Market Overview:

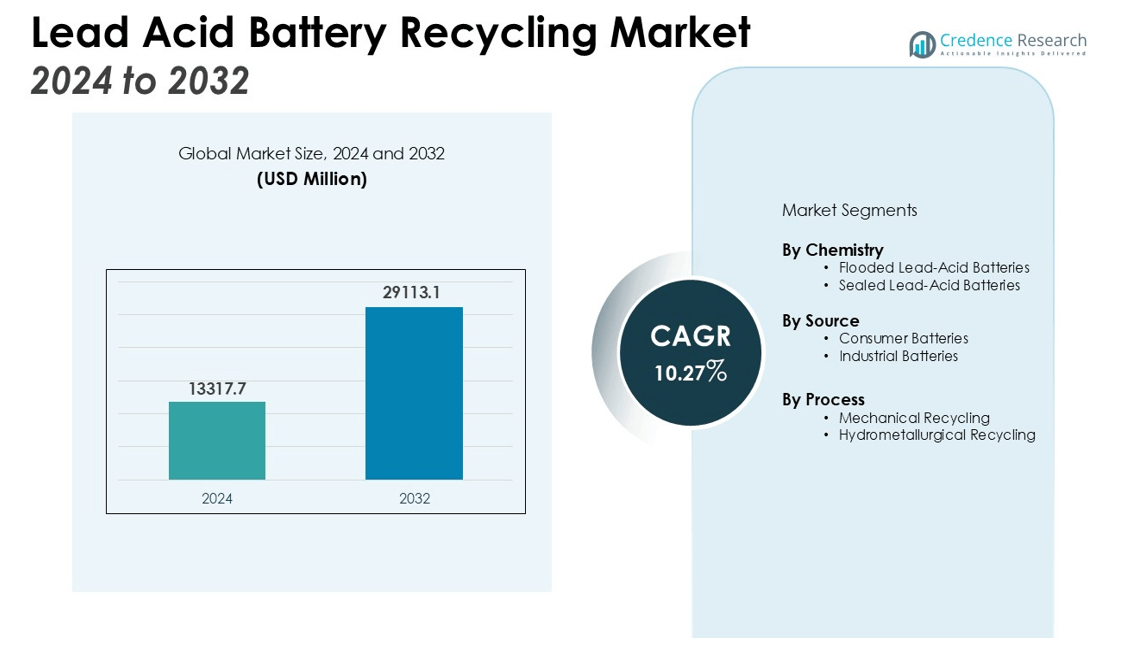

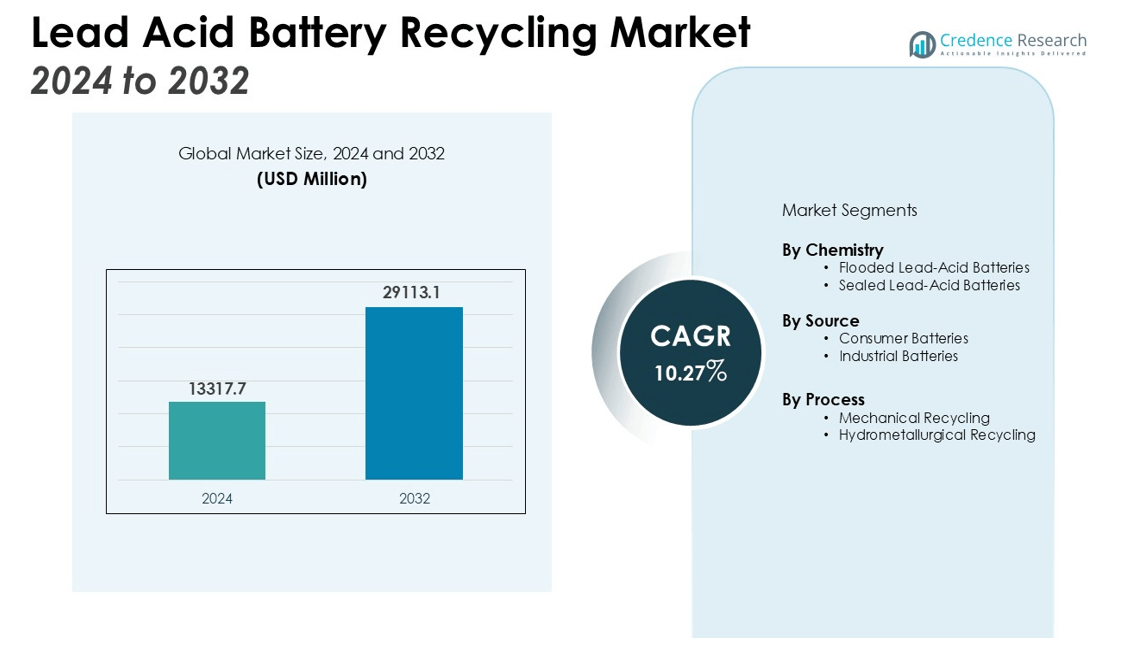

The Lead Acid Battery Recycling Market size was valued at USD 13317.7 million in 2024 and is anticipated to reach USD 29113.1 million by 2032, at a CAGR of 10.27% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lead Acid Battery Recycling Market Size 2024 |

USD 13317.7 million |

| Lead Acid Battery Recycling Market, CAGR |

10.27% |

| Lead Acid Battery Recycling Market Size 2032 |

USD 29113.1 million |

Key drivers of the market include the stringent regulations concerning waste disposal and environmental concerns associated with lead-acid batteries. The growing emphasis on circular economy models and the increasing adoption of electric vehicles (EVs) is propelling demand for lead-acid battery recycling. Additionally, the extraction of valuable materials such as lead, which is crucial for manufacturing new batteries, further fuels market expansion. The technological advancements in recycling processes and the development of eco-friendly recycling methods also contribute to market growth. Furthermore, the increasing focus on reducing environmental pollution and conserving natural resources is driving investments in recycling infrastructure.

Regionally, North America holds the largest market share, driven by the presence of established recycling infrastructure and supportive regulations. Europe follows closely, with stringent environmental regulations and a growing shift toward sustainable practices. The Asia-Pacific region is expected to witness the highest growth rate, fueled by rapid industrialization, urbanization, and growing investments in battery recycling technologies in emerging markets such as China and India.

Market Insights:

- The Lead Acid Battery Recycling Market is valued at USD 13,317.7 million in 2024 and is projected to reach USD 29,113.1 million by 2032, with a CAGR of 10.27%.

- Stringent environmental regulations promote safe disposal and recycling of lead-acid batteries, reducing hazardous material impact.

- The growing adoption of electric vehicles (EVs) boosts the demand for lead-acid battery recycling to support EV infrastructure.

- High demand for reusable materials, such as lead, supports sustainable practices and reduces reliance on raw material extraction.

- Technological advancements in recycling processes increase efficiency, lead recovery, and reduce environmental impact.

- North America holds a 35% market share, supported by strong recycling infrastructure and demand from the automotive and industrial sectors.

- Asia-Pacific, with 20% of the market share, is the fastest-growing region due to industrialization, urbanization, and investments in recycling technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Environmental Regulations and Waste Management Policies

Stringent environmental regulations surrounding lead acid batteries are a major driver of the Lead Acid Battery Recycling Market. Governments worldwide have implemented policies to ensure the safe disposal and recycling of hazardous materials found in these batteries. These regulations help minimize environmental pollution by ensuring that lead and sulfuric acid are properly managed and not released into the ecosystem. Recycling helps meet these regulations and encourages the adoption of safer disposal methods.

- For instance, demonstrating the scale of national collection efforts, the U.S.-based non-profit Call2Recycle successfully collected over 8 million pounds of batteries for recycling in 2023.

Growth of Electric Vehicle Adoption

The rise in electric vehicle (EV) adoption is significantly contributing to the market’s growth. Lead-acid batteries remain a crucial component in various EV applications, including in small-scale vehicles and energy storage systems. As the global EV market expands, the demand for efficient recycling of these batteries increases. The need for sustainable battery disposal methods is essential to support the growing EV infrastructure and reduce battery waste.

- For instance, Johnson Controls produced its 100 millionth battery at its plant in Burgos, Spain.

High Demand for Reusable Materials

The growing demand for lead, a valuable material used in new battery production, drives the recycling market. Lead-acid batteries contain a substantial amount of lead, which can be extracted and reused. This circular economy model offers a sustainable solution to the increasing need for raw materials, supporting both environmental goals and industry requirements. Lead recovery from recycled batteries reduces dependence on mining activities and preserves natural resources.

Technological Advancements in Recycling Processes

Advancements in recycling technology are enhancing the efficiency and sustainability of lead-acid battery recycling. Innovative techniques allow for the recovery of lead and other materials with greater precision and lower environmental impact. These technological improvements not only increase recycling rates but also make the process more economically viable. As the demand for cleaner and more efficient recycling methods rises, the market continues to evolve to meet these expectations.

Market Trends:

Increasing Focus on Sustainable and Eco-Friendly Practices

One of the most prominent trends in the Lead Acid Battery Recycling Market is the growing focus on sustainable and eco-friendly practices. Consumers and businesses alike are placing higher importance on reducing environmental impact, pushing industries to adopt greener recycling processes. Innovations such as closed-loop recycling systems are gaining traction, where materials from used batteries are directly reused to manufacture new batteries, minimizing waste. This trend aligns with global efforts to reduce carbon footprints and improve energy efficiency, encouraging governments and companies to prioritize sustainability in their recycling operations.

- For instance, Veolia’s subsidiary in France, Euro Dieuze Industrie (EDI), processes over 6,000 metric tons of batteries each year.

Advancements in Recycling Technologies and Automation

Technological advancements in recycling processes, particularly automation and AI, are transforming the Lead Acid Battery Recycling Market. Automation in sorting, discharging, and processing batteries is improving efficiency and lowering operational costs. The integration of AI enables more accurate detection of battery components, allowing for better material recovery. These innovations enhance the scalability of recycling operations, making it easier to process larger volumes of batteries. Furthermore, the rise of smart recycling technologies provides valuable data that companies use to optimize their processes and comply with environmental regulations. As these technologies mature, the recycling of lead-acid batteries will become more cost-effective, driving further market growth.

- For instance, ACE Green Recycling has implemented its proprietary zero-emissions technology at the facility of Taiwanese recycler ACME Metal Enterprise, which will have the capacity to process 20,000 metric tons of used lead-acid batteries per year.

Market Challenges Analysis:

High Costs of Recycling Infrastructure and Operations

A significant challenge facing the Lead Acid Battery Recycling Market is the high cost of setting up and maintaining recycling infrastructure. Establishing efficient recycling plants requires substantial capital investment in equipment and technology, particularly for facilities that handle hazardous materials like lead and sulfuric acid. The complexity of recycling processes also adds to operational expenses, making it challenging for smaller companies to enter the market. These high costs can deter investment, limiting the overall growth potential of the recycling sector.

Environmental and Health Risks

The environmental and health risks associated with lead-acid battery recycling present a considerable challenge. Improper handling of lead can lead to contamination of water and soil, posing a serious threat to ecosystems and human health. Despite advancements in recycling technologies, maintaining strict safety standards is essential to mitigate these risks. Ensuring the safe management of toxic substances during the recycling process remains a priority for both regulators and companies in the Lead Acid Battery Recycling Market. These concerns drive up operational costs and require continuous investments in safety protocols and monitoring systems.

Market Opportunities:

Expansion in Emerging Markets

The Lead Acid Battery Recycling Market holds significant growth opportunities in emerging economies, particularly in regions like Asia-Pacific and Latin America. Rapid industrialization and urbanization in countries such as China, India, and Brazil drive the demand for lead-acid batteries in sectors like automotive and energy storage. These regions are investing heavily in battery recycling infrastructure to address rising waste and environmental concerns. As these markets mature, the increasing adoption of sustainable practices and stricter regulations will create a favorable environment for growth in the recycling sector. Companies that can capitalize on this demand and expand operations in emerging markets will find substantial opportunities for long-term success.

Advancements in Battery Recycling Efficiency

Ongoing advancements in battery recycling technologies present an opportunity to significantly improve operational efficiency and material recovery rates. New methods, such as hydrometallurgical and biotechnological approaches, are gaining attention for their potential to reduce environmental impact and enhance lead recovery. These innovations not only improve the sustainability of the recycling process but also offer cost savings by increasing the yield of valuable materials. The ongoing development of more effective recycling solutions will strengthen the Lead Acid Battery Recycling Market, attracting investment and boosting profitability in the long run.

Market Segmentation Analysis:

By Chemistry

The Lead Acid Battery Recycling Market is primarily segmented by chemistry into two categories: flooded and sealed lead-acid batteries. Flooded lead-acid batteries dominate the market, owing to their widespread use in automotive applications. Sealed lead-acid batteries are increasingly preferred for energy storage solutions due to their maintenance-free design and improved safety. Both segments benefit from robust recycling processes that recover lead and sulfuric acid efficiently, making them environmentally sustainable.

- For instance, a 2025 study found that the U.S. lead battery industry, which heavily utilizes flooded batteries, directly and indirectly supports 106,050 jobs nationwide.

By Source

The market is also segmented by source, primarily focusing on consumer batteries and industrial batteries. Consumer batteries, including those used in vehicles and electronics, form the largest segment due to the high number of lead-acid batteries in circulation. Industrial batteries, which power backup systems and renewable energy storage, are growing as industrial applications increase. Both sources require efficient recycling solutions to recover valuable materials and meet environmental standards.

- For instance, in 2022, Call2Recycle collection programs in the U.S. successfully gathered nearly 8 million pounds of batteries for recycling, demonstrating the scale of consumer participation.

By Process

In terms of process, the Lead Acid Battery Recycling Market is divided into mechanical and hydrometallurgical recycling processes. The mechanical process, which involves physical separation and recovery of lead, remains the dominant method due to its cost-effectiveness. Hydrometallurgical processes, which use chemicals to extract lead, are gaining traction due to their higher material recovery rates and environmentally friendly nature. Both processes play an integral role in ensuring the sustainability and profitability of the recycling industry.

Segmentations:

- By Chemistry

- Flooded Lead-Acid Batteries

- Sealed Lead-Acid Batteries

- By Source

- Consumer Batteries

- Industrial Batteries

- By Process

- Mechanical Recycling

- Hydrometallurgical Recycling

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Established Market with Strong Regulatory Support

North America holds the largest share of the Lead Acid Battery Recycling Market, accounting for 35% of the global market. The U.S. and Canada have well-established infrastructure and stringent regulations governing battery recycling, driving market growth. Strong demand from the automotive and industrial sectors further fuels the need for efficient recycling systems. The region’s focus on sustainability and circular economy practices also promotes expansion, creating opportunities for companies to invest in advanced recycling technologies. With a high level of regulatory support, North America remains a key player in the global market.

Europe: Growth Driven by Sustainability Initiatives and Innovation

Europe holds a significant share of the Lead Acid Battery Recycling Market, representing 28% of the global market. The European Union’s commitment to sustainability, coupled with its stringent environmental policies, has fostered a favorable regulatory environment for battery recycling. Countries like Germany, the U.K., and France are leaders in adopting circular economy models, emphasizing the reuse of materials such as lead. The presence of major automotive manufacturers and a strong focus on green energy solutions further contribute to the demand for recycled batteries. Innovation in recycling technologies, especially in countries with robust R&D infrastructure, positions Europe for continued growth.

Asia-Pacific: Fastest Growing Region with Expanding Industrial Demand

The Asia-Pacific region holds 20% of the Lead Acid Battery Recycling Market and is expected to experience the highest growth rate. Countries like China and India are witnessing rapid industrialization and urbanization, leading to increased demand for lead-acid batteries in automotive, energy storage, and industrial applications. Governments in these regions are implementing stricter recycling regulations to combat environmental pollution and waste management issues. The region’s expanding manufacturing base and investments in recycling infrastructure present significant opportunities for market players. With rising environmental awareness, Asia-Pacific offers substantial growth potential in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Call2Recycle, Inc (U.S.)

- Glencore (Switzerland)

- Exide (India)

- SNAM (France)

- Umicore (Belgium)

- Cirba Solutions (U.S.)

- Gravita India Ltd (India)

- Aqua Metals (U.S.)

- EnerSys (U.S.)

- Battery Solutions (U.S.)

Competitive Analysis:

The Lead Acid Battery Recycling Market is competitive, with major players such as Johnson Controls, Exide Technologies, and Aqua Metals leading due to their large-scale operations and advanced recycling technologies. These companies dominate by leveraging extensive recycling infrastructure and adhering to stringent environmental regulations. Smaller regional players also contribute by offering specialized services, particularly in emerging markets where recycling demand is increasing. Technological advancements, including hydrometallurgical processes, are being adopted across the market to improve lead recovery and reduce environmental impact. Competition is intensifying as companies focus on innovation, cost-efficiency, and regulatory compliance to strengthen their market positions and collaborate with automotive and energy storage industries.

Recent Developments:

- In June 2025, Exide Technologies launched its new EZ800 Dual EFB battery, designed for Marine & Leisure applications.

- In July 2025, Call2Recycle launched the first territorial battery recycling program in Yukon, making it the first territory in Canada to join the company’s Extended Producer Responsibility (EPR) program.

- In August 2025, Glencore completed the acquisition of Li-Cycle, a battery recycling company. Following the acquisition, all services and support will be managed through Glencore Battery Recycling (GBR).

Market Concentration & Characteristics:

The Lead Acid Battery Recycling Market exhibits moderate concentration, with a few large players holding significant market share. Key companies, including Johnson Controls, Exide Technologies, and Aqua Metals, dominate the market through established recycling infrastructure, advanced technology, and compliance with environmental regulations. Smaller regional players contribute by focusing on niche services and catering to emerging markets with increasing demand for recycling solutions. The market is characterized by the continuous adoption of technological innovations such as hydrometallurgical recycling and improvements in lead recovery processes. Regulatory compliance and sustainability practices play a central role in shaping competitive dynamics. Companies focus on maintaining cost efficiency, improving recycling efficiency, and meeting rising environmental standards to strengthen their market positions.

Report Coverage:

The research report offers an in-depth analysis based Chemistry, Source, Process and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Lead Acid Battery Recycling Market will experience significant growth driven by increasing demand for lead-acid batteries in electric vehicles and energy storage systems.

- Advancements in recycling technologies, such as hydrometallurgical processes, will enhance efficiency and material recovery rates.

- Governments worldwide will implement stricter regulations, further encouraging the adoption of sustainable battery recycling methods.

- The expansion of the circular economy model will lead to a higher recovery of valuable materials like lead, reducing the dependency on mining operations.

- Growing environmental awareness among consumers will push industries to adopt more eco-friendly recycling practices.

- Emerging markets, particularly in Asia-Pacific, will witness the highest growth, spurred by rapid industrialization and urbanization.

- Investments in recycling infrastructure will increase, especially in regions with high demand for recycled materials and regulatory pressures.

- Companies will focus on improving operational efficiency through automation and AI-driven technologies in the recycling process.

- The increasing focus on sustainability in the automotive and industrial sectors will drive further demand for lead-acid battery recycling.

- Collaboration between battery manufacturers, recyclers, and regulators will be essential for shaping the future of the market, ensuring higher compliance with environmental standards.