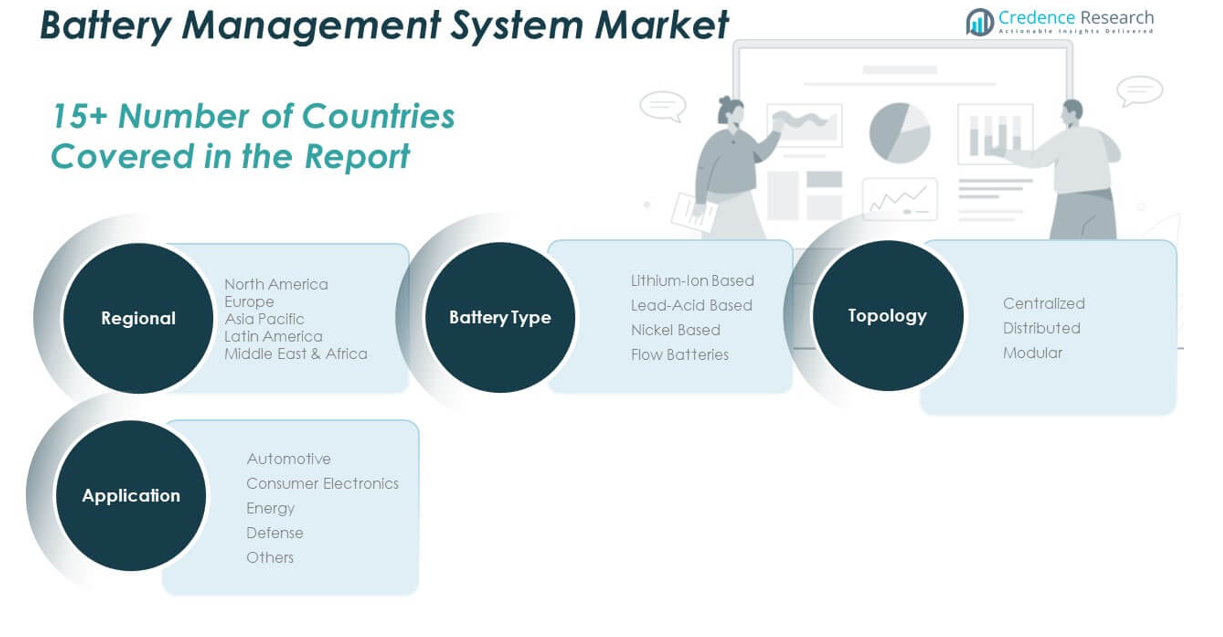

The Battery Management System Market is segmented by battery type, application, and topology, reflecting the diverse requirements across industries and technologies.

By battery types, lithium-ion based systems dominate due to their widespread use in electric vehicles, consumer electronics, and energy storage. It offers high energy density, longer life, and better efficiency, making it the preferred choice. Lead-acid batteries continue to serve industrial and backup power applications, while nickel-based and flow batteries find niche use in specific storage and defense systems.

- For example, Tesla’s 4680 lithium-ion battery cell, used in its Model Y vehicles, achieves an energy density of 272–296 Wh/kgat the cell level.

By application, the automotive segment holds the largest share, driven by the global push for electric mobility. It supports complex battery operations in electric and hybrid vehicles, ensuring safety and performance. Consumer electronics and energy sectors follow closely, benefiting from rising demand for portable devices and renewable energy storage. Defense and other industrial applications also require robust BMS to manage mission-critical battery systems.

By topology, centralized systems are commonly used in simpler battery configurations due to their cost-effectiveness. Distributed BMS offers better scalability and fault tolerance, gaining traction in larger energy storage setups. Modular topology is emerging as a preferred solution in EVs and commercial storage systems, offering flexibility, reliability, and easier maintenance. The Battery Management System Market continues to evolve across all segments to meet the performance, safety, and integration demands of modern battery technologies.

- For example, Microchip’s commercial-grade BMS for e-bikes and scooters features a single-unit controller overseeing 12S–16S lithium battery configurations. The unit measures all cell voltages and temperatures directly, offering a robust, cost-effective solution for small-format packs. With typical voltage monitoring precision at ±10 mV per cell, these units are priced for mass-market deployment and widely adopted in light electric mobility platforms.

Segmentation:

By Battery Type

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Flow Batteries

By Application

- Automotive

- Consumer Electronics

- Energy

- Defense

- Others

By Topology

- Centralized

- Distributed

- Modular

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Battery Management System Market size was valued at USD 1,586.70 million in 2018 to USD 3,292.54 million in 2024 and is anticipated to reach USD 17,504.69 million by 2032, at a CAGR of 23.4% during the forecast period. North America accounts for a significant 24% share of the global Battery Management System Market, driven by strong government support for electric vehicles and clean energy solutions. The region benefits from robust infrastructure, high consumer awareness, and aggressive emission regulations. It continues to witness rising investment in EV manufacturing, battery storage installations, and energy efficiency projects. The United States leads in both commercial deployment and technology innovation, supported by public funding and policy initiatives such as the Inflation Reduction Act. Canada is also expanding its battery supply chain and grid modernization efforts. Demand for advanced, cloud-connected BMS solutions remains strong across automotive, industrial, and utility applications.

Europe

The Europe Battery Management System Market size was valued at USD 757.27 million in 2018 to USD 1,501.48 million in 2024 and is anticipated to reach USD 7,350.59 million by 2032, at a CAGR of 22.1% during the forecast period. Europe holds nearly 17% of the global Battery Management System Market share, supported by strict carbon neutrality targets and a well-established automotive industry. Leading countries like Germany, France, and the Netherlands are actively scaling EV production and battery gigafactories. It benefits from EU-led initiatives like the European Battery Alliance and Green Deal, which prioritize battery value chain development. BMS adoption is expanding into energy storage systems that stabilize intermittent renewable energy. The demand for high-performance and regulation-compliant BMS continues to grow. Europe’s strong focus on sustainability and safety drives steady innovation in the regional market.

Asia Pacific

The Asia Pacific Battery Management System Market size was valued at USD 1,139.80 million in 2018 to USD 2,485.76 million in 2024 and is anticipated to reach USD 14,444.43 million by 2032, at a CAGR of 24.7% during the forecast period. Asia Pacific leads the global Battery Management System Market with a dominant 38% share, driven by high-volume EV manufacturing and battery production, especially in China. It benefits from strong government policies, urbanization, and expanding clean energy investments. China remains the largest consumer and exporter of lithium-ion batteries and BMS components. India, South Korea, and Japan also play a critical role with rapid EV adoption and industrial automation. The region hosts major OEMs and technology developers pushing innovations in wireless and AI-integrated BMS. Demand continues to surge across consumer electronics, automotive, and utility segments.

Latin America

The Latin America Battery Management System Market size was valued at USD 291.10 million in 2018 to USD 605.76 million in 2024 and is anticipated to reach USD 3,017.61 million by 2032, at a CAGR of 22.4% during the forecast period. Latin America accounts for approximately 8% of the global Battery Management System Market share. Brazil and Mexico are leading demand through emerging EV programs, industrial digitization, and energy transition initiatives. It sees growing interest in deploying battery storage to complement solar and wind power in off-grid areas. Government-led electrification projects and smart grid investments create opportunities for BMS deployment. Adoption remains slower compared to developed regions but shows strong upward potential. Regional focus is shifting toward localized manufacturing and tailored solutions for tropical and remote conditions.

Middle East

The Middle East Battery Management System Market size was valued at USD 196.80 million in 2018 to USD 392.37 million in 2024 and is anticipated to reach USD 1,928.92 million by 2032, at a CAGR of 22.2% during the forecast period. The Middle East contributes 6% to the global Battery Management System Market share, supported by clean energy mega-projects and industrial electrification. Countries like the UAE and Saudi Arabia are investing in EV infrastructure and battery storage to diversify their energy portfolios. It sees increasing BMS integration in solar parks, smart city projects, and commercial fleets. The demand for heat-resistant and remote-monitoring-enabled BMS systems is rising in desert environments. Local governments and utilities seek smart battery controls to meet grid reliability standards. The market shows steady growth due to rising sustainability commitments and digital transformation.

Africa

The Africa Battery Management System Market size was valued at USD 128.33 million in 2018 to USD 327.92 million in 2024 and is anticipated to reach USD 1,565.35 million by 2032, at a CAGR of 21.3% during the forecast period. Africa holds roughly 5% of the global Battery Management System Market share, driven by rural electrification efforts and donor-backed renewable projects. Countries like South Africa, Kenya, and Nigeria are promoting decentralized solar and battery solutions. It plays a key role in ensuring battery safety, efficiency, and longevity in microgrids and off-grid systems. Affordability and simplicity are central to BMS demand in this region. Energy access programs and mobile network expansion drive steady adoption in telecom towers and health facilities. The market offers long-term potential supported by energy inclusion and infrastructure development goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Elithion, Inc.

- Johnson Matthey

- Analog Devices, Inc.

- Lithium Balance A/S

- NXP Semiconductors N.V.

- Nuvation

- Texas Instruments Incorporated

- Leclanché SA

- Eberspaecher Vecture Inc.

- Infineon Technologies AG

Competitive Analysis:

The Battery Management System Market remains highly competitive, with key players focusing on innovation, strategic partnerships, and global expansion to strengthen their positions. Major companies such as Robert Bosch GmbH, Panasonic Holdings Corporation, LG Energy Solution, Texas Instruments, and BYD Company Limited lead the market through advanced product development and scalable BMS platforms. It shows growing activity in mergers, acquisitions, and joint ventures aimed at enhancing technological capabilities and extending product portfolios. Startups and mid-sized firms are also entering the space with wireless and AI-enabled BMS solutions tailored for niche applications. The market favors companies that offer high accuracy, real-time analytics, and compatibility with diverse battery chemistries. Regional players in Asia Pacific and North America are gaining traction through local manufacturing and cost-effective offerings. It continues to reward innovation, regulatory compliance, and adaptability across evolving mobility and energy sectors. Competitive intensity is expected to increase with the rise of new energy applications.

Recent Developments:

- In February 2025, KULR Technology Group formed a strategic partnership with Worksport Ltd. to advance battery innovation and boost U.S. manufacturing. They plan joint development of the COR Battery Pack System with optimized BMS cell configurations, enhanced thermal safety, and AI‑driven software for real‑time monitoring and predictive maintenance.

- In September 2024, LG Energy Solution unveiled its next‑generation BMTS platform, branded B.around, designed to streamline battery lifecycle management. The solution offers a comprehensive BMS suite emphasizing customer-centric support

- In Oct 2022, Sensata Technologiesannounced the launch of its new Lithium Balance n3-BMS, an advanced battery management system designed for a wider range of electric vehicle and industrial battery applications. The new product is aimed at supporting high-voltage battery packs and is expected to expand Sensata’s offerings in the rapidly growing battery management system sector.

Market Concentration & Characteristics:

The Battery Management System Market exhibits moderate to high market concentration, with a mix of established global players and emerging technology firms. It is characterized by rapid innovation, strong demand for customization, and increasing emphasis on software-driven solutions. Leading companies dominate through proprietary technologies, economies of scale, and integrated service offerings across automotive, energy, and industrial sectors. The market favors agile firms that can adapt to diverse battery chemistries, regulatory standards, and application-specific requirements. It continues to evolve with trends such as wireless architecture, AI integration, and second-life battery use. High entry barriers related to certification, safety compliance, and R&D investment maintain a competitive advantage for incumbents. The industry remains dynamic, shaped by evolving energy policies and electrification goals across global markets.

Report Coverage:

The research report offers an in-depth analysis based on battery type, application, and topology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing EV adoption worldwide will continue to drive strong demand for advanced battery management systems.

- Expansion of renewable energy storage solutions will create new opportunities for grid-integrated BMS applications.

- Integration of artificial intelligence and machine learning will enhance predictive maintenance and system efficiency.

- Wireless BMS adoption is expected to rise, particularly in automotive and aerospace sectors seeking weight reduction.

- Second-life battery applications will open a new revenue stream for adaptive and reconfigurable BMS platforms.

- Regulatory frameworks will tighten, pushing manufacturers to prioritize safety, compliance, and functional validation.

- Cloud-based BMS solutions will gain traction, offering remote diagnostics and real-time data analytics.

- Demand for modular and scalable BMS architectures will increase to support diverse battery formats and capacities.

- Emerging markets in Asia, Africa, and Latin America will present significant growth potential through electrification initiatives.

- Competitive landscape will intensify with new entrants, fostering innovation and cost optimization across the industry.