| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Healthcare Supply Chain Management Market Size 2023 |

USD 301.33 Million |

| China Healthcare Supply Chain Management Market, CAGR |

14.3% |

| China Healthcare Supply Chain Management Market Size 2032 |

USD 1,001.93 Million |

Market Overview

China Healthcare Supply Chain Management Market size was valued at USD 301.33 million in 2023 and is anticipated to reach USD 1,001.93 million by 2032, at a CAGR of 14.3% during the forecast period (2023-2032).

The China healthcare supply chain management sector is experiencing significant growth driven by key market drivers and emerging trends. The increasing demand for healthcare services, coupled with the nation’s expanding elderly population, is fueling the need for more efficient supply chain systems. Additionally, government policies promoting healthcare reforms and technological advancements, such as the adoption of AI and IoT in logistics, are enhancing operational efficiencies. The shift toward digitalization and automation, alongside a growing emphasis on transparency and regulatory compliance, is transforming supply chain processes. Furthermore, the rising focus on improving the quality of medical products and services is pushing companies to innovate in their supply chain strategies. As China moves towards a more patient-centric healthcare system, these trends are positioning the industry for long-term growth, optimizing delivery times, reducing costs, and improving overall supply chain resilience.

The China Healthcare Supply Chain Management market is witnessing strong growth across key regions, particularly in Eastern and Southern China, where advanced healthcare infrastructure and rapid digital transformation are driving demand for streamlined supply chain solutions. Eastern China, including cities like Shanghai and Beijing, leads in adoption due to the concentration of top-tier hospitals, research centers, and favorable government initiatives supporting healthcare modernization. Southern China is also emerging as a key hub, supported by increasing investments in smart healthcare technologies. The market features a competitive landscape with both global and domestic players contributing to innovation and service delivery. Key players operating in this space include IBM Corporation, SAP SE, Oracle Corporation, Sinopharm, Yusen Logistics, Infor, and UPS Healthcare. These companies are focusing on integrating AI, IoT, and cloud-based platforms to improve supply chain visibility and efficiency. Strategic partnerships and localized solutions are becoming essential as companies aim to address the unique challenges of China’s healthcare sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China Healthcare Supply Chain Management market was valued at USD 301.33 million in 2023 and is projected to reach USD 1,001.93 million by 2032, growing at a CAGR of 14.3%.

- The global healthcare supply chain management market was valued at USD 2,480.91 million in 2023 and is projected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% during the forecast period.

- Rising demand for efficient inventory and logistics solutions across hospitals and pharmacies is boosting market growth.

- Increasing digitalization in the healthcare sector is encouraging the adoption of cloud-based and AI-integrated SCM platforms.

- Leading players such as IBM, SAP, Oracle, and Cardinal Health are expanding their presence in China through partnerships and advanced SCM software offerings.

- High implementation costs and data security concerns may hinder adoption among small and mid-sized healthcare providers.

- Eastern China holds the largest market share due to the presence of major healthcare institutions and strong IT infrastructure.

- The trend towards integrated healthcare systems and real-time data tracking is reshaping the future of healthcare supply chain management in the region.

Report Scope

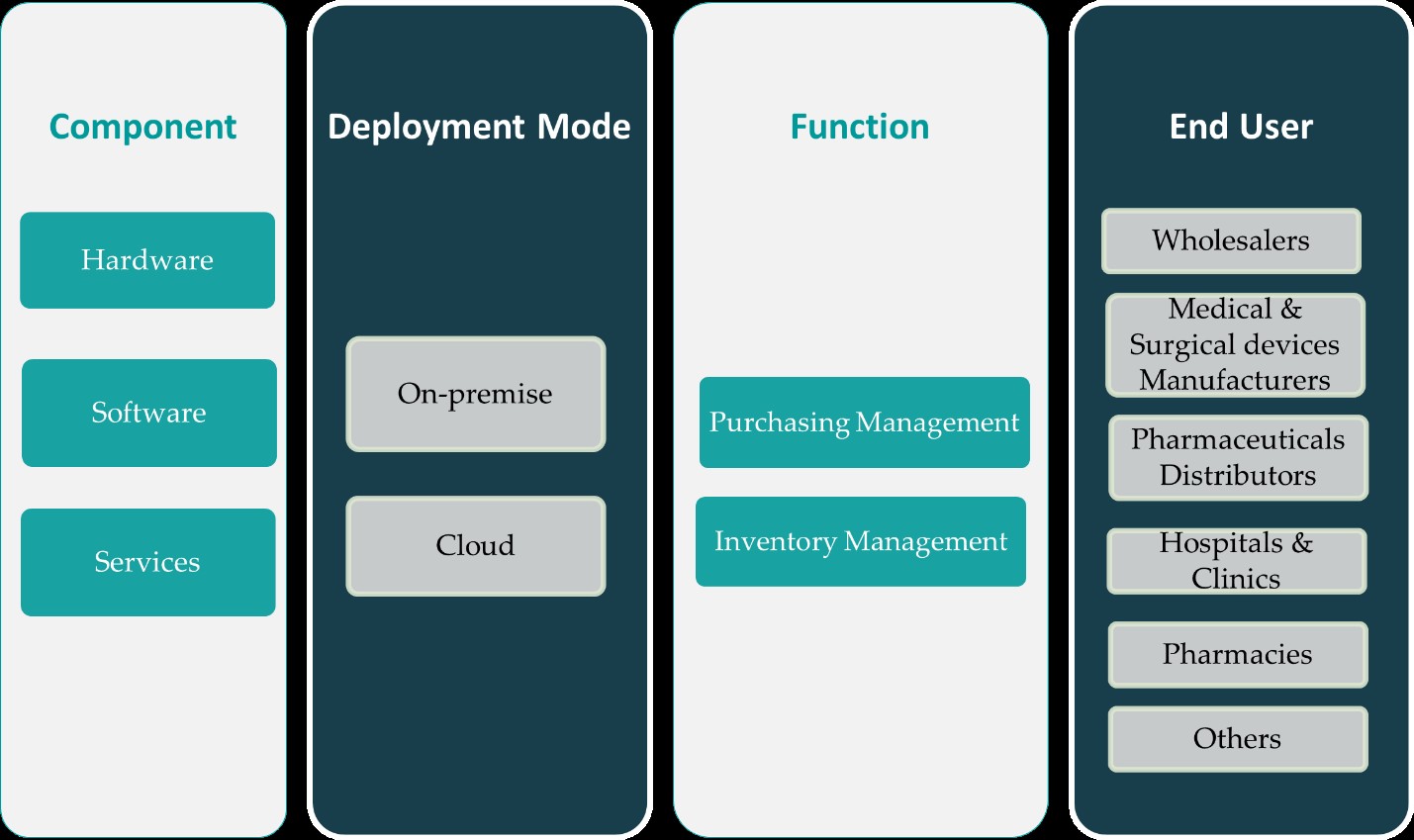

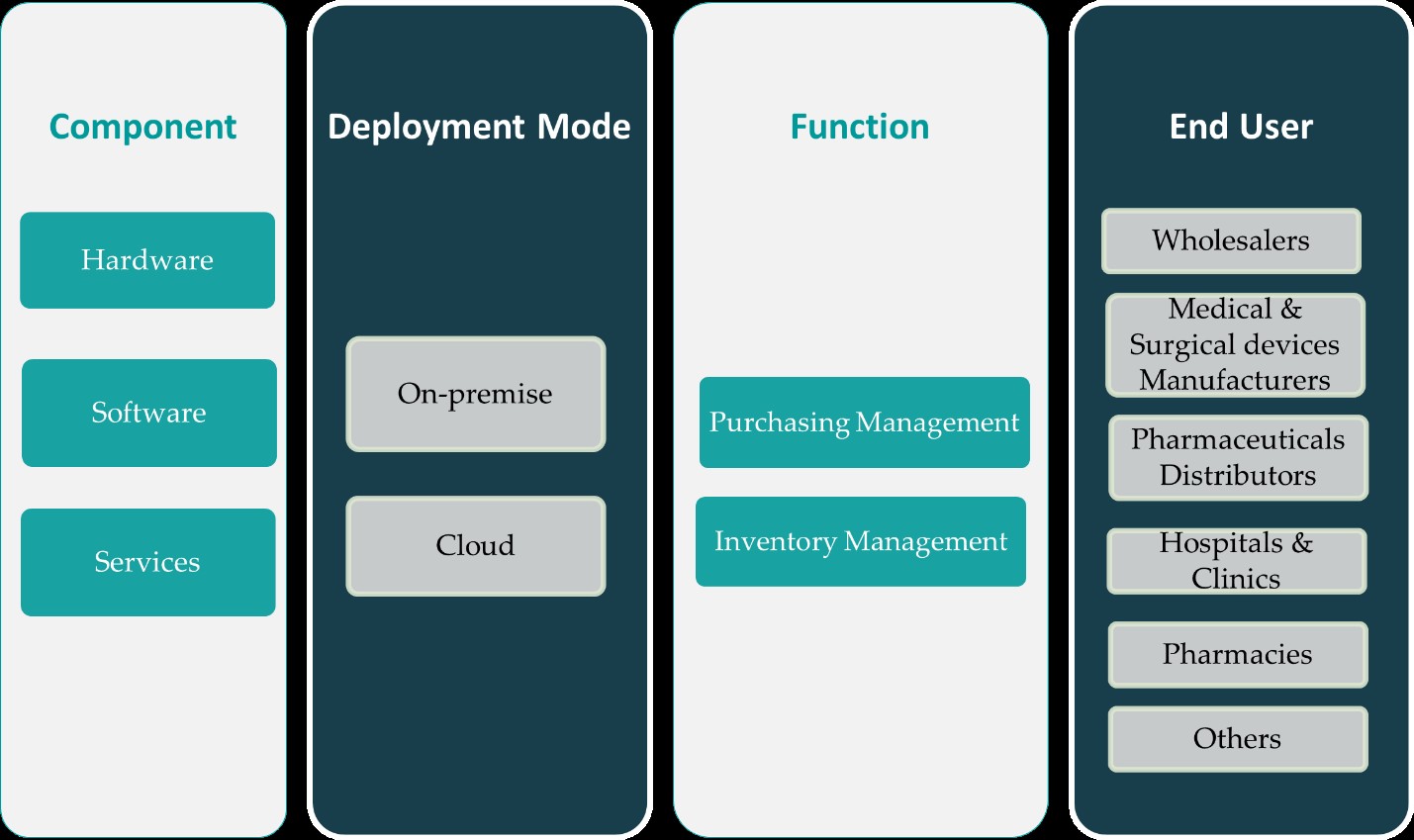

This report segments the China Healthcare Supply Chain Management Market as follows:

Market Drivers

Rising Healthcare Demand

One of the primary drivers of China’s healthcare supply chain management market is the rising demand for healthcare services. China’s rapidly aging population and the increase in chronic diseases are placing greater pressure on the healthcare system to meet the needs of patients. For instance, the Chinese government has reported that the “Healthy China 2030” initiative is addressing the needs of the elderly population by increasing access to medical products and pharmaceuticals. As the elderly population expands, there is a higher demand for medical products, equipment, and pharmaceuticals, creating a need for more efficient supply chain solutions to ensure timely delivery. Additionally, the rising middle class and improved standards of living have contributed to increased healthcare consumption, further driving the demand for healthcare supplies. In response, healthcare providers and suppliers are increasingly focusing on optimizing their supply chains to meet the growing demand for medical services and products.

Technological Advancements and Digital Transformation

Technological advancements, particularly in automation, artificial intelligence (AI), Internet of Things (IoT), and big data analytics, are key drivers of the China healthcare supply chain market. These technologies enable the automation of inventory management, real-time tracking, and enhanced forecasting, which are crucial for managing the complexities of healthcare supply chains. AI-driven predictive analytics allow for more accurate demand forecasting, minimizing stockouts and overstocking. IoT sensors monitor the condition of sensitive medical products during transportation, ensuring product integrity. Furthermore, the integration of blockchain technology improves traceability and transparency, allowing for better compliance with regulatory standards. As China embraces digital transformation, the healthcare supply chain is becoming more efficient, transparent, and adaptable to evolving demands.

Government Healthcare Reforms and Policies

Government policies and healthcare reforms play a pivotal role in shaping the growth of the healthcare supply chain management market in China. For instance, the “Healthy China 2030” initiative and reforms to the public procurement system have been instrumental in modernizing supply chain processes. Efforts to standardize procurement processes, reduce corruption, and increase transparency have led to greater investment in digital solutions and more efficient supply chain management systems. Additionally, initiatives aimed at expanding rural healthcare infrastructure and increasing access to medical supplies in remote areas are also boosting the demand for advanced supply chain solutions. As these policies continue to evolve, they will create new opportunities for innovation and growth within the healthcare supply chain market.

E-commerce and the Shift to Online Platforms

The rise of e-commerce and digital platforms is another significant driver of China’s healthcare supply chain management market. E-commerce platforms are transforming how healthcare products, including pharmaceuticals, medical devices, and over-the-counter drugs, are distributed across the country. Online platforms enable hospitals, clinics, pharmacies, and even consumers to directly order products, reducing the need for traditional intermediaries and enhancing supply chain efficiency. The COVID-19 pandemic further accelerated the adoption of e-commerce in the healthcare sector, as patients and healthcare providers increasingly rely on digital channels to access medical products. This shift towards online platforms has led to greater efficiency, lower costs, and more streamlined logistics. As e-commerce continues to expand in China, it will continue to reshape the healthcare supply chain, fostering a more accessible and responsive market.

Market Trends

Technological Advancements Driving Efficiency

Technological innovation is a key trend transforming China’s healthcare supply chain management. The integration of Artificial Intelligence (AI), Internet of Things (IoT), and big data analytics into supply chain operations has significantly enhanced efficiency, enabling real-time tracking, predictive analytics, and automated decision-making. For instance, a government-backed initiative in Beijing has implemented AI-powered demand forecasting systems in public hospitals, ensuring timely availability of essential medical supplies and reducing waste. These technologies allow healthcare providers and suppliers to better manage inventory, streamline procurement, and optimize distribution processes. AI-powered demand forecasting, for example, ensures that the right products are available at the right time, reducing stockouts and waste. IoT devices further enhance visibility by monitoring the condition of sensitive medical products during transportation, ensuring quality and compliance with regulatory standards. As technology continues to evolve, its adoption will be a primary driver of operational efficiency and cost reduction in the healthcare supply chain.

Government Policies and Regulatory Changes

Government policies and regulatory reforms are shaping the landscape of healthcare supply chain management in China. The Chinese government has been implementing measures to improve healthcare access and efficiency, with a strong emphasis on enhancing supply chain processes. Initiatives such as the “Healthy China 2030” plan and efforts to streamline the procurement process for pharmaceuticals and medical devices are pushing companies to adapt to new regulatory standards and ensure compliance. Furthermore, China’s recent focus on reducing corruption and improving transparency in public procurement has encouraged the adoption of more robust and accountable supply chain practices. These changes are driving investment in digital platforms that facilitate regulatory compliance, track product quality, and enhance supply chain visibility.

E-commerce and Digitalization

The rise of e-commerce and digital platforms is transforming China’s healthcare supply chain, particularly in the distribution of pharmaceuticals, medical devices, and other healthcare products. For instance, leading e-commerce platforms like JD Health have developed specialized portals for hospitals and clinics to procure medical supplies in bulk, streamlining the ordering and delivery process. Online platforms have facilitated direct-to-consumer sales, enabling healthcare providers and patients to access a broader range of products more efficiently. The digitalization of supply chains, including the use of blockchain for product traceability and digital contracts, is fostering greater transparency and reducing inefficiencies. As e-commerce continues to grow, these digital platforms will play an increasingly crucial role in the healthcare supply chain.

Focus on Sustainability and Cost Efficiency

Sustainability and cost-efficiency have become central to China’s healthcare supply chain management. With increasing pressure to reduce healthcare costs while maintaining high-quality standards, companies are adopting greener practices such as reducing packaging waste, optimizing transportation routes, and improving energy efficiency in storage and distribution. In line with global trends, Chinese healthcare companies are also focusing on sustainable sourcing of raw materials and reducing the environmental impact of their operations. The drive toward sustainability is not only regulatory but also a response to growing consumer and stakeholder expectations for more eco-friendly and cost-effective practices. As a result, companies are investing in innovative technologies and supply chain models that reduce waste, enhance resource utilization, and lower overall costs.

Market Challenges Analysis

Regulatory Complexity and Compliance

One of the key challenges facing China’s healthcare supply chain management is navigating the complex and ever-evolving regulatory landscape. China has stringent regulations governing the procurement, distribution, and storage of medical products and pharmaceuticals, which can vary significantly across regions. Compliance with these regulations requires healthcare providers and supply chain stakeholders to invest in sophisticated systems for monitoring product quality, maintaining traceability, and ensuring adherence to local laws. For instance, the State Administration for Market Regulation (SAMR) has introduced compliance guidelines for pharmaceutical companies to prevent commercial bribery, encouraging the adoption of advanced digital platforms to monitor transactions and ensure transparency. Additionally, a government initiative in Guangdong Province has implemented blockchain-based systems to enhance traceability and compliance in the distribution of medical products. As the Chinese government continues to update and refine healthcare policies, companies must remain agile and responsive to regulatory changes. This regulatory complexity increases operational costs and can create barriers to the smooth functioning of supply chains, especially for international players unfamiliar with the local regulatory environment.

Logistics and Infrastructure Limitations

Logistical challenges and infrastructure limitations also present significant hurdles to the growth of China’s healthcare supply chain management. Despite rapid urbanization, vast areas of China particularly rural and remote regions still face difficulties in accessing healthcare products and services. The lack of efficient transportation networks, particularly for temperature-sensitive or high-value medical goods, can result in delays, increased costs, and risks to product integrity. Additionally, the uneven distribution of healthcare resources and supply chain facilities across different regions creates inefficiencies, as products may be delayed or unavailable in certain areas. While major cities benefit from advanced logistics networks, rural regions often struggle with less reliable infrastructure, hindering the smooth flow of medical supplies. As demand for healthcare services rises, particularly in underserved regions, addressing these logistical and infrastructure challenges is crucial to ensuring the effective delivery of medical products across the country.

Market Opportunities

China’s healthcare supply chain management sector presents several market opportunities driven by the country’s ongoing economic growth and healthcare reforms. The rapid digital transformation within the healthcare system offers significant potential for businesses to innovate and capitalize on advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain. These technologies can enhance inventory management, improve traceability, and enable real-time monitoring of medical products, creating more efficient and transparent supply chains. As the demand for healthcare services continues to rise, there is a growing need for solutions that streamline procurement, reduce operational costs, and optimize distribution. Companies that leverage digital tools to automate processes and improve forecasting will be well-positioned to tap into this expanding market, especially as the government pushes for greater efficiency and transparency in the healthcare system.

Additionally, the focus on expanding healthcare access in underserved and rural areas offers significant opportunities for growth in the healthcare supply chain. As part of its “Healthy China 2030” initiative, the Chinese government is investing heavily in improving healthcare infrastructure, including logistics networks and distribution channels in remote regions. This creates opportunities for businesses to support the development of these areas by providing innovative supply chain solutions that ensure timely delivery of medical products and equipment. Furthermore, the growing trend of e-commerce and online healthcare services opens new avenues for companies to expand their reach, allowing them to connect directly with consumers and healthcare providers. As China continues to embrace digital healthcare solutions, businesses that provide efficient, scalable, and tech-driven supply chain management services will be positioned to benefit from this evolving landscape.

Market Segmentation Analysis:

By Component:

The China Healthcare Supply Chain Management market can be segmented based on components into hardware, software, and services, each of which plays a vital role in enhancing supply chain operations. Hardware is essential for managing physical aspects of the supply chain, such as inventory management, temperature control for sensitive products, and logistical support. This includes devices like RFID tags, barcode scanners, sensors, and storage equipment, which help ensure real-time monitoring and efficient inventory tracking. Software solutions in the healthcare supply chain enable automation, data analysis, and decision-making. These software platforms help in demand forecasting, order management, and compliance monitoring, improving overall efficiency and reducing errors. Services include consultation, system integration, and support services that assist healthcare organizations in optimizing their supply chain operations. The growing demand for data-driven decision-making and real-time tracking is leading to higher adoption of integrated hardware, software, and services, fostering a more agile and responsive healthcare supply chain environment.

By Deployment Mode:

The healthcare supply chain management market in China is further segmented by deployment mode, specifically on-premise and cloud. On-premise deployment involves installing software and hardware systems within the organization’s facilities, allowing for greater control and customization of supply chain operations. This deployment mode is particularly favored by large healthcare organizations with specific needs or those that prioritize data security and privacy. However, the upfront costs and maintenance required for on-premise systems can be high. On the other hand, cloud-based deployment offers a more scalable and cost-effective solution. Cloud platforms enable healthcare providers to access supply chain management systems remotely, allowing for real-time collaboration, reduced infrastructure costs, and easier scalability. Cloud-based systems also facilitate faster updates, better data integration, and improved disaster recovery. The growing preference for cloud solutions is driving the shift toward cloud-based healthcare supply chain management, especially among small and mid-sized organizations seeking flexibility and lower costs.

Segments:

Based on Component:

- Hardware

- Software

- Services

Based on Deployment Mode:

Based on Function:

- Purchasing Management

- Inventory Management

Based on End User:

- Medical & Surgical Device Manufacturers

- Pharmaceutical Distributors

- Wholesalers

- Hospital & Clinics

- Pharmacies

- Others

Based on the Geography:

- Beijing

- Shanghai

- Guangzhou

- Shenzhen

Regional Analysis

Beijing

Beijing, as the capital and one of the largest economic hubs, holds a substantial market share of approximately 22% in the healthcare supply chain sector. The city’s highly developed infrastructure, along with its concentration of government agencies and major healthcare institutions, makes it a key driver for the demand for innovative supply chain solutions. The strong emphasis on healthcare reforms and regulatory compliance in Beijing also promotes investments in advanced technologies such as AI, IoT, and blockchain, which enhance supply chain efficiency and transparency.

Shanghai

Shanghai, contributing around 18% to the overall market, is another major player in China’s healthcare supply chain landscape. As a global financial center and a highly industrialized city, Shanghai benefits from its robust logistics and transportation networks, making it an attractive location for pharmaceutical and medical device companies to establish operations. The city’s focus on technological advancement, combined with a growing demand for high-quality medical products, drives significant investments in automation, real-time tracking, and integrated supply chain solutions. Shanghai’s market growth is also supported by the increasing focus on e-commerce and the digitalization of healthcare services, providing new opportunities for businesses in the sector.

Guangzhou

Guangzhou, accounting for approximately 15% of the market, plays a crucial role in the healthcare supply chain due to its strategic location in southern China. The city is a major logistics and trade hub, facilitating easy access to both domestic and international markets. Guangzhou’s healthcare sector is experiencing rapid expansion, driven by both public and private investment in healthcare infrastructure and services. The rise in demand for pharmaceuticals, medical devices, and healthcare services, especially in the growing middle-class population, is creating significant opportunities for healthcare supply chain management solutions. As the city adopts more digital solutions, it enhances operational efficiencies and supports the growth of the sector.

Shenzhen

Shenzhen holds a market share of around 14%, with its rapid technological advancements making it a critical player in the healthcare supply chain market. Known as a technology and innovation hub, Shenzhen is home to a large number of medical device manufacturers and technology startups, driving the adoption of cutting-edge solutions in supply chain management. The city’s advanced logistics infrastructure and proximity to global markets contribute to its strategic importance in the healthcare supply chain ecosystem. Additionally, Shenzhen’s emphasis on digital healthcare, coupled with its growing healthcare industry, provides ample opportunities for companies offering cloud-based supply chain solutions, bolstering the region’s market position.

Key Player Analysis

- IBM Corporation

- SAP SE

- Sinopharm

- One Network Enterprises

- Oracle Corporation

- Yusen Logistics

- Infor

- UPS Healthcare

- Epicor Software Corporation

- Cardinal Health

- Blue Yonder Group, Inc.

- Arvato Systems

- Workday Inc.

- GEP

- Manhattan Associates

- Others

Competitive Analysis

The China Healthcare Supply Chain Management market is highly competitive, with global and regional players striving to enhance efficiency, traceability, and responsiveness in healthcare logistics and procurement. Leading players such as IBM Corporation, SAP SE, Oracle Corporation, Sinopharm, Yusen Logistics, Infor, UPS Healthcare, Epicor Software Corporation, Cardinal Health, Blue Yonder Group, Inc., Arvato Systems, Workday Inc., GEP, and Manhattan Associates are actively investing in digital technologies to strengthen their foothold. These companies are focusing on providing end-to-end supply chain visibility, predictive analytics, and automation solutions tailored to China’s evolving healthcare infrastructure. With China’s ongoing healthcare reforms and digital transformation initiatives, these players are introducing AI-powered platforms, cloud-based supply chain management tools, and blockchain-integrated systems to ensure real-time tracking, regulatory compliance, and cost optimization. Collaborations with local healthcare providers, pharmaceutical manufacturers, and logistics firms are helping these companies align with domestic needs. Additionally, multilingual interface support, regulatory adherence, and scalable deployment models are proving crucial in increasing adoption among both public and private healthcare entities. The competitive focus has also shifted toward offering agile and customizable solutions capable of addressing urgent public health scenarios, such as epidemic response and vaccine distribution, ensuring these companies remain pivotal in shaping China’s healthcare supply chain ecosystem.

Recent Developments

- In March 2025, SAP unveiled its vision for autonomous supply chains embedded with AI-first strategies and launched SAP Business Data Cloud for enhanced operational visibility.

- In February 2025, GHX celebrated its Supply Chains of Distinction Award, recognizing top-performing hospitals that excelled in automation and clinical integration.

- In January 2025, McKesson’s Practice Insights was named a Qualified Clinical Data Registry by CMS, enabling oncology practices to streamline data reporting and improve patient care.

- In November 2024, IBM integrated generative AI into its cognitive control tower, enabling natural language queries for faster decision-making. This transformation saved $388 million in inventory and shipping costs.

- In September 2024, Oracle introduced RFID-powered replenishment solutions in its Cloud SCM platform to automate inventory management and improve visibility across healthcare supply chains.

Market Concentration & Characteristics

The China Healthcare Supply Chain Management market exhibits moderate to high market concentration, with a few key players dominating the technological and service-oriented segments. Global companies with advanced digital capabilities, alongside large domestic firms with strong distribution networks, characterize the competitive landscape. The market is defined by rapid digital transformation, a growing emphasis on real-time data visibility, and increasing adoption of AI and cloud-based platforms. Customization, scalability, and compliance with China’s regulatory framework are key characteristics influencing solution design and adoption. Moreover, government initiatives to modernize healthcare infrastructure and improve logistics efficiency are accelerating the integration of advanced SCM systems. Demand is particularly strong from large hospitals, pharmaceutical manufacturers, and third-party logistics providers seeking end-to-end solutions. The market also reflects a trend toward ecosystem-based models, where supply chain platforms facilitate collaboration among suppliers, healthcare providers, and regulatory bodies. This evolving environment underscores the need for adaptive, secure, and transparent supply chain solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Mode, Function, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow rapidly due to increasing demand for efficient healthcare logistics and inventory systems.

- Adoption of AI, IoT, and blockchain technologies will enhance transparency and real-time decision-making.

- Cloud-based supply chain platforms will become more prevalent across hospitals and pharmaceutical companies.

- Integration of big data analytics will support better demand forecasting and resource planning.

- Domestic players will expand their technological capabilities to compete with global providers.

- Government support for digital healthcare infrastructure will accelerate market penetration.

- Public-private partnerships will increase to improve healthcare delivery and supply chain efficiency.

- Focus on sustainability and eco-friendly logistics will shape future SCM strategies.

- Greater emphasis will be placed on risk management and supply chain resilience post-pandemic.

- Customized and scalable solutions will gain traction among small and mid-sized