Market Overview

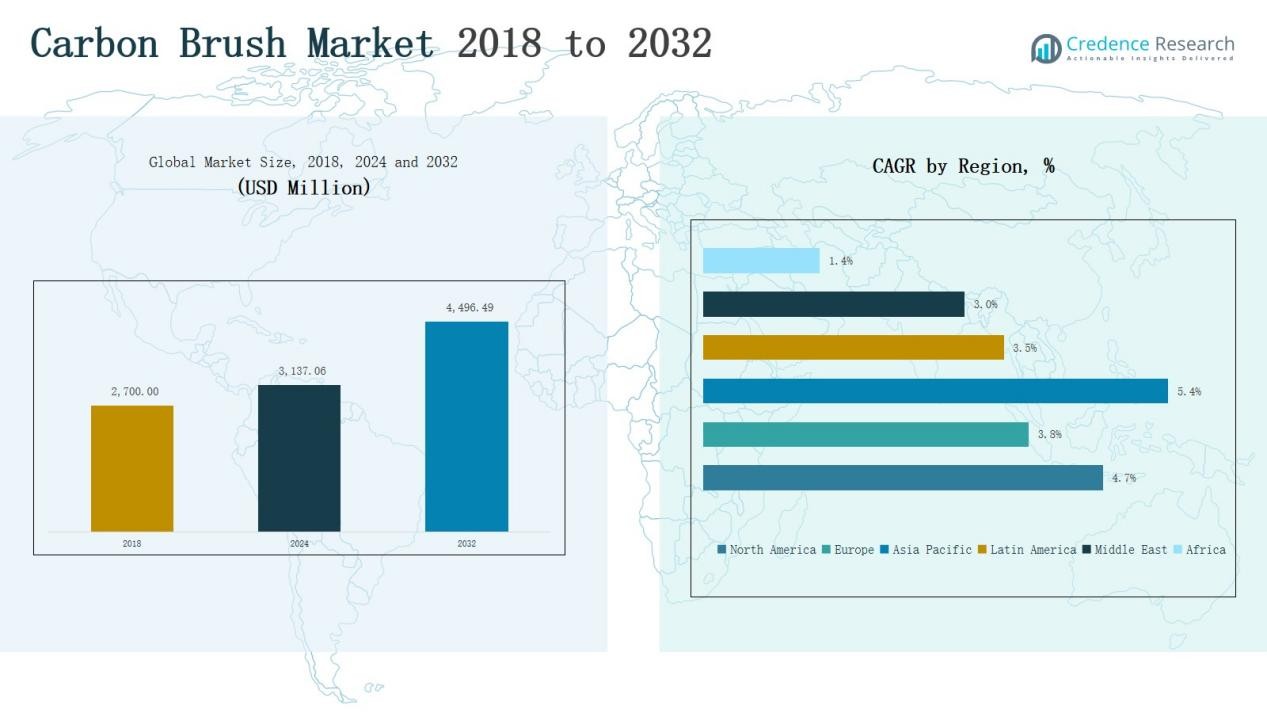

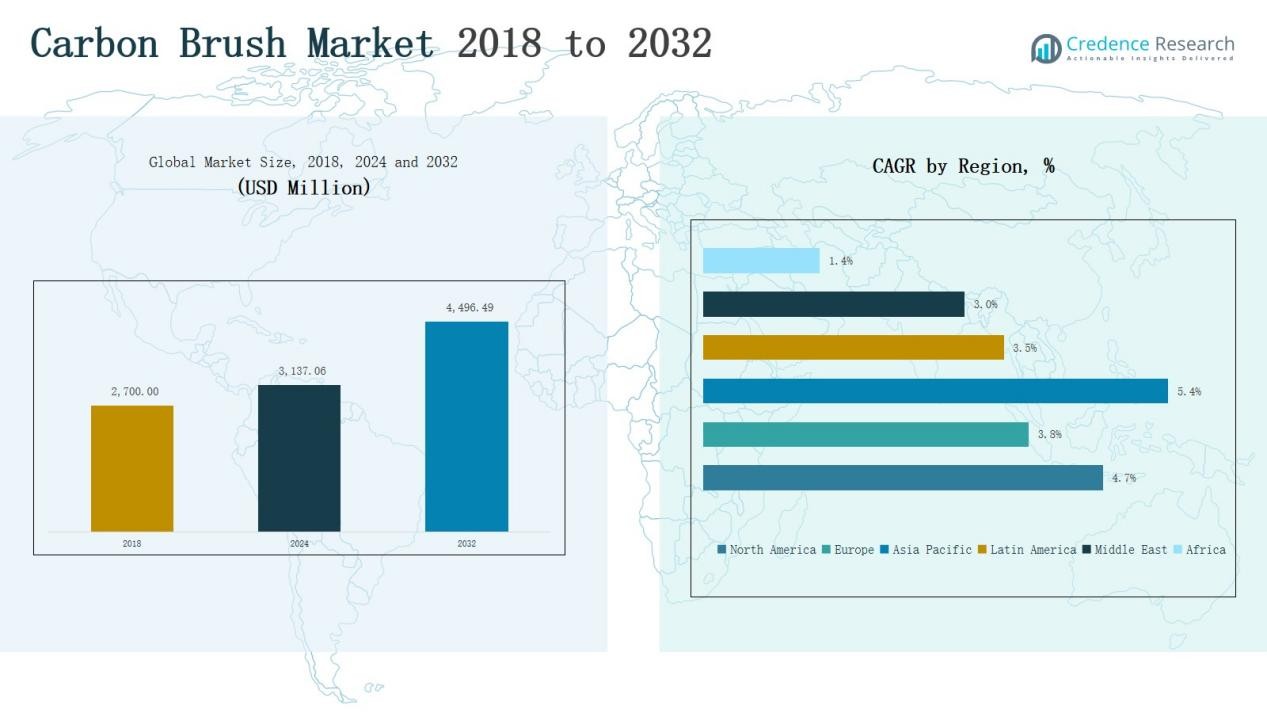

Carbon Brush Market size was valued at USD 2,700.00 million in 2018, reached USD 3,137.06 million in 2024, and is anticipated to reach USD 4,496.49 million by 2032, at a CAGR of 4.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carbon Brush Market Size 2024 |

USD 3,137.06 Million |

| Carbon Brush Market, CAGR |

4.65% |

| Carbon Brush Market Size 2032 |

USD 4,496.49 Million |

The Carbon Brush Market is shaped by global leaders including Mersen SA, Schunk Group, Helwig Carbon Products, Morgan Advanced Materials, and Fuji Carbon Mfg Co., Ltd., alongside notable players such as TRIS, E-Carbon, Aupac Co., Ltd., Assam Carbon Products Limited, Naeem Carbon and Industrial Products LLP, and Phynyx Industrial Products Pvt. Ltd. These companies compete through innovation in brush materials, durability, and conductivity to serve diverse applications across automotive, industrial, and power generation sectors. Regionally, Asia Pacific dominated with 43.7% market share in 2024, driven by rapid industrialization, strong automotive output, and expansion of renewable power infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Carbon Brush Market grew from USD 2,700.00 million in 2018 to USD 3,137.06 million in 2024 and is projected to reach USD 4,496.49 million by 2032 at a 65% CAGR.

- Asia Pacific led with 43.7% share in 2024, driven by industrialization, strong automotive production, and renewable power growth, followed by North America with 24% and Europe with 21.6%.

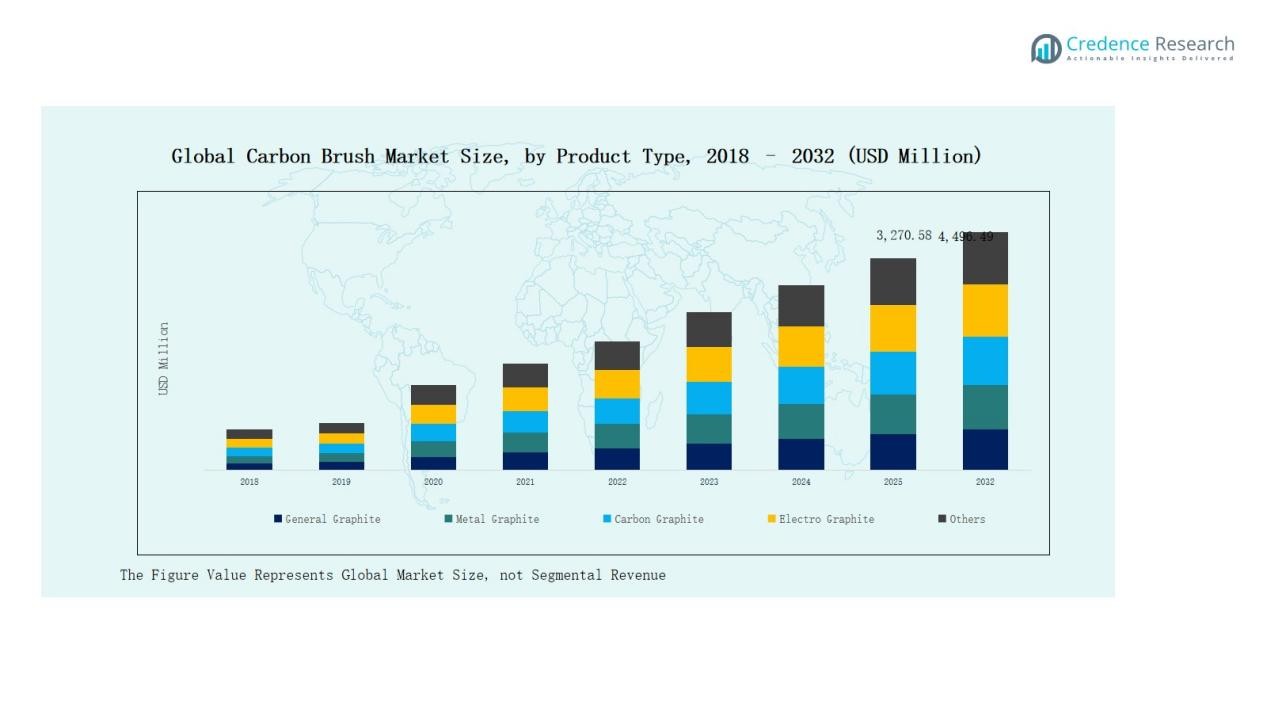

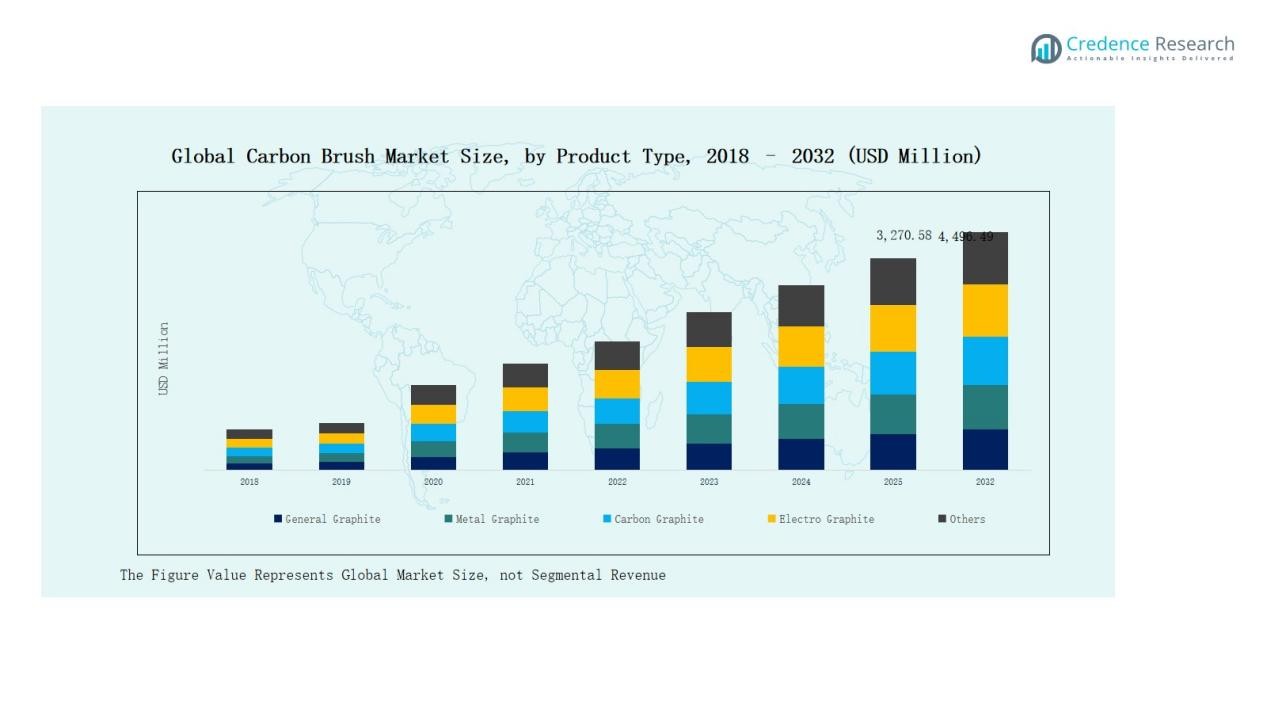

- By product type, Electro Graphite held 32% share in 2024, supported by durability, high-temperature resistance, and heavy-duty industrial use, while Metal Graphite gained traction in automotive alternators.

- By application, the Motor segment dominated with 45% share in 2024, supported by demand from electric vehicles, industrial machinery, HVAC systems, and consumer electronics, ensuring stable current flow and performance.

- Leading companies include Mersen SA, Schunk Group, Helwig Carbon Products, Morgan Advanced Materials, Fuji Carbon Mfg Co., Ltd., TRIS, E-Carbon, Aupac Co., Ltd., Assam Carbon Products, Naeem Carbon, and Phynyx Industrial Products.

Market Segment Insights

By Product Type

The carbon brush market by product type is dominated by Electro Graphite, holding around 32% share in 2024. Its superior durability, resistance to high temperatures, and suitability for heavy-duty applications in industrial motors and generators drive this leadership. Metal Graphite follows with strong adoption in automotive alternators due to excellent conductivity. Growing demand for high-performance and long-life brushes across manufacturing and power sectors continues to support Electro Graphite’s expansion, particularly as industries prioritize efficiency and operational reliability.

- For instance, Schunk Carbon Technology introduced upgraded electro graphite brushes designed for high-performance wind turbines, enhancing efficiency under harsh environmental conditions.

By Application

Within applications, the Motor segment leads with about 45% share in 2024, driven by widespread use in automotive, industrial machinery, and consumer electronics. Carbon brushes remain critical in providing stable current flow and ensuring motor performance. The growth in electric vehicles, HVAC systems, and automation has strengthened demand. Generators and alternators represent another key area, supported by rising energy needs. However, motor applications dominate due to higher production volumes and the ongoing transition toward electrification across multiple industries.

- For instance, Siemens introduced its SIMOTICS SD motor series optimized for high-efficiency industrial automation, which relies on carbon brushes to maintain consistent motor operation under heavy load conditions.

Key Growth Drivers

Rising Demand from Automotive Industry

The automotive industry drives strong demand for carbon brushes, particularly in alternators, starters, and electric motors. With electric vehicle (EV) production increasing globally, the need for reliable brushes in propulsion and auxiliary systems continues to grow. Carbon brushes ensure consistent current transmission, supporting battery charging and motor performance. Expanding EV adoption, combined with ongoing demand for traditional vehicles, secures automotive as a central growth contributor in the carbon brush market across developed and emerging economies.

- For instance, WEBER DRIVETRAIN inaugurated a semi-automated manufacturing plant in Pune, India, in late 2022, focused on producing carbon brushes and brushless DC motors aimed at the growing EV market in compliance with Indian regulations, underlining regional manufacturing growth in this category.

Industrial Expansion and Machinery Modernization

The expansion of industrial automation and modernization of heavy machinery significantly boosts carbon brush demand. Electro graphite and metal graphite brushes are increasingly used in motors, pumps, and conveyor systems, ensuring efficiency under high load conditions. Manufacturing hubs in Asia-Pacific, supported by infrastructure projects, drive consumption. Rising investments in smart factories and advanced equipment accelerate market growth, as carbon brushes remain vital for uninterrupted performance in motors powering industrial automation and production processes worldwide.

- For instance, Bosch Power Tools launched the GWS 800 Professional Angle Grinder, manufactured in Chennai, India, featuring an advanced carbon brush that simplifies maintenance while ensuring consistent motor performance under heavy use.

Growing Power Generation Sector

Power generation remains a major growth driver, with carbon brushes widely used in generators and alternators. Increasing electricity demand, combined with renewable energy integration, fuels installations of power equipment where high-performance brushes are critical. Developing economies invest heavily in expanding power infrastructure, while advanced markets focus on upgrading existing systems. This growing need for stable and efficient power transmission sustains demand for electro graphite and metal graphite brushes, strengthening their role in ensuring generator reliability and longevity.

Key Trends & Opportunities

Shift Toward Electrification and Green Energy

The global push for electrification and sustainability offers new opportunities for carbon brushes in renewable energy applications. Wind turbines, hydroelectric plants, and solar tracking systems rely on advanced brushes for continuous power flow. The growing adoption of clean energy sources supports higher demand, while governments and corporations invest in sustainable technologies. This shift not only drives innovation in brush materials but also expands market opportunities as energy systems evolve to meet carbon-neutral targets worldwide.

- For instance, Toyo Tanso’s carbon brushes have been widely adopted by major Japanese renewable energy operators for wind turbines, known for their excellent durability and ability to reduce damage to slip rings, thus supporting stable power generation.

Advancements in Brush Materials and Design

Material innovation is a notable trend shaping the market. Companies are developing brushes with enhanced conductivity, heat resistance, and longer lifespans to meet performance demands. Silver graphite and resin-bonded graphite segments benefit from this innovation, catering to industries requiring high precision. These advancements reduce maintenance costs and improve system efficiency, making them attractive for industries such as aerospace, defense, and heavy manufacturing. Continuous research in composite materials strengthens the competitive edge of players in the carbon brush market.

- For instance, Schunk Carbon Technology introduced silver graphite brushes designed for high-current, low-voltage environments in aerospace and rail industries, ensuring superior conductivity and thermal stability

Key Challenges

Shift Toward Brushless Motor Technology

A major challenge is the rising adoption of brushless motor technology in automotive, electronics, and industrial applications. Brushless motors offer longer lifespans, higher efficiency, and reduced maintenance compared to traditional brushed systems. As industries increasingly prioritize energy efficiency and durability, this transition threatens the long-term demand for carbon brushes. Companies must innovate or diversify their product portfolios to remain relevant as brushless technology continues to gain traction across multiple sectors.

High Maintenance and Replacement Costs

Carbon brushes, despite being cost-effective initially, require regular maintenance and replacement due to wear and tear. This increases operational expenses for industries relying on continuous equipment uptime, such as power generation and heavy manufacturing. The downtime associated with replacement also impacts productivity. These challenges push end-users to explore alternatives like advanced materials or brushless systems. Manufacturers face pressure to innovate designs that extend brush lifespan and reduce maintenance costs to maintain market competitiveness.

Raw Material Price Volatility

The carbon brush market is sensitive to fluctuations in raw material prices, particularly graphite, silver, and other conductive elements. Price volatility impacts manufacturing costs and profitability, making it difficult for companies to maintain stable margins. Global supply chain disruptions further exacerbate this challenge, creating uncertainty in procurement. Rising costs often lead to higher product prices, which can reduce competitiveness in price-sensitive markets. Addressing this challenge requires robust supply chain management and investment in alternative materials.

Regional Analysis

North America

The North America carbon brush market was valued at USD 671.49 million in 2018, reached USD 766.36 million in 2024, and is projected to hit USD 1,096.25 million by 2032, registering a CAGR of 4.7%. The region accounted for nearly 24% market share in 2024, supported by advanced automotive, aerospace, and industrial sectors. High adoption of electric vehicles and modernization of power systems further boost demand. Strong presence of leading manufacturers and steady technological adoption position North America as a key growth region with sustained opportunities.

Europe

The Europe carbon brush market was valued at USD 611.01 million in 2018, grew to USD 677.83 million in 2024, and is forecasted to reach USD 908.53 million by 2032, at a CAGR of 3.8%. The region represented around 21.6% market share in 2024, driven by automotive production, industrial machinery, and renewable energy adoption. Germany, France, and Italy lead demand due to strong manufacturing bases. However, increasing adoption of brushless technologies creates a gradual shift. Despite this, Europe remains significant due to its technological expertise and investments in energy-efficient solutions.

Asia Pacific

The Asia Pacific carbon brush market dominated globally, valued at USD 1,150.20 million in 2018, reaching USD 1,370.41 million in 2024, and projected to climb to USD 2,083.23 million by 2032, at a CAGR of 5.4%. Holding the largest 43.7% market share in 2024, the region is driven by strong industrialization, growing automotive production, and expansion of renewable power capacity in China, India, and Japan. Rapid urbanization and infrastructure development further increase demand. Asia Pacific’s dominance is reinforced by large-scale manufacturing and significant investments in heavy industries, ensuring its leadership through the forecast period.

Latin America

The Latin America carbon brush market was valued at USD 143.10 million in 2018, increased to USD 164.35 million in 2024, and is expected to reach USD 215.25 million by 2032, registering a CAGR of 3.5%. The region accounted for around 5.2% market share in 2024, with Brazil leading demand due to its industrial and automotive sectors. Growth in mining and energy projects also supports adoption. However, limited technological advancement and reliance on imports restrict rapid expansion. Despite these challenges, Latin America presents moderate growth opportunities, particularly in infrastructure modernization and localized manufacturing.

Middle East

The Middle East carbon brush market stood at USD 86.40 million in 2018, grew to USD 92.84 million in 2024, and is projected to reach USD 117.38 million by 2032, at a CAGR of 3.0%. Holding about 3% share of the market in 2024, the region’s demand is supported by investments in oil & gas, petrochemicals, and power generation. Industrial development in GCC countries and infrastructure growth create steady opportunities. However, reliance on imported carbon brushes and growing adoption of advanced motor technologies limit stronger expansion across the Middle East.

Africa

The Africa carbon brush market was valued at USD 37.80 million in 2018, rose to USD 65.26 million in 2024, and is expected to reach USD 75.85 million by 2032, with the lowest CAGR of 1.4%. Representing only 2.1% share in 2024, the region lags due to limited industrialization and weak technological adoption. South Africa leads consumption, supported by mining and energy sectors, while other countries show modest demand. Lack of large-scale manufacturing and infrastructure challenges hinder broader growth. Nonetheless, gradual investment in industrial projects offers selective opportunities within the African market.

Market Segmentations:

By Product Type

- General Graphite

- Metal Graphite

- Carbon Graphite

- Electro Graphite

- Silver Graphite

- Resin-Bonded Graphite

By Application

- Motor

- Generator & Alternator

- Current & Signal Transmission

- Grounding Devices

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The carbon brush market is moderately consolidated, with a mix of global leaders and regional players competing on product performance, durability, and innovation. Key companies such as Mersen SA, Schunk Group, Helwig Carbon Products, Morgan Advanced Materials, and Fuji Carbon Mfg Co., Ltd. hold strong positions through broad product portfolios and established customer networks. These firms focus on developing advanced materials like electro graphite and silver graphite to enhance conductivity and lifespan. Regional players, including Assam Carbon Products Limited and Phynyx Industrial Products Pvt. Ltd., serve localized markets with cost-effective solutions, intensifying competition. Strategic partnerships, product innovations, and geographic expansion remain central to sustaining market share. However, the rising adoption of brushless motor technology challenges traditional players, prompting diversification into new product lines. Overall, competition is shaped by technological advancements, end-user demand for efficiency, and the ability to adapt to evolving industrial and automotive requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Mersen SA

- Schunk Group

- Helwig Carbon Products, Inc.

- Morgan Advanced Materials

- Fuji Carbon Mfg Co., Ltd.

- TRIS

- E-Carbon

- Aupac Co., Ltd.

- Assam Carbon Products Limited

- Naeem Carbon and Industrial Products LLP

- Phynyx Industrial Products Pvt. Ltd.

Recent Developments

- l In August 2022, Baker Hughes acquired the Power Generation division of BRUSH Group, bolstering its offerings in generator and brush systems.

- l In 2023, Mersen launched a new line of high-performance carbon brushes aimed at electric vehicle applications, with enhanced durability and thermal management.

- l In 2024, Morgan Advanced Materials launched the National™ S22 silver carbon brush grade, tailored for wind turbines to reduce maintenance and boost durability.

- l In 2023, Mersen launched advanced high-performance carbon brushes for electric vehicle motors, focusing on durability and thermal management efficiency.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from the automotive sector will remain strong due to growing EV adoption.

- Industrial automation will continue to create opportunities for advanced carbon brushes.

- Power generation expansion will drive adoption of electro graphite and metal graphite brushes.

- Renewable energy projects will increase usage of carbon brushes in wind and hydro systems.

- Innovations in materials will improve conductivity, durability, and reduce maintenance costs.

- Asia Pacific will maintain its dominance due to rapid industrialization and manufacturing growth.

- North America and Europe will see steady demand led by modernization of industries.

- Brushless motor adoption will limit growth, pushing firms to diversify product portfolios.

- Emerging markets in Latin America and Africa will show gradual demand expansion.

- Strategic mergers and collaborations will shape competitive positioning among global and regional players.