Market Overview:

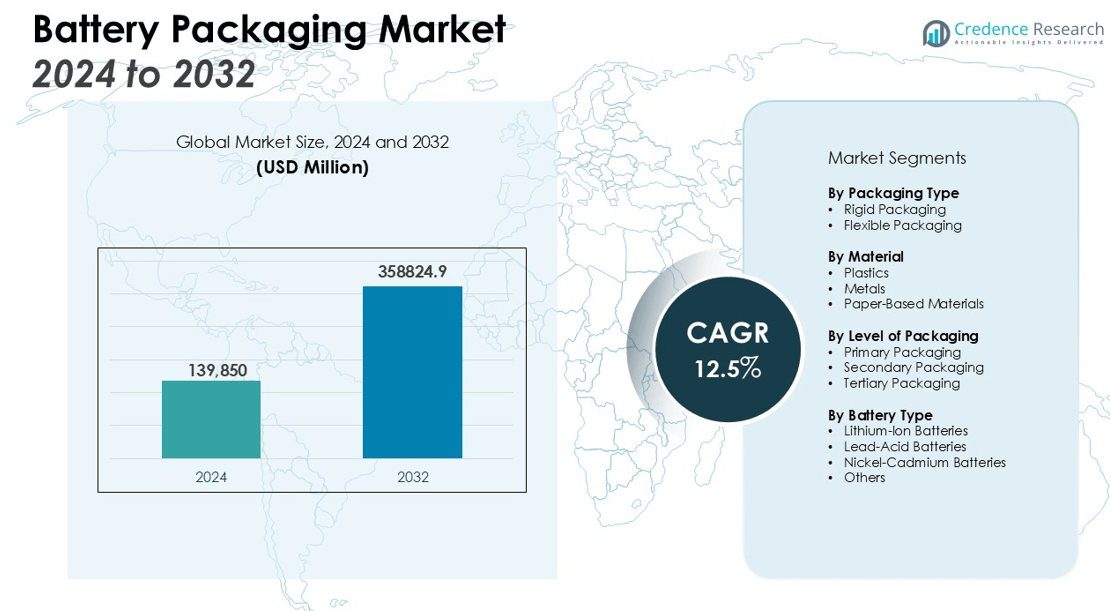

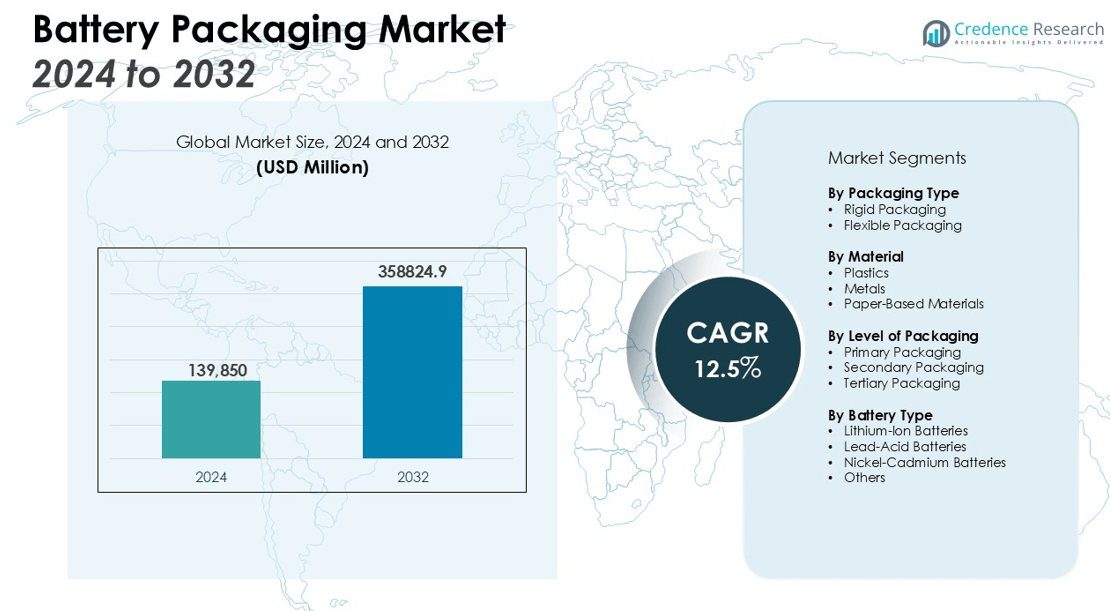

The Battery Packaging Market size was valued at USD 139,850 million in 2024 and is anticipated to reach USD 358824.9 million by 2032, at a CAGR of 12.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Battery Packaging Market Size 2024 |

USD 139,850 million |

| Battery Packaging Market, CAGR |

12.5% |

| Battery Packaging Market Size 2032 |

USD 358824.9 million |

Key market drivers include the growing focus on sustainability, with manufacturers increasingly seeking eco-friendly and recyclable packaging materials to meet regulatory standards and consumer expectations. The increasing adoption of lithium-ion batteries, owing to their high energy density and long lifespan, is also fueling the demand for specialized battery packaging. Furthermore, innovations in packaging technology, such as smart packaging solutions with enhanced protection and monitoring capabilities, are gaining traction across industries. The rising emphasis on energy efficiency and safety features is pushing manufacturers to develop advanced packaging that can protect against thermal runaway and enhance the performance of batteries.

Regionally, North America holds a dominant share in the battery packaging market, supported by the rapid growth of the EV and consumer electronics industries. The Asia Pacific region is anticipated to experience the highest growth rate during the forecast period, driven by the booming automotive and electronics sectors in countries like China, Japan, and India.

Market Insights:

- The Battery Packaging Market is expected to grow from USD 139,850 million in 2024 to USD 358,824.9 million by 2032, with a CAGR of 12.5% during the forecast period.

- The shift towards eco-friendly and recyclable materials in packaging is driving innovation to meet regulatory standards and consumer demands.

- Advancements in lithium-ion battery technology are increasing the need for specialized packaging to ensure battery safety and performance.

- The growth of the electric vehicle and consumer electronics sectors is accelerating the demand for compact, efficient, and reliable battery packaging solutions.

- Safety and protection features are becoming a priority, with manufacturers focusing on packaging solutions that protect against thermal runaway and extend battery life.

- North America, Asia Pacific, and Europe are key regions driving the market, with each region focusing on EV adoption, battery manufacturing, and sustainability.

- The high costs of advanced materials and smart packaging technologies pose challenges for manufacturers, making it difficult to balance affordability with innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Sustainable and Eco-Friendly Packaging Solutions

The growing focus on sustainability significantly impacts the Battery Packaging Market. With increasing environmental concerns, manufacturers are shifting towards eco-friendly and recyclable materials for packaging. Consumers and businesses alike are demanding greener alternatives that reduce environmental footprints. Regulatory bodies across regions are also tightening packaging standards, prompting companies to prioritize sustainability. This trend is driving innovation in packaging materials, ensuring that products meet both consumer expectations and regulatory requirements. As companies aim to align with environmental goals, demand for sustainable packaging solutions continues to rise.

Advancements in Battery Technology Fueling Packaging Needs

Technological advancements in battery design and efficiency are another critical driver of the Battery Packaging Market. The increasing adoption of lithium-ion batteries, due to their high energy density and longevity, has intensified the need for specialized packaging solutions. Batteries must be packaged securely to maintain their performance and ensure safe handling during transportation and use. With the expanding use of these batteries in electric vehicles, renewable energy storage, and consumer electronics, packaging solutions must adapt to meet the evolving demands of modern battery technologies.

- For instance, Asahi Kasei’s proprietary acetonitrile-based electrolyte enabled prototype cylindrical lithium-iron phosphate battery cells to achieve high power at −40°C and double the cycle life at 60°C before reaching 80% state of health, compared to cells with conventional electrolyte.

Focus on Safety and Protection Features in Battery Packaging

The need for enhanced safety and protection is a growing concern in the Battery Packaging Market. With the increasing use of high-energy-density batteries, there is a heightened risk of thermal runaway and other safety hazards. Packaging solutions that offer improved protection against such risks are in high demand. Companies are developing advanced packaging materials that provide insulation, shock absorption, and fire-resistant properties. This focus on safety not only ensures battery longevity but also reduces the likelihood of accidents and extends battery life.

- For instance, Shenzhen Kedali Industry’s battery packaging shells are used in over 60 advanced battery system designs, and their engineering reduces cell movement by 70 millimeters, significantly improving safety and stability for critical applications.

Expansion of Electric Vehicles and Consumer Electronics Driving Market Growth

The rapid growth of electric vehicles (EVs) and consumer electronics sectors is a major factor driving the Battery Packaging Market. As these industries expand, the need for efficient, reliable, and safe battery packaging solutions becomes more pronounced. The automotive industry’s shift towards electric mobility has led to a surge in battery demand, requiring specialized packaging for larger battery packs. Similarly, consumer electronics, such as smartphones, laptops, and wearables, demand compact and lightweight packaging solutions. These trends are further accelerating the growth of the battery packaging market.

Market Trends:

Increasing Adoption of Smart Packaging Solutions in Battery Packaging

A key trend in the Battery Packaging Market is the growing adoption of smart packaging technologies. These packaging solutions integrate sensors and monitoring systems to enhance battery performance and ensure safety throughout its lifecycle. By embedding smart technologies, packaging can track critical parameters such as temperature, humidity, and pressure, providing real-time data to detect potential issues before they arise. This trend is particularly prominent in sectors where battery safety is crucial, such as electric vehicles and renewable energy storage. The ability to monitor battery conditions helps prevent overheating or damage, improving overall performance and longevity. As consumer demand for advanced, reliable, and safe battery-powered devices increases, smart packaging solutions are becoming integral to the industry.

- For instance, CATL’s battery management system is installed in over 30,000,000 battery packs worldwide and, in every single second of operation, can monitor the voltage and temperature of every cell 12.5 times, and collect current data from the battery pack 200 times, ensuring detailed real-time cell-level diagnostics on a massive global scale.

Shift Toward Sustainable Packaging Materials and Design Innovations

The Battery Packaging Market is also witnessing a significant shift towards sustainable materials and innovative designs. With increasing concerns over environmental impact, companies are prioritizing the use of recyclable, biodegradable, and eco-friendly materials in battery packaging. Innovations in packaging designs, such as lightweight, minimalistic packaging that reduces material waste, are gaining traction across industries. These design changes not only address environmental concerns but also improve efficiency and cost-effectiveness. Consumers are increasingly inclined towards brands that adopt environmentally conscious practices, which is further driving the demand for sustainable packaging solutions. As the market grows, this trend toward sustainable innovation in packaging is expected to become a critical factor in the competitive landscape.

- For instance, Duracell introduced curbside recyclable, all-cartonboard paper-blister packaging for its batteries in 2025, which will enable Walmart alone to reduce its battery packaging materials by approximately 855,000 pounds each year.

Market Challenges Analysis:

Increasing Regulatory Pressures and Safety Concerns

A significant challenge facing the Battery Packaging Market is the increasing regulatory pressures surrounding safety standards. With the rising use of high-energy-density batteries, there is a growing emphasis on ensuring safe transportation and handling. Stringent regulations related to packaging materials and processes are pushing manufacturers to comply with evolving safety norms. Failure to meet these standards could result in penalties, recalls, and brand reputation damage. The challenge lies in balancing the need for compliance with the demand for cost-effective packaging solutions. As regulations continue to tighten globally, the market must adapt to maintain safety without compromising on packaging efficiency.

High Costs of Advanced Materials and Technologies

The high costs associated with advanced materials and technologies present another challenge in the Battery Packaging Market. While the demand for smart packaging and sustainable materials is rising, the production and integration of such innovations often require significant investment. Advanced packaging solutions, such as those incorporating sensors and protective features, can be expensive to manufacture. The cost of eco-friendly materials can also be higher than conventional alternatives, making it difficult for some companies to adopt them without increasing product prices. These factors pose a challenge for manufacturers aiming to remain competitive while addressing consumer demand for both high-quality and affordable packaging.

Market Opportunities:

Expansion of Electric Vehicle (EV) Market Driving Demand for Battery Packaging

The rapid growth of the electric vehicle (EV) market presents significant opportunities for the Battery Packaging Market. As the adoption of EVs continues to accelerate, the demand for advanced battery technologies and specialized packaging solutions grows. Battery packs in electric vehicles require secure, efficient, and sustainable packaging to ensure safety and performance. Manufacturers have the opportunity to cater to this expanding market by developing tailored packaging solutions that address the specific needs of high-performance EV batteries. With the global push toward cleaner energy and the increasing need for electric mobility, the demand for reliable battery packaging solutions is expected to continue rising.

Rise in Renewable Energy Storage Systems Offering Packaging Solutions

The increasing demand for renewable energy storage systems also presents a growing opportunity for the Battery Packaging Market. As more companies and governments invest in solar, wind, and other renewable energy sources, the need for efficient and durable energy storage solutions is expanding. Batteries used in energy storage systems require specialized packaging to maintain safety, performance, and longevity. Companies can tap into this market by providing packaging solutions that address these unique requirements, including those that enhance battery life and offer thermal protection. This trend opens up new avenues for growth in both industrial and residential energy storage sectors.

Market Segmentation Analysis:

By Packaging Type

The Battery Packaging Market is segmented into rigid and flexible packaging types. Rigid packaging is primarily used for high-capacity batteries, such as those in electric vehicles and large-scale energy storage systems, as it offers enhanced durability and safety during transportation. Flexible packaging is more common for smaller batteries, like those used in consumer electronics, as it provides flexibility and ease of use for compact applications.

- For instance, researchers at The Hong Kong Polytechnic University created a textile lithium-ion battery less than 0.5mm thick, which can be bent to a radius below 1mm and maintains full capacity after 1,000 folding cycles.

By Material

The market is divided into plastics, metals, and paper-based materials. Plastics dominate the sector due to their lightweight nature, cost-effectiveness, and ability to offer protection against moisture and impact. Metals, particularly aluminum, are preferred for premium applications requiring higher durability and heat resistance. Paper-based materials are gaining attention in the market due to their environmentally friendly characteristics, although they are less common compared to plastics and metals.

- For instance, Flora Food Group introduced a fully recyclable, plastic-free paper tub for plant-based spreads, which won the Overall Winner award at the 2024 European Packaging Awards after four years of R&D.

By Level of Packaging

The market is further segmented by primary, secondary, and tertiary packaging. Primary packaging directly encases the battery, ensuring its safety and functionality. Secondary packaging groups individual batteries, providing added protection during handling and transportation. Tertiary packaging is used for bulk storage and transit, focusing on safeguarding larger quantities of batteries. The growth of electric vehicles and consumer electronics drives demand for specialized packaging solutions at all levels to ensure battery protection, safety, and regulatory compliance.

Segmentations:

By Packaging Type

- Rigid Packaging

- Flexible Packaging

By Material

- Plastics

- Metals

- Paper-Based Materials

By Level of Packaging

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Battery Type

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Nickel-Cadmium Batteries

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Strong Demand Driven by Electric Vehicle and Consumer Electronics Sectors

North America holds a dominant share of 35% in the Battery Packaging Market, driven by the expansion of electric vehicles (EVs) and the consumer electronics sector. The region’s automotive industry, particularly the shift towards electric mobility, has created a significant demand for specialized battery packaging solutions. The U.S. and Canada are investing heavily in EV production, further fueling this market. The consumer electronics sector, especially in the U.S., also relies on advanced battery technologies, increasing the need for high-quality packaging solutions. Regulatory frameworks in North America push for stricter safety standards, compelling manufacturers to invest in packaging that ensures battery security and meets safety regulations. The region’s robust demand for efficient and sustainable packaging solutions is expected to continue as EV adoption accelerates and the electronics market grows.

Asia Pacific: Rapid Growth in Battery Manufacturing and Electric Vehicle Adoption

Asia Pacific accounts for a 40% share in the Battery Packaging Market, making it the fastest-growing region. Key economies like China, Japan, and India are leading in battery production and adoption. China, as a global leader in battery manufacturing, has seen significant demand for high-performance packaging solutions, particularly driven by the rapid growth of the electric vehicle and consumer electronics industries. India and Japan are also experiencing a surge in electric vehicle adoption, further creating opportunities for specialized battery packaging solutions. The region’s manufacturing base is robust, and with a growing focus on sustainability, there is increasing demand for both advanced packaging technologies and eco-friendly materials. The expansion of the renewable energy sector in the region also contributes to the rising need for energy storage systems and corresponding packaging solutions.

Europe: Increasing Regulatory Focus and Shift Towards Sustainable Packaging Solutions

Europe commands a 25% share of the Battery Packaging Market, driven by stringent environmental regulations and a growing focus on sustainability. The European Union’s regulations push for the use of recyclable and eco-friendly materials in packaging, thereby increasing demand for sustainable battery packaging solutions. The automotive sector in countries like Germany and France is transitioning rapidly toward electric vehicles, driving the demand for specialized battery packaging. In addition, Europe’s commitment to renewable energy adoption has fueled the growth of energy storage systems, creating a parallel need for innovative packaging solutions. As companies across Europe strive to meet both regulatory requirements and consumer demand for sustainable practices, the region continues to play a pivotal role in the Battery Packaging Market’s development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Key Player Analysis:

- NEFAB GROUP

- Wellplast AB

- C.L. Smith

- DGM

- Söhner Kunststofftechni GmbH

- GWP Protective

- Manika Plastech Pvt. Ltd.

- Covestro AG

- Labelmaster

- VIKING PLASTICS

- Trinseo

- CHEP

- EaglePicher Technologies

- Anchor Bay Packaging

Competitive Analysis:

The Battery Packaging Market is highly competitive, with key players focusing on innovations in packaging materials and technology to maintain market leadership. Leading companies are investing in eco-friendly and sustainable solutions to meet growing consumer demand and comply with stringent regulations. Packaging manufacturers are also enhancing their product offerings with smart packaging solutions, integrating sensors for battery monitoring and protection. Companies such as Amcor, Berry Global, and Sealed Air are advancing their technologies to provide enhanced safety, performance, and longevity for batteries. The rising demand for electric vehicles and consumer electronics presents significant growth opportunities for these players, pushing them to continuously innovate and improve their packaging solutions. Market participants are also leveraging strategic partnerships and acquisitions to expand their product portfolios and regional presence. The increasing focus on reducing carbon footprints and improving battery efficiency further intensifies competition among key players in the market.

Recent Developments:

- In May 2025, Nefab launched a new US-based web shop to provide American customers with quick access to standard packaging, including trays, thermoformed pallets, and rack accessories, all manufactured and fulfilled domestically.

- In May 2025, Nefab Group acquired Embalajes Echeberria, a Basque company in Spain specializing in heavy-duty and custom packaging solutions, further expanding Nefab’s reach and capability to support sectors including energy, defense, and aerospace.

Market Concentration & Characteristics:

The Battery Packaging Market is moderately concentrated, with a mix of global and regional players competing for market share. Large multinational companies, such as Amcor and Berry Global, dominate the market with their extensive product portfolios and technological innovations. These players focus on developing sustainable, smart packaging solutions to meet increasing demand from the electric vehicle and consumer electronics sectors. The market also features numerous regional players offering specialized packaging solutions tailored to local industry needs. With rapid technological advancements and growing regulatory requirements, manufacturers are under pressure to invest in new materials and designs that enhance battery safety, performance, and environmental sustainability. Competitive rivalry is high, with companies striving to differentiate their offerings through innovation, cost efficiency, and compliance with global packaging standards. The market’s dynamics are influenced by both large-scale manufacturers and niche players contributing to specialized packaging solutions.

Report Coverage:

The research report offers an in-depth analysis based on Packaging Type, Material, Level of Packaging, Battery Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Battery Packaging Market will continue to grow as demand for electric vehicles and renewable energy storage solutions increases.

- Asia Pacific will maintain its leadership, with China, Japan, and South Korea driving battery manufacturing and adoption.

- North America is expected to see the fastest growth, fueled by investments in EV infrastructure and consumer electronics.

- Europe’s expansion is supported by stringent environmental regulations and a shift toward sustainable packaging materials.

- Lithium-ion batteries will see significant growth, especially in electric vehicles and energy storage systems.

- Smart packaging solutions, including sensors for real-time monitoring, will gain traction to enhance battery safety and performance.

- The demand for recyclable and biodegradable materials will rise in response to environmental concerns and regulatory pressures.

- The growth of e-mobility and renewable energy storage will drive the need for specialized packaging solutions for high-capacity batteries.

- Companies will form strategic partnerships to enhance supply chain efficiency and develop innovative packaging solutions.

- Advancements in packaging materials and designs will improve battery longevity, safety, and performance across various applications.