Market Overview

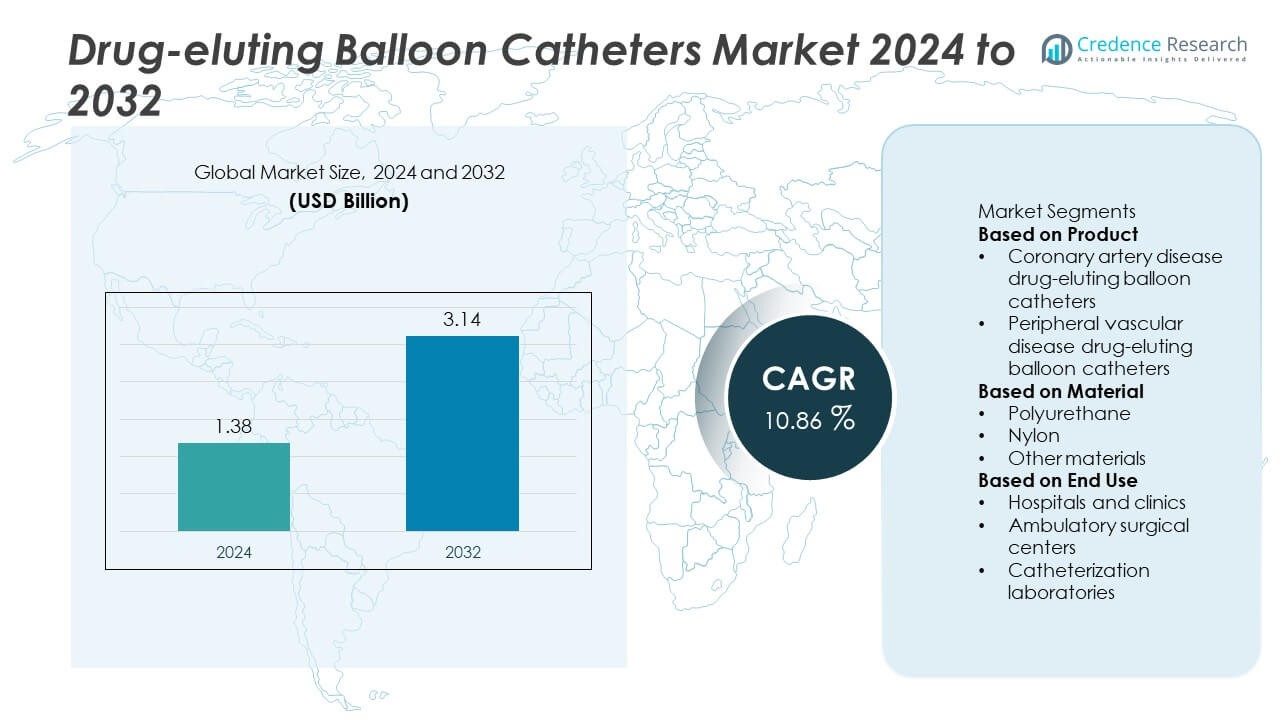

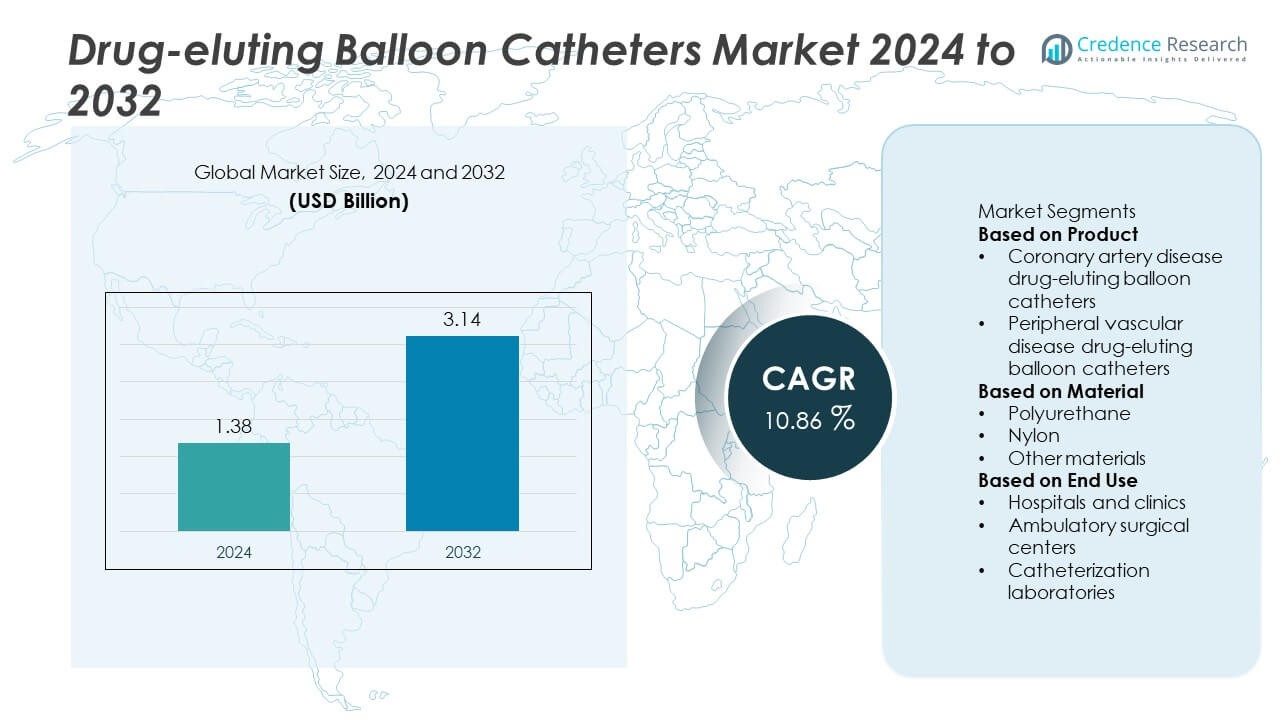

The Drug-Eluting Balloon Catheters market was valued at USD 1.38 billion in 2024 and is projected to reach USD 3.14 billion by 2032, registering a strong CAGR of 10.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug-Eluting Balloon Catheters Market Size 2024 |

USD 1.38 Billion |

| Drug-Eluting Balloon Catheters Market, CAGR |

10.86% |

| Drug-Eluting Balloon Catheters Market Size 2032 |

USD 3.14 Billion |

Top players in the Drug-Eluting Balloon Catheters market include Eurocor GmbH, B. Braun, MedAlliance, Lepu Medical Technology (Beijing) Co. Ltd., Aachen Resonance GmbH, Biotronik AG, iVascular S.L.U., Biosensors International, Becton, Dickinson and Company, and Boston Scientific Corporation. These companies strengthen competitiveness through advanced drug-coating technologies, durable balloon platforms, and expanding clinical evidence supporting stent-free vascular interventions. They focus on product innovation, global expansion, and partnerships with catheterization centers to support broader adoption. Regionally, North America leads the market with a 39% share, driven by strong procedural volumes and advanced cardiovascular infrastructure, while Europe follows with a 34% share, supported by high acceptance of drug-eluting balloons in coronary and peripheral interventions.

Market Insights

Market Insights

- The Drug-Eluting Balloon Catheters market reached USD 1.38 billion in 2024 and will grow at a 10.86% CAGR through 2032, driven by rising use in coronary and peripheral interventions.

- Market growth is supported by increasing cardiovascular disease cases and strong demand for stent-free therapies, with coronary DEB catheters holding a 61% segment share due to high use in restenosis and small-vessel disease.

- Key trends include advancements in drug-coating technology, expansion into new vascular indications, and increased adoption of minimally invasive endovascular procedures across hospitals and specialized centers.

- Competition intensifies as leading manufacturers enhance coating durability, invest in clinical trials, and expand portfolios to strengthen global presence, while pricing pressure and reimbursement gaps restrain adoption in developing regions.

- North America leads with a 39% share, followed by Europe at 34% and Asia Pacific at 22%, while hospitals and clinics dominate end-use demand with a 67% share due to high procedural volumes and advanced interventional facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Coronary artery disease drug-eluting balloon catheters dominated the market with a 61% share in 2024, driven by rising cases of coronary artery stenosis and strong clinical preference for non-stent treatment in small vessels and in-stent restenosis. These catheters deliver antiproliferative drugs directly to the lesion, reducing restenosis risk and eliminating the need for a permanent implant. Peripheral vascular disease drug-eluting balloon catheters held a 39% share, supported by growing incidence of peripheral artery disease and increasing adoption of minimally invasive procedures for lower-limb revascularization.

- For instance, MedAlliance reported sirolimus release kinetics designed for a sustained 90-day therapeutic window in its SELUTION SLR DEB, supported by over 3,000 enrolled patients in global clinical programs, demonstrating strong vessel healing outcomes.

By Material

Polyurethane-based drug-eluting balloon catheters led the market with a 54% share in 2024, driven by their flexibility, biocompatibility, and superior drug-coating stability. These material properties enable smooth navigation through complex vascular pathways and enhance drug transfer efficiency. Nylon catheters accounted for a 33% share, supported by their durability and high-pressure tolerance needed for resistant lesions. Other materials, including advanced polymer blends, held a 13% share, benefiting from ongoing innovations in drug-delivery coating technologies.

- For instance, Cordis designed its Aviator Plus balloon platform with a DURALYN™ structure tested to reach rated burst pressure thresholds of up to 14 atm.

By End Use

Hospitals and clinics dominated with a 67% share in 2024, supported by high patient volumes, advanced interventional cardiology units, and strong availability of skilled specialists. These facilities adopt drug-eluting balloon catheters for coronary and peripheral interventions due to improved outcomes and reduced recovery times. Ambulatory surgical centers accounted for a 21% share, driven by their cost-efficient services and increasing shift toward outpatient cardiovascular procedures. Catheterization laboratories held a 12% share, supported by rising use of dedicated interventional suites for complex, image-guided vascular procedures.

Key Growth Drivers

Rising Burden of Cardiovascular and Peripheral Artery Diseases

Increasing global prevalence of coronary artery disease and peripheral artery disease drives strong demand for drug-eluting balloon catheters. These devices offer targeted drug delivery without leaving a permanent implant, making them ideal for small vessels, bifurcations, and in-stent restenosis. As minimally invasive procedures rise, clinicians prefer DEB catheters for faster healing, reduced thrombosis risk, and improved long-term outcomes. Ageing populations and growing lifestyle-related disorders further accelerate procedural volumes, strengthening market growth across hospitals and cardiovascular centers.

- For instance, Medtronic reported clinical data from its IN.PACT Admiral program involving more than 4,000 enrolled patients, demonstrating sustained drug uptake supported by a balloon coating containing 3.5 µg/mm² of paclitaxel across controlled release studies.

Growing Preference for Minimally Invasive and Stent-Free Therapies

Demand for stent-free interventions continues to rise as physicians seek safer alternatives for complex lesions and patients unsuitable for stents. Drug-eluting balloon catheters provide uniform drug distribution and preserve vessel integrity, supporting greater clinical adoption. Reduced procedure times, shorter hospital stays, and lower complication rates make these catheters attractive for both coronary and peripheral interventions. Increasing clinical evidence demonstrating superior outcomes in restenosis cases further boosts acceptance across global interventional cardiology practices.

- For instance, Lepu Medical markets the Amphirion DEB platform, a device that facilitates the localized transfer of an antiproliferative drug (paclitaxel) to the vessel wall during a brief inflation period of usually 30 to 60 seconds, which is designed to help reduce scar tissue formation and arterial re-blockage without leaving a permanent implant.

Advancements in Drug-Coating and Polymer Technologies

Continuous innovation in coating materials, drug-binding polymers, and surface modification technologies enhances the effectiveness of drug-eluting balloon catheters. Improvements in drug-release kinetics, coating durability, and transfer efficiency support better therapeutic performance during short balloon inflation times. Manufacturers develop more stable antiproliferative formulations, improving safety and reducing the risk of late lumen loss. These technological upgrades strengthen product reliability and expand use across challenging anatomies and complex vascular procedures.

Key Trends & Opportunities

Expansion of Drug-Eluting Balloons into New Vascular Indications

Drug-eluting balloon catheters are gaining traction in emerging applications such as below-the-knee disease, arteriovenous fistula stenosis, and diabetic vascular complications. Their ability to deliver localized therapy without a permanent scaffold creates opportunities in areas where stents pose long-term risks. Growing clinical trials support wider adoption across peripheral and microvascular territories. As manufacturers explore new drug combinations and platform designs, the market is expected to expand into broader interventional specialties.

- For instance, B. Braun’s SeQuent Please BTK platform utilizes a paclitaxel concentration of 3 µg/mm², a concentration consistently used in its extensive clinical program involving thousands of patients across over 110 published studies.

Increasing Adoption in Outpatient and Ambulatory Care Settings

The shift toward outpatient cardiovascular procedures creates significant opportunities for DEB catheters. These devices support shorter recovery times and fewer post-procedure complications, aligning with the growth of ambulatory surgical centers. Enhanced imaging systems and improved catheter navigation techniques enable safe and efficient interventions outside hospital settings. This trend reduces healthcare costs and expands access to minimally invasive vascular treatments.

- For instance, Philips optimized its Volcano image-guided DEB workflow with an intravascular ultrasound system capable of acquiring vessel data at 60 frames per second, enabling precise catheter navigation during same-day peripheral interventions.

Rising Integration of AI and Digital Workflow Technologies

AI-assisted imaging, automated lesion assessment, and digital workflow platforms are increasingly supporting DEB catheter-based interventions. These tools enhance procedural accuracy, predict restenosis risk, and optimize device selection. Integration of digital tools helps clinicians plan and execute interventions more effectively, improving patient outcomes and reducing reintervention rates. As digital adoption grows, catheter manufacturers can differentiate through intelligent, workflow-supportive technologies.

Key Challenges

High Product Costs and Limited Reimbursement Coverage

Drug-eluting balloon catheters often cost more than conventional balloons or bare-metal options, creating budget challenges for hospitals, especially in developing regions. Limited or inconsistent reimbursement for DEB procedures restricts broader adoption. Healthcare providers may hesitate to adopt newer DEB technologies without clear reimbursement guidelines or proven long-term cost benefits. Addressing pricing disparities and expanding reimbursement frameworks remains essential for market penetration.

Regulatory Complexity and Variability Across Regions

Stringent approval processes and varying regulatory standards create delays in product introduction across global markets. Demonstrating long-term safety and efficacy requires extensive clinical data, increasing development timelines and costs for manufacturers. Regulatory differences across regions complicate global expansion and limit uniform access to advanced DEB technologies. Ensuring compliance with evolving clinical and safety standards is a major ongoing challenge for industry players.

Regional Analysis

North America

North America held a 39% share of the Drug-Eluting Balloon Catheters market in 2024, supported by high prevalence of cardiovascular diseases, strong adoption of minimally invasive procedures, and advanced healthcare infrastructure. The United States leads regional demand due to widespread use of drug-eluting balloons for coronary and peripheral interventions, supported by favorable clinical outcomes and improving reimbursement in selected indications. The presence of major medical device manufacturers and continuous investment in catheter-based innovations further strengthen regional growth. Increasing awareness of restenosis management and rising procedural volumes in ambulatory centers also contribute to sustained market expansion.

Europe

Europe accounted for a 34% share in 2024, driven by strong clinical acceptance of drug-eluting balloon technologies and growing emphasis on stent-free interventions in coronary and peripheral artery disease. Countries such as Germany, Italy, and the U.K. lead adoption due to established interventional cardiology programs and supportive clinical guidelines. Continuous clinical research, widespread use in in-stent restenosis treatment, and expansion of vascular centers reinforce demand. Favorable regulatory pathways and early adoption of advanced coating technologies further accelerate market growth across hospitals and specialized cardiovascular centers.

Asia Pacific

Asia Pacific captured a 22% share of the market in 2024, driven by rising cardiovascular disease incidence, expanding healthcare infrastructure, and growing penetration of minimally invasive vascular procedures. China, Japan, India, and South Korea demonstrate strong adoption due to increasing awareness of drug-eluting balloons and ongoing training programs for interventional cardiologists. Governments invest in modernizing catheterization laboratories and improving access to advanced endovascular therapies. The region benefits from large patient populations and growing preference for cost-effective, stent-free treatment options, supporting significant long-term growth potential.

Latin America

Latin America held a 3% share in 2024, supported by increasing adoption of minimally invasive endovascular procedures and rising awareness of drug-eluting balloons among vascular specialists. Brazil and Mexico lead the region with expanding interventional cardiology facilities and improving access to modern catheterization technologies. Although reimbursement limitations persist, private healthcare providers drive demand through adoption of advanced restenosis treatment solutions. Growing investments in healthcare infrastructure and increasing burden of peripheral artery disease contribute to gradual market growth across the region.

Middle East & Africa

The Middle East & Africa region recorded a 2% share in 2024, driven by rising investment in cardiac care infrastructure and increasing prevalence of coronary and peripheral artery diseases. Countries such as the UAE and Saudi Arabia adopt drug-eluting balloon catheters as part of modernizing cardiovascular treatment pathways. Expansion of private hospitals, improved access to catheterization labs, and rising demand for minimally invasive therapies support adoption. In Africa, uptake remains limited but is increasing with better training programs and partnerships with global medical device companies. The region shows steady long-term potential as healthcare systems continue to advance.

Market Segmentations:

By Product

- Coronary artery disease drug-eluting balloon catheters

- Peripheral vascular disease drug-eluting balloon catheters

By Material

- Polyurethane

- Nylon

- Other materials

By End Use

- Hospitals and clinics

- Ambulatory surgical centers

- Catheterization laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Drug-Eluting Balloon Catheters market includes major players such as Eurocor GmbH, B. Braun, MedAlliance, Lepu Medical Technology (Beijing) Co. Ltd., Aachen Resonance GmbH, Biotronik AG, iVascular S.L.U., Biosensors International, Becton, Dickinson and Company, and Boston Scientific Corporation. These companies strengthen their market positions by focusing on advanced drug-coating technologies, improved balloon designs, and optimized drug-release profiles to enhance procedural outcomes. Many players invest in clinical trials to demonstrate safety and effectiveness across coronary and peripheral artery disease indications. Strategic collaborations with hospitals, catheterization laboratories, and research institutions help expand adoption and support training for interventional specialists. Manufacturers also prioritize regulatory approvals, global market expansion, and cost-efficient manufacturing to improve accessibility in emerging regions. As demand for minimally invasive, stent-free vascular treatments increases, competition intensifies, driving continuous innovation in coating durability, polymer chemistry, and next-generation balloon platforms.

Key Player Analysis

- Eurocor GmbH

- Braun

- MedAlliance

- Lepu Medical Technology (Beijing) Co. Ltd.

- Aachen Resonance GmbH

- Biotronik AG

- iVascular S.L.U.

- Biosensors International

- Becton, Dickinson and Company

- Boston Scientific Corporation

Recent Developments

- In March 2024, Eurocor GmbH presented 5-year safety and efficacy data on its FREEWAY™ device at LINC 2024.

- In March 2024, Boston Scientific Corporation received FDA approval for its AGENT™ drug-coated balloon catheter for coronary in-stent restenosis (ISR).

- In March 2023, MedAlliance announced that its SELUTION DeNovo trial had reached a major milestone of enrolling over 1,000 patients across approximately 70 sites in 15 countries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for drug-eluting balloon catheters will rise as clinicians prefer stent-free vascular interventions.

- Advancements in coating technologies will improve drug-transfer efficiency and long-term vessel healing.

- Coronary in-stent restenosis treatments will remain a major growth area due to strong clinical outcomes.

- Peripheral artery disease interventions will expand as aging populations increase disease prevalence.

- Outpatient and ambulatory centers will adopt DEB catheters more widely as minimally invasive care grows.

- Emerging markets will see faster adoption as healthcare infrastructure and catheterization labs expand.

- AI-supported imaging and lesion assessment will enhance procedure planning and device selection.

- Cost-optimized DEB catheters will gain traction in price-sensitive regions.

- Manufacturers will form more clinical partnerships to strengthen evidence-based adoption.

- Regulatory approvals for new indications will widen clinical use across coronary and peripheral pathways.

Market Insights

Market Insights