Market Overview

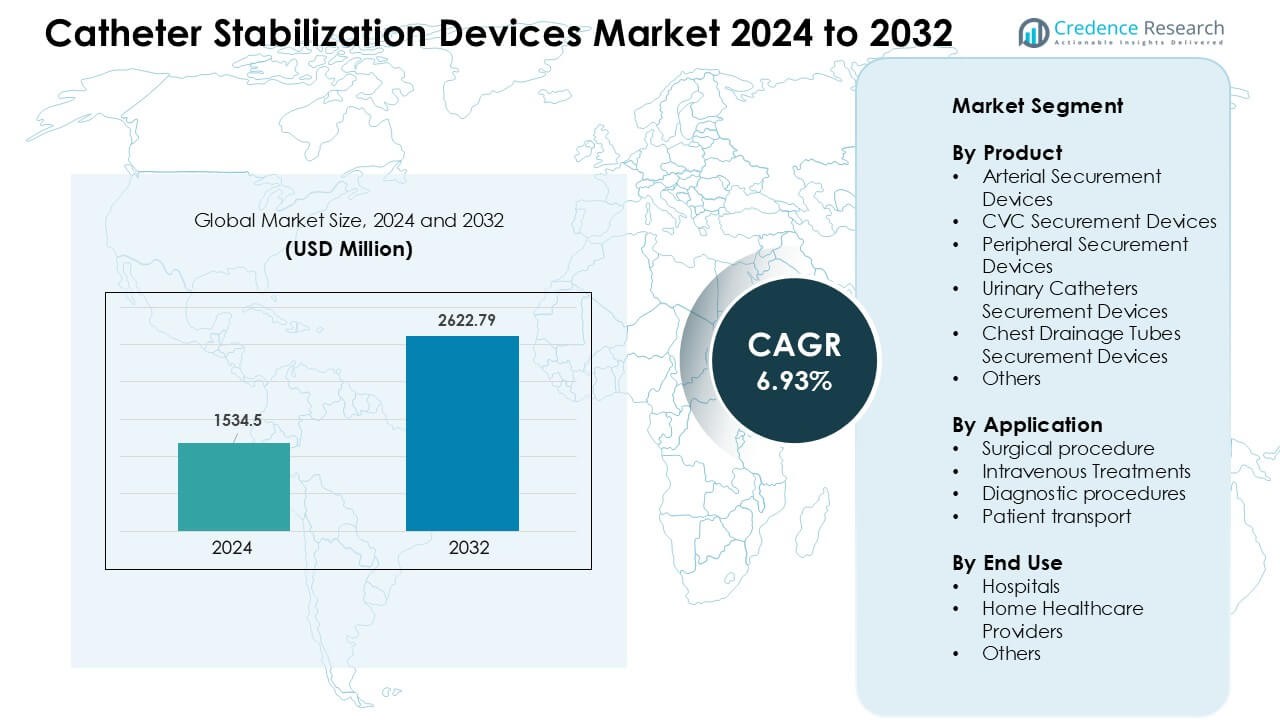

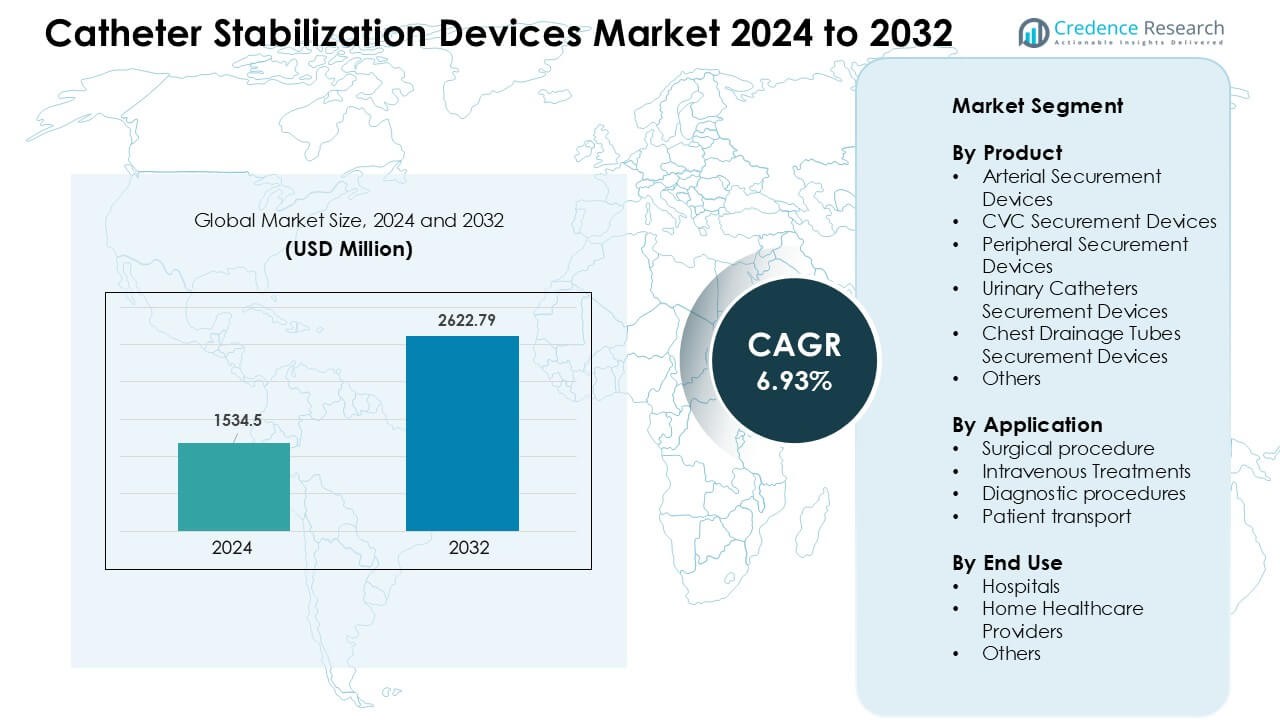

Catheter Stabilization Devices Market was valued at USD 1534.5 million in 2024 and is anticipated to reach USD 2622.79 million by 2032, growing at a CAGR of 6.93 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Catheter Stabilization Devices Market Size 2024 |

USD 1534.5 Million |

| Catheter Stabilization Devices Market, CAGR |

6.93 % |

| Catheter Stabilization Devices Market Size 2032 |

USD 2622.79 Million |

The Catheter Stabilization Devices Market is driven by key players such as Convatec Inc., TIDI Products LLC, Baxter, VYGON, B. Braun Medical Inc., DeRoyal Industries Inc., Zibo Qichuang Medical Products Co., Ltd., Merit Medical Systems, Dale Medical Products Inc., and 3M. These companies compete through advanced adhesive technologies, skin-friendly securement materials, and wider clinical adoption across hospitals and home-care settings. Product innovation focuses on reducing line dislodgement and supporting infection-prevention goals. North America led the market in 2024 with a 38% share, supported by strong healthcare infrastructure, high infusion therapy volumes, and early use of engineered securement devices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Catheter Stabilization Devices Market was valued at USD 5 million in 2024 and is projected to reach USD 2622.79 million by 2032, growing at a CAGR of 6.93%.

- Demand rises due to higher infusion therapy volumes, increased chronic disease treatment, and stronger infection-prevention standards; peripheral securement devices held about 41% share in 2024.

- Growing use of skin-friendly adhesives, extended-dwell catheter support, and rising home-care infusion adoption shape major trends in developed and emerging healthcare systems.

- Key players such as Convatec, Baxter, 3M, B. Braun, Merit Medical Systems, and VYGON expand through product innovation, stronger clinician training, and broader supply-chain networks; competition remains moderate with steady product upgrades.

- North America led the market with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 23%; hospitals accounted for 58% of total end-use share, supported by strict clinical protocols and high patient turnover.

Market Segmentation Analysis:

By Product

Peripheral securement devices held the dominant share in 2024 with about 41% of the Catheter Stabilization Devices Market. Hospitals used these devices widely because peripheral IV lines are the most common access points in acute and chronic care. Strong demand came from rising infusion procedures, higher device replacement rates, and growing infection-control focus. Arterial and CVC securement devices also saw steady use due to increased critical-care admissions. Urinary catheter and chest drainage tube securement devices gained traction as clinicians prioritized reduced skin trauma and improved patient mobility.

- For instance, many securement‑device vendors report that peripheral IV stabilizers remain the “workhorse” product: because peripheral IV insertions outnumber central‑line placements by a large margin in general wards. One market‑report indicates peripheral securement devices alone captured roughly 37.82% of global securement‑device revenue in 2024, reflecting how common short‑term IV therapy is across hospital departments.

By Application

Intravenous treatments accounted for the leading share in 2024 with nearly 46% of the Catheter Stabilization Devices Market. Growth came from higher infusion therapy volumes in emergency, oncology, and chronic disease care. Demand increased as care teams aimed to reduce dislodgement, secure access lines for longer durations, and prevent phlebitis. Surgical procedures also supported adoption due to rising perioperative catheter placement. Diagnostic procedures and patient transport added incremental demand where stable line fixation helped maintain safety and lower repeat insertions.

- For instance, rising use of outpatient infusion treatments, emergency‑department IV insertions, and short-term therapy sessions has maintained steady demand for securement devices; many hospitals and clinics now routinely use securement stabilizers rather than simple tape or bandages, especially for intravenous access.

By End Use

Hospitals dominated the market in 2024 with around 58% share, driven by high patient turnover, complex procedures, and strict infection-prevention standards. These facilities relied on securement devices to reduce line failure, cut accidental removal cases, and improve workflow in critical and general wards. Home healthcare providers expanded usage as more patients received long-term IV therapy at home, raising the need for safer catheter management. Other end users, including ambulatory centers, contributed through increasing outpatient infusion and minor surgery volumes.

Key Growth Drivers:

Rising Infusion Therapy Volumes

Growing infusion therapy needs drive strong demand for catheter stabilization devices across hospitals and outpatient centers. Chronic illnesses such as cancer, kidney disease, and autoimmune disorders require frequent IV access, which increases the need for secure catheter placement. Healthcare teams aim to reduce dislodgement and line failure because these issues lead to extra procedures and higher infection risks. Rising emergency admissions also push the use of securement devices as rapid drug delivery becomes common. As infusion care expands into home settings, caregivers prefer stabilization tools that support safer long-term use. The overall rise in IV therapy frequency continues to push hospitals and home-care providers to adopt more reliable securement solutions.

- For instance, the global demand for infusion therapy devices is rising as chronic diseases increase: one market review notes that the rise in chronic conditions such as cancer, cardiovascular diseases, and autoimmune disorders significantly drives infusion‑therapy demand worldwide.

Growing Focus on Infection Prevention

Infection-control programs encourage wider adoption of catheter stabilization devices to reduce complications linked to catheter movement. Better securement helps limit catheter-related bloodstream infections, which remain a major concern in intensive care and general wards. Healthcare regulators promote standards that reward lower infection rates, pushing providers to improve line management. Stabilization devices support this goal by lowering skin trauma and reducing dressing changes. Many clinicians prefer engineered securement over adhesive tape because it offers stronger hold and more consistent performance. As global infection-prevention rules strengthen, securement devices continue to gain priority across high-risk departments such as oncology, surgery, and emergency care.

- For instance, in a meta-analysis of 35 randomized controlled trials covering 8,494 patients, investigators concluded that sutureless securement devices (and antimicrobial/impregnated dressings) were among the strategies associated with the lowest rates of catheter failure and catheter‑related bloodstream infections per 1,000 catheter‑days.

Shift Toward Home and Outpatient Care

More patients now receive IV therapy outside hospitals, which increases the need for safer and more user-friendly catheter stabilization devices. Home-care nurses rely on securement systems that reduce unplanned removals and support longer catheter dwell times. Outpatient infusion centers also see growth due to rising demand for chronic disease treatment and cost-effective care. Stabilization devices help these facilities keep procedures smooth and reduce repeat insertions. Patients and families prefer secure systems that prevent accidental pulls during daily activity. This shift strengthens overall market expansion as countries encourage decentralized care and home-based treatment to ease hospital burden.

Key Trends & Opportunities:

Adoption of Advanced and Skin-Friendly Designs

Manufacturers focus on gentler materials and improved adhesive technologies that help reduce skin irritation among sensitive patients. These designs support better comfort and allow longer securement without frequent replacement. Many firms develop molded stabilization platforms and breathable adhesives that match modern infection-control needs. Hospitals value devices that combine strong hold with reduced trauma, which helps lower complication rates. This trend supports steady expansion as care teams seek products that improve patient safety and comfort.

- For instance, 3M offers its Tube Securement Device, which uses an adhesive that secures catheters and tubes to skin for up to 4 days while explicitly designed with no hard plastic components to lower risk of pressure injury and make removal gentle and less damaging to skin.

Expansion of Multiday and Extended-Dwell Catheters

Extended-dwell catheters gain traction in acute and chronic care, which increases the need for high-performance securement systems. These catheters stay in place longer, so securement devices must offer stronger stability and moisture-resistant designs. Growth in oncology, chronic infusion therapy, and emergency care supports wider adoption. As extended-use catheters expand across facilities, demand rises for securement devices that maintain consistent grip under daily movement and clinical handling.

- For instance, data comparing standard peripheral IVs and Extended Dwell Catheter (EDC) systems in emergency‑department settings found that EDCs had a median dwell time of 5.9 days versus 3.8 days for standard IVs showing that EDCs provide substantially longer reliable catheter life.

Key Challenges:

Risk of Skin Damage and Patient Discomfort

Some securement devices may cause skin irritation or adhesive trauma, especially among elderly or long-term patients. This limits adoption in sensitive populations and pushes clinicians to rely on bandaging or tape alternatives. Skin reactions increase dressing changes and raise overall care costs. These issues slow acceptance in home-care settings where caregivers prefer low-risk products. Manufacturers work to improve adhesives, but variation in patient skin types remains a consistent challenge.

Budget Constraints in Lower-Income Facilities

Hospitals in low-resource regions often choose cheaper tape-based methods instead of engineered securement devices. Limited reimbursement and tight operating budgets reduce their capacity to adopt advanced systems. This slows market penetration across public hospitals and rural centers. Purchasing managers prioritize essential supplies, which delays investment in specialized securement tools. These barriers restrict growth in emerging markets, even as global demand increases in high-income regions.

Regional Analysis

North America

North America held the largest share in 2024 with about 38% of the Catheter Stabilization Devices Market. The region benefited from high adoption of advanced IV therapy, strong infection-control programs, and widespread use of engineered securement solutions in hospitals. Demand increased further due to rising chronic disease cases and higher infusion therapy volumes. Large hospital networks, strong reimbursement support, and frequent regulatory updates also pushed providers to use standardized securement systems. Home-based infusion services expanded across the U.S. and Canada, strengthening long-term demand for skin-friendly and stable products.

Europe

Europe accounted for nearly 29% of the market in 2024, supported by strict clinical safety standards and strong preference for engineered catheter securement. Healthcare facilities in Germany, the U.K., France, and the Nordics emphasized reduced catheter-related infection rates, which encouraged adoption of structured stabilization protocols. Growing surgical volumes and an aging population increased catheter use across acute and long-term care settings. The region also saw rising demand for advanced adhesives and low-trauma devices. Expansion of outpatient infusion clinics improved product uptake across both Western and Eastern Europe.

Asia Pacific

Asia Pacific held about 23% share in 2024 and remained the fastest-growing region due to large patient volumes, rapid hospital expansion, and rising awareness of infection prevention. China, India, Japan, and South Korea increased investments in acute care and oncology treatment, driving higher catheter placement rates. Hospitals shifted from tape-based methods to engineered securement devices as training and infection-control guidelines improved. Rising chronic disease burden and growth of home-care services supported broader adoption. International brands and regional manufacturers expanded product availability across developing markets.

Latin America

Latin America captured nearly 6% of the market in 2024, driven by rising infusion therapy needs and improving hospital standards in Brazil, Mexico, Argentina, and Chile. Healthcare facilities expanded use of securement devices to reduce accidental line removal and lower treatment delays. Increased adoption came from oncology centers and emergency departments handling growing patient loads. However, limited budgets in public hospitals slowed widespread deployment. Gradual expansion of private healthcare networks and training programs continued to support steady market penetration.

Middle East & Africa

The Middle East & Africa region held around 4% share in 2024, supported by improving healthcare infrastructure in the UAE, Saudi Arabia, South Africa, and Egypt. Premium hospitals adopted advanced securement products to meet global infection-prevention benchmarks. Growth came mainly from critical-care units and surgical departments where line stability is essential. Budget constraints limited adoption in several African countries, but gradual investment in tertiary care facilities improved access. International suppliers expanded distribution partnerships, helping raise awareness of safe catheter management practices.

Market Segmentations:

By Product

- Arterial Securement Devices

- CVC Securement Devices

- Peripheral Securement Devices

- Urinary Catheters Securement Devices

- Chest Drainage Tubes Securement Devices

- Others

By Application

- Surgical procedure

- Intravenous Treatments

- Diagnostic procedures

- Patient transport

By End Use

- Hospitals

- Home Healthcare Providers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Catheter Stabilization Devices Market features strong competition led by companies such as Convatec Inc., TIDI Products LLC, Baxter, VYGON, B. Braun Medical Inc., DeRoyal Industries Inc., Zibo Qichuang Medical Products Co. Ltd., Merit Medical Systems, Dale Medical Products Inc., and 3M. These firms compete by expanding securement portfolios, improving adhesive technology, and introducing skin-friendly materials that reduce irritation and support longer wear times. Many manufacturers focus on infection-prevention performance, offering devices that lower catheter movement and reduce complication rates. Partnerships with hospitals and outpatient infusion centers help strengthen distribution reach. Several players invest in ergonomic designs that improve clinician workflow and patient comfort, while also targeting growth across home-care settings. Asia Pacific and North America remain key competitive regions where global brands and local suppliers expand training programs and product availability. Increasing focus on cost-effective securement solutions further shapes strategic positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Convatec Inc.

- TIDI Products, LLC.

- Baxter

- VYGON

- Braun Medical Inc.

- DeRoyal Industries, Inc.

- Zibo Qichuang Medical Products Co., Ltd.

- Merit Medical Systems

- Dale Medical Products, Inc.

- 3M

Recent Developments

- In November 2025 Convatec, Inc. trading update highlights new catheter product activity (for example the company announced the GentleCath Air™ for Women as a new compact catheter), signaling continued investment in the urinary-catheter space and related accessories (which supports demand for securement/stabilization solutions across their infusion/continence product lines).

- In January 2025, B. Braun Medical Inc. Launched the Clik-FIX® Epidural/PNB Catheter Securement Device (designed to be soft, low-profile and to reduce catheter displacement/dislodgement for regional anesthesia).

- In December 2024, DeRoyal Industries, Inc. Formed a strategic partnership with S2S Global to expand market reach and sales footprint (announced Dec 18, 2024), a move that supports broader distribution of DeRoyal patient-care and securement products (they continue to list catheter straps/securement items in their product portfolio).

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as infusion therapy volumes grow across acute and chronic care.

- Engineered securement devices will replace tape-based methods in most hospitals.

- Skin-friendly and low-trauma adhesives will gain wider adoption among sensitive patients.

- Home-care infusion growth will boost demand for easy-to-use securement solutions.

- Infection-prevention standards will drive hospitals to upgrade securement protocols.

- Extended-dwell catheters will increase the need for stronger and longer-lasting devices.

- Digital training tools will help clinicians improve securement practices and reduce errors.

- Regional manufacturers will expand in Asia Pacific, improving product affordability.

- Hybrid securement designs will emerge to support high-movement clinical environments.

- Sustainability requirements will push suppliers to adopt safer materials and reduced-waste packaging.