Market Overview

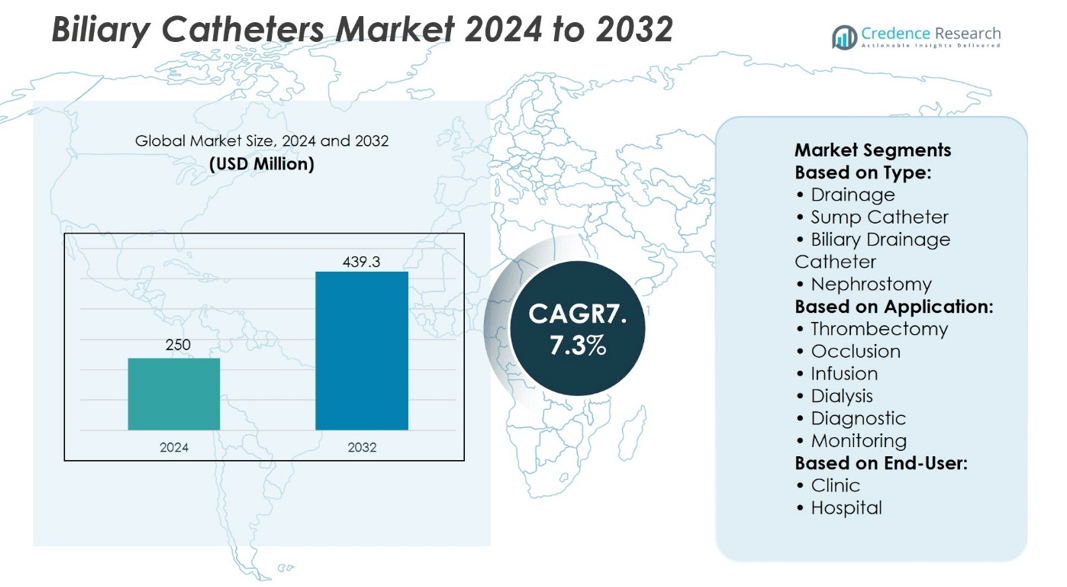

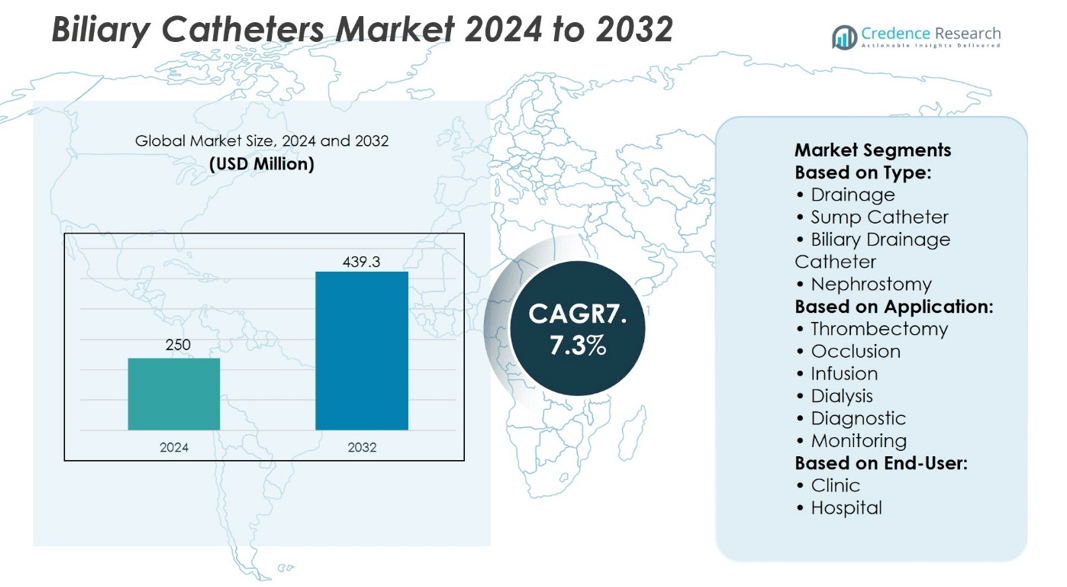

Biliary Catheters Market size was valued at USD 250 million in 2024 and is anticipated to reach USD 439.3 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biliary Catheters Market Size 2024 |

USD 250 million |

| Biliary Catheters Market, CAGR |

7.3% |

| Biliary Catheters Market Size 2032 |

USD 439.3 million |

The Biliary Catheters Market grows on strong demand driven by rising cases of hepatobiliary disorders, gallstones, and cancer-related obstructions that require effective drainage and intervention. It benefits from increasing adoption of minimally invasive procedures such as ERCP and PTC, which reduce recovery time and improve patient outcomes. Advancements in catheter design, including hydrophilic coatings, kink-resistant shafts, and radiopaque tips, strengthen safety and procedural accuracy. Growing healthcare investments in emerging economies and rising emphasis on palliative care further expand adoption. The market reflects a clear trend toward innovation, precision, and accessibility across diverse healthcare settings.

The Biliary Catheters Market demonstrates strong geographical presence, with North America leading in share, followed by Europe and Asia-Pacific as fast-growing regions due to expanding healthcare infrastructure and rising patient volumes. Latin America and the Middle East & Africa show gradual adoption supported by medical tourism and government investments. Key players such as Medtronic, Cook Medical, Abbott Laboratories, Angiodynamics, Conmed, C.R. Bard, Endo-Flex, Medi-Globe, Navilyst Medical, and Rontis Medical compete through innovation, regulatory compliance, and strategic global expansion.

Market Insights

- The Biliary Catheters Market was valued at USD 250 million in 2024 and is expected to reach USD 439.3 million by 2032, growing at a CAGR of 7.3%.

- Rising cases of hepatobiliary disorders, gallstones, and cancer-related obstructions drive steady demand for biliary catheters.

- Growing adoption of minimally invasive procedures such as ERCP and PTC supports faster recovery and improves clinical outcomes.

- Competitive landscape features global and regional players focusing on product innovation, regulatory compliance, and distribution expansion.

- High device costs, complex procedures, and risk of complications act as restraints limiting widespread adoption.

- North America leads in market share, followed by Europe and Asia-Pacific as fast-growing regions, while Latin America and the Middle East & Africa expand gradually.

- Continuous innovation in catheter design, emphasis on palliative care, and investment in emerging economies define the long-term growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Biliary Disorders Driving Product Utilization

The Biliary Catheters Market benefits from the growing prevalence of conditions such as gallstones, bile duct obstruction, and malignant strictures. It supports clinicians in managing complications where drainage and decompression are required to restore biliary flow. The rise in gastrointestinal cancers contributes significantly to demand as palliative interventions increasingly rely on catheter-based solutions. Patients with chronic liver disease also require effective biliary access, fueling steady adoption. Healthcare providers adopt these devices to minimize complications and improve patient recovery outcomes. Rising disease burden strengthens the role of catheters as a vital component of modern hepatobiliary care.

- For instance, Boston Scientific reported that its biliary stent and catheter systems were used in over 175,000 endoscopic retrograde cholangiopancreatography (ERCP) procedures globally in 2023, demonstrating their extensive clinical adoption for biliary obstruction management.

Expanding Minimally Invasive Procedures Creating Strong Demand

The shift toward minimally invasive techniques has accelerated the use of biliary catheters for diagnostic and therapeutic interventions. It aligns with a global healthcare trend focused on reducing hospital stays, minimizing surgical trauma, and lowering procedure-related risks. Endoscopic retrograde cholangiopancreatography (ERCP) and percutaneous transhepatic cholangiography (PTC) widely employ catheters, making them indispensable in advanced gastroenterology practices. Patients benefit from quicker recovery times and improved treatment tolerability, enhancing preference for catheter-based approaches. Growing procedural volumes in both developed and emerging markets stimulate consistent product demand. Hospitals and specialty clinics integrate these devices as part of routine interventional care pathways.

- For instance, Medtronic reported that its endoscopic and biliary catheter portfolio supported more than 2.1 million minimally invasive gastrointestinal procedures globally in 2023, reflecting the scale of adoption across diagnostic and therapeutic care pathways.

Technological Advancements Supporting Precision and Safety

Continuous improvements in design and material composition drive broader adoption of biliary catheters. It incorporates features such as hydrophilic coatings, kink-resistant structures, and radiopaque markers that aid precision placement and clinical safety. Manufacturers introduce innovative multi-lumen and balloon-tipped devices that enhance drainage efficiency and patient comfort. Advanced imaging compatibility also improves procedural success rates and reduces complications. Physicians value these developments as they address clinical challenges in complex biliary obstructions. Strong emphasis on patient safety and performance accelerates replacement cycles and encourages hospitals to adopt the latest models.

Expanding Healthcare Infrastructure in Emerging Markets Boosting Accessibility

The Biliary Catheters Market gains momentum from rising healthcare investment across Asia-Pacific, Latin America, and the Middle East. It benefits from the establishment of advanced hospitals and endoscopy centers capable of offering biliary interventions. Expanding insurance coverage and government initiatives for improved gastrointestinal care drive accessibility to specialized procedures. Training programs for gastroenterologists and interventional radiologists strengthen adoption in emerging economies. Medical tourism also contributes as patients seek cost-effective treatment for hepatobiliary conditions in these regions. Growth in infrastructure and clinical expertise widens the availability of catheter-based solutions beyond high-income countries.

Market Trends

Growing Preference for Minimally Invasive Biliary Interventions

The Biliary Catheters Market reflects a strong trend toward minimally invasive procedures for managing biliary obstruction and related conditions. It aligns with the healthcare industry’s focus on reducing patient trauma, lowering complication risks, and shortening recovery times. Hospitals and clinics increasingly integrate catheter-based approaches in endoscopic and percutaneous techniques. Rising acceptance of ERCP and PTC procedures underscores the critical role of catheters in advanced gastrointestinal care. Patients show greater willingness to opt for less invasive treatments that ensure quicker discharge and better quality of life. This preference reinforces steady adoption across diverse healthcare systems.

- For instance, Boston Scientific reported that its biliary stent and catheter solutions were utilized in over 1.8 million minimally invasive endoscopic procedures worldwide in 2023, supported by advancements in guidewire-assisted delivery systems that enhance procedural precision.

Integration of Advanced Materials and Design Innovations

Manufacturers emphasize catheter designs that enhance durability, safety, and precision in complex procedures. It incorporates features such as hydrophilic coatings, reinforced shafts, and radiopaque tips to support accurate navigation and placement. The adoption of multi-lumen structures and balloon-tipped models allows efficient drainage and improved patient comfort. Growing investment in biocompatible materials reduces infection risks and improves long-term clinical outcomes. Healthcare providers adopt these advanced devices to address rising procedural complexity in hepatobiliary care. Ongoing innovations ensure product differentiation and sustained competitive advantage.

Rising Demand in Oncology and Palliative Care Applications

Cancer-related biliary obstructions drive a significant trend in the widespread use of catheters for symptom relief. It plays a vital role in palliative care, offering effective drainage solutions for patients with malignant strictures. The increasing incidence of gastrointestinal and hepatobiliary cancers supports rising procedural volumes globally. Hospitals and specialty centers rely on catheters to manage complications and maintain quality of life in advanced cancer cases. Demand for long-term management devices grows alongside the expansion of oncology-focused healthcare services. This trend highlights the critical role of catheters in multidisciplinary cancer care strategies.

- For instance, Abbott reported that its biliary drainage catheters and stent systems were used in more than 1.6 million oncology and palliative care procedures globally in 2023, reflecting their critical role in managing malignant obstructions and improving patient comfort.

Expanding Adoption in Emerging Economies with Growing Healthcare Infrastructure

The Biliary Catheters Market witnesses accelerated growth in emerging regions driven by healthcare infrastructure development. It benefits from government-led investments in advanced medical facilities, specialized training programs, and wider insurance coverage. Expanding access to diagnostic and interventional gastroenterology enhances procedural adoption. Medical tourism in Asia-Pacific and Latin America further strengthens demand for biliary interventions. Local distributors and global manufacturers focus on expanding product availability to underserved areas. Rising healthcare expenditure ensures long-term opportunities for market penetration in fast-growing economies.

Market Challenges Analysis

Procedural Complications and Device-Related Limitations Hindering Broader Adoption

The Biliary Catheters Market faces challenges from complications associated with catheter placement and maintenance. It often encounters issues such as infection risk, bile leakage, stent migration, and blockage, which reduce patient safety and procedural efficiency. Physicians require high levels of skill to ensure accurate placement, creating dependency on experienced specialists. Device kinking or failure during complex procedures also undermines trust in product reliability. Hospitals often weigh these risks when deciding on large-scale adoption of advanced biliary catheters. Such concerns limit seamless integration of catheter-based solutions into routine clinical pathways.

High Costs, Limited Access, and Regulatory Barriers Restricting Market Expansion

The market struggles with high device costs and limited reimbursement structures that restrict adoption in cost-sensitive healthcare systems. It remains inaccessible to patients in low-income regions where advanced gastrointestinal care is still developing. Import dependency in emerging economies increases product prices and delays timely availability. Stringent regulatory approvals further slow the introduction of innovative catheter designs. Smaller hospitals often lack the infrastructure required to perform specialized procedures, reducing demand for advanced devices. These barriers collectively restrain the wider reach of biliary catheters despite growing clinical need.

Market Opportunities

Expanding Role of Advanced Imaging and Interventional Techniques Creating Growth Potential

The Biliary Catheters Market gains opportunities from the integration of advanced imaging technologies that support accurate placement and improved procedural outcomes. It benefits from the adoption of fluoroscopy, endoscopic ultrasound, and digital navigation systems that enhance precision in complex interventions. Growing investment in training programs for gastroenterologists and interventional radiologists further expands the skilled workforce capable of performing catheter-based procedures. Hospitals increasingly prioritize technologies that reduce complication rates and improve patient comfort, driving greater acceptance of new catheter designs. Manufacturers that align with this shift through product innovation can secure strong competitive positions. The combination of advanced imaging and specialized training sets the stage for sustainable market expansion.

Rising Healthcare Investment in Emerging Regions Driving Wider Adoption

The market holds significant opportunities in Asia-Pacific, Latin America, and the Middle East, where healthcare systems are undergoing rapid modernization. It benefits from government initiatives to expand specialty care infrastructure and broaden access to advanced gastrointestinal treatments. Rising insurance coverage and medical tourism trends in these regions stimulate demand for biliary interventions. Global players increasingly form partnerships with local distributors to strengthen supply chains and reach underserved populations. Affordable product ranges tailored for cost-sensitive markets create new pathways for growth. Expanding healthcare capacity ensures long-term opportunities for companies investing in these high-potential economies.

Market Segmentation Analysis:

By Type

The Biliary Catheters Market divides by type into drainage, sump catheter, biliary drainage catheter, and nephrostomy. Drainage catheters dominate due to their extensive use in managing bile duct obstruction and gallstone complications. It provides effective solutions for both temporary and long-term drainage requirements. Sump catheters hold a steady role in procedures requiring continuous suction and decompression. Biliary drainage catheters are preferred in malignant and benign strictures where targeted intervention is essential. Nephrostomy catheters support cases involving combined biliary and urinary complications, expanding their clinical relevance across multiple disciplines.

By Application

By application, the market segments into thrombectomy, occlusion, infusion, dialysis, diagnostic, and monitoring. Thrombectomy and occlusion procedures drive strong demand due to the rising incidence of blockages requiring catheter-based intervention. It plays a vital role in infusion therapies where controlled administration of fluids and contrast media is critical. Dialysis-related applications expand with increasing cases of chronic liver and kidney dysfunctions. Diagnostic uses grow with advancements in imaging and precision-based interventions, enabling physicians to map and access complex biliary structures. Monitoring applications gain traction as healthcare providers prioritize real-time assessment of patient outcomes and procedure success. Each application strengthens the positioning of biliary catheters as indispensable in interventional gastroenterology.

- For instance, Boston Scientific reported that its thrombectomy and occlusion catheter systems were used in over 1.9 million procedures globally in 2023, benefiting from advanced hydrophilic coatings and reinforced shafts that improve navigation through complex vasculature.

By End User

End-user segmentation highlights clinics and hospitals as primary adopters. Hospitals dominate the segment owing to their advanced infrastructure, specialized staff, and higher procedural volumes. It supports complex interventions such as ERCP and PTC, requiring multidisciplinary teams and advanced imaging technologies. Clinics contribute to market growth by addressing routine diagnostic and therapeutic procedures in outpatient settings. Their role expands in regions where healthcare decentralization promotes accessibility of biliary interventions. Both hospitals and clinics remain vital end users, ensuring consistent demand across diverse healthcare ecosystems.

Segments:

Based on Type:

- Drainage

- Sump Catheter

- Biliary Drainage Catheter

- Nephrostomy

Based on Application:

- Thrombectomy

- Occlusion

- Infusion

- Dialysis

- Diagnostic

- Monitoring

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Biliary Catheters Market, accounting for 38% of the global revenue. The region benefits from highly developed healthcare infrastructure, widespread availability of advanced endoscopic and interventional radiology services, and a strong presence of leading medical device manufacturers. It also benefits from favorable reimbursement policies that encourage the adoption of advanced biliary catheters for both diagnostic and therapeutic applications. The rising incidence of gallstones, liver disease, and gastrointestinal cancers contributes to steady demand across the United States and Canada. Hospitals in this region are well-equipped with skilled professionals and advanced imaging technologies, which support the success of catheter-based procedures. The market continues to grow as research centers and medical institutions push for innovative catheter designs and improved patient outcomes.

Europe

Europe accounts for 27% of the global biliary catheters market share, supported by strong healthcare systems, a growing geriatric population, and high demand for minimally invasive interventions. Countries such as Germany, France, and the United Kingdom lead in procedural volumes due to advanced hospital networks and widespread acceptance of catheter-based procedures. The region also benefits from strong regulatory frameworks that ensure the availability of safe and effective devices. Rising incidence of hepatobiliary disorders and gallbladder complications further fuels demand for drainage and diagnostic applications. The presence of leading European manufacturers and medical technology companies enhances product availability and market penetration. Training initiatives by healthcare organizations and medical societies strengthen physician expertise in using advanced biliary catheters, ensuring sustainable growth in the region.

Asia-Pacific

Asia-Pacific contributes 22% of the global market share, emerging as one of the fastest-growing regions. Expanding healthcare infrastructure, rising awareness of hepatobiliary conditions, and increasing cases of bile duct obstruction and liver cancer drive strong demand. Countries such as China, India, and Japan are at the forefront, supported by growing investments in hospital facilities and specialized care centers. The region also benefits from a large patient population, which amplifies procedural volumes and strengthens market opportunities. Governments in Asia-Pacific invest heavily in healthcare modernization, expanding access to advanced interventions and boosting demand for biliary catheters. Medical tourism in countries like India, Thailand, and Singapore further supports regional adoption by attracting international patients seeking cost-effective and high-quality care. Global manufacturers expand their presence through partnerships and local production facilities, ensuring product accessibility across diverse markets.

Latin America

Latin America represents 7% of the global market share, with Brazil and Mexico leading adoption. The region experiences gradual expansion driven by rising healthcare expenditure, government initiatives, and growing private sector investment in hospital networks. Biliary catheters gain importance in managing cancer-related biliary obstructions and gallstone-related complications, which are prevalent in the region. While access remains uneven across rural areas, urban hospitals increasingly adopt advanced catheter solutions supported by training and improved imaging systems. Medical tourism in countries like Brazil and Mexico supports the demand for minimally invasive biliary procedures. International collaborations with global manufacturers improve the availability of advanced devices in the region. Market growth is steady, though challenges in reimbursement and healthcare inequality remain.

Middle East and Africa

The Middle East and Africa together hold 6% of the global biliary catheters market share, driven by growing healthcare infrastructure in Gulf nations and gradual adoption in African countries. The Gulf Cooperation Council (GCC) countries, including Saudi Arabia and the United Arab Emirates, invest heavily in modern hospitals equipped with advanced endoscopy and interventional radiology departments. It strengthens demand for biliary catheters in both diagnostic and therapeutic procedures. Africa, on the other hand, remains at an early stage of adoption due to limited healthcare access and infrastructure constraints. International aid programs, public-private partnerships, and gradual government investments in specialty care help improve accessibility. Rising medical tourism in the Middle East also supports demand, with patients traveling for specialized gastrointestinal treatments. The region is expected to expand further as more hospitals integrate advanced technologies and physician training improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Navilyst Medical

- Medtronic

- Angiodynamics

- Endo-Flex

- Rontis Medical

- Abbott Laboratories

- Medi-Globe

- R. Bard, Inc.

- Conmed

- Cook Medical

Competitive Analysis

The Biliary Catheters Market features include Navilyst Medical, Medtronic, Angiodynamics, Endo-Flex, Rontis Medical, Abbott Laboratories, Medi-Globe, C.R. Bard, Inc., Conmed, and Cook Medical. The Biliary Catheters Market remains highly competitive, driven by continuous innovation in product design, expanding clinical applications, and growing global demand. Companies focus on improving device performance with advanced materials, hydrophilic coatings, and precision-engineered features that enhance safety and ease of use. Strategic emphasis lies on strengthening distribution networks, securing regulatory approvals, and expanding reach into emerging healthcare markets. The market also sees rising investment in research to develop catheters compatible with advanced imaging and minimally invasive techniques. Competition intensifies as manufacturers balance cost-effectiveness with technological advancement to address both premium and price-sensitive segments. This dynamic landscape fosters steady innovation and ensures sustained market growth across diverse healthcare settings.

Recent Developments

- In February 2024, B. Braun Melsungen AG (Germany) Launched Easymed biliary catheter series focused on patient comfort and high maneuverability.

- In January 2024, Cook Medical Inc. (USA) Expanded its biliary access product line with the release of the Fusion OMNI Drainage Catheter.

- In November 2023, Terumo Corporation (Japan) Opened a new manufacturing facility in Vietnam to scale up production of interventional catheters.

Market Concentration & Characteristics

The Biliary Catheters Market shows a moderately concentrated structure with a mix of global leaders and specialized regional players shaping its competitive landscape. It is characterized by strong reliance on technological advancements, with manufacturers focusing on enhanced materials, hydrophilic coatings, and precision-driven designs to improve procedural outcomes. Hospitals and specialty clinics drive consistent demand due to the rising burden of hepatobiliary disorders and the growing adoption of minimally invasive procedures. Market concentration remains evident in developed regions where advanced healthcare infrastructure supports high procedural volumes, while emerging markets provide opportunities for expansion through affordable product offerings and local partnerships. It maintains a balance between innovation-led competition and cost-sensitive demand, creating a dynamic environment where companies must invest in research, regulatory approvals, and distribution networks to strengthen their presence. The industry continues to evolve around clinical efficiency, safety, and accessibility, reinforcing its role as a critical segment within interventional gastroenterology.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising incidence of hepatobiliary diseases will continue to drive steady demand for biliary catheters.

- Growing adoption of minimally invasive techniques will expand procedural volumes across hospitals and clinics.

- Technological innovation in coatings and materials will improve durability and patient safety.

- Integration of advanced imaging compatibility will enhance precision in catheter placement.

- Expanding healthcare infrastructure in emerging regions will create new growth opportunities.

- Rising focus on oncology and palliative care will strengthen adoption in cancer-related interventions.

- Increasing medical tourism in Asia-Pacific and Latin America will boost demand for advanced catheter-based procedures.

- Strategic partnerships and acquisitions will accelerate market penetration for global manufacturers.

- Regulatory approvals and compliance standards will influence the pace of product introductions.

- Continuous investment in training programs for specialists will support wider procedural adoption.