Market Overview

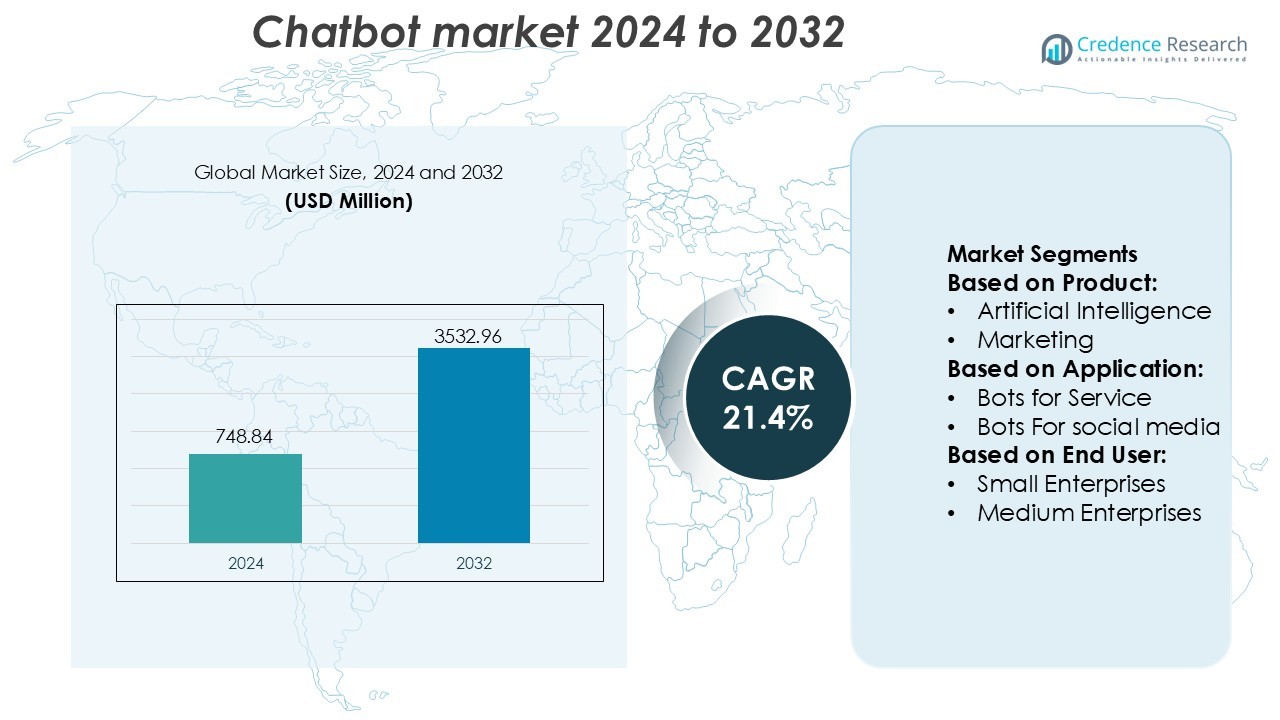

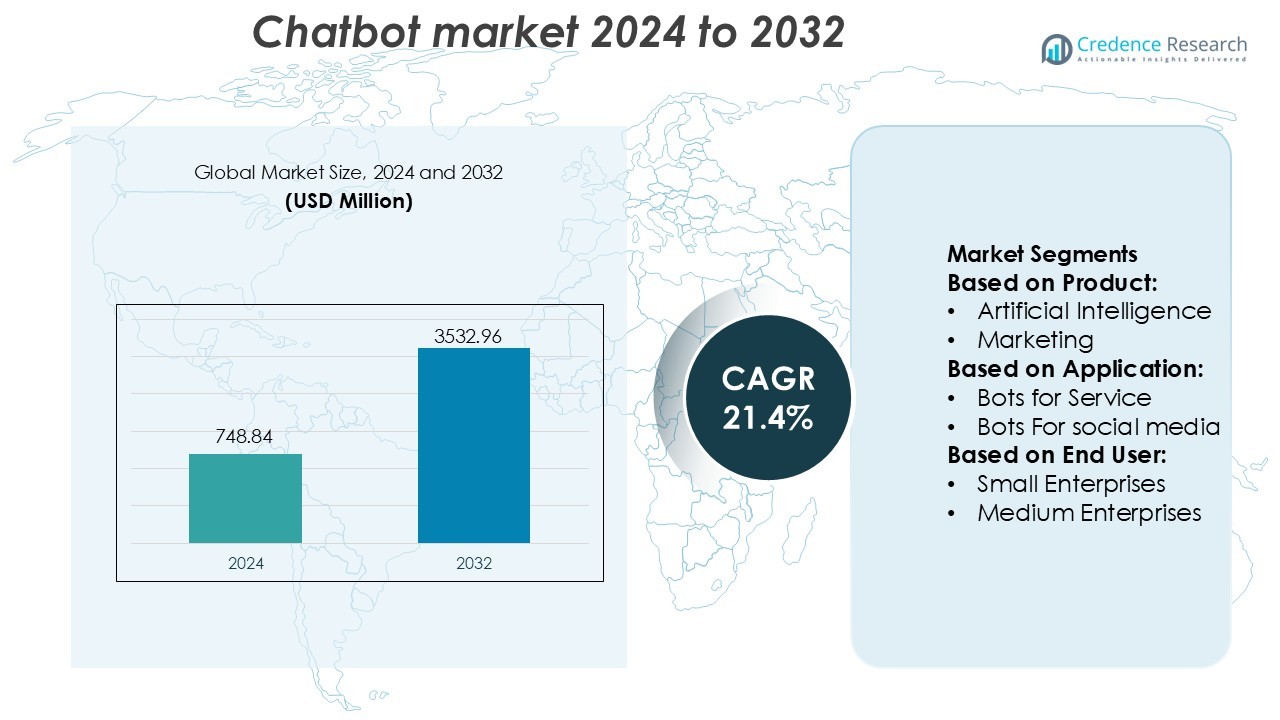

Chatbot market size was valued USD 748.84 million in 2024 and is anticipated to reach USD 3532.96 million by 2032, at a CAGR of 21.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chatbot market Size 2024 |

USD 748.84 Million |

| Chatbot market, CAGR |

21.4% |

| Chatbot market Size 2032 |

USD 3532.96 Million |

The chatbot market includes strong competition among major technology vendors and specialized AI platform providers. Companies expand their offerings with conversational AI, automated workflows, CRM integration, and multilingual capabilities to support large-scale enterprise deployment. North America holds the leading position with a 36% market share, driven by rapid adoption of AI-enabled customer service and strong investments in cloud infrastructure. Enterprises in retail, banking, telecom, and healthcare continue to adopt chatbots to reduce service costs and enhance customer engagement. Continuous platform innovation, voice support, and sentiment analysis strengthen market growth and maintain competitive momentum across the region.

Market Insights

- The chatbot market was valued at USD 748.84 million in 2024 and is projected to reach USD 3532.96 million by 2032, growing at a CAGR of 21.4%.

- Rising demand for automated customer service drives adoption across retail, banking, telecom, and healthcare, as enterprises use chatbots to reduce support costs and improve response time.

- Voice-enabled chatbots, multilingual support, and integration with CRM and cloud platforms represent strong market trends that enhance personalization and scalability for large deployments.

- The market remains competitive as vendors focus on conversational AI, automated workflows, sentiment analysis, and hybrid bots that combine human and machine interaction, while data security and complex query handling continue to challenge adoption.

- North America leads with 36% market share due to strong cloud investment and early AI adoption, while AI-based chatbots dominate product segmentation with the largest share as enterprises prioritize automation and real-time learning for customer engagement.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Artificial intelligence-based chatbots hold the dominant share at 62% due to strong NLP engines, automated responses, and real-time learning. Companies adopt AI bots to reduce support costs and improve customer experience at scale. These platforms analyze user intent, personalize recommendations, and resolve queries without human intervention. Marketing bots support campaign automation, but adoption remains smaller compared to AI bots. Human intelligence-assisted bots gain traction in industries that require complex support, compliance checks, or sensitive issue handling. Rising demand for 24/7 support and multilingual service continues to strengthen AI bot deployment across sectors.

- For instance, Aivo integrated its Engage marketing bot with Movistar’s sales ecosystem, generated over 50,000 automated product recommendations in a single quarter (or three months).

By Application

Bots for service lead the market with a 41% share, driven by their wide use in customer support, FAQs, and troubleshooting across retail, BFSI, telecom, and e-commerce. Enterprises deploy service bots to reduce call center loads and improve response time. Bots for payments and order processing grow steadily as companies integrate secure payment gateways and conversational commerce. Social media bots support brand engagement, while marketing bots automate lead nurturing and campaign responses. The push for frictionless service, faster ticket resolution, and higher customer satisfaction boosts service bot adoption.

- For instance, IBM’s Watson Assistant helped TIM S.A. (Brazil) complete more than 3 million voice interactions using natural-language AI, and achieved a 75% higher call retention rate on that virtual-agent channel versus traditional human service.

By End User

Large enterprises account for 54% share, making them the dominant end user due to high digital transformation budgets and strong AI adoption capacity. They integrate chatbots for sales, customer care, HR, and compliance support across multiple channels. Medium enterprises adopt bots for marketing automation and service operations as cost-effective tools. Small enterprises use entry-level chatbot platforms to handle inquiries and order booking. Large companies drive market growth because automation reduces operational costs, enhances personalization, and supports millions of interactions without human involvement.

Key Growth Drivers

- Increased Demand for Automated Customer Support

Companies deploy chatbots to offer 24/7 service, reduce call center workload, and deliver faster responses across web, mobile, and social platforms. Automated conversations lower operational costs and improve customer satisfaction by resolving routine queries without human agents. Enterprises use AI chatbots for ticket management, returns, troubleshooting, and account queries. Industries such as retail, banking, telecom, and e-commerce drive strong adoption. As customer expectations shift toward instant support, organizations continue to replace traditional support lines with scalable chatbot solutions that enhance service quality and retention.

- For instance, Botsify documented platform processed over 1.9 million automated messages within the documented period. The NLP-based engine handled customer replies efficiently, with documented resolution speeds of under 4 seconds per query.

- Rising Use of Conversational AI and NLP

Advanced NLP models enable chatbots to understand context, intent, and sentiment, resulting in more human-like interactions. Companies integrate conversational AI to personalize recommendations, automate decision-making, and handle complex workflows. Voice-based chatbots grow in popularity as smart speakers and IVR systems embed AI. The ability to learn user behavior and improve responses over time enhances accuracy and engagement. Continuous improvements in machine learning, multilingual processing, and cloud-based AI platforms accelerate enterprise deployment across customer service, healthcare support, fintech, travel, and logistics.

- For instance, Oracle recorded that its Digital Assistant handled more than 35 million monthly conversations across Oracle Fusion Cloud applications, documented in Oracle’s official AI usage report, and delivered automated answers using pretrained industry skills for HR, finance, supply-chain, and CX workflows.

- Growth of E-commerce and Digital Transactions

E-commerce platforms use chatbots to assist with product search, order tracking, refunds, and payment confirmations. Conversational commerce encourages impulse purchases and faster checkout by enabling buyers to shop directly through chat interfaces. Online stores integrate bots with payment gateways and loyalty programs to support repeat sales. As digital payments rise, businesses automate customer verification and billing support. Retailers rely on chatbots to manage seasonal surges during peak shopping periods. The push for seamless shopping experiences and lower customer acquisition costs continues to fuel demand for AI-driven commerce assistants.

Key Trends & Opportunities

- Multilingual and Voice-Enabled Chatbots

Businesses expand global operations and require multilingual bots that support regional languages. Voice-enabled chatbots gain traction across BFSI, healthcare, travel, and automotive sectors as users prefer hands-free interactions. These systems improve accessibility for senior users and people with disabilities. Smart speakers, IVR upgrades, and voice-controlled apps widen deployment opportunities. Companies adopt speech recognition and sentiment analysis to improve accuracy. The trend strengthens market opportunities for vendors offering localized language models and domain-trained speech AI.

- For instance, Microsoft confirmed that Azure AI Speech supports more than 400 neural voices across over 140 languages and variants, and processes speech at real-time latency below 300 milliseconds, according to Microsoft’s Azure Speech technical benchmark.

- Integration with CRM, ERP, and Cloud Platforms

Enterprises link chatbots with CRM and ERP systems to automate data entry, lead qualification, employee queries, and inventory updates. Cloud-hosted chatbot platforms reduce IT complexity and speed up deployment across multiple channels. Integration enables real-time customer insights, predictive recommendations, and automated workflows. Industries use bots to streamline HR requests, onboarding, and internal helpdesks. Vendors partner with SaaS providers to offer plug-and-play chatbot modules for small and medium enterprises. This trend supports deeper automation and data-driven decision-making.

- For instance, Google Cloud’s Contact Center AI (CCAI) achieved a 60% deflection rate for inbound customer calls for a major national banking organization within the first month of deployment.

Key Challenges

- Complex Query Handling and Context Retention

Basic rule-based chatbots struggle with complex questions or multi-step conversations. Customers often switch to human agents when chatbots misunderstand intent or fail to recall previous messages. Enterprises must invest in advanced NLP, sentiment analysis, and continuous training to improve accuracy. Poor conversational flow can reduce customer trust and satisfaction. Businesses face challenges in training chatbots for industry-specific vocabulary such as medical terms, banking compliance, or legal language, slowing adoption in specialized sectors.

- Data Privacy, Security, and Compliance Risks

Chatbots process sensitive customer data, including personal details, banking information, and authentication codes. Weak encryption or flawed API integration can expose data to cyberattacks. Enterprises must comply with strict data regulations such as GDPR, PCI-DSS, and banking security standards. Maintaining data transparency and securing cloud-based chatbot platforms increases IT workload and cost. Any breach can impact brand reputation. Security concerns continue to challenge deployment in financial institutions, government services, and healthcare.

Regional Analysis

North America

North America holds the largest share at 36% due to strong investment in AI and automation across retail, BFSI, healthcare, and telecom. Enterprises adopt chatbots to cut service costs, manage high customer volumes, and support omnichannel platforms. The United States leads due to early cloud adoption and the presence of major AI vendors. Companies integrate chatbots with CRM, payments, and marketing tools to boost customer engagement and sales. High consumer preference for digital self-service and rapid growth in conversational commerce continue to expand chatbot implementation across both large enterprises and small businesses.

Europe

Europe accounts for a 27% share, driven by strong e-commerce activity, multilingual customer engagement, and early GDPR-compliant chatbot deployments. Retailers, banks, airlines, and consumer brands use chatbots to automate customer support and improve online shopping experiences. The United Kingdom, Germany, France, and the Netherlands lead adoption because of advanced digital infrastructure. Voice-based bots and conversational AI platforms gain traction in automotive and travel sectors. Regional demand continues to grow as enterprises modernize service channels and integrate AI-driven virtual assistants into websites, apps, messaging platforms, and contact centers.

Asia-Pacific

Asia-Pacific holds a fast-growing 25% share, supported by expanding internet access, mobile commerce, and digital payments. China, India, Japan, and South Korea are major adopters as enterprises use chatbots to manage high customer traffic and multilingual support. E-commerce giants integrate conversational commerce for product recommendations, order processing, and smart payments. Banking, education, and healthcare sectors deploy AI bots to improve accessibility and reduce operational load. Startups and SMEs adopt low-cost cloud-based chatbots, creating strong market momentum. Government smart city initiatives and digital transformation programs drive steady expansion.

Latin America

Latin America captures an 8% share as enterprises adopt chatbots for customer service, retail sales, and automated appointments. Brazil and Mexico lead the market due to rising e-commerce transactions and the shift toward digital banking. Businesses deploy chatbots to manage WhatsApp-based customer interactions, a popular communication channel across the region. Telecom and financial service providers adopt AI bots to reduce waiting times and enhance customer satisfaction. Growing smartphone penetration and online retail growth continue to support chatbot demand among regional enterprises and startups.

Middle East & Africa

The Middle East & Africa account for a 4% share, driven by rising digital transformation in BFSI, government services, and telecom. Countries like the UAE, Saudi Arabia, and South Africa advance adoption as enterprises integrate chatbots for e-governance, utilities, transport, and financial services. Banks and telecom operators deploy AI bots to improve self-service platforms and reduce call center traffic. Rapid growth in mobile payments and online retail creates new adoption opportunities. Cloud-based chatbot platforms help small businesses expand customer support without high staffing costs, supporting steady market growth.

Market Segmentations:

By Product:

- Artificial Intelligence

- Marketing

By Application:

- Bots for Service

- Bots For social media

By End User:

- Small Enterprises

- Medium Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chatbot market includes major players such as Aivo, IBM Corporation, Botsify Inc, Artificial Solutions, Oracle, Microsoft, Creative Virtual Ltd., Google, AWS, and Acuvate. The chatbot market features strong innovation, rapid platform upgrades, and intense focus on enterprise automation. Vendors differentiate through conversational AI, multilingual NLP models, voice support, and integration with CRM, ERP, and cloud systems. Competitive strategies revolve around scalable deployments, domain-trained bots, and advanced analytics for real-time decision-making. Many providers offer no-code or low-code platforms, allowing non-technical teams to build and customize chatbots for customer service, sales, and marketing. Pricing flexibility, API ecosystems, and industry-specific templates increase adoption across retail, BFSI, healthcare, telecom, and e-commerce. Companies also prioritize sentiment analysis, omnichannel experience, and data security to improve customer trust. Continuous improvements in machine learning, predictive responses, and autonomous decision-making strengthen the competitive environment and push vendors toward higher accuracy, faster resolutions, and richer personalization.

Key Player Analysis

- Aivo

- IBM Corporation

- Botsify Inc

- Artificial Solutions

- Oracle

- Microsoft

- Creative Virtual Ltd.

- Google

- AWS

- Acuvate

Recent Developments

- In October 2025, IBM Corporation announced several new AI assistant innovations, including watsonx Assistant for Z, which supports mainframe teams with generative AI and automation. New features in watsonx Orchestrate, watsonx Assistant, and watsonx Code Assistant for Z aim to improve enterprise productivity by automating workflows and providing conversational search capabilities.

- In August 2025, Oracle deployed OpenAI GPT-5 across its database and SaaS applications portfolio, including Oracle Fusion Cloud Applications and NetSuite. This enables customers to leverage advanced GPT-5 capabilities for sophisticated coding, reasoning, and conversational AI in enterprise workflows.

- In April 2025, Deepgram published its State of Voice AI 2025 report, showing 97% corporate voice-tech adoption and 84% planned budget increases, signaling voice-chat convergence.

- In 2025, Creative Virtual promotes its next-generation V-Person technology suite with V-Studio for personalized conversational AI, V-Intelligence, and chatbots/virtual agents available in over 43 languages.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered chatbots will expand as enterprises modernize customer service.

- Voice-enabled and multilingual bots will support wider user accessibility.

- Integration with CRM and ERP platforms will streamline data-driven decision-making.

- Conversational commerce will grow as e-commerce uses chatbots for sales and payments.

- Healthcare, banking, and telecom will increase deployment for secure self-service.

- No-code chatbot platforms will help small businesses automate support at lower cost.

- Sentiment analysis and emotion recognition will improve response accuracy and personalization.

- Hybrid chatbots will combine AI with human assistance for complex interactions.

- Cloud-based chatbot solutions will advance scalability and cross-platform experience.

- Automation and AI training will reduce dependence on human agents and shorten response time.