Market Overview:

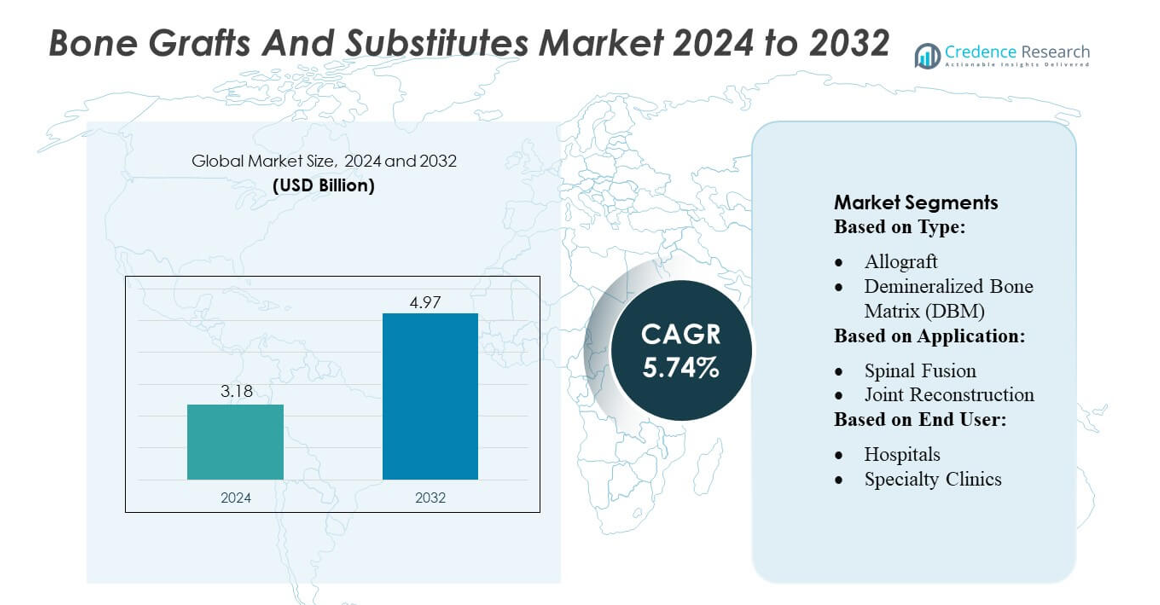

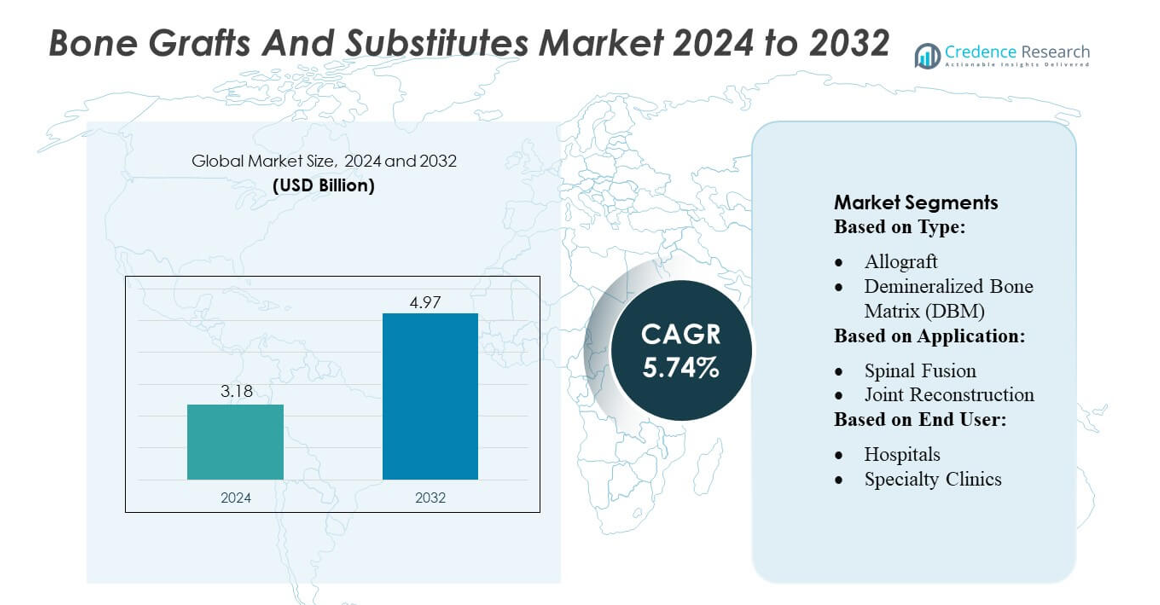

Bone Grafts And Substitutes Market size was valued USD 3.18 billion in 2024 and is anticipated to reach USD 4.97 billion by 2032, at a CAGR of 5.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bone Grafts and Substitutes Market Size 2024 |

USD 3.18 billion |

| Bone Grafts and Substitutes Market, CAGR |

5.74% |

| Bone Grafts and Substitutes Market Size 2032 |

USD 4.97 billion |

The Bone Grafts and Substitutes Market is highly competitive, with key players driving innovation through advanced graft materials and strategic collaborations. Companies such as AlloSource, DePuy Synthes (Johnson & Johnson), Baxter, NuVasive, Inc., Smith + Nephew, Medtronic, Orthofix Medical, Inc., OST Laboratories, Zimmer Biomet, and Geistlich Pharma AG maintain strong positions by expanding product portfolios, enhancing surgical compatibility, and investing in research and development. These firms focus on synthetic substitutes, demineralized bone matrix (DBM), and bioengineered scaffolds to improve clinical outcomes and meet surgeon preferences. North America remains the leading region, capturing approximately 38% of the global market, driven by advanced healthcare infrastructure, high adoption of minimally invasive procedures, and robust reimbursement frameworks. Strong regulatory compliance, extensive distribution networks, and ongoing innovations continue to consolidate market leadership in the region while supporting global expansion efforts.

Market Insights

- The Bone Grafts and Substitutes Market size was valued at USD 3.18 billion in 2024 and is projected to reach USD 4.97 billion by 2032, growing at a CAGR of 5.74% during the forecast period.

- North America leads the market with a 38% share, supported by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and strong reimbursement frameworks.

- The allograft segment dominates by type, driven by clinical acceptance, natural compatibility, and broad usage in spinal fusion and joint reconstruction procedures.

- Growth is fueled by rising prevalence of orthopedic disorders, technological advancements in synthetic and bioengineered grafts, and expansion of hospitals and specialty clinics globally.

- Market challenges include high costs of advanced graft materials, stringent regulatory requirements, and safety concerns, while trends show increasing adoption of synthetic grafts, minimally invasive techniques, and emerging market opportunities across Asia-Pacific and Latin America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the bone grafts and substitutes market, the allograft segment dominates, accounting for a significant share of approximately 40% due to its natural compatibility and broad clinical acceptance. Allografts offer ready-to-use solutions with reduced donor site morbidity, making them a preferred choice for various surgical procedures. Synthetic grafts and demineralized bone matrix (DBM) are gaining traction, driven by advancements in biomaterials and enhanced osteoinductive properties. Key growth drivers include rising prevalence of orthopedic disorders, increasing spinal fusion surgeries, and the growing adoption of minimally invasive techniques that favor off-the-shelf graft solutions.

- For instance, Zimmer Biomet supplies allograft‑based solutions such as its StaGraft® Fiber, which uses 100% cortical fiber demineralized bone matrix (DBM) and is available in single‑use kits of 2 cc, 5 cc or 10 cc.

By Application

Spinal fusion procedures represent the leading application in the bone grafts and substitutes market, capturing an estimated 45% market share. The high prevalence of degenerative spine disorders, coupled with technological innovations in spinal implants, drives demand for reliable graft materials. Joint reconstruction and foot & ankle surgeries are also expanding segments, supported by aging populations and the rise in osteoarthritis cases. Enhanced outcomes, reduced recovery times, and increasing surgeon preference for biocompatible graft materials further fuel market growth, with healthcare providers increasingly prioritizing patient safety and surgical efficiency.

- For instance, ACTIFUSE Flow Bone Graft Substitute by Baxter offers a ready‑to-use, pre‑loaded syringe (available in 1.5 mL, 3 mL, 5 mL sizes) enabling precise delivery into posterolateral spinal fusion sites and other small bony voids, benefiting both open and minimally invasive procedures.

By End-User

Hospitals remain the dominant end-user in the bone grafts and substitutes market, holding around 60% share due to their capacity to perform complex surgeries and maintain specialized storage facilities. Specialty clinics and ambulatory surgical centers are gradually increasing their share, propelled by the rise in outpatient orthopedic procedures and minimally invasive techniques. Growth drivers include expansion of orthopedic centers, rising patient awareness of treatment options, and government initiatives to improve healthcare infrastructure. Hospitals benefit from economies of scale, enabling bulk procurement of graft materials and integration with advanced surgical technologies.

Key Growth Drivers

Rising Prevalence of Orthopedic Disorders

The increasing incidence of musculoskeletal disorders, fractures, and degenerative bone diseases is a primary driver of the bone grafts and substitutes market. Aging populations and lifestyle-related factors, such as obesity and sedentary behavior, contribute to higher demand for spinal fusion, joint reconstruction, and fracture repair procedures. Surgeons increasingly prefer biocompatible and off-the-shelf graft materials to reduce operative time and enhance patient outcomes. The growth of orthopedic surgeries globally directly fuels demand for advanced graft materials with superior osteoconductive and osteoinductive properties.

- For instance, NuVasive’s synthetic graft substitute Attrax Putty — featuring a proprietary bio‑textured surface that guides mesenchymal stem cells (MSCs) to differentiate into bone‑forming osteoblasts — has been used in over 20,000 spine surgeries worldwide, underlining its clinical acceptance.

Technological Advancements in Graft Materials

Continuous innovation in synthetic grafts, demineralized bone matrices, and allografts is expanding the market. New biomaterials with enhanced osteogenesis, reduced immunogenicity, and improved handling characteristics enable surgeons to achieve better clinical outcomes. Developments in 3D printing, bioactive scaffolds, and composite grafts allow for patient-specific solutions, increasing procedural efficiency. Such technological progress also supports minimally invasive surgeries, reducing recovery times and complications, thereby driving the adoption of bone grafts across spinal, orthopedic, and trauma applications worldwide.

- For instance, Bio-Oss® is available in granule sizes from 0.25–1 mm up to 1–2 mm, corresponding to roughly 0.5–6 cc per vial, enabling adaptation for both small and large defects.

Expansion of Healthcare Infrastructure

The growing number of hospitals, specialty clinics, and ambulatory surgical centers is fueling demand for bone grafts and substitutes. Investment in modern surgical facilities, coupled with government initiatives to enhance orthopedic care access, supports higher procedural volumes. Enhanced training programs for surgeons and improved availability of advanced surgical tools increase adoption rates. Additionally, better reimbursement policies and healthcare coverage for bone-related surgeries incentivize patients to undergo procedures requiring grafts, further strengthening market growth in both developed and emerging regions.

Key Trends & Opportunities

Shift Toward Minimally Invasive Surgeries

Minimally invasive orthopedic procedures are gaining traction, promoting faster recovery, lower infection risk, and reduced hospital stays. Surgeons increasingly use off-the-shelf synthetic grafts and DBM to streamline operations and enhance precision. This trend opens opportunities for manufacturers to develop easy-to-use, pre-shaped grafts and bioactive materials. Integration with advanced surgical tools, such as navigation systems and robotics, further supports adoption, offering potential for product differentiation and higher-value offerings across spinal, joint, and trauma applications.

- For instance, REGENETEN Bioinductive Implant, used in tendon and soft‑tissue repair, has been associated with a 68% reduction in re‑tear rates at one year in medium-to-large full‑thickness tears — underscoring its efficacy in minimally invasive augmentations.

Growing Demand for Synthetic and Bioengineered Grafts

Synthetic grafts and bioengineered substitutes are witnessing increased adoption due to their predictable performance and lower risk of disease transmission. Innovations in calcium phosphate, hydroxyapatite composites, and collagen-based scaffolds provide enhanced osteoconductivity and mechanical strength. These materials enable customization for patient-specific defects, offering substantial market opportunities. Rising awareness among surgeons about the long-term benefits of synthetic solutions, alongside cost-effectiveness compared to traditional allografts, drives significant growth potential across orthopedic and trauma care segments.

- For instance, OsteoStrux™ scaffold blends 80% highly purified β‑TCP with 20% type‑I collagen to mimic the composition and pore‑structure of natural cancellous bone, offering 60–80% porosity for optimal osteoconduction.

Expansion in Emerging Markets

Emerging regions, particularly Asia-Pacific and Latin America, offer significant growth opportunities due to increasing healthcare investments and rising orthopedic procedure volumes. Growing urbanization, rising disposable incomes, and improved access to advanced medical care drive demand for bone graft materials. Manufacturers are focusing on local partnerships, awareness campaigns, and cost-effective solutions to capture these markets. Expanding insurance coverage and government-led initiatives to strengthen healthcare infrastructure further support adoption, creating long-term growth potential for both established and new entrants in the market.

Key Challenges

High Costs of Advanced Grafts

Advanced synthetic and bioengineered grafts remain expensive, limiting accessibility in price-sensitive markets. The high cost of research, development, and sterilization processes contributes to premium pricing, restricting adoption in emerging economies. Hospitals and clinics may prefer cost-effective alternatives, such as traditional allografts, despite the clinical advantages of newer materials. Balancing innovation with affordability remains a significant challenge for manufacturers seeking widespread adoption, particularly in regions with constrained healthcare budgets or limited insurance coverage.

Regulatory and Safety Concerns

Stringent regulatory approvals and safety concerns for bone grafts, especially allografts and xenografts, pose challenges for market expansion. Risks of disease transmission, immune reactions, and product recalls require robust compliance with international standards. Delays in approvals can slow product launches, while ongoing monitoring of adverse events increases operational costs. Manufacturers must navigate complex regulatory environments across regions, ensuring quality, traceability, and adherence to safety protocols to maintain clinician trust and patient safety.

Regional Analysis

North America

North America leads the bone grafts and substitutes market, holding approximately 38% share due to advanced healthcare infrastructure, high prevalence of orthopedic disorders, and early adoption of innovative graft materials. The United States, in particular, drives demand through increased spinal fusion and joint reconstruction procedures, supported by robust insurance coverage and reimbursement frameworks. Technological advancements in synthetic grafts, DBM, and minimally invasive surgical techniques further strengthen market growth. The presence of key market players and ongoing R&D activities enhances product availability and clinical outcomes, maintaining North America’s dominance in the global bone grafts and substitutes landscape.

Europe

Europe accounts for nearly 28% of the global bone grafts and substitutes market, driven by an aging population and rising orthopedic procedure volumes. Countries such as Germany, France, and the UK show strong demand for allografts and synthetic substitutes in spinal, joint, and trauma applications. Advancements in biomaterials, coupled with government initiatives to improve orthopedic care, contribute to growth. Surgeons increasingly prefer biocompatible and off-the-shelf grafts, while hospitals invest in modern surgical infrastructure. Regulatory support for medical innovations and increasing patient awareness further reinforce Europe’s position as a significant regional market with steady expansion prospects.

Asia-Pacific

Asia-Pacific holds around 22% market share and is emerging as a high-growth region due to rising healthcare expenditure, urbanization, and expanding orthopedic surgery volumes. Countries such as China, India, and Japan are witnessing growing demand for spinal fusion, joint reconstruction, and trauma-related bone grafts. Increasing availability of modern hospitals, better insurance coverage, and adoption of minimally invasive techniques accelerate market penetration. Manufacturers are targeting cost-effective synthetic and DBM products to cater to price-sensitive populations. Rapid improvements in healthcare infrastructure, coupled with growing awareness of advanced graft options, position Asia-Pacific as a key growth driver globally.

Latin America

Latin America represents approximately 7% of the global bone grafts and substitutes market, supported by increasing orthopedic surgeries and gradual adoption of advanced graft materials. Brazil and Mexico lead regional growth due to expanding hospital networks and rising patient awareness of orthopedic care. Despite price sensitivity, demand for allografts and synthetic substitutes is growing as minimally invasive techniques and advanced implants gain traction. Government initiatives to improve healthcare access and investments in modern surgical infrastructure further drive market expansion. The region offers significant opportunities for cost-effective products and partnerships with local healthcare providers to strengthen market presence.

Middle East & Africa

The Middle East and Africa hold around 5% market share, driven by growing orthopedic procedure volumes, rising prevalence of degenerative bone disorders, and expansion of modern hospitals. Countries such as Saudi Arabia, UAE, and South Africa show increasing demand for allografts and synthetic substitutes, particularly in spinal and trauma surgeries. Investments in healthcare infrastructure, government initiatives to enhance access to advanced orthopedic care, and adoption of minimally invasive techniques contribute to regional growth. Although the market remains nascent, rising awareness among surgeons and patients, coupled with partnerships by global manufacturers, presents significant opportunities for long-term market expansion.

Market Segmentations:

By Type:

- Allograft

- Demineralized Bone Matrix (DBM)

By Application:

- Spinal Fusion

- Joint Reconstruction

By End User:

- Hospitals

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the bone grafts and substitutes market players such as AlloSource, DePuy Synthes (Johnson & Johnson), Baxter, NuVasive, Inc., Smith + Nephew, Medtronic, Orthofix Medical, Inc., OST Laboratories, Zimmer Biomet, and Geistlich Pharma AG. The bone grafts and substitutes market is characterized by intense innovation and rapid technological advancements. Companies are increasingly focusing on research and development to introduce advanced graft materials, including synthetic substitutes, demineralized bone matrix (DBM), and bioengineered scaffolds, which offer improved osteoconductive and osteoinductive properties. Strategic collaborations with hospitals and specialty clinics enhance product adoption and expand market reach. Manufacturers differentiate through minimally invasive surgical compatibility, robust distribution networks, and targeted educational programs for surgeons. Regulatory compliance and quality assurance remain critical, while competitive pricing strategies and product customization help maintain market share in this growing global segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zimmer Biomet

- Baxter

- NuVasive, Inc.

- Geistlich Pharma AG

- Smith + Nephew

- OST Laboratories

- Orthofix Medical, Inc.

- DePuy Synthes (Johnson & Johnson)

- Medtronic

- AlloSource

Recent Developments

- In January 2025, Medtronic formed an exclusive five-year sales agency agreement with Kuros. The deal makes Medtronic the exclusive sales agent for the bone graft in mutually agreed upon U.S. spine territories.

- In April 2024, Swiss-based Geistlich Holding acquired Bionnovation Biomedical, a Brazilian medical technology company, to expand its regenerative product line in Latin America and other emerging markets. The acquisition was subject to closing conditions and aims to provide Geistlich with access to Bionnovation’s expertise in regenerative dentistry and its existing distribution network in over 20 countries.

- In April 2024, Nasoya entered the plant-based meat market with its new Plantspired Plant-Based Chick’n product, available in two Asian-inspired flavors: Bee-Free Honey Garlic and Kung Pao. The product is designed to be a versatile meat alternative for a variety of dishes and contains up to 45 grams of protein per pack.

- In October 2023, Orthofix Medical Inc. announced that OsteoCoveTM- a breakthrough bioactive synthetic graft received 510k and is commercially launched. Putty and strip form of osteoCove provides superior bone-building capabilities to numerous orthopedic and spine applications

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising prevalence of orthopedic disorders.

- Adoption of synthetic and bioengineered grafts will increase across spinal and joint procedures.

- Minimally invasive surgeries will drive higher demand for ready-to-use graft materials.

- Technological advancements in biomaterials will improve graft effectiveness and patient outcomes.

- Expansion of healthcare infrastructure in emerging regions will create new growth opportunities.

- Increasing awareness among surgeons and patients will support wider adoption of advanced grafts.

- Strategic partnerships and collaborations will enhance product availability and market reach.

- Regulatory approvals and safety standards will continue to shape product development.

- Cost-effective solutions will gain traction in price-sensitive markets.

- Integration of digital tools and surgical innovations will strengthen overall market efficiency and adoption.