Market Overview:

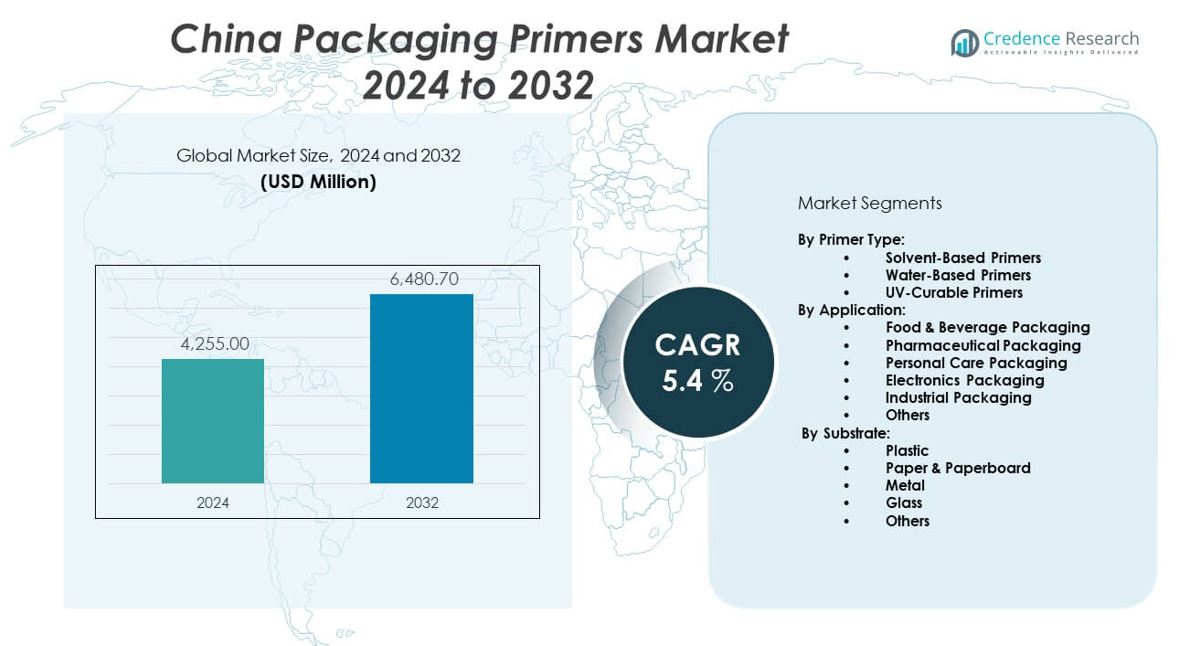

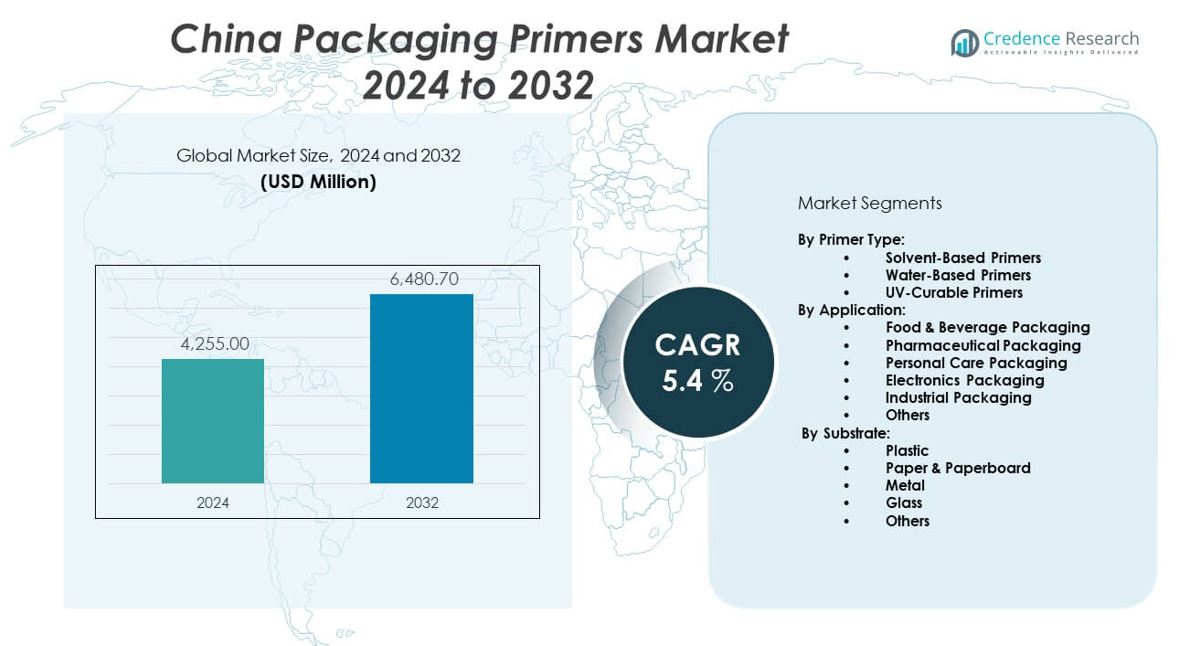

The China packaging primers market is projected to grow from USD 4,255 million in 2024 to an estimated USD 6,480.7 million by 2032, with a compound annual growth rate (CAGR) of 5.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Packaging Primers Market Size 2024 |

USD 4,255 million |

| China Packaging Primers Market, CAGR |

5.4% |

| China Packaging Primers Market Size 2032 |

USD 6,480.7 million |

Growth in the China packaging primers market is driven by rising demand across flexible packaging, food & beverage, personal care, and pharmaceutical sectors. Rapid expansion of e-commerce and increased focus on product shelf life and aesthetics have prompted manufacturers to adopt high-performance primers that enhance adhesion, printability, and barrier properties. The shift toward sustainable packaging has further accelerated the adoption of water-based and low-VOC primer technologies. Brands aim to improve substrate compatibility and operational efficiency through innovative primer solutions.

Eastern China leads the packaging primers market, with major industrial hubs and high concentrations of manufacturing and packaging converters. Coastal provinces like Jiangsu, Zhejiang, and Guangdong dominate due to advanced infrastructure and export-oriented industries. Central and Western regions are emerging as secondary markets, supported by government policies promoting industrial decentralization and regional investment. These areas attract growth from expanding local demand and relocation of production facilities.

Market Insights:

- The China packaging primers market is projected to grow from USD 4,255 million in 2024 to USD 6,480.7 million by 2032, at a CAGR of 5.4%.

- Demand for primers is rising across food & beverage, pharmaceutical, personal care, and flexible packaging sectors.

- Growth is driven by the need for better adhesion, print quality, and barrier properties in advanced packaging formats.

- The shift toward sustainable packaging boosts the adoption of water-based and low-VOC primer technologies.

- A key restraint includes high formulation costs and compatibility challenges with diverse substrates.

- Eastern China dominates the market due to industrial hubs in Jiangsu, Zhejiang, and Guangdong provinces.

- Central and Western regions are emerging as growth centers due to government-backed industrial decentralization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from End-Use Industries Drives Consistent Market Expansion:

The China packaging primers market benefits from rising demand in food and beverage, personal care, and pharmaceutical sectors. These industries require packaging that enhances product appeal and protects against environmental stressors. Primer technologies play a critical role in improving adhesion, print performance, and coating stability. Manufacturers use primers to optimize ink compatibility and prevent surface defects. Shelf appeal remains a top priority for consumer goods brands operating in competitive retail environments. It strengthens brand communication through high-quality printing. Regulatory compliance also pushes companies to use primers that meet safety and hygiene standards. The market aligns with the evolving packaging specifications of high-growth sectors across China.

- For instance, DIC’s waterborne polyurethane resin adhesive primers are used for optical and food packaging applications, especially with PET films. DIC documentation confirms that these primers enhance the bond between PET substrates and coating layers in multilayer packaging films, thus supporting adhesion in high-performance food packaging.

E-Commerce Boom and Changing Retail Channels Boost Primer Requirements:

China’s e-commerce sector continues to grow at a rapid pace, creating demand for packaging that withstands long-distance logistics. Packaging primers support this shift by enhancing resistance to abrasion, humidity, and handling stress. Businesses adopt primers to ensure the printed information and visuals remain intact during transportation. The growing use of digital printing in e-commerce packaging drives demand for primers compatible with diverse inks and substrates. It enables high-speed and short-run packaging formats preferred in online retail. Packaging plays a pivotal role in unboxing experiences, pushing brands to invest in aesthetically superior primers. The expansion of quick-commerce and delivery platforms amplifies this trend. The China packaging primers market gains momentum through this evolving supply chain.

Sustainability Goals Accelerate Adoption of Water-Based Primer Formulations:

Corporate sustainability agendas and policy pressure increase the use of water-based and low-VOC primers in China. These eco-friendly primers reduce environmental impact without sacrificing functional performance. Leading manufacturers shift to water-based technologies to align with national carbon reduction targets. This transition also supports safer working conditions in production plants. Demand rises for primers that allow recyclable or compostable packaging without delamination or print smudging. It also improves operational efficiency by reducing drying time and energy use. Environmental labeling laws and consumer expectations reinforce this trend. The China packaging primers market evolves to serve both environmental and performance needs.

- For instance, The expanded production at their Zhangjiagang facility (water-based primers, 90,000 tons per year) is aimed at reducing carbon footprint and VOC emissions in packaging lines across China.

Advancements in Packaging Machinery Create Demand for High-Performance Primers:

The introduction of high-speed and automated packaging lines in China drives the need for primers with enhanced drying, flow, and adhesion properties. These systems require substrates treated with primers that can handle fast ink transfer and lamination. Performance consistency becomes critical in preventing print rejection and substrate damage. The use of multi-layer flexible films increases, demanding primers with superior interlayer bonding. It ensures integrity under varying pressure and heat conditions in production environments. Manufacturers aim to reduce machine downtime through primers that require less curing or coating failures. The China packaging primers market benefits from the automation wave reshaping packaging operations.

Market Trends:

Shift Toward Functional Coatings Expands Use Cases for Primers in Packaging:

Manufacturers in China increasingly integrate functional coatings such as anti-fog, heat-seal, and antimicrobial layers into packaging structures. These coatings often rely on primers to ensure proper adhesion and longevity. The demand for multifunctional packaging drives the need for primers that interact with specialty coatings. It supports innovation in medical packaging and food-grade applications. Brands seek to combine visual appeal with performance, prompting suppliers to develop primers with dual-purpose properties. The China packaging primers market reflects this shift through increased research in hybrid formulations. Functional packaging formats create differentiated brand value in both traditional retail and e-commerce sectors.

- For instance, Toyochem Antibac Primer, adopted in major Chinese pharmaceutical blister packaging lines, demonstrated a 99.9% reduction rate in E. coli and S. aureus bacterial presence after 24-hour packaging integrity testing, enhancing product safety without compromising visual print quality.

Growth of Flexible Packaging Formats Requires Enhanced Primer Versatility:

Flexible packaging gains traction in China due to its lightweight, compact, and cost-effective nature. This shift encourages primer innovation for plastic films, paper laminates, and biodegradable substrates. Brands require primers that bond well with stretch films and metallized layers. It prompts development of primers offering heat resistance, ink receptivity, and barrier support. Demand rises for primers that withstand pouch filling, vacuum sealing, and flexographic printing. Manufacturers tailor primer formulations to fit roll-to-roll processes in flexible packaging plants. The China packaging primers market adapts to this diversification in substrate types and packaging performance requirements.

- For instance, BASF’s Joncryl® 8052 primer, used by Chinese snack packaging producers, has been shown to reduce ink set-off during high-speed flexographic printing on OPP films, supporting defect-free packaging at production speeds.

Premium Branding and Aesthetic Differentiation Drive Primer Customization:

Chinese consumers respond to premium packaging designs with sophisticated textures and visual effects. High-end personal care, luxury food, and health supplements use packaging to signal value. Primers enable the use of specialty inks, embossing, holographic films, and high-gloss finishes. Print sharpness, color vibrancy, and surface consistency all depend on primer quality. Brands require primer systems that support both tactile finishes and clear overcoats. It boosts demand for primers that work across paperboard, rigid plastics, and composite materials. The China packaging primers market reflects this trend through new launches tailored for aesthetic-focused segments.

Domestic Innovation in Coating Chemistry Enhances Local Competitive Strength:

Chinese chemical manufacturers improve in-house R&D capabilities to formulate primers with proprietary additives and polymers. This trend reduces reliance on imported technologies and fosters localized product customization. Innovations focus on enhancing moisture resistance, UV stability, and low-temperature performance. It allows local suppliers to serve niche segments, such as cold-chain packaging and hazardous materials. Regional players adopt new dispersion techniques and polymer blends to meet evolving customer requirements. The China packaging primers market becomes more self-reliant through this rise in domestic formulation capacity. This development also drives price competitiveness and shortens lead times.

Market Challenges Analysis:

High Performance Requirements Create Complexity in Primer Formulation and Compatibility:

Meeting the performance expectations of modern packaging formats presents a significant challenge for suppliers in the China packaging primers market. Customers demand adhesion across multiple substrates including films, foils, and coated boards. It forces formulators to balance chemical properties with drying times, resistance levels, and print quality. Creating universal primers that perform consistently across both water-based and solvent-based inks remains difficult. Certain substrates, like polyethylene or polylactic acid, have low surface energy, requiring specialized primers for proper bonding. These complex needs increase R&D costs and prolong formulation timelines. Maintaining performance in extreme temperatures or humidity further complicates product development. Frequent substrate changes by converters also limit standardization.

Regulatory Compliance and Environmental Pressure Increase Manufacturing Costs:

The tightening of environmental regulations in China mandates lower VOC levels and safer chemical use in primer production. Compliance requires investment in cleaner raw materials and advanced processing technologies. It raises input costs and narrows margins for domestic suppliers, especially smaller firms. Water-based primers, though preferred environmentally, may require more sophisticated coating machinery or controlled drying environments. The need to meet both environmental and technical standards strains production flexibility. Disposal of hazardous primer residues also faces stricter controls. The China packaging primers market must navigate rising compliance costs while delivering value to customers demanding price competitiveness.

Market Opportunities:

Surging Demand for Sustainable Packaging Unlocks Growth in Bio-Based Primer Technologies:

The China packaging primers market holds strong potential for growth in plant-based, biodegradable, and recyclable primer solutions. These alternatives align with rising consumer preference for eco-labeled packaging. It opens avenues for primer suppliers to partner with bio-resin developers and packaging converters. Brands willing to pay a premium for sustainability adopt these primers for high-visibility applications. Expanding public awareness of environmental issues in China further strengthens this trend.

Growth in High-Barrier Food Packaging Opens New Application Areas for Advanced Primers:

The food sector in China increasingly uses multi-layer and retort-grade packaging that demands strong primer adhesion. These formats support shelf-stable, ready-to-eat, and export-oriented products. It presents an opportunity for primers tailored to thermal resistance, aroma barrier enhancement, and antimicrobial support. Rising food safety standards also push adoption of primers with food-grade compliance. This growth creates a specialized niche within the broader China packaging primers market.

Market Segmentation Analysis:

By Primer Type: Diverse Formulations Meeting Performance and Regulatory Needs

The China packaging primers market offers three primary types: water-based, solvent-based, and UV-curable primers. Water-based primers lead in market share due to their compliance with environmental regulations and low VOC emissions. Solvent-based primers maintain relevance in demanding applications that require strong chemical resistance and adhesion to difficult substrates. UV-curable primers grow steadily, favored in automated production lines for their fast curing, high durability, and minimal energy consumption. Each formulation serves specific end-use sectors, supporting operational efficiency, print quality, and sustainability.

- PPG’s Zhangjiagang plant in China manufactures water-based primers with a production capacity increased to 90,000 tons annually as of December 2023. This investment focuses on serving packaging and industrial end-users with sustainable, low-VOC primers.

By Application: Food and Pharma Drive Demand, with Emerging Uses in Electronics and Personal Care

By application, food and beverage packaging dominates the China packaging primers market due to safety regulations, volume, and the need for clear, durable printing. Pharmaceutical packaging follows closely, demanding high-performance primers that ensure compliance and protect sensitive content. Personal care packaging emphasizes visual appeal, requiring primers compatible with specialty inks and finishes. Electronics packaging involves substrates needing anti-static, heat-resistant, and moisture-barrier primers. Industrial packaging spans chemical, automotive, and bulk products where performance under stress is key. Other applications include specialty use cases where customized primer properties are required.

- For instance, Used by packaging manufacturers for flexible food pouches and contact-sensitive packaging. Henkel provides product lines with tested compliance to Chinese food-contact standards and materials safety.

By Substrate: Compatibility Across Plastic, Paper, Metal, and Glass

Plastic is the most widely used substrate in China’s packaging industry, especially for flexible pouches and rigid containers, requiring versatile primers. Paper and paperboard benefit from water-based primers that enhance printability while preserving recyclability. Metal packaging demands corrosion-resistant primers with strong surface adhesion. Glass substrates, though niche, use primers to improve label bonding and aesthetic durability. Other substrates include biodegradable films and laminated materials, which require innovative primer formulations to support the transition to sustainable packaging solutions.

Segmentation:

By Primer Type:

- Solvent-Based Primers

- Water-Based Primers

- UV-Curable Primers

By Application:

- Food & Beverage Packaging

- Pharmaceutical Packaging

- Personal Care Packaging

- Electronics Packaging

- Industrial Packaging

- Others

By Substrate:

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Region:

- Eastern China (Shanghai, Jiangsu, Zhejiang)

- Southern China (Guangdong, Fujian)

- Northern China

- Other regions

Regional Analysis:

Eastern China Dominates Due to Industrial Maturity and Export Orientation

Eastern China holds the largest share of the China packaging primers market, accounting for approximately 58% of total revenue. This dominance is driven by the presence of major industrial and packaging hubs in provinces such as Jiangsu, Zhejiang, and Guangdong. These coastal regions have well-established manufacturing ecosystems, advanced infrastructure, and access to global export routes. High concentration of converters and packaging companies in this corridor supports continuous demand for high-performance primers. It also benefits from technological advancements and proximity to raw material suppliers. Many multinational and domestic companies operate their packaging units in these provinces due to operational efficiency and logistics convenience. The region sets the benchmark for adoption of innovative and sustainable primer technologies.

Central China Gains Momentum Through Rising Industrial Investment

Central China contributes around 24% of the China packaging primers market, supported by industrial decentralization and expanding manufacturing activity. Provinces such as Hunan, Hubei, and Henan attract government investment and private sector expansion. These regions benefit from improving transport networks, growing food and pharmaceutical industries, and lower operational costs compared to coastal provinces. It serves both local consumer demand and emerging e-commerce hubs inland. Local governments offer incentives for green production and packaging innovation, encouraging the use of water-based and low-VOC primers. It strengthens regional participation in national supply chains and drives consistent demand across flexible packaging applications.

Western China Emerges with Strategic Infrastructure and Local Demand Growth

Western China represents about 18% of the China packaging primers market. Though historically underdeveloped, the region experiences accelerated growth through state-led infrastructure development and industrial relocation. Provinces such as Sichuan, Shaanxi, and Chongqing see increased activity in logistics, food processing, and light manufacturing. It supports growing demand for packaging primers tailored to local production needs. Logistics corridors like the Belt and Road Initiative improve material flow and access to new markets. Companies explore the western region to reduce supply chain dependency on the east while tapping into the expanding consumer base. It plays an increasingly important role in regional balancing within the national packaging ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sherwin-Williams

- Henkel AG & Co. KGaA

- Axalta Coating Systems

- PPG Industries, Inc.

- Akzo Nobel N.V.

- DIC Corporation

- Siegwerk Druckfarben AG & Co. KGaA

- Toyo Ink SC Holdings Co., Ltd.

- Flint Group

- Sun Chemical Group

- B. Fuller Company

Competitive Analysis:

The China packaging primers market features intense competition among global coating giants and regional players. Companies such as Henkel, DIC Corporation, Toyo Ink, and Flint Group lead in technology adoption and product range. Domestic players strengthen their positions through cost-effective production and localized services. Major participants compete on primer performance, regulatory compliance, and compatibility with evolving packaging substrates. It continues to attract R&D investments in water-based and UV-curable formulations to align with sustainability mandates. Leading firms enhance customer retention through technical support, customization, and integrated packaging solutions. Strategic partnerships with converters and brand owners further strengthen market presence.

Recent Developments:

- In May 2025, Henkel AG & Co. KGaA elevated its collaboration with Nordmeccanica S.p.A. to a formal strategic partnership. This move aims to accelerate joint development of sustainable and innovative packaging solutions, focusing on digitalization, automation, and efficient adhesives and functional coatings—directly benefiting converters and brand owners in China’s evolving packaging ecosystem. The partnership includes upcoming introductions of novel solutions tailored for the Asian market and was highlighted at the drupa 2024 and Giflex 2025 events.

- In March 2025, Sherwin-Williams introduced its Global Core range of coatings, which includes innovative inorganic zinc primers and epoxy primers designed for versatile application and fast drying. These products are engineered to provide consistent quality for packaging and industrial projects globally, including China, enhancing productivity and supporting rapid asset turnover in packaging facilities.

- In July 2024, Siegwerk Druckfarben AG & Co. KGaA, in collaboration with Masterpress, unveiled a new UV flexo deinking primer technology for packaging labels. This technology targets enhanced recyclability of labeled packaging by enabling efficient deinking of self-adhesive labels, an increasingly important capability for China’s evolving circular packaging economy.

Market Concentration & Characteristics:

The China packaging primers market exhibits moderate to high concentration, with a mix of multinational leaders and agile domestic manufacturers. It favors players with robust R&D, strong distribution networks, and regulatory compliance capabilities. Product innovation centers on eco-friendly formulations and cross-substrate compatibility. The market demands fast turnaround times, customization, and technical service support. It is driven by consumer-focused sectors requiring performance and aesthetic value in packaging.

Report Coverage:

The research report offers an in-depth analysis based on Primer Type, Application, and Substrate. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable, low-VOC primers will accelerate with stricter environmental regulations.

- E-commerce packaging growth will drive adoption of abrasion- and moisture-resistant primer formulations.

- Water-based primers will gain share due to compliance with China’s green manufacturing standards.

- UV-curable technologies will expand in high-speed production lines for time and energy efficiency.

- Flexible packaging formats will require multi-functional primers tailored for barrier and sealing layers.

- Eastern China will retain market leadership, supported by infrastructure and mature manufacturing bases.

- Central and Western regions will witness increased investments in localized primer production facilities.

- Food and pharmaceutical applications will continue to dominate primer usage across packaging sectors.

- Integration of primers with digital and smart packaging technologies will create niche growth areas.

- Strategic alliances between local producers and global players will boost innovation and market expansion.