Market Overview:

The Bioresorbable Vascular Scaffold Market size was valued at USD 260.00 million in 2018 to USD 351.23 million in 2024 and is anticipated to reach USD 655.65 million by 2032, at a CAGR of 8.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioresorbable Vascular Scaffold Market Size 2024 |

USD 351.23 million |

| Bioresorbable Vascular Scaffold Market, CAGR |

8.13% |

| Bioresorbable Vascular Scaffold Market Size 2032 |

USD 655.65 million |

The growth of the Bioresorbable Vascular Scaffold (BVS) market is primarily fueled by the increasing global prevalence of cardiovascular diseases, particularly coronary artery disease, which continues to be a leading cause of mortality worldwide. This rise in cardiac conditions has intensified the demand for minimally invasive treatment options that offer long-term benefits without leaving permanent implants in the body. BVS devices provide a compelling solution by offering temporary support to blood vessels and then gradually dissolving, reducing the risks associated with permanent metallic stents such as chronic inflammation and late stent thrombosis. Another significant driver is the rapid advancement in biomaterials and scaffold engineering technologies. Innovations in polymer science and the development of magnesium-based bioresorbable materials have led to scaffolds with improved radial strength, biocompatibility, and predictable resorption timelines, enhancing their clinical safety and efficacy. Furthermore, the market benefits from favorable regulatory frameworks and increasing approvals of next-generation scaffolds across key healthcare markets, including the U.S., Europe, and Asia.

Regionally, North America dominates the Bioresorbable Vascular Scaffold market due to its advanced healthcare infrastructure, high incidence of cardiovascular disorders, and rapid adoption of innovative medical technologies. The presence of major market players and strong R&D investment also contribute to the region’s leading position. The U.S., in particular, represents a major revenue-generating country with robust reimbursement structures and early access to next-generation devices. Europe follows closely, driven by rising awareness of bioresorbable technologies, strong government support for medical research, and widespread adoption of minimally invasive cardiovascular procedures. Countries like Germany, France, and the U.K. are at the forefront due to their well-established interventional cardiology practices. Meanwhile, the Asia Pacific region is experiencing the fastest growth, attributed to the expanding geriatric population, increasing healthcare expenditure, and growing incidence of lifestyle-related cardiac diseases. China, Japan, and India are emerging as key markets, supported by improvements in healthcare infrastructure and increasing penetration of advanced stent technologies. Latin America and the Middle East & Africa are also expected to show steady growth due to rising healthcare investments and broader access to cardiovascular care in urban centers.

Market Insights:

- The Bioresorbable Vascular Scaffold Market was valued at USD 351.23 million in 2024 and is expected to reach USD 655.65 million by 2032, growing at a CAGR of 8.13%.

- Rising cases of coronary artery disease and demand for minimally invasive therapies are driving the adoption of bioresorbable scaffolds.

- Advancements in polymer science and magnesium-based materials have improved device performance, safety, and resorption reliability.

- Regulatory bodies in North America and Europe are accelerating approvals, while reimbursement policies are expanding hospital usage.

- Clinical preference is shifting toward temporary scaffolds that restore natural vessel function and reduce complications associated with metallic stents.

- North America leads the market due to advanced healthcare infrastructure and early product access; Asia Pacific shows the fastest growth, driven by aging populations and better cardiac care.

- High manufacturing costs and limited long-term safety data remain key challenges, requiring stronger evidence and cost-effective production for wider adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Burden of Cardiovascular Diseases Drives Demand for Advanced Scaffold Solutions

The escalating prevalence of cardiovascular diseases (CVDs), particularly coronary artery disease, serves as a primary driver for the Bioresorbable Vascular Scaffold Market. Increasing rates of obesity, hypertension, diabetes, and sedentary lifestyles have significantly contributed to the surge in CVD cases worldwide. Traditional metallic stents, while effective, leave permanent implants that may lead to long-term complications such as late stent thrombosis or vascular inflammation. In contrast, bioresorbable scaffolds provide temporary mechanical support to the vessel and then safely dissolve, reducing the risk of future adverse events. Hospitals and cardiologists are actively seeking alternatives that align with long-term vascular healing and improved patient safety. The Bioresorbable Vascular Scaffold Market benefits from this shift in clinical preference toward bio-integrative solutions.

- For example, Abbott’s Absorb GT1 Bioresorbable Vascular Scaffold (BVS), made of poly(L-lactide) (PLLA), provides temporary radial support and fully resorbs within approximately 3 years, as confirmed by intravascular imaging in the ABSORB III trial.

Technological Advancements in Scaffold Materials and Design Improve Clinical Outcomes

Continuous innovation in scaffold materials and device engineering has significantly enhanced the performance of bioresorbable vascular scaffolds. Modern devices now feature thinner struts, drug-eluting capabilities, and improved radial strength, which help ensure optimal vessel support during the critical healing period. New-generation polymers and magnesium-based alloys have addressed earlier concerns related to mechanical integrity and degradation control. These advances have improved procedural success rates and long-term patient outcomes, encouraging broader adoption across healthcare institutions. The Bioresorbable Vascular Scaffold Market gains momentum as manufacturers invest in R&D to produce safer, more efficient devices. It reflects a growing trust in next-generation solutions among healthcare providers.

- For instance, modern fully bioresorbable scaffolds, such as the REVA ReZolve2 (now acquired by Meril Life Sciences), utilize a tyrosine-derived polycarbonate scaffold with 100 µm struts, a 40% reduction in strut thickness compared to first-generation devices, enhancing deliverability and endothelialization.

Supportive Regulatory Pathways and Reimbursement Policies Facilitate Market Growth

Global regulatory bodies have begun to recognize the clinical potential of bioresorbable scaffolds and are accelerating product approvals through established pathways. In regions such as North America and Europe, regulators are creating favorable conditions for companies to conduct clinical trials and bring new technologies to market. These streamlined processes reduce the time-to-market for innovative scaffolds, enabling healthcare providers to access cutting-edge solutions more rapidly. At the same time, reimbursement agencies are beginning to cover procedures involving bioresorbable scaffolds, further incentivizing hospitals to adopt the technology. The Bioresorbable Vascular Scaffold Market leverages these developments to increase its footprint in both developed and emerging markets. It stands to benefit from growing institutional support and improved market access.

Increased Focus on Patient-Centric and Minimally Invasive Therapies Boosts Adoption

The healthcare sector is increasingly prioritizing patient outcomes, safety, and quality of life in treatment selection. Minimally invasive procedures are preferred due to reduced recovery times, lower procedural risks, and improved patient satisfaction. Bioresorbable vascular scaffolds align well with these goals, offering temporary therapeutic support without the drawbacks of permanent implants. They allow natural vessel restoration and preserve future intervention options, which is particularly important for younger patients. The Bioresorbable Vascular Scaffold Market addresses these evolving clinical demands with bioadaptive technology that integrates seamlessly with patient physiology. It continues to gain traction as physicians seek safer, long-term solutions for cardiovascular intervention.

Market Trends:

Shift Toward Next-Generation Scaffolds Featuring Enhanced Biocompatibility and Precision Engineering

The industry is witnessing a noticeable shift toward next-generation scaffolds with improved biocompatibility and structural precision. Manufacturers are prioritizing devices that reduce inflammatory response and accelerate endothelial healing, which enhances long-term safety. Innovations include ultrathin strut designs, tailored degradation rates, and hybrid materials that balance flexibility with strength. These features are addressing earlier concerns related to thrombosis and suboptimal resorption. The Bioresorbable Vascular Scaffold Market is aligning with these advancements, pushing product pipelines toward clinically superior outcomes. It reflects a growing preference for devices that can integrate seamlessly with vascular tissues and support personalized treatment.

- For example, Biotronik’s Freesolve™ scaffold, CE-marked in Europe, uses a BIOmag® magnesium alloy core with a bioresorbable polymer coating and achieves 3% resorption within 12 months. Strut thickness varies by size, from 99 µm to 117 µm, and the device is engineered to minimize inflammatory response.

Increased Integration of Drug-Eluting Technologies to Improve Therapeutic Efficacy

Scaffold developers are integrating antiproliferative and anti-inflammatory drugs into device surfaces to prevent restenosis and accelerate healing. Drug-eluting bioresorbable scaffolds combine mechanical support with pharmacological action, offering a dual approach to vascular restoration. This trend enhances the therapeutic value of the scaffolds and supports improved procedural outcomes across varied patient profiles. Developers are focusing on controlled drug-release kinetics to maximize vessel patency during the critical post-implantation phase. The Bioresorbable Vascular Scaffold Market is increasingly populated by products that offer both structural and pharmacological benefits. It is positioning itself as a multifaceted solution to complex cardiovascular challenges.

- For instance, Abbott’s Absorb GT1elutes everolimus (100 µg/cm²) with a controlled-release polymer that maintains >80% drug retention at 28 days post-implantation, per Abbott’s FDA Premarket Approval (PMA) data.

Emphasis on Clinical Trials and Real-World Data to Validate Long-Term Safety and Performance

Stakeholders are placing greater emphasis on generating robust clinical trial data and real-world evidence to build physician confidence and guide regulatory decisions. Longitudinal studies tracking post-procedural outcomes for several years are becoming standard practice. Real-world data is also playing a crucial role in validating performance metrics outside controlled environments. These insights help manufacturers refine device designs, improve patient selection, and secure broader reimbursement coverage. The Bioresorbable Vascular Scaffold Market is responding by increasing investments in clinical validation and post-market surveillance programs. It demonstrates the industry’s commitment to data-driven progress and outcome transparency.

Adoption of Artificial Intelligence and Imaging Technologies in Procedural Planning

Clinicians are beginning to use artificial intelligence and advanced imaging techniques to plan scaffold deployment more precisely. Tools such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) provide detailed vessel mapping and lesion characterization, enabling optimal scaffold placement. AI-assisted platforms support better decision-making during interventions, reducing procedural errors and improving patient outcomes. The Bioresorbable Vascular Scaffold Market is evolving in response to these digital innovations, creating opportunities for integrated therapy planning solutions. It is moving toward a future where precision medicine enhances both product performance and procedural success.

Market Challenges Analysis:

Limited Long-Term Clinical Evidence and Safety Concerns Hamper Widespread Adoption

Despite technological advancements, limited long-term clinical data remains a critical barrier for broader acceptance of bioresorbable scaffolds. Many early-generation devices faced scrutiny due to complications like scaffold thrombosis and inconsistent degradation timelines. These safety concerns have led to hesitation among cardiologists and healthcare providers when choosing bioresorbable options over proven metallic stents. Regulatory bodies require extensive post-market surveillance and high-quality trial data to validate long-term safety, increasing the cost and complexity of market entry. The Bioresorbable Vascular Scaffold Market continues to face skepticism until newer devices can demonstrate durable performance over multiple years. It must overcome past perceptions to establish a stronger clinical foundation for future growth.

High Manufacturing Costs and Technical Complexity Limit Commercial Scalability

The production of bioresorbable scaffolds involves specialized materials and precision engineering, leading to significantly higher manufacturing costs than traditional stents. Maintaining structural integrity while ensuring predictable degradation requires advanced fabrication technologies and rigorous quality control. These complexities often result in limited scalability and higher pricing for end users, making adoption less feasible in cost-sensitive healthcare systems. Manufacturers also encounter challenges in achieving uniformity across batches, which impacts regulatory approval and clinician confidence. The Bioresorbable Vascular Scaffold Market must address these technical and economic constraints to support broader commercialization. It requires sustained investment in manufacturing innovation and cost optimization to reach competitive parity with metallic alternatives.

Market Opportunities:

Expansion into Emerging Markets Creates Pathways for Scalable Growth

Rapid improvements in healthcare infrastructure across emerging economies provide fertile ground for growth in the Bioresorbable Vascular Scaffold Market. Countries in Asia Pacific, Latin America, and the Middle East are witnessing a sharp rise in cardiovascular disease prevalence alongside increasing access to advanced interventional procedures. Governments and private providers are investing in modern cardiac care, opening new avenues for bioresorbable scaffold adoption. Local manufacturing partnerships and tailored pricing models can further improve market penetration in these regions. The Bioresorbable Vascular Scaffold Market stands to benefit from this geographic expansion by addressing unmet clinical needs in underserved populations. It can unlock scalable demand through strategic regional engagement.

Cross-Sector Collaboration and Digital Integration Offer Innovation Potential

Partnerships between medtech firms, research institutions, and digital health startups are accelerating product development and integration. Combining bioresorbable scaffolds with digital tools like AI-based imaging and procedural navigation systems can enhance precision and treatment personalization. These collaborations can improve clinical outcomes while reducing procedural risks. The Bioresorbable Vascular Scaffold Market is well-positioned to harness these synergies to build differentiated offerings. It has the opportunity to lead in next-generation cardiovascular solutions that combine bioengineering with data intelligence. This convergence can redefine its value proposition in the evolving landscape of interventional cardiology.

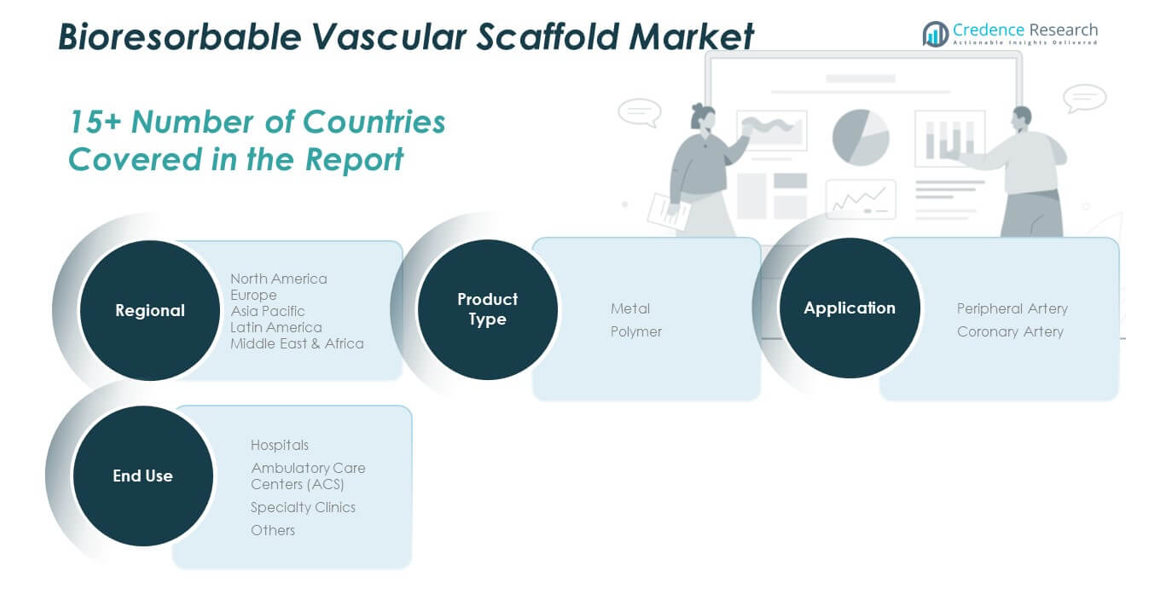

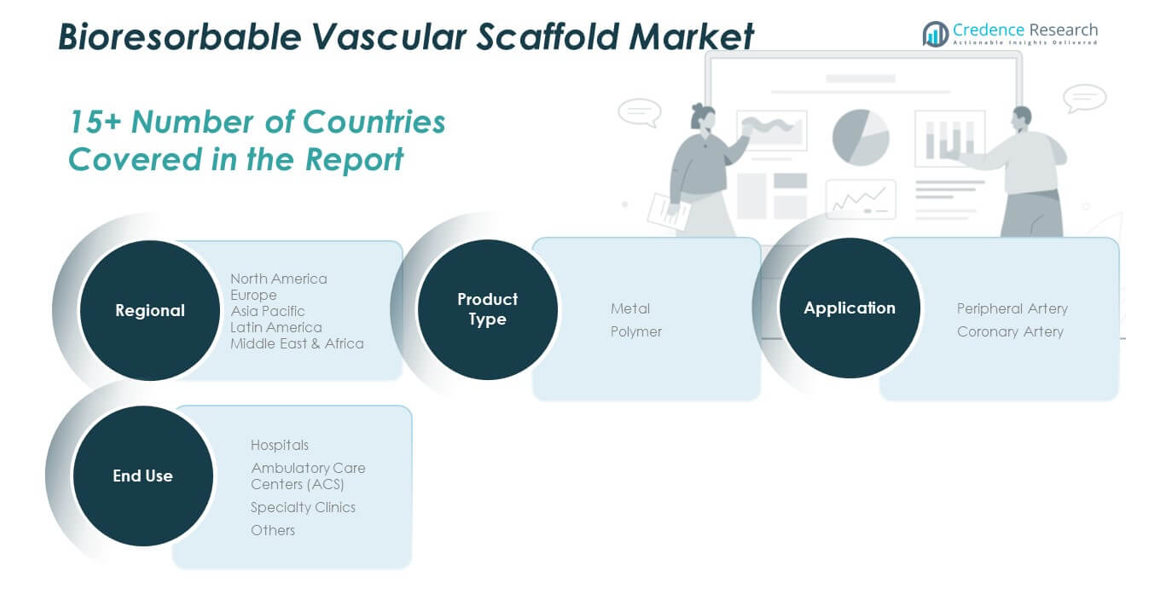

Market Segmentation Analysis:

The Bioresorbable Vascular Scaffold Market is segmented by product, application and end-use, each contributing distinctly to market dynamics.

By product, polymer-based scaffolds hold a dominant share due to their biocompatibility and controlled degradation profiles, while metal-based variants, particularly magnesium alloys, are gaining traction for their mechanical strength and predictable resorption.

- For example, Biotronik’s Magmaris scaffold uses a magnesium alloy backbone, offering superior radial strength and a predictable resorption timeline, with complete bioresorption documented at 12 months

By application, the coronary artery segment accounts for the largest revenue share, driven by the high global incidence of coronary artery disease and the clinical focus on minimally invasive treatments. The peripheral artery segment is expected to grow steadily with increased adoption in treating peripheral vascular conditions.

By end-use, hospitals lead the market due to high patient volumes, advanced infrastructure, and access to trained interventional cardiologists. Ambulatory Care Centers (ACCs) and specialty clinics are emerging segments benefiting from the shift toward outpatient cardiovascular procedures.

- For example, the Cleveland Clinic, one of the top cardiovascular centers in the U.S., performs over 10,000 percutaneous coronary interventions (PCIs) annually. While it explores advanced treatment options, next-generation bioresorbable scaffolds such as Absorb (formerly used) and Magmaris have been evaluated in select cases, though metallic drug-eluting stents remain the primary standard of care.

Segmentation:

By Product

By Application

- Peripheral Artery

- Coronary Artery

By End-use

- Hospitals

- Ambulatory Care Centers (ACCs)

- Specialty Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Bioresorbable Vascular Scaffold Market size was valued at USD 110.76 million in 2018 to USD 148.08 million in 2024 and is anticipated to reach USD 276.10 million by 2032, at a CAGR of 8.1% during the forecast period. North America holds the largest market share, accounting for over 34% of the global market in 2024. Strong adoption of advanced cardiovascular treatments, widespread availability of interventional cardiology infrastructure, and a favorable reimbursement environment support the region’s leadership. The United States drives most of the regional demand with its high patient awareness, early access to innovative devices, and robust regulatory support for clinical trials. It also benefits from the presence of leading industry players investing in R&D and commercial expansion. The Bioresorbable Vascular Scaffold Market in this region reflects a mature ecosystem that fosters rapid innovation and high procedural volumes. It continues to maintain strong momentum through strategic product launches and institutional collaborations.

Europe

The Europe Bioresorbable Vascular Scaffold Market size was valued at USD 64.22 million in 2018 to USD 83.16 million in 2024 and is anticipated to reach USD 146.44 million by 2032, at a CAGR of 7.4% during the forecast period. Europe accounts for approximately 19% of the global market share, led by countries such as Germany, France, and the United Kingdom. The region benefits from a strong clinical research landscape, established cardiovascular networks, and rapid uptake of minimally invasive technologies. Government support for medical innovation and public health initiatives continues to promote early diagnosis and advanced interventions. European regulatory bodies also provide streamlined pathways for novel scaffold approvals, allowing for quicker market access. The Bioresorbable Vascular Scaffold Market in Europe is expanding through strategic hospital partnerships and regional distribution networks. It leverages clinical evidence and physician training programs to increase penetration across secondary healthcare systems.

Asia Pacific

The Asia Pacific Bioresorbable Vascular Scaffold Market size was valued at USD 53.04 million in 2018 to USD 75.46 million in 2024 and is anticipated to reach USD 156.72 million by 2032, at a CAGR of 9.5% during the forecast period. Asia Pacific represents the fastest-growing regional market, contributing nearly 17% of the global share in 2024. China, Japan, and India lead regional growth due to rising cardiovascular disease incidence, healthcare infrastructure development, and growing access to tertiary care. Public and private investments are fueling demand for technologically advanced treatment options across urban hospitals. Domestic manufacturers are entering the market, improving affordability and regional competitiveness. The Bioresorbable Vascular Scaffold Market in Asia Pacific reflects strong commercial potential driven by demographics and clinical modernization. It offers significant opportunities for product localization, physician outreach, and scalable expansion.

Latin America

The Latin America Bioresorbable Vascular Scaffold Market size was valued at USD 16.64 million in 2018 to USD 22.26 million in 2024 and is anticipated to reach USD 38.60 million by 2032, at a CAGR of 7.2% during the forecast period. Latin America holds roughly 5% of the global market share, with Brazil and Mexico serving as primary revenue contributors. The market benefits from expanding private healthcare systems and growing interest in minimally invasive cardiovascular therapies. Economic development and greater insurance coverage have improved access to interventional procedures. However, cost remains a barrier in rural regions, limiting the reach of advanced scaffolding technologies. The Bioresorbable Vascular Scaffold Market in Latin America is gradually gaining traction through public–private partnerships and targeted training initiatives. It presents moderate but consistent growth potential for global and regional players.

Middle East

The Middle East Bioresorbable Vascular Scaffold Market size was valued at USD 11.23 million in 2018 to USD 14.33 million in 2024 and is anticipated to reach USD 24.46 million by 2032, at a CAGR of 6.9% during the forecast period. The region represents about 3% of the global market and is supported by rising investments in healthcare modernization and infrastructure. Gulf Cooperation Council (GCC) countries such as Saudi Arabia and the UAE are expanding specialized cardiac care centers, fueling demand for advanced stent technologies. Public health campaigns are also raising awareness about early cardiovascular intervention. The Bioresorbable Vascular Scaffold Market in the Middle East is progressing through government-led initiatives and hospital procurement programs. It provides niche growth opportunities for manufacturers offering tailored clinical solutions and pricing strategies.

Africa

The Africa Bioresorbable Vascular Scaffold Market size was valued at USD 4.11 million in 2018 to USD 7.94 million in 2024 and is anticipated to reach USD 13.34 million by 2032, at a CAGR of 6.3% during the forecast period. Africa remains the smallest regional contributor, holding less than 2% of global market share. Limited access to advanced cardiovascular care, low procedural volumes, and budget constraints hinder market development. However, urban centers in South Africa, Nigeria, and Egypt are beginning to adopt interventional treatments, supported by international aid and infrastructure upgrades. The Bioresorbable Vascular Scaffold Market in Africa remains in the early stages of growth and requires targeted investment in training and awareness. It may offer long-term potential as regional health systems evolve and public funding increases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Meril Life Sciences Pvt. Ltd.

- Zeus Company LLC

- Biotronik

- Abbott

- MicroPort Scientific Corporation

- Kyoto Medical

- Elixir Medical (MedImpact Healthcare Systems, Inc.)

- Cigna

- Braun Melsungen AG

- Boston Scientific Corporation

- REVA Medical

Competitive Analysis:

The Bioresorbable Vascular Scaffold Market is characterized by intense competition among established players and emerging innovators. Key companies such as Abbott Laboratories, Biotronik SE & Co. KG, Elixir Medical Corporation, Kyoto Medical Planning Co. Ltd., and Meril Life Sciences Ltd. lead the market through advanced product portfolios and global distribution networks. These players invest heavily in clinical trials, regulatory approvals, and material innovation to differentiate their offerings. Smaller companies and regional manufacturers are entering the space with cost-effective solutions and localized strategies. The market shows a strong focus on next-generation scaffolds featuring improved biocompatibility and mechanical performance. Strategic collaborations between medtech firms, research institutions, and hospitals are shaping new product development and commercial expansion. The Bioresorbable Vascular Scaffold Market remains dynamic, with competitive success tied closely to product efficacy, safety outcomes, and access to high-growth regions. It continues to evolve through R&D investments, pipeline diversification, and global expansion efforts.

Recent Developments:

- In July 2025, Teleflex announced a definitive agreement to acquire BIOTRONIK’s Vascular Intervention Business, which includes bioresorbable scaffold technologies. The €760 million deal, expected to close in Q3 2025, broadens Teleflex’s portfolio in interventional cardiology and peripheral vascular devices.

- In February 2024, BIOTRONIK gained CE approval and launched its third‑generation Freesolve™ Resorbable Magnesium Scaffold. The Freesolve RMS offers optimized vessel support with nearly complete magnesium resorption within 12 months. The scaffold’s ultrathin struts and advanced alloy design aimed for predictable performance in coronary artery lesions. Its commercial availability marked a milestone in metallic bioresorbable scaffold innovation supported by robust clinical outcomes from the BIOMAG‑I trial.

Market Concentration & Characteristics:

The Bioresorbable Vascular Scaffold Market is moderately concentrated, with a few multinational companies holding significant market share due to early technological leadership and extensive clinical validation. It exhibits high entry barriers driven by stringent regulatory requirements, complex manufacturing processes, and the need for long-term clinical data. The market emphasizes innovation, with performance, safety, and degradation control being critical differentiators. It favors companies with strong R&D capabilities and strategic partnerships that support product development and market access. Pricing pressure and physician trust play key roles in influencing adoption across regions. The Bioresorbable Vascular Scaffold Market maintains a competitive yet cautious environment, shaped by a balance of clinical promise and regulatory scrutiny.

Report Coverage:

The research report offers an in-depth analysis based on product, application and end-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Advancements in scaffold materials will lead to improved safety, performance, and controlled resorption timelines.

- Rising cardiovascular disease incidence will continue to drive demand for minimally invasive vascular solutions.

- Integration of AI and imaging technologies will enhance procedural accuracy and treatment planning.

- Regulatory approvals for next-generation devices will expand market access across key regions.

- Emerging economies will offer significant growth potential through infrastructure development and healthcare investments.

- Collaborations between medtech firms and research institutions will accelerate product innovation.

- Real-world clinical data will play a pivotal role in building physician confidence and driving adoption.

- Patient preference for temporary, bioresorbable implants will strengthen the market’s value proposition.

- Price optimization and scalable manufacturing will help increase affordability and global reach.

- Expanded indications beyond coronary artery disease may open new application areas for growth.