| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Industrial Catalyst Market Size 2024 |

USD 1062.59 Million |

| Canada Industrial Catalyst Market, CAGR |

5.55% |

| Canada Industrial Catalyst Market Size 2032 |

USD 1636.81 Million |

Market Overview:

The Canada Industrial Catalyst Market is projected to grow from USD 1062.59 million in 2024 to an estimated USD 1636.81 million by 2032, with a compound annual growth rate (CAGR) of 5.55% from 2024 to 2032.

The growth of the industrial catalyst market in Canada is primarily driven by technological advancements, environmental regulations, and the demand from key industrial sectors. Ongoing research and development in catalyst technologies have led to the creation of more efficient and selective catalysts, enhancing the overall effectiveness of industrial processes. Stringent environmental regulations are pushing industries to adopt cleaner, more sustainable technologies, where catalysts play a crucial role in reducing emissions and minimizing waste. Furthermore, the growth of Canada’s petrochemical, chemical, and refining sectors has significantly increased the demand for catalysts to optimize production processes and meet rising demands for various chemicals. Lastly, the shift towards renewable energy sources further fuels the market, as catalysts are necessary for efficient energy conversion and the development of green technologies.

Canada’s industrial catalyst market is closely linked to the overall North American market and is influenced by developments in both the United States and other global regions. The U.S. industrial catalyst market is experiencing steady growth, with advancements in catalyst technologies and the petrochemical industry’s expansion driving demand. As a result, Canada benefits from cross-border collaborations and the exchange of innovative technologies. Additionally, the Asia-Pacific region, particularly countries like South Korea, is experiencing robust growth in the industrial catalyst market. This offers Canadian companies new opportunities for trade and the adoption of advanced catalyst technologies. Similarly, Europe’s emphasis on sustainability and eco-friendly manufacturing practices boosts demand for industrial catalysts, opening up potential export avenues for Canadian manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Industrial Catalyst Market is projected to grow from USD 1,062.59 million in 2024 to USD 1,636.81 million by 2032, driven by technological advancements and increasing demand from key industrial sectors.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- Technological innovation is central to market growth, with research focusing on the development of more efficient, selective, and durable catalysts that improve process efficiency and reduce operational costs.

- Stringent environmental regulations are propelling the adoption of industrial catalysts, as industries strive to reduce emissions and comply with sustainable practices.

- The growth of Canada’s petrochemical, chemical, and refining sectors is significantly boosting the demand for catalysts to optimize production processes and meet rising chemical demands.

- The shift towards renewable energy sources is creating new opportunities for catalysts, particularly in hydrogen production, biofuels, and energy storage, supporting Canada’s transition to sustainable energy solutions.

- Despite growth, high catalyst development and production costs remain a challenge, with the use of precious metals and advanced materials limiting widespread adoption.

- Regional collaboration with the U.S. and Asia-Pacific countries, particularly South Korea, provides opportunities for Canadian companies to adopt innovative technologies and expand trade in industrial catalysts.

Market Drivers:

Technological Advancements in Catalyst Development

The Canadian industrial catalyst market is significantly driven by ongoing technological advancements. Continuous research and development efforts in catalyst technologies are leading to the creation of more efficient, selective, and durable catalysts. For example, technological innovation in catalyst development is the breakthrough by researchers at the University of Toronto Engineering, who developed a new catalyst capable of converting carbon dioxide into ethylene, a key building block for plastics. These innovations improve the overall efficiency of chemical processes, reducing energy consumption and operational costs. The development of advanced catalysts that can operate under extreme conditions or offer higher activity and selectivity is a key factor enhancing industrial productivity. Moreover, these advancements contribute to the production of high-value chemicals with improved yields, which is crucial for industries such as petrochemicals and refining.

Stringent Environmental Regulations

The increasing focus on environmental sustainability has been a major driver of the industrial catalyst market in Canada. Stricter environmental regulations require industries to adopt cleaner technologies that minimize harmful emissions and reduce environmental footprints. Catalysts play a pivotal role in these efforts, facilitating the reduction of greenhouse gas emissions and enabling industries to meet regulatory compliance standards. This growing emphasis on sustainability is compelling industries across various sectors, including automotive, chemicals, and energy, to incorporate catalysts in their processes to ensure environmentally friendly operations while maintaining cost-effectiveness.

Growth in Key Industrial Sectors

Canada’s industrial catalyst market is heavily influenced by the expansion of critical sectors such as petrochemicals, refining, and chemicals. These industries rely on catalysts to optimize production processes, enhance reaction efficiency, and improve product quality. For instance, resin catalysts enable the production of valuable products like gasoline and diesel by breaking down larger hydrocarbons. As demand for petrochemical products, such as plastics, fertilizers, and synthetic materials, continues to rise, so does the need for industrial catalysts. Similarly, the growing focus on refining processes to produce cleaner fuels and reduce sulfur content has further propelled the use of catalysts. This demand from key industries is expected to maintain robust growth within the Canadian market, driving the adoption of new and improved catalytic technologies.

Shift Toward Renewable Energy and Sustainability

The global transition towards renewable energy is another key factor driving the industrial catalyst market in Canada. As the country moves towards achieving sustainability goals, there is an increased demand for catalysts in renewable energy applications, including hydrogen production, biofuel synthesis, and energy storage. Catalysts are essential for enhancing the efficiency of these processes, enabling the production of cleaner energy at a lower environmental cost. The growing investments in green technologies and energy transition are creating new opportunities for the catalyst market, positioning Canada as a key player in the global push for cleaner energy solutions. This shift is expected to continue fostering growth in the industrial catalyst sector.

Market Trends:

Advancements in Catalyst Technologies

The Canadian industrial catalyst market is experiencing significant growth, driven by continuous advancements in catalyst technologies. These innovations focus on improving the efficiency, selectivity, and durability of catalysts, which enhance reaction rates and product yields across various industries. The incorporation of nanotechnology, for example, has allowed for the development of catalysts with increased surface areas, improving their effectiveness in chemical processes. These advancements not only optimize industrial operations but also support sustainability by reducing energy consumption and minimizing waste generation.

Expansion in Refining and Petrochemical Sectors

The refining and petrochemical sectors in Canada are key drivers of the industrial catalyst market. As these industries expand, the demand for catalysts continues to grow, especially for applications that enhance the production of cleaner fuels and improve operational efficiency. The adoption of advanced catalysts in refining processes helps meet environmental regulations by reducing emissions and increasing the yield of high-quality products. With an increasing need for more efficient and sustainable production, these sectors are expected to maintain strong demand for catalyst solutions, supporting continued growth in the industrial catalyst market.

Government Policies and Environmental Initiatives

Government policies and environmental initiatives play a critical role in shaping the industrial catalyst market in Canada. Federal carbon pricing systems and other environmental regulations are encouraging industries to adopt cleaner technologies and reduce their carbon footprints. However, shifts in political discourse and policy adjustments can create uncertainty regarding future regulations, which in turn can affect market growth. The stability of such policies is crucial for driving investment in sustainable technologies and ensuring that industries remain incentivized to adopt catalysts that facilitate cleaner, more efficient industrial processes.

Challenges in Renewable Fuel Production

The renewable fuel sector in Canada faces challenges that are influencing the industrial catalyst market. External factors, such as fluctuations in credit markets and import competition, can affect the financial viability of renewable fuel projects. A surge in renewable diesel imports from other regions can result in oversupply within local markets, affecting credit values and potentially impacting the financial returns from renewable fuel production. For example, British Columbia recently mandated that renewable diesel used to meet its blending targets must be produced within Canada starting April 2025. These challenges highlight the importance of stable market conditions and supportive policies to foster growth in the renewable fuel sector and drive continued demand for catalysts in energy conversion processes.

Market Challenges Analysis:

High Catalyst Development and Production Costs

The development and production of industrial catalysts in Canada are heavily influenced by the high costs associated with advanced materials like precious metals. For instance, platinum, palladium, and rhodium—key components in catalytic converters—are not only expensive but also subject to price volatility due to global supply constraints. These challenges are compounded by the need for extensive R&D to create catalysts capable of operating under high pressures and temperatures. To address these issues, some manufacturers are exploring innovative approaches such as core-shell structures and alloy catalysts, which aim to reduce precious metal content without compromising performance

Catalyst Deactivation and Maintenance Challenges

Over time, catalysts may experience deactivation caused by factors such as poisoning, sintering, or fouling, leading to reduced effectiveness. Addressing catalyst deactivation requires ongoing research to enhance catalyst stability and develop efficient regeneration techniques, ensuring sustained performance and minimizing operational disruptions.

Regulatory Compliance and Environmental Standards

Navigating the complex regulatory landscape poses challenges for catalyst manufacturers in Canada. Strict environmental standards necessitate the development of catalysts that not only meet performance requirements but also comply with safety and environmental regulations. Staying abreast of evolving regulations demands continuous investment in compliance efforts and adaptation of catalyst technologies.

Market Competition and Policy Uncertainties

The Canadian industrial catalyst market faces stiff competition, both domestically and internationally. Policy uncertainties, such as debates over carbon pricing mechanisms, add complexity to investment decisions. For instance, discussions about repealing Canada’s federal carbon pricing system have raised concerns about the stability of environmental policies, potentially impacting long-term projects like carbon capture initiatives.

Market Opportunities:

The Canadian industrial catalyst market presents significant opportunities, particularly within the petrochemical and refining sectors. As Canada’s demand for cleaner fuels and more efficient refining processes continues to grow, there is an increasing need for advanced catalysts that can optimize production and reduce emissions. The refining industry’s ongoing efforts to improve fuel quality, reduce sulfur content, and meet environmental standards create a consistent demand for innovative catalysts. Furthermore, as Canada’s petrochemical industry expands, the need for catalysts to enhance reaction efficiency and product yields in chemical production processes will drive market growth. Manufacturers can capitalize on these opportunities by developing catalysts that cater specifically to the evolving needs of these industries, positioning themselves as leaders in sustainable manufacturing practices.

Another key opportunity lies in the growing focus on renewable energy production. Canada’s commitment to reducing carbon emissions and transitioning towards sustainable energy sources presents an expanding market for industrial catalysts. Catalysts are crucial for efficient energy conversion processes such as hydrogen production, biofuel synthesis, and energy storage. As the demand for green energy technologies increases, there will be a significant push for catalysts that can improve the efficiency of these processes. Companies that invest in the development of catalysts for renewable energy applications will be well-positioned to tap into this emerging market. This shift towards sustainable energy solutions offers long-term growth prospects, enabling manufacturers to diversify their product offerings and gain a competitive edge in the global market.

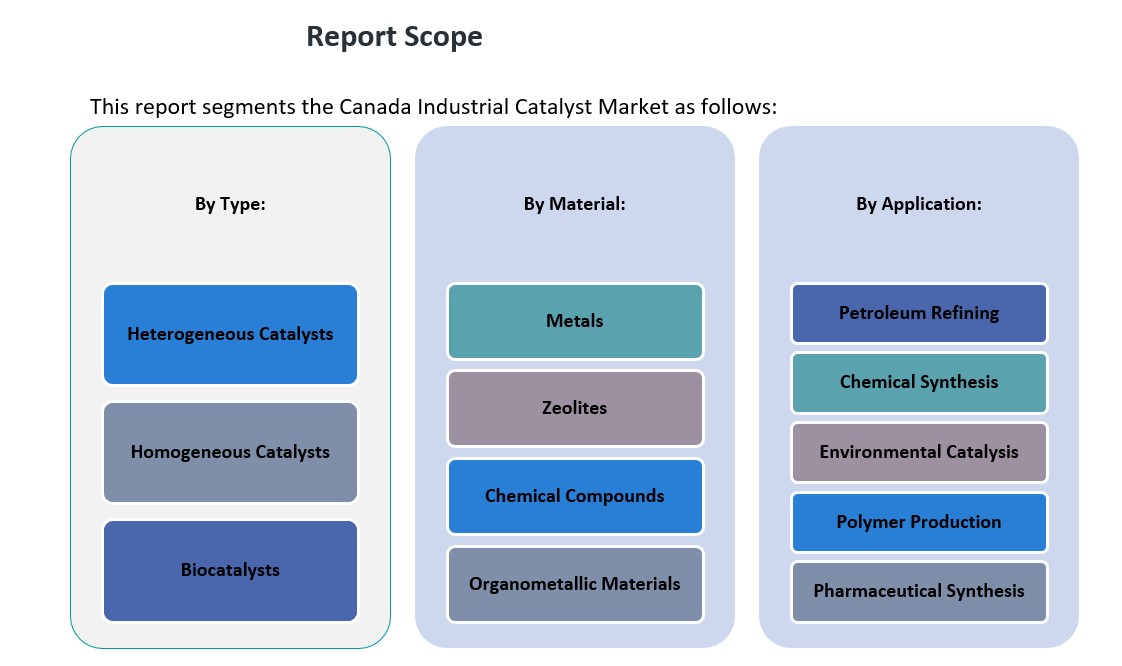

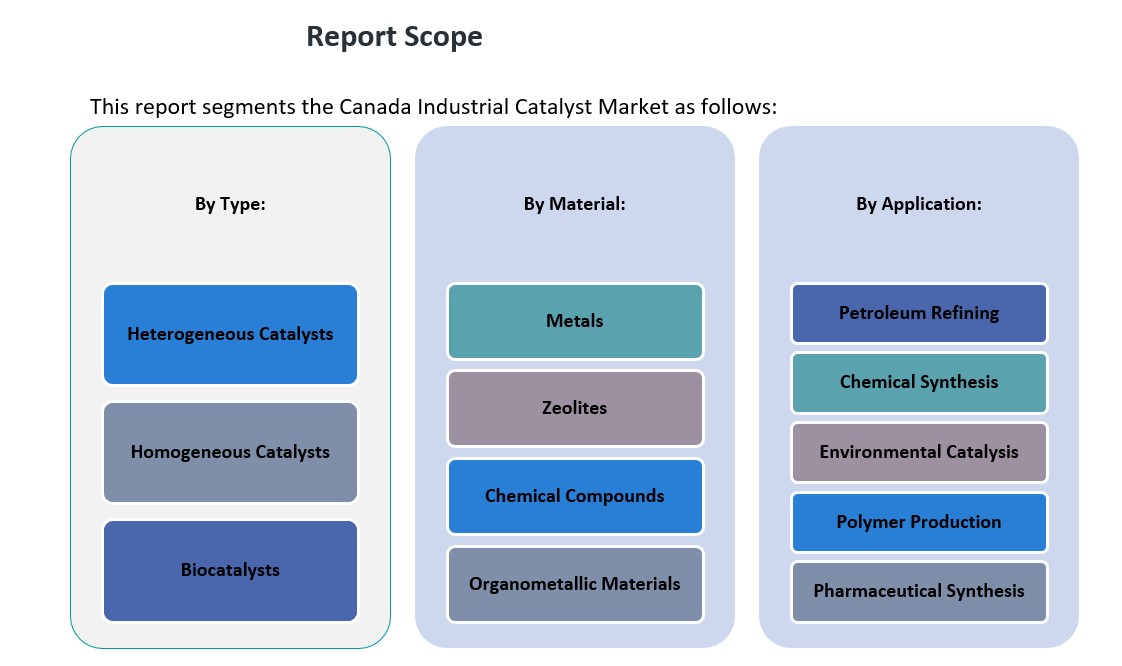

Market Segmentation Analysis:

The Canada Industrial Catalyst Market is segmented across various categories, each catering to specific industrial needs.

By Type Segment

The market is primarily divided into heterogeneous, homogeneous, and biocatalysts. Heterogeneous catalysts dominate the market due to their extensive use in chemical and petrochemical industries, offering high stability and ease of separation. Homogeneous catalysts are used in fine chemical and pharmaceutical synthesis, providing excellent selectivity and efficiency in reactions. Biocatalysts, though less common, are gaining traction in environmentally friendly applications, particularly in the production of biofuels and pharmaceutical synthesis.

By Application Segment

The key applications for industrial catalysts in Canada include petroleum refining, chemical synthesis, environmental catalysis, polymer production, and pharmaceutical synthesis. Petroleum refining holds the largest share, driven by the demand for cleaner fuels and efficient refining processes. Chemical synthesis and polymer production also contribute significantly, with catalysts playing a crucial role in optimizing reaction efficiency and enhancing product yields. Environmental catalysis is growing due to stringent regulations requiring industries to minimize emissions. Pharmaceutical synthesis continues to expand, driven by demand for more selective and efficient production processes.

By Material Segment

The material segment includes metals, zeolites, chemical compounds, and organometallic materials. Metals, such as platinum and palladium, are widely used in petroleum refining and chemical synthesis due to their excellent catalytic properties. Zeolites, known for their high surface area and selectivity, are primarily used in petrochemical applications. Chemical compounds and organometallic materials are also essential in specific applications, including pharmaceutical and fine chemical production.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The Canadian industrial catalyst market is shaped by distinct regional dynamics that influence its growth and development across the country.

Ontario

Ontario plays a central role in the Canadian industrial catalyst market due to its substantial chemical manufacturing sector. The province’s strong manufacturing base, particularly in chemicals, is a key driver of the demand for industrial catalysts. Ontario’s strategic location, advanced infrastructure, and well-established industrial networks provide a solid foundation for the application and innovation of catalysts. The province’s dominance in sectors such as automotive, chemicals, and manufacturing ensures that catalysts remain crucial in optimizing production processes and meeting environmental standards.

Alberta

Alberta’s economy is closely tied to the oil and gas sector, which drives the demand for industrial catalysts, particularly in refining processes. The province’s focus on upgrading bitumen and producing synthetic crude oil necessitates the use of advanced catalysts in hydroprocessing and upgrading technologies. Alberta’s oil sands operations and petrochemical industries continue to be a significant catalyst application market, with a growing emphasis on sustainable refining processes. As Alberta looks to modernize its energy sector, the demand for efficient and environmentally friendly catalytic solutions will continue to rise.

Prairie Provinces (Saskatchewan and Manitoba)

The Prairie Provinces, including Saskatchewan and Manitoba, have smaller chemical manufacturing sectors compared to Ontario and Alberta, but they are seeing growing interest in catalysts for biofuel production and agricultural chemical processes. These regions are home to industries focused on agriculture, renewable energy, and natural resources, where catalysts play a key role in improving process efficiency. As the demand for cleaner and more sustainable energy sources grows, catalysts will be essential in the production of biofuels and other eco-friendly chemicals, providing a developing market in these provinces.

Central Canada (Quebec)

Quebec’s industrial landscape is diverse, encompassing aerospace, technology, and manufacturing industries. The province’s focus on sustainable development and green technologies is fueling the adoption of catalysts in pollution control and green chemistry initiatives. Quebec’s growing emphasis on environmentally friendly practices in its industrial sectors is creating new opportunities for the application of industrial catalysts. Its strategic location and industrial diversity make it an important region for the continued growth of the industrial catalyst market.

Atlantic Canada (Newfoundland and Labrador, Nova Scotia, New Brunswick, Prince Edward Island)

The Atlantic provinces, while smaller in industrial scale, are experiencing growth in sectors such as seafood processing, shipbuilding, and renewable energy. These industries are increasingly adopting catalysts to improve process efficiency and meet environmental compliance standards. The demand for specialized catalytic solutions tailored to the needs of these regional industries is growing, providing opportunities for market expansion. Although the region is still developing in terms of industrial catalyst applications, the emerging demand signals a potential growth area for the market.

Key Player Analysis:

- BASF SE

- Johnson Matthey

- Albemarle Corporation

- ExxonMobil Chemical Company

- R. Grace & Co.

- Dow Inc.

- Honeywell UOP

- Chevron Phillips Chemical Company

- PQ Corporation

- Arkema Inc.

Competitive Analysis:

The Canadian industrial catalyst market is highly competitive, with several key players across diverse sectors such as petrochemicals, refining, and chemicals. Major catalyst manufacturers, including global leaders like BASF, Johnson Matthey, and Clariant, dominate the market due to their established technologies, extensive research and development capabilities, and broad product portfolios. These companies are focusing on technological innovation, such as the development of more efficient, selective, and environmentally friendly catalysts, to maintain their competitive edge. Regional players also contribute to the market by offering tailored solutions that cater to the unique demands of the Canadian industrial landscape, particularly in sectors like biofuels, agriculture, and renewable energy. The competitive environment is further shaped by the need for compliance with stringent environmental regulations, prompting firms to invest in sustainable catalyst technologies. As demand for cleaner and more efficient processes grows, competition will intensify, encouraging further innovation and partnerships in the market.

Recent Developments:

- In June 2024, Johnson Matthey partnered with Transform Materials to develop a lower-carbon and mercury-free process for producing vinyl chloride monomer (VCM), a key component in PVC manufacturing. This collaboration aims to reduce the environmental impact of traditional coal-based methods and enhance sustainability in the PVC industry.

- In March 2025, Clariant AGannounced the success of its EnviCat N2O-S catalyst at Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) in India. The catalyst reduced nitrous oxide emissions by 44,000 tons per month of CO2 equivalent, demonstrating its efficacy in industrial decarbonization efforts.

- In November 2024, Clariant launched its Plus series industrial syngas catalysts, including ReforMax LDP Plus, ShiftMax 217 Plus, and AmoMax 10 Plus. These catalysts are designed to enhance efficiency and sustainability in hydrogen, ammonia, and methanol production, supporting global efforts to transition to green and blue energy solutions.

Market Concentration & Characteristics:

The Canadian industrial catalyst market is characterized by moderate concentration, with a mix of global industry leaders and regional players. Large multinational companies, such as BASF, Johnson Matthey, and Clariant, hold a significant share of the market due to their extensive product portfolios, technological expertise, and global reach. These companies dominate the market by offering a wide range of catalysts for various applications, including petrochemical refining, biofuels, and energy production. Regional players complement this landscape by focusing on specialized solutions tailored to the unique needs of Canada’s industrial sectors, such as agriculture and renewable energy. The market is characterized by high research and development activities, with continuous advancements in catalyst technologies to meet evolving environmental and efficiency standards. As sustainability becomes a key focus, the industry is witnessing increased collaboration between global and local players, fostering innovation and reinforcing the competitive dynamics of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for catalysts in refining processes driven by the need for cleaner fuels and environmental compliance.

- Advancements in catalyst technologies, particularly those focused on higher efficiency and sustainability, will propel market growth.

- The growing adoption of renewable energy solutions will create new opportunities for catalysts in hydrogen production and biofuel synthesis.

- Government policies promoting cleaner industrial practices will accelerate the need for advanced catalysts in various sectors.

- Strong growth in the petrochemical sector, particularly in areas such as plastics and synthetic materials, will sustain catalyst demand.

- The rise in energy efficiency initiatives will drive further innovation in catalysts used in industrial manufacturing processes.

- Increased investments in R&D by both global and local players will lead to the development of more cost-effective and specialized catalysts.

- Regional specialization, particularly in biofuel and agricultural sectors, will support targeted catalyst solutions in specific Canadian industries.

- Enhanced collaboration between multinational corporations and regional firms will foster technology exchange and market penetration.

- The growing focus on reducing greenhouse gas emissions will continue to support the demand for catalysts in environmental protection technologies.