Market Overview

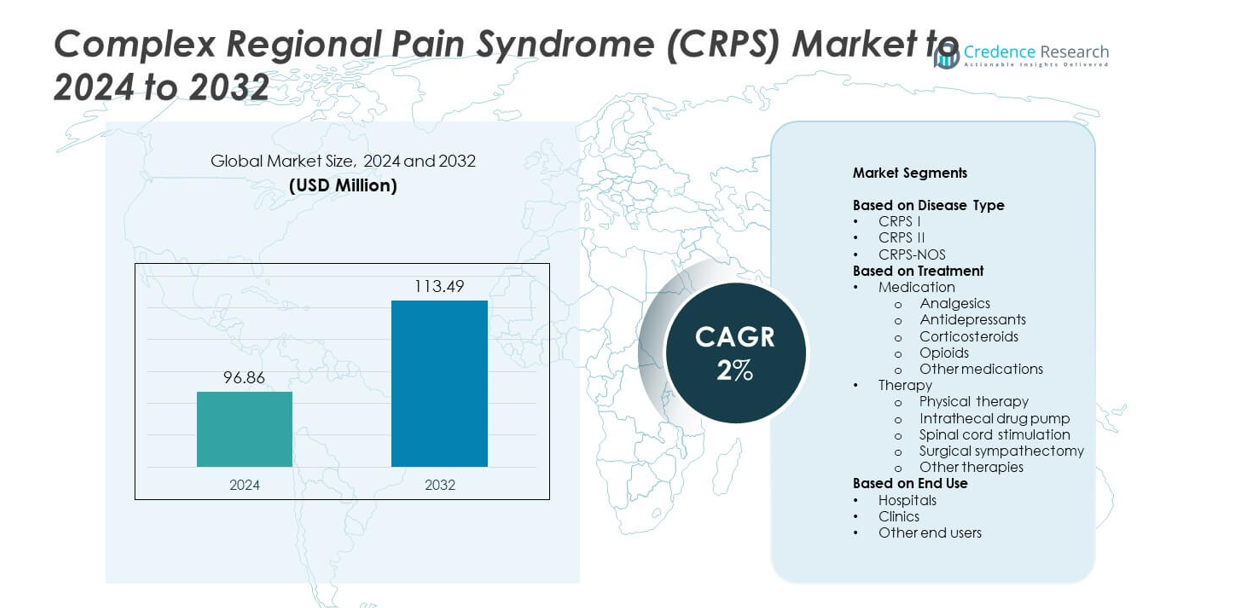

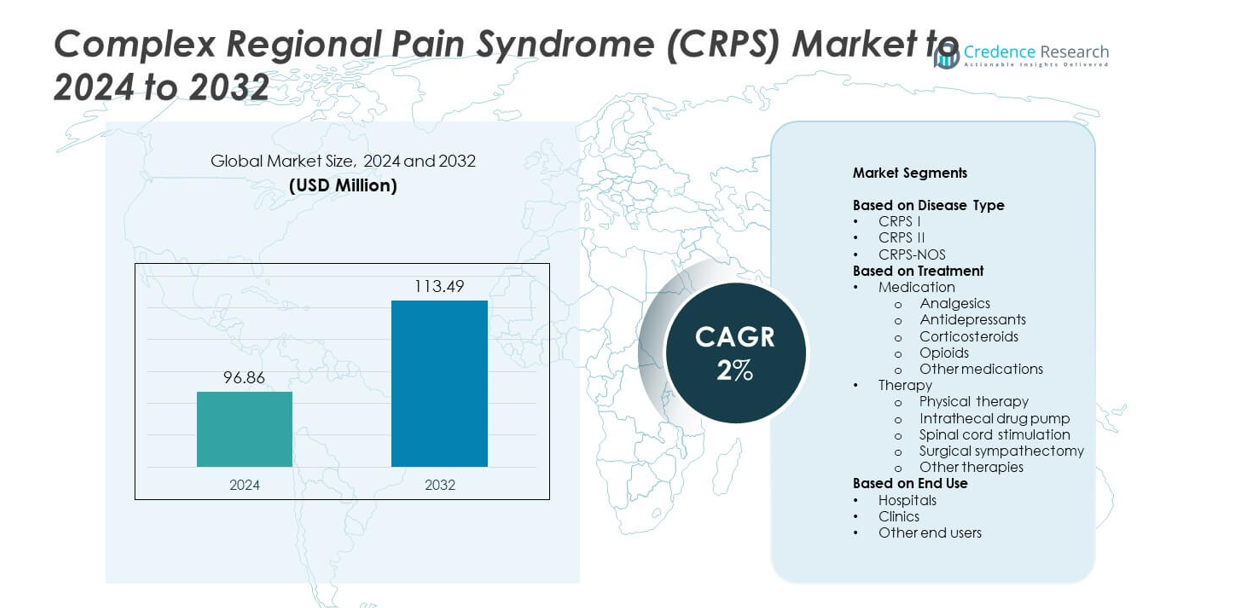

The Complex Regional Pain Syndrome (CRPS) Market size was valued at USD 96.86 million in 2024 and is anticipated to reach USD 113.49 million by 2032, at a CAGR of 2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Complex Regional Pain Syndrome (CRPS) Market Size 2024 |

USD 96.86 million |

| Complex Regional Pain Syndrome (CRPS) Market, CAGR |

2% |

| Complex Regional Pain Syndrome (CRPS) Market Size 2032 |

USD 113.49 million |

The Complex Regional Pain Syndrome (CRPS) market is led by major players such as Medtronic, AbbVie, Pfizer, Boston Scientific, Teva Pharmaceutical, Nevro Corp., Mallinckrodt Pharmaceuticals, Abbott Laboratories, Averitas Pharma, Sandoz, Biopharmaceutical Research Company, Eli Lilly and Company, and Collegium Pharmaceutical. These companies focus on developing advanced neuromodulation systems, targeted drug therapies, and innovative pain management solutions. Continuous investment in research collaborations and clinical trials supports new product introductions and improved treatment efficacy. Regionally, North America dominated the global CRPS market with a 41% share in 2024, driven by advanced healthcare infrastructure, high diagnosis rates, and strong adoption of next-generation pain management technologies.

Market Insights

- The Complex Regional Pain Syndrome (CRPS) Market was valued at USD 96.86 million in 2024 and is projected to reach USD 113.49 million by 2032, growing at a CAGR of 2%.

- Rising prevalence of chronic pain conditions, increasing post-surgical complications, and improved diagnostic awareness are driving market growth worldwide.

- Key trends include advancements in neuromodulation devices, adoption of personalized pain therapies, and integration of telehealth for remote treatment monitoring.

- The market is competitive, with companies focusing on R&D, digital health integration, and strategic collaborations to expand their therapeutic portfolios.

- North America led with a 41% share in 2024, followed by Europe at 30% and Asia-Pacific at 21%, while the CRPS I segment dominated the market with 62% of the total share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Disease Type

The CRPS I segment dominated the Complex Regional Pain Syndrome market with a 62% share in 2024. Its dominance is driven by higher diagnosis rates and prevalence among patients recovering from fractures, sprains, or minor injuries. CRPS I is more frequently identified due to the absence of nerve injury, leading to increased patient awareness and early treatment interventions. Advancements in imaging diagnostics, such as functional MRI and thermography, have also supported better identification of CRPS I cases, boosting demand for effective pain management therapies and rehabilitation programs across healthcare facilities.

- For instance, Abbott’s ACCURATE RCT in CRPS I/II reported higher treatment success for DRG stimulation: 81.2% at 3 months vs 55.7% with SCS, and 74.2% at 12 months vs 53.0% with SCS.

By Treatment

The medication segment accounted for the largest share of 54% in 2024, primarily driven by the widespread use of analgesics and corticosteroids. These drugs remain first-line treatment options due to their proven pain-relief efficacy and accessibility in both hospital and outpatient settings. Rising use of antidepressants and opioids for managing neuropathic pain further supports this dominance. Additionally, the growing preference for combination drug therapy and ongoing clinical trials exploring novel anti-inflammatory formulations are strengthening the role of pharmacological interventions in CRPS management.

- For instance, Grünenthal reported that in 2024, over 105,000 patients worldwide received treatment with its Qutenza 8% capsaicin patch. Clinical trials and real-world studies have consistently shown that the patch provides clinically meaningful pain reductions for various types of peripheral neuropathic pain.

By End Use

Hospitals held the leading position in 2024 with a 58% share of the CRPS market. This dominance is attributed to advanced diagnostic infrastructure, multidisciplinary pain management units, and access to interventional therapies such as spinal cord stimulation and sympathetic nerve blocks. Hospitals also handle most severe CRPS cases requiring continuous monitoring and surgical procedures. Increasing patient admissions for chronic pain treatment, along with government support for specialized pain care centers, continues to drive hospital-based CRPS treatment adoption across developed and emerging healthcare systems.

Key Growth Drivers

Rising Prevalence of Chronic Pain Disorders

The growing incidence of chronic pain conditions, post-surgical complications, and trauma-related injuries is driving demand for CRPS diagnosis and treatment. Increasing awareness among healthcare professionals about early symptom recognition has enhanced patient identification rates. Moreover, the rising number of orthopedic and neurological procedures globally contributes to higher CRPS occurrence. This expanding patient pool is creating strong demand for effective pain management solutions, supporting market growth across hospitals, clinics, and rehabilitation centers.

- For instance, Stryker’s orthopedic robotics reached a milestone of over 1 million Mako procedures globally by 2023, and surpassed 1.5 million procedures by March 2025.

Advancements in Neuromodulation and Drug Delivery Technologies

Innovations in neuromodulation systems and targeted drug delivery devices are reshaping CRPS management. Technologies such as spinal cord stimulation and intrathecal pumps provide sustained pain relief with reduced systemic side effects. The integration of digital monitoring tools and precision-based stimulation systems enhances therapy effectiveness and patient comfort. These developments have broadened treatment accessibility and improved long-term outcomes, positioning neuromodulation-based therapies as one of the most effective and rapidly growing approaches in CRPS management.

- For instance, Saluda Medical’s EVOKE closed-loop SCS showed 77.6% of patients achieved ≥50% pain reduction at 36 months vs 49.3% with open-loop SCS in its blinded RCT.

Increasing Healthcare Investments and Research Initiatives

Governments and private organizations are increasing investments in chronic pain research and clinical trials for CRPS. Expanding funding for novel analgesic and anti-inflammatory drug development supports the creation of safer and more effective therapies. Academic collaborations and institutional research are also improving understanding of CRPS pathophysiology. These efforts are encouraging the development of innovative treatment models and boosting global availability of advanced pain management solutions. Rising investment in rehabilitation infrastructure further enhances market adoption rates.

Key Trends and Opportunities

Integration of Digital and Telehealth Solutions

The adoption of telehealth and remote monitoring tools is improving CRPS care delivery. Digital platforms enable continuous tracking of patient progress and therapy adjustments without frequent hospital visits. Integration of wearable pain assessment tools and cloud-based treatment monitoring enhances adherence and clinical outcomes. This trend supports cost-effective and personalized care, especially for patients in remote regions. Growing demand for connected healthcare ecosystems presents significant opportunities for technology developers and medical device manufacturers.

- For instance, Boston Scientific’s mySCS mobile app users had a 91% trial success rate vs 85% for nonusers in a multicenter study.

Shift Toward Personalized and Multimodal Therapies

A growing preference for personalized CRPS management combining pharmacological, physical, and psychological therapies is reshaping treatment models. Healthcare providers are using patient-specific approaches based on symptom intensity, duration, and neurological involvement. This shift is supported by advancements in genetic analysis and pain biomarkers that guide therapy optimization. The trend offers strong opportunities for companies developing integrated care platforms and personalized drug formulations, helping improve overall patient outcomes and treatment satisfaction.

- For instance, SPR Therapeutics’ SPRINT PNS platform is backed by 7 randomized controlled trials and real-world analyses report 71% responders among 6,160 patients.

Key Challenges

Diagnostic Complexity and Misidentification

CRPS diagnosis remains challenging due to its overlapping symptoms with other neuropathic disorders. Limited access to specialized diagnostic tools and inconsistent clinical criteria often lead to delayed or incorrect diagnosis. This diagnostic complexity affects early treatment initiation and patient recovery outcomes. Lack of awareness among general practitioners and insufficient training in pain medicine further exacerbate this challenge, hindering optimal management and expanding the need for standardized diagnostic frameworks.

High Cost of Advanced Therapies

The growing reliance on advanced therapies such as spinal cord stimulation and intrathecal drug delivery presents cost-related challenges. High device costs, surgical expenses, and maintenance requirements restrict access for patients in low-income regions. Limited reimbursement coverage in several countries further adds to the financial burden. These economic barriers slow adoption rates and limit the widespread use of innovative treatment technologies, despite their proven effectiveness in long-term pain management and quality-of-life improvement.

Regional Analysis

North America

North America dominated the Complex Regional Pain Syndrome market with a 41% share in 2024. The region’s leadership is supported by advanced healthcare infrastructure, early diagnosis rates, and strong adoption of pain management technologies. The U.S. accounts for the majority of demand due to high treatment awareness and widespread access to neuromodulation therapies. Supportive reimbursement frameworks and ongoing research collaborations among medical institutions and device manufacturers further enhance regional growth. Increasing government funding for chronic pain research continues to strengthen the market outlook across hospitals and specialty clinics in the U.S. and Canada.

Europe

Europe held a 30% share of the Complex Regional Pain Syndrome market in 2024. The region benefits from well-established healthcare systems, growing emphasis on early pain management, and continuous innovation in neurostimulation devices. Germany, France, and the U.K. lead in CRPS diagnosis and treatment adoption, driven by extensive clinical research and advanced rehabilitation facilities. Favorable regulatory policies for medical device approvals also promote new therapy introductions. Rising aging populations and expanding healthcare budgets further support sustained demand for effective CRPS therapies across European hospitals and outpatient centers.

Asia-Pacific

Asia-Pacific accounted for 21% of the Complex Regional Pain Syndrome market in 2024. The region is witnessing rapid growth due to expanding healthcare infrastructure, increasing awareness of pain disorders, and rising investments in neurology and rehabilitation care. Countries such as Japan, China, and India are leading in the adoption of advanced diagnostic tools and pain management programs. Growth in medical tourism and improved access to specialized pain clinics are further fueling market expansion. Strategic collaborations between regional hospitals and global manufacturers are improving treatment affordability and patient reach across emerging economies.

Latin America

Latin America captured an 5% share of the Complex Regional Pain Syndrome market in 2024. The region’s growth is driven by expanding healthcare access, rising awareness of neuropathic pain conditions, and gradual adoption of advanced treatment modalities. Brazil and Mexico remain key contributors due to growing public healthcare investments and the presence of regional pain management centers. Despite limited availability of high-end devices, increased medical training and supportive government initiatives are fostering early diagnosis and improved patient care. Expanding pharmaceutical distribution networks further strengthen the region’s future market potential.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the Complex Regional Pain Syndrome market in 2024. Growth is supported by rising healthcare infrastructure development and improving access to pain treatment facilities. Gulf nations such as the UAE and Saudi Arabia are investing heavily in specialty hospitals and rehabilitation centers. However, limited awareness and high treatment costs still restrict widespread adoption. Ongoing government health reforms, coupled with training programs for healthcare professionals, are expected to enhance CRPS management capacity and improve diagnostic accuracy over the coming years.

Market Segmentations:

By Disease Type

By Treatment

- Medication

- Analgesics

- Antidepressants

- Corticosteroids

- Opioids

- Other medications

- Therapy

- Physical therapy

- Intrathecal drug pump

- Spinal cord stimulation

- Surgical sympathectomy

- Other therapies

By End Use

- Hospitals

- Clinics

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Complex Regional Pain Syndrome (CRPS) market features key players such as Medtronic, AbbVie, Pfizer, Boston Scientific, Teva Pharmaceutical, Nevro Corp., Mallinckrodt Pharmaceuticals, Abbott Laboratories, Averitas Pharma, Sandoz, Biopharmaceutical Research Company, Eli Lilly and Company, and Collegium Pharmaceutical. The market is characterized by intense competition, with companies focusing on developing novel pain management solutions, advanced neuromodulation systems, and targeted drug delivery devices. Strategic collaborations with research institutions and healthcare providers are driving innovation and clinical validation of new therapies. Firms are expanding their portfolios through regulatory approvals and product launches aimed at improving efficacy and reducing side effects. Growing emphasis on digital health integration and patient-centric treatment approaches further enhances competitive differentiation. Additionally, ongoing investment in clinical research and real-world studies is strengthening market presence and credibility. The competition remains dynamic, with continuous advancements shaping the future landscape of CRPS treatment globally.

Key Player Analysis

- Medtronic

- AbbVie

- Pfizer

- Boston Scientific

- Teva Pharmaceutical

- Nevro Corp.

- Mallinckrodt Pharmaceuticals

- Abbott Laboratories

- Averitas Pharma

- Sandoz

- Biopharmaceutical Research Company

- Eli Lilly and Company

- Collegium Pharmaceutical

Recent Developments

- In 2024, Nevro Corp.Received U.S. FDA clearance for an AI-based spinal cord stimulation system that automatically optimizes stimulation parameters based on real-time data, aiming to enhance pain relief for CRPS patients.

- In 2024, Collegium Pharmaceutical Expanded its pain management portfolio through a focus on developing and commercializing various pain medications.

- In 2024, Biopharmaceutical Research Company Secured U.S. FDA Orphan Drug Designation in December for its cannabinoid candidate, BRC-002, targeting CRPS. This status was granted to acknowledge the urgent need for new therapies for the rare and debilitating disease.

Report Coverage

The research report offers an in-depth analysis based on Disease Type, Treatment, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing focus on early diagnosis and intervention will improve CRPS treatment outcomes.

- Advancements in neuromodulation and pain stimulation devices will enhance long-term pain control.

- Increasing clinical trials for novel analgesic and anti-inflammatory drugs will expand treatment options.

- Integration of AI and digital monitoring tools will support personalized CRPS management.

- Rising healthcare investments will strengthen rehabilitation and pain management infrastructure.

- Expansion of telehealth services will improve patient access to specialist care.

- Growing awareness among physicians and patients will lead to earlier CRPS identification.

- Collaboration between pharmaceutical firms and research institutes will boost innovation.

- Favorable reimbursement policies will encourage adoption of advanced CRPS therapies.

- Emerging markets in Asia-Pacific and Latin America will experience higher treatment demand.