Market Overview

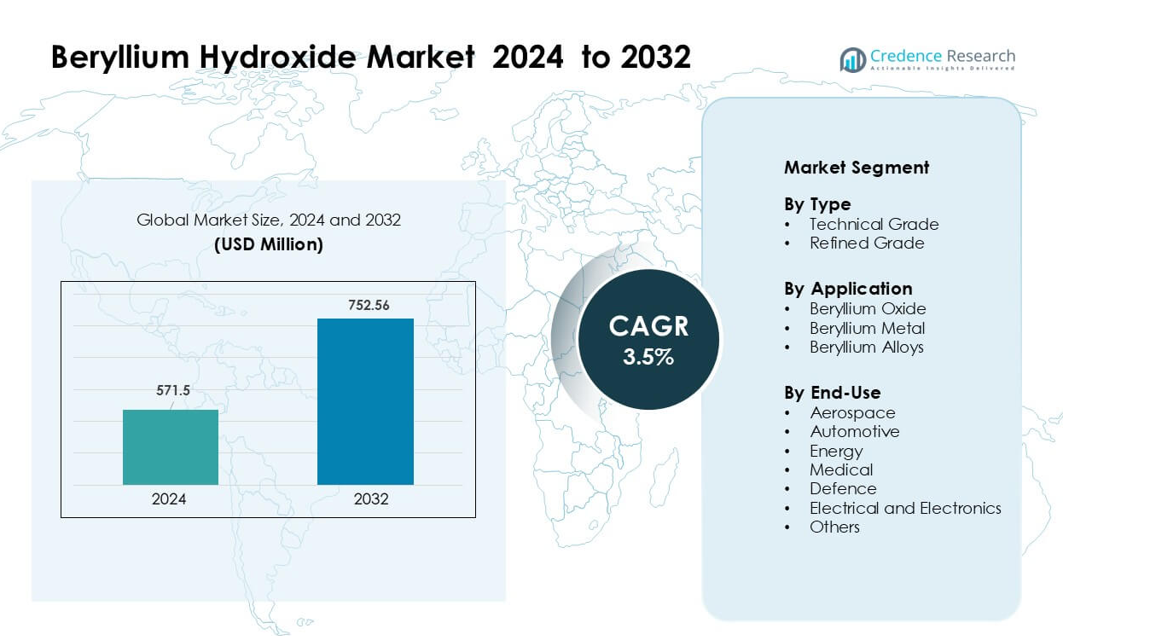

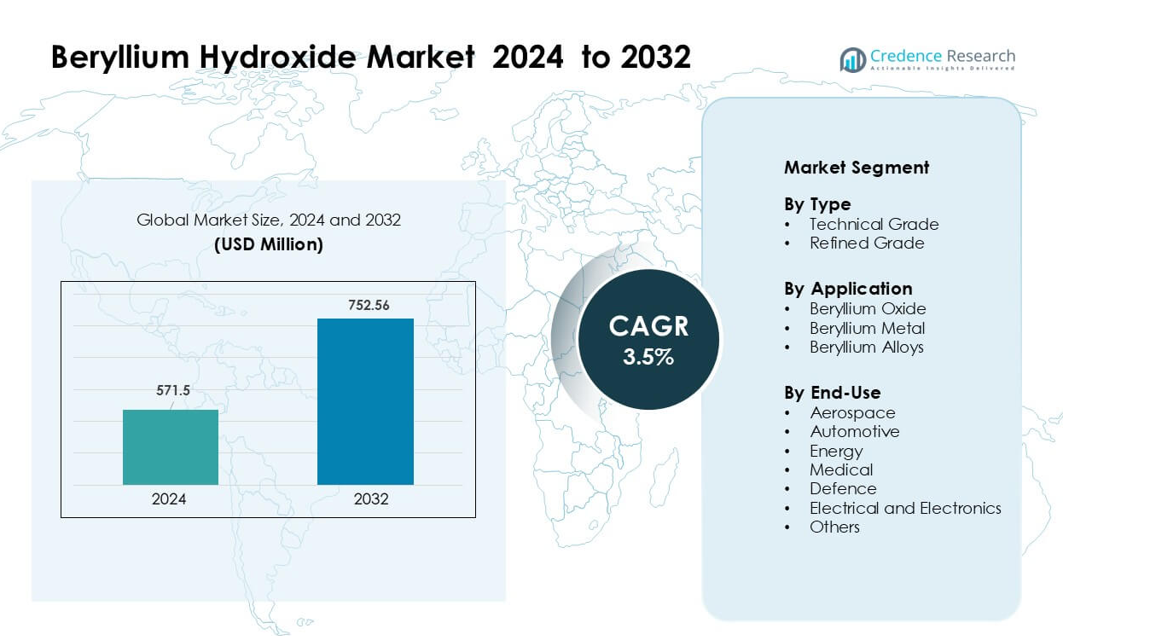

Beryllium Hydroxide Market was valued at USD 571.5 million in 2024 and is anticipated to reach USD 752.56 million by 2032, growing at a CAGR of 3.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Beryllium Hydroxide Market Size 2024 |

USD 571.5 million |

| Beryllium Hydroxide Market, CAGR |

3.5% |

| Beryllium Hydroxide Market Size 2032 |

USD 752.56 million |

Leading companies in the beryllium hydroxide market include Stanford Advanced Materials, NGK Metals Corporation, Xinjiang Nonferrous Metal Industry Group, Materion Corporation, Belmont Metals Inc., Ulba Metallurgical Plant JSC, EaglePicher Technologies LLC, Shanghai Feixing Special Ceramics Factory, IBC Advanced Alloys Corp., and American Beryllia Inc. These players focus on high-purity production, technological upgrades, and supply-chain integration to support aerospace, defense, electronics, and energy applications. North America remained the leading region in 2024 with about 41% share, supported by strong industrial capabilities, advanced refining facilities, and large-scale demand from defense and semiconductor manufacturers.

Market Insights

- The beryllium hydroxide market reached USD 571.5 million in 2024 and is projected to hit USD 752.56 million by 2032, growing at a 3.5% CAGR.

- Rising demand from aerospace, defense, and semiconductor manufacturing acts as a major driver, as these industries use beryllium derivatives for lightweight structures, advanced optics, and high-thermal-performance electronics.

- Trends highlight increased adoption of beryllium oxide ceramics and growing investment in high-precision components for satellites, EV power modules, and advanced communication systems.

- The competitive landscape includes material producers expanding purification capacity and forming partnerships with electronics and aerospace OEMs while facing strict regulatory and safety challenges that increase production costs.

- North America led the market with 41% share, followed by Europe at 27%, while beryllium oxide remained the dominant application segment with about 58% share, supported by strong use in power electronics and thermal management

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Technical grade dominated the beryllium hydroxide market in 2024 with about 63% share. Manufacturers preferred this grade because it supports large-volume processing for beryllium oxide and alloy production. Technical grade also offers stable purity levels for ceramics, sensors, and defense components. Refined grade grew at a steady pace due to rising use in medical devices and specialty electronics. However, technical grade stayed ahead because major producers focused on expanding capacity for high-temperature applications and lightweight structural materials across aerospace and defense programs.

- For instance, Materion Corporation produces beryllium hydroxide at its Delta, Utah plant (sourced from bertrandite ore) and in 2022 the plant had a capacity utilization of 53%.

By Application

Beryllium oxide held the leading position in 2024 with nearly 58% share. Demand stayed strong because beryllium oxide delivers high thermal conductivity and electrical insulation, making it essential for power electronics, semiconductor packaging, and advanced radar systems. Beryllium metal showed moderate growth in precision components, while beryllium alloys saw rising use in connectors and springs. The oxide segment maintained its lead as industries invested in high-performance electronics, electric vehicle systems, and defense-grade communication hardware that depend on stable ceramic substrates.

- For instance, Materion’s beryllium oxide ceramics used in high-power RF devices offer a thermal conductivity of up to 285 W/m·K and maintain dielectric strength above 14 kV/mm, enabling their adoption in radar T/R modules and semiconductor laser assemblies. The company also produces BeO substrates with mechanical strength exceeding 250 MPa, supporting reliability requirements in defense and aerospace electronics.

By End-Use

Aerospace led the end-use market in 2024 with around 34% share. Aircraft and satellite manufacturers used beryllium hydroxide-derived materials for lightweight structures, optical components, and heat-resistant systems. The defense sector followed due to growing adoption in targeting systems and surveillance equipment. Electrical and electronics applications grew with stronger demand for thermal management solutions in power devices. Medical and energy sectors expanded at a steady pace. Aerospace stayed dominant because global programs invested in next-generation spacecraft, high-precision optical assemblies, and advanced avionics requiring high-performance beryllium derivatives.

Key Growth Drivers

Expanding Use of Beryllium Ceramics in High-Performance Electronics

Growth in high-performance electronics drives major demand for beryllium hydroxide, as manufacturers convert the compound into beryllium oxide ceramics for power modules, RF components, and semiconductor packaging. These ceramics support strong thermal conductivity, electrical insulation, and dimensional stability, helping devices handle higher power densities in 5G networks, data centers, and compact consumer electronics. Rising adoption of electric vehicles strengthens demand for heat-spreaders and control modules made with beryllium ceramics. Defense communication systems also depend on advanced thermal ceramics, adding further pressure on supply chains. As global electronics firms shift toward miniaturization and higher efficiency, the need for high-grade beryllium hydroxide grows. Investments in fabrication plants, automation, and better powder-processing lines continue to reinforce long-term demand across North America, Europe, and Asia.

- For instance, Materion develops BeO ceramics for high-power RF and microwave systems with thermal conductivity levels reaching up to 285 W/m·K and dielectric constants between 6.7 and 6.9 at 1 MHz, enabling reliable heat dissipation in compact 5G modules. The company’s BeO packages also maintain mechanical strength above 250 MPa, supporting stable operation in defense communication hardware and high-density semiconductor devices.

Rising Adoption in Aerospace and Defense Structures

Aerospace and defense projects play a major role in expanding the beryllium hydroxide market, as the compound is essential for producing lightweight beryllium metal and beryllium-based alloys. These materials are used in optical systems, guidance components, satellite mirrors, inertial sensors, and high-strength structural parts where low density and high stiffness deliver clear performance gains. Growth in commercial satellite launches, defense modernization, and reusable spacecraft platforms increases demand for precision-grade beryllium derivatives. Governments across the U.S., Europe, and Japan continue funding space exploration and advanced reconnaissance programs, which rely on stable, high-purity beryllium materials. As supply chains evolve to support complex manufacturing needs, producers of beryllium hydroxide expand capacity and invest in purification technologies. This aerospace-driven momentum remains a strong long-term growth engine for the market.

- For instance, Materion supplies aerospace-grade beryllium for space telescopes and satellite systems, including the 1.32-meter primary mirror segments of NASA’s James Webb Space Telescope, each machined from beryllium blanks at cryogenic performance tolerance. The material delivers a stiffness-to-weight ratio nearly six times higher than aluminum, eabling precise optical stability for spaceborne imaging and guidance systems.

Increasing Use in Energy, Medical, and Nuclear Applications

Energy and medical technologies create strong demand for beryllium hydroxide as the compound serves as a precursor for alloys, ceramics, and metal components used in reactors, diagnostic devices, and precision instruments. Nuclear power systems use beryllium materials as neutron moderators and reflectors due to their strong stability under radiation. Medical imaging technologies rely on beryllium components for X-ray windows and precision diagnostic equipment, boosting consumption in healthcare manufacturing. Renewable energy industries also integrate beryllium alloys into sensors, battery components, and energy-conversion devices. Expansion of nuclear modernization programs, rising investments in advanced medical imaging, and increased demand for reliable power generation strengthen material consumption. The ongoing shift toward high-efficiency, durable systems across energy and healthcare industries continues to push the need for high-quality beryllium derivatives.

Key Trends & Opportunities

Growing Focus on Lightweight and High-Thermal Materials

The beryllium hydroxide market benefits from a rising trend toward lightweight and high-thermal-performance materials across aerospace, electronics, and mobility sectors. Manufacturers seek materials that support weight reduction, rapid heat dissipation, and structural stability. Beryllium-based ceramics and alloys deliver unique combinations of stiffness, thermal conductivity, and low density that outperform many conventional metals and composites. Growth in electric vehicles increases the need for efficient thermal systems in battery packs and power electronics. Aerospace programs transition toward lighter structural parts to boost fuel efficiency and payload capacity. Semiconductor and telecom industries rely on ceramic substrates that handle higher power densities without thermal failure. This shift toward performance-driven material selection strengthens long-term demand for refined beryllium hydroxide.

- For instance, Materion’s beryllium metal provides a density of 1.85 g/cm³ and a specific stiffness of up to 287 kN·m/kg, enabling significant weight reduction in aerospace optical benches. Its beryllium-copper alloys used in EV power electronics exhibit thermal conductivity values reaching 130 W/m·K, supporting rapid heat dissipation in compact modules. These performance characteristics allow manufacturers to design lighter and more thermally stable systems across mobility and semiconductor applications.

Expanding Applications in Next-Generation Technologies

New applications across quantum computing, advanced sensors, military optics, and high-precision manufacturing create emerging opportunities for beryllium hydroxide. Beryllium materials support ultra-stable optical assemblies used in high-resolution imaging, missile guidance, and space telescopes. Quantum hardware developers explore beryllium ions for specialized qubit systems, increasing research-level demand. The rise of high-frequency radar and communication systems strengthens the need for beryllium ceramics with superior thermal properties. Medical device miniaturization also creates new uses for beryllium alloys in compact, long-life diagnostic tools. Growing investments in clean-energy technologies support use in neutron-related systems, radiation-resistant parts, and high-performance measurement instruments. These next-generation sectors widen the long-term growth path for the beryllium hydroxide market.

- For instance, NIST has a long history of pioneering trapped-ion quantum computing with beryllium (Be⁺) and magnesium (Mg⁺) ions. While very long coherence times (exceeding 10 minutes) have been achieved in trapped-ion systems, these record times are typically for single qubits using different ion species like Yb⁺, often employing advanced techniques like sympathetic cooling and dynamical decoupling, rather than Be⁺ specifically with 10-second operational coherence for a multi-qubit processor as implied.

Key Challenge

Health, Environmental, and Regulatory Restrictions

Strict health and environmental regulations remain a major challenge for the beryllium hydroxide market. Processing beryllium compounds requires advanced safeguards due to risks associated with airborne particulates, workplace exposure, and waste management. Governments in the U.S., Europe, and Asia enforce stringent limits on occupational exposure, compelling companies to invest heavily in protective equipment, closed-loop systems, and specialized training. Compliance increases operational costs and slows production expansion. Environmental rules covering waste disposal and emissions add further complexity. These strict controls also limit the number of qualified processing facilities, constraining supply flexibility. As regulations tighten globally, manufacturers face increasing pressure to adopt cleaner technologies and improve worker safety without compromising output.

High Production Costs and Supply Concentration

The beryllium hydroxide market faces challenges from high production costs and limited global supply sources. Beryllium extraction, purification, and hydroxide processing require advanced metallurgy, high-purity inputs, and specialized handling, increasing capital intensity. With only a few major producers concentrated in the U.S., China, and select regions, supply disruptions can affect pricing and global availability. Mining limitations and geopolitical risks further strain the supply chain. Demand from aerospace, defense, and electronics adds pressure, intensifying competition for high-quality material. These supply constraints force manufacturers to maintain large inventories and invest in long-term sourcing strategies. As new applications expand, the market must balance rising demand with tight production capacity and high input costs.

Regional Analysis

North America

North America held the dominant position in the beryllium hydroxide market with about 41% share in 2024. The region benefited from strong aerospace, defense, and semiconductor industries that rely heavily on high-purity beryllium derivatives. The U.S. remained the central hub due to advanced mining operations, established refining capacity, and large federal investments in space and military programs. Electronics manufacturers increased demand for thermally efficient ceramics and precision alloys, reinforcing regional growth. Canada contributed modestly through supply-chain partnerships and research activities. Strong regulatory frameworks encouraged safe production while supporting steady long-term consumption.

Europe

Europe accounted for nearly 27% share in 2024, driven by its well-developed aerospace, satellite manufacturing, and electronics sectors. Germany, France, and the U.K. led adoption as manufacturers used beryllium derivatives for optical systems, high-frequency communication devices, and advanced automotive electronics. Research institutions across Europe increased demand for high-purity material for nuclear, medical imaging, and photonics applications. Strict environmental and safety standards increased operational costs but ensured stable, high-quality output. Rising investments in electric mobility and defense technologies supported additional growth. Supply-chain partnerships with North American and Asian producers helped maintain consistent raw material access.

Asia-Pacific

Asia-Pacific captured around 22% share in 2024, supported by fast-growing electronics, automotive, and energy industries. China and Japan drove most of the demand due to their expanding semiconductor production, precision optics development, and rising investment in power electronics. South Korea and Taiwan strengthened market growth through advanced chip packaging and communication hardware manufacturing. Regional aerospace programs, particularly in China and India, contributed to increased use of beryllium-based materials. Although environmental regulations varied across countries, manufacturing capacity grew steadily. Local producers expanded refining and processing capabilities, helping the region become a strong demand center for high-performance beryllium hydroxide.

Latin America

Latin America held about 6% share in 2024, with demand mainly driven by industrial equipment, energy projects, and limited aerospace-related manufacturing. Brazil led regional consumption due to rising investments in electronics assembly, radar systems, and optical components. Mexico showed moderate growth supported by its expanding automotive and electrical manufacturing base. The region relied heavily on imports from North America and Asia due to limited local processing capacity. Growing interest in nuclear research, industrial instrumentation, and defense modernization supported future adoption. However, inconsistent regulatory frameworks and slower industrialization kept overall demand lower compared with major global markets.

Middle East & Africa

The Middle East & Africa region accounted for roughly 4% share in 2024, driven by emerging demand in defense electronics, energy systems, and industrial monitoring applications. Gulf countries, including the UAE and Saudi Arabia, increased purchases for aerospace maintenance, satellite communication systems, and high-precision instrumentation. South Africa showed minor growth linked to mining instrumentation and research activities. Most countries depended on imports due to the absence of local refining facilities. Rising investment in nuclear technology, renewable energy projects, and advanced security systems created new opportunities, though overall market growth remained moderate due to limited manufacturing infrastructure.

Market Segmentations:

By Type

- Technical Grade

- Refined Grade

By Application

- Beryllium Oxide

- Beryllium Metal

- Beryllium Alloys

By End-Use

- Aerospace

- Automotive

- Energy

- Medical

- Defence

- Electrical and Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the beryllium hydroxide market features leading companies such as Stanford Advanced Materials, NGK Metals Corporation, Xinjiang Nonferrous Metal Industry Group, Materion Corporation, Belmont Metals Inc., Ulba Metallurgical Plant JSC, EaglePicher Technologies LLC, Shanghai Feixing Special Ceramics Factory, IBC Advanced Alloys Corp., and American Beryllia Inc. These players compete through capacity expansion, advancements in purification technologies, and strong integration across mining, refining, and alloy production. Many companies strengthen their positions by supplying high-purity grades for aerospace, defense, semiconductor, and medical applications that demand reliable thermal and structural performance. Strategic partnerships with electronics and space sector manufacturers help secure long-term contracts. Asian producers expand their role in mid-grade supply, while North American companies maintain leadership in technical-grade and defense-compliant material. Continuous investment in safety systems, environmental compliance, and advanced ceramics production shapes the competitive environment as demand for high-performance beryllium derivatives grows globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stanford Advanced Materials

- NGK Metals Corporation

- Xinjiang Nonferrous Metal Industry Group

- Materion Corporation

- Belmont Metals Inc.

- Ulba Metallurgical Plant JSC

- EaglePicher Technologies LLC

- Shanghai Feixing Special Ceramics Factory

- IBC Advanced Alloys Corp.

- American Beryllia Inc.

Recent Developments

- In March 2025, EaglePicher Technologies LLC GS Yuasa Lithium Power reported it had delivered EaglePicher’s order for Generation 4 LSE112 lithium-ion cells for a North American spaceflight program, highlighting EaglePicher’s continued focus on high-reliability aerospace power systems.

- In July 2023, IBC Advanced Alloys Corp. won new orders from a major aerospace and defense contractor.

- In July 2023, American Beryllia Inc. Market Growth Reports cites a contract under which American Beryllia will supply high-purity beryllium ceramics for satellite shielding systems to a U.S. defense agency

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as aerospace and defense programs expand globally.

- Demand will rise for high-purity grades used in advanced semiconductor manufacturing.

- Beryllium oxide ceramics will gain wider adoption in power electronics and telecom hardware.

- Producers will invest in safer and more efficient refining technologies.

- Supply chains will tighten as regulatory rules become more strict across major regions.

- New applications in medical imaging and diagnostic devices will support long-term growth.

- Energy technologies, including nuclear and renewable systems, will increase material consumption.

- Companies will form strategic partnerships to secure raw material access and technical expertise.

- Asia-Pacific will grow quickly as electronics and aerospace manufacturing expand.

- Innovation in lightweight materials and thermal solutions will strengthen market opportunities.