| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coated Recycled Paperboard Market Size 2024 |

USD 10,001.4 million |

| Coated Recycled Paperboard Market, CAGR |

4.70% |

| Coated Recycled Paperboard Market Size 2032 |

USD 14,458.7 million |

Market Overview

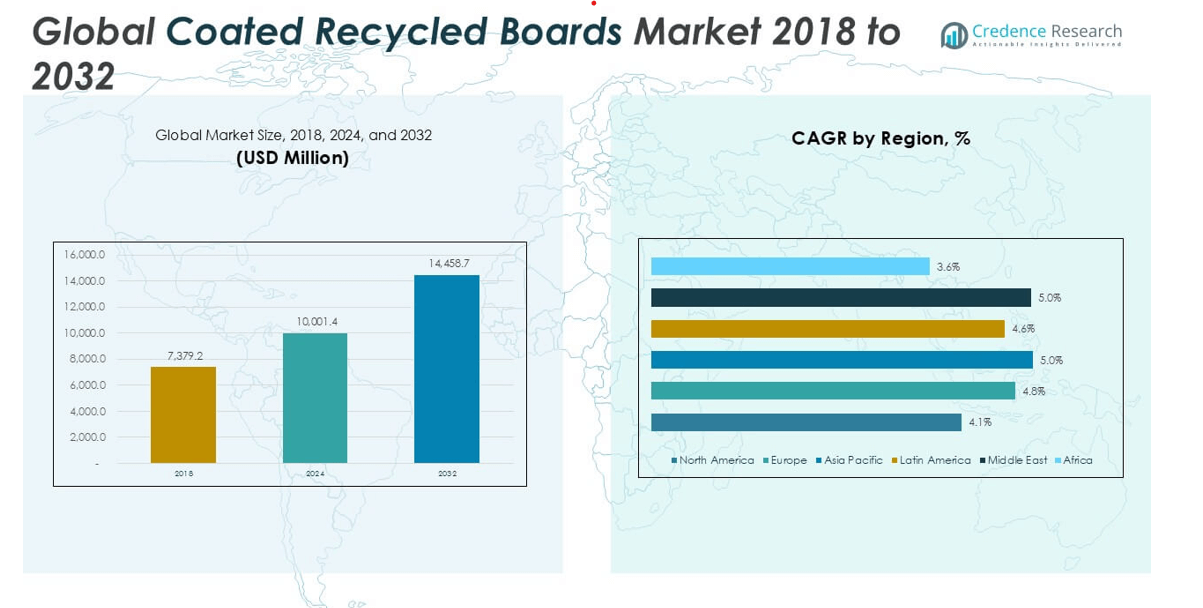

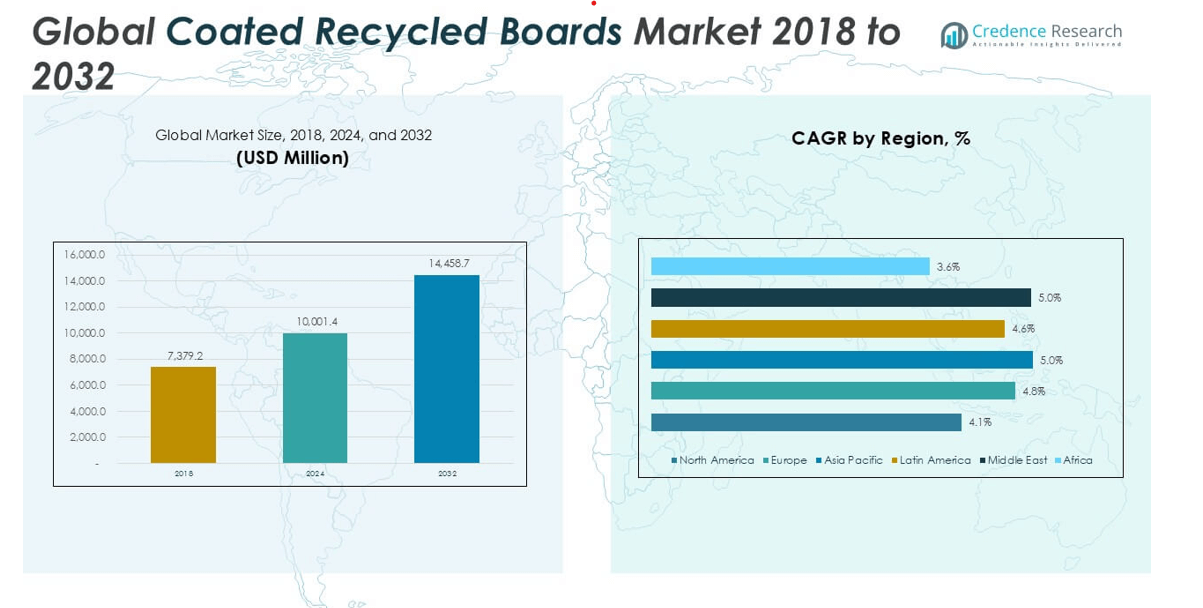

The Global Coated Recycled Paperboard Market is projected to grow from USD 10,001.4 million in 2024 to an estimated USD 14,458.7 million by 2032, registering a compound annual growth rate (CAGR) of 4.70% from 2025 to 2032.

The rising preference for sustainable and biodegradable packaging among consumers and businesses is a key driver for the market. Additionally, advances in coating technologies that enhance the barrier properties, durability, and print surface of recycled boards are supporting their wider adoption across end-use industries. The e-commerce boom and increasing consumption of packaged goods are also contributing to the market’s upward trajectory. Trends such as lightweight packaging and the integration of digital printing capabilities on recycled substrates are opening new avenues for manufacturers and converters.

Geographically, Asia Pacific dominates the Coated Recycled Paperboard market due to the presence of a large manufacturing base, rapid urbanization, and expanding retail and e-commerce sectors. North America and Europe follow closely, driven by regulatory pressure and consumer demand for green packaging solutions. Key players operating in the global market include Mondi Group, Smurfit Kappa Group, International Paper, Stora Enso, WestRock Company, and DS Smith, who continue to invest in product innovation and sustainable manufacturing processes.

Market Insights

- The market is projected to grow from USD 10,001.4 million in 2024 to USD 14,458.7 million by 2032, at a CAGR of 4.70% from 2025 to 2032.

- Increasing demand for eco-friendly, recyclable packaging materials is a key driver shaping product innovation and adoption.

- Improved barrier properties and printability are enhancing the functionality of Coated Recycled Paperboard across various applications.

- Strict environmental regulations and circular economy policies are compelling industries to shift toward recycled packaging solutions.

- Fluctuating quality and limited availability of recycled paper and fiber remain significant restraints affecting production consistency.

- Asia Pacific held the largest share of 39.6% in 2024, driven by rapid industrialization, packaging demand, and strong recycling infrastructure.

- Both regions benefit from mature recycling systems and high consumer awareness, contributing to stable market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Sustainable Packaging across Industries

The Global Coated Recycled Paperboard Market is experiencing strong growth due to the increasing focus on sustainability across multiple industries. Brands in food, personal care, and consumer goods sectors are adopting eco-friendly packaging to meet regulatory requirements and consumer expectations. Coated Recycled Paperboard offer a renewable alternative to plastic and virgin fiber-based materials, making them a preferred choice for environmentally conscious companies. Governments worldwide are enforcing stricter packaging waste regulations, pushing businesses to replace traditional packaging with recyclable solutions. The need for responsible sourcing and lower carbon footprints has positioned Coated Recycled Paperboard as a viable solution. It is gaining significant traction in both developed and emerging economies due to this environmental shift.

- For instance, a 2024 report by the Sustainable Packaging Coalition indicated that over 120,000 tons of Coated Recycled Paperboard were used in packaging applications across North America, reflecting the growing adoption of eco-friendly materials.

Advancements in Coating Technologies Enhancing Product Performance

Innovation in coating technologies is a major driver for the Global Coated Recycled Paperboard Market. New developments in barrier coatings improve water and grease resistance while maintaining recyclability. These improvements extend the usability of Coated Recycled Paperboard in high-performance applications such as frozen foods, ready-to-eat meals, and liquid packaging. Coatings now offer superior printability, helping brands maintain high visual appeal without compromising sustainability. It continues to benefit from research focused on non-plastic coatings that meet both functional and environmental needs. Improved coating processes also contribute to cost efficiency and product consistency, further encouraging adoption across industries.

- For instance, a 2024 survey by Packaging Innovations Ltd. found that more than 75 companies had adopted advanced barrier coating technologies, producing over 45,000 tons of Coated Recycled Paperboard with enhanced water and grease resistance.

Rising E-commerce and Retail Sector Expanding Packaging Needs

The rapid expansion of e-commerce and organized retail has created strong demand for robust and visually appealing packaging. The Global Coated Recycled Paperboard Market supports this growth by offering durable and printable solutions suitable for shipping and shelf display. Online retailers require protective yet lightweight packaging that aligns with sustainability goals, making Coated Recycled Paperboard an ideal fit. It offers versatility across box types, sleeves, and cartons used in the retail supply chain. Consumer preference for attractive and recyclable packaging is influencing purchase decisions, encouraging brands to invest in recycled board solutions. The growing frequency of product launches and seasonal campaigns further fuels packaging material demand.

Corporate Sustainability Goals and Circular Economy Initiatives

Large corporations are aligning their operations with global sustainability targets, influencing packaging choices. The Global Coated Recycled Paperboard Market is gaining momentum as companies prioritize circular economy models and waste reduction. Many organizations have committed to using a certain percentage of recycled content in packaging, directly increasing the demand for Coated Recycled Paperboard. It aligns with these goals by offering high recycled content while maintaining structural integrity and print performance. Manufacturers are also promoting closed-loop recycling systems to support long-term resource efficiency. These corporate commitments are expected to sustain long-term growth in demand across global markets.

Market Trends

Increased Focus on Circular Packaging Design and Waste Reduction

Companies are placing greater emphasis on circular packaging models that reduce waste and extend material life cycles. The Global Coated Recycled Paperboard Market benefits from this shift, as recycled boards align with closed-loop supply chain goals. Brands are redesigning packaging to enhance recyclability and reduce dependency on virgin materials. Coated Recycled Paperboard offer high recycled content without compromising on quality, helping businesses meet environmental targets. It supports circularity by being easily recyclable after use, minimizing landfill contributions. Governments and regulatory agencies are also promoting packaging standards that favor recyclable and renewable materials.

- For instance, a 2024 report by the Ellen MacArthur Foundation highlighted that over 2.5 billion tons of packaging waste was generated globally in 2023, with companies like Unilever and Nestlé committing to use at least 1 million tons of recycled materials annually in their packaging by 2025.

Growth in Premium and Customizable Sustainable Packaging

Consumer preferences are evolving toward premium and customized packaging that reflects brand values and sustainability. The Global Coated Recycled Paperboard Market is witnessing increased demand for high-quality finishes and creative designs printed on eco-friendly substrates. Brands are investing in Coated Recycled Paperboard for luxury products, gift packaging, and high-end retail applications. It supports detailed printing, embossing, and foil stamping while maintaining environmental compliance. This trend is influencing packaging suppliers to enhance their offerings with specialty coatings and visual appeal. Strong branding combined with sustainability is becoming a key competitive advantage.

- For instance, a 2023 survey by Smithers Pira found that more than 750 million units of premium sustainable packaging were produced worldwide in 2023, with luxury brands such as L’Oréal and Estée Lauder investing in over 500,000 square meters of coated recycled board materials for high-end product lines.

Rising Adoption in Foodservice and Quick-Service Restaurants

The foodservice industry is rapidly replacing plastic and foam packaging with recyclable paper-based alternatives. The Global Coated Recycled Paperboard Market is expanding in this segment due to its ability to provide grease-resistant, durable, and printable solutions. Restaurants and takeout chains are seeking compostable and recyclable containers that maintain food integrity. It offers a balance of functionality and sustainability, meeting the growing demand for eco-conscious food packaging. Market players are developing coatings that meet food safety standards without adding plastic barriers. This trend is shaping product innovation and expanding the market’s reach.

Digital Transformation Driving On-Demand and Short-Run Packaging

Digital printing advancements are transforming the packaging supply chain by enabling fast, flexible, and low-volume production. The Global Coated Recycled Paperboard Market is adapting to this trend, offering substrates compatible with digital presses and variable data printing. Brands are leveraging this capability for localized promotions, seasonal campaigns, and personalized packaging. It enables quicker turnaround times while reducing material waste and inventory costs. The integration of digital solutions into packaging workflows is becoming more common among converters and brands. This shift supports agile marketing strategies and boosts demand for recyclable yet print-ready board materials.

Market Challenges

Fluctuating Raw Material Quality and Limited Supply Chain Stability

The Global Coated Recycled Paperboard Market faces challenges related to the inconsistent quality and availability of recycled raw materials. Variations in fiber strength, contamination levels, and sorting processes affect product performance and reliability. It requires a steady supply of clean, high-grade recovered paper to maintain coating and printing standards. Limited recycling infrastructure in certain regions creates bottlenecks in the collection and processing stages. These supply chain inconsistencies increase production costs and delay fulfillment timelines for converters and end users. The industry must invest in better collection systems and fiber processing technologies to address these supply risks.

- For instance, the United States consumes approximately 30 million tonnes of recovered paper annually for recycling, with more than 200 recycling facilities operating nationwide to process and supply raw materials for coated recycled board production.

Stringent Regulations and Performance Trade-offs with Sustainable Coatings

Compliance with food safety, hygiene, and environmental regulations places pressure on manufacturers to develop safe, non-toxic coatings. The Global Coated Recycled Paperboard Market must balance recyclability with functional requirements like moisture and grease resistance. It often faces trade-offs between performance and sustainability, especially when replacing plastic-based barriers. Regulatory constraints limit the use of certain chemical additives, requiring continuous innovation and testing. Meeting diverse international standards also increases compliance costs and time to market. Companies must navigate these complexities while maintaining competitive pricing and consistent product performance.

Market Opportunities

Expanding Demand from Emerging Economies with Growing Packaging Needs

Emerging markets present significant growth opportunities for the Global Coated Recycled Paperboard Market due to rising urbanization and expanding retail sectors. Increasing consumer awareness about sustainability in these regions drives demand for eco-friendly packaging solutions. It can capitalize on relatively untapped markets where recycled board adoption remains low but shows strong potential. Growth in e-commerce and packaged food industries in Asia, Latin America, and Africa further supports market expansion. Companies focusing on localized production and distribution networks can reduce costs and improve market penetration. These regions offer a platform for innovation tailored to regional preferences and regulatory frameworks. Investing in emerging economies helps diversify revenue streams and enhances global market presence.

Innovations in Eco-Friendly Coating Technologies and Digital Printing Integration

The Global Coated Recycled Paperboard Market holds opportunities through the development of advanced, sustainable coatings that improve board performance without compromising recyclability. New bio-based and waterborne coatings respond to increasing regulatory and consumer demands for non-toxic, environmentally safe materials. It benefits from integrating digital printing technologies that enable short runs, customization, and faster market response. This combination supports brands seeking personalized packaging and reduced waste. Collaborations between coating developers and digital print technology providers can unlock new product features and market segments. Embracing these innovations strengthens competitive advantage and drives long-term sustainable growth.

Market Segmentation Analysis

By Product Type

The Global Coated Recycled Paperboard Market includes key product types such as coated recycled paperboard, coated recycled plasticboard, coated recycled composite boards, and others. Coated recycled paperboard holds the largest revenue share due to its widespread use in packaging for food, personal care, and household products. It offers excellent printability and structural strength while meeting sustainability goals. Coated recycled plasticboard caters to applications requiring higher moisture resistance, such as frozen food and industrial packaging. Composite boards, which combine multiple recycled materials, are gaining attention for their durability and flexibility in design. It supports a broad range of packaging formats tailored to product safety, branding, and environmental performance.

- For instance, the annual usage of coated recycled paperboard reached approximately 3,500,000 tonnes, while coated recycled plasticboard usage was around 1,200,000 tonnes. Additionally, production of coated recycled composite boards accounted for about 450,000 units in recent years.

By Coating Type

The market segments by coating type into clay-coated, polyethylene-coated, and other coatings. Clay-coated boards dominate due to their smooth surface and high-quality print finish, ideal for retail packaging and branding. Polyethylene-coated boards offer enhanced barrier properties, making them suitable for foodservice and perishables. Other coatings include bio-based and water-based options, which are gaining interest due to rising regulatory pressure to phase out plastic films. It reflects ongoing efforts to balance performance and sustainability, especially for applications demanding grease and moisture resistance. This segment continues to evolve with advancements in non-toxic and recyclable coating technologies.

- For instance, clay-coated boards accounted for a volume of about 2,800,000 tonnes, while polyethylene-coated boards reached approximately 900,000 tonnes. Interest in other coatings, including bio-based and water-based types, has been growing significantly, reflecting a 15% increase in adoption rates recently.

By End User Industry

The end user industry segmentation includes food and beverage, pharmaceuticals, electronics, personal care, and others. The food and beverage sector leads the market, driven by high demand for sustainable and safe packaging solutions. Pharmaceuticals use coated boards for secondary packaging that ensures product protection and compliance. Personal care and electronics industries prefer coated boards for their visual appeal and customization options. It supports branding and shelf impact while maintaining environmental integrity. Diverse end-use applications contribute to the market’s steady expansion across consumer and industrial domains.

Segments

Based on Product Type

- Coated Recycled Paperboad

- Coated Recycled Plasticboard

- Coated Recycled Composite Boards

- Others

Based on Coating Type

- Clay-Coated

- Polyethylene-Coated

- Other Coating

Based on End User Industry

- Food and Beverage

- Pharmaceuticals

- Electronics

- Personal Care

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Coated Recycled Paperboard Market

The North America Coated Recycled Paperboard Market is projected to grow from USD 1,942.26 million in 2024 to USD 2,674.87 million by 2032, registering a CAGR of 4.1% during the forecast period. The region accounted for approximately 19.4% of the global market share in 2024. Strong demand from the packaging industry, particularly in the food, beverage, and personal care sectors, drives this growth. The United States remains the primary revenue contributor, supported by strict environmental regulations and brand commitments to sustainability. It benefits from well-established recycling infrastructure and innovation in packaging technologies. Companies in the region are also focusing on replacing plastic-based packaging with recyclable board materials.

Europe Coated Recycled Paperboard Market

Europe’s Coated Recycled Paperboard Market reached USD 2,487.77 million in 2024 and is forecast to grow to USD 3,614.68 million by 2032, expanding at a CAGR of 4.8%. With a 24.9% share of the global market in 2024, Europe leads in regulatory enforcement for sustainable packaging solutions. Countries like Germany, France, and the UK are driving market momentum through circular economy mandates and eco-design requirements. It benefits from advanced recycling systems and growing public awareness about environmental impact. The demand for high-performance Coated Recycled Paperboard is increasing across consumer goods and retail packaging. European producers are also investing in biodegradable and plastic-free coatings.

Asia Pacific Coated Recycled Paperboard Market

Asia Pacific represents the largest regional segment, with market size increasing from USD 3,959.11 million in 2024 to USD 5,855.79 million in 2032, at a CAGR of 5.0%. The region held 39.6% of the global market share in 2024. Rapid industrialization, expanding urban populations, and rising e-commerce activity fuel market growth. China, India, and Japan are the major markets, supported by growing investments in packaging and recycling industries. It continues to expand due to consumer preference for sustainable and visually appealing packaging. The region presents significant growth opportunities for global players entering emerging markets with cost-effective coated board solutions.

Latin America Coated Recycled Paperboard Market

The Latin America Coated Recycled Paperboard Market is set to grow from USD 587.51 million in 2024 to USD 844.39 million by 2032, at a CAGR of 4.6%, contributing 5.9% of the global market share in 2024. Brazil and Mexico are the leading countries driving regional demand through investments in food processing and retail sectors. The market gains momentum from increased awareness of eco-friendly packaging among manufacturers and consumers. It faces challenges from limited recycling infrastructure but shows potential for improvement through policy support. The growing middle-class population supports demand for packaged consumer goods, further boosting board consumption. Regional players are adopting sustainable practices to meet export standards.

Middle East Coated Recycled Paperboard Market

In the Middle East, the market is projected to increase from USD 722.24 million in 2024 to USD 1,065.61 million by 2032, reflecting a CAGR of 5.0% and accounting for 7.2% of the global market share in 2024. The region is experiencing growing demand for sustainable packaging in sectors such as foodservice, retail, and FMCG. Countries like the UAE and Saudi Arabia are taking initiatives to reduce plastic waste and promote recyclable materials. It benefits from rising awareness and increased investment in domestic packaging production. The hospitality and food delivery sectors further contribute to market expansion. International manufacturers are forming partnerships to expand operations and distribution networks in the region.

Africa Coated Recycled Paperboard Market

The Africa Coated Recycled Paperboard Market reached USD 302.47 million in 2024 and is expected to grow to USD 403.40 million by 2032, with a CAGR of 3.6%, holding a 3.0% share of the global market. Growth is driven by urbanization, increased consumer spending, and a shift toward sustainable materials in packaging. South Africa and Nigeria are emerging as key markets due to their expanding retail and foodservice sectors. It faces limitations in recycling infrastructure, but efforts by governments and NGOs to promote environmental responsibility are supporting the market. Packaging demand for fast-moving consumer goods continues to rise. The region offers untapped opportunities for companies focusing on low-cost, recyclable packaging formats.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Caraustar

- WestRock

- Strathcona Paper

- Pacific Paper

- Upcyclers

- MM Board & Paper

- Spartan Paperboard

- Trim-Pac Inc.

- Papertec Inc.

- Cascades

Competitive Analysis

The Global Coated Recycled Paperboard Market features a mix of established global manufacturers and emerging regional players, creating a moderately fragmented competitive landscape. Companies such as WestRock, MM Board & Paper, and Cascades hold strong positions due to their extensive product portfolios, large-scale operations, and focus on sustainability. It benefits from increased investment in recycling technologies and product innovation aimed at improving performance and print quality. Mid-sized players like Spartan Paperboard and Trim-Pac Inc. are strengthening their market presence through customized offerings and agile supply chains. Strategic collaborations, mergers, and expansions help key players address rising demand across food, pharmaceutical, and personal care packaging sectors. Competition centers on cost efficiency, coating innovation, and sustainable production practices.

Recent Developments

- In May 2025, WestRock announced workforce reductions impacting approximately 650 employees due to the closure of multiple facilities, including the Texas mill. Specifically, the Texas mill closure resulted in the layoff of 200 employees. The closures are part of a broader effort by Smurfit Westrock to streamline operations and reduce capacity.

- In January 2024, Cascades introduced a new water-resistant coated recycled paperboard designed for food packaging. This product aims to meet higher performance and sustainability standards for food packaging applications. The material is intended to offer a more sustainable alternative to traditional, harder-to-recycle packaging options.

Market Concentration and Characteristics

The Global Coated Recycled Paperboard Market shows a moderate level of market concentration, with a few large players holding significant shares while numerous regional manufacturers serve localized demands. It is characterized by steady growth, driven by rising sustainability concerns and increasing demand for recyclable packaging across multiple industries. The market favors companies that invest in advanced coating technologies, efficient recycling processes, and regulatory compliance. Product differentiation, cost competitiveness, and supply chain flexibility are critical factors influencing market position. It operates under evolving environmental standards, which encourage innovation and strategic collaborations among key participants. Barriers to entry remain moderate due to capital investment requirements and quality control challenges.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Coating Type, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to see strong demand as companies prioritize sustainability and replace non-recyclable materials with Coated Recycled Paperboard.

- Rapid urbanization and consumer goods growth in Asia, Latin America, and Africa will drive increased adoption of recycled board packaging solutions.

- Manufacturers will invest in developing bio-based and water-based coatings that meet performance standards while complying with stricter environmental regulations.

- Digital printing technologies will gain more traction, allowing faster customization, shorter print runs, and reduced material waste for coated board packaging.

- Luxury and personal care brands will increasingly adopt Coated Recycled Paperboard for premium packaging that combines aesthetics with environmental value.

- Growth in e-commerce will create new opportunities for coated boards in protective, attractive, and sustainable secondary packaging formats.

- Industry players will pursue mergers, acquisitions, and partnerships to expand regional presence and strengthen production capabilities.

- Global regulations will push companies to integrate circular economy principles by using high-recycled-content boards and enhancing recyclability.

- Public and private sector investments in recycling and waste management systems will support supply consistency and material quality.

- Automation and digital tools in coating and converting processes will enhance production efficiency and product quality across the industry.