Market Overview

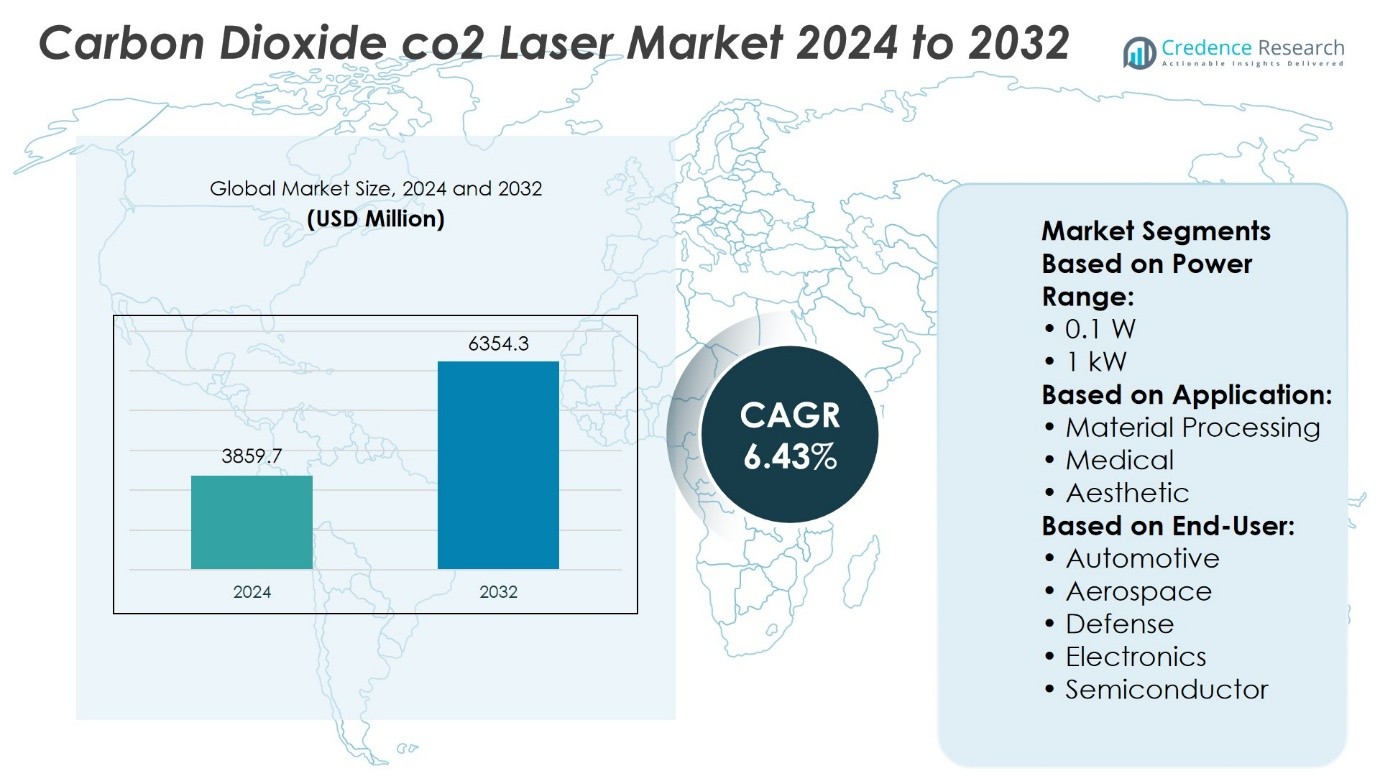

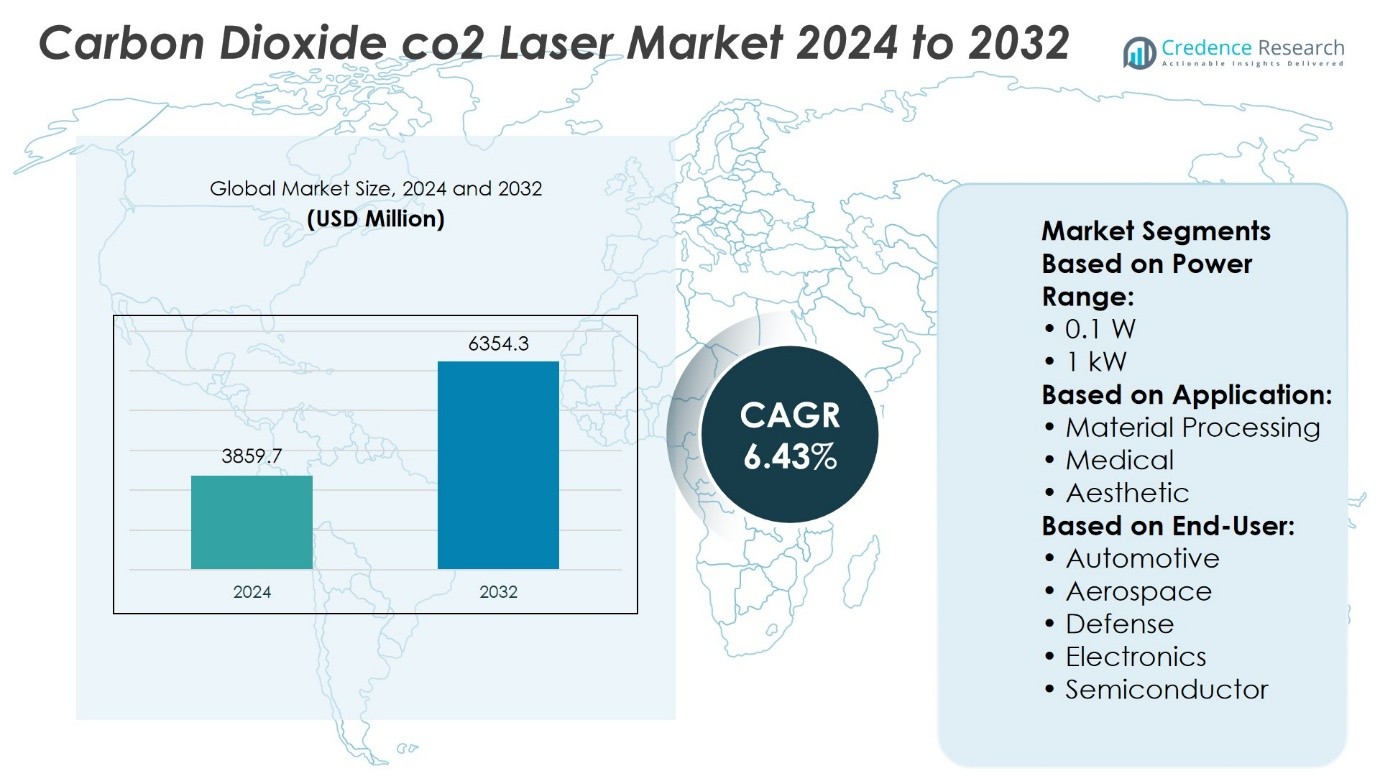

Carbon Dioxide CO2 Laser Market size was valued at USD 3859.7 million in 2024 and is anticipated to reach USD 6354.3 million by 2032, at a CAGR of 6.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carbon Dioxide CO2 Laser Market Size 2024 |

USD 3859.7 Million |

| Carbon Dioxide CO2 Laser Market, CAGR |

6.43% |

| Carbon Dioxide CO2 Laser Market Size 2032 |

USD 6354.3 Million |

The Carbon Dioxide CO₂ Laser Market grows on the strength of rising demand in medical, industrial, and packaging applications, supported by its precision, versatility, and energy efficiency. It benefits from increasing adoption in minimally invasive surgeries, high-speed material processing, and automated production lines. Advancements in beam quality, compact system design, and cooling technologies enhance performance and reduce operational costs. It aligns with sustainability goals through energy-efficient models and reduced material waste. Growing use in emerging applications such as microfabrication, aerospace components, and semiconductor processing, combined with integration of IoT-enabled monitoring, shapes the market’s evolving trends and long-term growth trajectory.

The Carbon Dioxide CO₂ Laser Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America and Europe leading in technological adoption and industrial applications. Asia-Pacific experiences rapid growth driven by manufacturing expansion and healthcare investments. Key players operate globally, offering advanced CO₂ laser solutions tailored to diverse sectors. Competitive positioning focuses on innovation, automation integration, and regional market penetration to address industry-specific requirements and maintain a strong global footprint.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Carbon Dioxide CO₂ Laser Market was valued at USD 3,859.7 million in 2024 and is projected to reach USD 6,354.3 million by 2032, growing at a CAGR of 6.43%.

- Rising demand from medical, industrial, and packaging sectors drives adoption due to precision, versatility, and efficiency.

- Increasing integration with automated production lines and IoT-enabled monitoring shapes technological advancements.

- Competition focuses on innovation, product customization, and automation compatibility to strengthen global positioning.

- High capital and maintenance costs, along with competition from alternative laser technologies, restrain growth in cost-sensitive markets.

- North America and Europe lead in technological adoption, while Asia-Pacific grows rapidly with manufacturing expansion and healthcare investments.

- Global players leverage regional market penetration strategies to address specific industry needs and maintain a competitive edge.

Market Drivers

Growing Demand from Medical and Aesthetic Applications

The Carbon Dioxide CO₂ Laser Market benefits from rising adoption in dermatology, surgery, and aesthetic procedures. It enables precise tissue removal, minimal bleeding, and faster recovery times, making it a preferred choice for healthcare providers. Hospitals and clinics increasingly integrate advanced CO₂ laser systems for skin resurfacing, scar revision, and tumor excision. It supports growing demand for non-invasive and minimally invasive treatments across diverse patient groups. Advances in fractional CO₂ laser technology enhance treatment accuracy and patient comfort. Strong demand from both developed and emerging healthcare markets sustains the segment’s momentum.

- For instance, LightScalpel’s surgical CO₂ laser systems have enabled vaporization of soft‑tissue targets with an ablation depth of 400–500 micrometers, allowing clinicians to remove skin lesions with microscale accuracy.

Advancements in Industrial Material Processing

Industrial applications contribute significantly to the Carbon Dioxide CO₂ Laser Market through its role in cutting, engraving, and welding materials. It offers high efficiency in processing metals, plastics, glass, and ceramics for sectors such as automotive, electronics, and packaging. Manufacturers adopt CO₂ lasers to achieve superior edge quality, high precision, and reduced waste in production lines. It supports automation initiatives by integrating seamlessly with robotic systems and CNC machinery. Innovations in high-power CO₂ laser sources extend their suitability for thicker material processing. Growing use in additive manufacturing and 3D printing expands its industrial relevance.

- For instance, in 2024, manufacturers across 89 countries installed over 132,800 CO₂ laser cutting machines, reflecting strong global uptake in industrial material processing.

Rising Adoption in Food and Beverage Packaging

The Carbon Dioxide CO₂ Laser Market gains traction in food and beverage labeling, marking, and perforation processes. It enables high-speed, contactless operations that maintain packaging integrity while delivering consistent quality. It helps manufacturers comply with traceability and labeling regulations by producing permanent, legible markings. Adoption grows due to its ability to mark on a wide range of substrates including paper, plastics, and films. Integration into high-throughput packaging lines increases productivity and operational efficiency. Demand strengthens with the expansion of packaged food markets globally.

Technological Innovations Enhancing Performance and Efficiency

The Carbon Dioxide CO₂ Laser Market advances through innovations that improve beam quality, energy efficiency, and operational lifespan. It benefits from compact designs, user-friendly interfaces, and enhanced cooling systems that reduce maintenance needs. Manufacturers invest in R&D to develop systems with higher power stability and lower operational costs. It aligns with sustainability goals by reducing energy consumption and material waste. Integration with IoT and AI-driven monitoring enhances predictive maintenance and process optimization. Such developments expand the scope of CO₂ laser applications across industries.

Market Trends

Increasing Integration with Digital and Automated Systems

The Carbon Dioxide CO₂ Laser Market witnesses a trend toward integration with advanced automation and digital control platforms. It aligns with the need for precision and repeatability in industrial processes. Manufacturers develop systems compatible with CNC machines, robotics, and automated production lines. It enables real-time adjustments, reducing downtime and improving throughput. Digital monitoring tools enhance process control and traceability in regulated sectors. This shift supports efficiency gains in industries such as automotive, electronics, and medical device manufacturing.

- For instance, Domino Printing Sciences PLC, known for its CO₂ laser coders and automation controllers, maintains operations across over 120 countries and employs approximately 2.8 million work hours annually dedicated to maintaining and integrating their laser systems into automated production line.

Growing Popularity of Compact and Portable Designs

The Carbon Dioxide CO₂ Laser Market shows a rising preference for compact, portable, and space-efficient equipment. It addresses space constraints in clinics, workshops, and small manufacturing units. Manufacturers design systems with integrated cooling, modular components, and reduced footprint without sacrificing output quality. It supports flexible deployment in diverse environments, from mobile medical units to remote industrial sites. Lightweight designs expand accessibility for small and medium-sized enterprises. This trend aligns with the increasing need for mobility and adaptability in operations.

- For instance, in 2024, Trumpf’s new compact CO₂ laser module manufacturing plant in Ditzingen, Germany, expanded by 68,000 square meters, an area akin to more than nine soccer fields, enabling production of 5.4 million compact modules annually.

Advancements in Energy Efficiency and Sustainability

The Carbon Dioxide CO₂ Laser Market evolves with innovations aimed at reducing energy consumption and operational costs. It incorporates improved beam delivery systems, energy recovery modules, and advanced cooling technologies. Manufacturers focus on developing eco-friendly solutions that meet strict environmental standards. It reduces waste and extends the service life of components through optimized system design. Energy-efficient models attract industries seeking to lower operational footprints. This trend strengthens adoption in markets prioritizing sustainable manufacturing practices.

Expansion into Emerging and Niche Applications

The Carbon Dioxide CO₂ Laser Market expands into specialized areas such as biomedical research, microfabrication, and aerospace component processing. It supports intricate applications requiring high precision and controlled heat input. Manufacturers tailor systems for niche needs, such as engraving microstructures or processing advanced composites. It enables breakthroughs in fields that demand extreme accuracy and minimal material alteration. Growth in such applications opens new revenue streams for equipment providers. This diversification enhances the market’s resilience to demand fluctuations in traditional sectors.

Market Challenges Analysis

High Capital and Maintenance Costs Limiting Adoption

The Carbon Dioxide CO₂ Laser Market faces constraints due to the high initial investment and ongoing maintenance requirements of advanced systems. It demands specialized components, precise alignment, and dedicated cooling infrastructure, which increase operational expenses. Small and medium-sized enterprises often find it challenging to justify the expenditure without clear short-term returns. It also requires skilled technicians for installation, calibration, and servicing, adding to labor costs. Frequent use in demanding industrial environments accelerates wear on optics and consumables. This cost burden slows adoption in cost-sensitive sectors, especially in emerging economies.

Operational Limitations and Intense Competitive Pressure

The Carbon Dioxide CO₂ Laser Market contends with operational challenges such as lower efficiency when processing reflective metals and susceptibility to thermal lensing effects. It may require supplementary equipment or alternative laser types for certain applications, increasing complexity for end users. Rapid advancements in fiber laser technology intensify competition, offering higher efficiency and reduced maintenance in some use cases. It puts pressure on manufacturers to continuously innovate while maintaining price competitiveness. The need to comply with evolving safety and environmental regulations further adds to product development timelines and costs. This combination of technical and market pressures tests the long-term competitiveness of CO₂ laser systems.

Market Opportunities

Expansion into High-Growth Medical and Aesthetic Segments

The Carbon Dioxide CO₂ Laser Market holds strong potential in the medical and aesthetic sectors where demand for precision-based treatments is rising. It offers advantages in dermatology, cosmetic surgery, and dental procedures, where minimal invasiveness and high accuracy are critical. Hospitals and specialty clinics increasingly seek advanced CO₂ laser systems for scar revision, skin resurfacing, and soft tissue surgeries. It supports the shift toward outpatient and same-day procedures, which improves patient turnover and efficiency. Technological advancements in fractional laser modes expand treatment options while reducing recovery time. This segment presents a scalable growth avenue supported by rising healthcare investments and patient awareness.

Adoption in Advanced Industrial and Emerging Applications

The Carbon Dioxide CO₂ Laser Market has opportunities in industrial manufacturing, aerospace, and electronics production where high-precision cutting and engraving are essential. It can address emerging needs in microfabrication, semiconductor processing, and composite material shaping. Integration with automated production lines and IoT-enabled monitoring enhances productivity and predictive maintenance capabilities. It meets the demand for complex geometries and high-quality surface finishes in next-generation products. Expanding applications in additive manufacturing and customized component production create further revenue potential. Strategic innovation in specialized laser sources tailored for niche markets can secure competitive advantages for manufacturers.

Market Segmentation Analysis:

By Power Range

The Carbon Dioxide CO₂ Laser Market is segmented into < 0.1 W, 0.1 – 1 kW, and > 1 kW categories, each serving distinct application requirements. The < 0.1 W segment caters to precision-focused tasks such as medical diagnostics, microfabrication, and research applications. It offers low thermal impact, making it ideal for delicate materials. The 0.1 – 1 kW range dominates in medium-scale industrial operations, supporting cutting, engraving, and welding in manufacturing lines. This range balances power efficiency with versatility, serving multiple industries from electronics to packaging. The > 1 kW segment addresses heavy-duty industrial uses, including thick metal cutting and large-scale fabrication in automotive and aerospace production. Its high-power capacity ensures faster processing speeds and greater penetration in demanding environments.

- For instance, the DIAMOND C/Cx Series CO₂ lasers by Coherent deliver 20 W to 120 W in low-power operation modes, making them suited for high-precision engraving and scoring on delicate substrates like thin plastics or textiles.

By Application

The market is categorized into material processing, medical and aesthetic, defense and military, and others such as telecom. Material processing holds a significant share, driven by demand in cutting, engraving, drilling, and marking across metals, plastics, and composites. Medical and aesthetic applications utilize CO₂ lasers for dermatological treatments, dental surgery, and precise tissue removal. It enables reduced recovery times and minimal invasiveness in surgical procedures. Defense and military use includes target designation, range finding, and precision machining of defense components. The telecom sector applies CO₂ lasers in optical fiber manufacturing and component processing, supporting high-speed communication networks.

- For instance, according to global market data, over 18.7 million CO₂ laser units were in circulation in 2024, reflecting their widespread role in material processing tasks across industries.

By End User

End users include automotive, aerospace and defense, electronics and semiconductor, metal, packaging, and textiles. The automotive sector uses CO₂ lasers for body panel cutting, welding, and intricate component fabrication. In aerospace and defense, it supports machining of lightweight alloys and composite materials for aircraft and weapon systems. Electronics and semiconductor manufacturers rely on it for precise micro-cutting, wafer scribing, and component marking. The metal industry applies high-power CO₂ lasers for structural fabrication and finishing processes. Packaging companies use CO₂ lasers for high-speed perforation, coding, and marking on diverse substrates. The textiles sector integrates laser systems for pattern cutting, fabric engraving, and customized design production with high repeatability.

Segments:

Based on Power Range:

Based on Application:

- Material Processing

- Medical

- Aesthetic

Based on End-User:

- Automotive

- Aerospace

- Defense

- Electronics

- Semiconductor

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds approximately 32% of the Carbon Dioxide CO₂ Laser Market, driven by its strong industrial base, advanced healthcare infrastructure, and high adoption of precision manufacturing technologies. The United States leads the region with widespread use in automotive, aerospace, defense, and medical applications. It benefits from a mature manufacturing ecosystem that actively integrates CO₂ laser systems into automated production lines. The medical sector in North America shows increasing demand for CO₂ laser devices in dermatology, cosmetic procedures, and minimally invasive surgeries. Defense and aerospace manufacturers deploy high-power CO₂ lasers for precision machining of critical components. Canada contributes through industrial automation in automotive parts production and healthcare applications, supported by favorable government investments in technology modernization.

Europe

Europe accounts for around 28% of the market, supported by its strong engineering capabilities, regulatory emphasis on manufacturing efficiency, and robust automotive and aerospace industries. Germany leads with extensive use of CO₂ lasers in metal fabrication, automotive assembly, and advanced material processing. The UK and France show significant adoption in defense and medical sectors, particularly in surgical lasers and high-precision tooling. Italy and Spain contribute through applications in packaging, textiles, and customized design production. The region’s stringent quality and environmental regulations encourage the adoption of energy-efficient laser systems. European manufacturers also focus on research and development, leading to innovations in high-power CO₂ lasers for industrial and medical uses.

Asia-Pacific

Asia-Pacific holds about 26% of the Carbon Dioxide CO₂ Laser Market, with rapid industrialization, expanding manufacturing capacity, and growing healthcare investments driving adoption. China leads the region with extensive use in electronics, semiconductor production, automotive manufacturing, and packaging industries. Japan and South Korea contribute significantly through high-precision electronics fabrication and medical device manufacturing. India shows fast-growing adoption due to infrastructure expansion and increasing healthcare modernization. The region benefits from cost-competitive manufacturing and a rising focus on export-oriented production. Technological advancements from regional manufacturers enhance the competitiveness of Asia-Pacific in both global and domestic markets.

Latin America

Latin America accounts for roughly 8% of the market, driven by growing adoption in packaging, automotive parts production, and healthcare services. Brazil leads the region with strong demand from its manufacturing and medical industries. Mexico benefits from its role as an automotive and electronics manufacturing hub, with CO₂ lasers integrated into assembly and marking processes. Argentina and Chile show gradual uptake in packaging and textiles applications. Regional growth is supported by increasing investments in industrial automation and modernization of production facilities.

Middle East & Africa

The Middle East & Africa hold around 6% of the Carbon Dioxide CO₂ Laser Market, with adoption primarily concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. The UAE and Saudi Arabia invest in advanced manufacturing technologies, including CO₂ lasers, to diversify their economies beyond oil. It finds use in defense manufacturing, architectural applications, and high-end packaging solutions. South Africa leads in the African market through mining equipment manufacturing and medical laser adoption in private healthcare facilities. Gradual industrial development and infrastructure projects create opportunities for broader adoption of CO₂ laser systems across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jiatai Laser Technology (China)

- LancerFab Tech (India)

- Amada (Japan)

- Messer Technogas (Germany)

- Bystronic (Switzerland)

- Scantech Laser (China)

- Mazak Corporation (Japan)

- Prima Industrie (Italy)

- TrumpF (Germany

- Epilog Laser (U.S.)

Competitive Analysis

The Carbon Dioxide CO₂ Laser Market key companies include Jiatai Laser Technology (China), LancerFab Tech (India), Amada (Japan), Messer Technogas (Germany), Bystronic (Switzerland), Scantech Laser (China), Mazak Corporation (Japan), Prima Industrie (Italy), and TrumpF (Germany). The Carbon Dioxide CO₂ Laser Market operates in a competitive environment characterized by rapid technological advancements and a diverse range of product offerings. Manufacturers focus on developing high-performance systems that deliver superior beam quality, energy efficiency, and reliability across industrial, medical, and specialized applications. Competition is driven by innovation in automation compatibility, compact system design, and advanced cooling technologies that reduce maintenance requirements. Companies invest in research and development to enhance operational precision and extend equipment lifespan, meeting the evolving needs of sectors such as automotive, aerospace, electronics, and healthcare. Strategic priorities include expanding global distribution networks, entering emerging markets, and offering tailored solutions to meet specific industry requirements. The competitive landscape continues to evolve as firms integrate IoT-enabled monitoring, AI-driven process control, and sustainable design features to align with modern production and regulatory demands.

Recent Developments

- In February 2025, Jiatai Laser showcased its latest high-speed, high-precision laser cutting machines, including the BV Series Laser Tube Cutting Machine, at the IMATECH 2025 exhibition in Izmir, Turkey.

- In November 2024, Laser Photonics Corporation announced the start of a research and development project aimed at industrial laser solutions for semiconductor marking, wafer scribing, and pharmaceutical tablet drilling.

- In June 2024, Luxinar, a leader in laser technology, is happy to announce the release of its newest CO2 laser source OEM series. A 450W sealed CO2 laser source with a small footprint, the OEM 45iE is perfect for installations with limited space.

- In January 2024, a collaborative effort between TRUMPF, ASML, and ZEISS resulted in the development of a high-power CO₂ laser system, reaching over 120 kW peak power. This laser system is capable of processing more than 100 substrates per hour, marking a significant advancement in both industrial and scientific applications

Market Concentration & Characteristics

The Carbon Dioxide CO₂ Laser Market displays a moderately concentrated structure, with a mix of global leaders and regionally dominant manufacturers competing across multiple application segments. It features established players with extensive technological expertise, robust distribution networks, and strong brand recognition, alongside emerging companies that focus on cost-effective and specialized solutions. The market is characterized by high entry barriers due to capital-intensive manufacturing, precision engineering requirements, and the need for skilled technical expertise. It serves diverse industries, including automotive, aerospace, electronics, medical, and packaging, each with specific performance and regulatory demands. Technological differentiation, such as improved beam quality, energy efficiency, and system integration capabilities, plays a critical role in securing competitive advantage. It experiences steady innovation driven by industrial automation trends, increasing adoption in medical procedures, and expanding use in niche applications such as microfabrication and telecommunications. The market’s competitive dynamics are shaped by product customization, after-sales service capabilities, and the ability to meet strict quality and environmental standards in global markets.

Report Coverage

The research report offers an in-depth analysis based on Power Range, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption in minimally invasive medical and aesthetic procedures.

- Manufacturers will focus on improving energy efficiency and extending system lifespan.

- Demand will grow for compact and portable CO₂ laser systems across industries.

- Integration with automation and digital monitoring platforms will expand.

- Use in high-precision industrial cutting and engraving will continue to rise.

- Emerging economies will offer strong growth opportunities through industrial modernization.

- Development of eco-friendly laser solutions will align with stricter environmental regulations.

- Adoption in aerospace and advanced material processing will strengthen.

- Customization for niche applications such as microfabrication will increase.

- Strategic collaborations and technology partnerships will shape competitive positioning.