| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Industrial Catalyst Market Size 2024 |

USD 3906.79 Million |

| China Industrial Catalyst Market, CAGR |

8.18% |

| China Industrial Catalyst Market Size 2032 |

USD 7330.05 Million |

Market Overview:

The China Industrial Catalyst Market is projected to grow from USD 3906.79 million in 2024 to an estimated USD 7330.05 million by 2032, with a compound annual growth rate (CAGR) of 8.18% from 2024 to 2032.

The growth of the China Industrial Catalyst Market is primarily driven by several factors. China’s robust petrochemical industry, being the largest consumer of petrochemicals globally, significantly drives the demand for industrial catalysts. These catalysts are crucial for refining processes like hydrocracking and catalytic reforming, which are essential for producing fuels and petrochemical feedstocks. Additionally, the country’s increasing environmental regulations and sustainability initiatives are pushing industries to adopt cleaner and more efficient technologies, making catalysts even more critical in reducing emissions and enhancing energy efficiency. Moreover, technological advancements and industrial upgrading efforts in China further boost the adoption of advanced catalytic technologies, helping to improve process efficiencies and enable the production of specialty chemicals, thus supporting the nation’s goals of higher-value manufacturing.

Regionally, the demand for industrial catalysts in China varies significantly. The eastern coastal regions, such as Jiangsu, Zhejiang, and Guangdong, are home to some of the country’s most advanced and largest petrochemical plants and manufacturing facilities, leading to a high concentration of industrial catalyst demand in these areas. These regions are not only economically developed but also serve as key export hubs, driving further demand for catalysts. Meanwhile, the central and western regions, including provinces like Sichuan and Shaanxi, are witnessing rapid industrialization, making them emerging hubs for petrochemical and manufacturing activities. As these regions continue to develop through regional development policies and infrastructure improvements, the demand for industrial catalysts is expected to rise significantly, contributing to the overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Industrial Catalyst Market is projected to grow from USD 3906.79 million in 2024 to USD 7330.05 million by 2032, with a CAGR of 8.18% from 2024 to 2032.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- The growth is mainly driven by China’s robust petrochemical industry, which is the largest consumer of petrochemicals globally.

- Increasing environmental regulations and sustainability initiatives are prompting industries to adopt cleaner, more efficient catalytic technologies.

- Technological advancements in catalytic processes, such as innovations in catalyst formulations and regeneration techniques, are further boosting market demand.

- Rising demand for specialty chemicals, including agrochemicals, pharmaceuticals, and high-performance materials, is creating new opportunities for industrial catalysts.

- Despite market growth, challenges such as the high cost of advanced catalysts, including those using precious metals, remain significant barriers.

- Regionally, Eastern China, with its advanced petrochemical plants, dominates the market, while Central and Western China are emerging as key hubs for catalyst demand.

Market Drivers:

Growth of the Petrochemical Industry

One of the primary drivers of the China Industrial Catalyst Market is the rapid expansion of the country’s petrochemical industry. As the world’s largest consumer of petrochemicals, China plays a critical role in the global supply chain for chemicals, fuels, and other petrochemical derivatives. For instance, Sinopec’s Zhenhai Refinery expansion, have strengthened China’s position as a global leader in petrochemical production. The refinery now boasts a capacity of 40 million tons per year, contributing to the Zhejiang Ningbo Petrochemical Industrial Base’s total refining capacity of over 50 million tons annually. Catalysts are essential in various refining processes such as catalytic reforming, hydrocracking, and alkylation, all of which are vital for producing high-quality fuels and chemicals. The continued investment in refining infrastructure and the demand for higher-grade petrochemical products significantly contribute to the increasing need for advanced industrial catalysts, propelling market growth.

Stringent Environmental Regulations

China’s commitment to environmental sustainability is another key factor driving the demand for industrial catalysts. With a focus on reducing carbon emissions and minimizing industrial pollution, the Chinese government has imposed strict environmental regulations on various industrial sectors, including oil refining and chemical production. For instance, environmental regulations have encouraged the adoption of green technologies such as hydrocracking and green methanol synthesis, which rely heavily on innovative catalysts. Industrial catalysts play an indispensable role in reducing harmful emissions by facilitating cleaner production processes. By enhancing process efficiency and enabling cleaner outputs, catalysts help industries comply with environmental regulations, which in turn boosts their adoption across various sectors. This growing focus on environmental protection is expected to sustain the demand for catalysts in the coming years.

Technological Advancements in Catalytic Processes

Technological advancements in catalytic processes are playing a significant role in shaping the demand for industrial catalysts in China. The increasing complexity of chemical production processes and the move toward higher-value-added products have driven the need for more efficient and specialized catalytic technologies. Innovations in catalyst formulations, regeneration techniques, and catalyst life cycle management have further enhanced the performance of industrial catalysts. These technological improvements allow manufacturers to achieve greater yields, reduce energy consumption, and improve product quality. As industries in China continue to upgrade their manufacturing capabilities and strive for higher efficiency, the adoption of these advanced catalytic technologies will continue to grow, providing a significant boost to the market.

Rising Demand for Specialty Chemicals

China’s growing demand for specialty chemicals is also a vital driver for the industrial catalyst market. The country’s industrial base is increasingly focused on producing high-value chemicals, including specialty materials, agrochemicals, and pharmaceuticals, which require advanced catalytic processes. As demand for these specialized products rises, the need for more sophisticated and efficient catalysts becomes even more apparent. The ability of catalysts to enable the production of such high-performance chemicals at scale is propelling the adoption of catalysts in China’s chemical manufacturing sector. This shift toward more specialized chemical production is expected to drive sustained growth in the industrial catalyst market as industries continue to focus on innovation and product diversification.

Market Trends:

Increasing Use of Green Catalysts

One of the prominent trends in the China Industrial Catalyst Market is the growing emphasis on green and sustainable catalysts. As part of the global push toward sustainability, China is increasingly adopting eco-friendly catalysts that reduce environmental impact. These catalysts are designed to minimize energy consumption, lower emissions, and reduce the use of hazardous chemicals in manufacturing processes. Green catalysts, such as bio-based or recyclable catalysts, are gaining traction in industries such as petrochemicals and fine chemicals, where efficiency and environmental compliance are critical. This shift is driven by both regulatory pressure and the market demand for cleaner production technologies, contributing to the transformation of the industrial catalyst landscape in China.

Shift Toward Customized Catalysts

The demand for more customized and application-specific catalysts is another key trend influencing the market. As China’s manufacturing industries continue to evolve, there is an increasing need for catalysts tailored to specific processes and production requirements. Customized catalysts can enhance process efficiency, improve product quality, and extend catalyst life cycles, making them highly sought after across industries such as oil refining, chemicals, and specialty materials. For example, BASF offers tailored catalyst manufacturing services that enhance process efficiency and product quality while meeting unique industrial needs. This trend is driven by the move toward high-value-added products, where precision and performance are paramount. Manufacturers are investing in R&D to create catalysts with improved activity, selectivity, and durability to meet the unique needs of different sectors, thereby driving market innovation.

Integration of Digital Technologies in Catalyst Management

The integration of digital technologies into catalyst management is a growing trend within the China Industrial Catalyst Market. Industries are increasingly leveraging data analytics, artificial intelligence (AI), and machine learning to optimize catalyst performance, monitor catalyst life cycles, and improve the overall efficiency of catalytic processes. Through real-time data collection and predictive analytics, companies can better manage catalyst regeneration and replacement schedules, reducing operational costs and downtime. This integration of digital technologies is helping businesses make more informed decisions about catalyst usage, leading to enhanced productivity and lower environmental impact. The continued development of smart catalysts and digital platforms is expected to further drive innovation in the market.

Expansion of Industrial Catalysts in Emerging Sectors

Another noteworthy trend is the growing adoption of industrial catalysts in emerging sectors such as renewable energy, electric vehicles (EVs), and waste management. As China continues to prioritize green energy initiatives and the transition to a low-carbon economy, industrial catalysts are playing a crucial role in new energy applications. For example, catalysts play a pivotal role in hydrogen production processes targeted under China’s plan to produce 100,000–200,000 tons of low-carbon hydrogen annually by 2025. In the EV sector, catalysts are used in battery recycling and material recovery. These emerging applications present new growth opportunities for the industrial catalyst market, offering a diverse range of revenue streams as China seeks to diversify its industrial base and reduce its reliance on traditional fossil fuels.

Market Challenges Analysis:

High Cost of Advanced Catalysts

One of the key restraints in the China Industrial Catalyst Market is the high cost associated with advanced catalysts. While these catalysts offer improved performance, efficiency, and sustainability, their development, production, and implementation come at a premium. For instance, volatile precious metal prices have impacted profit margins for manufacturers and end-users, making these catalysts less accessible to smaller industries. Additionally, the complex manufacturing processes involved in creating highly specialized catalysts further escalate the expenses. This high cost can be a barrier for small and medium-sized enterprises (SMEs) or industries operating on tight profit margins, limiting their ability to invest in advanced catalytic solutions.

Environmental and Regulatory Challenges

Despite the push for more sustainable production methods, the China Industrial Catalyst Market faces challenges related to evolving environmental regulations. Stringent rules on the use and disposal of catalysts, particularly those that contain hazardous substances, pose significant obstacles for businesses. While catalysts contribute to cleaner processes, the environmental impact of catalyst disposal and the management of used catalysts remain concerns. In addition, companies are under pressure to continually meet new government regulations aimed at reducing industrial emissions and improving sustainability. These constantly changing standards require significant investments in R&D and catalyst management, which can be burdensome for industries that are already grappling with the cost of compliance.

Limited Availability of Skilled Workforce

Another challenge hindering the growth of the China Industrial Catalyst Market is the limited availability of skilled professionals in catalyst research, development, and application. The highly specialized nature of catalyst technology requires experts who can innovate, optimize, and manage catalytic processes effectively. However, the fast pace of industrial growth in China has led to a shortage of trained professionals capable of addressing the complexities associated with catalyst design and implementation. This skills gap can delay the development of new catalytic solutions and hinder the widespread adoption of cutting-edge catalyst technologies in various industries.

Market Opportunities:

The China Industrial Catalyst Market presents significant opportunities driven by the country’s industrial transformation and the push for more sustainable and efficient manufacturing processes. As China continues to focus on reducing its carbon footprint and improving energy efficiency, the demand for advanced catalysts is expected to rise. Specifically, there is growing potential in the adoption of green catalysts that facilitate cleaner production methods. Industries such as petrochemicals, automotive, and renewable energy are investing in catalysts that improve process efficiency, reduce emissions, and meet stringent environmental regulations. This creates a considerable opportunity for catalyst manufacturers to develop innovative solutions that align with China’s sustainability goals.

Moreover, the increasing diversification of China’s industrial sectors opens up new avenues for industrial catalysts. As China shifts toward high-value-added products in industries such as specialty chemicals, electric vehicles, and renewable energy, there is a growing demand for highly specialized and customized catalysts. These emerging sectors require catalysts that can support complex processes, such as hydrogen production for clean energy, battery recycling, and biofuel refining. With the government’s commitment to green energy and technological advancements, companies that focus on developing catalysts for these next-generation applications are well-positioned to capitalize on this growth. Additionally, the rising trend of digital integration in catalyst management provides opportunities for businesses to offer smart catalysts that optimize production efficiency and reduce operational costs.

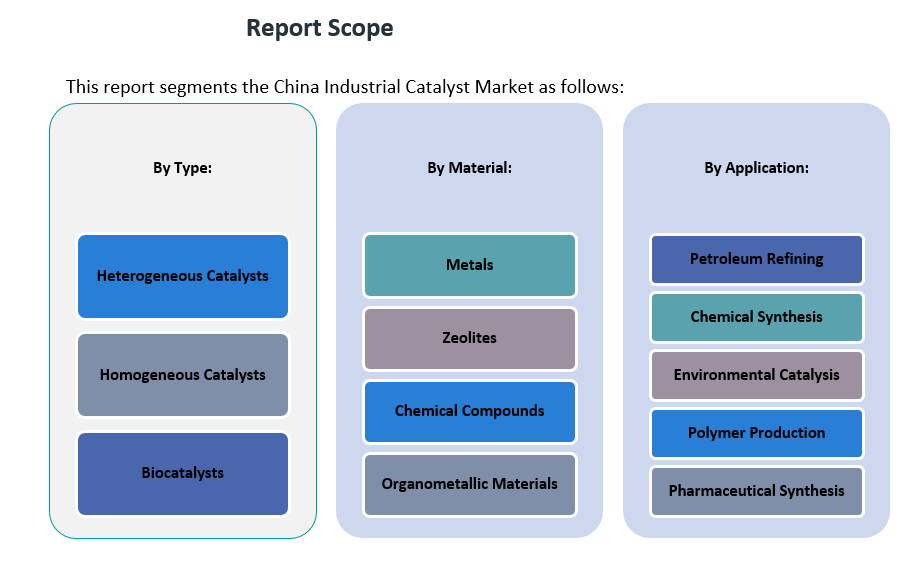

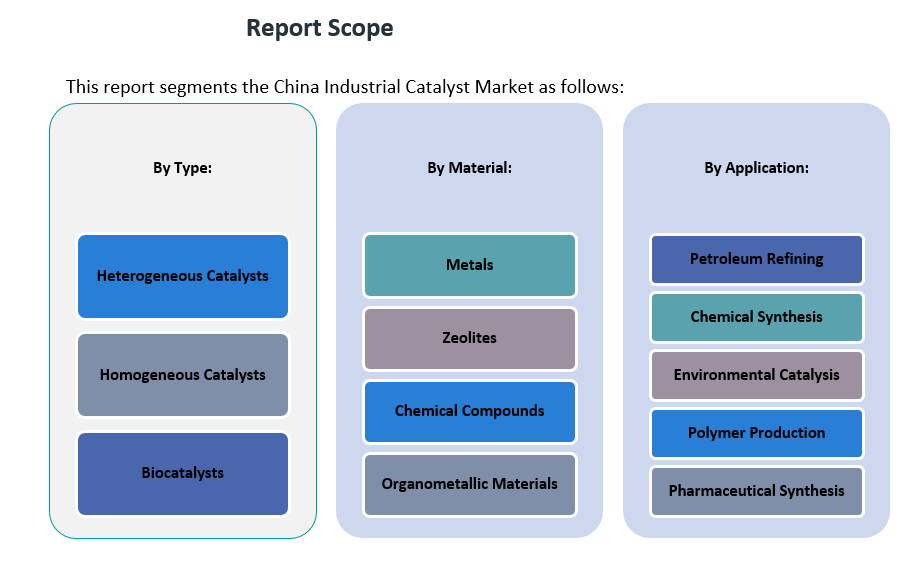

Market Segmentation Analysis:

The China Industrial Catalyst Market can be categorized into several segments based on type, application, and material.

By Type Segment

The market is primarily divided into heterogeneous, homogeneous, and biocatalysts. Heterogeneous catalysts dominate the market due to their extensive use in industries like petroleum refining and chemical synthesis. These catalysts, typically solid, offer better efficiency in large-scale processes. Homogeneous catalysts are used in chemical synthesis and pharmaceutical production, where high precision is required, though they are less common due to challenges in separation and recovery. Biocatalysts, while a smaller segment, are gaining traction in environmentally sustainable applications, particularly in chemical and pharmaceutical synthesis, as they offer greener alternatives.

By Application Segment

The key applications of industrial catalysts in China include petroleum refining, chemical synthesis, environmental catalysis, polymer production, and pharmaceutical synthesis. Petroleum refining is the largest segment, driven by China’s position as the global leader in refining activities. Catalysts are essential for processes like hydrocracking and catalytic reforming. Environmental catalysis is growing due to stricter environmental regulations, particularly for emission control. Chemical synthesis and pharmaceutical synthesis are also significant, driven by China’s demand for specialty chemicals and drugs. Polymer production remains a strong application area due to the country’s substantial plastic manufacturing industry.

By Material Segment

In terms of materials, metals (such as platinum, palladium, and rhodium) are the most commonly used in industrial catalysts, especially in petroleum refining and environmental catalysis. Zeolites are crucial in petrochemical processes, offering high surface area and catalytic properties. Chemical compounds and organometallic materials are used in chemical synthesis and pharmaceutical applications, where selectivity and precision are critical.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The China Industrial Catalyst Market exhibits significant regional variation, influenced by the distribution of industrial activity, economic development, and government policies across the country. As one of the largest and fastest-growing markets in the world, China’s diverse industrial landscape creates both opportunities and challenges for catalyst suppliers. The market is primarily driven by the manufacturing and petrochemical sectors, with key regions contributing differently to overall demand based on local industry strengths and growth patterns.

Eastern China

Eastern China, particularly the coastal provinces of Jiangsu, Zhejiang, and Guangdong, holds the largest share of the industrial catalyst market, accounting for approximately 35% of the total market. These regions are the industrial powerhouses of China, with a high concentration of petrochemical, chemical, and manufacturing facilities. The demand for industrial catalysts in these areas is driven by the extensive refining operations and the need for high-performance catalysts in chemical and specialty chemical production. The major cities of Shanghai and Guangzhou, as economic and manufacturing hubs, further boost catalyst consumption. This region’s industrial focus on innovation and efficiency, coupled with stringent environmental regulations, enhances the demand for advanced catalysts that can help reduce emissions and improve production processes.

Northern China

Northern China, including Beijing, Tianjin, and Hebei, contributes approximately 25% to the market. This region is crucial due to its large-scale industrial base, particularly in steel manufacturing, chemicals, and heavy industry. The heavy industrial nature of the region creates a steady demand for industrial catalysts, especially in areas related to refining and steel production, where catalysts are essential for optimizing energy use and reducing emissions. However, challenges such as air pollution and stricter environmental regulations have driven the adoption of cleaner and more efficient catalytic technologies in these industries.

Central and Western China

Central and Western China, including provinces such as Sichuan, Shaanxi, and Chongqing, account for around 20% of the industrial catalyst market. These regions are emerging as industrial hubs, with increasing investments in the petrochemical and chemical industries. While the market share in these regions is lower than in the east, the rapid industrialization and government-led initiatives to boost local economies present growth opportunities for catalyst suppliers. The expanding demand for catalysts in these areas is expected to grow as regional industries advance toward more sustainable practices and process optimization.

Southern China and Other Regions

Southern China, encompassing regions like Hainan and Guangxi, contributes roughly 15% to the market. This region is less industrialized compared to the eastern and northern parts but is witnessing steady growth due to increased infrastructure and investment in petrochemicals and specialty chemicals. The remaining 5% of the market share is distributed across other regions, including the northeast and some rural areas, where industrial activity is relatively limited but growing.

Key Player Analysis:

- Mitsubishi Chemical Corporation

- LG Chem

- R. Grace (Asia-Pacific operations)

- BASF SE (Regional)

- Reliance Industries Limited

- Sinopec Catalyst Co., Ltd.

- Johnson Matthey (Asia-Pacific operations)

- China National Petroleum Corporation (CNPC)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

Competitive Analysis:

The China Industrial Catalyst Market is highly competitive, with key players ranging from global corporations to regional suppliers. Leading international companies such as BASF, Johnson Matthey, and Honeywell dominate the market with their advanced catalytic solutions and strong research and development (R&D) capabilities. These companies leverage their global presence and technological expertise to meet the increasing demand for high-performance, eco-friendly catalysts in industries like petrochemicals, refining, and automotive. Local players, including Sinochem International Corporation and Zhongtai International, are also significant contributors to the market. These regional firms benefit from their deep understanding of local market dynamics and government regulations. They are increasingly focusing on developing customized catalysts to cater to the specific needs of the Chinese market, particularly in emerging sectors like renewable energy and specialty chemicals. The competition is intensifying as companies strive to develop cost-effective, environmentally compliant catalysts to address China’s growing emphasis on sustainability and industrial upgrading.

Recent Developments:

- In March 2025, Clariant AGannounced the success of its EnviCat N2O-S catalyst at Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) in India. The catalyst reduced nitrous oxide emissions by 44,000 tons per month of CO2 equivalent, demonstrating its efficacy in industrial decarbonization efforts.

- In November 2024, Clariant launched its Plus series industrial syngas catalysts, including ReforMax LDP Plus, ShiftMax 217 Plus, and AmoMax 10 Plus. These catalysts are designed to enhance efficiency and sustainability in hydrogen, ammonia, and methanol production, supporting global efforts to transition to green and blue energy solutions.

- in November 2024, BASF Environmental Catalyst and Metal Solutions inaugurated a hydrogen component lab in Hannover, Germany. The facility focuses on developing advanced PGM-containing catalysts for water electrolysis, emphasizing cost-effective solutions with low-iridium content to support green hydrogen production and global decarbonization efforts.

Market Concentration & Characteristics:

The China Industrial Catalyst Market is characterized by moderate to high concentration, with a few dominant global players and a growing number of regional suppliers. Leading multinational companies such as BASF, Johnson Matthey, and Honeywell hold a significant share of the market due to their extensive technological capabilities, strong R&D investment, and established relationships with major industrial sectors. These companies provide a wide range of advanced catalysts that cater to various industries, including petrochemicals, automotive, and refining. In contrast, local players like Sinochem International and Zhongtai International are gaining traction by offering cost-effective, region-specific solutions and benefiting from their deep understanding of China’s regulatory environment. The market is highly competitive, with a growing focus on sustainability and innovation. Companies are increasingly developing green catalysts that align with China’s environmental policies. As a result, the market is evolving, with both global and local players competing to capture opportunities in emerging sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The China Industrial Catalyst Market is expected to grow steadily, driven by increasing demand for efficient and sustainable manufacturing processes.

- Rapid industrialization in Central and Western China will contribute to higher catalyst adoption in emerging sectors.

- Technological advancements in catalyst design will enhance process efficiency, reducing costs and environmental impact.

- The growing push for green chemistry and sustainable manufacturing practices will drive demand for eco-friendly catalysts.

- Increasing environmental regulations will compel industries to invest in cleaner, high-performance catalysts.

- The shift toward high-value-added chemical production will lead to higher demand for specialized catalysts in industries like specialty chemicals and renewable energy.

- Smart catalysts, integrating digital technologies for real-time monitoring, will see higher adoption in process optimization.

- Regional disparities will continue, with Eastern China leading the market, while emerging regions like the West experience growing opportunities.

- The adoption of renewable energy technologies, including hydrogen production and biofuel refining, will increase catalyst demand.

- Competitive dynamics will intensify as both global and local players innovate to meet China’s evolving industrial needs.