Market Overview

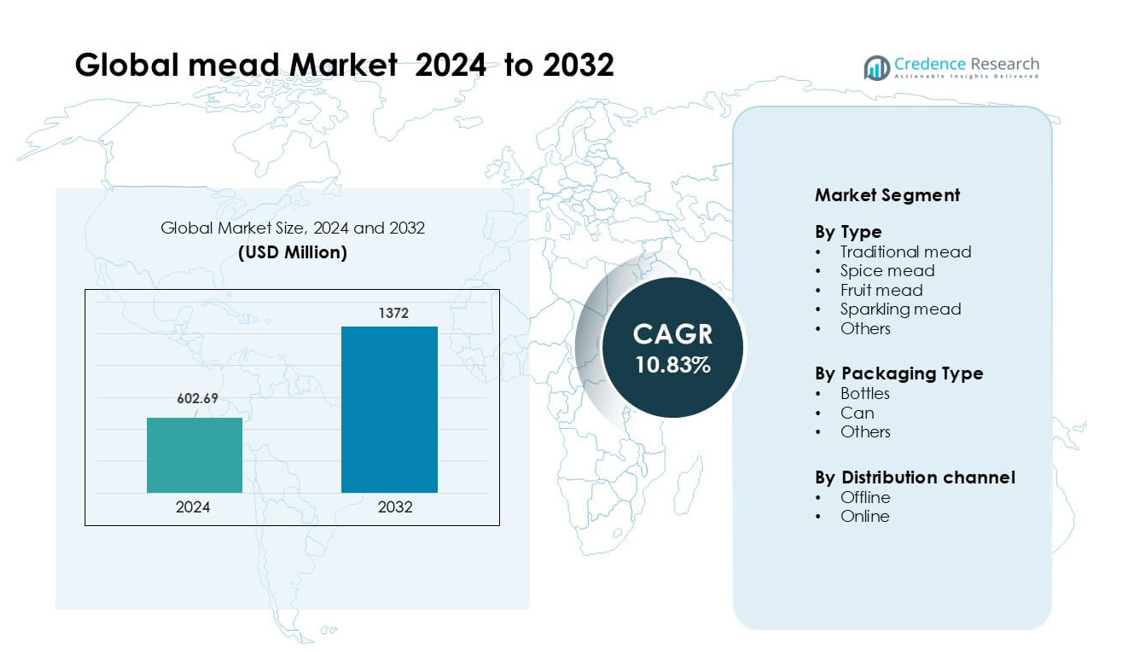

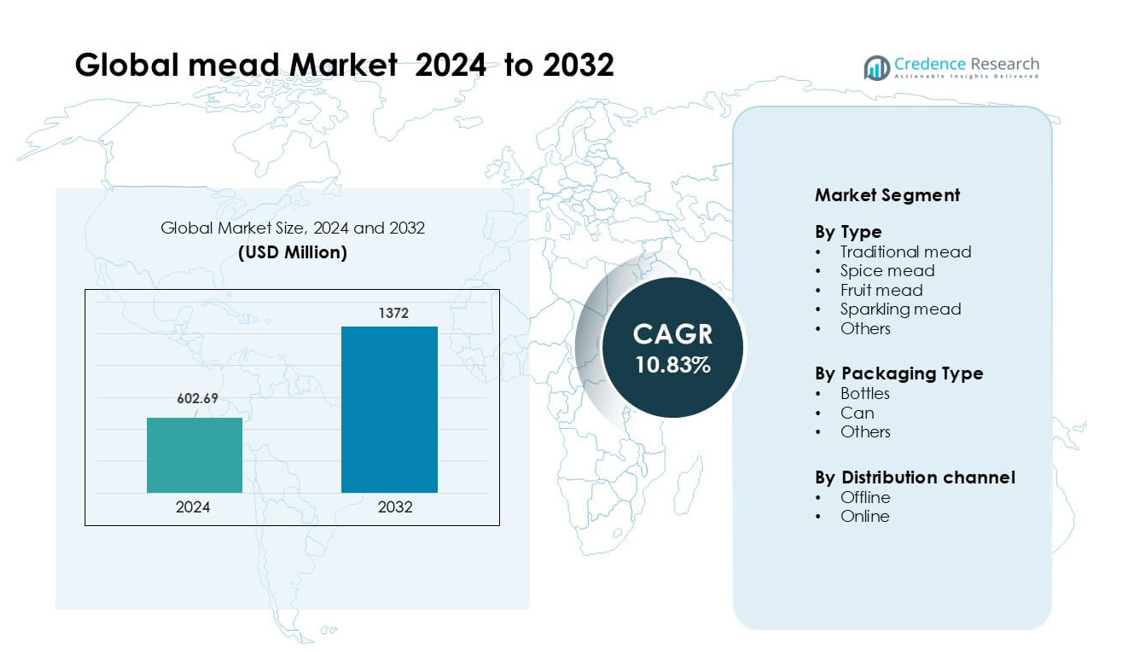

Global mead Market was valued at USD 602.69 million in 2024 and is anticipated to reach USD 1372 million by 2032, growing at a CAGR of 10.83 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mead Market Size 2024 |

USD 602.69 million |

| Mead Market, CAGR |

10.83% |

| Mead Market Size 2032 |

USD 1372 million |

The Global Mead Market is shaped by key players such as Charm City Meadworks, Redstone Meadery, BUNRATTY MEAD AND LIQUEUR CO. Ltd., Schramm’s Mead, Bored Beverages Company, PASIEKA JAROS, Nectar Creek, Heidrun Meadery, Kuhnhenn Mead, and B Nektar. These companies compete through craft-focused production, diversified flavor profiles, and expanding distribution across retail and online channels. Product quality, premium honey sourcing, and seasonal releases help strengthen brand positioning in a fast-growing craft alcohol category. North America led the global market in 2024 with a dominant 41% share, supported by strong consumer interest in artisanal beverages and a mature craft brewery ecosystem.

Market Insights

- The Global mead market reached USD 602.69 million in 2024 and is projected to hit USD 1372 million by 2032, growing at a CAGR of 10.83%.

- Demand grows as consumers shift toward craft, natural, and heritage alcoholic drinks, driving strong uptake of traditional mead, which held about 42% share.

- Trends reflect rising interest in fruit-based and sparkling variants, wider flavor experimentation, and premium small-batch releases gaining traction across specialty retail.

- Key companies strengthen competition through artisanal production, premium honey sourcing, and expanding online reach, while smaller producers face raw honey price instability.

- North America led the market with around 41% share in 2024, followed by Europe at about 32%, while bottles dominated packaging with nearly 67%, and offline channels held roughly 71% of global sales.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Traditional mead dominated the Global Mead Market in 2024 with about 42% share. Consumers preferred this category because it offers classic fermentation profiles and clean honey-forward taste that appeals to both new and experienced drinkers. Growth stayed steady as craft producers promoted heritage brewing methods and premium honey varieties. Fruit mead gained traction through flavored launches, but traditional mead remained ahead due to broader brand presence, stable production cycles, and higher acceptance in tasting rooms and specialty alcohol stores.

- For instance, Pasieka Jaros, a renowned Polish meadery, continues to produce traditional meads using classical fermentation methods: they manufacture trójniak (honey-to-water ratio of 1:2) with about 13% ABV, and their classic półtorak variants have around 16% ABV.

By Packaging Type

Bottles led the packaging segment in 2024 with nearly 67% share. Breweries used glass bottles to preserve aroma, maintain carbonation, and support premium positioning. Demand increased as consumers associated bottled mead with higher craftsmanship and longer shelf life. Cans expanded in convenience retail and outdoor events, yet bottles remained dominant because they suit small-batch production, support gift-focused sales, and align with traditional branding strategies favored by craft mead makers.

- For instance, Redstone Meadery in Boulder, Colorado, self-distributes over 110,000 glass bottles of mead annually across 35 U.S. states, leveraging the bottle format to reinforce its artisanal positioning.

By Distribution Channel

4Offline channels held the leading position in 2024 with around 71% share. Liquor stores, tasting rooms, and specialty outlets drove sales because buyers still prefer in-person sampling and expert recommendations for niche alcohol categories. Offline demand also grew through brewery-led promotions and regional festivals that introduced new consumers to mead varieties. Online sales increased due to rising e-commerce usage, but offline stayed dominant because of regulatory limits, delivery restrictions in some countries, and strong retail partnerships of craft producers.

Key Growth Drivers

Rising Consumer Shift Toward Craft and Artisanal Alcohol Beverages

The Global Mead Market grows as consumers show stronger interest in craft, small-batch, and heritage alcoholic drinks. Many buyers seek products with natural ingredients, clean labels, and traditional brewing styles, which positions mead as a unique alternative to beer, cider, and wine. Demand rises in urban markets where craft breweries, meaderies, and tasting rooms introduce customers to premium honey-based beverages. Younger consumers also explore niche drinks through festivals and curated tasting events, boosting adoption in North America and Europe. Social media exposure and influencer-driven promotion further support awareness by showcasing fruit-infused, spice-based, and sparkling mead varieties. Rising availability in specialty liquor stores and premium retail formats strengthens visibility. This shift toward artisanal beverages continues to act as a core driver for sustained category expansion.

- For instance, B. Nektar Meadery in Michigan produces over 100,000 gallons of mead each year and sources around 3,000 pounds of honey weekly from small-scale beekeepers, underscoring its deep roots in artisanal production.

Expansion of Flavor Innovation and Product Diversification

Flavor innovation remains a strong driver in the Global Mead Market as producers launch fruit, spice, botanical, and sparkling variants to attract a larger consumer base. New entrants and craft meaderies use diverse honey types and fermentation styles to create differentiated profiles that appeal to experimental drinkers. Hybrid formats that blend mead with cider, wine, or low-alcohol beverages also help broaden reach. Product diversification supports stronger sales in bars, restaurants, and festival circuits where customers look for novel taste experiences. Many brands introduce limited-edition batches, seasonal flavors, and premium barrel-aged offerings that elevate category value. This focus on variety increases shelf presence in specialty stores and encourages repeat purchases. As producers refine fermentation technology, flavor stability and consistency improve, enabling wider distribution across regions.

- For instance, B. Nektar Meadery in Michigan produces more than 100,000 gallons of mead annually and maintains a rotating lineup that exceeds 60 flavored SKUs, including fruit-forward releases such as Zombie Killer, a cherry-infused cyser at 5.5% ABV, and Necro, a blackberry mead at 6% ABV, demonstrating the commercial strength of flavor-driven innovation.

Retail Expansion and Growing Acceptance in Mainstream Alcohol Channels

The Global Mead Market benefits from expanding access in mainstream alcohol retail channels, including liquor stores, premium supermarkets, and curated beverage boutiques. As regulations ease in some regions, craft meaderies secure shelf listings that expose the category to a broader audience. Partnerships with distributors and alcohol wholesalers improve product flow to urban centers and tourist regions, where premium craft beverages experience faster turnover. Many restaurants and bars add mead to tasting menus, pairing sections, and seasonal drink lists, which enhances category recognition. Tourism-driven demand in countries with traditional honey-fermentation heritage also lifts sales. Combined with expanding e-commerce channels, this broader retail exposure strengthens consumer confidence and supports steady market penetration across both developed and emerging regions.

Key Trends & Opportunities

Rising Popularity of Low-Alcohol and Natural Fermented Beverages

A key trend shaping the Global Mead Market is the rising preference for low-alcohol, natural, and naturally fermented drinks. Health-conscious consumers view mead as a cleaner alternative due to its simple ingredient base of honey, water, and yeast. Producers respond by launching session-strength meads, botanical blends, and gluten-free variants that appeal to wellness-oriented buyers. Growth accelerates as consumers explore beverages tied to natural fermentation, probiotics, and minimal processing. This trend supports premium pricing and strengthens mead’s relevance within the broader craft beverage landscape.

- For instance, B. Nektar Meadery offers a Blackberry Mint mead at just 4.0% ABV, catering to the low-alcohol, easy-drinking segment.

Growing Tourism, Festivals, and Experiential Tasting Events

Experiential consumption offers strong market opportunities, as tourism and festival circuits help introduce new consumers to mead. Meaderies attract visitors through guided tastings, production tours, and food-pairing events that showcase artisanal craftsmanship. Regional alcohol festivals also highlight fruit meads, spice meads, and sparkling variants, helping producers gain direct exposure without heavy advertising spend. This experiential approach increases local brand loyalty and supports repeat purchases across retail channels. As travel resumes in many markets, these events become important catalysts for category expansion and innovation discovery.

- For instance, Alta Vista Botanical Gardens Mead Festival (Meading at the Gardens) on the U.S. West Coast, nearly 1,000 attendees participated in 2025, sampling meads from 14 meaderies, which helped these small producers gain high-touch exposure.

E-commerce and Direct-to-Consumer Growth

Online sales represent a major opportunity for the Global Mead Market as consumers increasingly purchase specialty alcohol through digital platforms. Direct-to-consumer models help small meaderies reach buyers outside local regions, bypassing distribution challenges. Subscription boxes, curated tasting kits, and limited-edition online drops help brands create steady revenue streams. Digital marketing and influencer-led collaborations further improve visibility. As regulations ease in several countries, e-commerce becomes a faster growth path for niche alcohol categories.

Key Challenges

Limited Consumer Awareness Beyond Key Regions

A major challenge for the Global Mead Market is low consumer awareness outside North America and parts of Europe. Many potential buyers are unfamiliar with mead’s taste profile, alcohol range, or food-pairing potential, slowing adoption. In emerging markets, stronger competition from beer, wine, and spirits further limits visibility. Producers must invest in educational campaigns, sampling programs, and experiential promotions to build category recognition. Without broader awareness, market penetration remains slow, especially in price-sensitive regions.

Supply Constraints and Price Volatility of Raw Honey

The market faces challenges due to fluctuating honey prices and supply instability driven by climate impacts, reduced bee populations, and regional production variations. Mead producers rely heavily on high-quality honey, and cost increases directly affect product pricing and profitability. Smaller craft meaderies often struggle to secure consistent supply at stable rates, which limits batch sizes and expansion plans. As global honey demand rises across food and cosmetic industries, competition further intensifies. These supply-side pressures remain a key operational challenge for market participants.

Regional Analysis

North America

North America held the largest share of the Global Mead Market in 2024 with about 41%. Strong craft alcohol culture, wide availability of premium honey varieties, and the presence of established meaderies supported steady regional expansion. Consumers in the U.S. and Canada showed rising interest in heritage fermentation and artisanal beverages, which boosted demand for traditional, fruit, and spice-based meads. Retail penetration increased through liquor stores, tasting rooms, and brewery taprooms, while e-commerce channels expanded access across states with flexible shipping rules. Festivals and tourism-driven tasting events also helped strengthen category visibility and long-term adoption.

Europe

Europe accounted for nearly 32% of the Global Mead Market in 2024, supported by deep historical roots of honey fermentation in Baltic and Nordic countries. Poland, Lithuania, and Denmark remained strong consumption hubs due to heritage brewing traditions and government-recognized quality classifications for mead types. Western Europe saw growing demand through craft beverage bars, gourmet retail stores, and premium supermarkets. Rising interest in low-alcohol and natural fermented drinks encouraged experimentation with botanical and fruit meads. Expanding tourism and cultural festivals created new exposure opportunities, further supporting category growth across both traditional and modern product formats.

Asia Pacific

Asia Pacific captured about 18% share in 2024, driven by rising consumer interest in premium imported beverages and craft alcohol culture in urban markets. Countries like Japan, South Korea, and Australia showed early adoption due to expanding specialty alcohol retail networks and strong appeal for unique flavor formats. Rising honey production in China and India supported local experimentation by small producers. Growth remained moderate in price-sensitive markets, but awareness increased through social media, online retail platforms, and tourism-driven sampling at bars and premium restaurants. Expanding e-commerce access is expected to accelerate regional market penetration.

Latin America

Latin America held roughly 6% of the Global Mead Market in 2024, with gradual adoption led by Brazil, Mexico, and Argentina. Rising interest in artisanal and natural alcoholic beverages helped position mead as a niche product in specialty liquor shops and craft bars. Regional honey availability supported small-scale production, particularly for fruit-infused meads aligned with local flavor preferences. Awareness levels remained modest, but tourism, cultural events, and online beverage communities expanded exposure. Regulatory complexities in alcohol distribution limited broader retail presence, yet growing urban demand for premium craft drinks supports future growth potential.

Middle East & Africa

The Middle East & Africa region represented nearly 3% share in 2024, reflecting early-stage category development and limited commercial-scale production. Demand remained concentrated in South Africa, Kenya, and the UAE, where expatriate populations and premium alcohol retailers introduced mead to niche consumer segments. Rising honey output in East Africa encouraged small producer experiments using local floral honey varieties. However, stringent alcohol regulations in many Middle Eastern countries restricted broader market penetration. Growth opportunities exist in tourism zones, specialty restaurants, and online premium beverage platforms that cater to internationally aware consumers.

Market Segmentations:

By Type

- Traditional mead

- Spice mead

- Fruit mead

- Sparkling mead

- Others

By Packaging Type

By Distribution channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Mead Market features leading players such as Charm City Meadworks, Redstone Meadery, BUNRATTY MEAD AND LIQUEUR CO. Ltd., Schramm’s Mead, and Bored Beverages Company, supported by PASIEKA JAROS, Nectar Creek, Heidrun Meadery, Kuhnhenn Mead, and B Nektar. These companies compete through flavor innovation, premium honey sourcing, and diversified product lines that include traditional, fruit, spice, and sparkling meads. Many producers focus on small-batch craft methods to strengthen brand identity and appeal to artisanal beverage consumers. Expanding distribution through liquor stores, tasting rooms, and e-commerce enhances market reach, while festival participation and experiential tasting events build consumer awareness. Several brands invest in modern fermentation technology and quality control to maintain consistency across batches. Partnerships with regional distributors, collaborations with breweries or cideries, and limited-edition seasonal launches further support competitive positioning. As consumer interest in natural fermented beverages rises, companies continue to strengthen product portfolios and expand into new geographic markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Redstone Meadery: announced expanded summer tasting-room hours (Weds–Fri 12–6, Sat 12–5) and highlighted recent new-release activity (e.g., Tupelo Mountain Honey Wine and returning Red Raspberry Mountain Honey Wine) available in the tasting room, online store, and select retailers.

- In March 2025, Charm City Meadworks: moving operations to Peabody Heights Brewery (401 E 30th St, Baltimore) and planning to begin production there in March 2025; products will be available on draft at the Peabody Heights taproom and continue in existing retail/distribution channels

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging Type, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global mead Market will expand as craft alcohol gains wider global acceptance.

- Traditional mead will keep strong demand due to steady interest in heritage beverages.

- Fruit, spice, and sparkling meads will attract new consumers seeking flavor variety.

- Premium and small-batch production will strengthen brand identity and customer loyalty.

- Online sales will rise as more regions ease alcohol delivery rules.

- Producers will invest in modern fermentation methods to improve product consistency.

- Tourism, festivals, and tasting events will boost awareness in emerging markets.

- New entrants will adopt sustainable honey sourcing to meet consumer expectations.

- Retail presence in specialty liquor stores and supermarkets will continue to increase.

- Global expansion will grow as brands form distributor partnerships across new regions.