| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Off The Road Tire Market Size 2023 |

USD 617.82 Million |

| Canada Off The Road Tire Market, CAGR |

3.84% |

| Canada Off The Road Tire Market Size 2032 |

USD 867.18 Million |

Market Overview:

Canada Off The Road Tire Market size was valued at USD 617.82 million in 2023 and is anticipated to reach USD 867.18 million by 2032, at a CAGR of 3.84% during the forecast period (2023-2032).

Several factors are propelling the growth of the OTR tire market in Canada. The expansion of mining operations, particularly in regions rich in natural resources, necessitates durable and high-performance tires capable of withstanding harsh terrains. Similarly, the construction sector’s growth, fueled by infrastructure development projects, increases the demand for OTR tires. Advancements in tire technology, such as enhanced durability and tread designs, further contribute to market growth by improving efficiency and reducing downtime for equipment operators. Additionally, growing investment in Canada’s energy sector, including oil sands and hydroelectric projects, boosts the need for heavy machinery and their supporting components like OTR tires. The increasing adoption of radial tires over bias tires for better performance and longevity also acts as a catalyst for market development.

Regionally, Canada’s OTR tire demand is concentrated in areas with intensive mining and construction activities. Provinces like Alberta and British Columbia, known for their rich mineral resources and ongoing infrastructure projects, are significant contributors to the market. The northern territories, with their challenging terrains and reliance on heavy machinery, also represent a substantial market for OTR tires. Additionally, the expansion of agricultural activities in provinces such as Saskatchewan and Manitoba drives the demand for specialized OTR tires suited for farming equipment. The proximity of key tire distribution hubs in Ontario and Quebec enables efficient supply chain management across various sectors. Furthermore, government infrastructure investments under initiatives like the Canada Infrastructure Bank amplify the regional demand for earthmoving and hauling vehicles equipped with OTR tires.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Off the Road Tire market was valued at USD 617.82 million in 2023 and is projected to reach USD 867.18 million by 2032, growing at a CAGR of 3.84%.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers include the expansion of mining operations and construction projects, both of which rely heavily on durable OTR tires for heavy machinery operating in harsh conditions.

- Technological advancements in tire manufacturing, such as enhanced tread designs and integration of IoT-enabled monitoring systems, are boosting tire efficiency and reducing operational downtime.

- The growth of Canada’s agricultural and energy sectors is also fueling demand for specialized OTR tires, with mechanized farming equipment and energy infrastructure projects requiring durable tires.

- Radial tires are increasingly being adopted over bias tires for their superior performance and longevity, further contributing to the market’s development.

- High upfront costs associated with premium OTR tires remain a challenge for small and medium-sized operators, potentially slowing market growth in certain sectors.

- Regional demand for OTR tires is concentrated in provinces with active mining, construction, and agriculture, with Alberta, British Columbia, and Saskatchewan leading the market.

Market Drivers:

Growing Demand from the Mining Sector

Canada’s abundant natural resources and extensive mining activities serve as a primary driver for the Off-the-Road (OTR) tire market. The country is a global leader in the production of minerals such as gold, nickel, potash, and uranium. These mining operations rely heavily on specialized heavy-duty vehicles that operate in rugged environments and extreme weather conditions. OTR tires play a critical role in ensuring the operational efficiency and safety of this machinery. As mining companies continue to expand exploration and production capacities in provinces like British Columbia, Ontario, and Quebec, the demand for robust and durable OTR tires is expected to escalate significantly.

Infrastructure Development and Construction Projects

Canada’s commitment to large-scale infrastructure development is another key driver contributing to the growth of the OTR tire market. The government has announced substantial investments in transportation, energy, and public infrastructure through initiatives such as the “Investing in Canada Plan.” For instance, the Canada Infrastructure Bank’s plan to invest USD 139 billion under its long-term infrastructure program by 2028 is fueling a surge in construction activities, requiring intensive use of equipment such as loaders, graders, and excavators—all dependent on high-performance OTR tires. These projects involve intensive use of construction equipment, including loaders, graders, and excavators, all of which require high-performance OTR tires. With urbanization on the rise and increasing pressure to modernize transportation networks, the construction industry is poised for sustained expansion. This, in turn, boosts the demand for reliable and long-lasting OTR tires capable of withstanding high loads and variable terrain.

Technological Advancements in Tire Manufacturing

The evolution of tire technology is playing a vital role in enhancing the performance and reliability of OTR tires, thereby driving market demand. Manufacturers are increasingly investing in research and development to produce tires with advanced compounds, improved tread patterns, and integrated monitoring systems. For example, Bridgestone Corporation announced a ¥25 billion strategic investment in its Kitakyushu Plant in August 2024, aimed at advancing its mining and construction vehicle tire solutions. These innovations are designed to extend tire life, reduce operational downtime, and improve fuel efficiency for off-road vehicles. The shift from bias to radial tires, which offer better stability and traction, is also gaining traction in the Canadian market. Furthermore, the integration of Internet of Things (IoT)-enabled sensors in OTR tires allows for real-time monitoring of tire conditions, helping fleet operators optimize maintenance schedules and reduce costs.

Expansion of Agriculture and Energy Sectors

Beyond mining and construction, Canada’s agriculture and energy sectors contribute substantially to OTR tire market growth. The modernization of farming practices has led to increased use of mechanized equipment such as tractors, harvesters, and sprayers, all of which require specialized tires for field operations. Similarly, the expansion of Canada’s energy sector—particularly oil sands operations in Alberta and hydroelectric projects in Quebec—demands heavy machinery outfitted with high-durability OTR tires. As both sectors continue to adopt advanced equipment to improve productivity and sustainability, the parallel demand for compatible tire technologies is expected to remain strong. These developments collectively ensure that OTR tires will remain a vital component across key Canadian industries.

Market Trends:

Increased Adoption of Radial OTR Tires

One of the most prominent trends shaping the Canada Off-the-Road (OTR) tire market is the growing shift from bias-ply to radial tire technology. Radial OTR tires offer enhanced traction, better fuel efficiency, reduced heat generation, and longer service life compared to their bias counterparts. Canadian end-users, especially in the construction and mining sectors, are increasingly favoring these tires for their superior performance on rough terrains and cost-saving potential over time. According to recent industry insights, radial tire adoption in the Canadian OTR segment has grown by nearly 25% over the last five years, and the trend is expected to continue as more fleet operators prioritize long-term operating efficiency.

Focus on Sustainable and Eco-Friendly Tire Solutions

Sustainability is becoming a key consideration for both manufacturers and consumers in the Canadian OTR tire market. Environmental regulations and corporate commitments to reducing carbon footprints are driving innovations in tire materials and manufacturing processes. Companies are investing in the development of eco-friendly compounds that reduce rolling resistance and improve fuel economy. For instance, Michelin launched a new range of OTR tires made from 60% recycled materials in 2023, and Bridgestone recently invested over USD 166 million in expanding sustainable tire production. Additionally, retreading services are gaining popularity as businesses seek cost-effective and sustainable alternatives to new tires. The Canadian retreading market for OTR tires has seen a growth rate of over 7% annually, highlighting a clear shift toward circular economy practices within heavy-duty sectors.

Integration of Smart Tire Technologies

Digitalization and smart technologies are making their way into the OTR tire landscape, with an increasing number of operators embracing intelligent tire monitoring systems. These systems, powered by IoT sensors and telematics, provide real-time data on tire pressure, temperature, and wear conditions. For example, Bridgestone introduced smart tire technology with real-time pressure and wear tracking in 2024, while OTR Engineered Solutions now integrates P.S.I.’s TireView® TPMS into its full line of pneumatic tire and wheel assemblies, allowing fleet managers to monitor tire health remotely and receive real-time alerts for potential issues. In industries where vehicle uptime is critical, such as mining and construction, predictive maintenance capabilities significantly reduce operational risks and downtime. Canadian operators, especially in remote regions, are recognizing the value of these technologies in improving equipment reliability. This trend is encouraging tire manufacturers to embed more advanced electronic components into their product offerings.

Rising Demand from Snow-Intensive Applications

Canada’s harsh winters and snow-heavy regions are contributing to a growing demand for OTR tires that can withstand cold temperatures and provide enhanced traction in icy conditions. This trend is particularly relevant in sectors like logging, snow removal, and winter road maintenance, where off-road equipment must function efficiently in sub-zero environments. Manufacturers are responding by designing specialized tread patterns and rubber compounds that remain flexible in extreme cold. The seasonal nature of these operations has prompted a rise in winter-specific OTR tire procurement, reflecting a unique demand pattern in the Canadian market compared to milder climates.

Market Challenges Analysis:

High Cost of Premium OTR Tires

One of the primary restraints impacting the growth of the Canada Off-the-Road (OTR) tire market is the high cost associated with premium tire technologies. OTR tires are engineered with advanced materials and robust manufacturing processes to ensure durability and performance in demanding environments, which drives up their initial purchase price. For example, industry sources confirm that the high initial investment required for OTR tires, particularly those using radial technology and specialized compounds, is substantial for businesses especially small and medium-sized operators in agriculture and construction. This financial burden often leads companies to delay tire replacements or opt for less advanced, lower-cost alternatives, which can slow the overall market adoption of premium solutions. The challenge is particularly acute during periods of economic uncertainty or tight budgets, when the upfront expense of high-quality OTR tires can significantly impact operational planning and financial flexibility.

Supply Chain Disruptions and Import Dependence

The Canadian OTR tire market is heavily reliant on international manufacturers and suppliers, making it vulnerable to global supply chain disruptions. Delays in raw material shipments, shipping container shortages, and fluctuating import tariffs can impact tire availability and pricing. In recent years, geopolitical tensions and pandemic-related logistics challenges have underscored the market’s exposure to external risks. This dependence on foreign supply chains hinders timely delivery and increases the operational uncertainty for Canadian industries dependent on heavy-duty machinery.

Operational Challenges in Remote Regions

Canada’s vast geography and the presence of key mining and infrastructure activities in remote or northern areas present logistical and operational challenges. Harsh weather conditions, limited road access, and long distances between service centers complicate tire delivery, maintenance, and replacement. Equipment downtime due to tire failures in these regions can result in substantial financial losses, and the lack of on-site support services further exacerbates these risks. Ensuring consistent tire performance under extreme conditions remains a persistent hurdle, especially for industries operating in Canada’s northern territories

Market Opportunities:

The Canada Off-the-Road (OTR) tire market presents significant opportunities driven by sustained investment in large-scale infrastructure and natural resource projects. With the federal and provincial governments prioritizing development in transportation, energy, and housing, the demand for construction and earthmoving equipment is set to rise. These vehicles rely on durable, high-performance OTR tires to operate in challenging terrains and under heavy loads. Additionally, the modernization of Canada’s mining industry and exploration of untapped mineral reserves across the country create a consistent need for tire solutions that can support productivity and safety in harsh environments. This evolving industrial landscape opens avenues for tire manufacturers to introduce advanced, application-specific products tailored to Canada’s unique operating conditions.

Furthermore, the increasing emphasis on sustainability and equipment optimization creates room for innovation in eco-friendly tire materials, smart tire monitoring technologies, and retreading services. Fleet operators across mining, agriculture, and construction are actively seeking ways to reduce lifecycle costs and improve asset utilization. Manufacturers that can offer cost-effective, fuel-efficient, and intelligent tire solutions stand to gain a competitive advantage. There is also untapped potential in regional aftermarket services, especially in remote areas where timely tire maintenance and replacement are critical. Expanding service networks, localized distribution channels, and integrated digital support can further enhance market reach and customer satisfaction. These factors collectively position the Canadian OTR tire market as a strategic growth frontier for manufacturers and service providers focused on long-term, value-driven solutions.

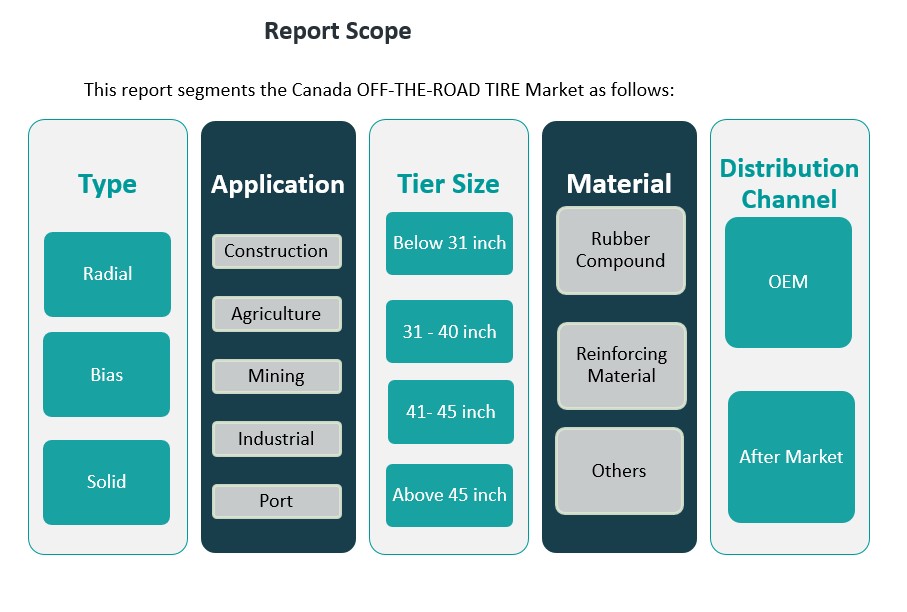

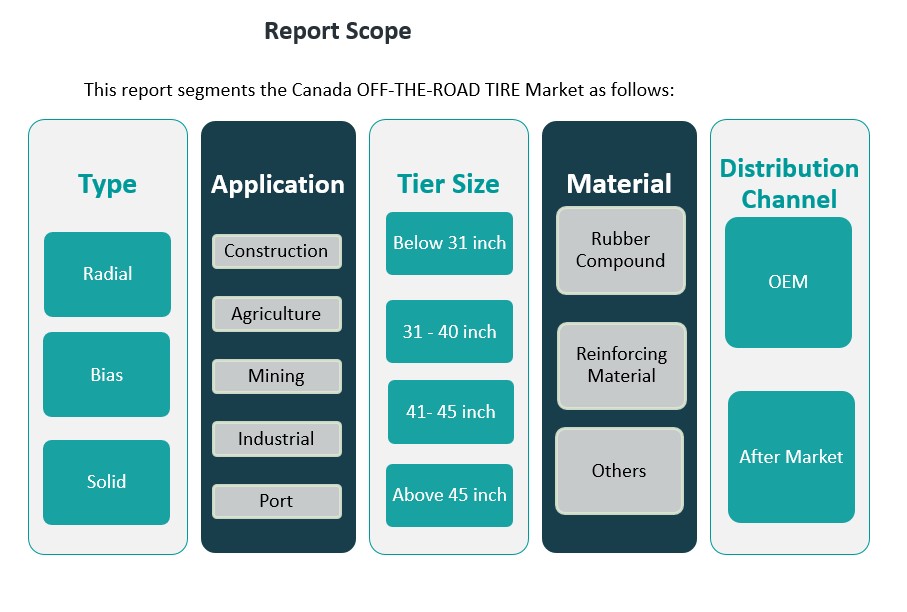

Market Segmentation Analysis:

The Canada Off-the-Road (OTR) tire market is segmented across multiple categories, each reflecting the diverse operational requirements of heavy-duty machinery.

By type, radial tires dominate due to their superior durability, fuel efficiency, and performance under challenging conditions. Bias tires continue to hold relevance in budget-conscious operations, while solid tires are favored in industrial and port environments where puncture resistance and load stability are critical.

By application, the construction and mining segments account for the largest share of the Canadian OTR tire market, driven by ongoing infrastructure projects and active resource extraction. Agriculture remains a stable contributor, supported by mechanization trends across key provinces. Industrial and port applications, while smaller in comparison, are growing steadily due to increased logistics and warehousing demands.

By tire size, the 31–40 inch and 41–45 inch categories are most in demand, aligning with equipment used in construction and mining. However, the above 45 inch segment is gaining traction in large-scale mining and heavy-duty transport applications. Smaller tire sizes below 31 inches remain relevant for agricultural and light industrial machinery.

By material, rubber compounds lead the market due to their flexibility, durability, and customization potential for various applications. Reinforcing materials, such as steel belts and synthetic fibers, enhance structural integrity and support evolving performance standards. Other specialty materials are being adopted for niche uses, including eco-friendly alternatives.

By distribution channel, the aftermarket segment holds a larger share than OEM, reflecting the recurring need for tire replacements and maintenance in Canada’s high-wear operating environments.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Canada Off-the-Road (OTR) tire market exhibits regional variations influenced by industrial activities, infrastructure development, and climatic conditions.

Eastern Canada (Ontario and Quebec)

Eastern Canada, encompassing Ontario and Quebec, holds a significant share of the OTR tire market. Ontario, with its robust construction sector and extensive mining operations, contributes substantially to the demand for OTR tires. Quebec’s emphasis on infrastructure projects and its active mining industry further bolster the region’s market share. The presence of major urban centers and transportation networks in these provinces facilitates efficient distribution and service provision for OTR tire manufacturers and suppliers.

Western Canada (British Columbia, Alberta, Saskatchewan, and Manitoba)

Western Canada is a vital region for the OTR tire market, driven by its rich natural resources and expansive agricultural activities. British Columbia’s forestry and mining industries necessitate durable OTR tires capable of withstanding rugged terrains. Alberta’s oil sands and construction projects contribute to the demand for heavy-duty tires. Saskatchewan and Manitoba, with their extensive farmlands, require specialized agricultural tires to support modern farming equipment. The region’s diverse industrial base ensures a steady demand for various OTR tire applications.

Northern Canada (Yukon, Northwest Territories, and Nunavut)

Northern Canada, though less populated, presents unique challenges and opportunities for the OTR tire market. The region’s mining activities, particularly in remote areas, demand reliable and robust tires capable of performing in extreme weather conditions. Logistical challenges, including limited infrastructure and accessibility, necessitate specialized distribution strategies and durable tire solutions to meet the operational needs of industries in these territories.

Atlantic Canada (Newfoundland and Labrador, New Brunswick, Nova Scotia, and Prince Edward Island)

Atlantic Canada’s OTR tire market is influenced by its fishing, forestry, and emerging construction sectors. While smaller in scale compared to other regions, the demand for OTR tires in these provinces is driven by the need for reliable equipment in challenging coastal and forested environments. Infrastructure development projects and resource-based industries contribute to the steady, albeit modest, growth of the OTR tire market in this region.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Michelin

- BFGoodrich

Competitive Analysis:

The Canada Off-the-Road (OTR) tire market is moderately consolidated, with global and regional players competing to meet diverse industry needs. Leading companies such as Michelin, Bridgestone, Goodyear, and Continental dominate the landscape by offering a wide range of radial and bias tire solutions tailored for mining, construction, and agricultural sectors. These companies invest significantly in R&D to enhance durability, fuel efficiency, and smart tire technologies. Meanwhile, regional and niche manufacturers focus on customized solutions and aftermarket services to strengthen their market presence. Distribution partnerships, localized service centers, and competitive pricing strategies play a key role in market differentiation. Additionally, the rise in demand for retreaded and eco-friendly tires has opened space for specialized players to gain traction. The competitive environment is expected to intensify as sustainability, digital integration, and cost-efficiency become central to purchasing decisions across the Canadian OTR tire market.

Recent Developments:

- In 2023, Michelin introduced a new range of sustainable OTR tires composed of 60% recycled materials, marking a significant step toward environmentally friendly solutions in the off-road tire sector. This launch reflects Michelin’s commitment to sustainability and innovation, addressing the increasing demand for eco-conscious products in construction, mining, and agriculture application.

- In 2023, Goodyear entered into a partnership with leading mining firms to pilot ultra-durable tire solutions tailored for the rigorous demands of mining operations. This collaboration is designed to deliver improved tire lifespan and reliability, supporting the productivity and cost-effectiveness of mining fleets in Canada and beyond.

- in March 2022, OTR Tyres, an Australian tire, wheel, and service provider, acquired Titan Australia. While this acquisition primarily strengthens OTR Tyres’ market presence in Australia, Titan International is a significant player in the global OTR tire market, including Canada. The move is indicative of ongoing consolidation and strategic expansion efforts among key industry participants to enhance product delivery and customer service capabilities worldwide.

Market Concentration & Characteristics:

The Canada Off-the-Road (OTR) tire market exhibits moderate to high market concentration, with a handful of global manufacturers accounting for a substantial share of total sales. Key players such as Michelin, Bridgestone, and Goodyear maintain a strong presence through established distribution networks, brand loyalty, and technologically advanced product offerings. These companies set market standards by continuously innovating in areas such as tread design, compound formulation, and integrated monitoring systems. The market is characterized by demand for durable, high-performance tires suited for extreme conditions, particularly in mining, construction, and agriculture. Seasonal variability, regional accessibility, and equipment-specific needs further shape market dynamics. Although OEM sales contribute to initial growth, the aftermarket segment dominates due to frequent tire replacements and maintenance. Additionally, the trend toward retreading and sustainability is influencing product development and purchasing behavior. Overall, the market’s competitive nature and technical requirements foster innovation and emphasize reliability and long-term value.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness steady growth driven by ongoing infrastructure investments across Canadian provinces.

- Increased mining activities in resource-rich regions will continue to fuel demand for high-durability OTR tires.

- Adoption of radial tires will rise as end-users seek improved performance and lower total cost of ownership.

- Technological advancements such as smart tire monitoring systems will gain traction in large-scale operations.

- Demand for retreaded tires is projected to grow, supported by sustainability goals and cost-efficiency.

- The aftermarket segment will remain dominant due to recurring replacement cycles and harsh operating environments.

- OEM partnerships with equipment manufacturers will play a critical role in expanding product reach.

- Climate-specific tire innovations, particularly for snow and extreme cold, will see increased adoption.

- Supply chain localization efforts may intensify to mitigate risks from global disruptions.

- Market players will increasingly focus on tailored solutions to meet the distinct needs of regional industries.