Market Overview

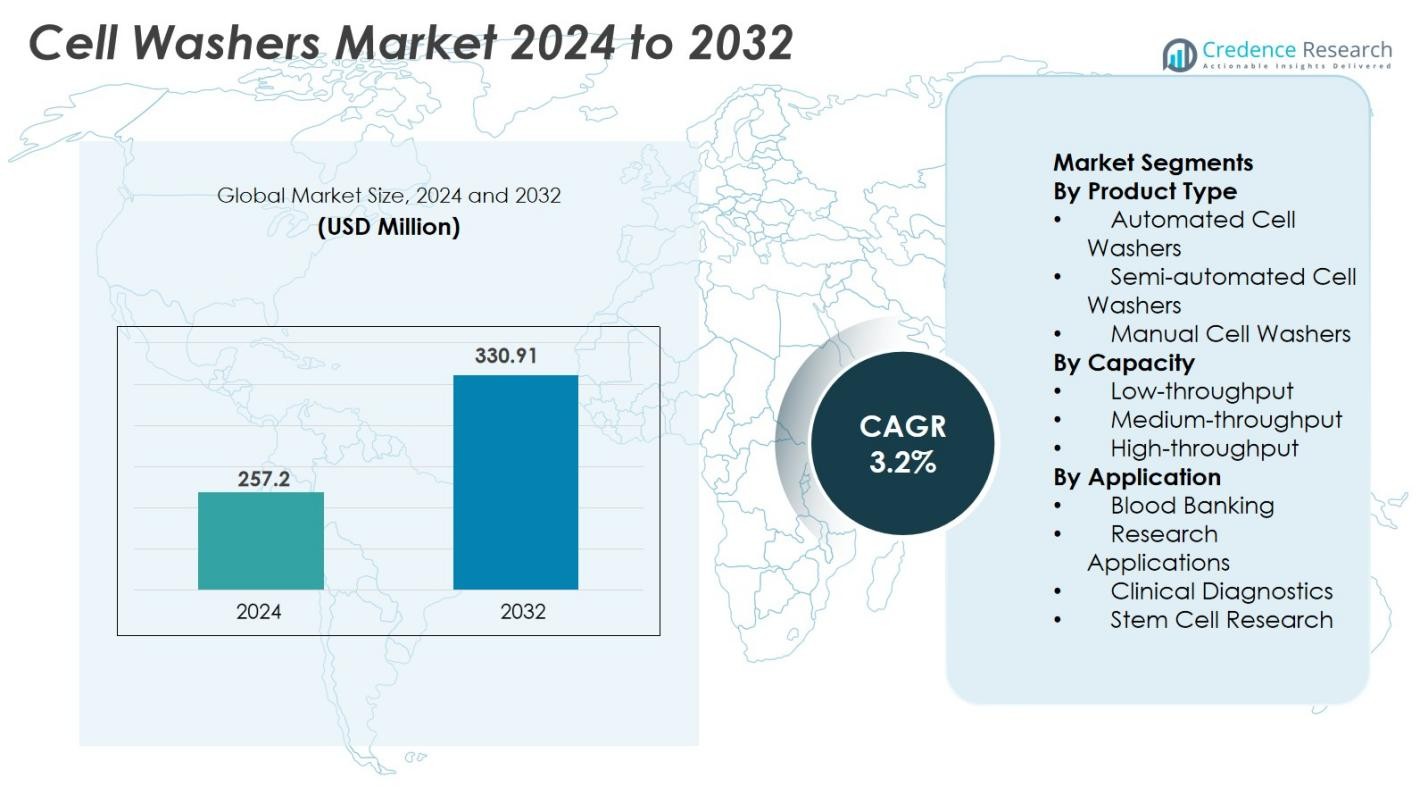

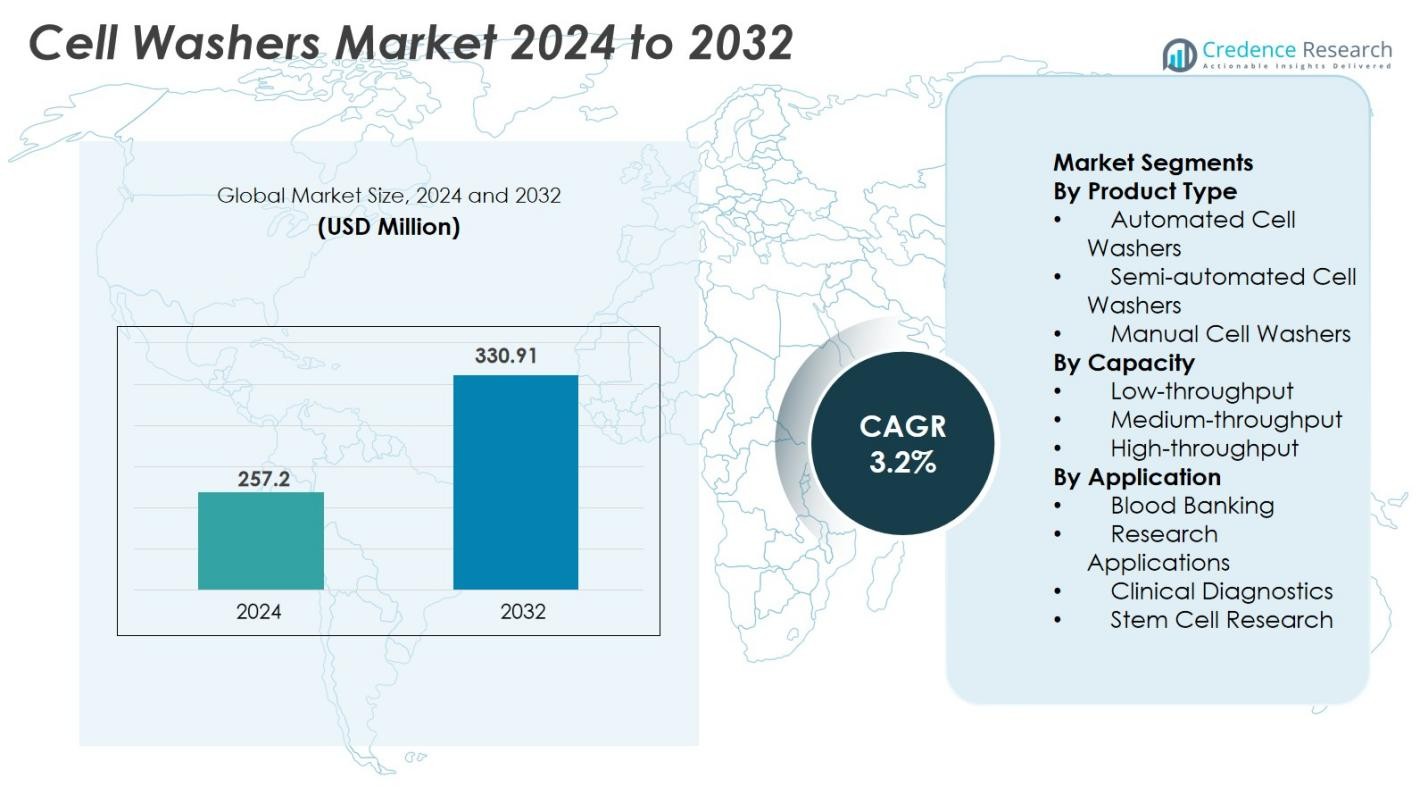

Cell Washers Market size was valued at USD 257.2 Million in 2024 and is anticipated to reach USD 330.91 Million by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Washers Market Size 2024 |

USD 257.2 Million |

| Cell Washers Market, CAGR |

3.2% |

| Cell Washers Market Size 2032 |

USD 330.91 Million |

Cell Washers Market is led by prominent players including Bio-Rad Laboratories, Inc., Danaher Corporation, Andreas Hettich GmbH & Co. KG, Corning Incorporated, and Fresenius SE & Co. KGaA, who dominate through advanced automation technologies, extensive portfolios, and strong distribution networks. These companies focus on enhancing product efficiency and integrating smart features to meet the growing demand for high-throughput and standardized cell processing. North America is the leading region, commanding a 38% market share in 2024, driven by advanced healthcare infrastructure and high adoption of automated laboratory systems. Europe follows with a 32% share, supported by robust clinical research and blood banking networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cell Washers Market size was valued at USD 257.2 Million in 2024 and is projected to reach USD 330.91 Million by 2032, growing at a CAGR of 3.2%.

- Market growth is driven by increasing demand for automated cell processing solutions in blood banks, diagnostic labs, and research settings, especially for high-throughput workflows.

- The rising trend of integrating AI and connected technologies into laboratory equipment is enhancing operational efficiency and enabling smart monitoring and data management.

- Leading players including Bio-Rad, Danaher, and Andreas Hettich focus on innovation and expanded global presence, while cost constraints and regulatory compliance challenges restrain wider adoption among smaller labs.

- North America holds the largest share at 38%, followed by Europe at 32%, with Automated Cell Washers dominating the product segment with a 55% share, driven by advanced healthcare infrastructure and high laboratory automation.

Market Segmentation Analysis

By Product Type

The Cell Washers Market is segmented into Automated, Semi-automated, and Manual Cell Washers, with Automated Cell Washers dominating the segment with over 55% market share in 2024. The demand for automated systems is driven by their high precision, throughput, and ability to minimize human error in high-volume laboratories and blood banks. Increasing adoption in clinical and diagnostic applications, coupled with advancements in workflow automation, is further accelerating market growth. Semi-automated and manual cell washers continue to serve smaller labs and low-volume operations, contributing to steady but limited share expansion.

- For instance, Fresenius SE & Co. KGaA’s LOVO Automated Cell Processing System enhances the washing and concentration of white blood cells with advanced precision and consistency.

By Capacity

Based on capacity, the market is classified into Low-throughput, Medium-throughput, and High-throughput systems. High-throughput cell washers held the largest share of 48% in 2024 due to rising demand from high-volume blood banks and research facilities, where productivity and sample integrity are critical. The increasing focus on automation, rapid sample processing, and reducing turnaround time in clinical and diagnostic settings drives the growth of this subsegment. Medium-throughput systems cater to mid-sized laboratories, while low-throughput models are preferred by smaller clinics and teaching institutions for routine cell washing tasks.

- For instance, Thermo Fisher Scientific’s Versette Automated Liquid Handler streamlines rapid sample processing in diagnostic labs, reducing turnaround time significantly.

By Application

The Cell Washers Market by application includes Blood Banking, Research Applications, Clinical Diagnostics, and Stem Cell Research. Blood Banking represents the dominant segment with a 42% market share in 2024, driven by the rising need for efficient sample preparation in transfusion medicine and hematology testing. The growing prevalence of chronic blood disorders and the increasing number of blood donation programs fuel demand. Clinical diagnostics and research labs also contribute significantly to market growth, while stem cell research is emerging as a high-growth area due to expanding regenerative medicine and cell therapy applications.

Key Growth Drivers

Increasing Demand for Blood Banking and Transfusion Services

The continuous rise in global blood transfusion rates and growing dependency on blood components in both emergency and planned medical interventions are key drivers for the Cell Washers Market. As the prevalence of chronic diseases, such as anemia, thalassemia, and cancer, increases, so does the need for efficient and accurate blood sample processing and preparation. Automated cell washers have become indispensable in ensuring high-quality packed red blood cells and platelets, free of unwanted plasma or contaminants. Additionally, growing investments in blood banking infrastructure across emerging economies, alongside stringent regulatory standards mandating the use of reliable separation equipment, are further accelerating adoption.

- For instance, Thermo Fisher Scientific offers the CW3 Cell Washer, an FDA-cleared device designed to provide reproducible washing of up to 24 blood cell samples per run, featuring automated alerts and user-friendly digital controls that streamline clinical and blood bank workflows.

Growing Adoption of Automated Laboratory Equipment

The demand for automated laboratory solutions is a significant catalyst in the expansion of the Cell Washers Market. As healthcare facilities and research institutions prioritize efficiency and accuracy, automated cell washers are increasingly preferred for their ability to handle large volumes of samples while maintaining high safety and reproducibility standards. Automation helps mitigate manual errors, increases productivity, and supports standard operating procedures in critical workflows, especially in laboratories handling immunohematology, serology, and transfusion-related diagnostics.

- For instance, Baxter’s Cytomate device enhances cell recovery and maintains graft quality during cord blood processing, automating the washing step to improve safety and reproducibility.

Rising Investment in Research and Development

Increased R&D spending in areas like regenerative medicine, stem cell therapies, and immunotherapy is fueling demand for precise and reliable cell washing systems. Research institutions require advanced equipment to prepare clean, uniform cell populations for experimental procedures and analytical assays. Innovations in cell therapy, especially CAR-T and stem cell-based treatments, rely heavily on efficient cell washing methods to ensure high purity and viability. To support this, manufacturers are investing in smart technologies, miniaturization, and multi-functional systems that match the diverse needs of scientific research. Initiatives by governments and biotech firms to scale up cell-based treatment platforms are also creating opportunities for specialized cell washers.

Key Trends & Opportunities

Emergence of AI-Integrated and Smart Cell Washing Systems

The integration of Artificial Intelligence (AI) and IoT technologies in laboratory equipment, including cell washers, is transforming the market landscape. AI-enabled systems enhance precision in cell separation workflows by enabling automated parameter adjustments based on cell type and sample quality. IoT features allow real-time equipment monitoring, predictive maintenance, and data synchronization across platforms. This connectivity not only increases uptime but also reduces maintenance costs while supporting regulatory compliance with detailed audit trails. Manufacturers are also focusing on cloud integration, enabling remote diagnostics and system updates.

- For instance, Molecular Devices’ CellXpress.ai Automated Cell Culture System uses machine learning to automate cell culture feeding and passaging schedules, reducing manual intervention and ensuring consistent, reproducible results.

Expansion in Personalized and Regenerative Medicine Applications

The growing focus on personalized medicine and regenerative therapies is creating new avenues for the cell washers market. Technologies like stem cell therapy, CART-cell therapy, and ex vivo gene editing demand high-purity cell samples free of contaminants for successful treatment outcomes. Cell washers facilitate this by providing efficient and consistent washes that preserve cellular integrity. As the global pipeline for cell-based therapeutics expands, particularly in oncology, genetic disorders, and tissue repair, the need for advanced cell processing tools rises. Companies are developing customized cell washing platforms compatible with small-batch, personalized treatments.

- For instance, Thermo Fisher Scientific’s Gibco™ CTS™ Rotea™ Counterflow Centrifugation system is used in clinical CAR-T cell manufacturing to wash and concentrate patient T cells after activation and bead removal, ensuring high cell viability and purity for downstream engineering and therapy.

Key Challenges

High Cost of Advanced Cell Washers and Operational Limitations

One of the major challenges in the Cell Washers Market is the high initial cost of advanced automated systems, which can be a barrier for smaller laboratories and clinics with limited budgets. The procurement, installation, and maintenance of high-throughput automated washers add to overall capital expenditure. Additionally, consumable costs, such as reagents and accessories needed for operation, further increase ongoing operational expenses. Smaller facilities often resort to semi-automated or manual systems, which can limit throughput and standardization. While automated systems offer accuracy and repeatability, they may require specialized training and adherence to complex maintenance schedules.

Regulatory Challenges and Quality Compliance Requirements

Cell washers used in clinical and diagnostic settings must comply with stringent regulatory requirements, including ISO, FDA, and CE certifications. Ensuring that equipment meets these standards involves extensive testing and documentation, which can delay time-to-market for new products. Moreover, regulatory differences across countries add complexity for manufacturers aiming at global expansion. Failure to meet compliance standards can lead to product recalls, legal repercussions, and reputational damage. Additionally, regulatory audits demand consistent monitoring, validation, and documentation of the equipment’s performance, creating operational challenges for laboratories.

Regional Analysis

North America

North America dominates the Cell Washers Market with a 38% market share in 2024, driven by advanced healthcare infrastructure and significant demand from blood banks and research institutions. The region benefits from strong adoption of laboratory automation, high investment in R&D, and a large presence of key market players. The U.S. leads with robust regulatory support and increased clinical applications in immunology and transfusion medicine. Growing focus on personalized medicine and regenerative therapies further supports the adoption of automated systems. The region’s mature market is expected to continue strong growth with rising application of cell-based research.

Europe

Europe holds a 32% market share in the Cell Washers Market, supported by well-established healthcare systems and widespread adoption of diagnostic and clinical testing technologies. Germany, the UK, and France lead the market due to strong investments in biopharmaceutical research and rising demand for blood processing equipment. Strict regulatory frameworks ensure high-quality standards for laboratory equipment, boosting the adoption of automated and semi-automated cell washers. Increasing focus on hematological disorders and cell therapy programs contributes to steady market growth. Collaborative initiatives between research institutions and biotech firms are further driving product innovation and adoption across the region.

Asia-Pacific

Asia-Pacific accounts for a 21% share of the Cell Washers Market, with rapid expansion driven by growing healthcare investments, rising blood donation rates, and increasing demand for advanced diagnostic tools. China, Japan, and India are major markets due to expanding hospital infrastructure, government healthcare reforms, and growing biotech activities. The region is witnessing accelerated adoption of automated cell washers in response to rising patient volumes and the need for quality transfusion practices. Growing research into regenerative medicine and stem cell therapies also supports market expansion. Local manufacturing and lower equipment costs are improving accessibility across emerging economies.

Latin America

Latin America captures a 5% share of the Cell Washers Market, reflecting gradual adoption due to improving healthcare facilities and rising awareness of transfusion medicine. Brazil and Mexico are leading contributors, driven by investments in public healthcare and diagnostic laboratory expansion. The market growth is supported by increasing efforts to modernize blood banking services and enhance laboratory automation. However, economic constraints and limited access to high-end equipment continue to restrict widespread adoption. Partnerships with global medical device firms and government initiatives promoting improved blood safety standards are expected to gradually propel market growth in the region.

Middle East & Africa

The Middle East & Africa region holds a 4% market share in the Cell Washers Market, with development led by countries like Saudi Arabia, UAE, and South Africa. While the adoption of advanced laboratory equipment is still emerging, increasing government spending on healthcare infrastructure and strategic plans to improve diagnostic services are driving demand. Blood transfusion services and clinical laboratories are adopting automation to enhance processing efficiency. However, cost barriers and skilled workforce shortages hinder market expansion. International collaborations and technology transfers are expected to improve access to modern cell washing systems across key healthcare hubs in the region.

Market Segmentations

By Product Type

- Automated Cell Washers

- Semi-automated Cell Washers

- Manual Cell Washers

By Capacity

- Low-throughput

- Medium-throughput

- High-throughput

By Application

- Blood Banking

- Research Applications

- Clinical Diagnostics

- Stem Cell Research

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cell Washers Market is characterized by the presence of established global players and emerging regional manufacturers competing on technological innovation, product reliability, and operational efficiency. Key players such as Andreas Hettich GmbH & Co. KG, Bio-Rad Laboratories, Inc., Danaher Corporation, Corning Incorporated, and Fresenius SE & Co. KGaA lead the market with extensive product portfolios, strong brand recognition, and a broad geographical presence. These companies prioritize innovation in automated systems, focusing on smart functionalities, connectivity, and integration into modern lab workflows. Emerging players like CYTENA GmbH and Centurion Scientific are gaining traction by offering cost-effective solutions with improved flexibility for small and mid-sized labs. Strategic partnerships, acquisitions, and investments in R&D are central to expanding product capabilities and maintaining a competitive edge. Additionally, companies are exploring new opportunities in regenerative medicine and clinical diagnostics to strengthen their market foothold and cater to evolving customer demands.

Key Player Analysis

- Haemonetics Corporation

- CYTENA GmbH

- Corning Incorporated

- Fresenius SE & Co. KGaA

- Danaher Corporation

- Changsha Yingtai Instrument Co., Ltd.

- Andreas Hettich GmbH & Co. KG

- Centurion Scientific

- Helmer Scientific Inc.

- Bio-Rad Laboratories, Inc.

Recent Developments

- In December 2024, GVS S.p.A. announced it would acquire the whole‑blood business of Haemonetics Corporation including its portfolio of proprietary blood collection, processing, filtration and transfusion solutions, thereby strengthening GVS’s vertical integration in transfusion‑medicine.

- In May 2023, Trane Technologies completed the acquisition of Helmer Scientific Inc. a company serving blood banks, laboratories and cell‑processing centres thereby bolstering its presence in laboratory and blood‑processing workflow equipment, which is relevant to the cell‑washer ecosystem.

- In March 2023, Haemonetics Corporation received 510(k) clearance from the U.S. Food & Drug Administration for its new software iteration for the Cell Saver Elite+ Autotransfusion System.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for automated cell washers will continue to rise as laboratories move toward fully integrated workflows.

- Increasing adoption in blood banks and diagnostic centers will drive consistent market expansion.

- Growth in stem cell and regenerative medicine will create new opportunities for advanced cell processing equipment.

- AI and IoT-based enhancements will improve system efficiency and reliability in laboratory operations.

- Emerging markets will witness greater adoption as healthcare infrastructure improves and automation becomes more affordable.

- Compact and portable solutions will gain popularity among smaller labs and clinics.

- Key players will focus on modular systems to support diversified cell processing applications.

- Regulatory compliance and quality certifications will remain essential for market entry and product success.

- Collaboration between research institutions and manufacturers will accelerate innovation in cell washing technologies.

- Sustainability and energy-efficient designs will begin influencing equipment development and purchasing decisions.