| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

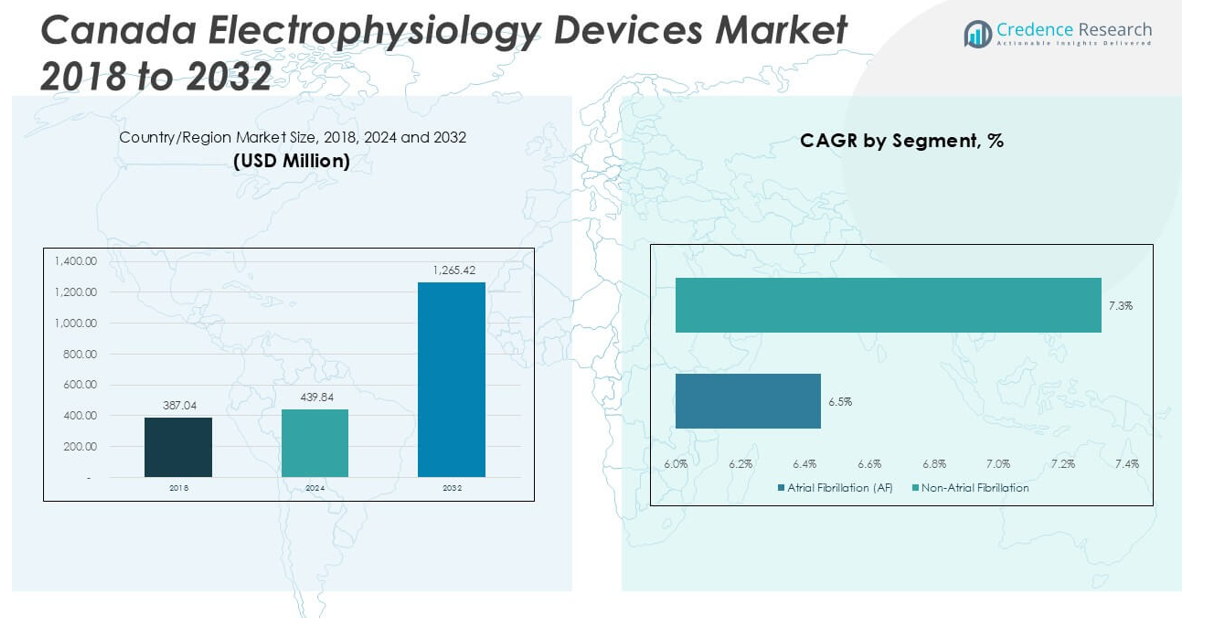

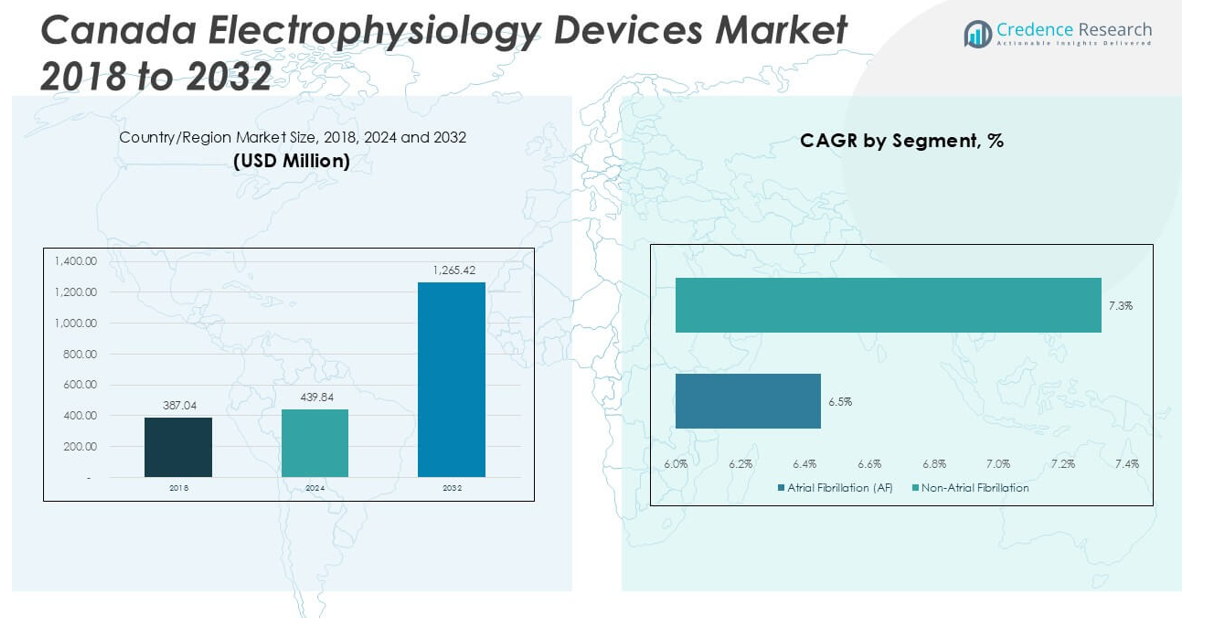

| Canada Electrophysiology Devices MarketSize 2024 |

USD 439.84 million |

| Canada Electrophysiology Devices Market, CAGR |

14.12% |

| Canada Electrophysiology Devices Market Size 2032 |

USD 1,265.42 million |

Market Overview

Canada Electrophysiology Devices Market size was valued at USD 387.04 million in 2023 to USD 439.84 million in 2024 and is anticipated to reach USD 1,265.42 million by 2032, at a CAGR of 14.12% during the forecast period.

The Canada Electrophysiology Devices Market is experiencing strong momentum, propelled by the increasing prevalence of cardiac arrhythmias, a growing aging population, and greater awareness of early diagnosis and intervention. The expansion of advanced healthcare infrastructure and rising adoption of minimally invasive cardiac procedures support higher demand for sophisticated electrophysiology systems. Technological advancements—such as improved 3D mapping, advanced ablation catheters, and real-time navigation tools—continue to enhance procedure accuracy and patient outcomes. Supportive government policies, ongoing healthcare investments, and favorable reimbursement frameworks further strengthen market growth. Collaborations between Canadian hospitals and leading global medical device manufacturers are facilitating the introduction of innovative, locally relevant solutions. In addition, the integration of digital health technologies and remote patient monitoring is streamlining care delivery and post-procedure follow-up, shaping key trends in the market. Together, these drivers and trends reinforce Canada’s position as an emerging and dynamic hub for electrophysiology innovation.

The geographical landscape of the Canada Electrophysiology Devices Market reflects strong demand and advanced healthcare capabilities across provinces such as Ontario, Quebec, British Columbia, and Western Canada. Leading urban centers including Toronto, Montreal, Vancouver, and Calgary are home to specialized cardiac hospitals and academic medical centers, driving the adoption of innovative electrophysiology technologies and procedures. Hospitals in these regions offer a comprehensive range of arrhythmia diagnostics, ablation therapies, and digital health solutions, enabling early intervention and improved patient outcomes. The presence of well-established healthcare infrastructure and a growing focus on minimally invasive cardiac care further support regional market growth. Key players such as Boston Scientific Corp., Medtronic, and Abbott play an influential role in supplying advanced electrophysiology devices, partnering with Canadian hospitals, and introducing cutting-edge products that address the evolving needs of clinicians and patients across the country.

Market Insights

- The Canada Electrophysiology Devices Market is projected to grow from USD 439.84 million in 2024 to USD 1,265.42 million by 2032, with a CAGR of 14.12%.

- Growing prevalence of cardiac arrhythmias and an aging population are major drivers, creating increased demand for advanced electrophysiology devices across the country.

- The market is witnessing rapid adoption of digital health platforms, remote monitoring solutions, and minimally invasive ablation techniques to enhance diagnostic and therapeutic outcomes.

- Ontario, Quebec, and Western Canada serve as regional hubs for electrophysiology innovation, with major hospitals and academic centers leading clinical advancements and early technology adoption.

- Leading players such as Boston Scientific Corp., Medtronic, and Abbott dominate the competitive landscape, consistently introducing new mapping systems, ablation catheters, and integrated digital solutions in collaboration with Canadian healthcare providers.

- High costs of advanced devices and workforce shortages, especially in rural and remote regions, act as significant restraints on market expansion and limit access to state-of-the-art treatments.

- The market is expected to benefit from expanded telehealth infrastructure, strategic collaborations, and ongoing investments in healthcare modernization, which are poised to improve access to specialized cardiac care and support future growth across Canada.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Cardiac Arrhythmias and Aging Population Drives Demand

The Canada Electrophysiology Devices Market is witnessing strong growth due to a significant increase in the incidence of cardiac arrhythmias, particularly among the aging population. The growing number of elderly individuals in Canada, coupled with lifestyle-related risk factors such as hypertension, obesity, and diabetes, is fueling the demand for timely and effective arrhythmia management. Hospitals and specialty clinics are reporting higher patient volumes for diagnostic and therapeutic electrophysiology procedures. Physicians are prioritizing early detection and intervention, leading to a greater reliance on advanced electrophysiology devices. Early diagnosis reduces the risk of severe cardiac events and improves long-term patient outcomes. The market benefits from heightened awareness campaigns and educational initiatives by both government and private healthcare organizations.

- For instance, cardiovascular diseases account for nearly 30% of all deaths in Canada, with atrial fibrillation affecting approximately 200,000 Canadians annually.

Expansion of Healthcare Infrastructure and Investments in Medical Technology

Investments in healthcare infrastructure play a pivotal role in shaping the growth trajectory of the Canada Electrophysiology Devices Market. Government and private sector initiatives to modernize hospitals and equip cardiac centers with advanced technology have improved access to electrophysiology procedures. Canadian healthcare providers are adopting state-of-the-art mapping systems and ablation catheters to enhance procedural efficiency and patient safety. Investments target upgrading existing facilities and establishing new specialized centers, supporting the delivery of minimally invasive procedures. Procurement of innovative electrophysiology equipment is a key focus in strategic hospital development plans. These infrastructure advancements ensure higher procedure volumes and improved care standards nationwide.

- For instance, Canada has invested in expanding electrophysiology labs, with hospitals upgrading facilities to accommodate advanced mapping and ablation technologies.

Technological Advancements Enhance Precision and Clinical Outcomes

Continuous technological innovation is a cornerstone for the Canada Electrophysiology Devices Market, supporting the development of devices that offer greater accuracy and ease of use. Advancements such as three-dimensional mapping, real-time navigation systems, and contact force-sensing catheters allow clinicians to perform complex ablations with higher precision. These technologies enable shorter procedure times and improved safety profiles for patients. It helps electrophysiologists achieve better success rates in treating various arrhythmias, including atrial fibrillation and ventricular tachycardia. Market players prioritize research and development to introduce solutions that address specific clinical needs. It encourages adoption across a broad range of healthcare facilities, from academic centers to regional hospitals.

Supportive Government Policies and Favorable Reimbursement Landscape

The regulatory environment in Canada supports the adoption of advanced electrophysiology devices by offering favorable reimbursement policies and streamlining product approvals. Health authorities are focusing on improving cardiac care delivery by promoting early intervention and timely access to innovative therapies. Financial incentives and reimbursement programs reduce the economic burden on hospitals and patients, facilitating broader access to electrophysiology procedures. The Canada Electrophysiology Devices Market benefits from partnerships between government bodies and industry leaders to develop training and education programs for healthcare professionals. Streamlined regulatory processes accelerate the availability of new devices in the market. It fosters an environment where continuous innovation can thrive, ultimately improving patient care outcomes.

Market Trends

Integration of Digital Health Platforms and Remote Monitoring Solutions

The integration of digital health platforms is redefining the landscape of the Canada Electrophysiology Devices Market. Hospitals and clinics increasingly rely on remote monitoring technologies to track cardiac rhythms and patient progress outside clinical settings. These solutions support timely detection of arrhythmias and provide valuable data for personalized treatment planning. Telehealth capabilities have become a standard component of post-procedure follow-up, allowing clinicians to monitor device performance and patient compliance remotely. The trend is fostering greater patient engagement and adherence to therapy protocols. It is driving efficiencies across the healthcare continuum, improving outcomes for patients with complex cardiac conditions.

- For instance, telehealth adoption in Canada has surged, with remote monitoring tools now playing a crucial role in post-procedure follow-ups for cardiac patients.

Growth in Adoption of Minimally Invasive Electrophysiology Procedures

Minimally invasive techniques have gained significant traction in the Canada Electrophysiology Devices Market, with physicians and healthcare systems shifting toward procedures that minimize patient risk and recovery time. Newer ablation technologies and advanced navigation systems allow for precise, targeted treatment of arrhythmias with smaller incisions and less trauma. Hospitals report reduced complication rates and shorter hospital stays, supporting a patient-centric approach to cardiac care. Demand for catheter-based interventions continues to rise, supported by ongoing clinical evidence and physician preference for minimally invasive solutions. The trend aligns with global efforts to enhance patient safety and procedural efficiency. It is helping Canadian cardiac centers establish themselves as leaders in innovative arrhythmia management.

- For instance, Canadian healthcare providers are expanding outpatient electrophysiology services to improve accessibility and reduce hospital stays.

Collaboration Between Domestic Providers and Global Device Manufacturers

Collaboration between Canadian healthcare providers and international electrophysiology device manufacturers is driving innovation in the market. Strategic partnerships facilitate the transfer of advanced technologies and clinical best practices, supporting the development of solutions tailored to local patient needs. Joint research initiatives and co-development agreements accelerate the introduction of next-generation devices, enhancing the competitiveness of Canadian cardiac centers. The Canada Electrophysiology Devices Market is benefiting from a continuous pipeline of product launches that address emerging clinical challenges. It encourages broader access to leading-edge technology and ensures ongoing knowledge exchange within the clinical community.

Emphasis on Training, Education, and Clinical Excellence

Ongoing training and education initiatives have become a central trend in the Canada Electrophysiology Devices Market, aiming to upskill healthcare professionals and standardize procedural quality nationwide. Hospitals, medical societies, and device manufacturers collaborate to offer workshops, certification programs, and simulation-based training. These efforts equip clinicians with the skills necessary to maximize the benefits of advanced mapping and ablation technologies. It promotes a culture of clinical excellence, ensuring patients receive the highest standards of care. The trend supports continuous improvement and adaptation to rapid technological advancements in electrophysiology. It strengthens the market’s long-term growth prospects by building a knowledgeable and skilled workforce.

Market Challenges Analysis

High Cost of Advanced Electrophysiology Devices and Financial Constraints

The Canada Electrophysiology Devices Market faces a major challenge due to the high cost associated with acquiring and maintaining advanced devices and supporting infrastructure. Hospitals and clinics, particularly those in smaller or rural communities, often encounter budgetary limitations that restrict access to the latest electrophysiology technology. The initial investment required for state-of-the-art mapping systems and ablation catheters remains substantial, deterring some facilities from upgrading existing equipment. While reimbursement frameworks have improved, gaps persist, and not all procedures or devices qualify for full coverage. This financial barrier can delay the widespread adoption of innovative solutions. It creates disparities in access to optimal cardiac care across the country.

- For instance, the cost of advanced electrophysiology mapping systems can exceed CAD 500,000, limiting accessibility for smaller hospitals.

Workforce Shortages and Need for Specialized Training

A shortage of skilled electrophysiologists and technical staff presents another significant challenge for the Canada Electrophysiology Devices Market. The complexity of electrophysiology procedures demands a high level of expertise and ongoing education, yet not all regions have sufficient access to specialized training programs. Rural and remote areas are particularly affected, resulting in unequal service availability. Hospitals must invest in continuous professional development to keep pace with rapidly advancing technologies. Delays in adopting new devices can arise when staff lack adequate training or experience. It impacts procedural volumes and limits the potential benefits of advanced electrophysiology systems across Canada.

Market Opportunities

Expansion of Digital Health Solutions and Remote Care Models

The growing adoption of digital health platforms and remote patient monitoring offers significant opportunities for the Canada Electrophysiology Devices Market. Hospitals and clinics can leverage advanced telehealth tools to improve early detection of arrhythmias, enhance patient follow-up, and support personalized treatment plans. The integration of wearable cardiac monitors and real-time data analytics creates pathways for proactive intervention, reducing hospital readmissions and improving long-term outcomes. Healthcare providers can extend specialized care to remote and underserved communities, bridging gaps in access. It positions the market to play a pivotal role in advancing nationwide cardiac care standards.

Strategic Collaborations and Product Innovation

Collaborations between Canadian healthcare institutions and global electrophysiology device manufacturers create a fertile environment for innovation and market expansion. Joint research initiatives and co-development projects accelerate the introduction of next-generation mapping systems, ablation catheters, and navigation tools. The Canada Electrophysiology Devices Market can benefit from customized solutions tailored to unique patient populations and clinical workflows. Strategic alliances facilitate knowledge transfer and upskilling, supporting the adoption of best practices and new technologies. It strengthens the competitive landscape and sets the stage for sustainable growth across the Canadian healthcare system.

Market Segmentation Analysis:

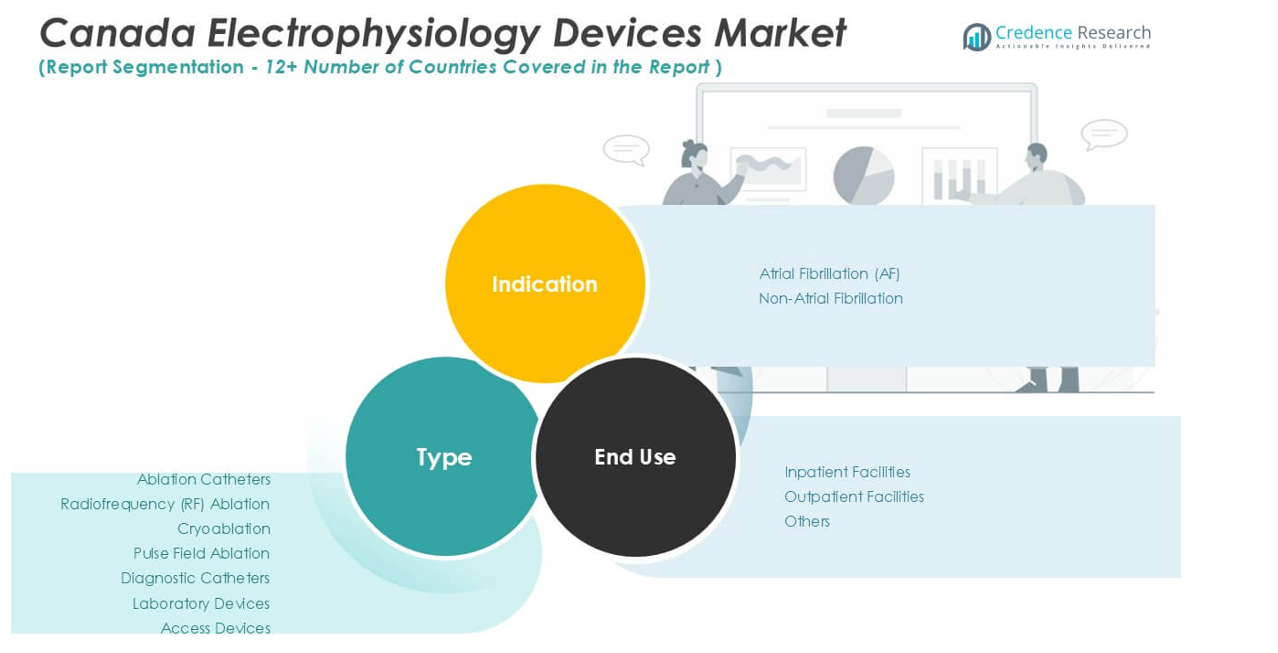

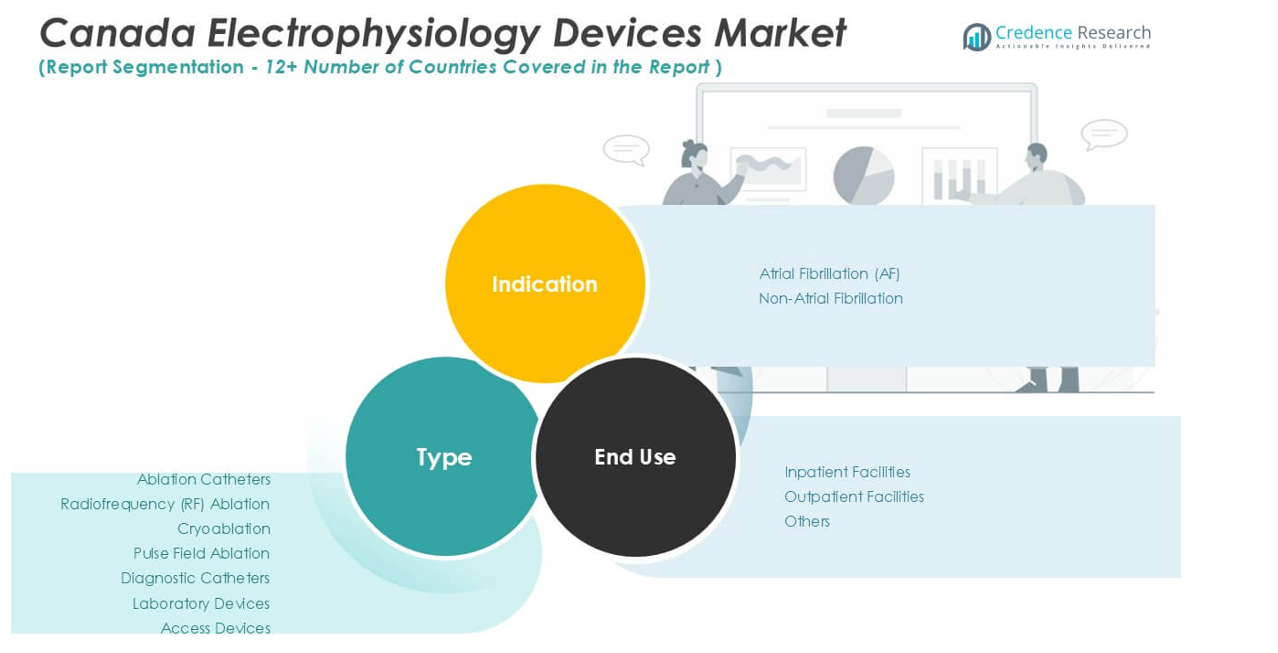

By Type:

Ablation catheters represent a vital product category, offering specialized solutions for targeted cardiac tissue ablation. The ablation catheters segment includes radiofrequency (RF) ablation, cryoablation, and pulse field ablation technologies. RF ablation remains widely adopted for its established efficacy and precision, while cryoablation attracts clinicians who seek lower risk of collateral tissue damage. Pulse field ablation, a newer technology, is gaining momentum due to its promising safety profile and ability to treat complex arrhythmias. The market also includes diagnostic catheters that facilitate detailed cardiac mapping and electrophysiological assessment, allowing clinicians to pinpoint arrhythmic sources with high accuracy. Laboratory devices such as electroanatomical mapping systems, stimulators, and recording devices support procedure planning and execution, ensuring reliable results in both routine and advanced cases. Access devices, designed to provide safe vascular entry, enable efficient catheter navigation and procedural success.

By Indication:

The Canada Electrophysiology Devices Market is segmented into atrial fibrillation (AF) and non-atrial fibrillation categories. Atrial fibrillation remains the leading indication, driven by the high prevalence of AF among the aging Canadian population and the strong clinical focus on early intervention. Non-atrial fibrillation indications cover a wide range of arrhythmias, including supraventricular tachycardia, ventricular tachycardia, and other complex rhythm disorders. It reflects the broadening application of electrophysiology devices beyond traditional AF management.

By End-Use:

The market divides into inpatient facilities, outpatient facilities, and others. Inpatient facilities, such as hospitals with dedicated cardiac electrophysiology labs, account for a significant share due to their advanced infrastructure and capacity for complex ablation procedures. Outpatient facilities are growing in importance, supported by the shift toward minimally invasive techniques and faster patient recovery. Other end-use segments include specialty clinics and ambulatory surgical centers, where targeted electrophysiology interventions are performed. It demonstrates the adaptability of market solutions across diverse clinical settings, reinforcing strong growth prospects throughout Canada.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario holds the largest share of the Canada Electrophysiology Devices Market, accounting for approximately 39% of the national market. The province’s robust healthcare infrastructure, including several leading academic medical centers and specialized cardiac hospitals, creates a strong foundation for growth and innovation. Ontario benefits from high procedural volumes, a large pool of skilled electrophysiologists, and continuous investments in advanced diagnostic and ablation technologies. Hospitals in Toronto, Ottawa, and other urban centers routinely perform complex electrophysiology procedures, often serving as regional referral centers for arrhythmia management. Public and private funding in Ontario enables the early adoption of next-generation devices and supports participation in multi-center clinical trials. Ongoing initiatives to expand telehealth and remote monitoring platforms further strengthen Ontario’s position as a hub for digital health integration in electrophysiology. The province’s favorable reimbursement environment and government support for cardiac care programs reinforce its leadership role in shaping the future of electrophysiology device adoption and clinical standards across Canada.

Quebec

Quebec represents the second-largest market for electrophysiology devices, capturing an estimated 24% share of the Canada Electrophysiology Devices Market. The region’s concentration of world-class research institutions, teaching hospitals, and cardiac specialty centers contributes to its leadership in innovation and clinical excellence. Hospitals in Montreal, Quebec City, and other urban areas offer advanced arrhythmia management services, including high-volume ablation and diagnostic procedures. Quebec’s provincial health policies emphasize early intervention and comprehensive cardiac care, fostering consistent demand for the latest electrophysiology devices. The region benefits from active collaboration between local hospitals and global medical device manufacturers, accelerating the introduction of cutting-edge mapping and ablation systems. Clinical research programs and professional development initiatives drive continuous knowledge transfer and upskilling, supporting high standards of patient care. Quebec’s growing adoption of remote monitoring and telehealth solutions reflects its proactive approach to integrating technology-driven models of care.

Western Canada

Western Canada, which includes Alberta, Saskatchewan, and Manitoba, accounts for roughly 18% of the Canada Electrophysiology Devices Market. The region’s major urban centers—Calgary, Edmonton, and Winnipeg—feature advanced cardiac facilities equipped with state-of-the-art electrophysiology labs. Western Canada has prioritized investments in healthcare infrastructure, resulting in the expansion of specialized cardiac programs and improved access to minimally invasive procedures. Provincial health authorities support the adoption of innovative electrophysiology technologies through funding and strategic partnerships with academic and industry stakeholders. The region faces unique geographic challenges that increase the value of telehealth and remote patient monitoring platforms, ensuring continuity of care for patients in rural and remote communities. Western Canada’s collaborative approach to training and professional development helps address workforce shortages and supports the delivery of high-quality electrophysiology services throughout the region.

British Columbia

British Columbia contributes about 13% of the total market share within the Canada Electrophysiology Devices Market. The province is home to leading cardiac centers in Vancouver and Victoria, where hospitals offer a full spectrum of electrophysiology services, including complex ablation procedures and advanced arrhythmia diagnostics. British Columbia’s focus on patient-centered care and minimally invasive interventions aligns with national trends, driving demand for sophisticated mapping and ablation catheters. Government initiatives and targeted investments in cardiac care infrastructure enable continuous upgrades to hospital facilities and technology platforms. The region benefits from a strong research and academic ecosystem that supports clinical trials, device innovation, and the early adoption of emerging solutions. British Columbia’s emphasis on digital health integration and remote patient management reflects its commitment to expanding access and improving outcomes for patients across urban, suburban, and remote areas.

Atlantic Canada

Atlantic Canada, encompassing New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador, represents approximately 6% of the Canada Electrophysiology Devices Market. While the region has a smaller population and fewer high-volume cardiac centers compared to larger provinces, Atlantic Canada continues to invest in expanding electrophysiology services. Hospitals in Halifax and St. John’s serve as key centers for arrhythmia management, offering specialized diagnostics and ablation procedures. Regional health authorities are actively working to address disparities in access through investments in telemedicine, collaborative care models, and workforce training. Partnerships with national organizations and device manufacturers help bring advanced technologies to the region’s hospitals and clinics. Atlantic Canada’s commitment to expanding cardiac care access and adopting best practices in electrophysiology supports steady market growth and improved health outcomes for patients across the eastern provinces.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster

- General Electric Company

- Siemens Healthcare AG

- Biotronik AG

Competitive Analysis

The competitive landscape of the Canada Electrophysiology Devices Market is shaped by several global leaders, including Boston Scientific Corp., Medtronic, Abbott, Biosense Webster, General Electric Company, Siemens Healthcare AG, and Biotronik AG. These companies hold a strong presence in Canada through extensive product portfolios, strategic partnerships with leading hospitals, and robust distribution networks. Each player focuses on continuous product innovation, bringing advanced mapping systems, ablation catheters, and digital monitoring solutions that address the evolving clinical needs of Canadian cardiologists and electrophysiologists. Companies invest heavily in research and development, focusing on technologies that improve clinical outcomes, reduce procedure times, and enhance patient safety. Strategic partnerships with hospitals, academic medical centers, and research organizations enable early adoption of cutting-edge devices and support ongoing education for clinicians. The competitive environment is further characterized by robust distribution networks and dedicated customer support programs, ensuring timely access to products and technical assistance across the country. Competitive differentiation often centers on device efficacy, integration with digital health platforms, and the ability to offer comprehensive training. The market continues to evolve rapidly, with innovation and collaboration serving as key pillars of sustained growth and leadership.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

- In September 2022, Johnson & Johnson (US) launched OCTARAY MAPPING SYSTEM which is used to treat cardiac arrhythmias.

Market Concentration & Characteristics

The Canada Electrophysiology Devices Market demonstrates moderate to high market concentration, with a few multinational manufacturers supplying the majority of advanced devices and solutions. It features a competitive yet collaborative environment, where companies differentiate their offerings through technological innovation, comprehensive product portfolios, and strong after-sales support. The market is characterized by a strong focus on minimally invasive procedures, integration of digital health tools, and rapid adoption of new mapping and ablation technologies. Hospitals and cardiac centers across major provinces favor vendors that provide proven clinical outcomes, seamless device integration, and continuous training. Strategic partnerships with healthcare providers and academic institutions support ongoing research, education, and the introduction of next-generation products. It maintains high standards for product quality, regulatory compliance, and clinical evidence, contributing to reliable outcomes and continued market growth across Canada.

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Canada electrophysiology devices market is projected to grow steadily, driven by the increasing prevalence of cardiac arrhythmias and a rising geriatric population.

- Technological advancements, including AI integration, 3D mapping, and robotic-assisted procedures, are enhancing diagnostic accuracy and treatment outcomes.

- The adoption of minimally invasive procedures, such as catheter-based ablations, is on the rise due to their benefits of reduced recovery times and lower complication rates.

- The expansion of specialized electrophysiology labs and cardiac care centers across Canada is improving patient access to advanced diagnostics and therapies.

- Growing awareness of arrhythmia symptoms and the importance of early diagnosis is encouraging timely interventions and boosting market demand.

- The development and adoption of high-density mapping catheters are gaining popularity, offering detailed electrical mapping of the heart for precise treatment.

- The shift toward cryoablation and laser-based technologies is providing alternative treatment options for specific arrhythmias, expanding therapeutic choices.

- The integration of home-based monitoring solutions, such as implantable loop recorders and wearable devices, is enabling remote monitoring and early detection of arrhythmias.

- Despite growth prospects, challenges such as high costs of advanced EP systems and the need for skilled professionals may impact market expansion.

- Regulatory reforms and favorable reimbursement policies are expected to support quicker market entry and adoption of innovative electrophysiology devices in Canada.