Market overview

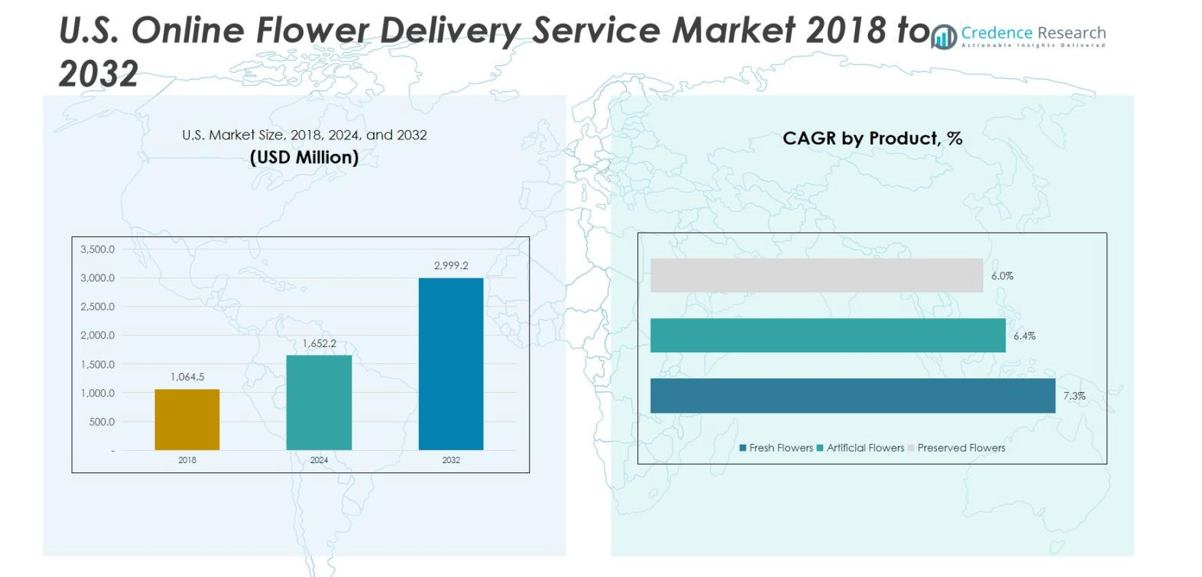

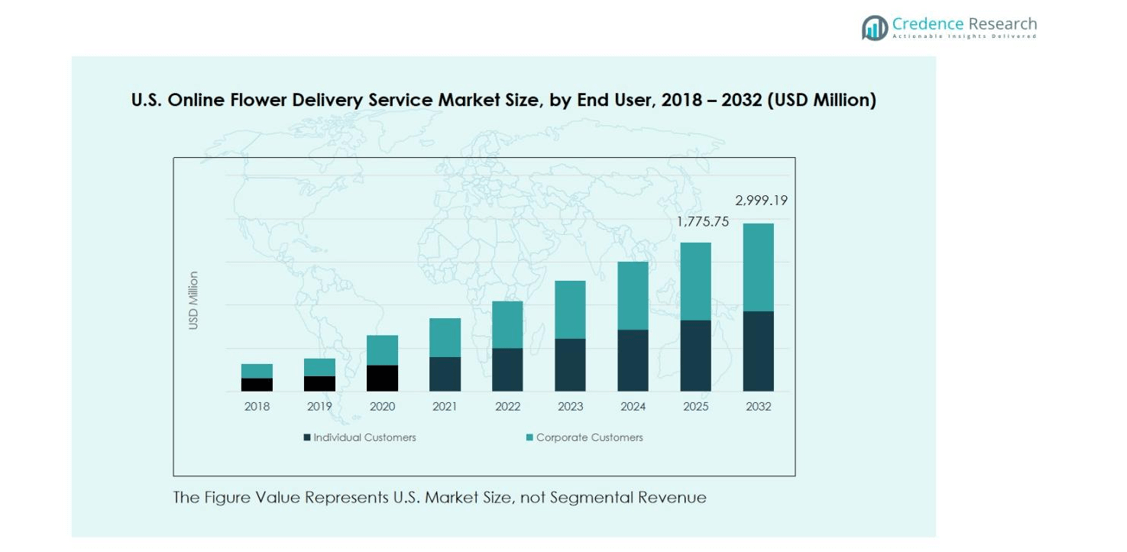

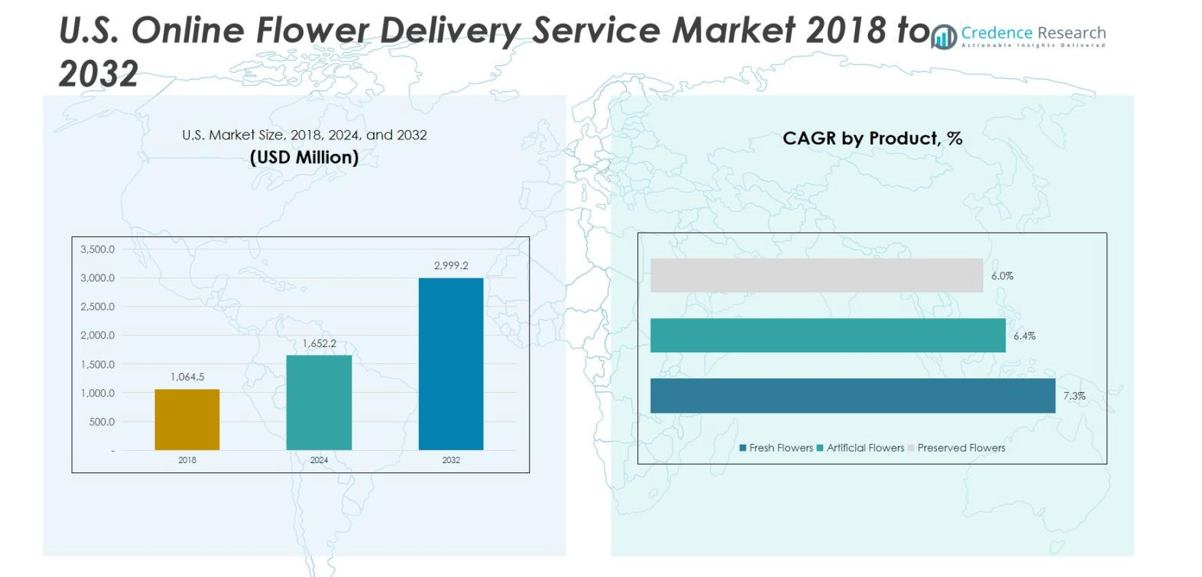

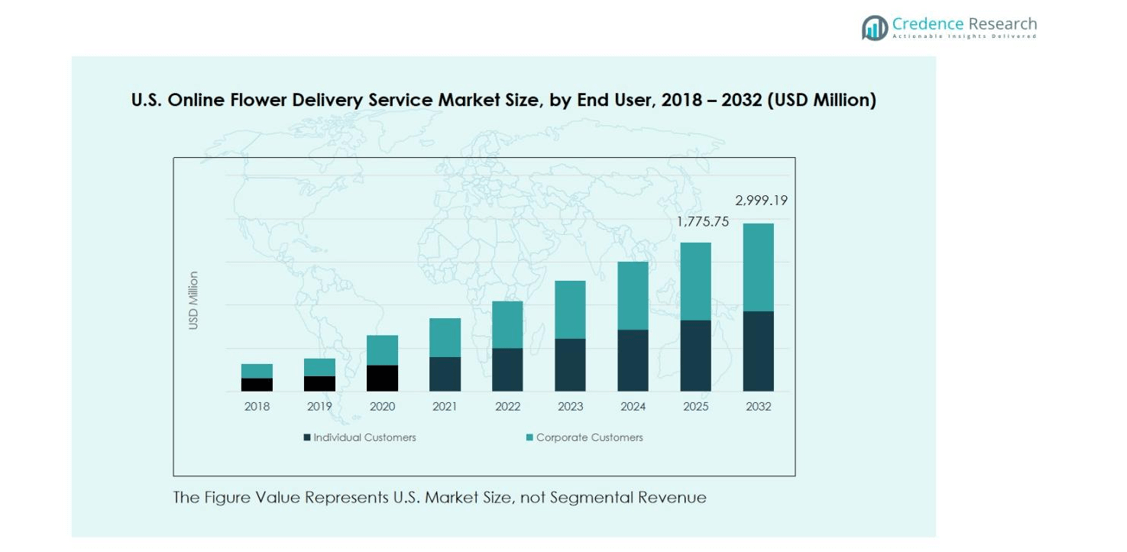

The U.S. Online Flower Delivery Service Market was valued at USD 1,064.5 million in 2018, is projected to reach USD 1,652.2 million by 2024, and is anticipated to grow to USD 2,999.2 million by 2032, at a CAGR of 7.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Online Flower Delivery Service Market Size 2024 |

USD 1,652.2 million |

| U.S. Online Flower Delivery Service Market, CAGR |

7.77% |

| U.S. Online Flower Delivery Service Market Size 2032 |

USD 2,999.2 million |

The U.S. Online Flower Delivery Service Market is led by prominent players such as 1‑800‑Flowers.com, The Bouqs Co., Teleflora, Proflowers, and UrbanStems. These companies dominate the market by offering a broad range of products, efficient delivery services, and strong customer relationships. The market’s regional distribution is notable, with the West commanding the largest share of 31.1%, driven by high demand in cities like Los Angeles and San Francisco. The South follows closely with a 29.2% share, fueled by cultural traditions of floral gifting in cities such as Houston and Atlanta. The Northeast and Midwest hold shares of 21.4% and 18.3%, respectively, with key urban centers like New York, Boston, and Chicago contributing to the market’s overall growth. The market continues to expand as these key players adapt to changing consumer preferences for convenience and personalization.

Market Insights

- The U.S. Online Flower Delivery Service Market was valued at USD 1,652.2 million in 2024 and is projected to grow to USD 2,999.2 million by 2032, at a CAGR of 7.77% during the forecast period.

- Key growth drivers include increasing demand for convenience, e-commerce adoption, and the rising trend of eco-friendly and personalized floral options.

- Market trends show growing interest in same-day and next-day delivery services, as well as a shift towards sustainable and custom floral arrangements.

- The market is highly competitive, with major players like 1-800-Flowers.com, The Bouqs Co., and Teleflora, offering extensive product portfolios and flexible delivery options.

- Regional analysis shows that the West dominates with a 1% share, followed by the South at 29.2%, while the Northeast holds 21.4% and the Midwest 18.3% share, reflecting varied consumer preferences and demand across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

The U.S. Online Flower Delivery Service Market is primarily driven by Fresh Flowers, which holds the largest share of the market at 56.8%. Fresh flowers are the preferred choice for customers due to their natural appeal and versatility, making them suitable for a wide range of occasions such as weddings, anniversaries, and celebrations. The demand for fresh flowers is further fueled by their aesthetic appeal and the growing preference for eco-friendly and sustainable products. Artificial Flowers, accounting for 25.4%, are gaining popularity due to their durability and low maintenance, while Preserved Flowers hold a smaller share at 17.8%, valued for their long-lasting nature.

- For instance, The Million Roses offers luxury preserved rose boxes that can last up to three years, attracting demand from corporate gifting and home décor categories.

By Occasion:

In the occasion-based sub-segment, Valentine’s Day dominates the U.S. Online Flower Delivery Service Market, commanding a market share of 35.2%. This surge is attributed to the tradition of giving flowers on Valentine’s Day, driving significant sales. Mother’s Day follows with 28.1% of the market share, benefiting from similar consumer behavior with flowers being a popular gift. Weddings, at 19.7%, are a staple occasion for flower delivery services, while Funerals hold a smaller share at 16.9%, reflecting the consistent, though more specialized demand for floral tributes during these somber events.

- For instance, on Mother’s Day flowers are included by 74 % of U.S. consumers as part of their celebration, illustrating how gifting preferences channel into floral purchases.

By Delivery Time:

The Same-Day Delivery segment leads in the U.S. Online Flower Delivery Service Market, holding a dominant share of 47.5%. This demand is driven by consumers’ desire for quick, last-minute purchases, especially for gifts or urgent occasions. The Next-Day Delivery segment accounts for 31.3% of the market, catering to customers who seek timely but not immediate deliveries. Scheduled Delivery, which holds a market share of 21.2%, is favored by those planning ahead for special events and gifts, offering flexibility and convenience for both consumers and service providers.

Key Growth Drivers

Increasing Consumer Demand for Convenience

The growing demand for convenience is one of the major growth drivers in the U.S. Online Flower Delivery Service Market. Consumers are increasingly opting for online platforms due to the ease and speed of ordering flowers from the comfort of their homes. The availability of same-day and next-day delivery options has significantly enhanced customer convenience, making floral purchases more accessible. This shift toward e-commerce is supported by the rising penetration of smartphones and internet access, allowing customers to place orders with minimal effort.

- For instance, 1-800-Flowersoffers same-day delivery on a wide variety of eligible products, fulfilled through a network of thousands of local florists to ensure freshness and quality. This service requires orders to be placed by a specific cutoff time (e.g., typically 2:30 p.m. on weekdays in the recipient’s time zone) and is backed by a 100% Satisfaction Guarantee.

Rise in Special Occasions and Gifting Culture

The U.S. market sees sustained growth driven by an increase in special occasions such as holidays, weddings, anniversaries, and birthdays. Flowers continue to be a favored gift choice for these events, supporting strong year-round demand. Holidays like Valentine’s Day and Mother’s Day contribute significantly to the market’s growth, further driving seasonal sales. As gifting culture grows across the U.S., people increasingly turn to online services for quick and personalized flower delivery, reinforcing the market’s expansion.

- For instance, The Bouqs Co. noted a surge in subscription-based gifting, with customers pre-ordering recurring flower deliveries for birthdays and anniversaries, underscoring the cultural shift toward thoughtful, planned gifting experiences.

Growth in E-commerce and Digital Transformation

The continued growth of e-commerce and digital transformation in the retail sector significantly impacts the U.S. Online Flower Delivery Service Market. More customers are shifting towards online purchases due to the ease of browsing, customizing, and purchasing flowers. The integration of AI-based recommendations, secure payment options, and improved user experiences further enhances customer satisfaction. Additionally, the availability of subscription-based flower delivery models offers recurring revenue streams for businesses, catering to the evolving preferences of consumers seeking convenience and personalized experiences.

Key Trends & Opportunities

Sustainability and Eco-Friendly Flower Options

Sustainability is becoming a significant trend in the U.S. Online Flower Delivery Service Market. Consumers are increasingly looking for eco-friendly options such as sustainably sourced flowers and recyclable or biodegradable packaging. As environmental concerns continue to rise, flower delivery services that emphasize green practices, such as using organic fertilizers or offering preserved flowers that reduce waste, are gaining popularity. This trend offers an opportunity for businesses to differentiate themselves by aligning with sustainable practices while meeting the demands of environmentally-conscious consumers.

- For instance, The Flora (India) sources flowers from a zero‑waste farm and has a delivery business built around reducing material footprint and sustainable practices.

Personalized and Custom Floral Arrangements

Personalized floral arrangements are gaining traction in the online flower delivery market, offering a growing opportunity for businesses to cater to individual customer preferences. Customization options, such as personalized messages, unique flower combinations, and bespoke arrangements, provide a competitive edge. Consumers increasingly value personalized experiences, especially when it comes to gifts and special occasions. This trend aligns with the broader consumer demand for bespoke products and presents a significant opportunity for online flower delivery services to enhance customer satisfaction and brand loyalty.

- For instance, Interflora allows customers to create customized bouquets, selecting from a wide variety of flowers such as roses, orchids, and lilies, crafted by flower experts who handpick the freshest blooms.

Key Challenges

Intense Competition and Price Sensitivity

The U.S. Online Flower Delivery Service Market is highly competitive, with numerous players offering similar services. This intense competition has led to price sensitivity among consumers, pushing companies to offer discounts, promotions, and deals to stay competitive. While this benefits consumers, it pressures profit margins for businesses. Smaller players may struggle to compete with larger, well-established platforms offering low prices and extensive delivery options. To stand out, businesses must invest in differentiation through quality, customer service, or unique offerings.

Supply Chain and Logistic Issues

chain and logistical challenges are a major hurdle in the online flower delivery service industry. The perishable nature of flowers demands efficient transportation and timely delivery to maintain product quality. Delays in shipping, seasonal shortages, or disruptions in supply chains can affect businesses’ ability to meet customer expectations. These logistical difficulties can lead to increased costs and reduced customer satisfaction, particularly when offering same-day or next-day delivery services. Flower delivery services must invest in robust logistics networks to ensure timely, quality deliveries.

Regional Analysis

Northeast

The Northeast region of the U.S. holds a market share of 21.4% in the Online Flower Delivery Service Market, driven by its large urban population and high demand for floral gifts during major occasions like Valentine’s Day, Mother’s Day, and weddings. Cities such as New York, Boston, and Philadelphia contribute significantly to the region’s market share. The widespread adoption of e-commerce, along with high disposable income levels, has led to a preference for online flower delivery services. Additionally, the region’s growing trend toward sustainability and eco-conscious purchasing has fueled the demand for eco-friendly and preserved flowers.

Midwest

The Midwest region captures 18.3% of the U.S. Online Flower Delivery Service Market. The region’s growth is primarily attributed to key cities like Chicago, Detroit, and Minneapolis, where online flower delivery services are increasingly popular for holidays and personal celebrations. The Midwest has witnessed a rise in e-commerce adoption, and flowers are a popular gift choice during major holidays such as Mother’s Day and Valentine’s Day. The demand for same-day and next-day delivery services continues to rise as consumers value the convenience of fast, reliable deliveries.

South

The South region holds a significant 29.2% share of the U.S. Online Flower Delivery Service Market, with demand driven by major cities such as Houston, Atlanta, and Miami. The Southern U.S. is known for its strong tradition of floral gifting, especially during weddings, funerals, and festive holidays. E-commerce penetration is growing rapidly, fueled by increasing smartphone usage and online shopping trends. The region’s diverse demographic also drives demand for a variety of floral arrangements, including fresh flowers, artificial flowers, and preserved flowers. Seasonal events and cultural celebrations also support steady growth in the market.

West

The West region is a major player in the U.S. Online Flower Delivery Service Market, holding a market share of 31.1%. Key cities like Los Angeles, San Francisco, and Seattle lead the market, driven by high demand for floral arrangements during special occasions such as weddings, anniversaries, and holidays. The West is known for embracing technological advancements, which has resulted in a high penetration of online flower delivery services. The demand for personalized and premium floral arrangements is strong, with consumers increasingly seeking customization options. Additionally, the region’s focus on sustainability drives interest in eco-friendly flower options.

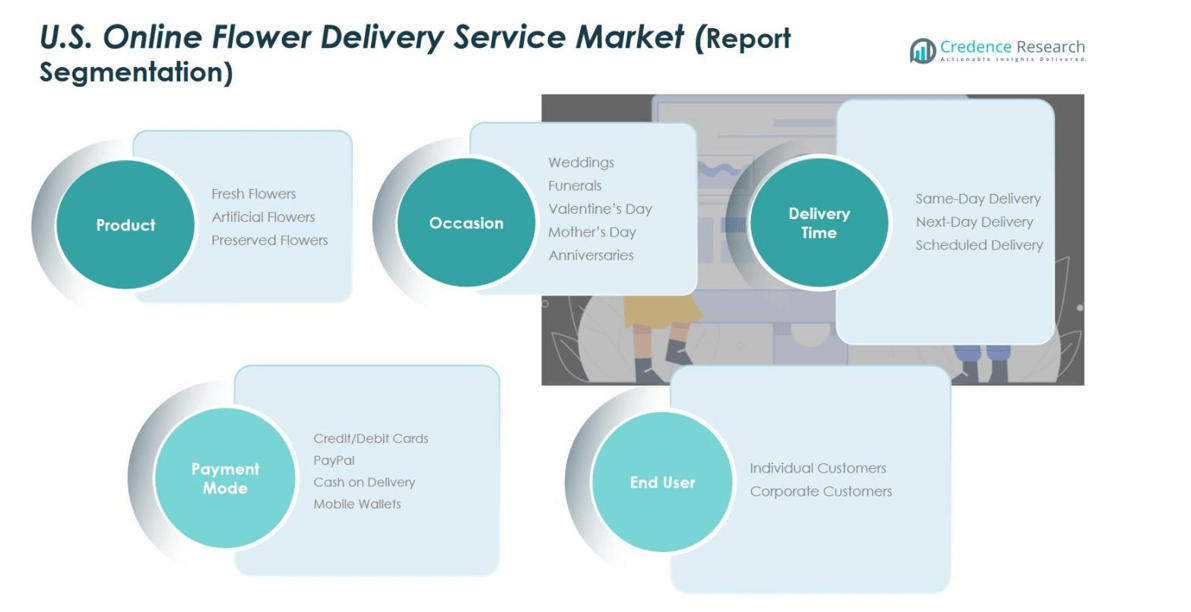

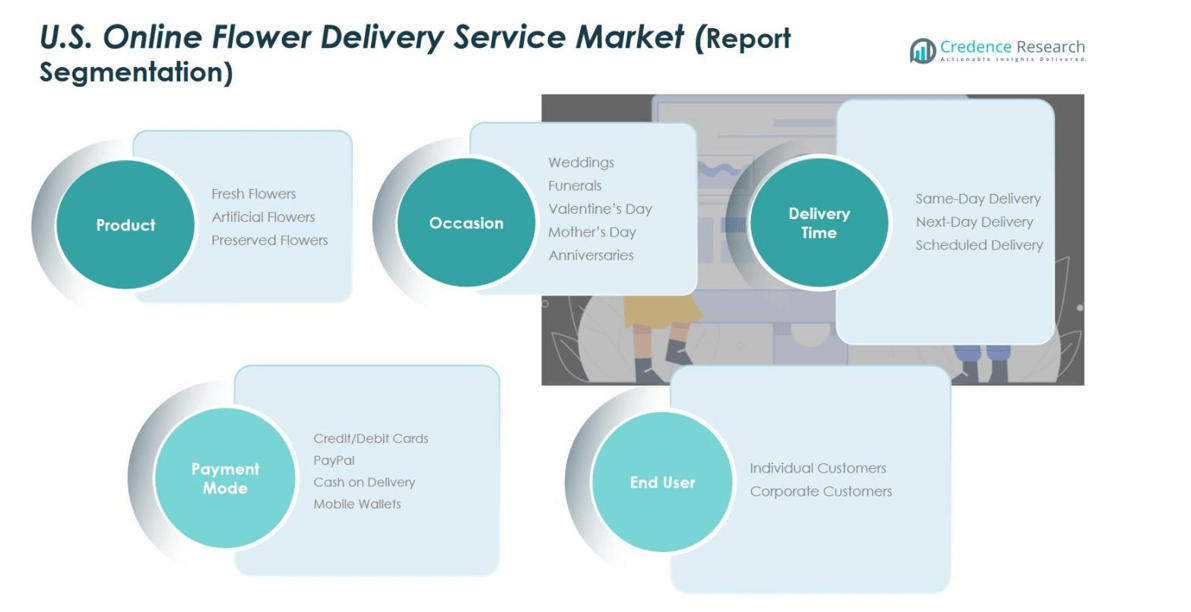

Market Segmentations:

By Product:

- Fresh Flowers

- Artificial Flowers

- Preserved Flowers

By Occasion:

- Weddings

- Funerals

- Valentine’s Day

- Mother’s Day

- Anniversaries

By Delivery Time:

- Same-Day Delivery

- Next-Day Delivery

- Scheduled Delivery

By Payment Mode:

- Credit/Debit Cards

- PayPal

- Cash on Delivery

- Mobile Wallets

By End User:

- Individual Customers

- Corporate Customers

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. Online Flower Delivery Service Market is highly competitive, with major players such as 1-800-Flowers.com, The Bouqs Co., Teleflora, UrbanStems, and Proflowers leading the market. These companies dominate through a combination of strong brand recognition, extensive product offerings, and reliable delivery services. To maintain their competitive edge, key players are continuously innovating with new services such as same-day delivery, customized floral arrangements, and subscription-based flower delivery models. Additionally, businesses are focusing on customer experience by offering personalized features, loyalty programs, and eco-friendly options to cater to the growing demand for sustainable products. With the rise of digital transformation, these companies are also enhancing their online platforms through AI-based recommendations, easy-to-use mobile apps, and secure payment systems. Despite this, the market remains fragmented with a mix of large players and smaller, niche businesses focusing on specialized offerings, creating a dynamic competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, BloomNation acquired Floom, an online marketplace connecting customers with local independent florists in the U.S. and UK.

- In February 2025, 1‑800‑Flowers.com, Inc. announced a partnership with Uber Technologies, Inc. via its Uber Direct delivery platform to support its BloomNet local‑florist network with on‑demand logistics ahead of the Valentine’s Day surge.

- In July 2024, The Bouqs Company launched three “shop‑in‑shop” flower retail units inside Whole Foods Market stores in California as part of its expansion into physical retail plus same‑day delivery via its online platform.

Report Coverage

The research report offers an in-depth analysis based on Product, Occasion, Delivery Time, Payment Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Online Flower Delivery Service Market is expected to continue growing, driven by increasing consumer preference for convenience and online shopping.

- Demand for same-day and next-day delivery services will remain strong, as consumers prioritize quick and reliable floral delivery options.

- Eco-friendly and sustainable floral options will see growing demand, with more consumers opting for environmentally conscious choices.

- Personalized floral arrangements will gain popularity, with customers seeking customized experiences for special occasions.

- Mobile commerce will play a significant role in the market’s growth, as consumers increasingly use smartphones to order flowers.

- Subscription-based delivery services will continue to expand, offering customers convenience and flexibility with regular floral deliveries.

- Technological advancements, including AI-driven recommendations and enhanced customer service, will shape the future of the market.

- Online flower delivery services will increasingly incorporate luxury and premium flower arrangements to cater to high-end consumers.

- The integration of digital payment solutions and secure transaction methods will improve customer experience and increase market adoption.

- The market will see further consolidation, with larger players acquiring smaller businesses to expand their reach and offerings.