| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Biomaterials Market Size 2024 |

USD 5,494.74 Million |

| Canada Biomaterials Market, CAGR |

13.99% |

| Canada Biomaterials Market Size 2032 |

USD 15,666.15 Million |

Market Overview

Canada Biomaterials Market size was valued at USD 5,494.74 million in 2024 and is anticipated to reach USD 15,666.15 million by 2032, at a CAGR of 13.99% during the forecast period (2024-2032).

The Canada biomaterials market is driven by the growing demand for advanced medical devices, implants, and prosthetics, alongside increasing awareness of sustainable materials in various industries. The rising prevalence of chronic diseases and an aging population further boosts the need for innovative healthcare solutions, including biocompatible materials for tissue engineering and drug delivery systems. Additionally, the expansion of the automotive and aerospace sectors is contributing to the adoption of biomaterials for lightweight, durable, and environmentally friendly components. Technological advancements in material science, including bioresorbable and nanostructured biomaterials, are also propelling market growth. A shift towards sustainable and eco-friendly products, along with supportive government regulations encouraging green initiatives, is enhancing the use of biomaterials in packaging, electronics, and other sectors. These drivers, combined with growing investments in research and development, are expected to propel the Canadian biomaterials market significantly over the forecast period.

The geographical landscape of the Canadian biomaterials market is shaped by regional strengths in innovation, research, and industrial capacity. Ontario and Quebec lead in research and development, supported by strong academic institutions and well-established healthcare industries. Western Canada leverages its rich natural resources and agricultural base to focus on bio-based material innovation, while British Columbia and Atlantic Canada contribute through niche areas such as marine-based biomaterials and sustainable product development. Key players driving growth in the Canadian biomaterials sector include Dynacast Canada, BioPolymer Technologies, Medtronic Canada, Zimmer Biomet Canada, and Bio-Tec Medical. These companies are at the forefront of developing and commercializing a diverse range of biomaterials used in healthcare, packaging, and environmental applications. Their strategic partnerships, investment in research, and commitment to innovation have helped shape Canada’s competitive position in the global biomaterials market. As demand continues to rise, these regions and key players are expected to play a pivotal role in advancing the sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada biomaterials market was valued at USD 5,494.74 million in 2024 and is projected to reach USD 15,666.15 million by 2032, growing at a CAGR of 13.99% during the forecast period.

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Rising demand for advanced medical treatments and regenerative therapies is a key factor driving market growth.

- Increased adoption of natural and bioresorbable materials is shaping new trends in the biomaterials landscape.

- Industry players are investing in R&D and forming strategic partnerships to enhance product offerings and expand market reach.

- High costs of development and regulatory hurdles remain major restraints to faster market adoption.

- Ontario and Quebec lead the regional market due to strong infrastructure, research hubs, and healthcare networks.

- The market is evolving with innovations in biocompatible polymers, ceramics, and hybrid materials to meet growing healthcare and sustainability demands.

Report Scope

This report segments the Canada Biomaterials Market as follows:

Market Drivers

Technological Advancements in Biomaterials

Technological advancements in biomaterials are also driving market growth in Canada. Innovations in material science, particularly in the development of bioresorbable, biodegradable, and nanostructured biomaterials, are revolutionizing the healthcare sector. For instance, Canada’s Biomanufacturing and Life Sciences Strategy has allocated $2.2 billion to develop cutting-edge biomanufacturing capabilities, including biomaterials research. Additionally, the use of nanomaterials in drug delivery systems enables more precise targeting of diseases, improving the efficacy of treatments while minimizing side effects. Research into materials that mimic human tissue properties for tissue engineering applications is also expanding the scope of biomaterials, contributing to breakthroughs in regenerative medicine. These technological advancements are expected to continue pushing the boundaries of what biomaterials can achieve in various industries.

Environmental Sustainability and Green Initiatives

The increasing focus on environmental sustainability is another significant driver for the biomaterials market in Canada. For instance, the Government of Canada has invested $6.5 million in Bioindustrial Innovation Canada to support the development of biomaterials derived from renewable resources, such as agricultural residues. As industries seek more eco-friendly alternatives to traditional synthetic materials, biomaterials offer an attractive solution. Biomaterials are renewable, biodegradable, and non-toxic, making them a preferred choice for various applications, including packaging, automotive components, and electronics. This shift towards sustainability is supported by both consumer demand for greener products and government regulations that promote the use of environmentally friendly materials. Additionally, industries are adopting biomaterials to reduce their carbon footprints, aligning with global sustainability goals. The push for eco-friendly solutions is helping drive the development of new biomaterial options that are both functional and environmentally responsible, thus fostering the growth of the market.

Growing Demand for Advanced Medical Devices and Implants

The increasing demand for advanced medical devices, implants, and prosthetics is a major driver of the Canada biomaterials market. With a rising aging population and the prevalence of chronic diseases such as cardiovascular conditions, diabetes, and orthopedic issues, there is a growing need for durable and biocompatible materials in healthcare. Biomaterials are essential in creating devices like joint replacements, dental implants, and heart valves, which are crucial for enhancing patients’ quality of life. The development of next-generation biomaterials, such as bioresorbable materials and 3D-printed implants, is further accelerating the adoption of these materials in medical applications. As healthcare providers and patients seek improved outcomes and faster recovery times, the demand for high-performance biomaterials is expected to grow significantly in Canada.

Government Support and Research Investment

Government initiatives and increased investments in research and development are fueling the growth of the biomaterials market in Canada. Various federal and provincial programs are designed to encourage innovation in material science, including funding for universities and research institutions focused on developing advanced biomaterials. Collaborative efforts between academia, industry, and government are leading to breakthroughs in new biomaterial technologies that address challenges in healthcare, manufacturing, and environmental sectors. Moreover, Canadian government policies that prioritize the adoption of sustainable practices in industries such as healthcare, automotive, and packaging further promote the integration of biomaterials. The strong support for R&D activities and the creation of favorable regulatory frameworks are expected to continue driving the market’s expansion in Canada, ensuring that biomaterials remain at the forefront of technological and industrial advancements.

Market Trends

Rise in Adoption of Natural Biomaterials

A prominent trend in the Canadian biomaterials market is the growing adoption of natural biomaterials, driven by their enhanced biocompatibility, biodegradability, and sustainability. For instance, Canada’s Forest Biomaterials Initiative is actively promoting the use of biomaterials derived from sustainable forestry practices, such as cellulose-based composites. Materials such as collagen, chitosan, and alginate are increasingly being used in a range of applications, including tissue engineering, wound healing, and drug delivery systems. Natural biomaterials closely mimic human tissue properties, which reduces the risk of adverse reactions when implanted in the body, making them highly suitable for medical applications. Furthermore, their biodegradability ensures that they safely break down after fulfilling their purpose, reducing long-term environmental impact. This shift towards natural biomaterials reflects a broader industry movement towards more sustainable and patient-friendly solutions, offering a significant advantage over synthetic alternatives.

Growth of Bioresorbable Polymers in Medical Devices

Bioresorbable polymers are gaining significant traction in the Canadian biomaterials market, particularly within the medical device industry. For instance, Canada’s Bioresorbable Polymers Market Report highlights the increasing adoption of polylactic acid (PLA) and polyglycolic acid (PGA) in orthopedic and cardiovascular applications. The key advantage of bioresorbable polymers is their ability to degrade safely and naturally in the body, eliminating the need for surgical removal of implants after they have served their purpose. This feature is especially valuable in applications like stents, sutures, and bone fixation devices. As the healthcare sector focuses on reducing patient recovery times and minimizing the risk of complications from long-term implants, bioresorbable polymers offer an effective solution. Furthermore, these materials are finding use in controlled drug delivery systems, enabling more precise and efficient drug administration.

Increased Government Support and Research Investment

The Canadian government is playing a crucial role in fostering the growth of the biomaterials market through increased support for research and development (R&D) initiatives. Several federal and provincial programs are designed to encourage innovation in biomaterials, with a particular focus on sustainable and medical applications. Funding for universities, research institutions, and private companies is aimed at advancing the science behind new biomaterials, such as those for tissue engineering, drug delivery, and biodegradable plastics. Government-backed initiatives are also facilitating partnerships between academia, industry, and healthcare providers, accelerating the commercialization of new biomaterial technologies. This growing R&D investment positions Canada as a leader in biomaterials research, providing a foundation for the continued development of high-performance materials.

Sustainability Focus Drives Biomaterials Integration

One of the most significant trends in the Canadian biomaterials market is the increasing integration of biomaterials into sustainable manufacturing processes. As industries across the globe face increasing pressure to reduce their environmental impact, biomaterials offer an attractive alternative to conventional synthetic materials. Biomaterials, such as plant-based polymers and biodegradable composites, are renewable and non-toxic, making them ideal for applications in packaging, automotive parts, and electronics. In Canada, this trend is particularly evident in industries looking to meet both consumer demand for eco-friendly products and regulatory standards for sustainability. Manufacturers are turning to biomaterials to replace petroleum-based plastics and metals, reducing waste and carbon emissions. Additionally, the growing consumer preference for green products is pushing companies to adopt more sustainable practices, further fueling the demand for biomaterials. The integration of biomaterials into a variety of industrial sectors signals a significant shift towards environmentally responsible manufacturing practices, positioning Canada as a key player in the global sustainability movement.

Market Challenges Analysis

High Production Costs and Limited Scalability

One of the primary challenges facing the Canada biomaterials market is the high production costs associated with these materials. Manufacturing biomaterials, especially advanced ones like bioresorbable polymers and natural biomaterials, requires specialized processes, high-quality raw materials, and extensive research and development. For instance, the Bioproducts Production and Development Survey conducted by Statistics Canada highlights that businesses developing bioproducts face significant financial constraints due to the complexity of production and the need for specialized equipment. These factors contribute to elevated production expenses, making biomaterials significantly more expensive than conventional materials. As a result, the high cost of production limits the widespread adoption of biomaterials in various industries, particularly in price-sensitive sectors such as packaging and consumer goods. Overcoming these cost barriers is crucial for the long-term growth and accessibility of biomaterials in the Canadian market.

Regulatory and Standardization Challenges

Another significant challenge in the Canadian biomaterials market is navigating the complex regulatory landscape and the lack of standardized practices. The approval process for new biomaterials, particularly in medical applications, can be lengthy and costly, as it requires rigorous testing and validation to ensure safety and effectiveness. Different regulatory bodies, such as Health Canada and the Canadian Standards Association, have specific requirements that vary depending on the material’s application. Furthermore, the lack of universal standards for biomaterials can create inconsistencies in product quality and performance. Manufacturers often face difficulties in ensuring that their products meet the diverse regulatory requirements across various provinces and applications. This regulatory uncertainty can delay the introduction of new biomaterials to the market and hinder innovation in the sector. To foster growth, it is essential to streamline the regulatory processes and establish clear, unified standards for biomaterials.

Market Opportunities

The Canadian biomaterials market presents significant opportunities due to the rising demand for advanced medical applications and sustainable materials. With an aging population and increasing prevalence of chronic diseases, there is a growing need for biocompatible materials in medical devices, implants, and prosthetics. Biomaterials are crucial in creating high-performance implants, such as joint replacements, dental implants, and cardiovascular stents, offering opportunities for innovation in tissue engineering, regenerative medicine, and controlled drug delivery systems. As healthcare continues to focus on improving patient outcomes and reducing recovery times, biomaterials that promote faster healing and integration with human tissue are highly sought after. The ongoing research and development efforts in biomaterials for personalized medicine, particularly those involving bioresorbable and nanostructured materials, are expected to unlock new possibilities for the Canadian healthcare sector.

In addition to the healthcare sector, the demand for eco-friendly biomaterials is creating growth opportunities in industries such as packaging, automotive, and electronics. As sustainability becomes a central focus for businesses and consumers, biomaterials offer a promising solution to replace conventional petroleum-based materials. Their biodegradability, renewability, and non-toxic nature make them attractive alternatives in manufacturing, particularly in packaging and automotive components, where environmentally conscious practices are increasingly prioritized. Furthermore, government initiatives and funding to support green technologies are fostering innovation in sustainable biomaterials, leading to the development of new materials that can be integrated into various industrial processes. The continued shift towards sustainability, paired with technological advancements in biomaterials, provides a broad range of opportunities for growth and market expansion in Canada.

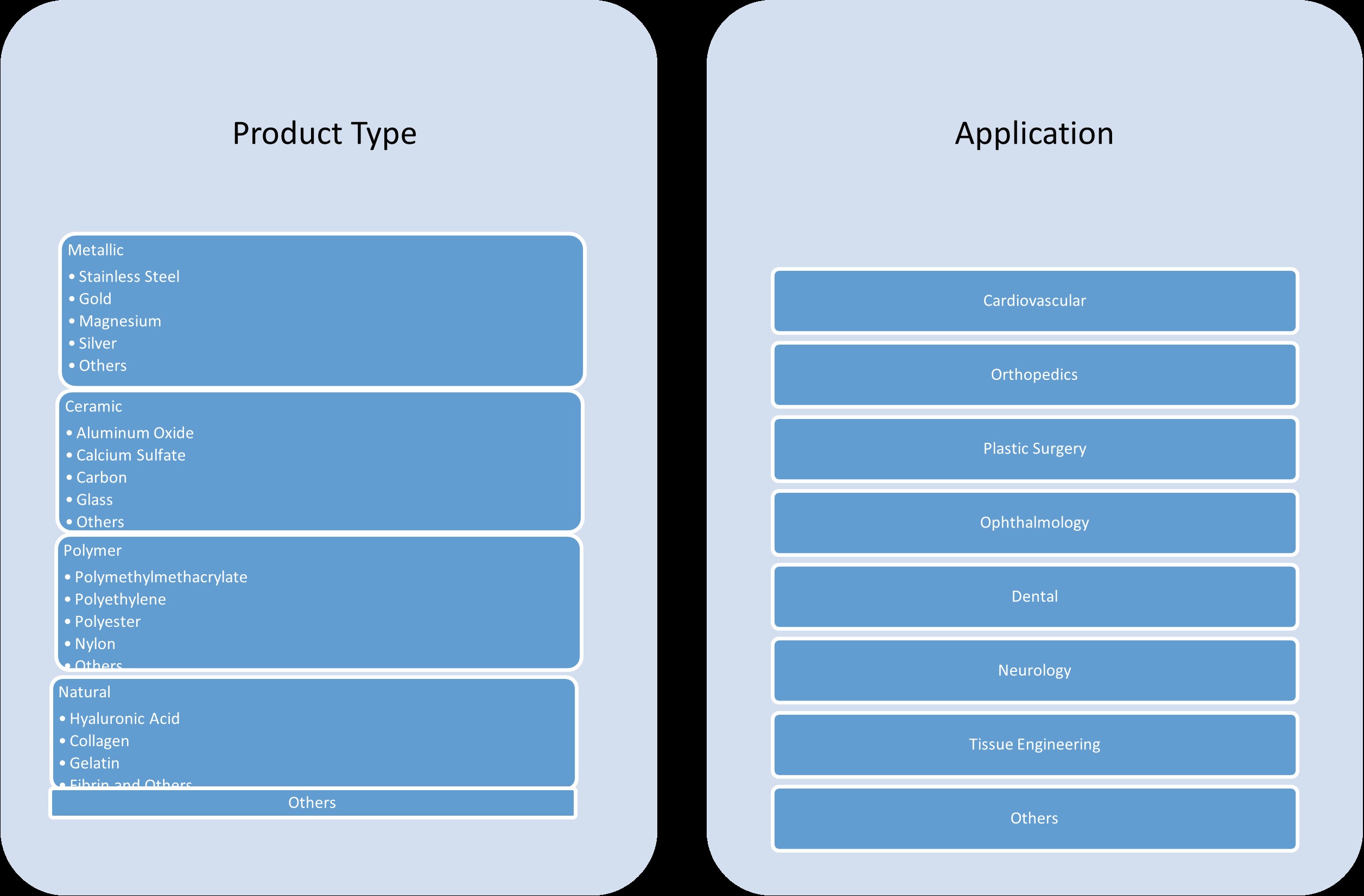

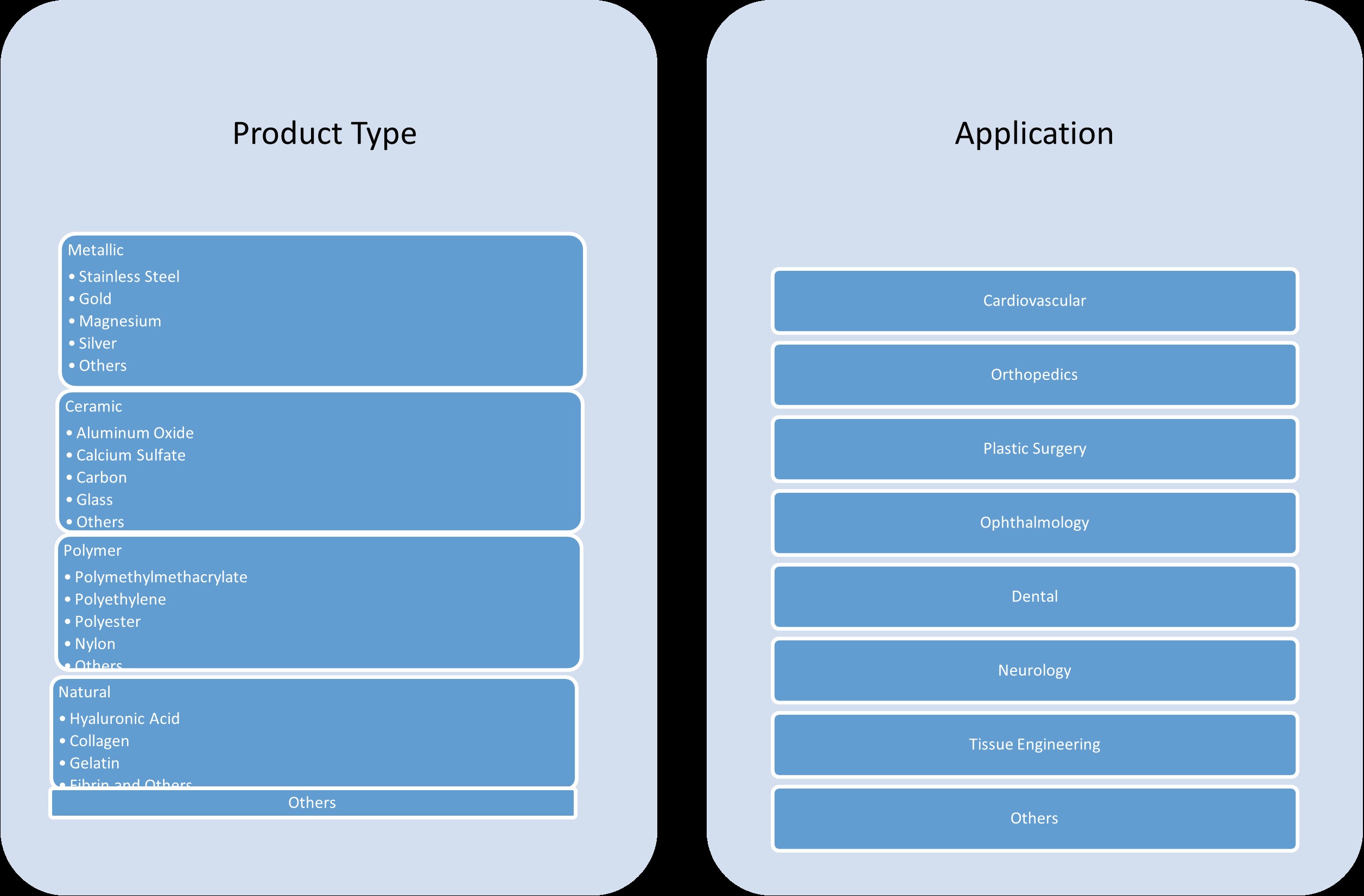

Market Segmentation Analysis:

By Product Type:

The Canadian biomaterials market is segmented by product type, which includes metallic, ceramic, polymer, natural, and other materials, each serving distinct applications. Metallic biomaterials, such as stainless steel, gold, magnesium, and silver, are commonly used in medical implants due to their strength, durability, and biocompatibility. Stainless steel is widely used in orthopedic devices, while magnesium is gaining traction for its biodegradability in implants. Ceramic biomaterials, including aluminum oxide, calcium sulfate, and carbon, offer high wear resistance and are particularly suitable for dental and orthopedic applications. These materials are preferred for their ability to mimic the properties of bone. Polymers, such as polymethylmethacrylate, polyethylene, and nylon, are utilized in various medical and dental applications due to their flexibility, ease of processing, and biocompatibility. Natural biomaterials like hyaluronic acid, collagen, gelatin, and fibrin are gaining popularity in tissue engineering and wound healing due to their bioactivity and support for cell growth. These diverse product types cater to a wide range of medical and industrial applications, driving market growth.

By Application:

In terms of application, the Canadian biomaterials market is expanding across various sectors, including cardiovascular, orthopedics, plastic surgery, ophthalmology, dental, neurology, tissue engineering, and others. Cardiovascular biomaterials, such as stents and heart valves, are in high demand as heart disease rates continue to rise. Orthopedic applications, including joint replacements and bone fixation devices, are another major segment, benefiting from advancements in both metallic and ceramic biomaterials. Plastic surgery applications use biomaterials in reconstructive and cosmetic procedures, while ophthalmology relies on biomaterials for corneal implants and artificial lenses. Dental biomaterials are also growing, with innovations in composites, ceramics, and natural materials for restorative and prosthetic applications. In neurology, biomaterials are used in neuroprosthetics and treatments for neurological disorders. Tissue engineering applications, which include the regeneration of damaged tissues and organs, are seeing rapid advancements with the development of novel biomaterials. The diverse range of applications across these sectors highlights the growing potential for biomaterials to address various medical needs in Canada.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario commands a dominant position in Canada’s biomaterials market, contributing approximately 44% of the nation’s bioproduct sales. This leadership stems from its robust infrastructure, encompassing a well-established pharmaceutical industry, advanced research institutions, and a skilled workforce. The province’s strategic location offers proximity to major U.S. markets, enhancing its appeal for both domestic and international stakeholders. Ontario’s emphasis on innovation is evident through its support for cutting-edge research in biomaterials, particularly in areas like regenerative medicine and sustainable bioproducts. The presence of leading universities and research centers fosters collaboration between academia and industry, driving advancements in biomaterials applications. Furthermore, government initiatives and funding programs bolster the province’s capacity to develop and commercialize novel biomaterials, solidifying Ontario’s status as a pivotal hub in Canada’s biomaterials landscape.

Quebec

Quebec holds a significant share of Canada’s biomaterials market, accounting for approximately 26% of the nation’s bioproduct sales. The province’s strength lies in its vibrant biotechnology sector, supported by a network of research institutions, universities, and specialized companies. Montreal, in particular, serves as a focal point for biomaterials research and development, attracting investments and fostering innovation. Quebec’s commitment to advancing biomaterials is further demonstrated through government incentives and policies that encourage research and commercialization. The province’s bilingual workforce and cultural diversity enhance its global competitiveness, facilitating collaborations with international partners. Quebec’s strategic emphasis on sustainable development aligns with the growing demand for eco-friendly biomaterials, positioning the province as a key player in the transition towards a bio-based economy.

Western Canada

Western Canada, encompassing provinces such as Alberta and Saskatchewan, contributes approximately 28% to Canada’s bioproduct sales, reflecting its growing prominence in the biomaterials sector. The region leverages its strong agricultural base and natural resources to develop bio-based materials, particularly in the areas of biofuels and bio-based chemicals. Research institutions and innovation hubs in cities like Edmonton and Saskatoon play a crucial role in advancing biomaterials research, focusing on applications in agriculture, energy, and environmental sustainability. Government support through funding programs and policy frameworks fosters a conducive environment for biomaterials development and commercialization. Western Canada’s emphasis on collaboration between academia, industry, and government entities accelerates the translation of research into market-ready products. As the region continues to diversify its economy, biomaterials present a promising avenue for sustainable growth and innovation.

British Columbia and Atlantic Canada

British Columbia and Atlantic Canada, while contributing smaller shares to Canada’s biomaterials market, are emerging as important regions for innovation and specialized applications. British Columbia accounts for approximately 2.2% of the nation’s bioproduct sales, with strengths in biotechnology and life sciences. The province’s focus on research and development, supported by institutions like the University of British Columbia, drives advancements in biomaterials for medical and environmental applications. Atlantic Canada, though representing a modest portion of the market, is making strides in biomaterials research, particularly in marine-based bioproducts and sustainable materials. The region’s commitment to fostering innovation is evident through government initiatives and collaborations with academic institutions. Both regions benefit from their unique geographical and resource advantages, contributing to the diversification and resilience of Canada’s biomaterials sector.

Key Player Analysis

- Dynacast Canada

- BioPolymer Technologies

- Medtronic Canada

- Zimmer Biomet Canada

- Bio-Tec Medical

Competitive Analysis

The competitive landscape of the Canadian biomaterials market is characterized by a mix of global leaders and specialized domestic firms, each contributing to innovation and market expansion. Leading players in the market include Dynacast Canada, BioPolymer Technologies, Medtronic Canada, Zimmer Biomet Canada, and Bio-Tec Medical. These companies compete on the basis of product quality, technological innovation, application diversity, and strategic partnerships. Companies operating in this space focus on expanding their biomaterial applications across various sectors, including orthopedics, cardiovascular, dental, and tissue engineering. Intense competition has encouraged increased investment in research and development to introduce new, biocompatible, and sustainable solutions that meet evolving medical and environmental standards. Collaborations between research institutions and manufacturers are also fueling product innovation and accelerating commercialization timelines. Additionally, players are adapting to shifting regulatory requirements and patient expectations by prioritizing safety, efficacy, and cost-efficiency in their offerings. The adoption of advanced manufacturing technologies, such as 3D printing and nanotechnology, is further enhancing the customization and performance of biomaterials. Overall, the market reflects a strong commitment to addressing both clinical challenges and sustainability goals, making it a fertile ground for technological breakthroughs and strategic growth opportunities.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Canada biomaterials market exhibits a moderately concentrated structure, characterized by a mix of established players and emerging innovators contributing to a dynamic competitive environment. The market is defined by a strong emphasis on research and development, with companies actively investing in advanced biomaterial technologies to cater to a growing range of medical and industrial applications. Key characteristics of the market include a high degree of product specialization, strong ties between academic institutions and industry, and a focus on sustainability and biocompatibility. Innovation is a primary driver, with firms leveraging advanced materials such as bioresorbable polymers, natural biomaterials, and hybrid composites. Regulatory compliance and quality assurance also shape the operational landscape, influencing product development and market entry strategies. Furthermore, regional variations in infrastructure and research capabilities contribute to a diversified yet integrated market ecosystem. This combination of innovation, specialization, and strategic collaboration defines the unique character and growth potential of Canada’s biomaterials sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Canadian biomaterials market is projected to experience robust growth, driven by increasing demand across healthcare and industrial sectors.

- Advancements in regenerative medicine and tissue engineering are expected to expand the applications of biomaterials in medical treatments.

- The integration of smart biomaterials with adaptive and responsive properties will enhance the functionality of medical devices and implants.

- Growing emphasis on sustainable and eco-friendly biomaterials will drive innovation in biodegradable and natural material development.

- Collaborations between research institutions and industry players will accelerate the development and commercialization of advanced biomaterials.

- The aging population in Canada will increase the demand for biomaterials used in orthopedic and cardiovascular applications.

- Government support and funding for biomaterials research will foster innovation and strengthen the country’s position in the global market.

- The adoption of 3D printing technology will enable the production of customized implants and prosthetics, enhancing patient-specific treatments.

- Advancements in nanotechnology will lead to the development of biomaterials with improved properties for drug delivery and diagnostics.

- The Canadian biomaterials market will continue to evolve, with a focus on innovation, sustainability, and meeting the diverse needs of the healthcare industry.