| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Water Pump Market Size 2023 |

USD 1,878.94 Million |

| Canada Water Pump Market, CAGR |

3.54% |

| Canada Water Pump Market Size 2032 |

USD 2,569.94 Million |

Market Overview:

Canada Water Pump Market size was valued at USD 1,878.94 million in 2023 and is anticipated to reach USD 2,569.94 million by 2032, at a CAGR of 3.54% during the forecast period (2023-2032).

Several key factors are driving the expansion of Canada’s water pump market. Foremost among these is the increasing emphasis on sustainable water management practices, prompting investments in advanced pumping solutions that offer energy efficiency and reduced environmental impact. The agricultural sector’s growing reliance on efficient irrigation systems to enhance crop yields further fuels demand for high-performance water pumps. Additionally, the industrial sector’s focus on wastewater treatment and recycling necessitates robust pumping systems capable of handling complex processes. Technological advancements, including the integration of Internet of Things (IoT) capabilities, are also contributing to market growth by enabling real-time monitoring and predictive maintenance of pump systems. These innovations not only reduce downtime but also extend the operational life of pump systems, making them cost-effective for long-term use.

Regionally, Canada’s water pump market exhibits varied dynamics influenced by local industrial activities and infrastructure development. Provinces with substantial agricultural operations, such as Alberta and Saskatchewan, demonstrate heightened demand for irrigation pumps. Meanwhile, urban centers like Ontario and British Columbia are investing in modernizing municipal water systems and wastewater treatment facilities, thereby driving the need for advanced pumping solutions. The oil and gas industry’s prominence, particularly in Alberta, also contributes to the demand for specialized pumps capable of handling challenging operational environments. These region-specific developments align with national goals to enhance water infrastructure resilience and promote efficient water usage across all provinces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Water Pump Market was valued at USD 1,878.94 million in 2023 and is projected to reach USD 2,569.94 million by 2032, growing at a CAGR of 3.54%.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Sustainable water management is a major growth driver, encouraging the adoption of energy-efficient and eco-friendly pumping technologies.

- Increasing demand from the agricultural sector, especially in Alberta and Saskatchewan, is boosting sales of advanced irrigation pumps.

- Industrial growth, particularly in oil & gas, mining, and wastewater treatment, is generating sustained demand for high-capacity, corrosion-resistant pumps.

- The integration of IoT and automation in pumping systems is enhancing operational efficiency through real-time monitoring and predictive maintenance.

- High upfront costs, complex maintenance, and regulatory compliance present challenges that limit adoption, especially in remote or budget-constrained regions.

- Ontario and British Columbia lead in pump demand due to urban infrastructure development, while Alberta drives growth through industrial and energy sector needs.

Market Drivers:

Growing Demand for Efficient Water Infrastructure

Canada is witnessing a growing emphasis on the modernization and expansion of water infrastructure to meet the rising demands of urban and rural populations. Municipal authorities are increasingly investing in advanced pumping systems for potable water distribution and wastewater treatment to ensure reliability, efficiency, and environmental compliance. For instance, in 2024, the Ontario government announced a $970 million investment in 54 water infrastructure projects across 60 municipalities, aiming to develop, repair, and expand critical water systems to support housing construction. As cities expand and rural regions require improved water access, demand for water pumps capable of delivering high output and operational longevity continues to rise. This infrastructural development is also supported by government-led initiatives that aim to enhance water system resilience in the face of climate change and growing population densities.

Expansion of Agricultural Irrigation Systems

The agricultural sector in Canada remains a significant contributor to the water pump market. Provinces such as Alberta, Saskatchewan, and Manitoba rely heavily on efficient irrigation systems to support crop cultivation throughout the growing season. With increasing concerns over water conservation and productivity, farmers are adopting advanced pump systems that minimize water waste while maximizing irrigation efficiency. Government subsidies and financial support for water-efficient technologies further accelerate the adoption of high-performance pumping solutions across agricultural regions. This trend is expected to persist as the agriculture sector prioritizes sustainable practices and precision irrigation.

Industrial Growth and Wastewater Management Needs

Rapid industrialization and a parallel rise in wastewater generation have created substantial demand for reliable water pump solutions in Canada. Industries such as oil and gas, chemical processing, food and beverage, and mining require pumping systems to manage water intake, treatment, and disposal processes. The need for high-capacity, corrosion-resistant, and durable pumps has intensified as environmental regulations become more stringent. Industries are also investing in advanced pumping technologies to facilitate closed-loop systems that reduce water consumption and promote reuse. This industrial shift toward responsible water use is significantly influencing the overall growth of the Canadian water pump market.

Technological Advancements in Pumping Systems

Technological innovation serves as a major catalyst in driving demand for modern water pumps across Canadian industries and utilities. The integration of smart technologies such as IoT, automation, and predictive maintenance tools is transforming traditional pumping systems into intelligent and energy-efficient solutions. These advancements allow operators to monitor performance in real time, identify anomalies, and implement preventive measures, thereby reducing operational downtime and maintenance costs. As energy efficiency becomes a critical selection criterion for water pump users, manufacturers are developing products that comply with global energy standards while offering superior performance. For instance, Goulds Water Technology, a brand under Xylem, offers a range of smart pumps equipped with variable frequency drives and remote monitoring capabilities, enhancing efficiency and reliability in water management systems. The convergence of digital technology and mechanical engineering is reshaping the competitive landscape of the water pump market in Canada, providing both operational and environmental benefits.

Market Trends:

Rising Integration of Variable Frequency Drives (VFDs)

A notable trend shaping the Canada water pump market is the growing adoption of Variable Frequency Drives (VFDs) to enhance operational efficiency. VFDs allow for the dynamic regulation of motor speed, enabling pumps to adjust their performance based on real-time demand. This capability significantly reduces energy consumption, especially in applications with fluctuating flow requirements. Utilities and commercial facilities across Canada are increasingly incorporating VFDs into both new installations and retrofitting projects to reduce operating costs and comply with energy-efficiency regulations. As energy prices continue to rise, the demand for VFD-equipped pump systems is expected to grow at a steady pace.

Shift Toward Solar-Powered Pumping Solutions

The transition to renewable energy sources is driving the popularity of solar-powered water pumps, particularly in remote and off-grid areas of Canada. These systems offer a sustainable and cost-effective solution for agricultural irrigation, livestock watering, and community water supply. The Canadian government’s support for clean energy initiatives has further encouraged the deployment of solar-based pumping systems, reducing dependency on fossil fuels and lowering carbon footprints. For example, Grundfos’ satellite-connected solar pumps provide livestock farmers with 24/7 monitoring capabilities via mobile apps, ensuring reliable water supply while minimizing labor and fuel expenses. This trend is particularly evident in rural provinces where conventional electricity access is limited and the economic viability of solar energy offers long-term advantages.

Increased Focus on Compact and Portable Pump Designs

There is a growing preference for compact and portable pump designs in both commercial and residential segments. End users are seeking water pumps that combine mobility with performance, particularly for temporary applications such as construction site dewatering, emergency flood response, and seasonal irrigation. Canadian manufacturers and distributors are responding to this demand by offering lightweight, user-friendly, and high-efficiency portable pumps that cater to diverse usage scenarios. This trend is not only driven by functionality but also by the need for flexible equipment that can be quickly deployed and relocated without extensive installation requirements.

Growth in Smart Pumping Systems and Remote Monitoring

The emergence of smart water pumping systems equipped with remote monitoring and control capabilities is revolutionizing the market landscape in Canada. Smart pumps integrated with sensors, cloud connectivity, and mobile interfaces allow operators to track performance metrics such as pressure, temperature, and flow rates in real time. These systems enable predictive maintenance, reduce unplanned downtime, and improve overall asset management. For example, See Water Inc.’s Pump Portal® centralizes pump monitoring via web interfaces accessible from any device, offering real-time data analytics and historical reports for optimized operations. Municipal water utilities, commercial facilities, and industrial operators are increasingly investing in these smart solutions to optimize operations and enhance system reliability. As digital transformation accelerates across Canada’s infrastructure sectors, smart water pumping technologies are expected to gain even greater traction.

Market Challenges Analysis:

High Initial Investment and Installation Costs

One of the primary restraints affecting the Canada water pump market is the significant upfront cost associated with purchasing and installing advanced pumping systems. High-efficiency pumps, particularly those integrated with smart technologies or renewable energy components, often require substantial capital outlay. For instance, integrating smart technologies such as IoT-enabled monitoring systems or renewable energy components into pumps can increase initial investment by up to 30% compared to traditional models. This can deter small and medium-sized enterprises, agricultural users, and municipalities operating under constrained budgets from adopting newer systems. Additionally, costs related to infrastructure modifications, specialized labor, and system integration further increase the total cost of ownership, slowing down market penetration in cost-sensitive regions.

Maintenance Complexity and Downtime Risks

Modern water pumps, especially those designed for industrial or municipal use, often incorporate complex mechanical and digital components that demand regular maintenance. The integration of technologies such as IoT sensors and automation adds further layers of complexity, requiring skilled technicians for diagnostics and servicing. In remote or less-developed areas, limited access to specialized maintenance services can result in prolonged downtimes, disrupting operations. This challenge discourages the widespread adoption of high-tech pumping systems and creates a dependency on traditional, less efficient alternatives that require less specialized maintenance.

Regulatory and Environmental Compliance Challenges

Stringent environmental regulations and compliance requirements related to water use, energy efficiency, and emissions pose additional challenges for market players. Manufacturers must continuously innovate to meet evolving standards, which increases research and development costs. At the same time, end users must ensure that their systems conform to both national and provincial regulations, which can vary across regions. Navigating this complex regulatory environment can delay project implementation and deter investments, particularly in sectors where margins are tight or where regulatory clarity is lacking.

Market Opportunities:

The Canada water pump market presents significant growth opportunities driven by the country’s increasing focus on infrastructure modernization, sustainable water management, and renewable energy integration. As aging municipal water systems reach the end of their service life, demand for technologically advanced and energy-efficient pumping solutions is set to rise. Federal and provincial governments are allocating substantial funding toward water infrastructure upgrades, creating a favorable environment for public-private partnerships and supplier engagement. Additionally, climate change-induced challenges, such as flooding and droughts, are prompting investments in resilient water pumping systems capable of addressing both emergency response and long-term water resource management.

Furthermore, the growing adoption of digital technologies across Canada’s industrial and utility sectors offers untapped potential for smart water pump systems. The integration of automation, remote monitoring, and predictive maintenance capabilities aligns with industry efforts to enhance operational efficiency and reduce life cycle costs. There is also rising interest in off-grid and solar-powered pumping solutions, especially in remote agricultural and indigenous communities, where access to traditional energy sources remains limited. As environmental regulations become more stringent and sustainability goals take precedence, companies that offer innovative, compliant, and cost-effective pump solutions are well-positioned to capture market share. These evolving dynamics indicate that the Canada water pump market holds substantial opportunity for manufacturers, technology providers, and infrastructure investors aiming to support the country’s transition toward smarter and more sustainable water systems.

Market Segmentation Analysis:

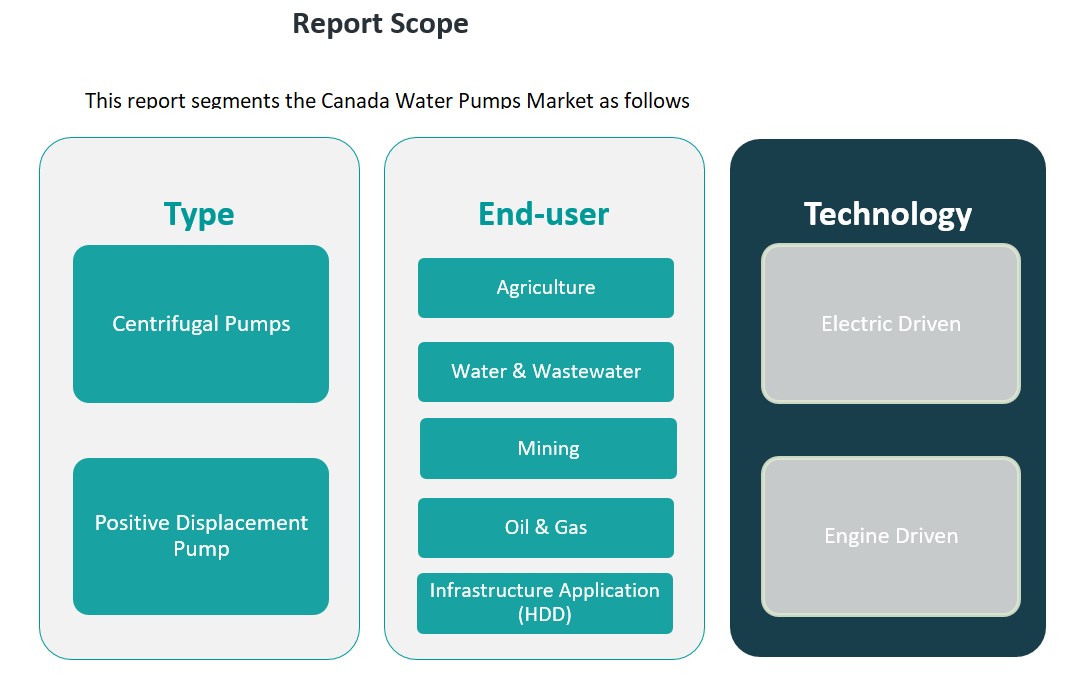

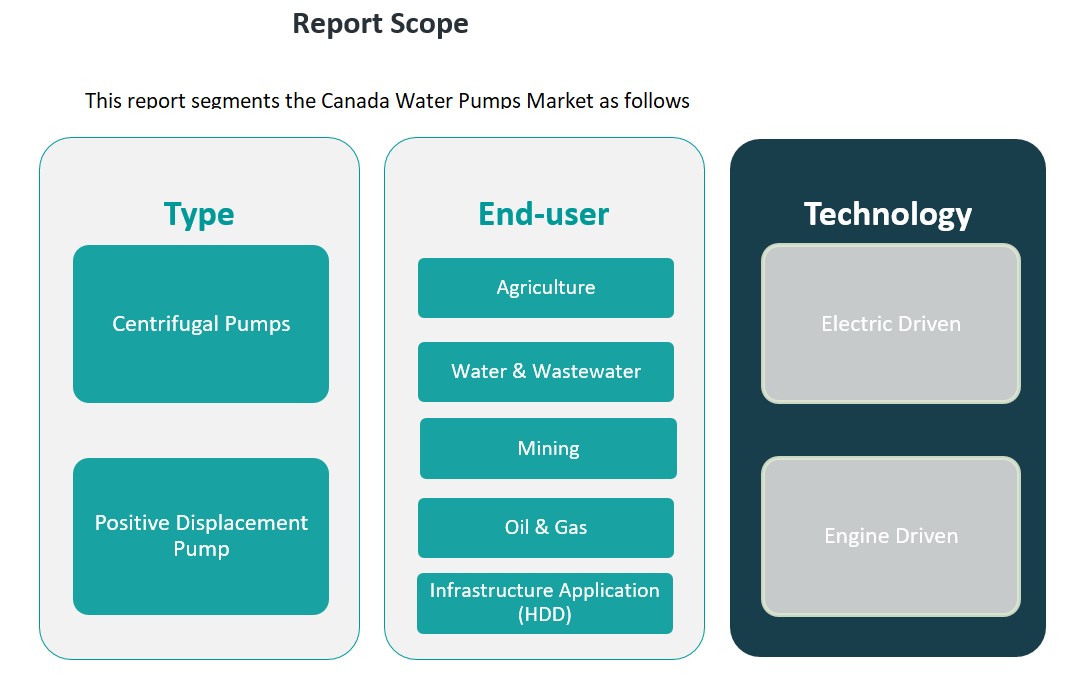

The Canada water pump market is segmented by type, end-user, and technology, each contributing uniquely to the industry’s overall growth.

By type, centrifugal pumps hold the largest market share, driven by their widespread use in water distribution, irrigation, and industrial processes due to their simple design, cost-efficiency, and high flow rates. Positive displacement pumps, while commanding a smaller share, are gaining momentum in applications requiring precise fluid handling, particularly in oil & gas and chemical processing sectors where consistency and pressure stability are crucial.

By end-user segments, the water and wastewater sector represents a major contributor to demand, owing to government-led initiatives for upgrading municipal systems and expanding wastewater treatment capacity. The agriculture segment also shows strong growth potential, particularly in western provinces, where irrigation infrastructure is essential. Mining and oil & gas industries continue to drive demand for heavy-duty pumps capable of handling abrasive and corrosive fluids in challenging environments. Infrastructure applications, such as horizontal directional drilling (HDD), are emerging as a niche but growing segment, propelled by urban development and pipeline installations.

By technology perspective, electric-driven pumps dominate the market due to their energy efficiency, reliability, and integration with automated systems. However, engine-driven pumps maintain strong relevance in remote areas or during power outages, offering flexibility in emergency or field-based applications. Together, these segments reflect the diverse application base and evolving technological landscape of the Canadian water pump market.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Canada water pump market exhibits diverse regional dynamics, influenced by varying industrial activities, infrastructure development, and environmental factors across provinces. Ontario leads the market, accounting for approximately 35% of the national revenue in 2024, driven by its robust industrial base, extensive urban infrastructure, and significant investments in water and wastewater management systems. British Columbia follows, contributing around 20% to the market, supported by its focus on sustainable water practices and infrastructure modernization initiatives. Alberta holds a market share of about 18%, propelled by its oil and gas industry’s demand for specialized pumping solutions and the province’s agricultural irrigation needs. Quebec contributes approximately 15% to the market, with growth stemming from its emphasis on renewable energy projects and water infrastructure upgrades. The remaining 12% is distributed among other provinces and territories, where smaller-scale industrial activities and rural water management projects drive demand.

In Ontario, the concentration of manufacturing industries and urban centers necessitates advanced water pumping systems for efficient municipal water supply and wastewater treatment. British Columbia’s commitment to environmental sustainability has led to increased adoption of energy-efficient and smart pumping technologies. Alberta’s oil sands operations require robust and reliable pumps capable of handling abrasive fluids, while its agricultural sector depends on efficient irrigation systems. Quebec’s investments in hydroelectric projects and infrastructure renewal contribute to the demand for high-capacity and technologically advanced water pumps. In the Atlantic provinces and the northern territories, the focus is on developing resilient water infrastructure to support remote communities, with an emphasis on portable and energy-efficient pumping solutions.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

- Amtrol

- Barnes Pumps

Competitive Analysis:

The Canada water pump market is characterized by a competitive landscape featuring both global and regional players. Leading companies such as Xylem Inc., Grundfos, Flowserve Corporation, KSB SE & Co. KGaA, and WILO SE have established a strong presence, leveraging their extensive product portfolios and technological advancements to cater to diverse industry needs. These multinational corporations focus on innovation, energy efficiency, and smart pumping solutions to maintain their market positions. Additionally, regional manufacturers and distributors contribute to the market by offering customized solutions and responsive customer service, particularly in niche applications and remote areas. The competitive dynamics are further influenced by factors such as pricing strategies, after-sales support, and the ability to meet stringent environmental regulations. As the market evolves, companies that invest in research and development, embrace digital technologies, and adapt to changing customer requirements are likely to achieve sustained growth and competitive advantage.

Recent Developments:

- Servotech Power Systems Ltd.launched solar pump controllers on October 28, 2024, designed for 2HP to 10HP water pumps. This aligns with initiatives like PM-KUSUM to promote sustainable farming practices through water-efficient solutions.

- Roto Pumps Ltd.announced the launch of its subsidiary, Roto Energy Systems Ltd., in Feb 2024. This new division focuses on solar-powered water pumping solutions, including submersible and surface pumps, catering to eco-friendly water management needs.

- Grundfos’ commitment to the Water Resilience Coalition in March 2025 aligns with the water pump market’s focus on sustainability and efficient water management. The coalition’s goals include measurable improvements in global water sustainability by 2030.

- On February 28, 2025, KSB launched the MultiTec Plus pump series, specifically optimized for drinking water transport. This product integrates energy-saving technologies and real-time monitoring capabilities, emphasizing advancements in smart and sustainable water pumping solutions.

Market Concentration & Characteristics:

The Canada water pump market exhibits a moderately concentrated structure, dominated by global players such as Xylem Inc., Grundfos, Flowserve Corporation, KSB SE & Co. KGaA, and WILO SE. These companies leverage extensive product portfolios and technological advancements to cater to diverse industry needs. Their focus on innovation, energy efficiency, and smart pumping solutions enables them to maintain significant market positions. Additionally, regional manufacturers and distributors contribute to the market by offering customized solutions and responsive customer service, particularly in niche applications and remote areas. The competitive dynamics are further influenced by factors such as pricing strategies, after-sales support, and the ability to meet stringent environmental regulations. As the market evolves, companies that invest in research and development, embrace digital technologies, and adapt to changing customer requirements are likely to achieve sustained growth and competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for energy-efficient pumps will rise due to stricter environmental regulations and sustainability goals.

- Smart pump systems with IoT integration will gain popularity across industrial and municipal sectors.

- Infrastructure upgrades in urban and rural regions will drive steady investment in advanced pumping technologies.

- The adoption of solar-powered pumps will expand in remote agricultural and off-grid areas.

- Growth in the oil and gas sector will sustain demand for heavy-duty and corrosion-resistant pumps.

- Increased government funding for wastewater treatment will support market expansion.

- Compact and portable pump models will see higher adoption in temporary and emergency applications.

- Local manufacturers may gain traction by offering tailored, cost-effective solutions for niche markets.

- Digital transformation and predictive maintenance will redefine long-term pump operation strategies.

- Cross-industry collaborations will foster innovation and accelerate the development of integrated pumping systems.