Market Overview

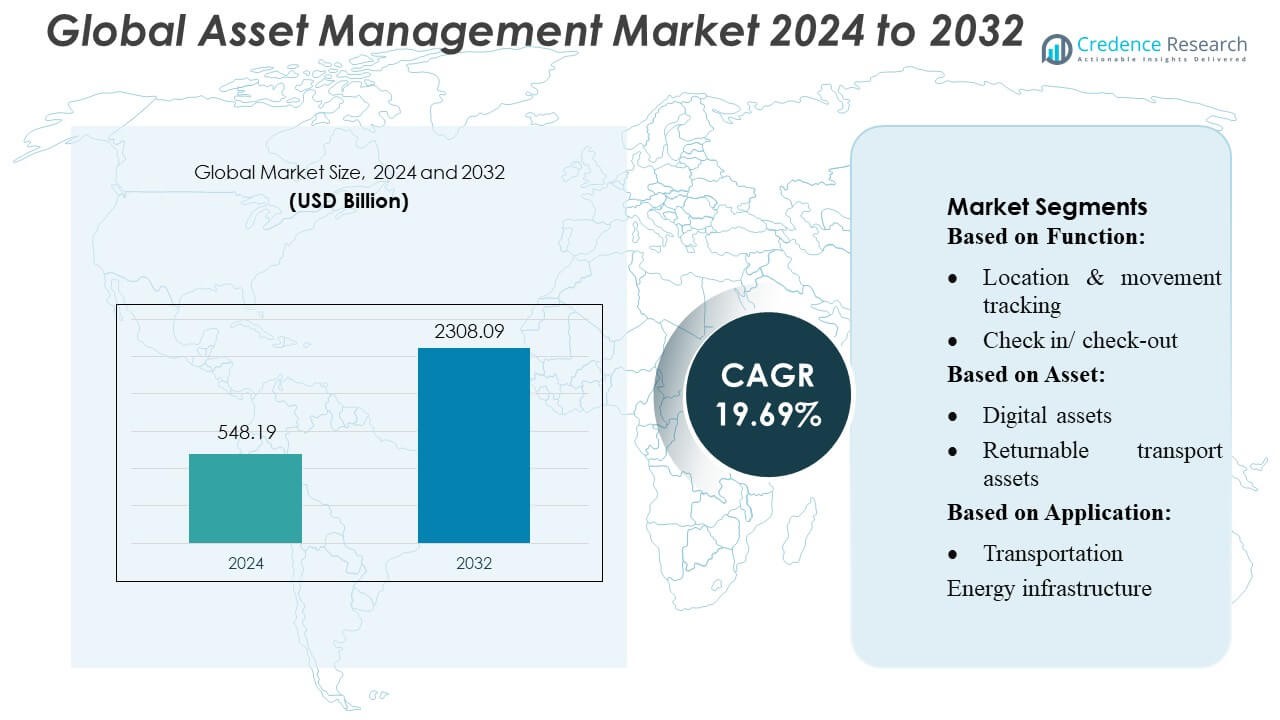

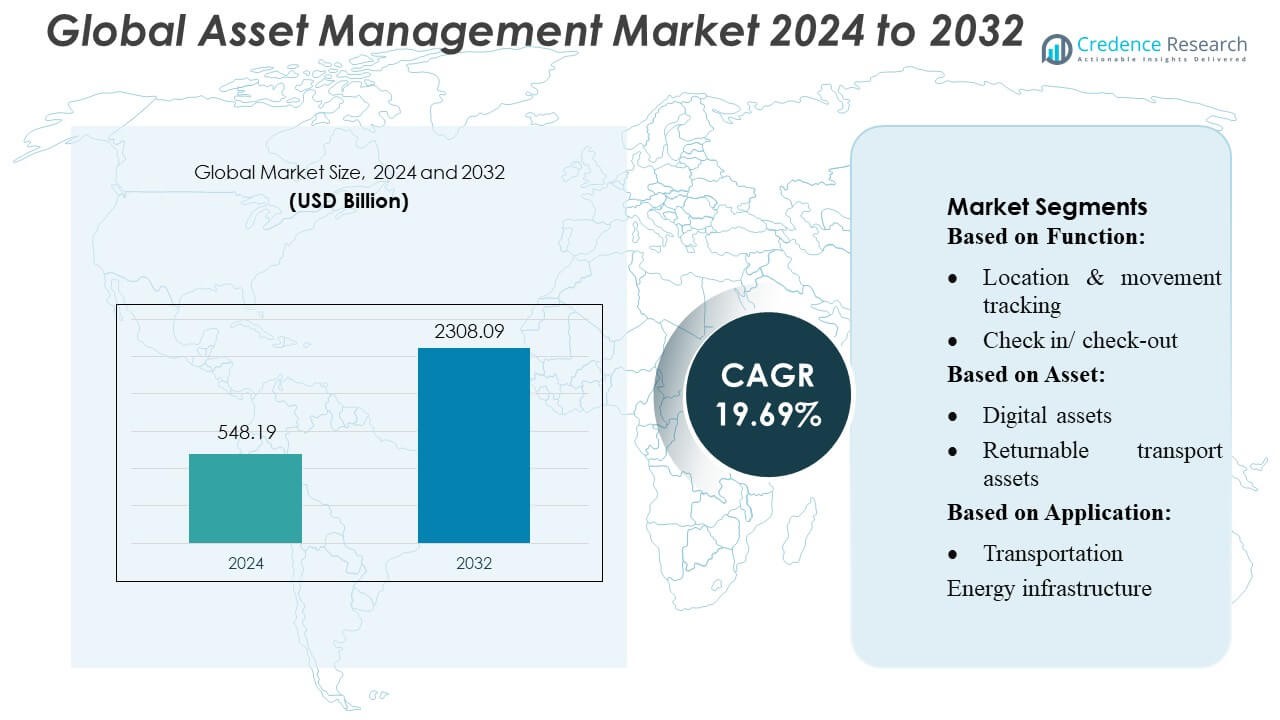

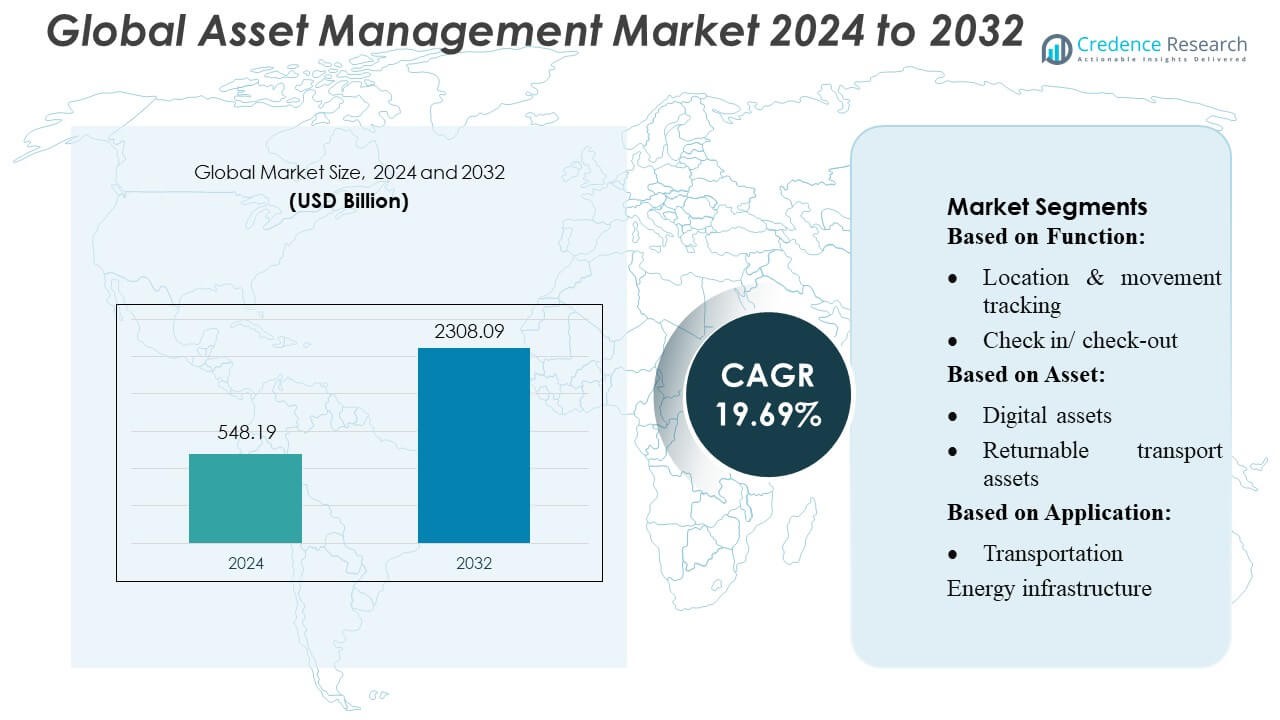

Global Asset Management Market size was valued USD 548.19 billion in 2024 and is anticipated to reach USD 2308.09 billion by 2032, at a CAGR of 19.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asset Management Market Size 2024 |

USD 548.19 Billion |

| Asset Management Market, CAGR |

19.69% |

| Asset Management Market Size 2032 |

USD 2308.09 Billion |

The Global Asset Management Market is shaped by major multinational firms such as Hitachi, Rockwell Automation, Zebra Technologies, IBM, Honeywell, Oracle, WSP Global, Siemens, Adobe, and Brookfield Asset Management. These companies drive innovation by embedding artificial intelligence, cloud platforms, Internet of Things, and predictive analytics into their asset management offerings, enabling clients to monitor assets in real time, improve uptime, and reduce operational costs. Their global scale and deep technical expertise support wide deployment across industries including manufacturing, infrastructure, utilities, and transportation. The market is regionally led by North America, which holds approximately 33.04% of the total market share, reflecting the region’s strong technological adoption, mature financial infrastructure, and presence of leading IT firms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Asset Management Market was valued at USD 548.19 billion in 2024 and is expected to reach USD 2308.09 billion by 2032, growing at a CAGR of 19.69%, supported by rising digital transformation and increasing demand for automated asset lifecycle solutions.

- Growing adoption of AI, IoT, cloud platforms, and predictive analytics acts as a major driver, helping organizations improve uptime, reduce operational costs, and strengthen real-time asset visibility.

- Ongoing trends such as smart asset monitoring, digital twins, and sustainability-focused asset strategies are reshaping industry investments and accelerating modernization across sectors.

- Competitive activity remains strong as leading players innovate and expand globally, while challenges arise from high implementation costs, integration complexities, and cybersecurity risks.

- Regionally, North America leads with 33.04% market share, while the software segment holds a dominant position due to rising use of advanced digital asset management systems across manufacturing, utilities, and infrastructure.

Market Segmentation Analysis:

By Function:

Location & movement tracking leads the global asset management market, holding the largest share as companies rely on real-time visibility to reduce asset loss and improve operational efficiency. Its dominance is driven by wider use of sensors, RFID, and IoT platforms that help track assets across facilities and supply chains. Check-in/check-out and repair & maintenance solutions show steady growth, but they remain smaller as organizations prioritize continuous monitoring over periodic asset-related activities.

- For instance, Rockwell Automation’s FactoryTalk Analytics GuardianAI consumes electrical signal data from PowerFlex 755 and 6000T variable frequency drives to detect early signs of wear—this approach avoids installing new sensors while supporting continuous condition-based monitoring.

By Asset Type:

Returnable transport assets represent the dominant asset category, accounting for the highest market share because industries such as logistics, retail, and manufacturing depend heavily on reusable pallets, crates, and containers. The need to reduce asset misplacement, improve cycle times, and cut operational costs drives strong adoption. Digital assets and in-transit assets continue to expand, but returnable transport assets maintain leadership due to their large volumes and frequent operational movement.

- For instance, Zebra Technologies’ RFID-based RTI tracking system uses UHF readers and overhead antennas to track tagged containers at checkpoints, enabling real-time location updates and delivering a reported 54% reduction in transportation misloads for a major online retailer.

By Application:

The transportation segment holds the largest share in the global asset management market, supported by the extensive use of fleets, containers, and mobile equipment that require constant tracking and maintenance. Its dominance is driven by growing demand for route optimization, theft prevention, and reduced downtime. Infrastructure, energy, water, and critical infrastructure segments are growing steadily, but transportation remains the top contributor due to its high asset intensity and strong digital adoption.

Key Growth Drivers

- Rising Adoption of Digital and Automated Investment Platforms

The rapid integration of AI, machine learning, and robotic process automation is accelerating the efficiency and scalability of asset management operations. Firms increasingly rely on automated advisory tools, algorithmic portfolio rebalancing, and predictive analytics to enhance investment outcomes. Digital onboarding and automated compliance reduce operational costs while improving client experience. This technological shift expands access to investment products for a broader audience, enabling firms to serve mass-affluent and retail segments effectively. As a result, digital transformation remains a central catalyst for market expansion.

- For instance, IBM’s Digital Asset Haven, built with Dfns, supports transaction lifecycle management across more than 40 public and private blockchains, while using multi-party authorization and hardware-based key management via IBM Crypto Express 8S on IBM Z and LinuxONE.

- Growth in High-Net-Worth Individuals and Institutional Investments

The expanding global population of high-net-worth individuals (HNWIs) and rising institutional participation continue to strengthen demand for structured asset management services. Pension funds, sovereign wealth funds, and insurance companies actively allocate larger portfolios toward diversified assets such as private equity, real estate, and alternative investments. This increasing complexity of financial portfolios drives the need for professional advisory expertise. Additionally, wealth creation in emerging economies is generating new revenue streams for global firms. These factors collectively support strong long-term growth momentum across the asset management sector.

- For instance, Oracle has built a digital twin environment that detects anomalies in connected industrial assets in 0.2 seconds using physics-based simulation and real-time streaming data.

- Expansion of Sustainable and ESG-Focused Investment Strategies

Environmental, social, and governance (ESG) investing has become a mainstream growth driver as investors prioritize long-term value preservation and responsible capital allocation. Asset managers integrate ESG scoring, climate-risk modeling, and ethical screening into portfolio strategies to meet regulatory expectations and client preferences. Demand for sustainable funds is expanding across institutional, retail, and sovereign investor groups. Enhanced transparency requirements and global sustainability frameworks further accelerate product development in green bonds, low-carbon funds, and impact-oriented portfolios. This structural preference for ESG-aligned assets continues to reshape market offerings.

Key Trends & Opportunities

1. Rising Adoption of Alternative Investments

Demand for alternative assets—such as private equity, hedge funds, infrastructure, and real estate—continues to grow as investors seek stable returns amid market volatility. Asset managers are expanding alternative product lines supported by advanced data analytics, risk-modeling tools, and performance benchmarking platforms. This trend unlocks new fee-based revenue opportunities, particularly from institutional clients. With long-duration assets offering inflation-hedging benefits and diversification advantages, alternatives remain a critical strategic focus for global firms aiming to differentiate portfolios and enhance long-term value generation.

- For instance, WSP and Microsoft partnered on a multiyear digital transformation initiative, co-developing AI-powered solutions where WSP contributes its engineering data (spanning 73,000 employees across 50+ countries) to build predictive infrastructure models.

2. Growth of Multi-Asset and Thematic Investment Strategies

Investors increasingly prefer multi-asset strategies that combine equities, fixed income, commodities, and alternatives for better risk-adjusted returns. Thematic investments—covering areas such as artificial intelligence, renewable energy, cybersecurity, and healthcare innovation—are gaining traction as clients seek targeted exposure to high-growth sectors. Asset managers capitalize on this trend by developing specialized funds supported by sophisticated research frameworks and data visualization tools. The flexibility and relevance of thematic and multi-asset offerings create strong opportunities for product innovation and competitive positioning in both retail and institutional segments.

- For instance, MindSphere IoT platform, Siemens connects 30 million automation systems, over 75 million smart meters, and more than 1 million connected devices, enabling real-time analytics for multi-asset infrastructure investments.

3. Expanding Opportunities in Emerging Markets

Emerging economies across Asia-Pacific, Latin America, the Middle East, and Africa present significant growth potential driven by increasing disposable incomes, expanding capital markets, and supportive regulatory reforms. Asset managers are introducing tailored investment products that target local equities, sovereign bonds, and infrastructure assets. Digital investment platforms further accelerate retail participation in these regions. As governments promote financial inclusion and investor education, global firms gain opportunities to strengthen geographic diversification and capture high-growth client segments, making emerging markets a vital frontier for future expansion.

Key Challenges

1. Increasing Regulatory Complexity Across Global Markets

Asset managers face rising compliance burdens due to evolving regulatory frameworks related to transparency, cybersecurity, data privacy, and ESG disclosures. Frequent changes in reporting standards across regions increase operational costs and require significant investment in risk-management systems. Firms must strengthen governance structures and continuously upgrade compliance technology to avoid penalties and maintain investor trust. Navigating these multilayered requirements remains a persistent challenge, particularly for global organizations managing cross-border portfolios under diverse regulatory regimes.

2. Fee Pressure and Intensifying Industry Competition

The proliferation of low-cost passive investment products and digital advisory platforms is driving downward pressure on management fees. Investors increasingly demand high performance at lower costs, forcing traditional asset managers to optimize operations and justify active management strategies. Competition from fintechs, global giants, and emerging low-fee providers further compresses margins. To remain competitive, firms must innovate through personalized solutions, technology integration, and value-added services. Sustaining profitability in this cost-sensitive environment remains one of the industry’s most significant hurdles.

Regional Analysis

North America

North America leads the Global Asset Management Market with around 33% market share. The region benefits from strong financial institutions, high adoption of digital platforms, and a mature investor base. The U.S. drives most of the demand due to large mutual funds, pension funds, and growing use of AI and analytics for portfolio and asset monitoring. The presence of major global asset managers and advanced regulatory frameworks further strengthen market growth. Increased interest in passive investing, ETF expansion, and sustainable investment strategies also contributes to North America’s dominant position.

Europe

Europe holds the second-largest position in the Global Asset Management Market, with an estimated 30% market share. The region’s growth is supported by strong regulatory systems, rising demand for ESG investment products, and increasing adoption of digital tools for asset tracking and risk management. Key markets such as the UK, Germany, France, and Switzerland host several major asset managers. Europe benefits from mature capital markets, expanding pension assets, and growing interest in sustainable and responsible investing. Enhanced investor protection rules and transparent financial practices also support steady market expansion across the region.

Asia Pacific

Asia Pacific accounts for approximately 27% market share, making it one of the fastest-growing regions in the Global Asset Management Market. Growth is driven by rising household wealth, expanding middle-class populations, and rapid digital transformation across countries such as China, India, Japan, and South Korea. Investments in pension funds, mutual funds, and infrastructure-focused portfolios continue to increase. Asset managers in the region actively adopt cloud platforms and AI tools to improve efficiency and client service. Regulatory improvements and growing financial awareness further boost market adoption across both institutional and retail segments.

Latin America

Latin America represents about 6% market share in the Global Asset Management Market. The region’s growth is supported by reforms in pension systems, rising financial inclusion, and improved stability in key markets like Brazil, Mexico, and Chile. Asset managers are increasingly focusing on digital platforms to enhance transparency and attract younger investors. Growing interest in diversified funds and increasing foreign investment also support market expansion. Although the market is smaller compared to other regions, steady economic development and government efforts to strengthen financial regulations offer positive growth potential.

Middle East & Africa

The Middle East & Africa region holds close to 4% market share. Growth is driven by rising sovereign wealth fund activities, infrastructure investments, and expanding wealth management demand in countries such as the UAE, Saudi Arabia, and South Africa. Digital transformation in financial services and increasing adoption of cloud-based asset management platforms support market development. The region is also witnessing growing interest in Sharia-compliant investment products and sustainable investment strategies. While the market remains comparatively smaller, strong government initiatives and financial sector modernization continue to create new opportunities.

Market Segmentations:

By Function:

- Location & movement tracking

- Check in/ check-out

By Asset:

- Digital assets

- Returnable transport assets

By Application:

- Transportation

- Energy infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Asset Management Market features leading players such as Hitachi, Ltd., Rockwell Automation, Inc., Zebra Technologies Corp., IBM Corp., Honeywell International Inc., Oracle Corp., WSP Global Inc., Siemens AG, Adobe Systems Inc., and Brookfield Asset Management Inc. The Global Asset Management Market is defined by rapid technological advancement, strong digital transformation initiatives, and increasing demand for predictive and automated asset solutions. Companies in this space focus on integrating AI, machine learning, IoT, and cloud-based platforms to enhance real-time monitoring, improve asset reliability, and reduce operational downtime. Competition intensifies as firms invest heavily in product innovation, industry-specific software, and advanced analytics to strengthen customer value. Strategic partnerships, mergers, and acquisitions further shape the market, enabling players to expand global reach and diversify solution portfolios. As industries prioritize efficiency, sustainability, and lifecycle optimization, providers continue to differentiate through smart asset management tools, scalable architectures, and comprehensive service offerings.

Key Player Analysis

Recent Developments

- In April 2025, Backbase unveiled an AI-powered banking platform that unifies customer service and digital sales, using an intelligence fabric to automate operations and accelerate revenue generation.

- In April 2024, Rockwell Automation demonstrated its collaboration with Ericsson by showcasing Plex Asset Performance Management (APM) at the Hannover Messe 2024 trade fair. The demonstration highlighted how Ericsson’s industrial private 5G connectivity enables Plex APM for real-time decision-making, particularly with autonomous mobile robots (AMRs).

- In March 2024, Adobe Inc. launched a new set of suites aimed at the enterprise sector, enabling brands to achieve individualized personalization on a large scale by leveraging generative AI and instantaneous insights.

- In February 2024, Vi Business, the enterprise arm of Vodafone Idea, launched IoT Smart Central, an integrated asset management platform designed to enhance the management and connectivity of Internet of Things (IoT) devices for enterprises. This new platform aims to provide businesses with a comprehensive solution for monitoring and controlling their IoT assets in real-time.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Function, Asset, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will adopt more AI-driven tools to improve predictive maintenance and asset performance.

- Cloud-based asset management platforms will expand as organizations seek scalable digital solutions.

- IoT integration will increase, enabling real-time asset tracking and faster decision-making.

- Demand for sustainability-focused asset strategies will rise across industries.

- Companies will invest more in automation to reduce downtime and enhance operational efficiency.

- Cybersecurity capabilities will strengthen as digital asset ecosystems grow.

- Asset managers will increasingly use advanced analytics to optimize lifecycle costs.

- Mobile-based asset management applications will gain wider adoption for remote operations.

- Regulatory compliance solutions will become more important in highly governed sectors.

- Partnerships and acquisitions will accelerate as firms expand portfolios and global presence.