| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Connected Safety RFID Systems Market Size 2024 |

USD 12,216.56 million |

| Connected Safety RFID Systems Market, CAGR |

9.48% |

| Connected Safety RFID Systems Market Size 2032 |

USD 26,520.32 million |

Market Overview

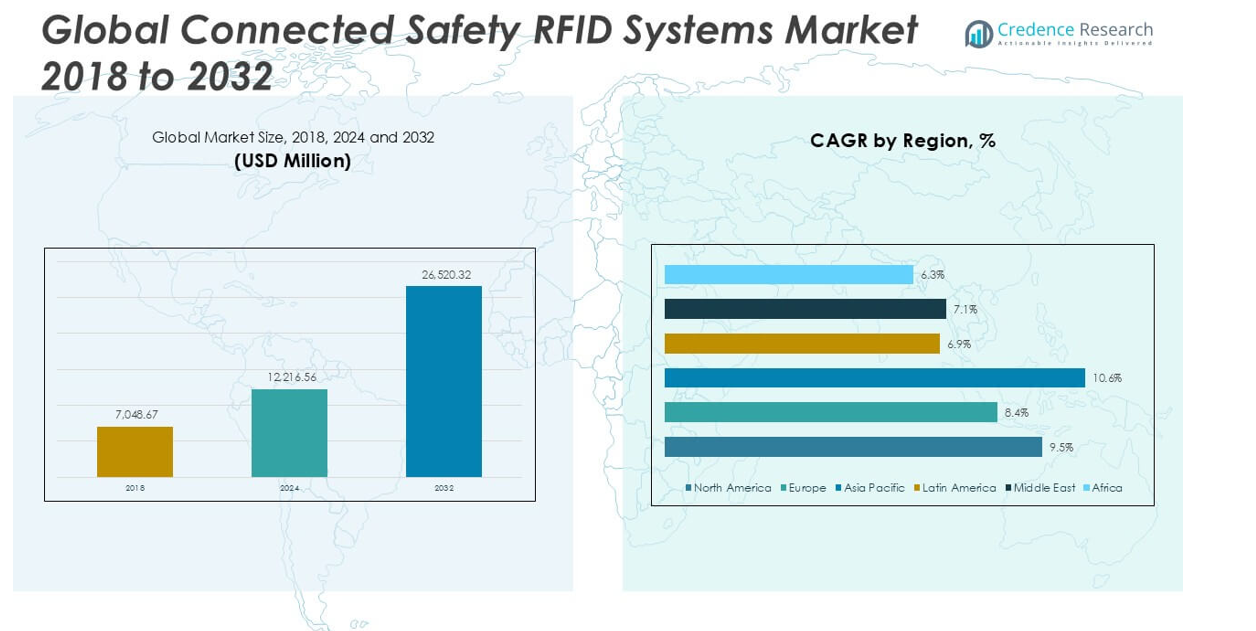

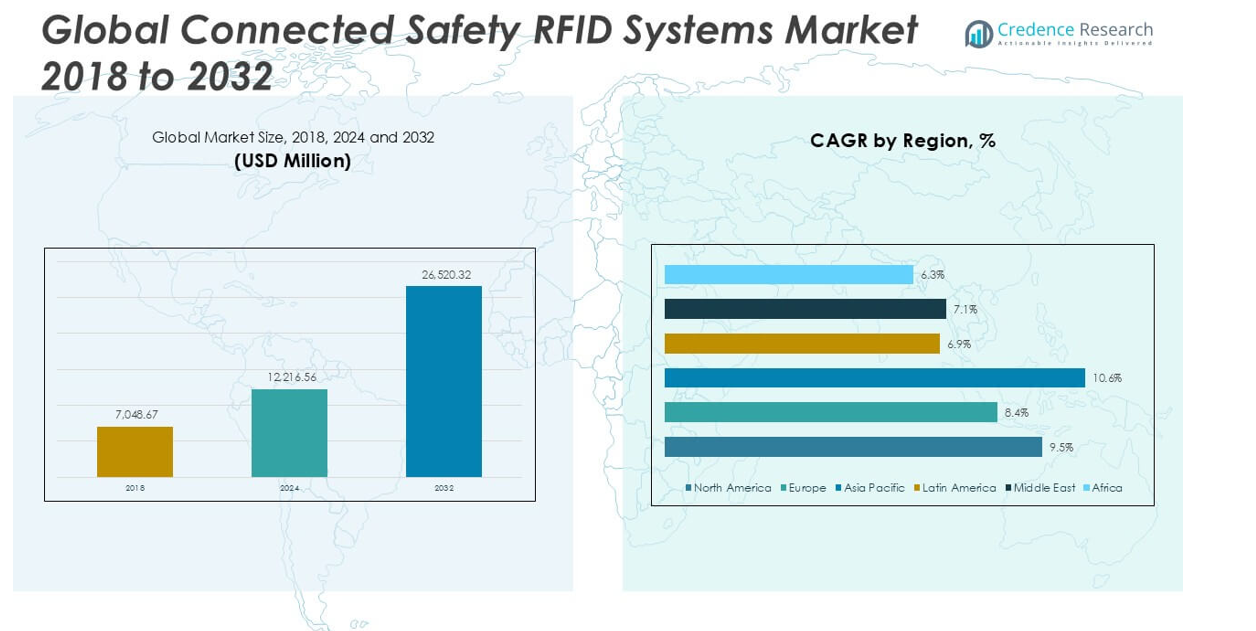

Connected Safety RFID Systems Market size was valued at USD 7,048.67 million in 2018 to USD 12,216.56 million in 2024 and is anticipated to reach USD 26,520.32 million by 2032, at a CAGR of 9.48% during the forecast period.

The Connected Safety RFID Systems Market is experiencing robust growth, primarily driven by the rising emphasis on workplace safety regulations and the increasing need for real-time monitoring across industrial sectors. Companies are rapidly adopting RFID-enabled safety solutions to enhance asset tracking, improve worker safety, and ensure regulatory compliance. The proliferation of IoT and advancements in wireless communication technologies are further accelerating market adoption, enabling seamless integration and data analytics for better decision-making. Growing demand from sectors such as manufacturing, construction, oil and gas, and logistics is fostering innovation in RFID hardware and software platforms. Key trends shaping the market include the integration of cloud-based management systems, the emergence of AI-driven predictive safety analytics, and the expansion of RFID applications into hazardous environments. As organizations prioritize safety, productivity, and operational transparency, the Connected Safety RFID Systems Market is set to witness sustained growth and evolving technological sophistication.

The Connected Safety RFID Systems Market demonstrates strong regional momentum, with North America, Asia Pacific, and Europe leading adoption due to advanced industrial infrastructure, regulatory standards, and increasing investments in workplace safety. The United States and Canada represent key growth areas in North America, while China, Japan, and India drive demand across Asia Pacific through rapid industrialization and digital transformation initiatives. Europe remains a robust market, supported by widespread integration of safety technology in manufacturing and logistics sectors, especially in Germany and the United Kingdom. Major industry players shaping the competitive landscape include Identiv Inc., Impinj Inc., and Zebra Technologies, who continuously invest in technology innovation, portfolio expansion, and strategic collaborations to address sector-specific requirements. HID Global also holds a strong market position, recognized for its comprehensive RFID product offerings and long-standing expertise in safety and security solutions. The dynamic competitive environment fosters technological progress and new applications across global markets.

Market Insights

- The Connected Safety RFID Systems Market reached USD 12,216.56 million in 2024 and is projected to reach USD 26,520.32 million by 2032, with a CAGR of 9.48%.

- Strong demand is driven by regulatory mandates for workplace safety, real-time monitoring requirements, and the need for operational transparency in high-risk sectors.

- Integration of IoT, cloud platforms, and AI-powered analytics is transforming RFID safety solutions, enabling predictive risk management and smart automation.

- Leading players such as Identiv Inc., Impinj Inc., HID Global, Zebra Technologies, and Honeywell International Inc. focus on expanding product portfolios and advancing RFID technology.

- High implementation costs, complex system integration, and concerns over data security challenge broader adoption, especially among small and medium-sized enterprises.

- North America leads with a 40% market share, followed by Asia Pacific at 35% and Europe at 20%; the United States, China, Germany, and Japan are key countries driving adoption.

- The market benefits from growing awareness in emerging regions, sector-specific customization, and investments in digital safety infrastructure, but faces competition from traditional safety solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Stringent Workplace Safety Regulations Propel Adoption of Connected Safety RFID Solutions

Governments and regulatory authorities worldwide continue to strengthen workplace safety mandates across industries such as manufacturing, construction, oil and gas, and logistics. Compliance requirements demand organizations deploy advanced monitoring and tracking technologies to ensure employee safety and reduce workplace incidents. The Connected Safety RFID Systems Market benefits significantly from these strict regulatory landscapes, which create a necessity for real-time data visibility and automated safety processes. Enterprises seek robust solutions to minimize risks, avoid penalties, and demonstrate proactive safety management. Regulatory compliance serves as a powerful motivator for organizations to integrate RFID-enabled safety systems into operational protocols. The market thus finds strong support from policies enforcing worker safety standards and industrial best practices.

- For instance, a U.S. Department of Labor report highlighted that after implementing RFID-based safety systems, one automotive plant recorded a decrease of 120 annual safety violatio to 38 within two years, while response times to incidents improved by nearly one hour on average.

Technological Advancements Drive System Integration and Performance Enhancements

Innovations in RFID hardware, sensor miniaturization, and wireless connectivity enable seamless integration of connected safety systems into existing infrastructure. The Connected Safety RFID Systems Market leverages advancements such as cloud computing, IoT, and AI to deliver real-time analytics and actionable insights. These technology improvements allow organizations to monitor assets, environments, and personnel with increased accuracy and efficiency. The adoption of predictive analytics and cloud-based platforms transforms safety management into a data-driven discipline. New system capabilities enhance automation, streamline workflows, and support the expansion of RFID into more complex operational environments. Continuous innovation maintains the market’s momentum, ensuring solutions remain relevant and scalable.

- For instance, a survey by the International Manufacturing Association showed that factories adopting RFID-based safety and monitoring platforms saw equipment downtime reduced from 230 hours to 90 hours annually, and asset utilization rates increased by 200 assets per site.

Growing Focus on Operational Efficiency and Productivity Enhancement

Enterprises prioritize operational efficiency and workforce productivity while maintaining high safety standards. The Connected Safety RFID Systems Market addresses these priorities by automating manual tracking and reporting processes, reducing administrative burden, and minimizing equipment downtime. RFID-enabled solutions help organizations optimize resource allocation and prevent unauthorized access to hazardous zones. Real-time monitoring ensures quick response to incidents, protecting both assets and personnel. Businesses recognize the value of streamlined safety operations in supporting profitability and long-term competitiveness. It serves organizations seeking both risk reduction and measurable productivity gains.

Rising Adoption in High-Risk Industries and Emerging Applications

Sectors with inherently hazardous environments, such as oil and gas, mining, and chemical processing, increasingly deploy connected safety RFID systems to protect workers and comply with safety standards. The Connected Safety RFID Systems Market continues to expand its footprint in these segments due to the clear need for advanced safety technologies. Companies invest in RFID solutions for hazardous material tracking, personnel location, and emergency response coordination. Emerging applications, such as smart PPE and remote safety compliance monitoring, contribute to broader market growth. Expanding use cases and ongoing risk mitigation requirements create a favorable outlook for the adoption of connected safety systems across diverse industries. The market evolves alongside industry-specific needs and technological progress.

Market Trends

Integration of IoT and Cloud Platforms Redefines Safety RFID Solutions

The convergence of IoT devices and cloud-based platforms stands out as a pivotal trend in the Connected Safety RFID Systems Market. Companies implement integrated systems that link RFID-enabled safety devices to centralized data platforms, supporting real-time monitoring and analytics. It helps organizations gain actionable insights, enhance incident response, and streamline compliance reporting. The integration of cloud and IoT technologies enables scalability, remote access, and continuous system updates, ensuring safety protocols stay aligned with evolving operational needs. Enhanced interoperability between connected devices allows seamless data exchange, improving transparency and decision-making. Market participants focus on developing versatile systems that address the complex requirements of multi-site enterprises.

- For instance, a survey of 500 global companies using integrated IoT-RFID systems found that more than 360 organizations managed to reduce the time needed for compliance reporting by 12 hours per quarter and eliminated over 1,000 manual error incidents across their operations.

Artificial Intelligence and Predictive Analytics Elevate Safety Management

Artificial intelligence and predictive analytics play a growing role in transforming safety management practices. The Connected Safety RFID Systems Market sees rapid deployment of AI-driven platforms that analyze RFID data to forecast safety risks and potential incidents before they occur. AI algorithms process vast datasets from RFID tags, sensors, and wearables, identifying patterns that indicate hazardous behavior or equipment malfunctions. Predictive analytics empower safety managers to implement preventative measures, optimize resource allocation, and reduce costly downtime. It allows for proactive risk mitigation, supporting a shift from reactive to anticipatory safety strategies. Adoption of AI in RFID systems elevates workplace safety to a new level of intelligence and precision.

- For instance, a workplace safety council found that facilities utilizing AI-driven RFID platforms recorded a drop in the number of annual near-miss incidents from 95 to 29, with incident detection times improving from 60 minutes to 18 minutes.

Expansion of Smart Personal Protective Equipment and Wearable RFID Solutions

The market witnesses significant advancements in smart personal protective equipment (PPE) integrated with RFID technology. The Connected Safety RFID Systems Market benefits from the development of wearables and PPE that monitor worker health, exposure, and compliance with safety protocols. Companies use RFID-enabled smart helmets, vests, and badges to track personnel location and ensure adherence to safety zones. Wearable RFID devices provide real-time feedback and alerts, helping reduce workplace injuries and improve overall safety culture. The rise of smart PPE demonstrates the industry’s commitment to adopting technology-driven solutions for worker protection. It underscores the importance of data-driven safety practices in dynamic and high-risk environments.

Customization and Industry-Specific Applications Broaden Market Reach

Manufacturers tailor RFID safety systems to address industry-specific requirements, reflecting a trend toward customization and specialized solutions. The Connected Safety RFID Systems Market responds to demand from sectors such as construction, healthcare, logistics, and energy with bespoke products and services. Customization enables integration with unique workflows, regulatory frameworks, and operational challenges. Industry-focused applications range from hazardous material tracking in chemical plants to patient safety monitoring in healthcare facilities. It allows solution providers to differentiate offerings and capture niche segments, driving competitive advantage and market growth. The emphasis on customization ensures RFID safety technologies remain adaptable and effective across diverse industries.

Market Challenges Analysis

High Implementation Costs and Complex Integration Limit Market Penetration

The initial investment required for deploying connected safety RFID systems remains a primary barrier for many organizations. The Connected Safety RFID Systems Market faces challenges from the high costs associated with hardware, software, installation, and ongoing maintenance. Small and medium-sized enterprises often struggle to justify the expenditure when compared to traditional safety measures. Integration with legacy systems presents further complexity, requiring specialized expertise and extended project timelines. Compatibility issues and the need for customized solutions can increase total costs and create delays. Market participants must demonstrate clear returns on investment to drive broader adoption.

Data Security Concerns and Limited Technical Expertise Hinder Adoption

Data security and privacy issues create significant challenges for companies adopting RFID-based safety systems. The Connected Safety RFID Systems Market must address concerns related to unauthorized access, data breaches, and system vulnerabilities, especially when transmitting sensitive safety information over wireless networks. Organizations lacking technical expertise may encounter difficulties managing advanced RFID infrastructure, leading to operational inefficiencies. It highlights a critical skills gap, as businesses require knowledgeable staff for system configuration, monitoring, and maintenance. Overcoming these barriers is essential for building user confidence and realizing the full potential of connected safety technologies.

Market Opportunities

Expansion into Emerging Markets and Untapped Industry Verticals Presents Significant Growth Potential

Emerging economies offer promising opportunities for the Connected Safety RFID Systems Market as industrialization accelerates and regulatory standards evolve. Rapid infrastructure development and increasing investments in sectors such as manufacturing, construction, and logistics create a strong demand for advanced safety solutions. Organizations in these regions seek to modernize safety protocols and align with global compliance requirements. The market stands to benefit from initiatives promoting workplace safety and government-led digitalization programs. Companies focusing on local partnerships and customized offerings can secure a competitive edge in these high-growth regions. Expansion into new geographies remains a key strategy for broadening the customer base.

Rising Demand for Advanced Analytics and Integration with Next-Generation Technologies

Integration of RFID safety systems with technologies such as AI, machine learning, and IoT opens new avenues for market advancement. The Connected Safety RFID Systems Market can leverage real-time data analytics to provide predictive safety insights and improve incident prevention. Organizations recognize the value of comprehensive solutions that link RFID with wearable devices, cloud platforms, and automated reporting tools. It supports the evolution of safety management into a data-driven discipline, enabling proactive risk mitigation and operational transparency. Solution providers developing scalable, interoperable systems position themselves to capture emerging opportunities in digital transformation. The market is poised for further growth as businesses prioritize innovation and intelligent safety management.

Market Segmentation Analysis:

By Type:

The Connected Safety RFID Systems Market divides into Active RFID Systems and Passive RFID Systems. Active RFID Systems utilize battery-powered tags for continuous signal transmission, supporting real-time location tracking and monitoring of high-value assets and personnel in complex industrial environments. These systems suit scenarios that demand robust, long-range communication and instant updates. Passive RFID Systems operate without an internal power source, drawing energy from the RFID reader signal. They provide cost-effective solutions for asset identification and inventory management across large-scale operations. Market participants often choose between active and passive systems based on the required range, frequency of data transmission, and operational budgets.

- For instance, a global logistics company tracked over 25,000 assets across 12 warehouses using active RFID, improving lost asset recovery times by 14 days per incident.

By Frequency Band:

The market segments into Low Frequency (LF), High Frequency (HF), and Ultra-High Frequency (UHF) solutions. Low Frequency RFID excels in environments with metal interference and supports applications that demand short-range but reliable communication, such as access control and worker authentication. High Frequency RFID offers moderate read range and faster data transfer, making it suitable for healthcare, retail, and smart card applications. Ultra-High Frequency RFID provides the longest read ranges and high-speed identification, enabling efficient tracking of assets, personnel, and safety equipment in dynamic, large-scale settings. It allows organizations to choose frequency bands that best align with their environmental constraints and operational priorities.

- For instance, a mining company deployed 5,000 LF RFID-enabled badges to restrict access to hazardous zones, logging over 150,000 safe entries in a year.

By End-User:

End-user segmentation covers Manufacturing, Healthcare, Retail, Transportation and Logistics, and Others. Manufacturing organizations lead adoption, deploying RFID safety solutions to monitor equipment, enforce compliance, and protect workers in hazardous environments. Healthcare facilities leverage RFID for patient safety, asset tracking, and controlled access to sensitive zones, enhancing operational transparency and safety standards. Retailers implement RFID to improve inventory management and employee safety across multi-location stores. The transportation and logistics sector adopts connected safety RFID systems to secure supply chains, monitor worker movement, and track high-value shipments. Other sectors—including construction, mining, and utilities—seek advanced safety solutions to address industry-specific risks and regulatory mandates. The diversity in end-user demand highlights the versatility and scalability of the Connected Safety RFID Systems Market across various operational environments.

Segments:

Based on Type:

- Active RFID Systems

- Passive RFID Systems

Based on Frequency Band:

- Low Frequency (LF)

- High Frequency (HF)

- Ultra-High Frequency (UHF)

Based on End-User:

- Manufacturing

- Healthcare

- Retail

- Transportation and Logistics

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Connected Safety RFID Systems Market

North America Connected Safety RFID Systems Market grew from USD 2,809.32 million in 2018 to USD 4,813.63 million in 2024 and is projected to reach USD 10,481.49 million by 2032, reflecting a compound annual growth rate (CAGR) of 9.5%. North America is holding a 40% market share. The United States leads adoption, driven by strict regulatory compliance, technological leadership, and significant investments in industrial safety solutions. Canada and Mexico follow, with expanding applications in manufacturing and logistics. Key industries implement connected safety RFID systems for real-time asset and personnel tracking, reinforcing regional safety standards. Market participants benefit from a mature technology ecosystem and a strong focus on workplace safety.

Europe Connected Safety RFID Systems Market

Europe Connected Safety RFID Systems Market grew from USD 1,559.87 million in 2018 to USD 2,578.58 million in 2024 and is expected to reach USD 5,173.39 million by 2032, at a CAGR of 8.4%. Europe is holding a 20% market share. Germany, France, and the United Kingdom remain at the forefront, emphasizing worker protection and compliance with evolving EU regulations. Adoption accelerates across sectors including automotive, healthcare, and energy, where organizations demand advanced RFID systems for risk management and asset control. The region supports strong collaboration between technology providers and industrial end users. European countries prioritize integration of RFID with digital platforms to ensure seamless safety monitoring.

Asia Pacific Connected Safety RFID Systems Market

Asia Pacific Connected Safety RFID Systems Market grew from USD 2,152.24 million in 2018 to USD 3,927.32 million in 2024 and is forecast to reach USD 9,258.64 million by 2032, with the highest CAGR of 10.6%. Asia Pacific accounts for a 35% market share. China, Japan, and India drive growth, supported by rapid industrialization, expanding manufacturing bases, and evolving workplace safety standards. Market momentum comes from large-scale infrastructure projects and rising investment in smart factory initiatives. Regional governments and corporations adopt connected safety RFID systems to enhance productivity and protect workers in complex operational environments. The region shows high potential for further expansion across diverse industries.

Latin America Connected Safety RFID Systems Market

Latin America Connected Safety RFID Systems Market grew from USD 227.95 million in 2018 to USD 387.91 million in 2024 and is projected to reach USD 699.95 million by 2032, achieving a CAGR of 6.9%. Latin America holds a 3% market share. Brazil and Mexico are the primary adopters, focusing on the logistics and industrial sectors to improve safety compliance and reduce workplace incidents. Regional governments promote modernization of safety practices through incentives and regulatory reforms. Adoption remains moderate but shows steady growth as technology awareness increases. The market benefits from growing demand for reliable tracking solutions in high-risk industries.

Middle East Connected Safety RFID Systems Market

Middle East Connected Safety RFID Systems Market grew from USD 193.49 million in 2018 to USD 305.95 million in 2024 and is anticipated to reach USD 558.08 million by 2032, reflecting a CAGR of 7.1%. The Middle East commands a 2% market share. The United Arab Emirates and Saudi Arabia lead regional adoption, with strong emphasis on safety management in oil and gas, construction, and utilities. Investments in smart infrastructure and digitalization initiatives foster RFID deployment for real-time safety monitoring. The market responds to regulatory mandates and the need for operational efficiency in large-scale industrial projects. Local players collaborate with global technology providers to meet sector-specific requirements.

Africa Connected Safety RFID Systems Market

Africa Connected Safety RFID Systems Market grew from USD 105.80 million in 2018 to USD 203.17 million in 2024 and is expected to reach USD 348.77 million by 2032, achieving a CAGR of 6.3%. Africa holds a 1% market share. South Africa, Nigeria, and Egypt represent key markets, where sectors such as mining, energy, and transportation drive adoption. Organizations seek advanced safety solutions to address hazardous work environments and enhance regulatory compliance. The market shows potential for growth, supported by increasing foreign investment and rising awareness of digital safety technologies. RFID systems gain traction as companies modernize their operations across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Identiv Inc.

- Impinj Inc.

- HID Global

- Tageos

- Checkpoint Systems

- Zebra Technologies

- Honeywell International Inc.

- Smartrac Technology

- Alien Technology

- NXP Semiconductors

Competitive Analysis

The Connected Safety RFID Systems Market features a competitive landscape led by prominent players such as Identiv Inc., Impinj Inc., HID Global, Tageos, Checkpoint Systems, Zebra Technologies, Honeywell International Inc., Smartrac Technology, Alien Technology, and NXP Semiconductors. These companies maintain their leadership by focusing on continuous innovation in RFID hardware, software, and integrated safety solutions tailored for high-risk industrial environments. Product development strategies include advanced tag design, long-range tracking, robust data encryption, and seamless system integration with IoT and cloud platforms. Leading players actively engage in strategic partnerships and acquisitions to expand their market reach and enhance technological capabilities. They target verticals such as manufacturing, logistics, oil and gas, healthcare, and retail, ensuring solutions meet specific safety, compliance, and operational needs. Investment in research and development remains a priority, driving new applications for smart personal protective equipment and predictive analytics. The competitive environment is further shaped by the ability of these players to provide scalable, reliable, and cost-effective RFID safety solutions, positioning them as preferred partners for global enterprises seeking advanced safety infrastructure.

Recent Developments

- In June 2024, Zebra Technologies Corp. launched Zebra FXR90, a new UHF RFID Fixed Reader series. This new line of fixed RFID readers is notable for its ultra-rugged design and endurance to harsh weather conditions with dual IP 65/67 sealing. The FXR90’s dual sealing IP rating certifies it as IP 67 for temporary submersion and IP 65 for resistance to dust and moisture. In addition, these readers can operate in a wider temperature range of -40 °C to +65 °C, which is 20 °C colder than the typical RFID fixed readers available today. The Zebra FXR90 RAIN RFID Readers can read up to 1,300 RFID tags per second, featuring a maximum receive sensitivity of -92 dBm and a peak transmit power of 33 dBm. With an optimal RFID tag and equipment configuration, the Zebra FXR90 RAIN Readers can achieve a maximum read distance of 100 feet (30.5 meters) using the integrated antenna.

- In April 2024, AVERY DENNISON CORPORATION announced the expansion of its AD Pure s, eries, featuring a collection of inlays and tags that are completely free of PET plastic. The AD Pure inlays and tags are produced sustainably using advanced antenna manufacturing techniques. The antennas and chips are applied directly to paper, ensuring the range is entirely plastic-free. These inlays and tags deliver significant carbon footprint reduction of 70% to 90% compared to traditional inlay production methods, as confirmed by independent Life Cycle Analysis (LCA) studies. The product lineup includes the AD Midas Flagtag U9 Pure, AD Dogbone U9 Pure, AD Belt U9 Pure, AD Web U9 Pure, and AD Miniweb U9 ETSI Pure.

- In February 2024, CAEN RFID S.r.l., in collaboration with IRADETS from Istanbul expanded its geographical presence by launching CAEN RFID products in Georgia and Azerbaijan. This expansion enables CAEN to explore new markets and support system integrators in the region, providing advanced RFID solutions to enhance operational efficiency.

- In January 2024, Zebra Technologies introduced the FXR90 ultra-rugged fixed RFID reader at the NRF 2024 event. This new device is designed to enhance visibility in high-volume and rugged environments, supporting various applications in retail and supply chain management.

Market Concentration & Characteristics

The Connected Safety RFID Systems Market demonstrates moderate to high market concentration, with a core group of leading global players holding significant influence over technological innovation, product standards, and distribution networks. It features a mix of established multinational corporations and specialized RFID technology providers, which enables a diverse range of solutions suited to various industry requirements. The market is characterized by rapid adoption of IoT-enabled systems, strong demand for real-time safety monitoring, and increasing regulatory pressures across industrial sectors. It supports customization and scalable deployment, meeting the needs of industries such as manufacturing, healthcare, logistics, and construction. Barriers to entry include high initial investment, technical complexity, and the need for ongoing innovation to address evolving safety protocols. Companies focus on building strong relationships with end users and channel partners to expand their reach and maintain competitive advantage. Continuous research and development, system interoperability, and adherence to global safety standards define the overall market landscape

Report Coverage

The research report offers an in-depth analysis based on Type, Frequency Band, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is set to expand with rising industrial automation and stricter safety regulations.

- Adoption of IoT-enabled RFID systems will enhance real-time monitoring capabilities.

- Artificial intelligence and predictive analytics will play a key role in incident prevention.

- Cloud integration will make safety data more accessible and improve remote management.

- Wearable RFID technology will become common in hazardous work environments.

- Customization of RFID solutions for specific industries will drive further demand.

- Strategic partnerships and mergers will strengthen product portfolios and market reach.

- Cost reduction in RFID hardware and software will increase adoption among small and mid-sized enterprises.

- Investments in cybersecurity will address concerns about data privacy and system vulnerabilities.

- Emerging markets will provide significant growth opportunities through industrialization and digital transformation.