| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI in Fintech Market Size 2024 |

USD 11,091.12 million |

| AI in Fintech Market, CAGR |

18.58% |

| AI in Fintech Market Size 2032 |

USD 47,446.74 million |

Market Overview:

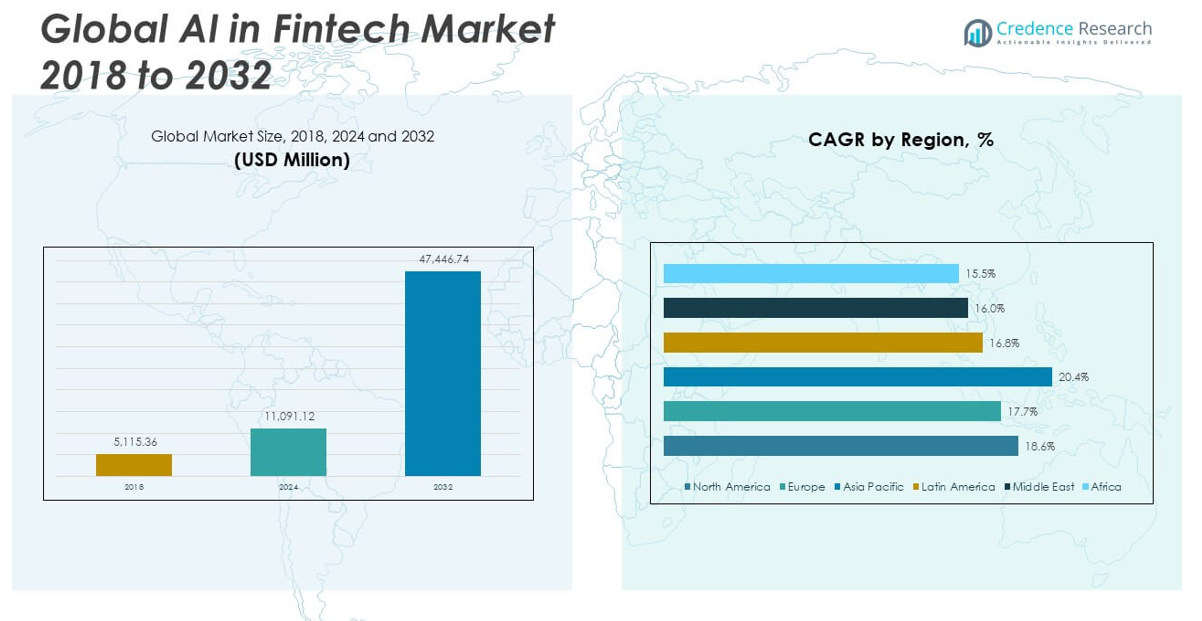

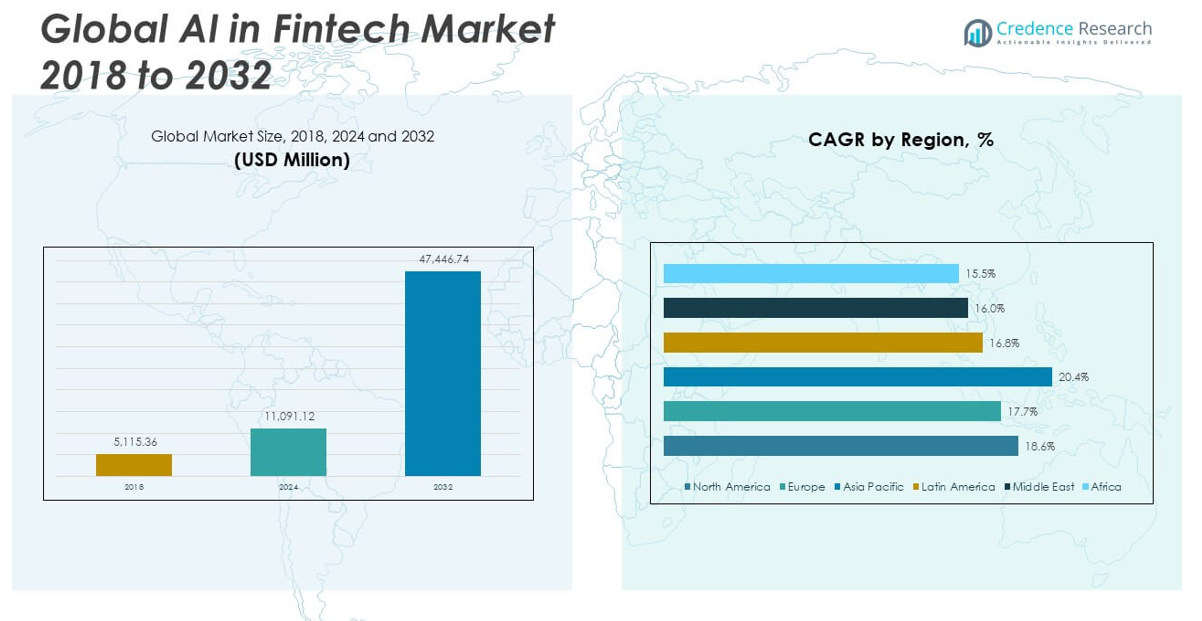

The Global AI in Fintech Market size was valued at USD 5,115.36 million in 2018 to USD 11,091.12 million in 2024 and is anticipated to reach USD 47,446.74 million by 2032, at a CAGR of 18.58% during the forecast period.

The growth of the AI in fintech market is primarily driven by several factors that are transforming the financial services industry. One of the key drivers is the increasing need for enhanced fraud detection and risk management. AI technologies can analyze large datasets in real-time, enabling financial institutions to identify potential fraudulent activities and assess risks more accurately, which helps mitigate financial losses. Another significant driver is the rising demand for improved customer experiences. AI-powered solutions like chatbots and virtual assistants offer personalized services, enhancing customer engagement and satisfaction. Additionally, AI’s ability to automate repetitive tasks is driving operational efficiency in financial institutions. By reducing the need for manual intervention, AI helps streamline processes, cut operational costs, and minimize errors. Furthermore, AI’s data-driven capabilities enable better decision-making by providing actionable insights through predictive analytics, allowing financial organizations to improve their services and optimize business strategies.

The global AI in fintech market is geographically diverse, with each region contributing uniquely to its growth. North America holds the largest share of the market, driven by the strong presence of financial giants and early adoption of AI technologies in the banking, insurance, and investment sectors. The U.S. has established itself as a key hub for fintech innovation, with numerous startups and tech companies working on AI-driven financial solutions. Europe, particularly the UK, follows closely behind as a significant player, with financial institutions focusing heavily on AI for fraud prevention, compliance, and customer support. The European market benefits from favorable regulatory environments and significant investments in AI research and development. In the Asia-Pacific region, the rapid digitalization of financial services in countries like India and China is propelling the adoption of AI in fintech. Latin America and the Middle East & Africa are emerging markets where AI adoption is gaining momentum, fueled by the need for improved financial inclusion and the digitization of banking services.

Market Insigh

- The Global AI in Fintech Market was valued at USD 5,115.36 million in 2018 and is expected to reach USD 47,446.74 million by 2032, growing at a CAGR of 18.58%.

- Fraud detection is one of the primary drivers, with AI technologies allowing financial institutions to analyze large datasets in real-time to identify patterns and prevent fraudulent activities.

- Customer experience personalization is a key trend, with AI-powered chatbots and virtual assistants offering tailored financial advice, enhancing customer satisfaction and fostering loyalty.

- Automation of routine tasks, such as data entry and transaction processing, is reducing operational costs and increasing efficiency within financial institutions.

- Data-driven decision-making using AI is enabling better predictions, trend analysis, and strategic planning, helping financial companies stay competitive in a dynamic market.

- Data privacy and security concerns present challenges, as AI systems rely on vast amounts of sensitive data, creating potential risks for data breaches and cyberattacks.

- Integration with legacy systems remains a barrier, as many financial institutions still operate outdated infrastructure, requiring significant investments to implement AI effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Enhanced Fraud Detection and Risk Management in the Global AI in Fintech Market

Fraud detection and risk management are among the primary drivers propelling the growth of the Global AI in Fintech Market. Financial institutions are increasingly relying on AI to analyze vast amounts of data in real time, enabling them to identify patterns and detect fraudulent transactions with greater accuracy. AI algorithms can learn from historical data and improve over time, providing enhanced security measures that reduce the likelihood of fraud. It also improves the process of assessing risk, allowing for more accurate evaluations of creditworthiness, insurance claims, and other financial decisions. With growing concerns over cyber threats and financial fraud, AI offers a significant edge by providing faster, more reliable solutions that protect both institutions and their customers.

- For instance, Plaid Signalis a machine-learning risk engine that analyzes over 1,000 data points and more than 60 attributes to assess ACH transaction risk, including both customer-initiated (unauthorized) and bank-initiated returns.

Improved Customer Experience through Personalization

Personalization has become a key focus in the Global AI in Fintech Market, driven by the demand for better customer experiences. AI-driven tools, such as chatbots and virtual assistants, enable financial institutions to offer tailored financial advice and support to customers, addressing their specific needs and preferences. It enhances the overall service experience by ensuring that clients receive prompt, accurate responses to their queries 24/7. By leveraging AI, fintech companies can engage customers in meaningful ways, making interactions more efficient and effective. Personalized services not only improve customer satisfaction but also foster greater loyalty, as customers feel that their unique requirements are being met in a timely manner.

- For instance, Wealthsimple, for instance, achieved a 98% employee adoption ratefor its AI-driven knowledge management system, saving over $1 million annually.

Automation and Operational Efficiency in Financial Institutions

Automation is another significant driver fueling the growth of the Global AI in Fintech Market. Financial institutions are increasingly adopting AI to automate routine tasks that traditionally required manual intervention. AI streamlines operations by performing tasks such as data entry, transaction processing, and report generation more efficiently than human employees. It reduces operational costs by eliminating the need for extensive human labor while also minimizing errors. As institutions strive for greater efficiency, AI-powered automation is becoming essential in managing large volumes of transactions and data, ensuring that operations run smoothly and cost-effectively.

Data-Driven Decision Making for Strategic Growth

Data-driven decision-making is crucial for the success of financial institutions, and AI plays a pivotal role in transforming how decisions are made within the Global AI in Fintech Market. AI-powered analytics tools can process vast amounts of financial data to uncover insights that were previously difficult to identify manually. It enables decision-makers to make more informed choices based on predictive models and trends, enhancing strategic planning. By leveraging AI to forecast market shifts, analyze consumer behavior, and optimize resource allocation, fintech companies can stay ahead of the competition. This data-centric approach supports better business strategies, helping companies improve their service offerings and maximize profitability.

Market Trends:

Rising Integration of AI with Blockchain Technology in the Global AI in Fintech Market

One of the notable trends in the Global AI in Fintech Market is the increasing integration of AI with blockchain technology. This combination is revolutionizing the way financial institutions approach security and transparency in transactions. AI enhances blockchain’s capabilities by improving fraud detection, ensuring compliance, and enabling faster processing of blockchain transactions. It also facilitates real-time tracking of assets and more efficient management of smart contracts. The convergence of these two technologies is particularly beneficial for sectors such as banking, insurance, and cross-border payments, where data integrity and operational efficiency are critical. Financial institutions are investing in blockchain-AI solutions to reduce operational risks and enhance customer trust.

AI-Powered Predictive Analytics for Enhanced Financial Forecasting

Predictive analytics driven by AI has become a significant trend within the Global AI in Fintech Market. Financial organizations are leveraging AI to anticipate market movements, forecast consumer behavior, and optimize investment strategies. These predictive models help institutions make proactive decisions based on data-driven insights, reducing uncertainty and enhancing profitability. By processing large datasets from diverse sources, AI algorithms can identify emerging trends, market fluctuations, and potential risks, providing a competitive edge. The ability to predict financial outcomes with a higher degree of accuracy is transforming investment strategies and risk management practices within the fintech sector, ensuring that institutions are prepared for future challenges.

- For instance, BlackRock utilizes AI to analyze over 5,000 earnings call transcripts and 6,000 broker reports daily, significantly enhancing the granularity and timeliness of risk management. AI-driven predictive analytics now enables real-time analysis of thousands of transactions per second for fraud detection, with machine learning models continuously adapting to new fraud patterns and reducing false positives.

Expansion of AI-Based Robotic Process Automation in Financial Services

The adoption of AI-based Robotic Process Automation (RPA) in financial services is another key trend within the Global AI in Fintech Market. RPA uses AI to automate repetitive, time-consuming tasks such as data entry, invoice processing, and regulatory compliance checks. This trend is accelerating as financial organizations aim to improve efficiency, reduce human error, and free up resources for higher-value tasks. AI-powered RPA not only reduces operational costs but also improves the speed and accuracy of routine processes. By automating back-office functions, financial institutions are able to focus on strategic objectives while enhancing overall service delivery and operational agility.

Growing Demand for AI-Driven Wealth Management Solutions

AI-driven wealth management solutions are gaining traction in the Global AI in Fintech Market, particularly as consumer preferences shift towards personalized financial planning. High-net-worth individuals and retail investors alike are increasingly turning to AI-powered platforms that offer customized investment advice based on their financial goals, risk tolerance, and market conditions. These platforms leverage AI to analyze vast amounts of data, allowing them to recommend investment strategies tailored to individual needs. It enhances accessibility by providing personalized wealth management services at a fraction of the cost of traditional financial advisors. The demand for AI-driven wealth management is expected to continue growing as consumers seek smarter, more affordable ways to manage their portfolios.

- For instance, Velexa reports that AI-driven tools have reduced the time spent on client portfolio reviews and consulting by 80%, allowing wealth managers to service more clients without sacrificing quality.

Market Challenges Analysis:

Data Privacy and Security Concerns in the Global AI in Fintech Market

One of the significant challenges facing the Global AI in Fintech Market is the issue of data privacy and security. With financial institutions increasingly relying on AI to process vast amounts of sensitive personal and financial data, the risk of data breaches and cyberattacks has heightened. AI systems often require access to large datasets to function effectively, but this creates vulnerabilities that malicious actors can exploit. Regulatory frameworks such as GDPR and other data protection laws further complicate AI implementation, as institutions must ensure compliance with strict data handling requirements. Balancing the need for data to improve AI accuracy and security is critical, as any lapse could lead to severe consequences, including financial losses and reputational damage. Addressing these concerns requires robust cybersecurity measures and continuous monitoring of AI systems to safeguard sensitive information.

Integration and Legacy System Compatibility in the Global AI in Fintech Market

Another challenge in the Global AI in Fintech Market is the integration of AI technologies with existing legacy systems. Many financial institutions still rely on outdated infrastructure that was not designed to support advanced AI tools. These legacy systems can hinder the smooth implementation of AI, as they often lack the necessary flexibility and scalability to accommodate modern technologies. Furthermore, integrating AI into traditional workflows requires significant investments in infrastructure upgrades and training. This can be a resource-intensive process, especially for smaller institutions that may not have the budget or expertise to make these transitions. Financial institutions must carefully plan and execute their AI adoption strategies to ensure that integration with existing systems is seamless, efficient, and cost-effective.

Market Opportunities:

Expanding AI-Driven Financial Inclusion in the Global AI in Fintech Market

The Global AI in Fintech Market presents significant opportunities for expanding financial inclusion. AI-powered technologies can help bridge the gap between underserved populations and financial services by offering low-cost, scalable solutions. With AI, fintech companies can provide personalized services to individuals who lack access to traditional banking systems, especially in emerging markets. Mobile banking, powered by AI, can reach rural areas, offering services such as microloans, insurance, and payment solutions. These innovations create new avenues for financial institutions to tap into previously overlooked customer segments, enhancing their customer base and revenue potential.

AI for Enhanced Compliance and Regulatory Reporting in the Global AI in Fintech Market

Another opportunity in the Global AI in Fintech Market lies in the increasing demand for AI solutions to streamline compliance and regulatory reporting. Financial institutions face complex regulatory environments and must continuously monitor and report various activities to ensure compliance. AI can automate compliance processes, reduce human error, and ensure timely reporting, thus improving operational efficiency. By integrating AI, fintech companies can avoid costly fines, improve accuracy, and reduce the time spent on compliance tasks. This opportunity is particularly valuable as the regulatory landscape continues to evolve and becomes more demanding, presenting a growing need for AI-powered solutions.

Market Segmentation Analysis:

The Global AI in Fintech Market is segmented into components, deployment models, and applications, each contributing uniquely to its growth.

By Component, the market is divided into Solutions and Services. Solutions, such as AI-powered software and platforms, enable automation, fraud detection, and customer service improvements. Services, including consulting, integration, and maintenance, support the implementation and optimization of AI systems in financial institutions.

- For instance, Mastercard’s AI-powered fraud detection solutionanalyzes over 30 billion transactions annually, resulting in a 50% reduction in fraud rates and saving billions in losses for financial institutions.

By Deployment, the market is categorized into Cloud and On-premise models. Cloud deployment is rapidly gaining traction due to its scalability, flexibility, and cost-effectiveness. It allows financial institutions to leverage AI capabilities without significant infrastructure investments. On-premise deployment, while less common, offers enhanced security and control, making it preferred by organizations with strict data privacy requirements.

By Application, key segments include Virtual Assistant (Chatbots), Business Analytics and Reporting, Customer Behavioral Analytics, Fraud Detection, Quantitative and Asset Management, and Others. Virtual assistants and chatbots are transforming customer service with personalized interactions, while business analytics and reporting help financial firms make data-driven decisions. Customer behavioral analytics and fraud detection solutions improve risk management and enhance security. Quantitative and asset management applications leverage AI for more accurate predictions and optimized portfolio management.

- For example, Tableau (Salesforce)’s AI-driven analytics platformenables financial firms to reduce reporting time and increase data accuracy

Segmentation:

By Component:

By Deployment:

By Application:

- Virtual Assistant (Chatbots)

- Business Analytics and Reporting

- Customer Behavioral Analytics

- Fraud Detection

- Quantitative and Asset Management

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America AI in Fintech Market

The North America AI in Fintech Market size was valued at USD 2,124.61 million in 2018 USD 4,556.29 million in 2024 and is expected to reach USD 19,548.29 million by 2032, growing at a CAGR of 18.6% during the forecast period. North America holds the largest market share in the Global AI in Fintech Market, driven by the region’s early adoption of advanced technologies and the presence of leading financial institutions and technology companies. The U.S. plays a dominant role in shaping market trends, with numerous fintech startups integrating AI into their services to enhance customer experiences, risk management, and fraud detection. The increasing regulatory emphasis on data security and compliance further boosts AI adoption in this sector. The region’s growth is also fueled by high investments in AI research and development, making it a hub for fintech innovation.

Europe AI in Fintech Market

The Europe AI in Fintech Market size was valued at USD 1,522.13 million in 2018 to USD 3,186.84 million in 2024 and is projected to reach USD 12,873.85 million by 2032, with a CAGR of 17.7% during the forecast period. Europe holds a strong position in the market, particularly due to its robust regulatory environment, which encourages the development and adoption of AI technologies in the financial sector. The UK, Germany, and France are the major contributors to the region’s growth, with financial institutions focusing on using AI for fraud prevention, compliance, and customer service. AI adoption is accelerating as financial companies seek to improve operational efficiency and provide personalized services. The region’s regulatory frameworks, such as the GDPR, have also contributed to fostering innovation while ensuring consumer privacy and security.

Asia Pacific AI in Fintech Market

The Asia Pacific AI in Fintech Market size was valued at USD 999.23 million in 2018 to USD 2,345.49 million in 2024 and is expected to reach USD 11,345.23 million by 2032, growing at a CAGR of 20.4% during the forecast period. The region is experiencing rapid growth, driven by the increasing digitalization of financial services in countries like China, India, and Japan. The adoption of AI in fintech is accelerating, with advancements in mobile payments, digital banking, and AI-driven wealth management solutions. The expanding middle class, coupled with the proliferation of smartphones and internet access, is creating new opportunities for AI in financial services. Fintech companies are leveraging AI to enhance customer experiences, streamline operations, and improve financial inclusion, particularly in underserved and rural areas.

Latin America AI in Fintech Market

The Latin America AI in Fintech Market size was valued at USD 242.19 million in 2018 to USD 518.60 million in 2024 and is projected to reach USD 1,964.19 million by 2032, growing at a CAGR of 16.8% during the forecast period. The Latin American market is experiencing significant growth, driven by increasing mobile phone penetration, internet access, and the growing need for financial inclusion. Countries like Brazil and Mexico are leading the adoption of AI technologies, with fintech startups leveraging AI to provide accessible financial services such as digital payments, lending, and micro-insurance. The demand for AI solutions is further supported by the growing fintech ecosystem and regulatory support for digital financial services.

Middle East AI in Fintech Market

The Middle East AI in Fintech Market size was valued at USD 140.42 million in 2018 to USD 277.76 million in 2024 and is expected to reach USD 998.45 million by 2032, growing at a CAGR of 16.0% during the forecast period. The market in the Middle East is growing rapidly, driven by increasing investments in digital transformation and fintech innovation across the region. Countries such as the UAE and Saudi Arabia are investing heavily in AI to modernize their financial systems, enhance customer service, and improve risk management practices. The rise of fintech hubs and government initiatives promoting digital banking solutions is fueling the growth of AI in the financial sector, making it a key area for future development.

Africa AI in Fintech Market

The Africa AI in Fintech Market size was valued at USD 86.78 million in 2018 to USD 206.14 million in 2024 and is anticipated to reach USD 716.73 million by 2032, growing at a CAGR of 15.5% during the forecast period. Africa is witnessing significant growth in AI adoption within fintech, especially in countries like Nigeria, Kenya, and South Africa. The demand for digital financial services is increasing due to higher smartphone penetration, internet access, and the need for improved financial inclusion. AI technologies are being utilized to enhance payment solutions, digital banking, and micro-lending platforms. The growing fintech ecosystem, combined with the need for financial services in underserved populations, is driving the adoption of AI across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Upstart Network, Inc.

- Instructure, Inc.

- Intel

- Google LLC

- Salesforce, Inc.

- International Business Machines Corp. (IBM)

- Microsoft

- Amelia U.S. LLC

- Nuance Communications, Inc.

- com

Competitive Analysis:

The competitive landscape of the Global AI in Fintech Market is characterized by the presence of both established financial institutions and innovative fintech startups. Major players such as IBM, Microsoft, and Google are leveraging AI to enhance their financial solutions, focusing on areas like fraud detection, predictive analytics, and customer service automation. These companies invest heavily in AI research and development to maintain their market leadership. Fintech companies like Square, Stripe, and Ant Group are also emerging as strong competitors, integrating AI into payment processing, digital banking, and lending platforms. These players aim to disrupt traditional financial services by offering more personalized, cost-effective solutions. The market also sees increased collaboration between fintech startups and large tech companies, fostering innovation and accelerating AI adoption. Intense competition is expected to drive continuous advancements in AI technologies, providing significant opportunities for growth and differentiation in the sector.

Recent Developments:

- In May 2025, Upstart announced a significant partnership with Fortress Investment Group, securing a $1.2 billion forward-flow commitment to purchase loans originated through its AI-powered lending platform. This deal, running through March 2026, is a major liquidity boost and diversifies Upstart’s capital sources.

- In May 2025, Google launched the “AI Futures Fund,” a new initiative to invest in AI startups. This fund offers selected startups not only capital but also early access to Google’s AI models, hands-on support from Google’s experts, and credits for Google Cloud services.

Market Concentration & Characteristics:

The Global AI in Fintech Market is moderately concentrated, with a few dominant players leading the market, such as IBM, Microsoft, and Google, alongside a growing number of innovative fintech startups. Large technology companies provide advanced AI solutions that cater to a wide range of financial services, including fraud detection, risk management, and customer service automation. Smaller fintech companies are increasingly disrupting traditional models by offering niche, AI-driven solutions that target specific financial sectors, such as lending or payments. The market is characterized by rapid technological advancements, frequent collaborations, and strategic partnerships between fintech firms and tech giants, fostering innovation. Companies in this space focus on scalability, security, and personalization to meet the evolving needs of financial institutions and their customers, creating a dynamic and competitive market environment. The combination of established players and emerging startups drives continuous growth and innovation within the sector.

Report Coverage:

The research report offers an in-depth analysis based on components, deployment models, and applications. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global AI in Fintech Market is expected to experience significant growth by 2032.

- AI-driven customer personalization will continue to be a key growth factor, enhancing user experience and engagement.

- The integration of AI with blockchain technology will improve security and streamline financial transactions.

- Financial institutions will increasingly adopt AI for risk management and predictive analytics to optimize decision-making.

- Automation through AI will reduce operational costs and improve efficiency in back-office operations.

- AI adoption in wealth management will expand, offering personalized investment solutions to a broader customer base.

- The demand for AI-powered fraud detection and compliance solutions will increase, driven by rising cybersecurity concerns.

- Emerging markets, particularly in Asia-Pacific and Latin America, will see faster AI adoption due to digital transformation.

- Increased regulatory support will foster AI integration in financial services while ensuring data privacy and security.

- Collaboration between fintech startups and large tech companies will drive innovation and accelerate AI implementation across sectors.