Market Overview:

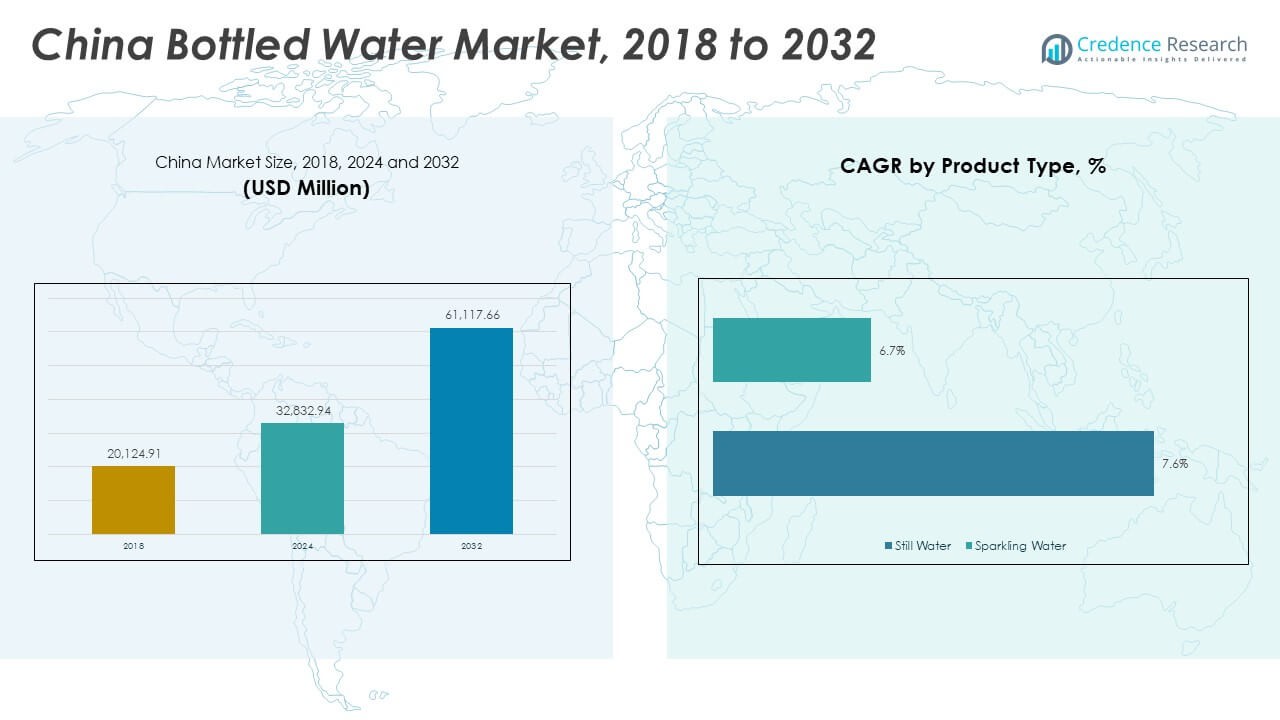

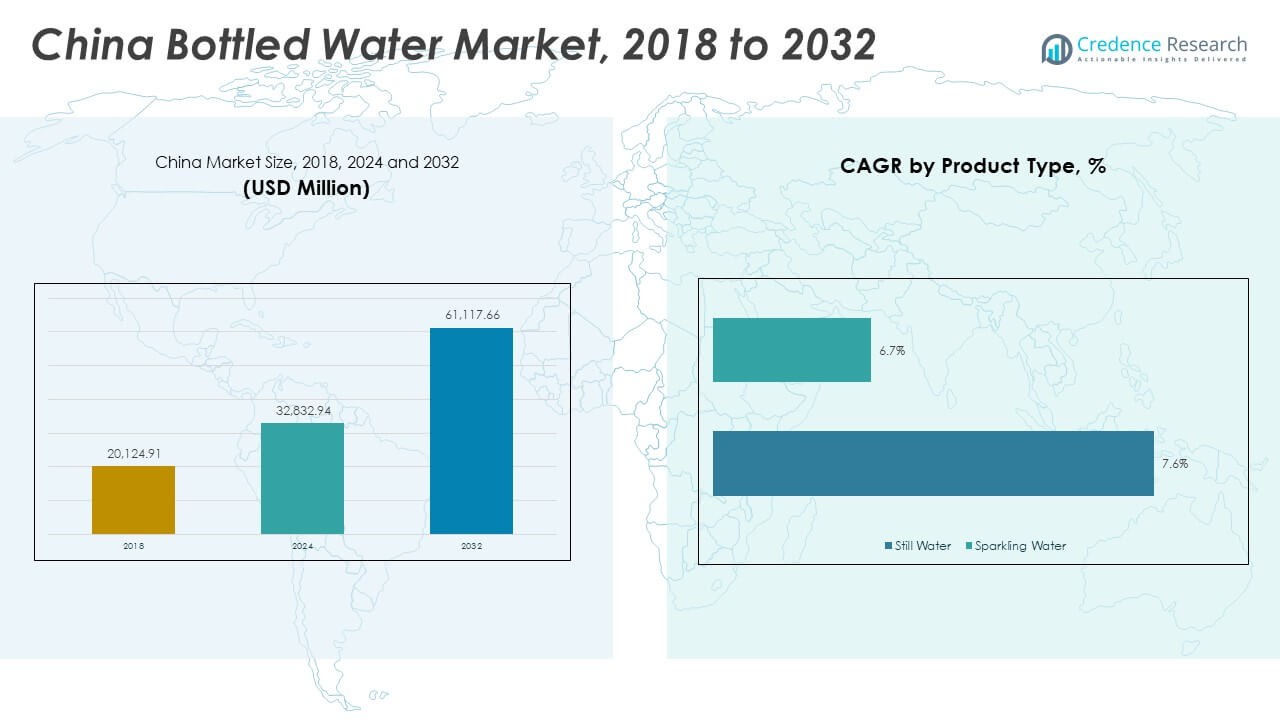

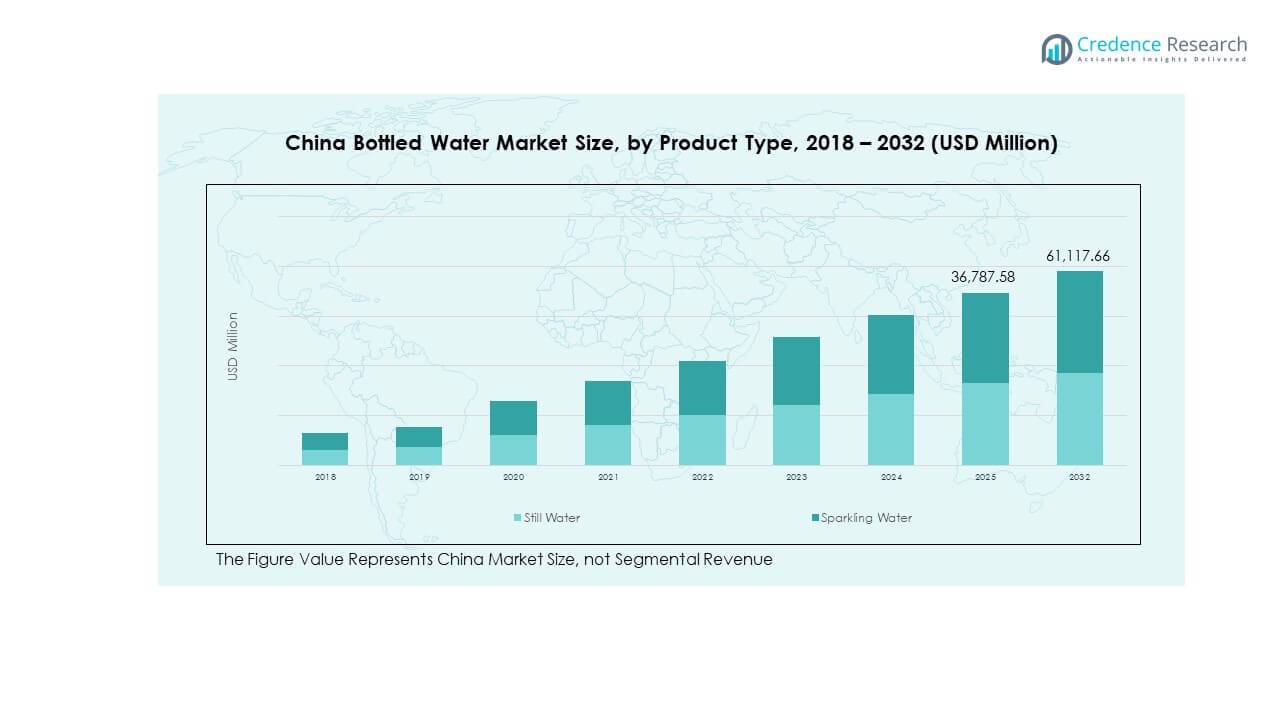

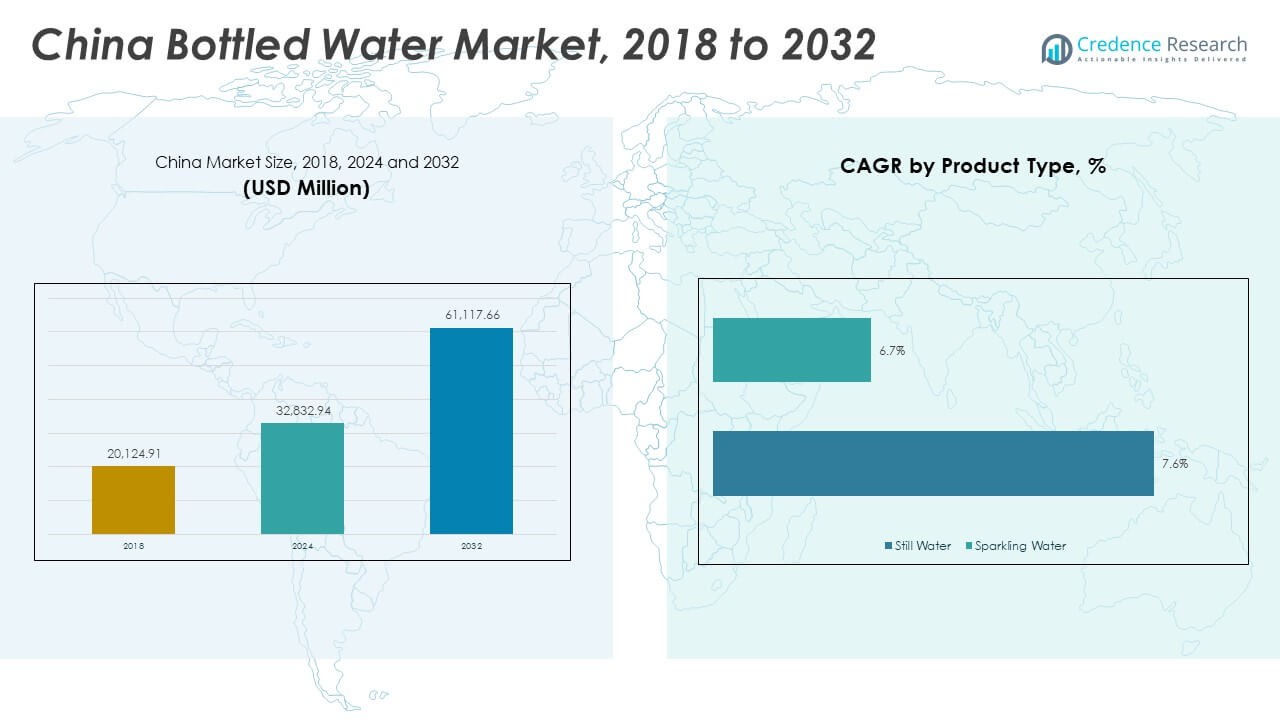

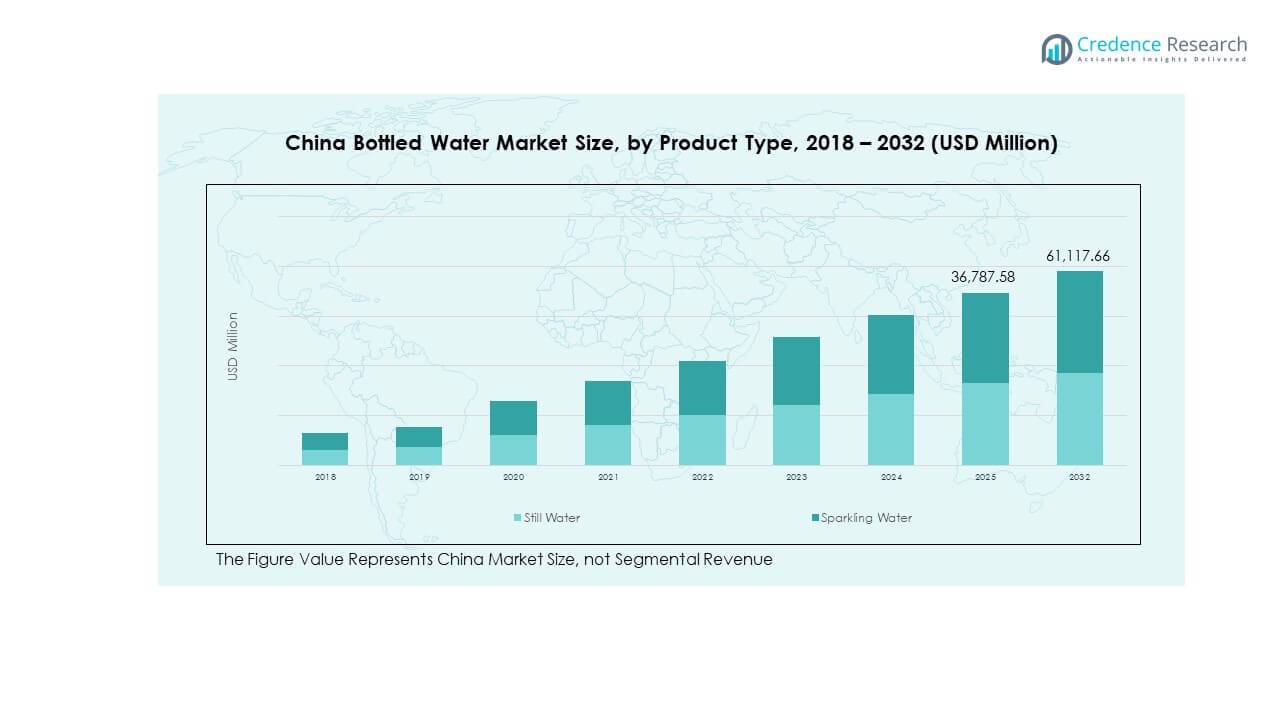

The China Bottled Water Market size was valued at USD 20,124.91 million in 2018 to USD 32,832.94 million in 2024 and is anticipated to reach USD 61,117.66 million by 2032, at a CAGR of 7.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Bottled Water Market Size 2024 |

USD 32,832.94 Million |

| China Bottled Water Market , CAGR |

7.52% |

| China Bottled Water Market Size 2032 |

USD 61,117.66 Million |

Growth is driven by rising health awareness, greater preference for safe packaged drinking water, and widespread concern over tap-water quality in major urban centres. Consumers shift toward still and mineral water for daily hydration, supported by strong brand visibility across retail formats. Expanding disposable income boosts spending on premium and functional water products. Product innovations, including flavoured and enriched variants, strengthen the market’s appeal. Modern retail and e-commerce continue to accelerate category penetration across all age groups.

Regionally, eastern provinces lead due to high urbanisation, dense retail networks and strong brand engagement. Southern provinces follow, supported by hospitality growth and evolving lifestyle preferences. Central and western regions emerge gradually as household adoption increases and retail infrastructure expands. Consumers in coastal cities show stronger demand for premium and functional water, while inland markets display rising interest in affordable formats. This geographic spread highlights a balanced growth pattern across the China Bottled Water Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China Bottled Water Market grew from USD 20,124.91 million in 2018 to USD 32,832.94 million in 2024 and is projected to reach USD 61,117.66 million by 2032, supported by a CAGR of 7.52%.

- Eastern China leads with about 40% share due to dense urbanisation and strong retail development, followed by Southern China at 30% supported by tourism and lifestyle demand, while Central & Western China hold 30% due to expanding household adoption.

- Central & Western China represent the fastest-growing region with a 30% share, driven by rising middle-class consumption and gradual improvement in retail access.

- Still water accounts for roughly 70% of the total category share in the chart, reflecting strong household and everyday hydration demand.

- Sparkling water holds about 30% share in the chart and shows steady growth supported by premium, lifestyle-focused consumer segments.

Key Market Drivers

Rising Health Awareness and Preference for Safe Drinking Water

China Bottled Water Market expansion is fueled by a rising health-conscious population preferring clean hydration. Consumers increasingly avoid sugary beverages and carbonated drinks, turning toward purified and mineral water options. Concerns over urban water contamination push bottled options as a safe daily choice. Marketing campaigns by leading brands emphasize purity and mineral benefits. Young and middle-income groups choose bottled water for everyday consumption. It benefits from the growing trend of healthy lifestyles across cities. Public trust in branded water quality enhances steady demand. Expanding awareness across smaller towns strengthens nationwide adoption.

- For instance, Nongfu Spring reported in its 2023 annual financial results that bottled water generated RMB 20.26 billion in revenue, recording 10.9% year-on-year growth. Bottled water contributed 47.5% of the company’s total revenue, according to figures disclosed in its official filings and widely reported by industry media.

Urbanization and Strong Distribution Networks Boosting Accessibility

Rapid urbanization drives bottled water penetration across convenience stores, supermarkets, and e-commerce platforms. Expanding retail chains and logistics networks make bottled water available in both cities and rural regions. It benefits from an organized supply chain ensuring steady delivery and product consistency. Busy urban lifestyles promote ready-to-drink packaging formats suitable for travel and office use. The rising middle class increases spending on convenience-oriented beverages. Retail partnerships with local delivery services widen product reach. E-commerce platforms enable direct brand-to-consumer access. Continuous expansion of modern retail infrastructure sustains strong national demand.

- For instance, China Resources C’Estbon reported a retail sales volume of around 13.5 million tons in 2023, according to data disclosed in its IPO filings and market reports. The company supplies bottled water through more than 300,000 retail outlets nationwide, supported by a combination of self-operated and partnered logistics hubs that ensure broad coverage across both urban and rural regions.

Innovation in Packaging and Brand Differentiation Enhancing Consumer Appeal

Packaging innovation remains a core driver shaping consumer preferences and loyalty. Companies invest in eco-friendly and lightweight bottles to attract environmentally aware buyers. Unique bottle designs and smart labels improve market visibility and brand recognition. The China Bottled Water Market benefits from premiumization trends emphasizing natural springs and imported origins. Product diversification, including alkaline and vitamin-enriched water, supports segment growth. Leading brands focus on recyclable packaging to align with sustainability goals. Technology integration in production ensures purity control. Continuous improvement in design and materials helps maintain brand competitiveness.

Rising Tourism and Hospitality Industry Driving Consumption Growth

The tourism and hospitality sectors contribute significantly to bottled water sales growth. Hotels, resorts, and restaurants rely heavily on packaged water for guest services. Increasing domestic tourism stimulates consistent on-the-go demand across major travel destinations. Event venues and transportation hubs maintain large-scale consumption. It benefits from government initiatives promoting local tourism and health safety standards. Rising international arrivals enhance the market for premium imported water. Seasonal travel peaks amplify sales volumes. The hospitality industry’s expansion continues to reinforce bottled water’s role in lifestyle consumption.

Key Market Trends

Shift Toward Premium and Functional Bottled Water Categories

The China Bottled Water Market is witnessing a clear shift toward premium and functional offerings. Consumers seek products with added health benefits, including mineral-rich, electrolyte-infused, and alkaline water. Brands position these as lifestyle choices reflecting wellness and sophistication. Imported natural spring water gains attention from urban professionals. Functional products targeting hydration efficiency are rapidly entering retail channels. Packaging innovations showcase product transparency and source authenticity. Celebrity endorsements further elevate brand image. Growing disposable incomes sustain the momentum for high-value bottled water options.

Expansion of Sustainable and Eco-Conscious Packaging Solutions

Sustainability becomes a key focus across the Chinese beverage industry. Manufacturers invest in biodegradable and recycled PET bottles to reduce environmental impact. The China Bottled Water Market sees government and corporate alignment on carbon reduction goals. Companies like Nongfu Spring and Wahaha experiment with plant-based materials. Bottle cap redesigns aim to minimize plastic waste. Consumers increasingly value packaging sustainability when choosing products. Awareness campaigns highlight environmental responsibility and brand integrity. The transition toward green packaging enhances reputation and long-term brand trust.

- For instance, Incom Resources (盈创汇智), a leading Chinese recycling company, expanded its food-grade rPET facility in 2023, increasing its waste beverage bottle processing capacity to 80,000 tons per year. The company produces food-grade rPET chips for beverage and bottled water brands in China, supported by EFSA and U.S. FDA certifications, according to verified company disclosures.

Integration of Smart Technology and Supply Chain Efficiency

Technology adoption reshapes production, distribution, and consumer engagement strategies. Smart bottling systems ensure precision in filtration and mineral balance. The China Bottled Water Market leverages IoT-based logistics to enhance supply chain transparency. QR-coded packaging allows consumers to trace product origin instantly. Digital platforms track shelf-life and stock movement efficiently. Online retail analytics provide data-driven insights into regional demand trends. Automation improves manufacturing accuracy and reduces wastage. Technology strengthens consumer trust by ensuring quality verification. Integration of AI-based systems ensures predictive inventory management across retail outlets.

Rising Influence of Online Retail and Direct-to-Consumer Sales Channels

E-commerce channels play a transformative role in the bottled water industry. Digital platforms like JD.com and Alibaba enhance brand visibility and access. Subscription-based bottled water delivery models gain popularity in urban areas. The China Bottled Water Market benefits from app-driven ordering convenience. Online promotions and flash sales influence younger demographics. Real-time tracking ensures timely home delivery. Cross-platform collaborations enable targeted marketing strategies. It allows brands to collect consumer feedback and personalize offers. Continuous growth in online grocery and quick-commerce sectors strengthens future sales potential.

- For instance, JD.com’s 2024 consumer insights highlight strong bottled water demand across its platform, with Nongfu Spring, C’Estbon, and Evian ranking among the top-selling brands. JD.com also reports rising adoption of home water delivery and subscription services, driven by growing urban convenience preferences and its extensive logistics network.

Market Challenges Analysis

Environmental Concerns and Plastic Waste Management Pressure

Plastic waste generation remains one of the toughest issues for bottled water producers. The rising consumption of single-use bottles amplifies ecological concerns. Government policies tightening plastic use standards create operational challenges. The China Bottled Water Market faces growing scrutiny from sustainability advocates. Companies must invest in recycling systems and eco-pack innovations. Consumer perception about plastic waste affects brand loyalty. Recyclable materials increase production costs, reducing price competitiveness. Balancing affordability with environmental responsibility becomes a key industry dilemma.

Intense Market Competition and Price Volatility Affecting Profit Margins

The Chinese bottled water sector experiences intense rivalry among domestic and global brands. Established players like Nongfu Spring, Wahaha, and Coca-Cola compete for brand dominance. It faces aggressive pricing strategies, making differentiation difficult. Premium brands struggle to sustain margins amid rising operational expenses. Frequent promotional campaigns reduce profitability for small manufacturers. Retail shelf space competition grows with increasing product varieties. Logistics and raw material fluctuations add pressure on pricing strategies. Companies must balance innovation and cost control to maintain stability in a highly fragmented market.

Market Opportunities

Rising Demand for Premium and Functional Products Among Urban Consumers

Premiumization offers strong growth prospects across major Chinese cities. Urban consumers prefer water enriched with minerals and natural electrolytes. The China Bottled Water Market can capitalize on this shift through value-added formulations. Expanding gym and fitness culture promotes bottled hydration solutions. Collaboration with wellness brands creates targeted marketing channels. Brands introducing imported or source-verified options enhance perceived quality. Growth in organized retail supports distribution of specialized bottled water. Expanding middle-class income strengthens the willingness to spend on premium categories.

Expansion in Lower-Tier Cities and Rural Distribution Networks

Emerging markets in lower-tier cities present untapped sales potential. Rural consumers increasingly adopt bottled water for daily use due to health awareness. It benefits from government initiatives improving regional water infrastructure. Local bottlers can leverage affordability-focused products to reach new demographics. Distribution through small retailers and mobile delivery enhances accessibility. Digital commerce platforms extend reach to less urbanized areas. Growing logistics efficiency enables large-scale delivery networks. Future expansion beyond metropolitan hubs will secure consistent long-term growth.

Market Segmentation Analysis

By Product Type

Still water dominates the China Bottled Water Market, supported by strong consumer preference for daily hydration and affordability. Unflavored variants maintain high demand for household and office use, while flavored still water appeals to younger consumers seeking taste diversity without sugar. Sparkling water grows rapidly, driven by lifestyle changes and premium positioning in urban centers. Flavored sparkling options attract health-conscious buyers looking for low-calorie alternatives. Unflavored sparkling water continues to perform well in hospitality and fine-dining establishments due to its perceived sophistication.

- For instance, Master Kong (Tingyi Holding Corp.) stated in its 2024 interim results that still water remained the core of its bottled water category performance in the first half of the year. The company also partnered with Meituan Flash Sale to promote full-case direct-to-home delivery of its bottled drinking water, supporting faster retail volume growth in major urban markets.

By Source

Mineral water leads the segment due to its natural mineral content and perceived health benefits. Consumers favor spring water sourced from reputed mountain regions for purity and freshness. Purified and distilled water remains popular in commercial and institutional use due to consistent quality control and low production costs. The China Bottled Water Market benefits from growing awareness about mineral composition and safety certification. Regional players expand sourcing partnerships to ensure supply stability across provinces.

- For instance, Tibet Water Resources Ltd. reported a 32.9% year-on-year increase in revenue from its packaged drinking water products in 2023, driven by stronger commercial and hospitality channel demand. The company disclosed this performance in its official financial results, showing solid momentum within its core bottled water category.

By Packaging

Bottled formats under 1 liter dominate on-the-go consumption in retail and travel sectors. Large bottles over 1 liter remain preferred for household and office use. Cans gain traction among younger demographics seeking trendy, recyclable alternatives. Bulk water through dispensers sustains steady demand from institutions and corporate offices. It leverages strong logistics networks and efficient refilling systems to maintain cost competitiveness and accessibility.

By End User

Household consumption holds the highest share due to increasing focus on safe drinking water at home. Commercial and institutional buyers, including offices and schools, ensure consistent purchase volumes. The travel and tourism sector drives seasonal demand spikes, especially during festivals and domestic travel peaks. It supports premium and small-format packaging designed for convenience and hygiene assurance.

By Sales Channel

Modern trade, including supermarkets and convenience stores, remains the primary sales channel. Traditional trade sustains rural distribution networks and small retailers. Online retail expands fast due to digital shopping adoption and doorstep delivery convenience. HORECA outlets rely on bulk and premium-packaged options for consistent service quality. It continues to strengthen its presence through partnerships with beverage suppliers and hospitality groups.

Segmentation

By Product Type

- Still Water

- Sparkling Water

By Source

- Mineral Water

- Spring Water

- Purified/Distilled Water

By Packaging

- Bottles (<500 ml, 500–1000 ml, >1L)

- Cans

- Bulk Water (Refill/Dispensers)

By End User

- Household Consumption

- Commercial / Institutional

- Travel & Tourism Sector

By Sales Channel

- Modern Trade

- Traditional Trade

- Online Retail

- HORECA (Hotels, Restaurants, Cafés, and Catering)

By Country

Regional Analysis

Eastern China (Approx. 40% Share)

The China Bottled Water Market records its largest concentration in Eastern China, capturing roughly 40 % of national volume. Economic centres such as Shanghai, Jiangsu and Zhejiang lead in premium bottled water consumption and modern retail penetration. Urban households show strong demand for mineral and spring-water offerings. Retail infrastructure, including supermarkets and e-commerce, functions at high density and strengthens product access. It benefits from elevated disposable incomes and widespread marketing of branded options. Brand loyalty among eastern consumers further bolsters regional dominance.

Southern China (Approx. 30% Share)

Southern China holds an estimated 30 % share of the bottled-water market. Provinces such as Guangdong, Guangxi and Hainan drive demand through rising urbanisation and evolving lifestyle trends. The hospitality and tourism sectors support bottled water consumption for onsite services and premium segments. It supports regional manufacturers and international entrants targeting affluent coastal populations. Health awareness and shift toward functional water variants gain traction here. Distribution networks in southern cities facilitate rapid product roll-out and brand expansion.

Central & Western China (Remaining ~30% Share)

The remaining market share resides in Central and Western China, accounting for roughly 30 % of the total bottled-water market. Inland provinces display growth potential due to expanding middle-class households and improving retail infrastructure. It faces logistical challenges and lower per-capita consumption relative to coastal zones. Emerging urban centres in these regions register faster growth rates than mature eastern or southern markets. Local bottlers leverage regional sourcing and lower‐cost formats to reach price-sensitive consumers. The region represents a key frontier for expansion, given untapped demand and improving access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The China Bottled Water Market features strong competition among both domestic and international players vying for scale, distribution reach and brand differentiation. Domestic brands such as Nongfu Spring Co., Ltd. dominate shelf space, utilising extensive regional sourcing networks and deep retail penetration. Global entrants leverage premium positioning and imported water sources to appeal to affluent urban consumers. It faces margin pressure from escalating costs in raw materials, packaging and logistics, forcing firms to optimise operations and differentiate on value. Regional producers exploit fast-moving formats and smaller pack sizes to secure footprint in lower-tier cities. Strategic developments include line expansions, acquisitions and partnerships aimed at increasing market share and geographic reach. It demands continuous innovation in health-oriented and value-driven products to retain consumer interest.

Recent Developments

- In June 2025, Nongfu Spring strengthened its presence in the China Bottled Water Market by officially entering the Hong Kong market through its distributor Uni-China Group. The company showcased its full premium bottled beverage portfolio at a high-profile launch event, expanding brand visibility and widening regional access. This move reinforced its strategic focus on premium segments and cross-border market growth.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Packaging, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding driven by growing urbanisation and changing hydration habits.

- Premium bottled water will gain wider traction as consumers prioritise natural minerals and purity.

- Functional and flavoured water products will strengthen their position in wellness-driven consumer groups.

- Sustainability will become a decisive factor, pushing brands toward recyclable and biodegradable packaging.

- Online retail will evolve as a core sales channel, supported by subscription and doorstep delivery models.

- Local manufacturers will focus on automation and logistics upgrades to manage large-scale distribution.

- International players will invest in niche and luxury categories targeting affluent city consumers.

- The hospitality and tourism sectors will create strong off-season demand for premium bottled options.

- Water source protection and certification standards will become key differentiators among brands.

- Consolidation through mergers and partnerships will reshape the competitive structure, improving efficiency.