Market overview

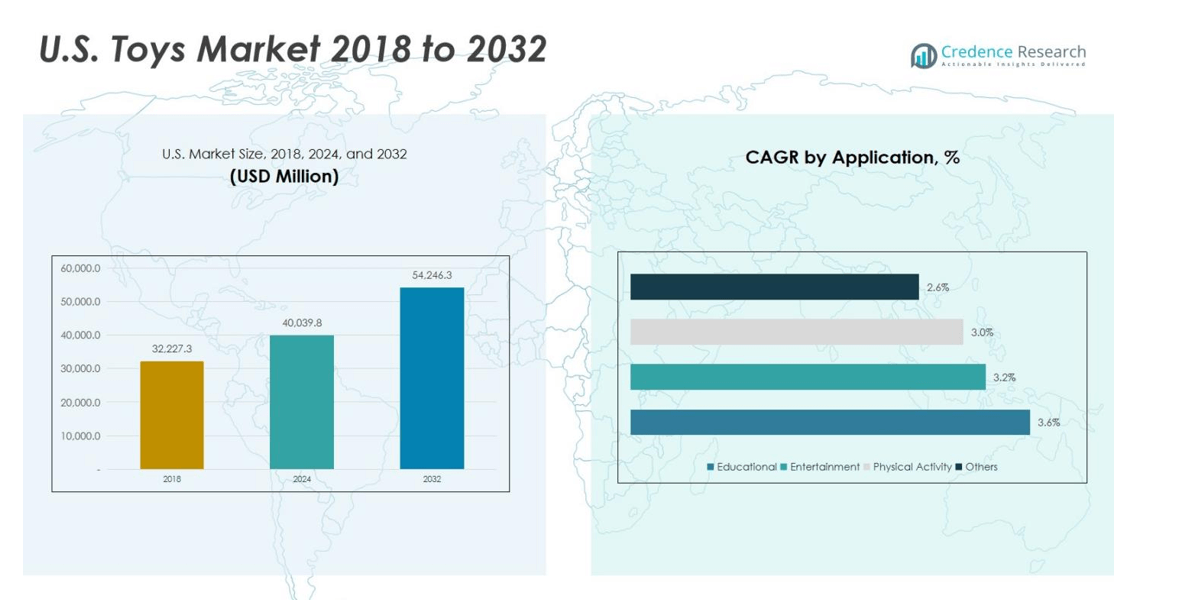

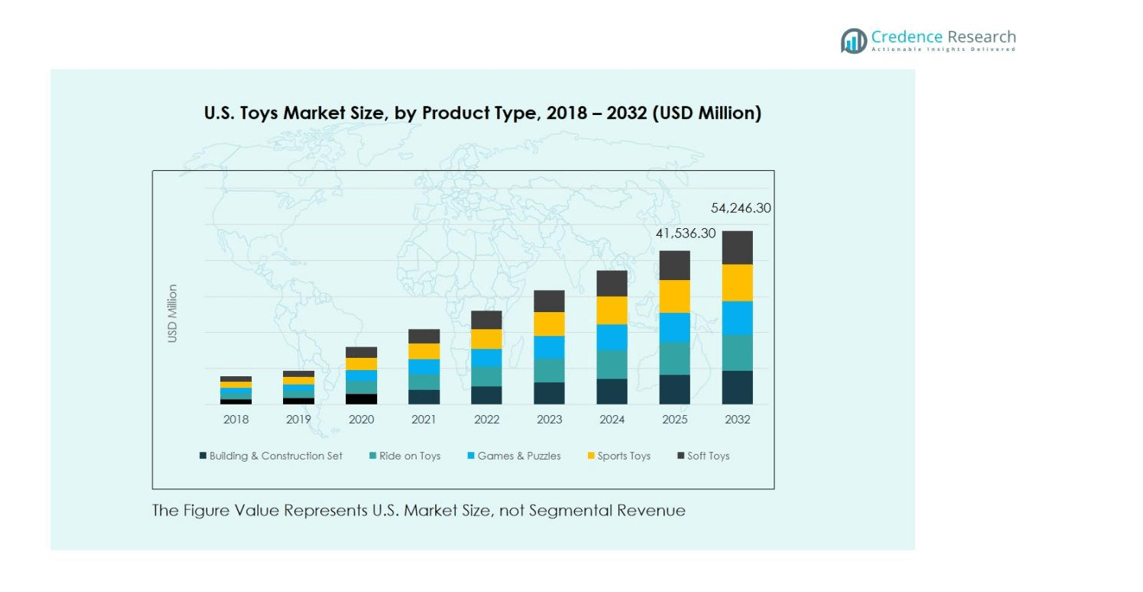

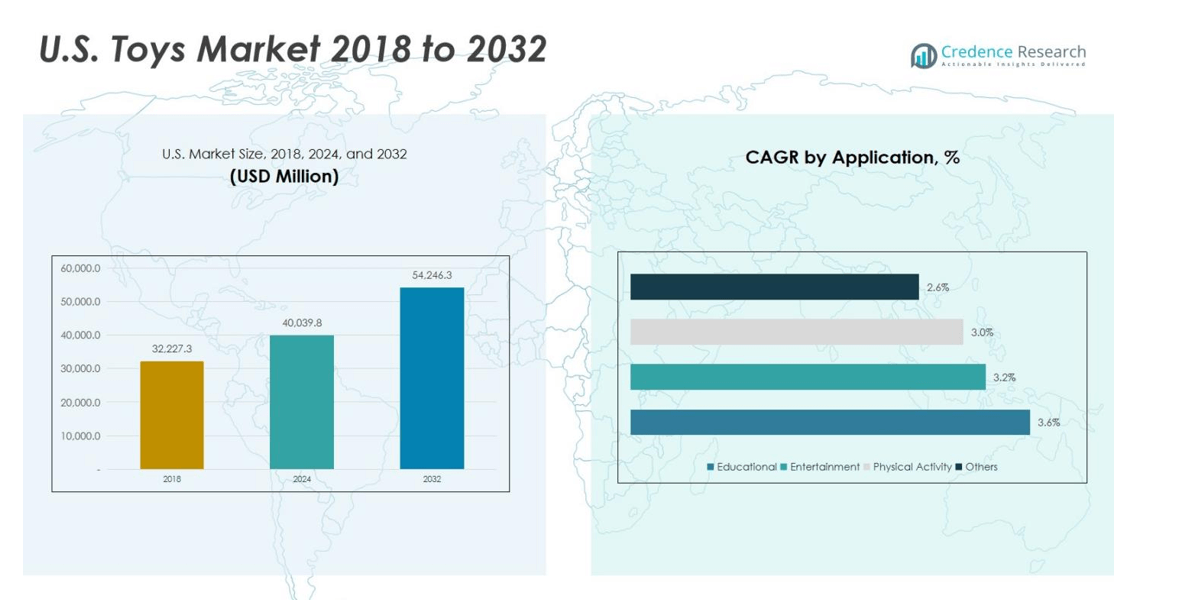

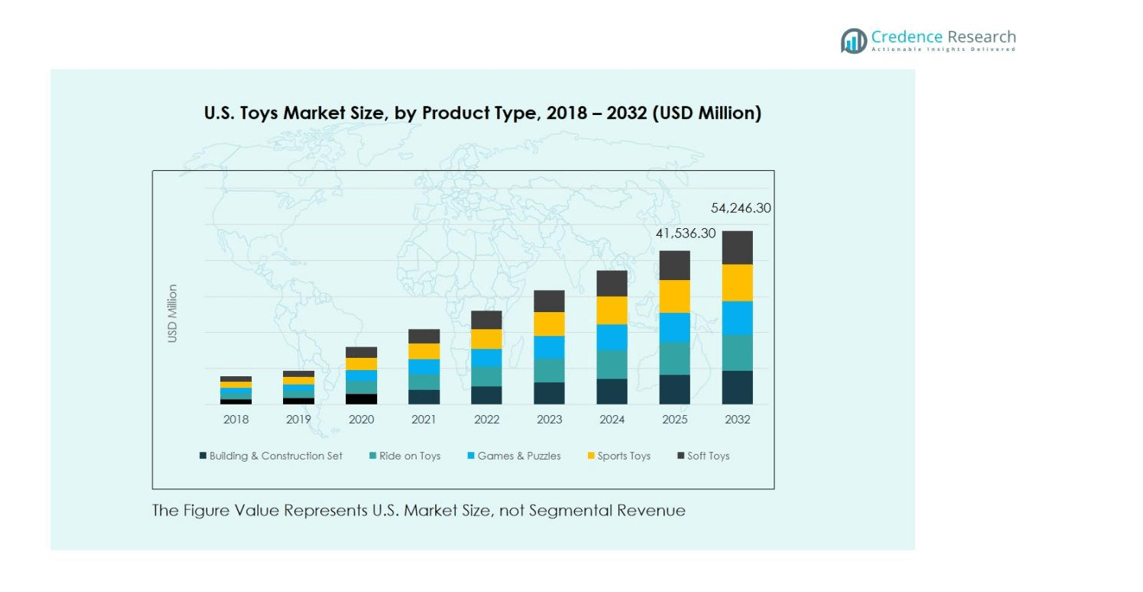

U.S. Toys Market size was valued at USD 32,227.3 Million in 2018, increased to USD 40,039.8 Million in 2024, and is anticipated to reach USD 54,246.3 Million by 2032, at a CAGR of 3.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Toy Market Size 2024 |

USD 40,039.8 Million |

| U.S. Toy Market, CAGR |

3.89% |

| U.S. Toy Market Size 2032 |

USD 54,246.3 Million |

The U.S. Toys Market is shaped by prominent players such as Mattel Inc., Hasbro Inc., LEGO Group, JAKKS Pacific Inc., Bandai Namco, and Funko Inc., each strengthening their presence through licensed merchandise, digital-interactive toys, and continuous product innovation. These companies leverage strong brand recognition and extensive retail partnerships to maintain wide market reach. Regionally, the South region leads the U.S. Toys Market with a 34.2% share, driven by its large population base, high consumer spending, and rapid expansion of online and offline retail channels. Strong demand for entertainment merchandise, outdoor toys, and character-based products further reinforces the South’s dominant position.

Market Insights

- The U.S. Toys Market reached USD 40,039.8 million in 2024 and is projected to grow to USD 54,246.3 million by 2032 at a CAGR of 3.89%, supported by stable demand across key product categories.

- Strong market drivers include rising adoption of STEM-based toys, expanding licensed merchandise, and increased e-commerce penetration that improves accessibility and product variety for consumers nationwide.

- Key trends highlight growing interest in tech-enabled smart toys, sustainable materials, and collectible product lines, while the Games & Puzzles segment leads with a 4% share driven by cognitive-learning demand.

- Major players such as Mattel, Hasbro, LEGO, JAKKS Pacific, Bandai Namco, and Funko strengthen market value through innovation, franchise partnerships, and omnichannel retail strategies.

- Regional analysis shows the South region leading with 34.2%, followed by the Northeast at 23.6%, Midwest at 21.4%, and West at 20.8%, reflecting diverse consumer preferences and strong retail networks across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

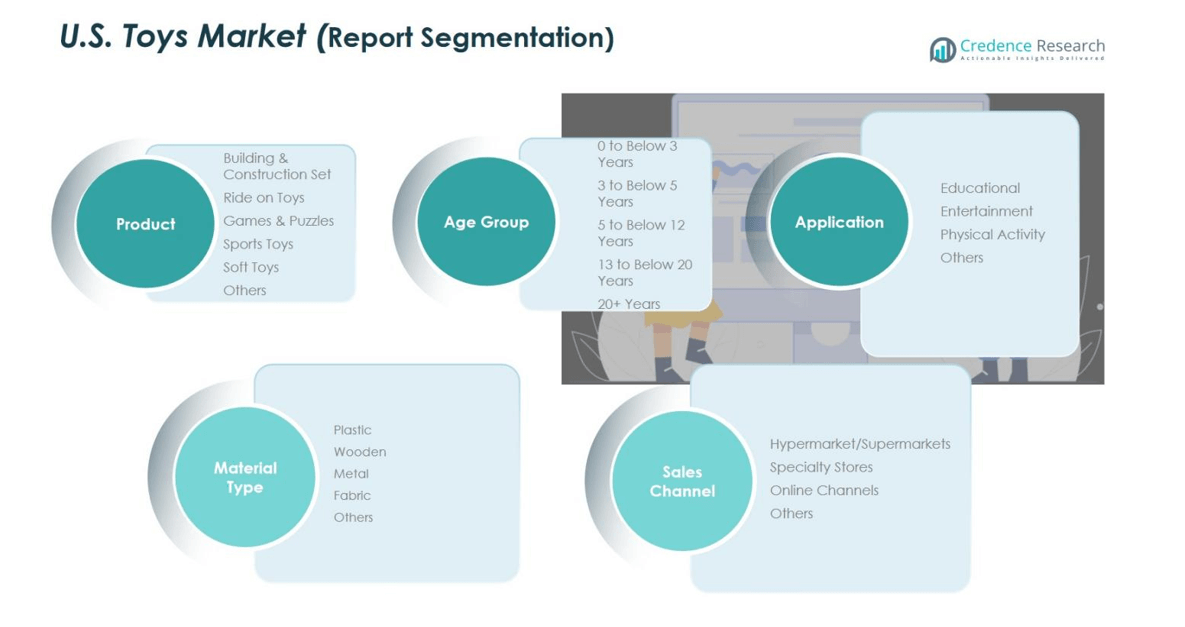

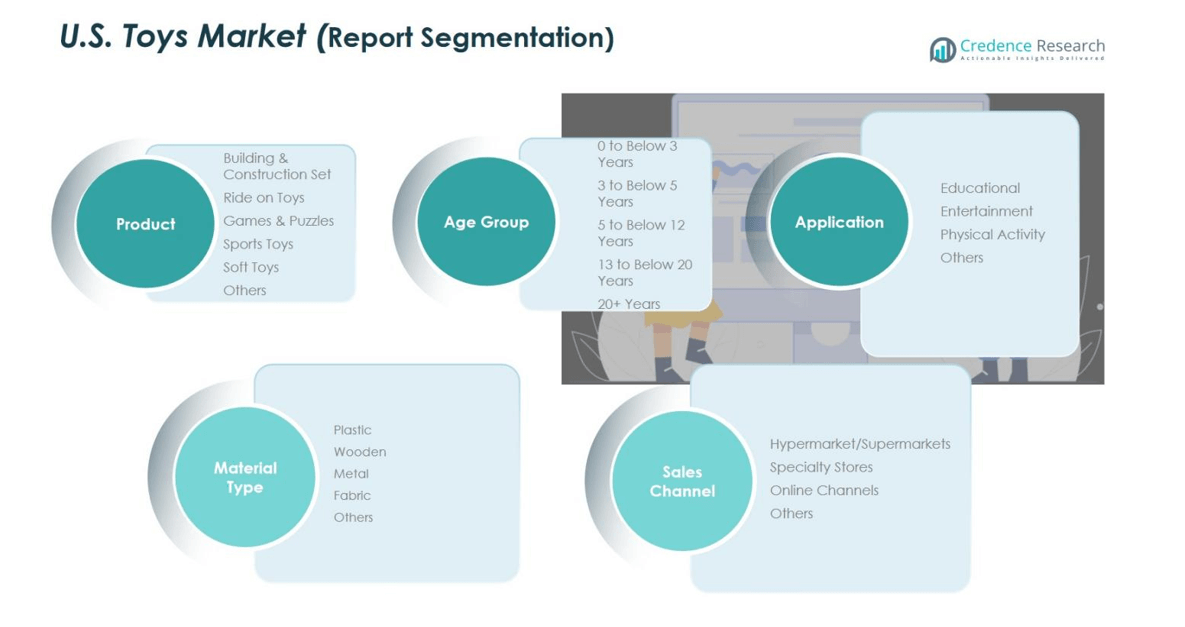

Market Segmentation Analysis:

By Product

The U.S. Toys Market by product is led by Games & Puzzles, which accounted for 28.4% share in 2024, driven by rising demand for cognitive development toys and strong consumer preference for board games, strategy games, and licensed puzzles. Building & Construction Sets hold a significant share as STEM-focused play continues to expand. Ride-on Toys and Sports Toys benefit from increased emphasis on physical engagement, while Soft Toys retain steady demand across younger age groups. Other toy categories also contribute to market expansion through innovative designs, collectible themes, and character-driven product launches.

- For instance, Ride-on Toys are benefiting from innovations such as battery-powered electric models with Bluetooth connectivity, as seen in Fisher-Price’s latest ride-on lineup, which emphasizes active play and safety.

By Age Group

In the U.S. Toys Market, the 5 to Below 11 Years group dominated with 36.7% share in 2024, supported by high demand for educational kits, construction sets, board games, and digital-interactive toys. This segment benefits from increased parental spending on cognitive skill development and enrichment-based play. The 0 to Below 3 Years group follows with strong uptake of soft toys and sensory products, while the 3 to Below 5 Years category grows with preschool learning aids. Pre-teen and adult segments also contribute through collectibles, hobby kits, and licensed franchise-driven purchases.

- For instance, leading retailers and reviewers consistently highlight products such as Fisher‑Price interactive playmats and Bright Starts light‑up sensory spinners as top-rated infant toys that support early motor, visual, and auditory skills for babies under 2 years.

By Application

The U.S. Toys Market by application is dominated by the Entertainment segment, which captured 52.1% share in 2024 due to strong consumer preference for character-based toys, interactive game sets, and franchise merchandise. Entertainment-focused products remain central to overall toy spending, supported by movie tie-ins, digital gaming influence, and collectible culture. Educational toys continue to expand with rising demand for STEM kits and early-learning products, while Physical Activity toys gain traction through outdoor play items and sports sets. Other applications add value through novelty items, fidget toys, and themed lifestyle toys.

Key Growth Drivers

Rising Demand for Educational and STEM-Based Toys

The U.S. Toys Market experiences strong growth driven by the increasing adoption of educational and STEM-focused toys that support cognitive development and skill-building. Parents actively prioritize learning-based play to enhance problem-solving, creativity, and early literacy, leading to rising demand for construction sets, coding kits, and science models. Schools and learning centers also integrate STEM toys into structured programs, further reinforcing market expansion. Continuous innovation, coupled with the integration of interactive components and age-specific learning modules, strengthens this segment’s long-term growth outlook across diverse consumer groups.

- For instance, schools and learning centers increasingly use STEM toys like Sphero robots and Thames & Kosmos science kits within structured programs to enhance problem-solving and creativity in students.

Expansion of Licensed and Franchise-Based Toy Lines

Licensed toys remain a powerful driver of U.S. market growth, supported by blockbuster movies, streaming content, gaming franchises, and global entertainment characters. Toy manufacturers benefit significantly from the strong influence of media-driven storytelling, which boosts demand for action figures, collectibles, and themed merchandise. Frequent releases from major studios sustain product refresh cycles throughout the year, encouraging repeat purchases. Collaborations between toy brands and digital platforms further accelerate the appeal of character-centric products, contributing to stable revenue streams and heightened brand engagement across multiple consumer demographics.

- For instance, Mattel’s renewed multi‑year global licensing agreement with Disney for Disney Princess and Frozen gives it continuing rights to develop fashion dolls and figures tied to upcoming content such as Frozen 3, ensuring a pipeline of refreshed character toys aligned with major releases.

Growing Popularity of E-Commerce and Omnichannel Retailing

The rise of e-commerce and omnichannel strategies significantly boosts the U.S. Toys Market by enhancing accessibility, product visibility, and consumer convenience. Online platforms offer extensive product selections, competitive pricing, and personalized recommendations that drive purchasing decisions across all age groups. Retailers increasingly adopt hybrid models that integrate digital browsing with in-store pickups, creating seamless shopping experiences. Seasonal promotions, influencer-driven marketing, and subscription-based toy boxes elevate demand further. Enhanced logistics networks and rapid delivery infrastructure continue supporting strong online sales momentum within the U.S. market.

Key Trends & Opportunities

Integration of Smart and Interactive Technology in Toys

A major trend shaping the U.S. Toys Market is the rapid integration of technology, including AI-enabled toys, app-connected devices, augmented reality features, and interactive learning systems. Parents and children increasingly prefer toys that combine entertainment with digital engagement, fostering immersive learning and advanced play experiences. Companies are leveraging sensors, voice interaction, and educational analytics to differentiate offerings and expand product portfolios. This trend opens significant growth opportunities for innovative startups and leading brands focused on blending physical play with digital capabilities, particularly within gaming and STEM categories.

- For instance, WowWee has developed the Dog-E robot dog, an app-connected toy that uses sensors and AI to mimic real dog behaviors, including movement, sounds, and interactive play.

Rising Demand for Sustainable and Eco-Friendly Toy Materials

Sustainability presents a strong opportunity as U.S. consumers actively seek toys made from recycled plastics, organic fabrics, biodegradable materials, and sustainably sourced wood. Environmentally conscious purchasing increases across both premium and mass-market segments, driven by growing awareness of product safety and environmental impact. Manufacturers respond by redesigning packaging, adopting green production techniques, and introducing eco-certified toy lines. Retailers also prioritize eco-friendly assortments, expanding shelf space for sustainable categories. This shift positions environmentally responsible brands for accelerated growth and long-term competitive differentiation.

- For instance, Melissa & Doug is the first global toy brand to be 100% carbon neutral in its own operations. It ensures 100% of paper products and over half of its wood products are FSC-certified, with plans to reach 95% curbside recyclable packaging by 2025.

Key Challenges

Stringent Safety Regulations and Compliance Requirements

The U.S. Toys Market faces significant challenges due to strict safety regulations, testing protocols, and compliance mandates that manufacturers must follow before product commercialization. Requirements related to choking hazards, chemical composition, material quality, and labeling increase production complexity and compliance costs. Smaller manufacturers struggle to manage certification expenses and documentation, which can delay product launches. Regulatory updates also demand continuous process adjustments, adding operational burden. While essential for consumer protection, these standards require consistent investment in quality control and manufacturing precision across the supply chain.

Intensifying Competition and Pricing Pressure

The U.S. Toys Market undergoes rising competitive pressure as global brands, local manufacturers, and digital-native companies compete for market share. The presence of low-cost imports heightens price sensitivity, forcing established players to balance innovation with cost efficiency. Frequent discounting across e-commerce platforms compresses margins, making profitability more challenging during off-season periods. Rapid product turnover and short-lived trends further complicate inventory management. To remain competitive, manufacturers must invest in product differentiation, licensing agreements, and technology-driven enhancements while navigating increasingly constrained pricing environments.

Regional Analysis

Northeast Region

The Northeast region holds 23.6% share of the U.S. Toys Market, supported by strong consumer spending, high urban concentration, and a well-developed specialty retail landscape. States such as New York, Massachusetts, and New Jersey drive demand through a mix of premium educational toys, STEM kits, licensed collectibles, and early-learning products. The region benefits from affluent households and strong adoption of eco-friendly and tech-enabled toys. Online retail penetration remains high, further boosting category diversity and accessibility. Seasonal purchases surge during major holidays, reinforcing the Northeast as a key revenue-generating market.

Midwest Region

The Midwest accounts for 21.4% share of the U.S. Toys Market, driven by strong household participation in traditional play categories such as sports toys, construction sets, outdoor toys, and board games. Family-centric lifestyles and high demand for learning-oriented toys contribute to steady growth across states like Illinois, Ohio, and Michigan. Retail chains and hypermarkets remain key distribution channels in the region, supported by expanding e-commerce penetration. Manufacturers benefit from stable consumer loyalty toward value-driven products, while rising interest in STEM and educational play continues to strengthen market performance across Midwestern households.

South Region

The South region leads the U.S. Toys Market with 34.2% share, supported by its large population base, rising disposable incomes, and strong retail expansion across states including Texas, Florida, and Georgia. Demand remains robust for outdoor toys, ride-on models, entertainment merchandise, and character-based products driven by media influence. The region shows rapid e-commerce growth, with consumers actively purchasing toys through online channels during seasonal and promotional events. Growing urbanization and demographic diversity further boost consumption patterns, making the South the most dominant and fastest-expanding regional market within the United States.

West Region

The West holds 20.8% share of the U.S. Toys Market, shaped by strong preference for innovative, tech-enabled, and eco-friendly toy categories. States such as California, Washington, and Colorado drive high demand for smart toys, interactive gaming sets, sustainable materials, and collectibles linked to entertainment franchises. The region benefits from a strong concentration of tech-savvy consumers and high adoption of premium, design-driven products. Online marketplaces dominate distribution, supported by rapid fulfillment infrastructure. The West also experiences strong year-round demand from tourism and theme-park-linked merchandise, further strengthening regional market performance.

Market Segmentations:

By Product

- Building & Construction Set

- Ride-on Toys

- Games & Puzzles

- Sports Toys

- Soft Toys

- Others

By Age Group

- 0 to Below 3 Years

- 3 to Below 5 Years

- 5 to Below 11 Years

- 12 to Below 20 Years

- 20+ Years

By Application

- Educational

- Entertainment

- Physical Activity

- Others

By Material Type

- Plastic

- Wooden

- Metal

- Fabric

- Others

By Sales Channel

- Hypermarkets / Supermarkets

- Specialty Stores

- Online Channels

- Others

By Geography

- Northeast Region

- Midwest Region

- South Region

- West Region

Competitive Landscape

Competitive landscape in the U.S. Toys Market is defined by leading players such as Mattel Inc., Hasbro Inc., LEGO Group, JAKKS Pacific Inc., Bandai Namco, Funko Inc., and Clementoni S.p.A., each competing through innovation, licensing partnerships, and diversified product portfolios. The market exhibits strong competition driven by rapid product refresh cycles, franchise-based merchandise, and technology-integrated toys that appeal to digitally engaged consumers. Companies invest heavily in character licensing agreements with major entertainment studios to strengthen brand presence and capture demand surges linked to movie releases and streaming content. Sustainability-focused product development, expansion of STEM and educational toy lines, and growing omnichannel retail strategies further shape the competitive environment. E-commerce platforms intensify rivalry by fostering price transparency and accelerating product comparison, compelling manufacturers to differentiate through quality, safety compliance, and interactive features. Smaller niche brands also gain traction by targeting eco-friendly, sensory, and artisanal toy categories, contributing to a dynamic and evolving competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Mattel Inc. announced the launch of the UNO Elite™ Formula 1® 2025 Core Edition Starter Pack and Booster Set featuring licensed elements from the Formula 1® teams.

- In March 2025, Bandai Namco Toys & Collectibles America Inc. announced a four-year partnership with Angel City FC, launching a limited-edition co-branded Tamagotchi device available March 16.

- In September 2025, Hasbro Inc. and Disney Consumer Products announced a multi-year, multi-property collaboration to bring licensed PLAY-DOH products under Disney brands to market.

Report Coverage

The research report offers an in-depth analysis based on Product, Age group, Application, Material Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Toys Market will see continued growth driven by rising demand for educational and STEM-focused products.

- Digital integration in toys will expand as smart, app-connected, and interactive solutions gain stronger consumer acceptance.

- Licensed and franchise-based toys will remain major revenue drivers as entertainment content releases increase.

- Eco-friendly and sustainably produced toys will experience rapid adoption as consumer preference shifts toward green materials.

- E-commerce will further strengthen its position as a primary distribution channel supported by fast delivery and broader assortment.

- Collectibles and hobby-based toys will grow as adult consumers increasingly engage in nostalgia-driven purchases.

- Physical activity and outdoor play categories will expand as parents prioritize active and healthy play.

- Manufacturers will invest more in personalization and limited-edition product lines to enhance brand differentiation.

- Retailers will adopt omnichannel strategies to improve customer experience and inventory efficiency.

- Compliance with safety standards will remain a priority, encouraging companies to enhance quality control and testing.