Market Overview

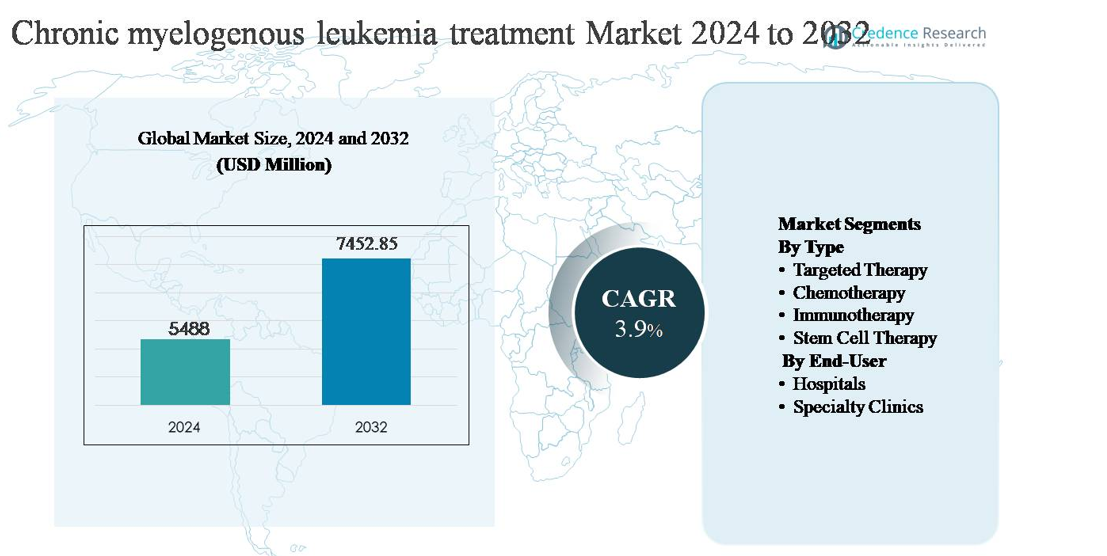

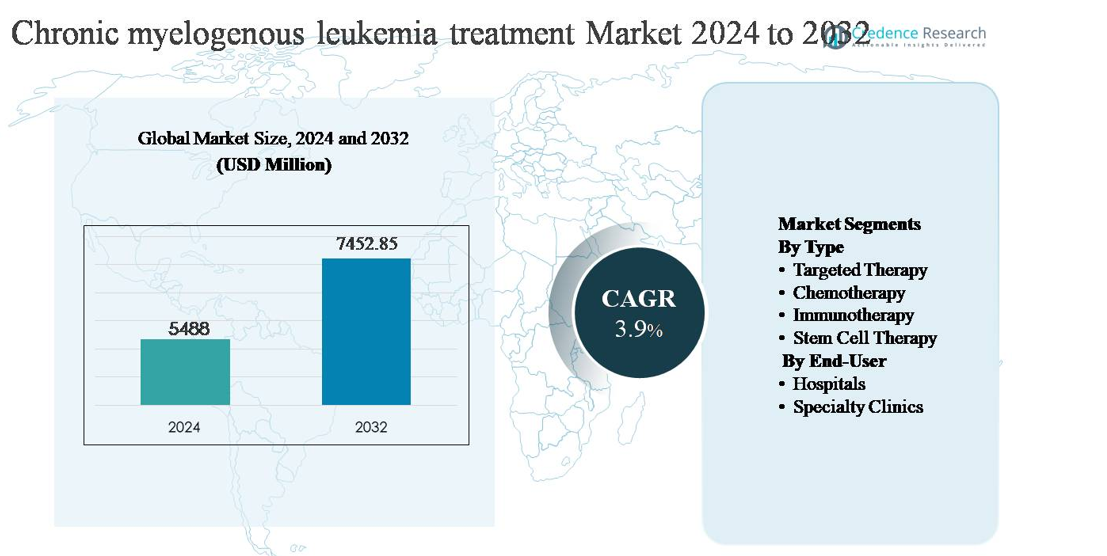

The chronic myelogenous leukemia (CML) treatment market was valued at USD 5,488 million in 2024 and is anticipated to reach USD 7,452.85 million by 2032, expanding at a compound annual growth rate (CAGR) of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

Chronic Myelogenous Leukemia Treatment Market Size 2024

|

USD 5,488 million |

| Chronic Myelogenous Leukemia Treatment Market, CAGR |

3.9% |

| Chronic Myelogenous Leukemia Treatment Market Size 2032 |

USD 7,452.85 million |

The chronic myelogenous leukemia (CML) treatment market is led by a concentrated group of global pharmaceutical companies with strong expertise in targeted oncology therapies, including Novartis AG, Pfizer Inc., Bristol-Myers Squibb Company, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Otsuka Holdings Co., Ltd., Incyte, Biopath Holdings Inc., and Stragen Pharma SA. These players compete through differentiated tyrosine kinase inhibitor portfolios, lifecycle management strategies, and global commercialization capabilities. North America is the leading region, accounting for approximately 42% of the global market, supported by early diagnosis, advanced molecular monitoring, and high treatment adherence. Europe follows as a major contributor, while Asia-Pacific continues to gain importance due to expanding access to affordable therapies and improving oncology infrastructure.

Market Insights

- The chronic myelogenous leukemia (CML) treatment market was valued at USD 5,488 million in 2024 and is projected to reach USD 7,452.85 million by 2032, expanding at a CAGR of 3.9% during the forecast period, supported by long-term therapy demand and sustained patient treatment cycles.

- Market growth is driven by the widespread adoption of targeted therapies, which represent the dominant segment with over 75% share, due to their role as first-line treatment, high efficacy in achieving molecular remission, and requirement for prolonged or lifelong use.

- Key market trends include increasing focus on treatment-free remission strategies, next-generation tyrosine kinase inhibitors for resistant cases, and rising use of generics, which improve affordability while intensifying competitive dynamics.

- The competitive landscape is characterized by established pharmaceutical players focusing on portfolio optimization, lifecycle extensions, and global distribution, while generic manufacturers exert pricing pressure and expand access in emerging markets.

- Regionally, North America leads with around 42% market share, followed by Europe at ~30%, Asia-Pacific at ~18%, with Latin America and the Middle East & Africa together accounting for the remaining share, driven by improving diagnostics and therapy access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The chronic myelogenous leukemia (CML) treatment market is dominated by targeted therapy, which holds the largest market share due to its position as the global standard of care across all disease phases. Tyrosine kinase inhibitors (TKIs) effectively suppress BCR-ABL activity, enabling durable molecular remission and long-term disease control. High prescription volumes, lifelong treatment duration, and strong clinical guideline endorsement continue to drive demand. Chemotherapy remains limited to advanced or blast-phase cases, while immunotherapy is emerging through clinical development. Stem cell therapy, despite curative potential, remains restricted due to procedural risk and eligibility constraints.

- For instance, Bristol Myers Squibb’s dasatinib (Sprycel®) is prescribed at 100 mg once daily for chronic-phase CML and demonstrates activity against over 30 documented BCR-ABL1 kinase domain mutations, supporting its use after first-line failure.

By End-User:

Hospitals represent the dominant end-user segment in the CML treatment market, accounting for the highest share owing to their advanced oncology infrastructure and integrated hematology services. Hospitals lead in diagnosis, molecular monitoring, treatment initiation, and management of complex or resistant cases, including stem cell transplantation. Their access to specialized clinicians and inpatient capabilities supports sustained utilization. Specialty clinics are increasingly important in long-term outpatient management, particularly for stable patients receiving oral targeted therapies, driven by convenience, continuity of care, and reduced hospitalization needs.

- For instance, MD Anderson Cancer Center operates a dedicated Leukemia Department that performs quantitative BCR-ABL1 monitoring using real-time PCR (RQ-PCR) assays. These assays are highly sensitive and capable of detecting transcript levels below the 0.0032% mark (MR4.5) on the International Scale, with the lab’s stated limit of quantification being 002% IS (MR4.7).

Key Growth Driver

Sustained Reliance on Targeted Therapies as Standard of Care

The chronic myelogenous leukemia (CML) treatment market continues to be driven by the long-term reliance on tyrosine kinase inhibitors (TKIs) as the established first-line therapy. These agents have significantly improved survival outcomes by enabling durable molecular remission and transforming CML into a manageable chronic condition for most patients. Lifelong treatment requirements for many patients result in consistent therapy demand, reinforcing revenue stability. The availability of multiple generations of TKIs supports sequential treatment strategies in cases of resistance or intolerance, further extending treatment duration. In addition, expanding access to generic TKIs in several regions has increased patient reach, supporting broader diagnosis-to-treatment conversion and sustaining overall market expansion.

- For instance, Novartis’ imatinib mesylate (Gleevec®) is prescribed at a standard starting dose of 400 mg once daily for newly diagnosed chronic-phase CML, with long-term follow-up data extending beyond two decades since its initial regulatory approval in 2001, demonstrating persistent molecular control under continuous dosing.

Rising Diagnosis Rates and Improved Molecular Monitoring

Growth in the CML treatment market is also supported by rising diagnosis rates enabled by improved access to cytogenetic and molecular diagnostic tools. Advances in real-time quantitative PCR testing allow for early detection and precise monitoring of BCR-ABL transcript levels, encouraging timely treatment initiation and therapy optimization. Increased physician awareness and standardized monitoring protocols have strengthened adherence to long-term treatment plans, reducing disease progression rates. As healthcare systems invest in diagnostic infrastructure, particularly in emerging economies, a larger patient pool is entering structured treatment pathways, directly contributing to increased therapy uptake and sustained market growth.

- For instance, Roche’s LightCycler® 480 System II supports RT-qPCR workflows with reaction volumes as low as 5 µL and cycling times under 40 minutes, allowing high-throughput BCR-ABL1 transcript analysis in clinical laboratories.

Expanding Treatment Access Across Emerging Healthcare Markets

The gradual expansion of oncology care infrastructure across emerging markets represents a significant growth driver for CML treatment. Governments and private healthcare providers are improving access to essential cancer therapies through reimbursement programs, public-private partnerships, and inclusion of TKIs in national treatment formularies. Improved affordability through generics and patient assistance programs has reduced treatment gaps, enabling earlier intervention and continuous therapy. As access improves, treatment adherence and survival outcomes rise, reinforcing demand for long-term pharmacological management and supporting steady market expansion across developing regions.

Key Trend & Opportunity:

Shift Toward Treatment-Free Remission Strategies

An important trend shaping the CML treatment landscape is the growing clinical focus on treatment-free remission (TFR). Advances in molecular monitoring have enabled select patients with sustained deep molecular responses to safely discontinue TKIs under strict supervision. This shift is driving innovation in patient stratification, response monitoring, and relapse management protocols. While TFR may reduce long-term drug exposure for eligible patients, it creates opportunities for premium diagnostics, specialized follow-up services, and next-generation therapies designed to deepen molecular responses. Pharmaceutical developers are increasingly positioning newer TKIs to support durable remission outcomes aligned with TFR objectives.

- For instance, Otsuka Pharmaceutical Co., Ltd. developed and obtained approval for the “Major BCR-ABL mRNA Measurement Kit” in Japan, which is used as an aid to diagnose and monitor the effectiveness of treatment for chronic myeloid leukemia (CML), and which is covered by national health insurance as of April 1, 2015.

Development of Next-Generation and Combination Therapies

Ongoing research into next-generation TKIs and combination treatment approaches presents a major opportunity within the CML treatment market. Novel agents are being developed to address resistance mutations and improve tolerability profiles, particularly for patients with long-term treatment exposure. Combination strategies integrating targeted therapy with immune-modulating agents are also under investigation to enhance response depth. These developments support product differentiation and lifecycle management strategies, enabling manufacturers to strengthen their competitive positioning while addressing unmet clinical needs in resistant or refractory patient populations.

- For instance, Takeda Pharmaceutical Company Limited advanced ponatinib life-cycle optimization strategies through dose-modification protocols validated in clinical programs where ponatinib was initiated at 45 mg once daily with protocol-defined reductions to 15 mg once daily following achievement of molecular milestones, supported by serial BCR-ABL1 transcript monitoring at 3-month intervals using centralized laboratories calibrated to international reference standards.

Key Challenge

Long-Term Treatment Adherence and Safety Concerns

Despite therapeutic advances, long-term treatment adherence remains a significant challenge in CML management. Lifelong or extended therapy increases the risk of cumulative adverse effects, including cardiovascular and metabolic complications, which can impact patient compliance. Managing chronic toxicity requires ongoing monitoring and potential therapy switching, increasing clinical complexity. Non-adherence can lead to suboptimal molecular responses and disease progression, undermining treatment effectiveness. These challenges place pressure on healthcare providers to balance efficacy with tolerability, while pharmaceutical companies must continue improving safety profiles to sustain long-term patient engagement.

Pricing Pressures and Generic Competition

The increasing penetration of generic TKIs presents a structural challenge for branded therapies within the CML treatment market. While generics improve patient access, they intensify pricing pressure and limit revenue growth for originator products. Payers are prioritizing cost containment, particularly for long-term therapies, which can restrict uptake of newer, higher-priced agents unless clear clinical advantages are demonstrated. Manufacturers must navigate competitive pricing environments while investing in innovation, creating a challenging balance between affordability, differentiation, and sustainable profitability in a market characterized by extended treatment durations.

Regional Analysis

North America:

North America holds the largest share of the chronic myelogenous leukemia (CML) treatment market, accounting for approximately 42% of global revenue. The region benefits from early disease diagnosis, widespread access to molecular testing, and strong adoption of targeted therapies as first-line treatment. High treatment adherence, established reimbursement frameworks, and the presence of leading pharmaceutical innovators support sustained therapy utilization. The United States dominates regional demand due to advanced oncology infrastructure and long-term patient management protocols, while Canada contributes through universal healthcare coverage and standardized clinical guidelines supporting continuous CML treatment.

Europe:

Europe represents around 30% of the global CML treatment market, supported by strong public healthcare systems and broad access to tyrosine kinase inhibitors across major countries. Western Europe leads regional consumption due to well-established hematology networks, routine molecular monitoring, and favorable reimbursement policies. Countries such as Germany, the United Kingdom, and France maintain high treatment continuity rates through national cancer programs. Eastern Europe shows gradual growth as access to diagnostics and generics improves. The region also benefits from strong clinical research activity and structured long-term disease management frameworks.

Asia-Pacific:

Asia-Pacific accounts for approximately 18% of the global CML treatment market and represents the fastest-expanding regional opportunity. Growth is driven by rising disease awareness, improving diagnostic penetration, and expanding access to affordable generic targeted therapies. Countries such as China, India, Japan, and South Korea are strengthening oncology infrastructure and increasing inclusion of CML treatments in public reimbursement programs. Large patient populations and improving healthcare investment continue to expand the treated patient base. While access disparities remain across rural areas, urban centers are increasingly adopting guideline-based CML management.

Latin America:

Latin America holds around 6% of the global CML treatment market, supported by gradual improvements in cancer care access and expanding use of targeted therapies. Brazil and Mexico dominate regional demand due to higher healthcare spending and growing availability of reimbursed oncology drugs. Public healthcare systems increasingly incorporate generic TKIs to improve affordability, while private healthcare providers support advanced diagnostics and monitoring. Despite progress, uneven access and delayed diagnosis in certain countries limit full market potential. Continued healthcare reforms and investment in oncology services are expected to support steady regional growth.

Middle East & Africa:

The Middle East & Africa region accounts for approximately 4% of the global CML treatment market, reflecting limited but gradually improving access to advanced leukemia therapies. Gulf Cooperation Council countries lead regional demand due to higher healthcare expenditure, access to branded therapies, and specialized oncology centers. In contrast, much of Africa faces challenges related to late diagnosis, limited molecular testing, and constrained treatment availability. International aid programs, expanding generic penetration, and gradual healthcare infrastructure development are improving access, supporting incremental growth across select Middle Eastern and African markets.

Market Segmentations:

By Type

- Targeted Therapy

- Chemotherapy

- Immunotherapy

- Stem Cell Therapy

By End-User

- Hospitals

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chronic myelogenous leukemia (CML) treatment market is characterized by the presence of established pharmaceutical companies with strong oncology portfolios and extensive experience in targeted therapies. Market competition centers on the development, commercialization, and lifecycle management of tyrosine kinase inhibitors, with companies focusing on efficacy, safety profiles, and resistance management. Leading players leverage robust clinical data, long-term patient outcomes, and global distribution networks to maintain market positions. Generic manufacturers intensify competition by expanding access and exerting pricing pressure, particularly in emerging markets. Strategic priorities include label expansions, next-generation molecule development, and partnerships to support advanced diagnostics and monitoring. Companies also invest in real-world evidence generation and patient support programs to strengthen treatment adherence and brand differentiation in a market defined by chronic disease management and prolonged therapy durations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Novartis AG

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Otsuka Holdings Co., Ltd.

- Incyte

- Biopath Holdings Inc.

- Stragen Pharma SA

Recent Developments

- In April 2024,Takeda highlighted updated clinical practice data in April 2024 supporting its response-based dosing strategy for ponatinib, originally validated in the OPTIC trial. Treatment initiation at 45 mg once daily, followed by protocol-defined reduction to 15 mg once daily upon achievement of BCR-ABL1 transcript levels ≤1%, was reaffirmed as an effective approach for patients with resistant CML, including those harboring the T315I mutation. Molecular response assessments were based on serial quantitative PCR testing aligned with international reference laboratories, ensuring early detection of molecular relapse and sustained disease control.

- In February 2024, Bristol-Myers Squibb referenced extended follow-up analyses from long-running dasatinib clinical cohorts, including patients receiving 100 mg once daily dosing in chronic-phase CML. These analyses reaffirmed durable molecular response maintenance over extended treatment durations, with molecular monitoring conducted via centralized PCR assays calibrated to International Scale standards. While dasatinib has transitioned to a mature lifecycle phase, BMS continues to support long-term safety and response durability documentation in both adult and pediatric populations.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Targeted therapies will continue to anchor chronic myelogenous leukemia treatment due to their proven long-term efficacy and established clinical acceptance.

- Next-generation tyrosine kinase inhibitors will gain wider adoption to address resistance and intolerance in long-term treated patients.

- Treatment-free remission strategies will increasingly influence clinical decision-making for patients achieving deep and sustained molecular responses.

- Molecular diagnostics and real-time monitoring will play a more central role in therapy optimization and relapse prevention.

- Generic penetration will expand further, improving treatment accessibility while increasing price competition across markets.

- Combination therapy research will accelerate to enhance response durability and minimize disease progression risks.

- Specialty clinics will grow in importance for long-term outpatient management of stable patients.

- Emerging markets will experience higher treatment uptake as healthcare infrastructure and reimbursement frameworks improve.

- Patient adherence and long-term safety management will remain critical focus areas for healthcare providers.

- Innovation in personalized treatment approaches will shape future clinical guidelines and care pathways.